Beruflich Dokumente

Kultur Dokumente

Introduction To Commodity Exchange

Hochgeladen von

Vinay ArtwaniOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Introduction To Commodity Exchange

Hochgeladen von

Vinay ArtwaniCopyright:

Verfügbare Formate

SYBFM

TOKYO COMMODITY EXCHANGE

1.1 Introduction to Commodity Exchange

A commodities exchange is an exchange where various commodities and derivatives products are traded. Most commodity markets across the world trade in agricultural products and other raw materials (like wheat, barley, sugar, maize, cotton, cocoa, coffee, milk products, pork bellies, oil, metals, etc.) and contracts based on them. These contracts can include spot prices, forwards, futures and options on futures. Other sophisticated products may include interest rates, environmental instruments, swaps, or ocean freight contracts. Commodities exchanges usually trade futures contracts on commodities, such as trading contracts to receive something, say corn, in a certain month. A farmer raising corn can sell a future contract on his corn, which will not be harvested for several months, and guarantee the price he will be paid when he delivers; a breakfast cereal producer buys the contract now and guarantees the price will not go up when it is delivered. This protects the farmer from price drops and the buyer from price rises. Speculators and investors also buy and sell the futures contracts in attempt to make a profit and provide liquidity to the system. However, due to the leverage provided by the exchange to traders those participating in commodity futures trading face substantial amounts of speculative risk. Commodity markets are markets where raw or primary products are exchanged. These raw commodities are traded on regulated commodities exchanges, in which they are bought and sold in standardized contracts. This article focuses on the history and current debates regarding global commodity markets. It covers physical product (food, metals, and electricity) markets but not the ways that services, including those of governments, nor investment, nor debt, can be seen as a commodity. Articles on reinsurance markets, stock markets, bond markets and currency markets cover those concerns separately and in more depth. One focus of this article is the relationship between simple commodity money and the more complex instruments offered in the commodity markets.

1|Page

SYBFM

TOKYO COMMODITY EXCHANGE

1.2 Commodities exchanges across the world AFRICA Exchange

Ethiopia Commodity Exchange Africa Mercantile Exchange AfMX Nairobi, Kenya Agricultural,equities and energy products ECX Addis Ababa, Ethiopia Agricultural

Abbreviation

Location

Product Types

AMERICA Exchange

Brazilian Mercantile and Futures Exchange BMF So Paulo, Brazil

Abbreviation

Location

Product Types

Agricultural, Biofuels, Precious Metals Grains, Ethanol,

Chicago Board of Trade

CBOT

Chicago, US

Treasuries, Equity Index, Metals Meats, Currencies,

Chicago Mercantile Exchange Chicago Climate Exchange

CME

Chicago, US

Eurodollars, Equity Index

CCX

Chicago, US

Emissions Energy, industrial

HedgeStreet

California, US

Metals

2|Page

SYBFM

TOKYO COMMODITY EXCHANGE

Exchange Integrated Nano-Science Commodity Exchange Kansas City Board of Trade Memphis Cotton Exchange Mercado a Termino de Buenos Aires MATba Buenos Aires, Argentina Mercado a Termino de Rosario ROFEX Rosario, Argentina Financial, Agricultural Minneapolis Grain Exchange MGEX Minneapolis Agricultural Energy, Precious New York Mercantile Exchange U.S. Futures Exchange USFE Chicago, US Energy NYMEX New York, US Metals, Industrial Metals Agricultural Memphis, US Agricultural KCBT Kansas City, US Agricultural INSCX United Kingdom Engineered nanomaterials

3|Page

SYBFM

TOKYO COMMODITY EXCHANGE

ASIA Exchange

Agricultural Futures Exchange of Thailand Bursa Malaysia Commodity Futures Exchange MDEX CFX Malaysia Kathmandu, Nepal Biofuels Agricultural, Precious Metals, Base Metals, Energy. Cambodian Mercantile Exchange CMEX Phnom Penh, Cambodia Energy, Industrial Metals, Rubber, Precious Metals, Agri Commodities. Central Japan Commodity Exchange Dalian Commodity Exchange DCE Dalian, China Agricultural, Plastics, Energy, Agri Commodities Derivatives and Commodity Exchange Dubai Mercantile Exchange Dubai Gold & Commodities DGCX Dubai Precious Metals DME Dubai DCX Kathmandu, Nepal Agricultural, Energy & Agri Commodities Energy Nagoya,Japan Energy, Industrial Metals, Rubber

Abbreviation

AFET

Location

Bangkok Thailand

Product Types

Agricultural

4|Page

SYBFM

TOKYO COMMODITY EXCHANGE

Exchange Hong Kong Mercantile Exchange Hong Kong Mercantile Exchange Industrial and Mineral Products, Iran Mercantile Exchange IME Tehran, Iran Oil By-products and Petrochemicals Products, Agricultural Products Iranian oil bourse IOB Kish Island, Iran Oil, Gas, Petrochemicals Kansai Commodities Exchange Commodities & Metal Exchange Nepal Ltd. National Spot Exchange Limited [NSEL] Mumbai, India Spot Trading in commodities, ESeries Nepal Derivative Exchange Limited [NDEX] Kathmandu, Nepal Agricultural, Precious Metals, Base Metals, Energy National Spot Exchange Limited Nepal [NSX] Kathmandu, Nepal E-Gold, E-Silver, ECopper, E-Iron, ECRUDE OIL, and COMEN Nepal Gold and Silver KANEX Osaka,Japan Agricultural Hong Kong Gold

