Beruflich Dokumente

Kultur Dokumente

Comparison of Halsey & Rowan incentive schemes

Hochgeladen von

Niki JosephOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Comparison of Halsey & Rowan incentive schemes

Hochgeladen von

Niki JosephCopyright:

Verfügbare Formate

Comparison of Halsey & Rowan Scheme Between the The In both is benefits output & the two schemes,

time schemes, dependent of rate the upon in of the following is standard the time fixed are the points in a of similarity both job the the or & the operation is dissimilarity:

Points

(a) (b) (c) (d) (e)

of

Similarity:

scheme. fixed. time.

guaranteed time time are for saved allowed per

completing out to unit of both is

Bonus The Higher

allowed employer by both

standard & the

saving lower rate

employee. schemes.

overhead

provided

(f) When the worker takes of the time allowed to finish the job, bonus hours in that case are same in both the schemes.

Points

of

Dissimilarity:

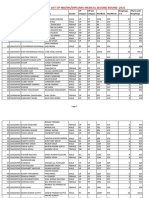

(a) If the time saved is less than of the time allowed, better bonus is provided by the Rowan scheme than the Halsey scheme. On the other hand, if the time saved is more than of the time allowed, the Halsey scheme provides better bonus than the Rowan scheme. (b) The bonus hours, under the Halsey scheme, are equal to 50% of the time saved by the workers, whereas, under the Rowan scheme, the bonus hours are that proportion of time taken as the time saved bears to the time allowed. (c) Under the Halsey scheme, more the time saved more will be the bonus; which is not true, under the Rowan scheme, if more than of the time allowed is saved by the worker. Example: The time allowed for a completing a job is 24 hours. The hourly rate is $. 4. For every 4 hours saved progressively, prepare a statement showing the bonus earned, earnings per hour & total earnings under Halsey system (50% to worker) & Rowan system of premium bonus & comment on comparative findings in the two systems.

Solution: Bonus

under Halsey Scheme=1/2*(Time Bonus under Rowan Scheme= (Time saved/Time allowed)*Time taken*Time rate

saved*Time

rate)

From the above prepared comparative statement, the following observations could be drawn: (1) Under Halsey system, with the increase in efficiency the bonus increases steadily. On the other hand, under Rowan system, up to certain level of efficiency, i.e. where time saved is 50% of allotted time, bonus increases & then it begins to decline. (2) More wages is earned by the worker under Rowan system than under Halsey system, where time saved is less than 50% of the standard time. On the other hand, more wages will be the earned by the worker under Halsey system than

under Rowan system, when more than 50% of the standard time will be saved. Same bonus may be earned by the less efficient worker as well as by the more efficient one under Rowan system. Therefore, a safeguard is provided against a loose fixation of standards by the Rowan system. (3) The worker, if he can save 2/3rd of the standard time, doubles his earnings per hour under Halsey system whereas earnings per hour can never be doubled under Rowan system. (4) Under Halsey system, with a view to earning more bonuses, the quality of work may deteriorate which may arise due to over speed in work. On the other hand, as there is automatic check on the earnings under Rowan system, over speeding is arrested. (5) Bonus under both the systems is the same, when the time saved is of the standard time. It may be concluded from the above observations that the Rowan scheme is better than the Halsey scheme, provided no loose fixation of standard is there. There are other premium bonus schemes also, like (a) Barth scheme, (b) Accelerating premium bonus. (a) Barth scheme: Time wage is not guaranteed under this scheme, i.e. wage is not provided to the worker on the basis of time worked by him. By multiplying the square root of the product of the time allowed & time taken by the hourly rate, his wages will be calculated. Under this scheme, with the increase in efficiency, there is a fall in the rate of increase in total earnings. The calculation of wages is not understandable by the ordinary workers; still the beginners & unskilled workers prefer the scheme. (b) Accelerating Premium Bonus: There is generally no accepted formula under this scheme. Own formula is made by the employer for each individual.

