Beruflich Dokumente

Kultur Dokumente

Results Tracker: Tuesday, 24 July 2012

Hochgeladen von

Mansukh Investment & Trading SolutionsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Results Tracker: Tuesday, 24 July 2012

Hochgeladen von

Mansukh Investment & Trading SolutionsCopyright:

Verfügbare Formate

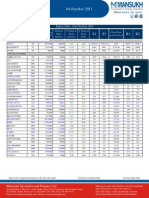

Results Tracker

Tuesday, 24 July 2012

make more, for sure.

Q1FY13

Results to be Declared on Tuesday, 24th July 2012

COMPANIES NAME

Ashok Leyland

ASM Tech

Canara Bank

Century Ply

Flex Foods

FORTIS MLR

GEECEE

IL&FS Invest Mgrs

LIC Housing Fin

Lupin

Mac Charles

Nivi Trading

SE Investments

Sesa Goa

Shriram Trans

SKF India

THANGAMAYIL

Tinplate Co

Torrent Power

Vintron Info

Container Corp

Eclerx Serv

ING Vysya Bank

Page Inds

State Bank BikJpr

WABCO India

Jindal Steel

Peoples Invest

Styrolution ABS

Wipro

Zyden Gentec

Esab India

Jubilant Inds

Pidilite Inds

Sunraj Diamond

Essar Ports

KAR Mobiles

Polaris Fin Tec

Taneja Aero

Everest Inds

Kirloskar Ferro

Ricoh India

Tata Elxsi

Results Announced on 23rd July 2012 (Rs Million)

Larsen & Toubro

Quarter ended

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

119553.5

6058.4

15008.9

2284.1

12341.4

0

12341.4

3704.9

0

8636.5

94826.1

2961.8

14226.5

1612.6

12613.9

1678.5

10935.4

3473.9

61

7461.5

Equity

PBIDTM(%)

1225.6

12.23

1220

14.85

Year to Date

201206

201106

104.55

5.5

41.64

-2.16

0

12.86

6.65

0

15.75

119553.5

6058.4

15008.9

2284.1

12341.4

0

12341.4

3704.9

0

8636.5

94826.1

2961.8

14226.5

1612.6

12613.9

1678.5

10935.4

3473.9

61

7461.5

0.46

-17.64

1225.6

12.55

1220

15

% Var

26.08

Year ended

201203

201103

104.55

5.5

41.64

-2.16

0

12.86

6.65

0

15.75

531705.2

13382.8

76208.9

6661

70097.9

6994.6

63103.3

18538.3

397

44565

439058.7

11474.6

67870.3

6192.5

64298.5

5992.2

58306.3

19435.8

1670

38870.5

0.46

-16.32

1224.8

14.18

1217.7

15.32

% Var

26.08

% Var

21.1

16.63

12.29

7.57

9.02

16.73

8.23

-4.62

-76.23

14.65

0.58

-7.44

A decent increase of about 26.08% in the sales to Rs. 119553.50 millions was observed for the quarter ended June 2012. The sales figure

stood at Rs. 94826.10 millions during the year-ago period.Modest increase of 15.75% in the Net Profit was reported from. 7461.50 millions

to Rs. 8636.50 millions.The company reported a good operating profit of 15008.90 millions compared to 14226.50 millions of

corresponding previous quarter.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Idea Cellular

Sales

Quarter ended

201206

201106

54274.4

44841.1

% Var

21.04

Year to Date

201206

54274.4

201106

44841.1

% Var

21.04

Year ended

201203

193223.3

201103

153890

% Var

25.56

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

0

5080

2366.7

2713.3

0

2713.3

813.7

0

1899.6

0

10169.1

2061.8

8107.3

5960.6

2146.7

649.4

0

1497.3

0

-50.04

14.79

-66.53

0

26.39

25.3

0

26.87

0

5080

2366.7

2713.3

0

2713.3

813.7

0

1899.6

0

10169.1

2061.8

8107.3

5960.6

2146.7

649.4

0

1497.3

0

-50.04

14.79

-66.53

0

26.39

25.3

0

26.87

0

43128.4

9078.1

34050.3

25627.7

8422.6

2657.2

0

5765.4

0

31280.7

2487.4

28793.3

19730.1

9063.2

617.2

0

8446

0

37.88

264.96

18.26

29.89

-7.07

330.52

0

-31.74

Equity

PBIDTM(%)

