Beruflich Dokumente

Kultur Dokumente

Payers & Providers National Edition - Issue of July 2012

Hochgeladen von

PayersandProvidersOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Payers & Providers National Edition - Issue of July 2012

Hochgeladen von

PayersandProvidersCopyright:

Verfügbare Formate

July 2012

National Edition

In this Issue

1. News

Hospital Value-Based Purchasing

Hospital Value-Based Purchasing An Exploration of These New Contracts

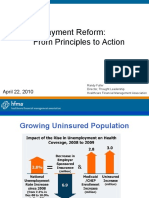

Payers & Providers recently convened a webinar with MCOL focusing on the Centers for Medicare and Medicaid Services value-based purchasing program for hospitals. The webinar, Hospital Value Based Purchasing: A Roadmap, featured presentations from Robert A. Minkin, Senior Vice President at The Camden Group, Guy DAndrea, President of Discern, LLC and Jason Lee, Senior Manager at ECG Management Consultants, on what is going on at hospitals in California and elsewhere to prepare for this program? where might the savings be found? and where might care and outcomes be improved? According to the Centers for Medicare and Medicaid Services, value-based purchasing begins in fiscal year 2013, and will focus on payments for discharges occurring on or after October 1, 2012. Under the program, CMS will make value-based incentive payments to acute care hospitals, based either on how well the hospitals perform on certain quality measures or how much the hospitals' performance improves on certain benchmarks during a baseline period. The higher a hospital's performance or improvement during the performance period for a fiscal year, the higher the hospital's value-based incentive payment for the fiscal year would be. Guy DAndrea, whose presentation began the webinar, summed up the goal of the program by noting that the program would reward better value, outcomes and innovations not volume. This payment reform is needed because, as DAndrea lays out, purchasers define payment systems if they are using traditional payment models, they are part of the problem because fee-for-service rewards the wrong things i.e. Volume, Complexity, Indifferent to quality and outcomes. The incentives the program provides hospitals to move away from a fee-for-service model are based on a set of quality measures. There are currently thirteen measures which focus on how closely hospitals follow best clinical practices and how well hospitals enhance patients experiences of care. In the future CMS will add additional measures that focus on improved patient outcomes and prevention of hospital-acquired conditions. DAndrea outlined how CMS will use these measures to base their incentive payments. The way that CMS is scoring each of these measures is it is comparing each hospital to all of its peers and then assigning for each hospital an achievement score and an improvement score. The way a hospital earns achievement points is by doing better than other hospitals that are in the program which is all the other hospitals that Medicare reimburses, he said. The way that hospitals earn improvement points is by doing better than its own previous performance. Although, it still has to achieve a base level of performance even to receive any improvement points. Then the way that this works is CMS looks at the achievement score and the improvement score for each of the measures and awards a hospital the higher of the two.

continued on page 2

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

3. Vitals

U.S. Medical Cost Trends, Physician Adoption of EHR Systems, Reasons adults with a mouth or tooth problem did not see a dentist or other dental health professional, Annual Growth Rate of Pharmaceutical Spending

4. California

Jones Rejects Blue Shield Closures Briefs - CMS Announces 89 New ACOs, Six of Those Named Will Operate in California, Health Net Wins Web Design Awards

5. Midwest

Minn. Awards Exchange Contracts Take Care Opens Wellness Center Briefs - Childhood Obesity Creeps Upward In Minnesota

6. WebinarsWhite Papers

Recent and Upcoming Events The Many Stories of One Litigious Physician Healthcare and Campaign Finance in California

7. Marketplace

Employment Advertising Opportunities Paid Subscriptions

8. Order Form

Payers & Providers Order Form

Volume 2, Issue 7 July, 2012

www.payersandproviders.com

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT NEWS

Page 2

Page 7

Value-Based Purchasing continued

He explained the other aspects measured. In the hospital consumer assessment of healthcare providers and systems survey (HCAHPS) domain there is also a provision for consistency, which basically means that a hospital that does well across the board on all the HCAHPS' sub elements is going to get some points for that versus hospitals that do very well on certain elements of patient experience of care versus hospitals that do poorly on other elements, he said. These points are combined into an overall score which DAndrea specifies as a sum of weighted performance scores for each domain being; 70% based on clinical process of care measures and 30% on HCAHPS patient experience of care measures. The thirteen current measures this process is based on are: Percent of Heart Attack Patients Given Fibrinolytic Medication Within 30 Minutes Of Arrival Percent of Heart Attack Patients Given PCI Within 90 Minutes Of Arrival Percent of Heart Failure Patients Given Discharge Instructions Percent of Pneumonia Patients Whose Initial Emergency Room Blood Culture Was Performed Prior To The Administration Of The First Hospital Dose Of Antibiotics Initial Antibiotic Selection for CAP in Immunocompetent Patient Prophylactic Antibiotic Received Within One Hour Prior to Surgical Incision Prophylactic Antibiotic Selection for Surgical Patients Prophylactic Antibiotics Discontinued Within 24 Hours After Surgery End Time Cardiac Surgery Patients with Controlled 6AM Postoperative Serum Glucose Surgery Patients on a Beta Blocker Prior to Arrival That Received a Beta Blocker During the Perioperative Period Surgery Patients with Recommended Thromboembolism Prophylaxis Ordered Venous

In Lees presentation he listed five considerations for hospitals and health systems that are contracting in todays market. The considerations are meant to assess how ready a hospital or health system is to incorporate value-based concepts into its managed care contracts: 1. 2. Familiarity Does the hospital/system have experience with the metrics tied to the incentives? Preparedness How prepared is the hospital/system from a technology and informatics perspective to take advantage of the incentive (e.g., monitor, track, report)? Ability to Be Achieved Is the incentive realistic under the hospital/systems current performance? Can more than one incentive level be included in the agreement (i.e., reachable target vs. stretch goal)? Competition Will there be too much competition in the marketplace to maximize the agreement? Internal Incentives Are there sufficient internal incentives for your staff and physicians to achieve the goals?

3.

4. 5.