5|Page

SYBFM

TOKYO COMMODITY EXCHANGE

Local Agro Products Mercantile Exchange Nepal Limited Nepal Spot Exchange Limited Ace Derivatives & Commodity Exchange Indian Commodity Exchange Limited ICEX India Energy, Precious Metals, Base Metals, Agricultural Multi Commodity Exchange MCX India Precious Metals, Metals, Energy, Agricultural National MultiCommodity Exchange of India Ltd National Commodity Exchange Limited Bhatinda Om & Oil Exchange Ltd. National Commodity and Derivatives Exchange NCDEX India All BOOE India Agricultural NCEL Pakistan Precious Metals, Agriculture NMCE India Precious Metals, Metals, Agricultural ACE India NSE Kathmandu, Nepal MEX Kathmandu, Nepal Agricultural, Bullion, Base Metals, Energy Agricultural, Bullion Agricultural

6|Page

SYBFM

TOKYO COMMODITY EXCHANGE

Shanghai Futures Exchange

Shanghai, China

Industrial metals, Gold, Fuel Oil, Rubber

Singapore Commodity Exchange Singapore Mercantile Exchange

SICOM

Singapore

Agricultural, Rubber

SMX

Singapore

Futures & Options contracts in Precious Metals such as physically delivered Gold, Base Metals, Agriculture Commodities, Energy such as WTI and Brent denominated in Euro, Currencies such as Euro-US Dollar Contract, Commodity Indices

Tokyo Commodity Exchange

TOCOM

Tokyo, Japan

Energy, Precious Metals, Industrial Metals, Agricultural

Tokyo Grain Exchange Zhengzhou Commodity Exchange

TGE

Tokyo, Japan

Agricultural

CZCE

Zhengzhou, China

Agricultural, PTA

7|Page

SYBFM

TOKYO COMMODITY EXCHANGE

1.3 Commonly Traded Commodities

Before the advent of the industrial revolution, trading mainly took place with agricultural commodities such as corn, maize, oats, wheat, livestock, hogs and pigs. In 1848, the worlds oldest futures exchange was formed and it was named the Chicago Board Of Trade [CBOT]. Thereafter, many such exchanges were formed all around the world. The trading is done by contracts, which include 1.) Spot trading, where the delivery takes place immediately or in minimum time, 2.) forward contract, where the buyer and seller agree to a price for a commodity, which is to be delivered at a mutually agreed date and quantity, and 3.) futures contracts, where the conditions are the same as the forward contract, but are transacted through a futures exchange. There are many agricultural and industrial commodities now being traded in the commodities market. The list of the most common commodities and the exchanges they are normally dealt through are given below: The most commonly traded commodity is Crude Oil, and its various derivatives such as heating oil and gasoline. These commodities are mostly traded in the New York Mercantile Exchange [NYMEX], ICE Futures, the Dubai Mercantile Exchange [DME] and the Central Japan Commodity Exchange [C-COM]. The second most traded commodity is Coffee [value wise]. Coffee is mainly traded through the New York Board of Trade [NYBOT], the Kansai Commodities Exchange [in Osaka, Japan], the Singapore Commodities Exchange [SICOM] and Euronext [London]. Common commodities in agriculture include wheat, corn, maize, oats, rice, soybeans and they are traded in the Chicago Board of Trade [CBOT], the Kansai Commodities Exchange [in Osaka, Japan], the Risk Management Exchange [RMX-in Hannover], the Minneapolis Grain Exchange, the Winnipeg Commodity Exchange [WCE], The Tokyo Grain Exchange [TGE] and Euro next.

Animals and animal products such as live and feeder cattle, beef, frozen and

fresh pork bellies and eggs are mainly traded in the Chicago.

8|Page

SYBFM

TOKYO COMMODITY EXCHANGE

1.4 History of Tokyo Commodity Exchange

Compared to other major commodity exchanges, TOCOMs origins are relatively recent. While many of the other most important exchanges have their roots in the boom of the 19th century, the birth of the Tokyo Commodity Exchange can be traced to the economic reconstruction of Japan after the Second World War. As part of this reconstruction effort, the Tokyo Textile Exchange was founded in 1951 as a focus for the recovering textiles trade in Japan and the wider Far East. A year later the Tokyo Rubber Exchange was founded, with the aim of supporting the similarly recovering rubber trade. It wasnt until 1984, however, that the Tokyo Commodity Exchange was founded. TOCOM was formed from the amalgamation of three previously existing commodity exchanges: the aforementioned Tokyo-based rubber and textiles exchanges, and also the Tokyo Gold Exchange, itself founded only two years earlier in 1982. The latter was perhaps the most important constituent part of the new Tokyo Commodity Exchange, as the trade in precious metals became the primary focus of the new entity. Since its inception, TOCOM has added a number of new commodities to its trading portfolio, including precious metals, non-ferrous industrial metals and crude oil and several of its derivatives. In this way, it has strengthened its position as one of the worlds premier commodity exchanges, with consistently high volumes of trade in some of the worlds key commodities. The Tokyo Commodity Exchange (also known as TOCOM) is not only Japans primary commodity exchange; it is one of the most important commodity exchanges in the world. Its main trade is in precious metals, oil and its derivatives, and rubber, though there is also some trade in non-precious metals.

9|Page

SYBFM

TOKYO COMMODITY EXCHANGE

1.5 Introduction to Tokyo Commodity Exchange

The Tokyo Textile Exchange with two other exchanges. The Tokyo Commodity Exchange, Inc. (TOCOM) is Japan's largest derivatives platform, offering futures contracts on precious and industrial metals, oil-related energy products, and rubber as well as options on gold futures. On December 1, 2008, TOCOM demutualized and transformed itself from a membership organization into a corporation and changed its name to Tokyo Commodity Exchange, Inc. It was the first commodity futures exchanges in Japan to undergo such a transformation. TOCOM was ranked as the world's 34th-largest derivatives exchange by volume in 2010, falling two places from the previous year, according to the annual volume survey published by the Futures Industry Association (FIA). The FIA report, published in March of 2011, notes that the exchanges's total volume for 2010 declined by 4.3% from the previous year, falling to about 27.64 million contracts.