33097.5

9.36

33037.6

22.68

0.18

-58.73

33097.5

9.36

33037.6

22.68

0.18

-58.73

33088.5

22.32

33032.7

20.33

0.17

9.81

The Revenue for the quarter ended June 2012 of Rs. 54274.40 millions grew by 21.04 % from Rs. 44841.10 millions.A comparatively good

net profit growth of 26.87% to Rs. 1899.60 millions was reported for the quarter ended June 2012 compared to Rs. 1497.30 millions of

previous same quarter.The company reported a degrowth in operating Profit to 5080.00 millions from 10169.10 millions.

Jubilant LifeScience

Quarter ended

201206

201106

% Var

19.84

Year to Date

201206

201106

6196.6

23.5

1267.3

300.3

940.2

276.8

663.4

124.5

0

538.9

159.3

20.45

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

7425.7

17.4

1222.5

450.5

-270.4

360.7

-631.1

104.9

0

-736

6196.6

23.5

1267.3

300.3

940.2

276.8

663.4

124.5

0

538.9

-25.96

-3.54

50.02

-128.76

30.31

-195.13

-15.74

0

-236.57

7425.7

17.4

1222.5

450.5

-270.4

360.7

-631.1

104.9

0

-736

Equity

PBIDTM(%)

159.3

16.46

159.3

20.45

0

-19.5

159.3

16.46

Year ended

201203

201103

-25.96

-3.54

50.02

-128.76

30.31

-195.13

-15.74

0

-236.57

26410.7

89.4

4205.6

1544.2

860.6

1320

-459.4

349.7

0

-809.1

22084.8

51.4

4510.6

466.5

3998.6

999.1

2999.5

203.2

0

2796.3

73.93

-6.76

231.02

-78.48

32.12

-115.32

72.1

0

-128.93

0

-19.5

159.3

15.92

159.3

20.42

0

-22.03

% Var

19.84

% Var

19.59

The revenue zoomed 19.84% to Rs. 7425.70 millions for the quarter ended June 2012 as compared to Rs. 6196.60 millions during the

corresponding quarter last year.The Net Loss for the quarter ended June 2012 is Rs. -736.00 millions as compared to Net Profit of Rs.

538.90 millions of corresponding quarter ended June 2011The company reported a degrowth in operating Profit to 1222.50 millions from

1267.30 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Coromandel Interntl.

Quarter ended

Year to Date

201206

201106

Sales

17528.2

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

180.3

2149.2

427.7

1721.5

0

1721.5

440.6

0

1280.9

Equity

PBIDTM(%)

282.7

12.26

Year ended

201206

201106

17956.7

% Var

-2.39

201203

201103

17956.7

% Var

-2.39

98232.7

76392.6

% Var

28.59

17528.2

190.8

2689

243.4

2445.6

142.1

2303.5

710

0

1593.5

-5.5

-20.07

75.72

-29.61

0

-25.27

-37.94

0

-19.62

180.3

2149.2

427.7

1721.5

0

1721.5

440.6

0

1280.9

190.8

2689

243.4

2445.6

142.1

2303.5

710

0

1593.5

-5.5

-20.07

75.72

-29.61

0

-25.27

-37.94

0

-19.62

1166.7

11779.7

1165.1

10259.3

561.6

9697.7

2765

0

6932.7

797.6

11364.9

862.9

10502

617.4

9884.6

2940

0

6944.6

46.28

3.65

35.02

-2.31

-9.04

-1.89

-5.95

0

-0.17

282

14.97

0.25

-18.12

282.7

12.26

282

14.97

0.25

-18.12

282.6

11.99

281.8

14.88

0.28

-19.4

The revenue for the June 2012 quarter is pegged at Rs. 17528.20 millions against Rs. 17956.70 millions recorded during the year-ago

period.A slender decline of -19.62% was recorded to Rs. 1280.90 millions from Rs. 1593.50 millions in the corresponding previous

uarter.Operating Profit reported a sharp decline to 2149.20 millions from 2689.00 millions in the corresponding previous quarter.

