Beruflich Dokumente

Kultur Dokumente

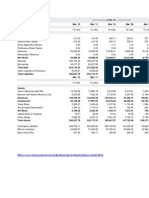

Key Financial Ratios of Shree Cements

Hochgeladen von

kishandabasiyaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Key Financial Ratios of Shree Cements

Hochgeladen von

kishandabasiyaCopyright:

Verfügbare Formate

Key Financial Ratios of

Shree Cements

------------------- in Rs. Cr. -------------------

Mar '05

Mar '06

Mar '07

Mar '08

Ma

10.00

10.00

10.00

10.00

4.00

5.00

6.00

8.00

50.02

63.26

170.49

248.40

27

172.85

199.45

402.74

605.16

77

37.63

37.69

82.08

147.89

30

--

--

--

--

28.94

31.71

42.33

41.04

8.46

8.08

11.29

17.76

Gross Profit Margin(%)

26.12

30.15

42.45

18.33

Cash Profit Margin(%)

25.08

26.13

42.84

36.23

Adjusted Cash Margin(%)

25.62

28.74

41.46

36.23

Net Profit Margin(%)

4.79

2.63

12.43

11.96

Adjusted Net Profit Margin(%)

5.09

2.07

11.04

11.96

Return On Capital Employed(%)

9.38

5.76

13.62

23.37

Return On Net Worth(%)

10.04

6.21

38.94

38.69

Adjusted Return on Net Worth(%)

10.67

4.88

34.61

46.03

Return on Assets Excluding Revaluations

3.69

1.95

10.28

10.48

Return on Assets Including Revaluations

4.01

2.06

10.58

10.48

10.29

6.16

13.62

23.78

Current Ratio

0.69

0.71

2.30

1.84

Quick Ratio

0.52

0.43

1.82

1.70

Debt Equity Ratio

0.98

1.17

1.94

1.89

Long Term Debt Equity Ratio

0.80

1.03

1.94

1.84

Interest Cover

2.71

2.90

17.53

9.13

Total Debt to Owners Fund

0.98

1.17

1.94

1.89

Financial Charges Coverage Ratio

8.56

16.01

51.07

17.93

Financial Charges Coverage Ratio Post Tax

8.38

15.66

51.67

15.21

8.35

6.18

9.12

28.34

Debtors Turnover Ratio

22.44

32.92

63.01

55.73

Investments Turnover Ratio

20.27

11.14

15.74

28.34

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

Operating Profit Margin(%)

Profit Before Interest And Tax Margin(%)

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Debt Coverage Ratios

Management Efficiency Ratios

Inventory Turnover Ratio

Fixed Assets Turnover Ratio

1.09

1.12

1.85

0.96

Total Assets Turnover Ratio

1.05

1.08

1.05

1.09

Asset Turnover Ratio

0.61

0.54

0.85

0.96

Average Raw Material Holding

45.43

78.76

29.69

10.54

Average Finished Goods Held

3.51

7.82

4.01

4.45

Number of Days In Working Capital

0.50

-14.95

113.27

98.02

19.24

22.60

18.42

17.85

--

--

--

--

20.14

20.90

15.98

17.06

--

--

--

0.81

Dividend Payout Ratio Net Profit

54.66

107.92

13.46

12.52

Dividend Payout Ratio Cash Profit

10.35

9.71

3.90

4.41

Earning Retention Ratio

48.59

-37.19

84.86

89.48

Cash Earning Retention Ratio

89.77

90.10

95.97

95.87

1.82

1.73

1.49

1.61

Mar '05

Mar '06

Mar '07

Mar '08

Ma

8.34

5.28

50.81

74.74

16

83.10

85.05

130.48

193.13

34

Profit & Loss Account Ratios

Material Cost Composition

Imported Composition of Raw Materials

Consumed

Selling Distribution Cost Composition

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

AdjustedCash Flow Times

Earnings Per Share

Book Value

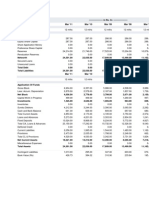

Key Financial Ratios of

Shree Cements

------------------- in Rs. Cr. -------------------

Mar '05

Mar '06

Mar '07

Mar '08

Ma

10.00

10.00

10.00

10.00

4.00

5.00

6.00

8.00

50.02

63.26

170.49

248.40

27

172.85

199.45

402.74

605.16

77

37.63

37.69

82.08

147.89

30

--

--

--

--

28.94

31.71

42.33

41.04

8.46

8.08

11.29

17.76

Gross Profit Margin(%)