Robert Minkin ended the webinar by focusing on bundled payments and episodes of care payment. He opened his presentation by saying that There is no question that the entire health care system is being pushed together for the purpose of creating higher level of value and the functional and practical definition of that is the provider assuming a much greater level of financial risk for broader sets of levels of care and episodes of care at a fixed price. Minkin used the timeline below to demonstrate how many commercial plans and large integrated organizations have used bundled payment or episodes of care arrangements over the past decade in order to shift risk and create greater levels of value.

Surgery Patients Who Received Appropriate Venous Thromboembolism Prophylaxis Within 24 Hours Prior to Surgery to 24 Hours After Surgery Patient Experience of Care (Hospital Consumer Assessment of Healthcare Providers and Systems [HCAHPS] Survey) Minkin closed his presentation by mentioning some next steps, the step he concluded on which summarizes his presentation was Be prepared to take some risks and be prepared to learn from it.

Following DAndreas presentation, Jason Lee, expanded on value based purchasing by looking beyond just contracts with Medicare but also with commercial payers.

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT VITALS

LISTS from

Page 3

Page 7

Trend: U.S. Medical Costs Increasing

Gross 2009* 2010 2011 2012 (Expected)

Reasons adults aged 1864 with a mouth or tooth problem did not see a dentist or other dental health professional in the past 6 months

9.10% 10.75% 11.50% 11.83%

1. Could not afford / no insurance 41.7% 2. Didn't think problem was important 25.9% 3. Problem went away 25.4% 4. Fear 9.7% 5. Didn't think dentist could fix problem 6.1% 6. waiting for an Appointment 4.0% 7. No transportation 2.8%

Source: Oral Health Status and Access to Oral Health Care for U.S. Adults Aged 1864: National Health Interview Survey, National Center For Health Statistics http://www.cdc.gov/nchs/data/series/sr_10/sr10_253.pdf

Net** 2009* 2010 2011 2012 (Expected)

9.10% 9.10% 8.51% 10.62%

*2009 rates are drawn from the 2011 Global Medical Trends Survey. **Net of general inflation Source: 2012 Global Medical Trends, Towers Watson http://www.towerswatson.com/assets/pdf/7394/TowersWatsonGlobalMedTrendsSvyRpt-NA-2012-23911.pdf

Check out more healthsprocket lists at: www.healthsprocket.com

Physician Adoption of Electronic Health Record Systems

In 2011, 55% of physicians had adopted an electronic health record (EHR) system. 77% of physicians who have adopted an EHR system reported that their system meets federal "meaningful use" criteria. 85% of physicians who have adopted an EHR system reported being somewhat (47%) or very (38%) satisfied with their system. 74% of adopters reported that using their EHR system resulted in enhanced patient care. 48% of physicians currently without an EHR system plan to purchase or use one already purchased within the next year.

Source: NCHS Data Brief, Number 98, July 2012, National Center for Health Statistics http://www.cdc.gov/nchs/data/databriefs/db98.htm

Annual Growth Rate of Pharmaceutical Spending

MCOLBlog: The Emerging Pharmaceutical Pendulum Country/Region U.S. Europe Japan Growth Rate 1 to 4% -1 to 2% 1 to 4%

Data source: IMS Institute for Healthcare Informatics, The Global Use of Medicines: Outlook through 2016

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT CALIFORNIA

Page 4

Page 7

In Brief

CMS Announces 89 New ACOs, Six of Those Named Will Operate in California

The Centers for Medicare and Medicaid Services has named 89 new accountable care organizations across the nation, with six of those operating in California. The California ACOs will be operated by ApolloMed in Glendale; Golden Life Healthcare in Sacramento; the John Muir Physician Network in Walnut Creek; Meridian Holdings in Hawthorne; North Coast Medical ACO in Oceanside; and Torrance Memorial Integrated Physicians. ApolloMed reported it has already signed up 130 area physicians to participate in its ACO. Such initiatives are designed to consolidate payments for care and cut overall costs. This new group of ACOs adds to a solid foundation, said CMS Administrator Marilyn Tavenner. The accountable care model represents the future of healthcare delivery in the United States," said Eli Hendel, M.D., chairman of ApolloMed ACOs board. We are very excited about the opportunity to provide leadership in achieving the goals of the Medicare Shared Savings Program.

Jones Rejects Blue Shield Closures

Insurer Being Sued Over So-Called Death Spiral

California Insurance Commissioner Dave Jones last week rejected a controversial plan by a Blue Shield of California affiliate to close a variety of its health plans to new subscribers. Blue Shield Life & Health Co. had filed a plan with Jones officer earlier this year to close as many as 22 different plans regulated by his office with 152,000 enrollees. Jones initially rejected the plan in March and asked for more information from the San Francisco based insurer. He maintained the rejection in a ruling issued on July 3. According to Jones, Blue Shields plans would move many of the current enrollees into plans whose pooling practices would likely lead to significantly higher premiums. Moreover, about 20,000 enrollees in the Vital Shield 2900 plan would also have to undergo underwriting if the switched plans, leading to potential coverage rejections. When consumers purchase health insurance, they should not have to worry that their health insurer will make decisions to open new products and close others in ways that put the policyholder at risk of being pooled with unhealthy lives whose claims costs are likely to cause premiums to increase, Jones said in a statement. While insurers are allowed under certain circumstances to close products, when they do so they have to pool the policyholders in those blocks with other open blocks so that closed blocks don't end up in a death spiral with mounting costs for policyholders in the closed blocks because new policyholders are not coming into the block. Blue Shield denied that it was engaged in such a practice. Everyone can stay in the plans theyre in, if they want. No one is being forced to change plans, said vice president of corporate communications Steve Shivinsky. We are making these changes because we want our products to be appealing in the marketplace. We introduce new plans and stop selling old plans when people tell us they would prefer to buy something we're not currently offering, just like in any other business. Shivinsky claimed that there are no scheduled rate increases until March 2013, unless enrollees hit a certain age band (those reaching the age of 45, for example, would see an automatic increase); move to another geographical area; or add dependents to their coverage. The reference to a death spiral was first made last month by the Santa Monica-based advocacy group Consumer Watchdog, when it filed suit against Blue Shield in San Francisco Superior Court. It claimed Blue Shield was using the practice of moving enrollees into different plans in order to cut the benefits and raise premiums for older members. Instead of providing coverage to loyal customers who have paid their premiums, Blue Shield pushes consumers into skimpier coverage or prices them out of care altogether when they are sick and need insurance the most, Consumer Watchdog Staff Attorney Jerry Flanagan said at the time the suit was filed. As an alternative, Blue Shield has begun offering new products regulated by the Department of Managed Health Care. Industry observers have suggested that agency is a more lenient regulator that Jones office.