Cairn India

Quarter ended

Year to Date

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

8

222.3

-75.3

263.5

-338.8

0

-338.8

0

0

-338.8

5.5

272.9

124.9

287.2

-162.3

0.1

-162.4

0.7

0

-163.1

Equity

PBIDTM(%)

19078.7

-941.25

19022.5

2270.91

% Var

45.45

Year ended

201206

201106

-18.54

-160.29

-8.25

108.75

0

108.62

-100

0

-107.73

8

222.3

-75.3

263.5

-338.8

0

-338.8

0

0

-338.8

5.5

272.9

124.9

287.2

-162.3

0.1

-162.4

0.7

0

-163.1

0.3

-141.45

19078.7

-941.25

19022.5

2270.91

% Var

45.45

201203

201103

-18.54

-160.29

-8.25

108.75

0

108.62

-100

0

107.73

88

2401.4

1589.9

1114.5

475.4

0.4

475

35.4

0

439.6

23.9

927.1

-259.5

1866.9

-2126.4

0.3

-2126.7

0

0

-2126.7

% Var

268.2

159.02

-712.68

-40.3

-122.36

33.33

-122.34

0

0

-120.67

0.3

-141.45

19074

1806.7

19019.2

-1085.77

0.29

-266.4

The sales figure stood at Rs. 8.00 millions for the June 2012 quarter. The mentioned figure indicates a growth of about 45.45% as

compared to Rs. 5.50 millions during the year-ago period.The Net Loss for the quarter ended June 2012 is Rs. -338.80 millions as

compared to Net Loss of Rs. -163.10 millions of corresponding quarter ended June 2011Operating profit Margin for the quarter ended

June 2012 slipped to -75.30% as compared to 124.90% of corresponding quarter ended June 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

SJVN

Quarter ended

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

5042.5

530.1

5067.3

157.5

4909.8

1114

3795.8

643.1

-116.4

3152.7

5659.4

442.9

5548.3

234.2

5314.1

1100.9

4213.2

731.1

-111.9

3482.1

Equity

PBIDTM(%)

41366.3

100.49

41366.3

98.04

Year to Date

201206

201106

19.69

-8.67

-32.75

-7.61

1.19

-9.91

-12.04

4.02

-9.46

5042.5

530.1

5067.3

157.5

4909.8

1114

3795.8

643.1

-116.4

3152.7

5659.4

442.9

5548.3

234.2

5314.1

1100.9

4213.2

731.1

-111.9

3482.1

0

2.5

41366.3

100.49

41366.3

98.04

% Var

-10.9

Year ended

201203

201103

19.69

-8.67

-32.75

-7.61

1.19

-9.91

-12.04

4.02

-9.46

19275

2092.9

18882.7

836.5

17918.9

4460

13458.9

2772.1

-520.7

10686.8

18297.4

1494.2

17395.7

1328.2

16067.5

4505.6

11561.9

2440.6

-500.3

9121.3

0

2.5

41366.3

97.96

41366.3

95.07

% Var

-10.9

% Var

5.34

40.07

8.55

-37.02

11.52

-1.01

16.41

13.58

4.08

17.16

0

3.04

The sales is pegged at Rs. 5042.50 millions for the June 2012 quarter. The mentioned figure indicates decline with the sales recorded at Rs.

5659.40 millions during the year-ago period.The Net proft of the company remain more or less same to Rs. 3152.70 millions from Rs.

?482.10 millions ,decline by -9.46%.The Operating Profit of the company witnessed a decrease to 5067.30 millions from 5548.30 millions.

