Beruflich Dokumente

Kultur Dokumente

Sha Mika Ravi

Hochgeladen von

Labh JanjuaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sha Mika Ravi

Hochgeladen von

Labh JanjuaCopyright:

Verfügbare Formate

Eect of Interest Rate on Consumption

Mudit Kapoor and Shamika Ravi

y

Indian School of Business

Hyderabad, India

Abstract

This paper estimates the response of consumption to higher real interest rate. We exploit the

change in Indian banking legislation which encourages all banks to oer a higher interest rate

on deposits to citizens above sixty years. We use Indian National Sample Survey for monthly

consumption expenditure and calculate regression discontinuity estimates, based on age cut-

os. We nd that an increase of 50 basis points in interest rate leads to an immediate decline

of consumption expenditure by 10 percent. A breakup of monthly consumption expenditure

reveals that the decline is primarily in non-food, non-essential items. Next, we calculate similar

estimates for data prior to the banking legislation and nd no signicant dierence in the

monthly consumption expendture.

This is a preliminary draft. We would like to thank Bhagwan Choudhary, Jonathan Morduch, Sudip Gupta,

Rajesh Chakravarty, Sumit Agarwal and NR Prabhala for useful discussions. Kunal Sawardekar provided excellent

research assistance. Shamika Ravi gratefully acknowledges nancial support from MFMI, Open Society Institute.

Remaining errors are our own.

y

mudit_kapoor@isb.edu; shamika_ravi@isb.edu

1

1 Introduction

Under the Permanent Income Hypothesis the elasticities of consumption and saving to interest

rate depends on the model parameters such as the intertemporal elasticity of substitution. These

elasticities have wide ranging implications for monetary policy, business cycles [King, Plosser and

Rebelo 1988], and tax incentives for saving. Most studies have found small eects of interest rates

on consumption and saving [e.g. Hall 1988]. However, it remains unclear whether interest rate

elasticities are truly small or these ndings are spurious due to endogeneity of interest rate [Sum-

mers 1982, Hall 1988 and Balassa 1989] or measurement problems like the diculty of observing

household specic interest rate [Browning and Lusardi 1996; Mishkin 1995].

To test the real eect of interest rate, this paper exploits an Indian banking legislation of April

2001, when the Reserve Bank of India permitted and actively encouraged banks to oer higher

interest rates on xed deposits of any size to senior citizens - dened as people over 60 years of

age. The Government of India too launched a Senior Citizens Savings Scheme (SCSS) in 2004

with higher interest rate exclusively for the benet of senior citizens. Today all private and public

sector banks in India provide a higher interest rate to senior citizens amounting to 50 basis points

on an average. This provides a neat identication strategy. We use the regression discontinuity

2

approach to estimate the precise causal eect that interest rate has on consumption and savings of

individuals.

This paper makes two major contribution to the literature. First, it employs unusually good

data from two sources - the National Sample Survey (NSS) 61st Round (2005-06) from India

for consumption details and proprietary client level savings data from a leading private bank in

India which includes transaction details and exact birth dates of clients. The NSS includes a

representative sample of close to 40,000 households while the bank data is for 800,000 clients. The

bank data has monthly transactions and balance details of all accounts that an individual client

possesses with the particular bank.

Second, the methodology used in this paper precisely estimates the causal eect of interest rate

on savings and consumption by overcoming the bias due to endogenous relationship of interest rate

to savings and consumption.

To preview the results, we nd that an increase of 50 basis points in interest rate leads to an

immediate decline of consumption expenditure by 11 percent. A breakup of monthly consumption

expenditure reveals that the decline is primarily in non-food, non-essential items. Next, we compare

the change in consumption expenditure prior to the banking legislation and nd no signicant

dierence.

3

The paper proceeds as follows. Section II describes the empirical strategy, while section III

describes the data. Sections IV and V discuss results for Consumption and Savings respectively.

Section VI discusses an alternate hypothesis that could explain the pattern of results and provides

evidence against it - robustness check. Section VII concludes with policy implications.

2 Empirical Strategy

Our main empirical approach exploits the discontinuity in interest rate at age 60 to estimate the

causal eect of interest rate on consumption. A linear model estimated by OLS provides a starting

point:

C

ia

= c + ,

1

r

ia

+ A

ia

,

2

+ c

ia

(1)

where C

i

is the monthly consumption expenditure of individual i of age a , r

i

is the rate of

interest earned by this individual and A

i

is a vector of household variables and the errors c

i

are

independently distributed.

