Beruflich Dokumente

Kultur Dokumente

Source Code: Govt. Servant

Hochgeladen von

mujebaliOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Source Code: Govt. Servant

Hochgeladen von

mujebaliCopyright:

Verfügbare Formate

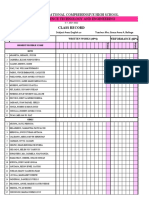

RETURN OF TOTAL INCOME/STATEMENT OF FINA

CNIC

(for Individual)

UNDER THE INCOME TAX ORDINANCE, 2001 (FOR INDIV

3520114008571 syed Mujeeb Ali Bokhari

Taxpayer's Name

Business Name

Govt. Servant Code

64013 64011 64012 64015

Source

47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 Imports

Dividend Profit on Debt Royalties/Fees (Non-Resident) Contracts (Non-Resident) Insurance Premium (Non-Resident) Advertisement Services (Non-Resident) Supply of Goods

64032 64033 64041 640511 640512 640521 640524 640525 640611 640612 640613

Payments to Ginners Contracts (Resident) Exports/related Commission/Service Foreign Indenting Commission Prizes/Winnings of cross word puzzles Winnings - Others Petroleum Commission Brokerage/Commission Advertising Commission Goods Transport Vehicles Gas consumption by CNG Station

Distribution of cigaratte and pharmaceutical products

640614 640631 640641 64072 64075 64091 64092 64101 64121 64122

64142 64143 310102 310103 210101 610401 610402 610403 310431 112001 63311

Retail Turnover upto 5 million Retail Turnover above 5 million Property Income

Capital gains on Securities held for < 6 months Capital gains on Securities held for >= 6 months and < 12 months Capital gains on Securities held for >= 12 months

Fixed Tax

Purchase of locally produced edible oil

Flying Allowance Services rendered / contracts executed outside Pakistan

Fi

84 85

Employment Termination Benefits

118301

Final/Fixed Tax Chargeable (47 to 84)

SYED MUJEEB ALI BOKHARI 352011400857-1

I, holder of CNIC No.

Verification

LIBRARIAN

Self/ Partner or Member of Association of Persons/ Representative (as defined in section 172 of the Income Tax Ordinance, 2001) of Taxpaye solemnly declare that to the best of my knowledge and belief the information given in this Return/Statement u/s 115(4) and the attached Ann Document(s) or Detail(s) is/are correct and complete in accordance with the provisions of the Income Tax Ordinance, 2001 and Income Tax Rul the verification, which is not applicable, should be scored out).

Date :

Note-1 : Grey blank fields are for official use

18.10.2011

Signatures

Back to Control Centre

NCOME/STATEMENT OF FINAL TAXATION

TAX ORDINANCE, 2001 (FOR INDIVIDUAL / AOP)

IT-2 (Page 2 of 2)

N NTN Tax Year RTO/LTU

2413069-9

2011

0 Tax Chargeable

-

Receipts/Value

Rate (%)

Code

92013 92011 92012 92015 92032 92033 92041 920511 920512

5 2 1 3 10 7.5 10 15 6 5 10 3.5 1.5 1 6 0.5 1 5 10 20 10 10 5 4 1 1

920521 920524 920525 920611 920612 920613 920614 920631 920641 92072 92075 92091 92092 92101 92121 92122 92141 92142 92143 920202 920203 920235

10 7.50 0 2 2.5 1

961041 961042 961043 920208 920234 920236

920211

9202 Acknowledgement

, in my capacity as

ARI 7-1

ncome Tax Ordinance, 2001) of Taxpayer named above, do Statement u/s 115(4) and the attached Annex(es), Statement(s), Tax Ordinance, 2001 and Income Tax Rules, 2002 (The alternative in

Signatures

Signatures & Stamp of Receiving Officer with Date

Back to Control Centre

age 2 of 2)

069-9

11

-

0 argeable

amp with Date

Centre

Das könnte Ihnen auch gefallen

- IT-2 2011 With Formula and Surcharge and Annex DDokument15 SeitenIT-2 2011 With Formula and Surcharge and Annex DPatti DaudNoch keine Bewertungen

- IT Return IT1 WithAnnexure 23454434Dokument3 SeitenIT Return IT1 WithAnnexure 23454434khurramacaaNoch keine Bewertungen

- "Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1Dokument6 Seiten"Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1hina08855Noch keine Bewertungen

- NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage CapitalDokument5 SeitenNTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capitalhati1Noch keine Bewertungen

- Tax ReturnDokument7 SeitenTax Returnsyedfaisal_sNoch keine Bewertungen

- 201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFDokument7 Seiten201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFOmer PashaNoch keine Bewertungen

- Akhtar Tax ReturnDokument7 SeitenAkhtar Tax Returnsyedfaisal_sNoch keine Bewertungen

- Return ChallanDokument20 SeitenReturn Challansyedfaisal_sNoch keine Bewertungen