Dabur India

Quarter ended

Year to Date

201206

201106

Sales

10174.7

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

216.2

1709.3

16.9

1692.4

179.2

1513.2

324

0

1189.2

Equity

PBIDTM(%)

1742.8

16.8

Year ended

201206

201106

8466.7

% Var

20.17

201203

201103

8466.7

% Var

20.17

37593.3

32806.1

% Var

14.59

10174.7

145

1399.5

65.6

1333.9

178.8

1155.1

244.1

0

911

49.1

22.14

-74.24

26.88

0.22

31

32.73

0

30.54

216.2

1709.3

16.9

1692.4

179.2

1513.2

324

0

1189.2

145

1399.5

65.6

1333.9

178.8

1155.1

244.1

0

911

49.1

22.14

-74.24

26.88

0.22

31

32.73

0

30.54

533.5

7119

141

6978

658.8

6319.2

1237.9

0

5081.3

263.5

6761.6

120

6641.6

679

5962.7

1248.5

0

4714.3

102.47

5.29

17.5

5.07

-2.97

5.98

-0.85

0

7.78

1740.7

16.53

0.12

1.63

1742.8

16.8

1740.7

16.53

0.12

1.63

1742.1

18.94

1740.7

20.61

0.08

-8.12

The Revenue for the quarter ended June 2012 of Rs. 10174.70 millions grew by 20.17 % from Rs. 8466.70 millions.A good growth in profit

of 30.54% reported to Rs. 1189.20 millions over Rs. 911.00 millions of corresponding previous quarter.Operating profit surged to 1709.30

millions from the corresponding previous quarter of 1399.50 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Colgate Palmol. (I)

Quarter ended

Year to Date

Year ended

201206

201106

201106

201103

6293.7

7560.9

6293.7

% Var

20.13

201203

7560.9

% Var

20.13

201206

Sales

26932.3

22861.2

% Var

17.81

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

112.2

1736.7

0

1736.7

105.1

1631.6

457.4

0

1174.2

119.8

1475.4

6.1

1469.3

88

1381.3

376.9

0

1004.4

-6.34

17.71

-100

18.2

19.43

18.12

21.36

0

16.91

112.2

1736.7

0

1736.7

105.1

1631.6

457.4

0

1174.2

119.8

1475.4

6.1

1469.3

88

1381.3

376.9

0

1004.4

-6.34

17.71

-100

18.2

19.43

18.12

21.36

0

16.91

506.9

6292.1

15.1

6277

393.1

5883.9

1419.2

0

4464.7

412.4

5558.1

16.1

5542

342.5

5199.5

1173.7

0

4025.8

22.91

13.21

-6.21

13.26

14.77

13.16

20.92

0

10.9

Equity

PBIDTM(%)

136

22.97

136

23.44

0

-2.02

136

22.97

136

23.44

0

-2.02

136

23.36

136

24.31

0

-3.91

The Revenue for the quarter ended June 2012 of Rs. 7560.90 millions grew by 20.13 % from Rs. 6293.70 millions.Net profit stood at Rs.

1174.20 millions compared to Rs. 1004.40 millions in the corresponding previous quarter,high by 16.91%.OP of the company witnessed a

marginal growth to 1736.70 millions from 1475.40 millions in the same quarter last year.

Greenply Industries

Quarter ended

Year to Date

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

4308.37

13.42

512.83

158

354.83

124.41

230.42

50.74

6.32

179.67

3526.82

12.23

392.34

132.72

259.63

113.47

146.16

16.59

16.59

129.57

Equity

PBIDTM(%)