Health Net Wins Web Design Awards

Woodland Hills-based insurer Health Net has won three awards related to the design and deployment of its websites. Health Net won a first place Web Health Awards for its T2X teen health literacy social media website and initiative. It also received awards for its corporate website and mobile application. It is important to make decison making tools user-friendly and readily available for our members, said Mark Brooks, Health Nets chief technology officer. Altogether, more than 600 submissions were considered. The awards contest was organized by the Health Information Resource Center, a national clearinghouse.

The Payers & Providers California Edition is published every Thursday with six pages of hard-hitting healthcare business and policy news and insights

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT MIDWEST

Page 5

Page 7

In Brief

Childhood Obesity Creeps Upward In Minnesota

A new study by the Chilidrens Hospitals and Clinics of Minnesota has concluded that unhealthy eating habits are contributing to the obesity of the states children. Altogether, about 11% of Minnesotas children are obese, while 23% have some weight problems. Although both are below the national average, the rates have continued to climb in recent years, according to the report, which is entitled Starting Early to Prevent Childhood Obesity. We've seen a disturbing growth in obesity-related diseases among our kids," said Alan L. Goldbloom, M.D., CEO of Children's of Minnesota. This increase includes conditions like Type 2 diabetes, heart disease, liver disease, asthma, and joint problems some of which were previously uncommon in children. This is an epidemic communities must join together to fight at our kitchen tables, in our schools and across our healthcare system. The report links the growing obesity rate to unhealthy eating habits only 20% of the states childrens eat the recommended portions of fruits and vegetables, and 34.4% do not meals with their families. Minority children are also more likely to be obese because they live in places with few parks and places to buy groceries. The report recommended that public and private health organizations develop research projects and collaborations to address the obesity epidemic. "When it comes to preventing obesity, the earlier we get started with children, the better the chance of success. Investing in early intervention is critical," said Julie Boman,M.D., a Childrens pediatrician and hospitalist.

Minn. Awards Exchange Contracts

Maximus, Connecture Win Construction Pacts

While many other states are on the fence on constructing health insurance exchanges, Minnesota announced two contracts this week to build and support its own. Maximus, a Reston, Va.-based firm that specializes in Medicare and Medicaid program administration, won a $41 million, 21-month contract to build the exchange and design and launch its website. Connecture, a Wisconsin-based firm that specializes in systems automation for the health insurance industry, won a bid to become the primary subcontractor. Maximus will deploy State Advantage, Connecture designed software, to operate the primary components of the exchange, including enrollment and plan administration. That contracts value was not immediately disclosed. IBM and EngagePoint were also named subcontractors. This contract is a significant milestone in the design and development of a Minnesota health insurance exchange, said state Commerce Commissioner Mike Rothman. We can now move forward on developing the technology backbone of the exchange. State officials have projected as many as 1.2 million Minnesotans will use the exchange to purchase their insurance coverage, many of whom will have premiums subsidized by federal tax breaks starting in January 2014. It is expected to launch in November 2013. About 463,000 Minnesotans currently lack health insurance, according to the Kaiser Family Foundation 9% of the states residents, one of the lowest rates in the nation. A statement issued by Maximus suggests the company will be bidding on exchange contracts in other states. The awarding of this contract represents a significant opportunity for MAXIMUS as we begin to gain traction and establish our leadership role in this emerging market, said Maximus Chief Executive Officer Richard A. Montoni. This award speaks to our capabilities to translate policy into effective solutions for our clients, and further positions Maximus to capitalize on new growth prospects.

New Center on Campus of Notre Dame University

Walgreens affiliate Take Care Health Systems has opened a wellness center on the campus of Notre Dame University in South Bend, Ind. The 7,000-square-foot facility provides services to university faculty and employees, their spouses and dependents, as well as graduate students and their families. It offers primary care, urgent care, lab testing and pharmacy services. Officials say the clinic will serve about 12,000 individuals overall. We are increasingly seeing educational institutions recognizing what many innovative companies have found namely that by investing in broad worksite health programs they can expect to see improved patient outcomes, overall savings and happier and more productive employees, said Peter Hotz, a group vice president for Walgreens health and wellness division. The financial arrangements between Take Care and Notre Dame were not disclosed. According to a report released last year by Towers Watson and National Business Group on Health, 23% of companies surveyed said they currently offer onsite health services, and that another 12% plan to offer such services this year.

The Payers & Providers Midwest Edition is published every Tuesday with six pages of hard-hitting healthcare business and policy news and insights