26.12

30.15

42.45

18.33

Cash Profit Margin(%)

25.08

26.13

42.84

36.23

Adjusted Cash Margin(%)

25.62

28.74

41.46

36.23

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

Operating Profit Margin(%)

Profit Before Interest And Tax Margin(%)

Net Profit Margin(%)

4.79

2.63

12.43

11.96

Adjusted Net Profit Margin(%)

5.09

2.07

11.04

11.96

Return On Capital Employed(%)

9.38

5.76

13.62

23.37

Return On Net Worth(%)

10.04

6.21

38.94

38.69

Adjusted Return on Net Worth(%)

10.67

4.88

34.61

46.03

Return on Assets Excluding Revaluations

3.69

1.95

10.28

10.48

Return on Assets Including Revaluations

4.01

2.06

10.58

10.48

10.29

6.16

13.62

23.78

Current Ratio

0.69

0.71

2.30

1.84

Quick Ratio

0.52

0.43

1.82

1.70

Debt Equity Ratio

0.98

1.17

1.94

1.89

Long Term Debt Equity Ratio

0.80

1.03

1.94

1.84

Interest Cover

2.71

2.90

17.53

9.13

Total Debt to Owners Fund

0.98

1.17

1.94

1.89

Financial Charges Coverage Ratio

8.56

16.01

51.07

17.93

Financial Charges Coverage Ratio Post Tax

8.38

15.66

51.67

15.21

8.35

6.18

9.12

28.34

Debtors Turnover Ratio

22.44

32.92

63.01

55.73

Investments Turnover Ratio

20.27

11.14

15.74

28.34

Fixed Assets Turnover Ratio

1.09

1.12

1.85

0.96

Total Assets Turnover Ratio

1.05

1.08

1.05

1.09

Asset Turnover Ratio

0.61

0.54

0.85

0.96

Average Raw Material Holding

45.43

78.76

29.69

10.54

Average Finished Goods Held

3.51

7.82

4.01

4.45

Number of Days In Working Capital

0.50

-14.95

113.27

98.02

19.24

22.60

18.42

17.85

--

--

--

--

20.14

20.90

15.98

17.06

--

--

--

0.81

Dividend Payout Ratio Net Profit

54.66

107.92

13.46

12.52

Dividend Payout Ratio Cash Profit

10.35

9.71

3.90

4.41

Earning Retention Ratio

48.59

-37.19

84.86

89.48

Cash Earning Retention Ratio

89.77

90.10

95.97

95.87

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Debt Coverage Ratios

Management Efficiency Ratios

Inventory Turnover Ratio

Profit & Loss Account Ratios

Material Cost Composition

Imported Composition of Raw Materials

Consumed

Selling Distribution Cost Composition

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

AdjustedCash Flow Times

Earnings Per Share

Book Value

1.82

1.73

1.49

1.61

Mar '05

Mar '06

Mar '07

Mar '08

Ma

8.34

5.28

50.81

74.74

16

83.10

85.05

130.48

193.13

34

Das könnte Ihnen auch gefallen

- Chettinadu Cment - FinancialsDokument10 SeitenChettinadu Cment - FinancialsvmktptNoch keine Bewertungen

- Balance Sheet of Ambuja CementsDokument6 SeitenBalance Sheet of Ambuja CementsShirish GutheNoch keine Bewertungen

- Balance Sheet of Bharti AirtelDokument7 SeitenBalance Sheet of Bharti Airteltiku_048Noch keine Bewertungen

- Valuation SheetDokument23 SeitenValuation SheetDanish KhanNoch keine Bewertungen

- Balance Sheet of Bharat Petroleum CorporationDokument4 SeitenBalance Sheet of Bharat Petroleum CorporationPradipna LodhNoch keine Bewertungen

- Key Financial Ratios of Infosys TechnologiesDokument6 SeitenKey Financial Ratios of Infosys TechnologiesRishita SharmaNoch keine Bewertungen

- Horizontal Analysis Balance Sheet Profit & Loss Key RatiosDokument18 SeitenHorizontal Analysis Balance Sheet Profit & Loss Key Ratiosvinayjain221Noch keine Bewertungen