10 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

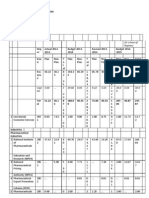

Year

1951

Month

February

Description

Tokyo Textile Exchange founded in Nihonbashi Horidome-cho, Chuo-ku, Tokyo

1952 1982 1991 2010

December February April March

Tokyo Rubber Exchange founded Tokyo Gold Exchange founded Continuous trading on electronic platform started Started providing Nikkei-TOCOM Commodity Index market, launched Nikkei-TOCOM Commodity Index futures

The Tokyo Commodity Exchange provides a complete technical and organizational infrastructure for smooth trading and the clearing of exchange trades, and its ongoing information and communications work contributes to the steady growth of supply and demand. Tokyo Commodity Exchange is registered with the Tokyo Stock Options Group.

It has been a full-fledged Limited-risk Options Commission Merchant since 1999 (not just an Introducing Broker), which means that it exceed the industry's most demanding capital levels and are subject to the industry's most rigorous oversight and financial reporting requirements. Tokyo Commodity Exchange, Inc. (TOCOM) strives to become a prominent derivatives exchange in Asia. TOCOM introduced its new system, which meets international standards on functionality and has the worlds highest level of performance, on 7 May 2009.

11 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.6 TOCOM Trading System

TOCOM selected a trading/clearing package provided by NASDAQ OMX Group, which already provides since its establishment in 1984 operational support and system implementation to many overseas exchanges. NTT Data, in collaboration with NASDAQ OMX, developed and operates the new system. NTT Data has a high level of know-how based on its over seventeen years of experience in developing/operating the Exchanges systems. The Exchanges electronic trading system offers the following speed and capacity: Order Transaction Response Time: 10 milliseconds. Maximum Number of Order Transactions: 1,000 orders/second (or 5 million orders/day). Maximum Number of Executions: 1.85 million execution/day. By introducing this new system, resulting from the combination of the internationally recognized NASDAQ OMX technology and the exceptional skills of NTT Data in building/operating systems, TOCOM aims to offer a wider range of services to all market participants in a faster and more efficient way, in order for the Exchange to grow and better position itself among global derivatives markets. Gold options were the single-largest product in 2006, accounting for a third of total contract volume, with gasoline futures ranked second at 22 percent, followed by platinum at 16 percent and rubber at 14 percent. The merged exchange started with precious metals, rubber and textiles with the latter withdrawn in 1991. The complex was expanded with palladium futures in 1992, adding aluminum in 1997 and establishing the oil market with futures in gasoline and kerosene - in 1999. An unsuccessful push into Middle East crude oil futures followed in 2001, and gas oil futures - now also suspended - followed in 2003. Options on gold futures were launched in 2004 and the Tocom Index was started in 2006.

12 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.7 Trading Schedule

Order Acceptance and Trading Hours Trading hours are separated between a day session (order acceptance: from 8:30; trading: 9:00 to 15:30) and a night session (order acceptance: from 16:45; trading: 17:00 to 04:00 except for the Rubber market). The night session for rubber is from 17:00 to 19:00 (order acceptance: from 16:45).

Commodity

Precious Market Oil Market Chukyo-Oil Rubber Market Market Metals

Day Session

(8:30) 9:00-15:30 (no lunch break)

Night Session

(16:45) 17:00-04:00 (16:45) 17:00-19:00

Clearing Period For a regular business day, one clearing period corresponds to: previous business days night session (from 17:00) + todays day session (until 15:30). The end of one clearing period will correspond to the closing of the day session. The clearing period for the last business day of the year corresponds to: previous business days night session (from 17:00) + last business day of the years day session (until 15:30). The clearing period for the first business day of the year corresponds to: first business day of the years day session (from 9:00 to 15:30) since there wont be a night session following the end of the day session on the last business day of the year. In the case of a holiday, the night session of the day preceding the holiday and the day session of the day following the holiday make one clearing period.

13 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.8 Trading Methods

The trading method is continuous trading with an opening auction . At the opening of the day session (9:00) and the night session (17:00), all contract months (all options series) start trading at the same time.

Type of Transaction

Physically Delivered Futures Transactions Cash-settled Futures Transactions Options Transactions Spread Transactions

Trading Method

Continuous trading with opening auction

Continuous trading

Opening Auction: Opening Auction takes place at the start or reopening of a session (following an interruption after a Circuit Breaker has been triggered, for example) and corresponds to a trading method where orders accepted by the Exchanges trading system are all executed at once, in accordance with the conditions prescribed by the Exchange. Under this method, the price at which a maximum number of orders can be executed becomes the execution price (all of the orders are not necessarily executed). Unexecuted orders with an order condition will be kept in the order book in the continuous trading session. Continuous Trading: Continuous trading takes place between the opening and the closing of a session and corresponds to a trading method where orders are executed whenever a match is possible, in accordance with the type of order/condition. Thus, there are many execution prices formed during continuous trading.