120.68

11.9

120.68

10.65

% Var

22.16

Year ended

201206

201106

9.73

30.71

19.05

36.67

9.64

57.65

205.85

-61.9

38.67

4308.37

13.42

512.83

158

354.83

124.41

230.42

50.74

6.32

179.67

3526.82

12.23

392.34

132.72

259.63

113.47

146.16

16.59

16.59

129.57

0

11.72

120.68

11.9

120.68

11.12

% Var

22.16

201203

201103

9.73

30.71

19.05

36.67

9.64

57.65

205.85

-61.9

38.67

16436.58

59.07

1724.73

607.82

1116.91

467.71

649.19

115.09

88.58

534.1

12174.12

46.74

1161.25

442.67

718.58

409.94

308.63

57.74

57.74

250.89

0

7

120.68

10.49

120.68

9.54

% Var

35.01

26.38

48.52

37.31

55.43

14.09

110.35

99.32

53.41

112.88

0

10.01

The company witnessed a 22.16% growth in the revenue at Rs. 4308.37 millions for the quarter ended June 2012 as compared to Rs.

3526.82 millions during the year-ago period.Net Profit recorded in the quarter ended June 2012 rise to 38.67% to Rs. 179.67 millions

compared to R. 129.57 millions in corresponding previous quarter.Operating profit surged to 512.83 millions from the corresponding

previous quarter of 392.34 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Indian Bank

Quarter ended

Year to Date

201206

201106

Interest Earned

33738.02

Other Income

Interest Expended

Operating Expenses

Operating Profit

Prov.& Contigencies

Tax

PAT

2227.02

22206.47

5356.22

6945.32

1457.02

2327.86

4617.46

4297.7

24.9

Equity

OPM

Year ended

201206

201106

27814.41

% Var

21.3

201203

201103

27814.41

% Var

21.3

122313.23

93610.28

% Var

30.66

33738.02

2493.01

17514.35

5356.22

0

1769.58

1972.32

4069.31

-10.67

26.79

7.51

0

-17.66

18.03

13.47

2227.02

22206.47

5356.22

6945.32

1457.02

2327.86

4617.46

2493.01

17514.35

4981.86

0

1769.58

1972.32

4069.31

-10.67

26.79

7.51

0

-17.66

18.03

13.47

11798.3

78133.21

21869.97

0

11952.72

5209.26

17469.67

11818.89

53249.16

19263.16

0

6572.24

9203.86

17140.75

-0.17

46.73

13.53

0

81.87

-43.4

1.92

4297.7

28.08

0

-11.32

4297.7

24.9

4297.7

28.08

0

-11.32

4297.7

27.89

4297.7

35.16

0

-20.7

The revenue zoomed 21.30% to Rs. 33738.02 millions for the quarter ended June 2012 as compared to Rs. 27814.41 millions during the

corresponding quarter last year.A humble growth in net profit of 13.47% reported in the quarter ended June 2012 to Rs. 4617.46 millions

from Rs. 4069.31 millions.

Geometric

Quarter ended

Year to Date

Year ended

201206

845.3

201106

604

% Var

39.95

201206

845.3

201106

604

% Var

39.95

201203

2697.32

201103

2349.92

% Var

14.78

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

32.8

85.6

0.6

85

21.9

63.1

26.8

0

36.3

133

106.4

1.1

105.3

24

81.3

2.8

0

78.5

-75.34

-19.55

-45.45

-19.28

-8.75

-22.39

857.14

0

-53.76

32.8

85.6

0.6

85

21.9

63.1

26.8

0

36.3

133

106.4

1.1

105.3

24

81.3

2.8

0

78.5

-75.34

-19.55

-45.45

-19.28

-8.75

-22.39

857.14

0

-53.76

358.01

366.84

3.91

606.87

88.76

518.11

106.13

0

411.98

264.75

319.15

6.14

313.01

79.91

233.1

10.03

0

223.07

35.23

14.94

-36.32

93.88

11.07

122.27

958.13

0

84.69

Equity

PBIDTM(%)

125.4

10.13

125.1

17.62

0.24

-42.51

125.4

10.13

125.1

17.62

0.24

-42.51

125.34

13.6

124.85

13.58

0.39

0.14

Sales

The sales moved up 39.95% to Rs. 845.30 millions for the June 2012 quarter as compared to Rs. 604.00 millions during the year-ago

period.The Company to register a -53.76% fall in the net profit for the quarter ended June 2012.The company reported a degrowth in

operating Profit to 85.60 millions from 106.40 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Data Source : ACE Equity