Take Care Opens Wellness Center

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT WEBINARS WHITE PAPERS

Page 6

Page 7

Recent and Upcoming Webinar Events

CD-ROMs with full audio recordings and presentation slides from all recent HealthcareWebSummit events cosponsored by Payers & Providers are available, and attendee registrations are accepted for all upcoming events. To order a CD-ROM or register to attend any of the following recent or upcoming events, call 209.577.4888 or go to www.healthwebsummit.com The California Healthcare Exchange: A Progress Report to be held August 15, 2012 at 10 AM Pacific with David Panush, Director of Government Relations, California Health Benefits Exchange, Anthony Wright, Executive Director, Health Access and Jon Gabel, Senior Fellow, NORC at the University of Chicago Hospital Value Based Purchasing: A Roadmap June 27, 2012 with Robert A. Minkin, Senior Vice President, The Camden Group, Guy DAndrea, President, Discern, LLC, Jason Lee, Senior Manager, ECG Management Consultants Patient Finance: Issues and Pathways June 13, 2012 with Mitch Patridge, Chief Executive Officer, CSI Financial Services, Ron Shinkman, Publisher, Payers & Providers, and Rick Tsupros, President, Match Point Solutions Hospital Districts: Mapping the Future May 24, 2012 with Michael A. Dowell, Partner, Hinshaw & Culbertson LLP, Walter Kopp, President, Medical Management Services, Inc. and Cleo E. Burtley, Manager, The Camden Group Claims Processing: A Collaborative Effort April 26, 2012 with Kenny Deng, Senior Director of Provider Services and Operations, Blue Shield of California, George H. Mack, Vice President, Payer/Provider Relations, and Vice President, Member Relations, Hospital Association of Southern California, and Dan Martinez, Director of Patient Financial Services, Mission Hospital Reducing Readmissions: Collateral Effects April 11, 2012 with Daniel C. Cusator, M.D., Vice President The Camden Group and Maria Lopes, M.D., Chief Medical Officer, AMC Health Managing an Increasing Trend of Elective Preterm Deliveries February 24, 2012 with Larry Boress, President & CEO at Midwest Business Group on Health, Harold Miller, Executive Director, Center for Healthcare, Quality and Payment Reform, and Peter Weeks, M.D., Chairman, Department of Obstetrics & Gynecology at Edward Hospital Charity Care & Community Benefits: The New Paradigm February 16, 2012 with Ronald Sorensen, Director of Community Partnerships at Providence Health and Services Hospital C-Suite Compensation: How Much is Too Much? January 20th, 2012 with Claudia Wyatt-Johnson, CoFounder, Partners in Performance, Ron Shinkman, Publisher, Payers & Providers and Mike Rosenbaum, Partner and Vice Chair of Employee Benefits and Executive Compensation Practice Group, Drinker Biddle & Reath LLP

On May 30, 2012 Payers & Providers released a special white paper, The Many Stories of One Litigious Physician. It is about a prominent surgeons decision to sue the patients she treated at hospital emergency rooms. Many had suffered serious injuries. She sued even if these patients and their families had insurance. She sued even after regulators ordered her to stop. This white paper raises significant questions regarding the payment levels specialist physicians receive to be on call, the role hospitals play in supervising their medical staffs, and the consumer protections available to patients. The Many Stories of One Litigious Physician is available in pdf format for $149. This white paper is the product of months of reporting. It might be the single most significant piece of journalism Payers & Providers has published. To order, call 209.577.4888 or go to www.healthexecstore.com

The Payers & Providers white paper, Follow The Money: Healthcare and Campaign Finance in California, discusses and analyzes the influence of the sectors money on politics and policy. It traces the biggest healthcare industry contributors to candidates and political action committees, how much theyre giving, and where that money is going. Follow the Money is available for $149. In addition to this concise and in-depth investigation, two databases in an easyto-read Excel spreadsheet format are also available for purchase for $129, or with the white paper for $199. They include: All healthcare-related organizations and the itemized contributions they made to candidates and PACs for the 2009-2010 campaign season. Details on more than 90 organizations and big individual contributors are included. A database of the largest donations made by individual employees of Californias hospitals, insurance plans and other healthcare organizations. Details on more than 200 entities are included. Both databases are available in an easy-to-read Excel spreadsheet format.

Given the ramifications of the landmark U.S. Supreme Court Citizens United case, you and your organization simply cannot lack a roadmap to where the political money flows from the healthcare industry in California. To order, call 209.577.4888 or go to www.healthexecstore.com

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT MARKETPLACE

Page 7

Page 7

Employment

The following employment opportunities are listed in the Payers & Providers MCOL Employment Marketplace online at www.mcol.com/emp.htm Director of Provider Services - New Hampshire Director, Utilization Management - Chicago, IL EDI Software Engineer III - Ashland, OR AVP - Accountable Care Organization-Cincinnati, OH

Advertising Opportunities

Payers & Providers, publishes the weekly California and Midwest Editions in electronic format and the monthly National Edition in print and electronic format, and serves as the superior source for healthcare business and policy news and insights. Available advertising solutions through these publications include: Dedicated e-blasts to applicable Payer&Providers distribution lists Sponsor messages in each cover email of any Edition Display Advertising inside each Edition Inquire about Sponsored white paper and webinar opportunities To request a 2012 Payers & Providers Media Kit or other detailed Advertising information, please call 209.577.4888.

The Payers & Providers MCOL Employment Marketplace provides three solutions for employers and recruitment firms to promote employment opportunities to the MCOL and Payers & Providers audience: 1. Payers & Providers Display Ads - that prominently feature your opportunity in the California, Midwest and or National Editions of Payers & Providers. 2. Payers & Providers Marketplace Ads - economically provide readers detailed information on your opportunity in any editions of Payers & Providers. 3. Online Advertising - with a package including web site listings of your opportunity in mcol.com and PayersandProviders.com, plus inclusion of your listing in the monthly edition of MCOL's @Career enewsletter, and eligibility to post the announcement in MCOL's member LinkedIn group. All Payers & Providers Display Advertising, plus qualifying Payers & Providers Marketplace ads receive the online advertising package at no additional cost. Call 209.577.4888 or go to www.mcol.com/aboutcls.htm to request an Employment Advertising Kit, post an employment opportunity or obtain additional information.