- Reliance Industries: Previous YearsDokument6 SeitenReliance Industries: Previous YearsSweta ChakravartyNoch keine Bewertungen

- Balance Sheet of Axis BankDokument8 SeitenBalance Sheet of Axis BankKushal GuptaNoch keine Bewertungen

- Key Financial Ratios of ACCDokument2 SeitenKey Financial Ratios of ACCcool_mani11Noch keine Bewertungen

- Mahindra & Mahindra Financial Services: Previous YearsDokument4 SeitenMahindra & Mahindra Financial Services: Previous YearsJacob KvNoch keine Bewertungen

- Balance Sheet of Hero Motocorp - in Rs. Cr.Dokument16 SeitenBalance Sheet of Hero Motocorp - in Rs. Cr.Khushboo VishwakarmaNoch keine Bewertungen

- Balance Sheet 29Dokument15 SeitenBalance Sheet 29Jasleen KaurNoch keine Bewertungen

- Money RolDokument2 SeitenMoney RolAman BansalNoch keine Bewertungen

- Previous Years: Tata Motor S - in Rs. Cr.Dokument28 SeitenPrevious Years: Tata Motor S - in Rs. Cr.priya4112Noch keine Bewertungen

- M&M Annual ReportDokument21 SeitenM&M Annual ReportThakkar GayatriNoch keine Bewertungen

- Balance Sheet of Chettinad CementDokument2 SeitenBalance Sheet of Chettinad CementManish SharmaNoch keine Bewertungen

- Balance Sheet: Sources of FundsDokument4 SeitenBalance Sheet: Sources of FundsYogesh GuwalaniNoch keine Bewertungen

- Balance Sheet of InfosysDokument5 SeitenBalance Sheet of InfosysLincy SubinNoch keine Bewertungen

- in Rs. Cr.Dokument4 Seitenin Rs. Cr.Ananthu BalachandranNoch keine Bewertungen

- Six Yrs Per OGDCLDokument2 SeitenSix Yrs Per OGDCLMAk KhanNoch keine Bewertungen

- All Bank of RajasthanDokument7 SeitenAll Bank of RajasthanAnonymous 6TyOtlNoch keine Bewertungen

- Audited Financial Results March 2009Dokument40 SeitenAudited Financial Results March 2009Ashwin SwamiNoch keine Bewertungen

- F Steel Authority of IndiaDokument4 SeitenF Steel Authority of IndiaJatinGuleriaNoch keine Bewertungen

- Key Financial Ratios of Tata Consultancy ServicesDokument13 SeitenKey Financial Ratios of Tata Consultancy ServicesSanket KhairnarNoch keine Bewertungen

- Balance Sheet of Indian Oil CorporationDokument4 SeitenBalance Sheet of Indian Oil CorporationPradipna LodhNoch keine Bewertungen

- Auto SectorDokument38 SeitenAuto SectorvimabodaNoch keine Bewertungen

- Asian PaintsDokument10 SeitenAsian PaintsNeer YadavNoch keine Bewertungen

- Idea Cellular: Previous YearsDokument12 SeitenIdea Cellular: Previous YearsSumit MalikNoch keine Bewertungen

- Key Financial Ratios Mar '12 Mar '11 Mar '10 Mar '09 Mar '08Dokument4 SeitenKey Financial Ratios Mar '12 Mar '11 Mar '10 Mar '09 Mar '08Madani MaddyNoch keine Bewertungen

- Comman Size Balance Sheet of Manappuram Finance Ltd. For The Ending Year March 31,2007-2011Dokument4 SeitenComman Size Balance Sheet of Manappuram Finance Ltd. For The Ending Year March 31,2007-2011Amarjeet MahajanNoch keine Bewertungen

- Balance Sheet of Axis Bank: - in Rs. Cr.Dokument37 SeitenBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniNoch keine Bewertungen

- Balance Sheet of Titan IndustriesDokument24 SeitenBalance Sheet of Titan IndustriesAkanksha NandaNoch keine Bewertungen