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Das könnte Ihnen auch gefallen

- Results Tracker: Thursday, 02 Aug 2012Dokument7 SeitenResults Tracker: Thursday, 02 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Saturday, 21 July 2012Dokument10 SeitenResults Tracker: Saturday, 21 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Friday, 20 July 2012Dokument7 SeitenResults Tracker: Friday, 20 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 26 July 2012Dokument7 SeitenResults Tracker: Thursday, 26 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Tuesday, 07 Aug 2012Dokument7 SeitenResults Tracker: Tuesday, 07 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Tuesday, 25 Oct 2011Dokument5 SeitenResults Tracker: Tuesday, 25 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 19 July 2012Dokument4 SeitenResults Tracker: Thursday, 19 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Wednesday, 02 Nov 2011Dokument8 SeitenResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Wednesday, 19 Oct 2011Dokument6 SeitenResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 16 Aug 2012Dokument8 SeitenResults Tracker: Thursday, 16 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Wednesday, 08 Aug 2012Dokument4 SeitenResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Saturday, 14 July 2012Dokument4 SeitenResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 20 Oct 2011Dokument6 SeitenResults Tracker: Thursday, 20 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Tuesday, 01 Nov 2011Dokument13 SeitenResults Tracker: Tuesday, 01 Nov 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 03 Nov 2011Dokument6 SeitenResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 21.04.12Dokument3 SeitenResults Tracker 21.04.12Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Financial Modeling of TCS LockDokument62 SeitenFinancial Modeling of TCS LocksharadkulloliNoch keine Bewertungen

- Faysal Bank Spread Accounts 2012Dokument133 SeitenFaysal Bank Spread Accounts 2012waqas_haider_1Noch keine Bewertungen

- Results Tracker 07.11.2013Dokument3 SeitenResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Friday, 21 Oct 2011Dokument8 SeitenResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Saturday, 28 July 2012Dokument13 SeitenResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Q2FY12 - Results Tracker 28.10.11Dokument7 SeitenQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Saturday, 04 Aug 2012Dokument7 SeitenResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- PTCLDokument169 SeitenPTCLSumaiya Muzaffar100% (1)

- Auto Model PDFDokument21 SeitenAuto Model PDFAAOI2Noch keine Bewertungen

- Accounts AssignmentDokument15 SeitenAccounts AssignmentGagandeep SinghNoch keine Bewertungen

- Financial Analysis of Lucky Cement LTD For The Year 2013Dokument11 SeitenFinancial Analysis of Lucky Cement LTD For The Year 2013Fightclub ErNoch keine Bewertungen

- Fin Analysis - Tvs Motor CompanyDokument16 SeitenFin Analysis - Tvs Motor Companygarconfrancais06Noch keine Bewertungen

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Dokument11 SeitenProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniNoch keine Bewertungen

- Results Tracker: Tuesday, 18 Oct 2011Dokument4 SeitenResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Dokument9 SeitenTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaNoch keine Bewertungen

- InfosysDokument9 SeitenInfosysvibhach1Noch keine Bewertungen

- Weekly Market Outlook 23.04.12Dokument5 SeitenWeekly Market Outlook 23.04.12Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Assignments Semester IDokument13 SeitenAssignments Semester Idriger43Noch keine Bewertungen

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDokument68 SeitenCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNoch keine Bewertungen

- Final Final HDFCDokument46 SeitenFinal Final HDFCJhonny BoyeeNoch keine Bewertungen

- Colgate Palmolive (India)Dokument22 SeitenColgate Palmolive (India)Indraneal BalasubramanianNoch keine Bewertungen

- Redco Textiles LimitedDokument18 SeitenRedco Textiles LimitedUmer FarooqNoch keine Bewertungen