Volume 2, Issue 7

Payors & Providers Natinal Edition is published monthly by Payers & Providers Publishing, LLC. Inquiries may be directed to: Phone: (877) 248-2360 e-mail: info@payersandproviders.com Postal: 818 N. Hollywood Way, Suite B, Burbank CA 91505 Web: www.payersandproviders.com Facebook: http://www.facebook.com/Payers-Providers Twitter: www.twitter.com/payersproviders Editorial Board Members: California Edition: Steven T. Valentine, President, The Camden Group; Ross Goldberg, Immediate Past President, Los Robles Hospital and Medical Center; Mark Finucone, Managing Director, Alvarez & Marsol; Henry Loubet, Chief Strategy Officer, Keenan; Anthony Wright, Executive Director, Health Access California Midwest Edition: William M. Dwyer, Healthcare Strategist, Jay Warden, Senior Vice President, , The Camden Group, Ross A. Slotten, M.D., Klein Slotten & French, Michael L. Millenson, President, Health Quality Advisors LLC, Publisher /Editor: Ron Shinkman publisher@payersandproviders.com

Paid Subscriptions

Payers & Providers is the premier publication covering healthcare business and policy news in California, the Midwest and Nationally. Each issue of the weekly California and Midwest Editions includes feature articles, Editorials, News Briefs and more, all dedicated to payer and provider news of direct interest to stakeholders. Paid Subscriptions are available for $99 annually for individuals or $149 in bulk for up to ten subscribers. Payer and Provider California or Midwest Edition Paid Subscriptions receive the applicable weekly Edition via email notification listing issue highlights, with links to two viewing options for each issue (direct pdf download, and online viewing). Along with the following additional benefits: Exclusive access to an online archive of past applicable Editions A copy at no additional cost of upcomingl Payers & Providers Quarterly White Papers for that Edition (typically valued at $149 per edition)* Complimentary attendance to Payers & Providers sponsored Healthcare Web Summit event each December: Healthcare Trends (a $225 value) 50% discount on registrations with other Payers & Providers co-sponsored Healthcare Web Summit events Complimentary electronic subscription to Payers and Provider National Edition (a $99 value)

*Note: Paid subscriptions must be in effect for 30 days in order to be eligible to receive upcoming Quarterly White papers at no additional cost.

National Edition Paid Subscriptions receive exclusive access to an online archive of past national editions; Delivery of each national edition in pdf and print formats; electronic delivery of weekly regional editions (California and Midwest; an annual complimentary electronic copy of one Payers & Providers Quarterly White Papers; and a 50% discount on registrations with other Payers & Providers co-sponsored Healthcare Web Summit events

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Payers & Providers

Payers & Providers

MARKETPLACE/EMPLOYMENT ORDER FORM

Page 8

Page 7

Payers & Providers Order Form

This Payers & Providers Order Form is available for Paid Subscription and White Paper ordering, via postal or fax submissions. Detailed information, pricing, and online ordering is available at www.healthexecstore.com. For Payers & Providers recent or upcoming webinar orders, call 209.577.4888 or go to www.healthwebsummit.com/cdroms.htm. Subscriptions

Editions (check applicable) CA Midwest National Subscription Level Paid Paid Two Year Bulk Rate Bulk Two Year

Annual Cost@ $99.00 $175.00 $149.00 $275.00

Description (Annual Cost is per each edition) Paid Individual Subscription for one year Paid subscription for two years License for up to ten paid subscriptions indicate primary contact below Bulk Rate for two years

Quantity

White Paper Order Information

Item (list items and applicable prices)

Price@

Total

Delivery Requested (circle) Electronic Hard Copy Sub-Total CA Sales Tax (CA Residents Only) only required for Hard Copy Processing Fee Grand Total

Payment Information (paid subscriptions) Payment by Credit Card: (Circle One) American Express Card Number: Payment by check: (Circle One) Payment Enclosed MasterCard Visa Discover Expires Please Invoice Us

7.375%

$8.00

You may cancel subscriptions at any time. Annual payments will receive pro-rata refunds upon cancellation.

To Submit Your Order:

Fax: 209.577.3557 Phone: 209.577.4888 Web: www.PayersandProviders.com Mail: MCOL 1101 Standiford Avenue, Suite C-3 Modesto, CA 95350

2012, by Payers & Providers Publishing LLC and MCOL. All rights reserved

Das könnte Ihnen auch gefallen

- Textbook of Urgent Care Management: Chapter 41, Measuring and Improving Patient SatisfactionVon EverandTextbook of Urgent Care Management: Chapter 41, Measuring and Improving Patient SatisfactionNoch keine Bewertungen

- Do You Know The Fair Market Value of Quality?: Jen JohnsonDokument8 SeitenDo You Know The Fair Market Value of Quality?: Jen JohnsonG Mohan Kumar100% (1)

- The Top 6 Examples of Quality Improvement in HealthcareDokument7 SeitenThe Top 6 Examples of Quality Improvement in HealthcareDennis Junior ChorumaNoch keine Bewertungen

- HW5Dokument4 SeitenHW5Karthik GanesuniNoch keine Bewertungen

- Quality Improvement in Health CareDokument7 SeitenQuality Improvement in Health CareFarihaNoch keine Bewertungen

- Health Payment Brief 2011Dokument8 SeitenHealth Payment Brief 2011char2183Noch keine Bewertungen

- Key Steps To Improve and Measure Clinical Outcomes RyanDokument25 SeitenKey Steps To Improve and Measure Clinical Outcomes RyansaphyqNoch keine Bewertungen

- Making The Business Case: For Payment and Delivery ReformDokument28 SeitenMaking The Business Case: For Payment and Delivery ReformiggybauNoch keine Bewertungen

- BUS 644 Week 2 Assignment-A.randolphDokument5 SeitenBUS 644 Week 2 Assignment-A.randolphAntdrone RandolphNoch keine Bewertungen

- Opinion: Healthcare's Next Big HIT?Dokument2 SeitenOpinion: Healthcare's Next Big HIT?Milagros Karina Calapuja QuispeNoch keine Bewertungen

- TQM in HealthcareDokument4 SeitenTQM in HealthcareALtit66Noch keine Bewertungen

- Steven District HospitalDokument8 SeitenSteven District HospitalDeepak DavisNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 34, Engaging Accountable Care Organizations in Urgent Care CentersVon EverandTextbook of Urgent Care Management: Chapter 34, Engaging Accountable Care Organizations in Urgent Care CentersNoch keine Bewertungen