- Taxation in SA 2009 2008 - 09pdfDokument132 SeitenTaxation in SA 2009 2008 - 09pdfvikramaditya_n84Noch keine Bewertungen

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDokument11 SeitenTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86Noch keine Bewertungen

- 0605Dokument6 Seiten0605Ivy TampusNoch keine Bewertungen

- Return Saifee Hsopital TrustDokument6 SeitenReturn Saifee Hsopital TrustAnonymous u6Zg0QhNoch keine Bewertungen

- Bir Form 0605Dokument2 SeitenBir Form 0605alona_245883% (6)

- BIR 1702Q FormDokument3 SeitenBIR 1702Q FormyellahfellahNoch keine Bewertungen

- Form Sr. Instruction Instructions For Filling in Return Form & Wealth StatementDokument8 SeitenForm Sr. Instruction Instructions For Filling in Return Form & Wealth StatementajgondalNoch keine Bewertungen

- 21 Useful Charts For Tax ComplianceDokument24 Seiten21 Useful Charts For Tax Compliancevrj1091Noch keine Bewertungen

- BIR Form 2307Dokument20 SeitenBIR Form 2307Lean Isidro0% (1)

- BIR FormsDokument6 SeitenBIR FormsVanessaManaoatNoch keine Bewertungen

- FGFGDokument13 SeitenFGFGamir farooquiNoch keine Bewertungen

- Appendices and Aayat Niryat FormsDokument470 SeitenAppendices and Aayat Niryat FormsAnupam GandhiNoch keine Bewertungen

- TDS Rate Financial Year 13-14Dokument10 SeitenTDS Rate Financial Year 13-14Heena AgreNoch keine Bewertungen

- Taxation of Salaried EmployeesDokument39 SeitenTaxation of Salaried Employeessailolla30Noch keine Bewertungen

- E ServicesDokument52 SeitenE ServicesRheneir MoraNoch keine Bewertungen

- Witholding TaxDokument68 SeitenWitholding TaxReynante GungonNoch keine Bewertungen

- 21 Tax Compliance Charts - Tax Print AY.16-17Dokument32 Seiten21 Tax Compliance Charts - Tax Print AY.16-17ImranMamajiwalaNoch keine Bewertungen

- 1601E BIR FormDokument7 Seiten1601E BIR FormAdonis Zoleta AranilloNoch keine Bewertungen

- Tds Rate Chart Fy 2014-15 Ay 2015-16Dokument26 SeitenTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86Noch keine Bewertungen

- Tdsnew Document With Ecc6Dokument76 SeitenTdsnew Document With Ecc6jsphdvdNoch keine Bewertungen

- 1601EDokument7 Seiten1601EEnrique Membrere SupsupNoch keine Bewertungen

- Return of Total Income/Statement of Final TaxationDokument1 SeiteReturn of Total Income/Statement of Final TaxationJazzy BadshahNoch keine Bewertungen

- 2307Dokument16 Seiten2307Analyn Velasco Matibag100% (1)

- Circular 52 2018 Customs NewDokument2 SeitenCircular 52 2018 Customs NewSteve MclarenNoch keine Bewertungen

- BIR Form 1600Dokument39 SeitenBIR Form 1600maeshach60% (5)

- Brochure Collection and Deduction of Tax at Source 2013Dokument76 SeitenBrochure Collection and Deduction of Tax at Source 2013Asif MalikNoch keine Bewertungen

- Day 1 - Training MaterialsDokument12 SeitenDay 1 - Training MaterialsFarjana AkterNoch keine Bewertungen

- Pais - Tailandia-2011-Costs of Bussiness PDFDokument73 SeitenPais - Tailandia-2011-Costs of Bussiness PDFEdutamNoch keine Bewertungen

- 1601e Form PDFDokument3 Seiten1601e Form PDFLee GhaiaNoch keine Bewertungen

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- Motorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryVon EverandMotorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryVon EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Automobile Club Revenues World Summary: Market Values & Financials by CountryVon EverandAutomobile Club Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Petroleum Bulk Stations & Terminals Revenues World Summary: Market Values & Financials by CountryVon EverandPetroleum Bulk Stations & Terminals Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryVon EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryVon EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- Miscellaneous Direct Insurance Carrier Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Direct Insurance Carrier Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryVon EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Sports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryVon EverandSports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Telephone Answering Service Revenues World Summary: Market Values & Financials by CountryVon EverandTelephone Answering Service Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Freight Transportation Arrangement Revenues World Summary: Market Values & Financials by CountryVon EverandFreight Transportation Arrangement Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Traveler Accommodation Revenues World Summary: Market Values & Financials by CountryVon EverandTraveler Accommodation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Travel Arrangement & Reservation Services Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandTravel Arrangement & Reservation Services Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Importance of Implementation of Methodologies For Teaching Sign Language For Students of Education CareersDokument9 SeitenImportance of Implementation of Methodologies For Teaching Sign Language For Students of Education CareersREBECA ROMERONoch keine Bewertungen