To improve on equation C1, we exploit the exogenous variation on the interest rate earned by

individual above 60 years of age. Identication of interest rate eect on consumption is based on

comparing the outcomes of "treated" individuals consumption expenditure, who are 60 years and

above with those of the control group - individuals who are just below the cuto age. The causal

4

interpretation of such comparisons hinges upon the assumption that birth dates are random near

the cuto. In our context this is perfectly valid assumption. Consider the regression model:

C

ia

= c + ,

1

1

ia

+ c(a) + A

ia

,

2

+ c

ia

(2)

where the eect of age on consumption is captured by c(a) and 1 is a treatment dummy that

captures higher interest rate for individuals who are 60 years or older. In equation C2, ,

1

is the

causal eect on consumption of an unit increase in interest rate. The identication assumption

that underlies the regression discontinuity strategy is that c(a) is a smooth function. Under this

assumption, the treatment eect ,

1

is obtained by estimating the discontinuity in the empirical

regression function at the point where the treatment variable switches from 0 to 1. We have

a "sharp" RD design since the treatment variable is a deterministic function of the regression

variable (age).

The assumption that c(a) is a continuous function means that dierential interest rates are

the only source of discontinuity in consumption level at age 60, after we control for observables

A. There is, however, one crucial factor why the assumption of c(a) being a continuous function

at age 60 may be violated and we could nd an abrupt change in consumption at age 60. The

government of India revised the retirement age of employees from age 58 to 60 in 2000 and this

5

could potentially aect the consumption expenditure of households. We resolve this problem by

only looking at sample of self employed households as there is no strict retirement age for this

category.

We need to adapt the RD approach to the limitations of the data. One problem is that we

only observe the age in years of the individual at the census day. This means that the best we can

do is to compare all individuals who are 60 at census date. In other words, we cannot compare

people who "just turned 60" to people "just about to turn 60". Because of this limitation, all the

information available in the data can be summarized in the age specic means of the variables.

The empirical model we work with is the age cell version of equation 2:

C

a

= c + ,

1

1

a

+ c(a) + A

a

,

2

+ c

a

(3)

Regression estimates of equation 2 based on micro data are identical to weighted estimates of

equation 3 when the weight used is the number of observations by age group. The bandwidth in

our analysis is one year period. We have compared the consumption level of 60 year old population

with that of 59 year old and 61 years old population.

6

3 Data Description

We used a nationwide sample from India collected by the National Sample Survey Organization

(NSSO) as a part of its 62nd round (July 2005-June 2006). The NSSO conducts regular consumer

expenditure surveys through household interviews, using a random sample of households covering

practically the entire geographical area of India. The household consumer expenditure schedule

used for the survey collected information on quantity and value of household consumption with

a reference period of "last 30 days" for some items of consumption and "last 365 days" for some

less frequently purchased items. To minimize recall errors, a very detailed item classication was

adopted to collect information, including 148 food items, 13 items of fuel, 28 items of clothing,

bedding and footwear, 18 items of educational and medical expenses, 52 items of durable goods

and about 85 other items. The total sample size is 39436 households of which 18992 are rural

households and 20444 are urban.

The all India average monthly per capita consumption expenditure for a rural household was

Rs.625 (USD14.7) and for an urban household was Rs.1171(USD27.6). A food and non-food

breakup reveals that rural households on average spend Rs.333 on food and Rs.291 on non-food

items. For urban households the magnitude is reversed as they spend lesser on food, (Rs.468)

7

and more on non-food (Rs.703). Table 1 highlights the summary statistics for an average Indian

household.

Apart from consumption expenditure, the NSS data also has information on some additional

aspects mainly qualitative of living conditions. The specic aspects are structure of dwelling

unit, energy used for cooking and lighting, educational level of population, land ownership and

covered area of dwelling unit. In addition, information on household occupational type and social

group as well as occupancy status are also available.

In our analysis we are only looking at households that are self employed. The occupation

denitions are based on the source of income. Several households are engaged in more than one

form of occupation so the denitions depend on the majority source of income. From table 1, we

see that nearly 60 percent of households are self employed. The self employed category includes

households self engaged in agriculture, self employed in non-agriculture and urban self employed

households.