14 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.9 Order Types

Although the Exchange offers seven types of sell and buys orders, it is possible to produce a variety of orders by specifying the order condition. The order type and order condition must be specified when placing an order. With regards to order types, please note that Members can choose not to use all of the order types offered by TOCOM. Members may also develop their own specific type of order. Limit Order An order to buy or sell with a specified price, a sell LO is executed at the specified price or above, while a buy LO is executed at the specified price or lower. Market Order An order to buy or sell without specifying a price, an MO is executed immediately if there is a corresponding order on the other side of the market, but if there is no corresponding orders on the other side of the market, the remaining part of the order is cancelled (the same shall apply during the opening auction: the MO is executed if there is a corresponding order on the other side of the market, but if there is no corresponding orders on the other side of the market, the remaining part of the order is cancelled). Market To Limit Order Its an order to buy or sell without specifying a price. Depending on the order book at the time that the MTLO was received.

15 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

Best Limit Order An order to buy or sell without specifying a price. When accepted, this order becomes a LO at a price equal to the best bid/offer on the same side of the market. This order will not have Precedence over other LOs at the same price that were placed earlier (in accordance with time priority). If there is no bid/offer on the same side of the market, the order is cancelled. Stop Order Stop Order (no order condition available; valid for current session only an order that can convert into a MO, LO, MTLO, BLO or SCO if the market reaches designated conditions.

LIMIT ORDER

MARKET ORDER STOP ORDER BEST LIMIT ORDER MARKET TO LIMIT ORDER

16 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.10 Japan Commodity Clearing House

JCCH was established on December 24, 2004, to conduct an independent centralized Clearing-House operation. It is organized as a stock company owned by all Japanese Commodity Exchanges and the Japan Commodity Futures Industry Association which is an association of FCMs. On May 2, 2005, JCCH started providing clearing and settlement services for the transactions of all commodity exchanges in Japan. These services are integral to the efficient operation of all of the commodity markets, as JCCH imposes itself as the counterparty to each trade. This service provides a high level of market integrity as it minimizes the risk of default by either party to each and every transaction. Market Credibility Efficient Operation JCCH enhances market integrity. JCCH acts as the counterparty to each transaction, thereby minimizing the risk of counterparty default to all market participants. JCCH improves efficiency in investment funds by aggregating the margin and mark-to-market profit or loss. JCCH is the common Clearing House for Commodity Exchanges in Japan, which allows JCCH to adopt SPAN Margining system, permitting to offset risks between Commodity Exchanges and aggregate mark-to-market profit or loss that is generated from all Commodity Exchanges. JCCH provides for efficient management of clearing funds. Prior to the establishment of JCCH, FCMs had to provide clearing funds sufficient to satisfy different exchanges, for both the house account and the customer account. This required managing some different accounts for clearing and settlement. Under the JCCH model, each clearing participant maintains one account at JCCH which is netted based on the daily marking - to - market requirements for all positions held at all exchanges. JCCH allows for the streamlining of back office operations for all clearing participants. As marking - to - market operation and management of margins are integrated through JCCH, there is a reduction in error and a simultaneous corresponding cost savings.

17 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.11 Clearing System

JCCH acts as counterparty to every transaction executed on the member exchanges, and insures performance on the terms of the contract to the benefit of all market participants. Execution of trading between clearing participants and non-clearing participants

Execution of trading among clearing participants

18 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.12 Commodities Traded at the Tokyo Commodity Exchange

A variety of commodities are traded at the Tokyo Commodity Exchange, falling into three main classes: precious metal commodities and energy commodities. There are also other commodities traded at TOCOM outside these main classes.

Agricultural Commodities: Rubber. Energy Commodities: Crude Oil, Gas Oil, Gasoline and Kerosene. Industrial Metal Commodities: Aluminum. Precious Metal Commodities: Gold, Palladium, Platinum, Silver.

The trading of rubber represents the trade from TOCOMs precursor exchange, the Tokyo Rubber Exchange.

1.13 Membership of the Tokyo Commodity Exchange

There are four levels of membership of TOCOM. These are:

Broker Membership: the standard class for firms of commodity brokers and traders. All members of this class may trade on their own behalf or on behalf of clients, and must be Japanese organizations.

Trade Membership: this class is similar to Broker Membership, but members may only trade on their own behalf: they may not conduct trades for clients. Again, members in this class must be Japanese.

Affiliate Membership: these members may trade through brokers licensed by TOCOM. There is no restriction on national origin for these members: nonJapanese organizations may join.

Associate membership: these members can only be foreign companies etc, but they must be members of an exchange that trades in the relevant commodities, or a trade association connected with that commodity. Associate members may trade through TOCOM licensed brokers.

19 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.14 Japan Commodity Trading Advisors

The Japan CTA Association was established in October of 1994 right after the permission for business was put in practice. With the commodity fund law as the base, the association along with the establishment of the self regulations, has been set up in means of cooperation of mutual problems and in aiming toward the sound development of the CTA business. Through this, the association has aimed for contributing toward the development of the economy as a voluntary group of CTAs. As of April 10th 2009, 8 companies are registered as a member of the association. In Japan, with the arrival of the monetary Big Bang, and also with the wave of the deregulation, the needs of the investors are becoming more and more complex each day to find a more profitable investment opportunity. Thus the form of the monetary services is being looked over again. Many services are being designed to match the needs of the investors. One of the services that are being focused on is the commodity fund business which manages the assets by investing in the commodity and monetary markets, and the commodity trading advisor business which are entrusted the investment judgement in mainly the commodity markets. By managing a fair operation in each field, and by fair investment in the commodity market, we will be able to expect an economical meaning through the smooth flow of the production and distribution of each commodity and by the diversification of the investment chances. The commodity trading business along with the commodity fund business (commodity pool business) was proclaimed on May 1991, and enforced in April 1992, based upon the "Commodity Investment Regulations" (so called "commodity fund law") under the jurisdiction of the Ministry of Finance, the Ministry of Agriculture, Forestry and Fisheries and the Ministry of International Trade and Industry.The commodity trading advisor, with the expert knowledge of investment in the commodity futures, commodity index and the commodity option markets are traders who will manage assets entrusted by investors, offering the same services as the securities investment advisor and the CTAs in the US.