- Fact Sheet: Medicare Federally Qualified Health Center Advanced Primary Care Practice DemonstrationDokument6 SeitenFact Sheet: Medicare Federally Qualified Health Center Advanced Primary Care Practice Demonstrationapi-94302037Noch keine Bewertungen

- Six Sigma Approach To Health Carel Quality Management-Revised-1 by Jay Bandyopadhyay and Karen CoppensDokument13 SeitenSix Sigma Approach To Health Carel Quality Management-Revised-1 by Jay Bandyopadhyay and Karen Coppensmisslopez89Noch keine Bewertungen

- Using ISO 9001 in Healthcare: Applications for Quality Systems, Performance Improvement, Clinical Integration, and AccreditationVon EverandUsing ISO 9001 in Healthcare: Applications for Quality Systems, Performance Improvement, Clinical Integration, and AccreditationNoch keine Bewertungen

- Radiology Aco Whitepaper 11-18-14Dokument9 SeitenRadiology Aco Whitepaper 11-18-14api-271257796Noch keine Bewertungen

- Strategic Management Processes in Healthcare Organizations: Abdulaziz Saddique Pharm.D., CPHQ, CSSMBBDokument10 SeitenStrategic Management Processes in Healthcare Organizations: Abdulaziz Saddique Pharm.D., CPHQ, CSSMBBtheresia anggitaNoch keine Bewertungen

- What Is Value-Based Healthcare - NEJM CatalystDokument3 SeitenWhat Is Value-Based Healthcare - NEJM CatalystRémi DANHOUNDONoch keine Bewertungen

- Ambulatory Service Center Pro FormaDokument20 SeitenAmbulatory Service Center Pro FormajorhnNoch keine Bewertungen

- Value Based Org Assessment Improvement PlanDokument10 SeitenValue Based Org Assessment Improvement PlanSunil SamuelNoch keine Bewertungen

- Excellence in Patient Satisfaction Within A Patient-Centered CultureDokument4 SeitenExcellence in Patient Satisfaction Within A Patient-Centered CultureYepi AboucathNoch keine Bewertungen

- SVH Strategic Plan 2012 PDFDokument42 SeitenSVH Strategic Plan 2012 PDFRichard HutasoitNoch keine Bewertungen

- AHA Patient Centered Medical HomeDokument21 SeitenAHA Patient Centered Medical Homein678Noch keine Bewertungen

- Frontline of Healthcare - It's Time To Elevate The Patient Experience in Healthcare - Bain & CompanyDokument5 SeitenFrontline of Healthcare - It's Time To Elevate The Patient Experience in Healthcare - Bain & Companyb00810902Noch keine Bewertungen

- Ehr Selection: Fall 2009 Idn Summit Peer-To-Peer Learning Exchange Research ReportsDokument9 SeitenEhr Selection: Fall 2009 Idn Summit Peer-To-Peer Learning Exchange Research Reportsraduben5403Noch keine Bewertungen

- Hospital Reform Implimentation and EvaluationDokument39 SeitenHospital Reform Implimentation and EvaluationAdi MawardiNoch keine Bewertungen

- Using Behavioral Science To Improve The Customer Experience: February 2010Dokument5 SeitenUsing Behavioral Science To Improve The Customer Experience: February 2010Ankush SharmaNoch keine Bewertungen

- Health Care Solutions From America's Business Community: The Path Forward For U.S. Health ReformDokument67 SeitenHealth Care Solutions From America's Business Community: The Path Forward For U.S. Health ReformU.S. Chamber of CommerceNoch keine Bewertungen

- HCD WP 2012 ValueBasedPurchasingWhatHospitalsAndHealthSystemsNeedDokument8 SeitenHCD WP 2012 ValueBasedPurchasingWhatHospitalsAndHealthSystemsNeedPatBickleyNoch keine Bewertungen

- Patient Satisfaction Surveys and Quality of Care: An Information PaperDokument7 SeitenPatient Satisfaction Surveys and Quality of Care: An Information Papernidaus syahidahNoch keine Bewertungen

- Value Based HealthcareDokument48 SeitenValue Based HealthcareAsem Shadid100% (1)

- EHR and Meaningful UseDokument4 SeitenEHR and Meaningful UseNkeletseng MakakaNoch keine Bewertungen

- Abstract - Jaipuria2 - Re-Engineering The Revenue CycleDokument2 SeitenAbstract - Jaipuria2 - Re-Engineering The Revenue Cyclemunish_tiwari2007Noch keine Bewertungen

- 11 Hospi PerformanceDokument5 Seiten11 Hospi PerformancedoctoooorNoch keine Bewertungen

- AHM 250 SummaryDokument116 SeitenAHM 250 SummaryDinesh Anbumani100% (5)

- Building A New Partnership For ValueDokument16 SeitenBuilding A New Partnership For ValuePartnership to Fight Chronic DiseaseNoch keine Bewertungen

- Journal Article Review - Development of A Performance Measurement System at The Mayo ClinicDokument4 SeitenJournal Article Review - Development of A Performance Measurement System at The Mayo ClinicMeidi Imanullah50% (2)

- Transition Test 2 Notes BDokument20 SeitenTransition Test 2 Notes Bapi-3822433Noch keine Bewertungen

- Licensure, Accreditation, and CertificationDokument62 SeitenLicensure, Accreditation, and CertificationSohib KawaiNoch keine Bewertungen

- Abstract PorfolioDokument5 SeitenAbstract Porfolioapi-271900931Noch keine Bewertungen

- Lean Management and U.S. Public Hospital Performance Results From A National SurveyDokument17 SeitenLean Management and U.S. Public Hospital Performance Results From A National SurveyArnoldYRPNoch keine Bewertungen

- American Wells Case SolutionDokument3 SeitenAmerican Wells Case SolutionAnne SinitraNoch keine Bewertungen

- Module 4 - Purchasing Health ServicesDokument18 SeitenModule 4 - Purchasing Health Services98b5jc5hgtNoch keine Bewertungen

- Role of Big Data in The Healthcare IndustryDokument4 SeitenRole of Big Data in The Healthcare IndustrymarutishNoch keine Bewertungen