For information on interest rates, we have looked at all private banks, public banks, foreign

banks, State Cooperative banks and regional rural banks in India. The Reserve Bank of India

displays their names and some details on its website. Data on exact interest rates that are being

oered to senior citizens are available on their websites. On an average banks are oering about

8

50 basis points higher interest rates to senior citizens.

We provide a simple graphical representation of the monthly consumption expenditure for dier-

ent age population. Figures1a and 1b shows the kernel densities of monthly household consumption

expenditure. Figure 1a shows the kernel densities for the year 2005-06 which was after the banking

legislation and gure 1b shows the densities for the year 2000-2001 which was before the legislation.

It is clearly evident from the two graphs that the household monthly consumption expenditure is

lower for the 60 year population than the 59 year olds in the year 2005-06. However there is no

obvious dierence in the year 2000-2001 which was prior to the change in banking norm. We have

also tested for the equality of distributions using Kolmogorov - Smirnov tests which conrms that

the distributions are statistically dierent in 2005-06 and equal in 2000-01.

4 Empirical Results

Our results based on the specication in section 2 are shown in the tables 2 through 4. First we

look at the change in monthly household consumption expenditure (MHCE) in table 2. Then in

order to understand the exact source of this reduction in consumption, we disaggregate the MHCE

across food and non food items in table 3. Then nally in table 4, we look at the change in MHCE

in 2000-01 i.e. before the banking legislation was changed.

9

In all the regressions we have used the logarithm of household monthly consumption expenditure

as the dependent variable. The coecients of interest are the ones against age dummies. There are

some standard controls like the size of household, education level, amount of land owned, type of

dwelling unit and energy used for cooking and lighting. We also have additional controls to capture

state level eects and urban-rural eect by adding state dummies and a dummy for urban.

Our total sample consist of self employed households whose oldest members are 59, 60 or 61

years old. In the rst set of regressions we have a sample size of 1470 households and prior to the

banking legislation i.e. for the year 2000-01, we have a sample size of 2484 households. We use two

age dummies. The rst age dummy (Dummy for age=60) equals 1 if the oldest household member

is 60 years of age and 0 if they are 59 years old. The second age dummy (Dummy for age=61)

equals 1 if the oldest household member is 61 years old and 0 if they are 59 years old. So the

benchmark group for both is age of 59 years.

4.1 Results (2005-06) and Discussion

Table 2 has the results of an OLS regression and the dependent variable is logarithm of the total

monthly consumption expenditure of a household. Coecient on the 60 age dummy is 0.1 and

statistically signicant. The average increase in interest rate for individuals who are 60 and older

10

is 50 basis points across all banks in India. This implies that when the interest rate increases by 50

basis points, the consumption of households aged 60 falls by 10 percent. This is not, however, the

case for 61 year old households. This group too earns higher interest rate but their consumption

is not signicantly dierent from 59 year olds. The coecient on 61 is small and statistically not

signicant.

The results reveal an interesting age-wise pattern to the eect of higher interest rate. There

is an immediate reduction in consumption or an intertemporal substitution when interest rate is

increased. However, over the long run the eect on consumption is smaller. This could be due to

an income eect i.e. consumption rises due to higher income from interest earnings. It is important

to note here that the 61 year old population in our sample also earned the higher interest rate

when they were 60. This is because the data is from 2005-06 while the banking norm changed from

middle of 2001 onwards. As expected, the household size and asset holdings positively impact the

monthly consumption level. Households with more members consume more while households with

larger covered area dwellings consume more. These are statistically signicant results.

Next, to understand where the reduction in consumption is coming from, we will disaggregate

the monthly consumption expenditure into food and non-food items. We run the same regressions

on these two groups of expenditure separately. The ndings are not unexpected. We see that an

11

increase in interest rate does not aect household expenditure on food items. The coecient is

insignicant. Whereas there is a signicant reduction of nearly 13 percent on non-food consumption

expenditure. Non food items include durables, clothing, footwear, medical and educational and

travel expenses.

Once again within each of these categories of expenses, the 61 year dummy is insignicant.

This implies that despite the higher interest rate earned by a 61 year old, her food and non-food

expenses are not dierent from a 59 year old. The size of household and asset holding positively

aects consumption expenditure for both food and non-food items.

4.2 Results (2000-01) and Discussion

Prior to the banking norm that lead to higher interest rate for senior citizens, was there a marked

dierence in the consumption pattern of 60 year olds from 59 year olds? To answer this question,

we look the NSS round of 2000-01 which was held just before the change in banking norm in the

middle of 2001. We run the regression with the same specication as before using the same controls.