20 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.15 Commodity Exchange Act

The Commodity Exchange Act (CEA) regulates the trading of commodity futures in the United States. Passed in 1936, it has been amended several times since then. The CEA establishes the statutory framework under which the CFTC operates. Under this Act, the CFTC has authority to establish regulations that are published in title 17 of the Code of Federal Regulations. For convenience, we provide the following links to the CEA and related documents:

Access the Commodity Exchange Act on the Cornell University Law School Website

Commodity Exchange Act-U.S. Code Conversion Chart.The CEA section numbers do not always correspond directly to the sections in the U.S. Code where the CEA is codified. As a research tool, we provide a conversion chart that lists the sections of the CEA and the corresponding sections in the U.S. Code. Section 3 of the CEA, for example, is codified at 7 USC 5. This chart has no legal force and is not intended to substitute for review of the statutes to which it refers.

Commodity Futures Modernization Act of 2000 (PDF) (Appendix E of P.L.106554, 114 Stat. 2763) Title XIII of the Food, Conservation, and Energy Act of 2008, PL 110-246, 122 Stat. 2189, which made amendments to the CEA, and the Conference Report.

21 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.16 Fraud Awareness & Prevention

The CFTC's fraud awareness and prevention program involves

Educating futures market users Protecting futures market participants and Reviewing information and complaints that market participants send to us.

The CFTC is the Federal agency that regulates the trading of commodity futures and options contracts in the United States and takes action against firms suspected of illegally or fraudulently selling commodity futures and options. Before you trade in commodities or futures, know the kinds and signs of fraud and the basics of futures trading. Protect yourself from the many types of commodities fraud that exist in todays financial markets. Be suspicious of a promise of high profits with low risk. Scams that falsely promise high profits with low risks are everywhere. Many are targeted at specific ethnic communities using the language of that community, from New York to South Florida, from the Southwest to California, and in other areas. Be wary of any firm or individual offering to sell you commodity futures or options on commodities, including

Precious metals, such as silver or gold Foreign currency, such as Euros, Yen, or Deutschmarks, or Crude oil, heating oil, unleaded gas, or agricultural products such as corn, soybeans, or cattle.

Be wary of any firm or individual offering to trade your money for you in commodity futures or options, or to pool your money with other customers.

22 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.17 Warning Signs of Fraud

Get-rich-quick schemes that sound too good to be true. Theres never a free lunch. Be very careful if you recently retired or came into money and youre looking for a safe investment. You could be a very attractive target for a crook. Once your money is gone, it can be impossible to get it back.

Predictions or guarantees of large profits. Always get as much information as you can about a firm or individuals track record and verify that informationeven if you know the people involved or they are recommended by friends or relatives. If you cant get solid information about your investment and the company, dont invest. Before you invest, always check it out with someone whose financial advice you can trust.

Promises of little or no financial risk. Be suspicious if the firm or individual says there is little risk. Be suspicious if someone tells you that a written risk disclosure statement is only a routine formality. Written risk disclosure statements are important to read thoroughly and understand. Claims of trading in the Interbank Market. If a firm claims that they will trade foreign currency for you in the interbank market, or that you should trade in the interbank market, be cautious. The term interbank market refers to a loose network of currency transactions negotiated between financial institutions, usually banks and investment banks, and other large companies. Unsolicited telephone calls about investing. Be skeptical if someone you dont know calls you about investment opportunities.

Someone asking you to send cash immediately. Be very cautious if someone tries to convince you to send cash or transfer money to them immediately by overnight express, the Internet, mail, or any other method.

23 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.18 Kinds of Frauds

Foreign Currency Trading (Forex)

Foreign currency trading scams often attract customers through advertisements in local newspapers, radio promotions, or on attractive Internet sites. These advertisements may peddle high-return, low-risk investment opportunities in foreign currency trading, or even highly-paid currency-trading employment opportunities. Precious metals scams often work the same way.

The CFTC urges you to be skeptical when promoters of foreign currency trading claim that their services or account management will earn high profits with minimal risks, or that employment as a currency trader will make you wealthy quickly.

Commodity Pool Operators

Commodity pool operators often solicit investments from friends, neighbors, coworkers, and fellow religious or social group members by using their reputations in the community or their personal relationships. In many cases, however, these investment schemes turn out to be fraudulent, and you can lose your entire investment, in many cases as a result of outright theft.

Individuals and firms that fraudulently solicit funds from investors for commodity futures and options trading are usually not registered with the CFTC. They may operate Ponzi schemes in which little or none of the money sent in by investors is ever invested as promised in the commodity markets. Instead, the operator of the scam steals the funds, and creates the illusion of a successful business by using some of the money put in by later investors to pay phony profits" to earlier investors. This tactic makes it appear to investors that the investment is actually making money, which in turn attracts additional investors.

24 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

Introducing Brokers

Introducing brokers often use advertisements and infomercials on radio and television to promote commodity futures and options. These advertisements may claim that seasonal trends in the demand for certain commodities or well-known current events (such as a hurricane or a terror attack) create an opportunity to make big money by trading in commodity futures and options. They promise quick riches, like turning $5,000 into $20,000 in just a few months, with little risk.