- Ashok LeylandDokument13 SeitenAshok LeylandNeha GuptaNoch keine Bewertungen

- Airtel RatiosDokument9 SeitenAirtel RatiosakshayuppalNoch keine Bewertungen

- Previous Years : Reliance Industrie SDokument13 SeitenPrevious Years : Reliance Industrie SAditya KumarNoch keine Bewertungen

- Balance Sheet of Bajaj AutoDokument6 SeitenBalance Sheet of Bajaj Autogurjit20Noch keine Bewertungen

- Networth - 12,919.82 - 5,082.40 - 2,951.19 - 3,898.45Dokument3 SeitenNetworth - 12,919.82 - 5,082.40 - 2,951.19 - 3,898.45Shashank MadimaneNoch keine Bewertungen

- Hindustan Petroleum Corporation: PrintDokument2 SeitenHindustan Petroleum Corporation: PrintRakesh RoshanNoch keine Bewertungen

- Maruti Suzuki India LTDDokument8 SeitenMaruti Suzuki India LTDRushikesh PawarNoch keine Bewertungen

- Infosys Technologies LTD RatioDokument4 SeitenInfosys Technologies LTD Ratioron1436Noch keine Bewertungen

- Cse Daily On 28 06 2012Dokument15 SeitenCse Daily On 28 06 2012colomboanalystNoch keine Bewertungen

- Development Sales Lacking: Wheelock Properties (S)Dokument7 SeitenDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerNoch keine Bewertungen

- in Rs. Cr.Dokument19 Seitenin Rs. Cr.Ashish Kumar SharmaNoch keine Bewertungen

- Archies Financial StatmentsDokument5 SeitenArchies Financial StatmentsShitiz JainNoch keine Bewertungen

- Balance Sheet of Idea CellularDokument4 SeitenBalance Sheet of Idea CellularJohn NewmanNoch keine Bewertungen

- Cash Flow of Cadbury India: - in Rs. Cr.Dokument6 SeitenCash Flow of Cadbury India: - in Rs. Cr.Somraj RoyNoch keine Bewertungen

- 17 Financial HighlightsDokument2 Seiten17 Financial HighlightsTahir HussainNoch keine Bewertungen

- Balance Sheet of NTPC: - in Rs. Cr.Dokument15 SeitenBalance Sheet of NTPC: - in Rs. Cr.Ram LakhanNoch keine Bewertungen

- Balance Sheet P&LDokument36 SeitenBalance Sheet P&Lshashank_shekhar_74Noch keine Bewertungen

- Key Financial Ratios of Ultratech Cement: Next Years Previous YearsDokument6 SeitenKey Financial Ratios of Ultratech Cement: Next Years Previous YearsRamana VaitlaNoch keine Bewertungen

- Balance Sheet of ICICI Bank: - in Rs. Cr.Dokument10 SeitenBalance Sheet of ICICI Bank: - in Rs. Cr.teslinbaby2Noch keine Bewertungen

- FMCG Dividend PolicyDokument11 SeitenFMCG Dividend PolicyNilkesh ChikhaliyaNoch keine Bewertungen

- Ten Year Highlights 0910Dokument1 SeiteTen Year Highlights 0910Hitesh GurnasinghaniNoch keine Bewertungen

- Balance Sheet of Reliance IndustriesDokument7 SeitenBalance Sheet of Reliance IndustriesNEHAAA26Noch keine Bewertungen

- Capital and Liabilities:: ApplicationDokument6 SeitenCapital and Liabilities:: ApplicationKeshav GoyalNoch keine Bewertungen

- Bongaigaon Ref - FinanDokument10 SeitenBongaigaon Ref - FinansdNoch keine Bewertungen

- Balance Sheet: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Dokument3 SeitenBalance Sheet: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Rajnish KumarNoch keine Bewertungen

- Profitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019Von EverandProfitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019Noch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- RR No. 11-2018 SummaryDokument6 SeitenRR No. 11-2018 SummaryCaliNoch keine Bewertungen

- (D) The Liability Is Payable To A Specifically Identified PayeeDokument13 Seiten(D) The Liability Is Payable To A Specifically Identified PayeeAngela Luz de LimaNoch keine Bewertungen

- CH 6Dokument15 SeitenCH 6anjo hosmerNoch keine Bewertungen

- P2 07Dokument3 SeitenP2 07rietzhel22Noch keine Bewertungen

- Capital and Revenue ExpendituresDokument5 SeitenCapital and Revenue ExpendituresALI KHANNoch keine Bewertungen