The sample size however is larger with 2484 households.

The results conrm our story. The coecients on both the age dummies are insignicant. This

implies that when there was no dierence in the interest rates for people of 60 year and above,

12

there was no dierence in their consumption behavior. The size of the coecients on the 60 year

dummy is similar to the 61 year dummy implying that both groups are not signicantly dierent

from 59 year group in consumption expenditures.

The eect of household size and asset holding on consumption is positive and the size of the

coecients are similar to earlier results.

5 Conclusion

The ndings of earlier works that have measured interest rate elasticities are spurious due to

endogeneity of interest rate and/or measurement problems like the diculty of observing household

specic interest rate. To test the real eect of interest rate, this paper exploits an Indian banking

legislation of April 2001, when the Reserve Bank of India permitted and actively encouraged banks

to oer higher interest rates on xed deposits of any size to senior citizens - dened as people over

60 years of age. The Government of India too launched a Senior Citizens Savings Scheme (SCSS)

in 2004 with higher interest rate exclusively for the benet of senior citizens. Today all private

and public sector banks in India provide a higher interest rate to senior citizens amounting to 50

basis points on an average. This provides a neat identication strategy. We use the regression

discontinuity approach to estimate the precise causal eect that interest rate has on consumption

13

of individuals.

Our basic ndings are that an increase of 50 basis points in interest rate leads to an immediate

decline of consumption expenditure by 10 percent. A breakup of monthly consumption expenditure

reveals that this decline is primarily in non-food, non-essential items and the magnitude is 12.8

percent. There is no signicant change in the consumption of essentials and food items.

The results also reveal an interesting age-wise pattern to the eect of interest rate. There is an

immediate reduction in consumption when interest rate is increased. This is captured by reduced

consumption expenditure of 60 year olds in comparison to 59 year olds. However, over the long

run the eect of interest rate on consumption is smaller as is shown by insignicant dierence in

consumption expenditure of 61 year olds to the 59 year olds. This could be due to an income eect.

Next, we compare the results with data prior to the banking legislation and nd no signicant

dierence in consumption behavior of dierent age groups.

14

References

[1] Balassa, B. (1989). The Eects of Interest Rates on Savings in Developing Countries, World

Development Report.

[2] Browning and Lusardi 1996, Household Saving: Micro Theories and Micro Facts, Journal of

Economic Literature.

[3] Hall, R. (1988). Intertemporal Substitution in Consumption, Journal of Political Economy.

[4] King, Robert. Charles Plosser and Sergio Rebelo (1988), Journal of Monetary Economics, XX1

(195-232).

[5] Mishkin, F. (1995). Symposium on the Monetary Transmission Mechanism, Journal of Eco-

nomic Perspective.

[6] Summers, Lawrence H. The After-Tax Rate Of Return Aects Private Savings, American

Economic Review, 1984, v74(2), 249-253.

15

Table 1: Summary Statistics

Variable Mean Standard

Deviation

Observations

Monthly Household Expenditure (in Rs.)

Total 3902.73 124.46 1482

Food-Group 2019.25 58.26 1482

Non-Food Group 1883.53 77.36 1482

Incremental Interest Rate (basis points)

roi(60years) roi (59years)

47.06 25.23 76

Self employed households (dummy) .59 1482

Source: Household Consumer Expenditure in India, 2005-06; NSS 62

nd

Round (July 2005-June 2006); National Sample

Survey Organization, Ministry of Statistics and Programme Implementation, Government of India

Figure 1a: Kernel density graphs of Monthly Household Consumption Expenditure (2005-2006)

0

.

2

.

4

.

6

.

8

D

e

n

s

i

t

y

6 7 8 9 10 11

Log of monthly household expenditure

Age 59 Age 60

Source: National Sample Survey 62

nd

Round (July 2005 June 2006): Household Consumption Expenditure in India

Figure 1b: Kernel density graphs of Monthly Household Consumption Expenditure 2000-2001)

0

.

2

.

4

.

6

.