Das könnte Ihnen auch gefallen

- OTL Boot Camp r12Dokument91 SeitenOTL Boot Camp r12ahosainy100% (2)

- Pay For PerformanceDokument25 SeitenPay For Performanceaparna kalla100% (1)

- Incentive Plans: Submitted byDokument33 SeitenIncentive Plans: Submitted byShaurya ThakurNoch keine Bewertungen

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityVon EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNoch keine Bewertungen

- Compensation and Incentive PlansDokument48 SeitenCompensation and Incentive Planssatyam7Noch keine Bewertungen

- Wage PaymentDokument41 SeitenWage PaymentKonika VohraNoch keine Bewertungen

- CH-7 IncentivesDokument34 SeitenCH-7 IncentivesAPARNA YADAVANoch keine Bewertungen

- Greenwood Press - World War IDokument239 SeitenGreenwood Press - World War Imikle97100% (3)

- Methods of Wage Payment and IncentivesDokument9 SeitenMethods of Wage Payment and IncentivesSumit Malra100% (3)

- OTL California Setups and ExamplesDokument16 SeitenOTL California Setups and ExamplesSavez Shabkhez100% (2)

- USAID Civil Society Engagement ProgramDokument3 SeitenUSAID Civil Society Engagement ProgramUSAID Civil Society Engagement ProgramNoch keine Bewertungen

- Incentive PlansDokument21 SeitenIncentive Plansnmhrk1118Noch keine Bewertungen

- The Job Seeker's Playbook: A Guide to Finding, Succeeding At, and Changing JobsVon EverandThe Job Seeker's Playbook: A Guide to Finding, Succeeding At, and Changing JobsNoch keine Bewertungen

- Pay-For-Perfoomance PlanDokument40 SeitenPay-For-Perfoomance Plantexteagle2Noch keine Bewertungen

- Aerospace MRO Leader's Guide to Achieving Breakthrough Performance, Within 7 Days!Von EverandAerospace MRO Leader's Guide to Achieving Breakthrough Performance, Within 7 Days!Noch keine Bewertungen

- Labour Remuneration Methods ExplainedDokument3 SeitenLabour Remuneration Methods ExplainedMohit SinghNoch keine Bewertungen

- The Myth of AbsolutismDokument256 SeitenThe Myth of AbsolutismLetícia Roberto Dos Santos100% (2)

- Vocabulary Builders Synonyms and Antonyms PDFDokument8 SeitenVocabulary Builders Synonyms and Antonyms PDFNiki JosephNoch keine Bewertungen

- Vocabulary Builders Synonyms and Antonyms PDFDokument8 SeitenVocabulary Builders Synonyms and Antonyms PDFNiki JosephNoch keine Bewertungen

- Costing ProjectDokument12 SeitenCosting ProjectSaahil LedwaniNoch keine Bewertungen

- A Morphological Analysis of Loan Words Among Yoruba Speakers of English LanguageDokument106 SeitenA Morphological Analysis of Loan Words Among Yoruba Speakers of English Languagekareem abayomiNoch keine Bewertungen

- Anglo-Norwegian Fisheries Case (United Kingdom vs. Norway)Dokument2 SeitenAnglo-Norwegian Fisheries Case (United Kingdom vs. Norway)Jesa BayonetaNoch keine Bewertungen

- Aldrin Jeff Cudia Vs The Superintendent of The Philippine Military Academy (G.R. No. 211362, February 24, 2015)Dokument6 SeitenAldrin Jeff Cudia Vs The Superintendent of The Philippine Military Academy (G.R. No. 211362, February 24, 2015)Ei BinNoch keine Bewertungen

- Types of Incentive SchemesDokument27 SeitenTypes of Incentive SchemesAnika KumarNoch keine Bewertungen

- HRM Incentive PlansDokument10 SeitenHRM Incentive PlansYashu ReddyNoch keine Bewertungen

- St. Xavier's College (Autonomous), Kolkata: Cost and Management Accounting AssignmentDokument5 SeitenSt. Xavier's College (Autonomous), Kolkata: Cost and Management Accounting AssignmentTejal ChandakNoch keine Bewertungen