25 | P a g e

SYBFM

TOKYO COMMODITY EXCHANGE

1.19 Conclusion

Hence we can conclude that. The Tokyo Commodity Exchange, Inc. is Japan's largest derivatives platform, offering futures contracts on precious and industrial metals, oil-related energy products, and rubber as well as options on gold futures. The Tokyo Commodity Exchange provides a complete technical and organizational infrastructure for smooth trading and the clearing of exchange trades, and its ongoing information and communications work contributes to the steady growth of supply and demand. Tokyo Commodity Exchange is registered with the Tokyo Stock Options Group. TOCOM introduced its new system, which meets international standards on functionality and has the worlds highest level of performance.

JCCH was established, to conduct an independent centralized Clearing-House operation. It is organized as a stock company owned by all Japanese Commodity Exchanges and the Japan Commodity Futures Industry Association which is an association of FCMs. JCCH acts as counterparty to every transaction executed on the member exchanges, and insures performance on the terms of the contract to the benefit of all market participants.

The Japan CTA Association was established right after the permission for business was put in practice. With the commodity fund law as the base, the association along with the establishment of the self regulations, has been set up in means of cooperation of mutual problems and in aiming toward the sound development of the CTA business.

26 | P a g e

Das könnte Ihnen auch gefallen

- Up To Date Business Including Lessons in Banking, Exchange, Business Geography, Finance, Transportation and Commercial Law Home Study Circle Library Series (Volume II.)Von EverandUp To Date Business Including Lessons in Banking, Exchange, Business Geography, Finance, Transportation and Commercial Law Home Study Circle Library Series (Volume II.)Noch keine Bewertungen

- Wind Turbines - I. Al-BahadlyDokument664 SeitenWind Turbines - I. Al-Bahadlykevin_leigh_1Noch keine Bewertungen

- The World Trade Organization: A Beginner's GuideVon EverandThe World Trade Organization: A Beginner's GuideBewertung: 4 von 5 Sternen4/5 (1)

- Killer Commodities: How to Cash in on the Hottest New Trading TrendsVon EverandKiller Commodities: How to Cash in on the Hottest New Trading TrendsNoch keine Bewertungen

- Commodity Market: Presented By: Akhilesh Gadkar PG-13-14 Pritesh Shah PG-13-50 Arpit Shah PG-13-59Dokument37 SeitenCommodity Market: Presented By: Akhilesh Gadkar PG-13-14 Pritesh Shah PG-13-50 Arpit Shah PG-13-59Laura ButlerNoch keine Bewertungen

- A Project On Commodity TradingDokument80 SeitenA Project On Commodity Tradingswami808100% (9)

- Commodity MarketDokument12 SeitenCommodity MarketMukesh Patel100% (6)

- Gold As An Investment OptionDokument51 SeitenGold As An Investment OptionAjmel Azad Elias100% (1)

- Commodity Trading: Navigating Markets, Sustainability, and InnovationVon EverandCommodity Trading: Navigating Markets, Sustainability, and InnovationNoch keine Bewertungen

- I. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Dokument5 SeitenI. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Shelton Lyndon CemanesNoch keine Bewertungen

- The Economist Guide to Commodities 2nd edition: Producers, players and prices; markets, consumers and trendsVon EverandThe Economist Guide to Commodities 2nd edition: Producers, players and prices; markets, consumers and trendsBewertung: 3 von 5 Sternen3/5 (1)

- QuerySurge Models Mappings DocumentDokument28 SeitenQuerySurge Models Mappings Documentchiranjeev mishra100% (1)

- Commodity Derivatives: Markets and ApplicationsVon EverandCommodity Derivatives: Markets and ApplicationsBewertung: 4 von 5 Sternen4/5 (1)

- CSCU Module 08 Securing Online Transactions PDFDokument29 SeitenCSCU Module 08 Securing Online Transactions PDFdkdkaNoch keine Bewertungen

- Commodity TradingDokument0 SeitenCommodity TradingNIKNISHNoch keine Bewertungen

- RELATION AND FUNCTION - ModuleDokument5 SeitenRELATION AND FUNCTION - ModuleAna Marie ValenzuelaNoch keine Bewertungen

- The Commodities Investor: A beginner's guide to diversifying your portfolio with commoditiesVon EverandThe Commodities Investor: A beginner's guide to diversifying your portfolio with commoditiesBewertung: 5 von 5 Sternen5/5 (1)

- Activity Sheet Housekeeping Week - 8 - Grades 9-10Dokument5 SeitenActivity Sheet Housekeeping Week - 8 - Grades 9-10Anne AlejandrinoNoch keine Bewertungen

- 14 - Presentation On Commodity TradingDokument15 Seiten14 - Presentation On Commodity TradingvijayxkumarNoch keine Bewertungen

- Worlds Major Commodity Exchanges: The New York Mercantile Exchange (NYMEX)Dokument4 SeitenWorlds Major Commodity Exchanges: The New York Mercantile Exchange (NYMEX)Amit TrivediNoch keine Bewertungen

- Performance Evaluation of Selected CommoditiesDokument73 SeitenPerformance Evaluation of Selected CommoditiesMessiNoch keine Bewertungen

- Industry Profile: CommodityDokument12 SeitenIndustry Profile: CommoditySaidi ReddyNoch keine Bewertungen

- Executive Summary: Commodities Market in IndiaDokument67 SeitenExecutive Summary: Commodities Market in IndiaSushil RajguruNoch keine Bewertungen

- Commodity Future Markets in India: 1. History of Commodity FuturesDokument16 SeitenCommodity Future Markets in India: 1. History of Commodity FuturesPrashant KumarNoch keine Bewertungen

- Presentation 2Dokument30 SeitenPresentation 2Rishabh RankaNoch keine Bewertungen