8

D

e

n

s

i

t

y

6 7 8 9 10 11

Log of monthly household expenditure

Age 59 Age 60

Source: National Sample Survey 56

th

Round (July 2000 June 2001): Household Consumption Expenditure in India

Table 2: Monthly Household Expenditure (OLS)

Dependent variable: Log (MHE)

Dummy for Age = 60 -.10*

(0.053)

Dummy for Age = 61 -.03

(.074)

Log of Household Size .665***

(0.029)

Log of covered area .12***

(.03)

Number of Observations 1470

R

2

0.76

Note Standard errors are in parenthesis; * significant at 10 % confidence; ** significant at 5 % confidence; ***

significant at 1 % confidence. There are additional controls for education level, amount of land owned in hectares,

dwelling unit, dwelling type, energy source used for cooking, lighting source and dummies for urban and state. Source:

National Sample Survey 62

nd

Round (July 2005 June 2006): Household Consumption Expenditure in India

Table 3: Monthly Household Expenditure (OLS) (Food- non food breakup)

Log (MHE)

Food Items

Log (MHE)

Non-Food

Items

Dummy for Age = 60 -.075

(0.047)

-.128*

(.071)

Dummy for Age = 61 .060

(0.066)

-.035

(.091)

Log of Household Size .699***

(0.032)

.639***

(.040)

Log of covered area .072***

(0.027)

.166***

(.036)

Number of Observations 1470 1470

R

2

0.773 0.693

Note Standard errors are in parenthesis; * significant at 10 % confidence; ** significant at 5 % confidence; ***

significant at 1 % confidence. There are additional controls for education level, amount of land owned in hectares,

dwelling unit, dwelling type, energy source used for cooking, lighting source and dummies for urban and state. Source:

National Sample Survey 62

nd

Round (July 2005 June 2006): Household Consumption Expenditure in India

Table 4: Monthly Household Expenditure (OLS)

Dependent variable: Log (MHE)

Dummy for Age = 60 -.03

(0.080)

Dummy for Age = 61 .037

(0.098)

Log of Household Size .672***

(0.036)

Log of covered area .111***

(.080)

Number of Observations 2484

R

2

0.71

Note Standard errors are in parenthesis; * significant at 10 % confidence; ** significant at 5 % confidence; ***

significant at 1 % confidence. There are additional controls for education level, amount of land owned in hectares,

dwelling unit, dwelling type, energy source used for cooking, lighting source and dummies for urban and state. Source:

National Sample Survey 56

th

Round (July 2000 June 2001): Household Consumption Expenditure in India

Das könnte Ihnen auch gefallen

- The Implications of Richer Earnings Dynamics For Consumption and WealthDokument62 SeitenThe Implications of Richer Earnings Dynamics For Consumption and WealthPippoNoch keine Bewertungen

- Assignment1 OCTOBER2023Dokument2 SeitenAssignment1 OCTOBER2023nkvkdkmskNoch keine Bewertungen

- 30 Case StudyDokument12 Seiten30 Case Studyapi-737834018Noch keine Bewertungen

- EconometricsDokument15 SeitenEconometricsLeonor FerreiraNoch keine Bewertungen

- Economic Studies and Related Methods: TitleDokument21 SeitenEconomic Studies and Related Methods: TitleNajia TasnimNoch keine Bewertungen

- Lab 7Dokument4 SeitenLab 7api-638728331Noch keine Bewertungen

- An Empirical Model of Social Insurance at The End of The Life CycleDokument22 SeitenAn Empirical Model of Social Insurance at The End of The Life CyclepostscriptNoch keine Bewertungen

- Pension StudyDokument10 SeitenPension StudyJon OrtizNoch keine Bewertungen

- My Literature ReviewDokument10 SeitenMy Literature ReviewPawan Kumar DubeyNoch keine Bewertungen

- Module 1 - Basic Concepts of StatisticsDokument6 SeitenModule 1 - Basic Concepts of Statisticsprecious gabadNoch keine Bewertungen

- Financial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesVon EverandFinancial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesNoch keine Bewertungen

- Module 21 Point Estimation of The PopulationDokument5 SeitenModule 21 Point Estimation of The PopulationAlayka Mae Bandales LorzanoNoch keine Bewertungen

- DSML Project Report - Group05Dokument14 SeitenDSML Project Report - Group05deepak rajNoch keine Bewertungen

- DSML Project Report - Group05Dokument14 SeitenDSML Project Report - Group05deepak rajNoch keine Bewertungen

- Final Math IaDokument26 SeitenFinal Math IaPhuong AnhhNoch keine Bewertungen

- Trends in Poverty With An Anchored Supplemental Poverty MeasureDokument25 SeitenTrends in Poverty With An Anchored Supplemental Poverty MeasureTahar LswNoch keine Bewertungen