- Ch06 Falls ChurchDokument5 SeitenCh06 Falls ChurchBen Yao25% (4)

- AHM 250 SummaryDokument117 SeitenAHM 250 Summarysenthilj82Noch keine Bewertungen

- Evolving Health Care ModelDokument47 SeitenEvolving Health Care Modelibson045001256Noch keine Bewertungen

- White Paper - Utilization Management Through The Lens of Value-Based CareDokument7 SeitenWhite Paper - Utilization Management Through The Lens of Value-Based CarevamseeNoch keine Bewertungen

- Managing The Health Benefits Supply ChainDokument12 SeitenManaging The Health Benefits Supply ChainJim RoseNoch keine Bewertungen

- Hospital Business Models For Consumer-Centric HealthcareDokument8 SeitenHospital Business Models For Consumer-Centric HealthcareFairuzaman Ja'afarNoch keine Bewertungen

- Turning The Vision of Connected Health Into A RealityDokument14 SeitenTurning The Vision of Connected Health Into A RealityCognizant100% (2)

- Primer Hosp Acct Finance 4 The DDokument32 SeitenPrimer Hosp Acct Finance 4 The DTejinder SinghNoch keine Bewertungen

- Running Head: Patient-Centered Care 1Dokument9 SeitenRunning Head: Patient-Centered Care 1Anonymous mZC2qZNoch keine Bewertungen

- 5 RandyFuller Las Vegas 04 - 10 v2Dokument34 Seiten5 RandyFuller Las Vegas 04 - 10 v2ibson045001256Noch keine Bewertungen

- Quality Management in Multi Speciality HospitalDokument15 SeitenQuality Management in Multi Speciality HospitalIrfana kNoch keine Bewertungen

- Medical Revenue Cycle Management - The Comprehensive GuideVon EverandMedical Revenue Cycle Management - The Comprehensive GuideNoch keine Bewertungen

- Chapter 1Dokument41 SeitenChapter 1HazelNoch keine Bewertungen

- Group Practice Journal: Key Success Factors For Private Practice Hospital Medicine GroupsDokument4 SeitenGroup Practice Journal: Key Success Factors For Private Practice Hospital Medicine GroupsMhini Baba JayNoch keine Bewertungen

- California Edition: Health Net, DHCS Settle Rate LawsuitDokument5 SeitenCalifornia Edition: Health Net, DHCS Settle Rate LawsuitPayersandProviders100% (1)

- Midwest Edition: Ford Merger Likely To DisappointDokument5 SeitenMidwest Edition: Ford Merger Likely To DisappointPayersandProvidersNoch keine Bewertungen

- Supervisor Janet Nguyen's Presentation On Orange County Grand Jury Report.Dokument20 SeitenSupervisor Janet Nguyen's Presentation On Orange County Grand Jury Report.PayersandProvidersNoch keine Bewertungen

- California Edition: Dignity Health Facing ChallengesDokument5 SeitenCalifornia Edition: Dignity Health Facing ChallengesPayersandProvidersNoch keine Bewertungen

- California Edition: Dignity Health Facing ChallengesDokument5 SeitenCalifornia Edition: Dignity Health Facing ChallengesPayersandProvidersNoch keine Bewertungen

- Midwest Edition: Michigan Has A $1 Billion QuestionDokument5 SeitenMidwest Edition: Michigan Has A $1 Billion QuestionPayersandProvidersNoch keine Bewertungen

- Midwest Edition: Sequester May Hit Health ResearchDokument5 SeitenMidwest Edition: Sequester May Hit Health ResearchPayersandProvidersNoch keine Bewertungen

- Midwest Edition: UM Docs Slash Dual-Eligible CostsDokument5 SeitenMidwest Edition: UM Docs Slash Dual-Eligible CostsPayersandProvidersNoch keine Bewertungen

- Midwest Edition: Vouchers Could Spike PremiumsDokument5 SeitenMidwest Edition: Vouchers Could Spike PremiumsPayersandProvidersNoch keine Bewertungen

- California Edition: State's Hospitals Make Quality GainsDokument6 SeitenCalifornia Edition: State's Hospitals Make Quality GainsPayersandProvidersNoch keine Bewertungen

- California Edition: The Long, Mysterious Appeals RoadDokument6 SeitenCalifornia Edition: The Long, Mysterious Appeals RoadPayersandProvidersNoch keine Bewertungen

- California Edition: IHA Cites Medical Groups For QualityDokument6 SeitenCalifornia Edition: IHA Cites Medical Groups For QualityPayersandProvidersNoch keine Bewertungen

- Payers & Providers Midwest Edition - Issue of October 9, 2012Dokument5 SeitenPayers & Providers Midwest Edition - Issue of October 9, 2012PayersandProvidersNoch keine Bewertungen

- Midwest Edition: Healthpartners, Park Nicollet MergeDokument5 SeitenMidwest Edition: Healthpartners, Park Nicollet MergePayersandProvidersNoch keine Bewertungen

- Midwest Edition: Accretive Settles Minnesota ChargesDokument6 SeitenMidwest Edition: Accretive Settles Minnesota ChargesPayersandProvidersNoch keine Bewertungen

- California Edition: SPD Costs Dog Molina, Health NetDokument6 SeitenCalifornia Edition: SPD Costs Dog Molina, Health NetPayersandProvidersNoch keine Bewertungen

- Midwest Edition: Missouri Throws Out Med-Mal CapDokument5 SeitenMidwest Edition: Missouri Throws Out Med-Mal CapPayersandProvidersNoch keine Bewertungen

- Midwest Edition: Wellpoint at Bottom of Hospitals' ListDokument5 SeitenMidwest Edition: Wellpoint at Bottom of Hospitals' ListPayersandProvidersNoch keine Bewertungen

- Midwest Edition: Clock Is Ticking On ExchangesDokument6 SeitenMidwest Edition: Clock Is Ticking On ExchangesPayersandProvidersNoch keine Bewertungen