- HDFC Bank AnnualReport 2012 13Dokument180 SeitenHDFC Bank AnnualReport 2012 13Rohan BahriNoch keine Bewertungen

- Accounts AssignmentDokument7 SeitenAccounts AssignmentHari PrasaadhNoch keine Bewertungen

- Financial Reporting and Analysis ProjectDokument15 SeitenFinancial Reporting and Analysis Projectsonar_neel100% (1)

- Yes Bank P&LDokument4 SeitenYes Bank P&LsasikumarmmbaNoch keine Bewertungen

- CIL (Maintain Buy) 3QFY12 Result Update 25 January 2012 (IFIN)Dokument5 SeitenCIL (Maintain Buy) 3QFY12 Result Update 25 January 2012 (IFIN)Gaayaatrii BehuraaNoch keine Bewertungen

- Oil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)Dokument16 SeitenOil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)ravi198522Noch keine Bewertungen

- Results Tracker 18 August 2011Dokument3 SeitenResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Bajaj Hindusthan (BAJHIN) : Underperformance To ContinueDokument6 SeitenBajaj Hindusthan (BAJHIN) : Underperformance To Continuedrsivaprasad7Noch keine Bewertungen

- Study Of: Prof. Neeraj AmarnaniDokument20 SeitenStudy Of: Prof. Neeraj Amarnanipankil_dalalNoch keine Bewertungen

- Cost Accounting ProjectDokument14 SeitenCost Accounting Projectdipesh bajajNoch keine Bewertungen

- MorningNote Keynote PDFDokument2 SeitenMorningNote Keynote PDFEric MillerNoch keine Bewertungen

- Siyaram Silk Mills Result UpdatedDokument9 SeitenSiyaram Silk Mills Result UpdatedAngel BrokingNoch keine Bewertungen

- Kingsbury AR - 2012 PDFDokument52 SeitenKingsbury AR - 2012 PDFSanath FernandoNoch keine Bewertungen

- Itc LTD Financial Analysis: Group 4Dokument20 SeitenItc LTD Financial Analysis: Group 4Kanav ChaudharyNoch keine Bewertungen

- Information On Dena BankDokument17 SeitenInformation On Dena BankPradip VishwakarmaNoch keine Bewertungen

- Dena Bank (DENBAN) : Core Performance Drives ProfitabilityDokument7 SeitenDena Bank (DENBAN) : Core Performance Drives ProfitabilitySachin GuptaNoch keine Bewertungen

- Itc Limited: Equity AnalysisDokument15 SeitenItc Limited: Equity AnalysisrskatochNoch keine Bewertungen

- Results Tracker: Friday, 03 Feb 2012Dokument7 SeitenResults Tracker: Friday, 03 Feb 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Income Statement: Altus Honda Cars Pakistan LimitedDokument23 SeitenIncome Statement: Altus Honda Cars Pakistan LimitedTahir HussainNoch keine Bewertungen

- Q1FY12 Results Tracker 17th August-Mansukh Investment and TradingDokument5 SeitenQ1FY12 Results Tracker 17th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Financial AccountingDokument18 SeitenFinancial AccountingBhargavi RathodNoch keine Bewertungen

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 08.11.2013Dokument3 SeitenResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 09.11.2013Dokument3 SeitenResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 07.11.2013Dokument3 SeitenResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Horizontal and Vertical Analysis Excel Workbook Vintage Value InvestingDokument2 SeitenHorizontal and Vertical Analysis Excel Workbook Vintage Value InvestingWensky RagpalaNoch keine Bewertungen

- Pt. Wijaya Karya (Persero) TBK 30 September 2020Dokument213 SeitenPt. Wijaya Karya (Persero) TBK 30 September 2020Ammaliya AnjaniNoch keine Bewertungen

- BusCom Intercompany SalesDokument13 SeitenBusCom Intercompany SalesCarmela BautistaNoch keine Bewertungen

- Financial Accounting BBA MUDokument19 SeitenFinancial Accounting BBA MUbhimNoch keine Bewertungen