- Incentive PlansDokument4 SeitenIncentive PlansmaraiaNoch keine Bewertungen

- Incentive System of WagesDokument3 SeitenIncentive System of WagesÑàdààñ ShubhàmNoch keine Bewertungen

- Incentives Individual Incentives: 1) Piece Rate Work Plan I) Taylor's Differential Piece Rate System - F.W TaylorDokument6 SeitenIncentives Individual Incentives: 1) Piece Rate Work Plan I) Taylor's Differential Piece Rate System - F.W Taylorashwani kumarNoch keine Bewertungen

- Rowan Bonus Plan: FormulaDokument1 SeiteRowan Bonus Plan: FormulaPravalika ReddyNoch keine Bewertungen

- Labour Remuneration SchemesDokument3 SeitenLabour Remuneration SchemesAbu Ashraf Quader Iqbal0% (1)

- Hasley Premium Bonus PlanDokument4 SeitenHasley Premium Bonus PlanGaurav NayalNoch keine Bewertungen

- Labour Cost Accounting Methods ExplainedDokument19 SeitenLabour Cost Accounting Methods ExplainedSoumendra RoyNoch keine Bewertungen

- Department of Mba: Topic: Types of PFP PlansDokument28 SeitenDepartment of Mba: Topic: Types of PFP PlansAppu SpecialNoch keine Bewertungen

- Incentive Plan DescriptionDokument14 SeitenIncentive Plan Descriptionssd200123Noch keine Bewertungen

- Saahil Final Cost ProjectDokument28 SeitenSaahil Final Cost ProjectSaahil LedwaniNoch keine Bewertungen

- Incentive Lecture 3Dokument17 SeitenIncentive Lecture 3guru212Noch keine Bewertungen

- Types of Wage Incentive PlansDokument6 SeitenTypes of Wage Incentive PlansRichi BansalNoch keine Bewertungen

- Incentive Wage PlansDokument5 SeitenIncentive Wage PlansHarshini SandadiNoch keine Bewertungen

- Halsey Premium and Rowan Plan ComparisonDokument3 SeitenHalsey Premium and Rowan Plan ComparisonRamakrishna SNoch keine Bewertungen

- Incentives and ErrorsDokument32 SeitenIncentives and Errorstrendy FashionNoch keine Bewertungen

- Questions A B C D SolutionDokument3 SeitenQuestions A B C D SolutionNIDHI KOTIANNoch keine Bewertungen

- LABOUR REMUNERATION Presention1Dokument10 SeitenLABOUR REMUNERATION Presention1peterkiamaw492Noch keine Bewertungen

- Time Based Compensation vs. Output Based CompensationDokument3 SeitenTime Based Compensation vs. Output Based CompensationKim Roque-AquinoNoch keine Bewertungen

- Master of Business Administration-MBA Semester IV: Subject Code - Subject NameDokument8 SeitenMaster of Business Administration-MBA Semester IV: Subject Code - Subject NameroshreshNoch keine Bewertungen

- Emerson PlanDokument9 SeitenEmerson PlanBhavnidhiNoch keine Bewertungen

- LabourDokument35 SeitenLabourazra khanNoch keine Bewertungen

- Piece Rate System and Time Rate SystemDokument6 SeitenPiece Rate System and Time Rate Systemsohail merchantNoch keine Bewertungen

- Cost Assignment TOPICDokument16 SeitenCost Assignment TOPICatifatanvir1758100% (1)

- Labour 2Dokument54 SeitenLabour 2Monir ZamanNoch keine Bewertungen

- Individual Incentive Plans - Sample MathsDokument4 SeitenIndividual Incentive Plans - Sample MathsAbdul ShukkurNoch keine Bewertungen

- Incentive SystemDokument24 SeitenIncentive SystemSaurabh BethariaNoch keine Bewertungen

- Human Resource Management UNIT 12Dokument18 SeitenHuman Resource Management UNIT 12tjnihalNoch keine Bewertungen