- Prequalifying Exam Level 2 3 Set A AK FSUU AccountingDokument9 SeitenPrequalifying Exam Level 2 3 Set A AK FSUU AccountingRobert CastilloNoch keine Bewertungen

- Budgeting in HospitalsDokument25 SeitenBudgeting in HospitalsPraissy Vineesh92% (12)

- Cae15 Chap16 TheoriesDokument21 SeitenCae15 Chap16 TheoriesJomarNoch keine Bewertungen

- Quiz 6 Inventory ManagementDokument6 SeitenQuiz 6 Inventory ManagementCindy Jane OmillioNoch keine Bewertungen

- Merchandising - Review Materials (Theories)Dokument69 SeitenMerchandising - Review Materials (Theories)julsNoch keine Bewertungen

- Advance Loss of Profit InsuranceDokument13 SeitenAdvance Loss of Profit InsuranceshreemanthsNoch keine Bewertungen

- DWA 2009 Q2 Earnings Call TranscriptDokument13 SeitenDWA 2009 Q2 Earnings Call Transcriptdieu thuyenNoch keine Bewertungen

- Hindustan Unilever Limited: Statement of Profit and LossDokument22 SeitenHindustan Unilever Limited: Statement of Profit and LossSakshi Jain Jaipuria JaipurNoch keine Bewertungen

- Stuvia 2689947 Fac1601 Assignment 5 Answers Semester 2 2023 Distinction GuaranteedDokument40 SeitenStuvia 2689947 Fac1601 Assignment 5 Answers Semester 2 2023 Distinction GuaranteedPhumelele NxumaloNoch keine Bewertungen

- Books-A-Million Inc: (BAMM)Dokument1 SeiteBooks-A-Million Inc: (BAMM)Old School ValueNoch keine Bewertungen

- Introduction To Receivables ManagementDokument74 SeitenIntroduction To Receivables ManagementArif RehmanNoch keine Bewertungen

- ACC501 All Solved Mid Term MCQsDokument31 SeitenACC501 All Solved Mid Term MCQsMuhammad aqeeb qureshiNoch keine Bewertungen

- Catering Policy 2005Dokument23 SeitenCatering Policy 2005samim2010Noch keine Bewertungen

- Vinall 2014 - ValuationDokument19 SeitenVinall 2014 - ValuationOmar MalikNoch keine Bewertungen

- Group AcctsDokument16 SeitenGroup AcctsMichael AsieduNoch keine Bewertungen

- Financial Analysis of Reliance Industries Limited: A Project Report OnDokument108 SeitenFinancial Analysis of Reliance Industries Limited: A Project Report OnVirendra Jha0% (1)

- Benefit/Cost Ratio: Engineering EconomyDokument12 SeitenBenefit/Cost Ratio: Engineering EconomyChristine Alderama MurilloNoch keine Bewertungen

- Responsibility CenterDokument14 SeitenResponsibility CenterKashif TradingNoch keine Bewertungen

- Case 6 - McKinsey - Direct Mail RetailerDokument3 SeitenCase 6 - McKinsey - Direct Mail Retailern00bzt0rNoch keine Bewertungen

- Fund. of ABM LAA KEYDokument2 SeitenFund. of ABM LAA KEYAngelique HernandezNoch keine Bewertungen

- Module 3 Financial Ratios Practice ProblemsDokument2 SeitenModule 3 Financial Ratios Practice ProblemsMeg CruzNoch keine Bewertungen

- Dn1212 Ezine - CompressedDokument144 SeitenDn1212 Ezine - CompressedWillow100% (1)

- 5 Air Canada v. Commissioner of Internal RevenueDokument54 Seiten5 Air Canada v. Commissioner of Internal RevenueVianice BaroroNoch keine Bewertungen

- Indian US Gaap and IFRSDokument52 SeitenIndian US Gaap and IFRSAnkit JaniNoch keine Bewertungen

- Full Download Solution Manual For Financial Accounting A Business Process Approach 3 e 3rd Edition Jane L Reimers PDF Full ChapterDokument36 SeitenFull Download Solution Manual For Financial Accounting A Business Process Approach 3 e 3rd Edition Jane L Reimers PDF Full Chapterunwill.eadishvj8p100% (19)