- Inaugration of Mayor and SB ScriptDokument6 SeitenInaugration of Mayor and SB ScriptJun Greg MaboloNoch keine Bewertungen

- SK Resolution No. 04-2021 (Approving ABYIP2022)Dokument2 SeitenSK Resolution No. 04-2021 (Approving ABYIP2022)Rene FabriaNoch keine Bewertungen

- BSUPDokument5 SeitenBSUPvidishaNoch keine Bewertungen

- Blackbirded Sicilians LouisianaDokument2 SeitenBlackbirded Sicilians LouisianaAuntie DogmaNoch keine Bewertungen

- Imbong V. Ochoa TitleDokument3 SeitenImbong V. Ochoa TitleNerry Neil TeologoNoch keine Bewertungen

- Water Resources Planning & Management: Dr.P.Vincent, Professor, Dept - of Civil Engg Mepco Schlenk Engg - College, SivakasiDokument19 SeitenWater Resources Planning & Management: Dr.P.Vincent, Professor, Dept - of Civil Engg Mepco Schlenk Engg - College, SivakasiManoj PrinceNoch keine Bewertungen

- Today's Security News - May 17 2017Dokument14 SeitenToday's Security News - May 17 2017ElmerFGuevarraNoch keine Bewertungen

- JurisdictionDokument3 SeitenJurisdictionCarmel LouiseNoch keine Bewertungen

- Re Customizing Customary International LawDokument36 SeitenRe Customizing Customary International LawLiway Czarina S RuizoNoch keine Bewertungen

- Language Maintenance and Shift: SociolinguisticDokument6 SeitenLanguage Maintenance and Shift: SociolinguisticRaul LozanoNoch keine Bewertungen

- The Anti-Rape Law of 1997 - Philippine E-Legal Forum PDFDokument7 SeitenThe Anti-Rape Law of 1997 - Philippine E-Legal Forum PDFPrhylleNoch keine Bewertungen

- New Lucena National Comprehensive High School Grade 10 Science Technology and EngineeringDokument11 SeitenNew Lucena National Comprehensive High School Grade 10 Science Technology and EngineeringGrace Anne Adoracion-BellogaNoch keine Bewertungen

- 1 StarhawkDokument5 Seiten1 StarhawkЯрослав ДерубаNoch keine Bewertungen

- Ordinance 2018-01 S. 2018 - Barangay Official Seal OrdinanceDokument5 SeitenOrdinance 2018-01 S. 2018 - Barangay Official Seal OrdinanceRobe Jan Ivan Pagulong100% (3)

- This Content Downloaded From 175.176.46.131 On Sun, 17 Oct 2021 10:10:25 UTCDokument15 SeitenThis Content Downloaded From 175.176.46.131 On Sun, 17 Oct 2021 10:10:25 UTCGen UriNoch keine Bewertungen

- Emperor of CorruptionDokument128 SeitenEmperor of CorruptionRam CharanNoch keine Bewertungen

- Hasil Tes TOEFL Batch 14Dokument169 SeitenHasil Tes TOEFL Batch 14Rizal Ozi SetiawanNoch keine Bewertungen

- Dypedahl - Snow Falling On Cedars As A Historical (Crime) NovelDokument17 SeitenDypedahl - Snow Falling On Cedars As A Historical (Crime) NoveldekonstrukcijaNoch keine Bewertungen

- Bhau Ram V Janak Singh and OrsDokument3 SeitenBhau Ram V Janak Singh and OrsVishakaRajNoch keine Bewertungen

- NC Vs FCCDokument135 SeitenNC Vs FCCjbrodkin2000Noch keine Bewertungen

- Journal 2020 PLA Strategic Support ForceDokument48 SeitenJournal 2020 PLA Strategic Support ForceDENoch keine Bewertungen

- Board Reso For Pag Ibig FundDokument2 SeitenBoard Reso For Pag Ibig FundGloria83% (12)

- Dreaming Black BoyDokument15 SeitenDreaming Black BoyChrisana Lawrence100% (6)

- Al JazeeraDokument2 SeitenAl JazeeraHarshika KapoorNoch keine Bewertungen

- Why Were The Bolsheviks Successful in 1917Dokument2 SeitenWhy Were The Bolsheviks Successful in 1917samking1234711Noch keine Bewertungen

- TANADA Vs TUVERADokument1 SeiteTANADA Vs TUVERAFranzMordenoNoch keine Bewertungen

- Ob Module 4 MDokument103 SeitenOb Module 4 MAnusha UnnikrishnanNoch keine Bewertungen

- Sample Essay - template.TOEFLDokument2 SeitenSample Essay - template.TOEFLSharon Leigh MercadoNoch keine Bewertungen

- ET Domain Project: Defence SectorDokument73 SeitenET Domain Project: Defence SectorRanjan RaoNoch keine Bewertungen