- ReseacrhedDokument4 SeitenReseacrhedsurbhiaggarwal13Noch keine Bewertungen

- Methods of Wage PaymentsDokument7 SeitenMethods of Wage PaymentsSaurabh M. SaleNoch keine Bewertungen

- Compensation: Case Study: Loafers at Lakeside Utility CompanyDokument16 SeitenCompensation: Case Study: Loafers at Lakeside Utility CompanyTri Febrianti67% (3)

- Time Reporting Memo: Enforcement: The Department of Labor May Recover Back Wages Either Administratively orDokument3 SeitenTime Reporting Memo: Enforcement: The Department of Labor May Recover Back Wages Either Administratively orsamNoch keine Bewertungen

- Labor SlidesDokument13 SeitenLabor SlidesShahvaiz MeerNoch keine Bewertungen

- Meaning of Labour CostDokument12 SeitenMeaning of Labour CostNandan Kumar JenaNoch keine Bewertungen

- Types of Incentive SchemesDokument20 SeitenTypes of Incentive Schemespanch321Noch keine Bewertungen

- Wages and Salary AdministrationDokument20 SeitenWages and Salary AdministrationKamaldeep Kaur GrewalNoch keine Bewertungen

- Objectives of Wage Incentive SchemesDokument11 SeitenObjectives of Wage Incentive SchemesSaiful IslamNoch keine Bewertungen

- Marathon Notes - EmployeeDokument16 SeitenMarathon Notes - Employeeprogamerqwerty1122Noch keine Bewertungen

- Wage Incentive PlansDokument4 SeitenWage Incentive PlansBhaskaran BalamuraliNoch keine Bewertungen

- Chapter 5Dokument6 SeitenChapter 5Mackie DorimonNoch keine Bewertungen

- UNIT-3 Incentives: BY-Prof - Preeti DwivediDokument24 SeitenUNIT-3 Incentives: BY-Prof - Preeti DwivedirpsinghsikarwarNoch keine Bewertungen

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsVon EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNoch keine Bewertungen

- Teaching Children With Visual ImpairmentDokument6 SeitenTeaching Children With Visual ImpairmentNiki JosephNoch keine Bewertungen

- Pronoun UnitDokument5 SeitenPronoun UnitMaryJoy Abulencia FerrerNoch keine Bewertungen

- Food Chain Activity SheetDokument2 SeitenFood Chain Activity SheetNiki JosephNoch keine Bewertungen

- ArticlesDokument3 SeitenArticlesseema_singhNoch keine Bewertungen

- F 107008 Dainty EarringsDokument1 SeiteF 107008 Dainty EarringsNiki JosephNoch keine Bewertungen

- Longmeadow Broomstick CuffDokument2 SeitenLongmeadow Broomstick CuffNiki JosephNoch keine Bewertungen

- CBR Travel BillsDokument3 SeitenCBR Travel BillsNiki JosephNoch keine Bewertungen

- Kapil NewDokument2 SeitenKapil NewNiki JosephNoch keine Bewertungen

- Title PageDokument2 SeitenTitle PageNiki JosephNoch keine Bewertungen

- The Theme of Prejudice in To Kill A Mocking BirdDokument2 SeitenThe Theme of Prejudice in To Kill A Mocking BirdNiki JosephNoch keine Bewertungen

- Tribes India ShowroomsDokument3 SeitenTribes India ShowroomsNiki JosephNoch keine Bewertungen

- Season 3 QuotesDokument4 SeitenSeason 3 QuotesNiki JosephNoch keine Bewertungen

- A History of England's Irish Catholic Slavery in America and Throughout The WorldDokument6 SeitenA History of England's Irish Catholic Slavery in America and Throughout The WorldConservative Report100% (1)

- Notes: Introduction: Anthony Giddens - Social Theory and PoliticsDokument46 SeitenNotes: Introduction: Anthony Giddens - Social Theory and Politics01,CE-11th Tasneem Ahmed ShuvoNoch keine Bewertungen

- Extradition Costs To CPSDokument2 SeitenExtradition Costs To CPSJulia O'dwyerNoch keine Bewertungen