- A Study On Future Scenario of Bullion MarketDokument86 SeitenA Study On Future Scenario of Bullion Marketjonathan-vaz-622867% (6)

- Combined CDM NotesDokument118 SeitenCombined CDM NotesMihiiiNoch keine Bewertungen

- Definition of CommoditiesDokument16 SeitenDefinition of CommoditiesDeepika MahnaNoch keine Bewertungen

- Project Report On Commodity MarketsDokument65 SeitenProject Report On Commodity Marketskrittika03Noch keine Bewertungen

- What Is Commodity MarketDokument12 SeitenWhat Is Commodity MarketVivek GittuwalaNoch keine Bewertungen

- Commodity Market ReportDokument10 SeitenCommodity Market ReportsaturunNoch keine Bewertungen

- S AshfaqDokument45 SeitenS AshfaqCMA-1013 V.NAVEENNoch keine Bewertungen

- FM PPT - Commodities MKTDokument18 SeitenFM PPT - Commodities MKTrichabhagat2906Noch keine Bewertungen

- Indian Commodity MarketDokument9 SeitenIndian Commodity MarketSweta SinghNoch keine Bewertungen

- Commodity ExchangesDokument21 SeitenCommodity ExchangesCray AlisterNoch keine Bewertungen

- Commodity Market Full NotesDokument83 SeitenCommodity Market Full NotesHarshitha RNoch keine Bewertungen

- Final ProjectDokument90 SeitenFinal Projectaryanabhi123Noch keine Bewertungen

- 11 Chapter 4Dokument12 Seiten11 Chapter 4CuriosityShopNoch keine Bewertungen

- Faq Booklet EnglishDokument30 SeitenFaq Booklet EnglishSameer MishraNoch keine Bewertungen

- Commodity MarketDokument6 SeitenCommodity MarketsalmanbeckenbauerNoch keine Bewertungen

- Review of Literature 3. Rationale of Study 4. Objectives of The Study 5. Research Methodology 6. Hypotheses of The StudyDokument15 SeitenReview of Literature 3. Rationale of Study 4. Objectives of The Study 5. Research Methodology 6. Hypotheses of The Studysourabhjain94Noch keine Bewertungen

- 1 - World Comm Exchanges 7.9.19Dokument70 Seiten1 - World Comm Exchanges 7.9.19Ajay KumarNoch keine Bewertungen

- Indian Commodity MarketDokument28 SeitenIndian Commodity MarketVishal VincentNoch keine Bewertungen

- Relationship Between Inflation and Price of CommodityDokument41 SeitenRelationship Between Inflation and Price of CommoditydhruvgujaratiNoch keine Bewertungen

- Indian Commodity Market - GroundnutDokument42 SeitenIndian Commodity Market - GroundnutAnjali PanchalNoch keine Bewertungen

- Commodities Exchanges Commodity: Commodity Markets Are Markets Where Raw or Primary Products Are Exchanged. TheseDokument10 SeitenCommodities Exchanges Commodity: Commodity Markets Are Markets Where Raw or Primary Products Are Exchanged. Thesehv_g7991Noch keine Bewertungen

- Mba Project by FrajvalDokument28 SeitenMba Project by FrajvalmorganNoch keine Bewertungen

- Commodity NotesDokument12 SeitenCommodity NotesVatsalya DashoraNoch keine Bewertungen

- Commodity Derivatives 1Dokument29 SeitenCommodity Derivatives 1Bibhudatta MishraNoch keine Bewertungen

- Commodity Market: By, Anitha. R Assistant ProfessorDokument16 SeitenCommodity Market: By, Anitha. R Assistant ProfessorAnitha RNoch keine Bewertungen

- A Research ReportDokument57 SeitenA Research ReportShridhar BhatNoch keine Bewertungen

- Commodity MKT InfoDokument4 SeitenCommodity MKT InfoManoj NikamNoch keine Bewertungen

- Synopsis On Commodity MarketDokument8 SeitenSynopsis On Commodity MarketsonaliasudaniNoch keine Bewertungen

- Indian Commodity Futures MarketsDokument6 SeitenIndian Commodity Futures MarketsMahesh JadhavNoch keine Bewertungen

- Commodity Market: "Advice Is The Only Commodity On The Market Where The Supply Exceeds The Demand."Dokument53 SeitenCommodity Market: "Advice Is The Only Commodity On The Market Where The Supply Exceeds The Demand."harikrishnaNoch keine Bewertungen

- What Is Commodity Trading?: MBA Education & CareersDokument0 SeitenWhat Is Commodity Trading?: MBA Education & CareersprajuprathuNoch keine Bewertungen

- Chapter - IDokument34 SeitenChapter - ITriveni ItnalNoch keine Bewertungen

- Commodity DerivativeDokument40 SeitenCommodity Derivative1989_guru100% (2)

- Commodity Basics - The Financial DoctorsDokument30 SeitenCommodity Basics - The Financial DoctorsAnsumanNathNoch keine Bewertungen

- Commodity MarketDokument8 SeitenCommodity MarketRushabh ShahNoch keine Bewertungen

- Performance Analysis of Indian Commodity Market: March 2020Dokument16 SeitenPerformance Analysis of Indian Commodity Market: March 2020Suraj O V 1820368Noch keine Bewertungen

- If - Comm Futures Deepa and Ankita & RohanDokument13 SeitenIf - Comm Futures Deepa and Ankita & RohanmundheudayNoch keine Bewertungen