- Advanced Accounting 2BDokument4 SeitenAdvanced Accounting 2BHarusiNoch keine Bewertungen

- Accountancy Model QuestionsDokument19 SeitenAccountancy Model QuestionsSunil Kumar AgarwalaNoch keine Bewertungen

- FABM 2 - Midterm ExamDokument6 SeitenFABM 2 - Midterm ExamJessica Esmeña100% (1)

- E3 (ANS) - Depreciation of Non-Current AssetsDokument18 SeitenE3 (ANS) - Depreciation of Non-Current AssetsansonNoch keine Bewertungen

- Tally Practical RecordDokument95 SeitenTally Practical RecordPiyali Maiti100% (2)

- Class Exercise Session 5, 6 and 7Dokument20 SeitenClass Exercise Session 5, 6 and 7Sumeet Kumar100% (1)

- Problems For CBDokument28 SeitenProblems For CBĐức HàNoch keine Bewertungen

- Emanuel Swedenborg Menny Es PokolDokument7 SeitenEmanuel Swedenborg Menny Es PokolImre VíghNoch keine Bewertungen

- Funds Flow - ZUARIDokument55 SeitenFunds Flow - ZUARIVenkatramulu Kate50% (2)

- 633862581-21 Solution (ArtnershipDokument36 Seiten633862581-21 Solution (ArtnershipPhilip K BugaNoch keine Bewertungen

- Audit of LiabilitiesDokument33 SeitenAudit of Liabilitiesxxxxxxxxx96% (28)

- FSA 8e Ch05 SMDokument39 SeitenFSA 8e Ch05 SMnufusNoch keine Bewertungen

- Amount of Investment Bonus Method: Than Investment Greater Than InvestmentDokument14 SeitenAmount of Investment Bonus Method: Than Investment Greater Than InvestmentElla Mae Clavano NuicaNoch keine Bewertungen

- Accounting For Government and Not-For-Profit Organizations: ACCO 30033Dokument24 SeitenAccounting For Government and Not-For-Profit Organizations: ACCO 30033hehehedontmind me100% (1)

- May 2020 - AP Drill 3 (Investments and Inventories) - FinalDokument7 SeitenMay 2020 - AP Drill 3 (Investments and Inventories) - FinalROMAR A. PIGANoch keine Bewertungen

- Engineering Economics Financial Decision Making For Engineers Canadian 6th Edition Fraser Test Bank Full Chapter PDFDokument41 SeitenEngineering Economics Financial Decision Making For Engineers Canadian 6th Edition Fraser Test Bank Full Chapter PDFRobertFordicwr100% (15)

- At 7Dokument9 SeitenAt 7Leah Jane Tablante Esguerra100% (1)

- 12 x10 Financial Statement AnalysisDokument22 Seiten12 x10 Financial Statement AnalysisRaffi Tamayo92% (25)

- Chapters Marathon Questionnaire Group 2 Nov 22Dokument27 SeitenChapters Marathon Questionnaire Group 2 Nov 22Abhishek GoenkaNoch keine Bewertungen

- University of Mauritius: Faculty of Law and ManagementDokument9 SeitenUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNoch keine Bewertungen

- Chapter 16 Problem SolvingDokument3 SeitenChapter 16 Problem SolvingWeStan LegendsNoch keine Bewertungen

- Igcse May 2022 Paper 2R MSDokument10 SeitenIgcse May 2022 Paper 2R MSmihirNoch keine Bewertungen

- Ia3 Midterm QuizDokument11 SeitenIa3 Midterm QuizJalyn Jalando-onNoch keine Bewertungen

- Accounting QuestionsDokument12 SeitenAccounting Questionssnowd.0820Noch keine Bewertungen

- Income Statement SimDokument5 SeitenIncome Statement Simjustwon100% (1)

- Unit 4 Cash Flow StatementDokument26 SeitenUnit 4 Cash Flow Statementjatin4verma-2Noch keine Bewertungen