- Response To Rep. Jamaal Bowman's Withdrawal of Support For The Israel Relations Normalization ActDokument3 SeitenResponse To Rep. Jamaal Bowman's Withdrawal of Support For The Israel Relations Normalization ActJacob KornbluhNoch keine Bewertungen

- Walmart Job ApplicationDokument2 SeitenWalmart Job Applicationapi-386838041Noch keine Bewertungen

- Foucault, Race, and Racism: Rey ChowDokument15 SeitenFoucault, Race, and Racism: Rey ChowNenad TomićNoch keine Bewertungen

- Application For ObserverDokument4 SeitenApplication For Observerসোমনাথ মহাপাত্রNoch keine Bewertungen

- UP MDMS Merit List 2021 Round2Dokument168 SeitenUP MDMS Merit List 2021 Round2AarshNoch keine Bewertungen

- Independence and Partition (1935-1947)Dokument3 SeitenIndependence and Partition (1935-1947)puneya sachdevaNoch keine Bewertungen

- CentresDokument172 SeitenCentresnaimaNoch keine Bewertungen

- Sex Among Allies ReviewDokument3 SeitenSex Among Allies ReviewlbburgessNoch keine Bewertungen

- Hydro Politics in Pakistan: Understanding Perceptions and MisperceptionsDokument18 SeitenHydro Politics in Pakistan: Understanding Perceptions and MisperceptionsIqraNoch keine Bewertungen

- Robert Halfon - Brief UpdateDokument1 SeiteRobert Halfon - Brief UpdateRobert H HalfonNoch keine Bewertungen

- Fiqh 2 - Kitab Al-HajjDokument7 SeitenFiqh 2 - Kitab Al-HajjNoor-uz-Zamaan AcademyNoch keine Bewertungen

- M.A (Pol Science) Scheme of StudyDokument2 SeitenM.A (Pol Science) Scheme of StudyahsanNoch keine Bewertungen

- Thu Moi Tham Gia CT Binh Chon Thuong Hieu Noi Tieng ASEAN Cua Tap Chi Doanh Nghiệp Và Thương Hiệu 15 5 13 (Tras)Dokument2 SeitenThu Moi Tham Gia CT Binh Chon Thuong Hieu Noi Tieng ASEAN Cua Tap Chi Doanh Nghiệp Và Thương Hiệu 15 5 13 (Tras)Julie NguyenNoch keine Bewertungen

- Individualism vs Government Control in Auden's The Unknown CitizenDokument3 SeitenIndividualism vs Government Control in Auden's The Unknown CitizenIchi BerryNoch keine Bewertungen

- Cifra Club - Pink Floyd - Another Brick in The WallDokument3 SeitenCifra Club - Pink Floyd - Another Brick in The WallFabio DantasNoch keine Bewertungen

- Recognitions and Permits by Bacolod LGUDokument4 SeitenRecognitions and Permits by Bacolod LGUAlfons Janssen Alpoy MarceraNoch keine Bewertungen

- The Tradition of Baralek Gadang (Big Party) Weddings in Minangkabau SocietyDokument3 SeitenThe Tradition of Baralek Gadang (Big Party) Weddings in Minangkabau SocietySaskia Putri NabillaNoch keine Bewertungen

- I. Concepts and Definitions I. Concepts and DefinitionsDokument64 SeitenI. Concepts and Definitions I. Concepts and DefinitionsAmbrose KessyNoch keine Bewertungen

- Should Women Work at Late Night Shifts in Offices ?Dokument13 SeitenShould Women Work at Late Night Shifts in Offices ?RITIKANoch keine Bewertungen

- Human Rights Law Assessment on Limitations in the Botswana ConstitutionDokument13 SeitenHuman Rights Law Assessment on Limitations in the Botswana ConstitutionThato X Bathusi100% (1)

- Letter To A Teacher by Nora Rossi and Tom Cole - 1228602 - 2023 - 11!07!09 - 54Dokument19 SeitenLetter To A Teacher by Nora Rossi and Tom Cole - 1228602 - 2023 - 11!07!09 - 54Deepak Kumar Singh50% (2)