- CommodityDokument14 SeitenCommodityChamp DsouzaNoch keine Bewertungen

- Commodity Markets: Commodity Market and Its EmergenceDokument8 SeitenCommodity Markets: Commodity Market and Its EmergenceURVIL DESAINoch keine Bewertungen

- Commodities Derivatives Market in India: The Road Traveled and Challenges AheadDokument22 SeitenCommodities Derivatives Market in India: The Road Traveled and Challenges AheadyenNoch keine Bewertungen

- Equity Linked SavingsDokument70 SeitenEquity Linked SavingsVinay ArtwaniNoch keine Bewertungen

- China ProductsDokument21 SeitenChina ProductsNikhil JethwaniNoch keine Bewertungen

- Driving Growth Through Strategic Workforce Planning: Wipro Consulting ServicesDokument7 SeitenDriving Growth Through Strategic Workforce Planning: Wipro Consulting ServicesVinay ArtwaniNoch keine Bewertungen

- Ministry of Chemicals and FertilisersDokument7 SeitenMinistry of Chemicals and FertilisersVinay ArtwaniNoch keine Bewertungen

- An American Depository ReceiptDokument13 SeitenAn American Depository ReceiptVinay ArtwaniNoch keine Bewertungen

- Depositary ReceiptsDokument21 SeitenDepositary ReceiptsVinay ArtwaniNoch keine Bewertungen

- Foreign Direct Investment in Multi-Brand RetailDokument16 SeitenForeign Direct Investment in Multi-Brand RetailVinay ArtwaniNoch keine Bewertungen

- FinalDokument2 SeitenFinalVinay ArtwaniNoch keine Bewertungen

- Vanishing CompaniesDokument7 SeitenVanishing CompaniesVinay Artwani100% (1)

- Introduction To European Sovereign Debt CrisisDokument8 SeitenIntroduction To European Sovereign Debt CrisisVinay ArtwaniNoch keine Bewertungen

- Introduction To Financial SystemsDokument21 SeitenIntroduction To Financial SystemsVinay ArtwaniNoch keine Bewertungen

- Demand Determinants EEMDokument22 SeitenDemand Determinants EEMPrabha KaranNoch keine Bewertungen

- DU Series MCCB CatalogueDokument8 SeitenDU Series MCCB Cataloguerobinknit2009Noch keine Bewertungen

- Knitting in Satellite AntennaDokument4 SeitenKnitting in Satellite AntennaBhaswati PandaNoch keine Bewertungen

- Forensic My Cology Mcgraw HillDokument8 SeitenForensic My Cology Mcgraw HillJayanti RaufNoch keine Bewertungen

- Unit 2 Operations of PolynomialsDokument28 SeitenUnit 2 Operations of Polynomialsapi-287816312Noch keine Bewertungen

- TSC M34PV - TSC M48PV - User Manual - CryoMed - General Purpose - Rev A - EnglishDokument93 SeitenTSC M34PV - TSC M48PV - User Manual - CryoMed - General Purpose - Rev A - EnglishMurielle HeuchonNoch keine Bewertungen

- BDRRM Sample Draft EoDokument5 SeitenBDRRM Sample Draft EoJezreelJhizelRamosMendozaNoch keine Bewertungen

- A Summer Training ReportDokument39 SeitenA Summer Training ReportShubham SainyNoch keine Bewertungen

- The Function and Importance of TransitionsDokument4 SeitenThe Function and Importance of TransitionsMarc Jalen ReladorNoch keine Bewertungen

- CAMEL Model With Detailed Explanations and Proper FormulasDokument4 SeitenCAMEL Model With Detailed Explanations and Proper FormulasHarsh AgarwalNoch keine Bewertungen

- Drawbot 1Dokument4 SeitenDrawbot 1SayanSanyalNoch keine Bewertungen

- Mtech Vlsi Lab ManualDokument38 SeitenMtech Vlsi Lab ManualRajesh Aaitha100% (2)

- Acc 106 Account ReceivablesDokument40 SeitenAcc 106 Account ReceivablesAmirah NordinNoch keine Bewertungen

- Accounting System (Compatibility Mode) PDFDokument10 SeitenAccounting System (Compatibility Mode) PDFAftab AlamNoch keine Bewertungen

- Portfolio AdityaDokument26 SeitenPortfolio AdityaAditya DisNoch keine Bewertungen

- Fh84fr6ht GBR EngDokument6 SeitenFh84fr6ht GBR EngEsmir ŠkreboNoch keine Bewertungen

- British Birds 10 LondDokument376 SeitenBritish Birds 10 Londcassy98Noch keine Bewertungen

- UK Tabloids and Broadsheet NewspapersDokument14 SeitenUK Tabloids and Broadsheet NewspapersBianca KissNoch keine Bewertungen

- CCTV Guidelines - Commission Letter Dated 27.08.2022Dokument2 SeitenCCTV Guidelines - Commission Letter Dated 27.08.2022Sumeet TripathiNoch keine Bewertungen

- Crown BeverageDokument13 SeitenCrown BeverageMoniruzzaman JurorNoch keine Bewertungen

- Discover It For StudentsDokument1 SeiteDiscover It For StudentsVinod ChintalapudiNoch keine Bewertungen

- So Tim Penilik N10 16 Desember 2022 Finish-1Dokument163 SeitenSo Tim Penilik N10 16 Desember 2022 Finish-1Muhammad EkiNoch keine Bewertungen

- Line Integrals in The Plane: 4. 4A. Plane Vector FieldsDokument7 SeitenLine Integrals in The Plane: 4. 4A. Plane Vector FieldsShaip DautiNoch keine Bewertungen

- Intertext: HypertextDokument8 SeitenIntertext: HypertextRaihana MacabandingNoch keine Bewertungen