- Midwest Edition: Two Rural Hospital Funds May Dry UpDokument5 SeitenMidwest Edition: Two Rural Hospital Funds May Dry UpPayersandProvidersNoch keine Bewertungen

- Midwest Edition: States Taking Their Own ACA TackDokument6 SeitenMidwest Edition: States Taking Their Own ACA TackPayersandProvidersNoch keine Bewertungen

- California Edition: DMHC, Anthem Clash On ClaimsDokument7 SeitenCalifornia Edition: DMHC, Anthem Clash On ClaimsPayersandProvidersNoch keine Bewertungen

- California Edition: Much of ACA Survives A SqueakerDokument7 SeitenCalifornia Edition: Much of ACA Survives A SqueakerPayersandProvidersNoch keine Bewertungen

- California Edition: Ucla, Minuteclinic Enter Into DealDokument7 SeitenCalifornia Edition: Ucla, Minuteclinic Enter Into DealPayersandProvidersNoch keine Bewertungen

- California Edition: Could ACA Split Lead To Migrations?Dokument7 SeitenCalifornia Edition: Could ACA Split Lead To Migrations?PayersandProvidersNoch keine Bewertungen

- Payers & Providers Midwest Edition - Issue of July 17, 2012Dokument6 SeitenPayers & Providers Midwest Edition - Issue of July 17, 2012PayersandProvidersNoch keine Bewertungen

- Entity Buy-Sell Agreement OverviewDokument1 SeiteEntity Buy-Sell Agreement OverviewProvada Insurance ServicesNoch keine Bewertungen

- Gerontological Nursing: Principles of GeriatricsDokument20 SeitenGerontological Nursing: Principles of GeriatricsMyrrha Velarde Filomeno TaganasNoch keine Bewertungen

- Excellus Cap Abstract 2015 DraftDokument2 SeitenExcellus Cap Abstract 2015 Draftapi-290857382Noch keine Bewertungen

- Important Resources For Older AdultsDokument4 SeitenImportant Resources For Older AdultsState Senator Liz KruegerNoch keine Bewertungen

- Review Jurnal Pembiayaan Kesehatan 2Dokument5 SeitenReview Jurnal Pembiayaan Kesehatan 2SUCI PERMATANoch keine Bewertungen

- RA 11223 UHC Act SearchableDokument18 SeitenRA 11223 UHC Act Searchablemarifort rafaelNoch keine Bewertungen

- MVP Sample LetterDokument2 SeitenMVP Sample LetterKristieNoch keine Bewertungen

- UnpublishedDokument29 SeitenUnpublishedScribd Government DocsNoch keine Bewertungen

- OT 535 Documentation & ReimbursementDokument27 SeitenOT 535 Documentation & ReimbursementJoanna RiveraNoch keine Bewertungen

- Special Needs GuideDokument11 SeitenSpecial Needs GuideBegley Law Group100% (1)

- HIPAA Web Course Test AnswersDokument4 SeitenHIPAA Web Course Test AnswersMokeshdharan RNoch keine Bewertungen

- MOMMIES Act 116th CongressDokument36 SeitenMOMMIES Act 116th CongressSenator Cory BookerNoch keine Bewertungen

- SepsisScreenTreatmentAlgorithm BaylorUMedicalCenter PDFDokument66 SeitenSepsisScreenTreatmentAlgorithm BaylorUMedicalCenter PDFFanie BeatriceNoch keine Bewertungen

- Senate Opioid Investigation ReportDokument31 SeitenSenate Opioid Investigation ReportcronkitenewsNoch keine Bewertungen

- First Circuit Brief About Final Rule Next StepsDokument109 SeitenFirst Circuit Brief About Final Rule Next StepsLindsey KaleyNoch keine Bewertungen

- Hospitality in HospitalsDokument25 SeitenHospitality in Hospitalsrahul100% (1)

- Houston ISD School Board Agenda Item Regarding Consultant Kenneth Wells and AlkenDokument2 SeitenHouston ISD School Board Agenda Item Regarding Consultant Kenneth Wells and AlkenTexas WatchdogNoch keine Bewertungen

- 10-103 Conexia LehrichDokument15 Seiten10-103 Conexia Lehrichstenyjohnson0% (1)

- Eastbourne MapDokument1 SeiteEastbourne MapRajin MaahiNoch keine Bewertungen

- Leering University Healthcare StrategyDokument18 SeitenLeering University Healthcare Strategychuff6675Noch keine Bewertungen

- Significance of The StudyDokument3 SeitenSignificance of The StudyFrecious ConcepcionNoch keine Bewertungen

- Arguement EssayDokument4 SeitenArguement Essayapi-575360305Noch keine Bewertungen

- Silow Carroll - Hosp - Quality - Improve - Strategies - Lessons - 1009 PDFDokument70 SeitenSilow Carroll - Hosp - Quality - Improve - Strategies - Lessons - 1009 PDFSebrindaa GinaNoch keine Bewertungen

- Healthcare System in JapanDokument4 SeitenHealthcare System in JapanBayuAkbarSyarifNoch keine Bewertungen

- Hcr201 v6 Wk1 Medical Billing Terminology WorksheetDokument2 SeitenHcr201 v6 Wk1 Medical Billing Terminology WorksheetMarissa Marie100% (1)

- Heather Rodd Resume - Billing and Coding SpecialistDokument2 SeitenHeather Rodd Resume - Billing and Coding Specialistapi-312572829Noch keine Bewertungen

- Rogerian ArgumentDokument8 SeitenRogerian Argumentapi-232536315100% (1)

- Motivating High Performance in Pharmaceutical Sales Teams PDFDokument12 SeitenMotivating High Performance in Pharmaceutical Sales Teams PDFJasmin FajićNoch keine Bewertungen

- 2016 TechnologyWatch Vol1Dokument27 Seiten2016 TechnologyWatch Vol1amit545Noch keine Bewertungen

- Caregiving: Helping The Elderly With Activity LimitationsDokument6 SeitenCaregiving: Helping The Elderly With Activity LimitationsisishamalielNoch keine Bewertungen