- Household Finance Handbook Chapter 2018 07 23Dokument115 SeitenHousehold Finance Handbook Chapter 2018 07 23Verónica Isabel Armas AyarzaNoch keine Bewertungen

- Intro To Data Analysis, Economic Statistics and EconometricsDokument9 SeitenIntro To Data Analysis, Economic Statistics and EconometricsJelaniNoch keine Bewertungen

- Statictics For ManagementDokument7 SeitenStatictics For ManagementKhushal SainiNoch keine Bewertungen

- Consumo en CascadaDokument34 SeitenConsumo en Cascadasoni_aguilarNoch keine Bewertungen

- Living Wage Calculator User's Guide / Technical Notes 2020-2021 UpdateDokument10 SeitenLiving Wage Calculator User's Guide / Technical Notes 2020-2021 UpdateknackkayNoch keine Bewertungen

- Case Study 2 - Lane 1Dokument9 SeitenCase Study 2 - Lane 1api-737534119Noch keine Bewertungen

- 11.univariate and Bivariate Analysis of DataDokument18 Seiten11.univariate and Bivariate Analysis of DataDaxita Rachchha100% (1)

- Qm-250 Chapter 2 - LectureDokument13 SeitenQm-250 Chapter 2 - Lecturealaamabood6Noch keine Bewertungen

- Whollotta InfoDokument30 SeitenWhollotta InfoJohn AbruzziNoch keine Bewertungen

- Problem Formulation &ECONOMETRICSDokument16 SeitenProblem Formulation &ECONOMETRICSAbhimanyu VermaNoch keine Bewertungen

- Chitwwan PDFDokument4 SeitenChitwwan PDFyogendraNoch keine Bewertungen

- Pratica AtuarialDokument28 SeitenPratica AtuarialAndrey MouraNoch keine Bewertungen

- Ravi and Engler 2009 (NREGA)Dokument42 SeitenRavi and Engler 2009 (NREGA)rozgarNoch keine Bewertungen

- The Benefits and Costs of A Child AllowanceDokument28 SeitenThe Benefits and Costs of A Child AllowancebgultekinaNoch keine Bewertungen

- The Journal of The Economics of Ageing: David Knapp, Italo Lopez Garcia, Krishna Kumar, Jinkook Lee, Jongwook WonDokument19 SeitenThe Journal of The Economics of Ageing: David Knapp, Italo Lopez Garcia, Krishna Kumar, Jinkook Lee, Jongwook WonNadia Cenat CenutNoch keine Bewertungen

- Proj On Poverty LineDokument4 SeitenProj On Poverty LinePranab MahayNoch keine Bewertungen

- Optimal Automatic StabilizersDokument67 SeitenOptimal Automatic StabilizersNarcis PostelnicuNoch keine Bewertungen

- Econometrics PaperDokument24 SeitenEconometrics PaperPam Ramos0% (1)

- Poverty in India: Measurement, Trends and Other Issues: C. Rangarajan and S. Mahendra DevDokument42 SeitenPoverty in India: Measurement, Trends and Other Issues: C. Rangarajan and S. Mahendra DevHarsh Kumar GuptaNoch keine Bewertungen

- MAS5302 - I.D.C.M.Premachandra 1.abstract: Case Study (Linear Models) 2020APST24Dokument5 SeitenMAS5302 - I.D.C.M.Premachandra 1.abstract: Case Study (Linear Models) 2020APST24Nuwan ChathurangaNoch keine Bewertungen

- Team 14 - Project Documentation - Taiwan Credit Defaults v1.0Dokument3 SeitenTeam 14 - Project Documentation - Taiwan Credit Defaults v1.0Swetha KarthikeyanNoch keine Bewertungen

- Assessing The Demand For Micropensions Among India's PoorDokument11 SeitenAssessing The Demand For Micropensions Among India's PoorwindNoch keine Bewertungen

- Literature Review On Old Age PensionDokument5 SeitenLiterature Review On Old Age Pensionfvf66j19100% (1)

- Group 1 Project Report DADokument65 SeitenGroup 1 Project Report DABhadriNoch keine Bewertungen

- Assignment IIDokument5 SeitenAssignment IIsarah josephNoch keine Bewertungen

- The Regression Project ReportDokument4 SeitenThe Regression Project Reportapi-283170417Noch keine Bewertungen

- Spandana Case Study: An Analysis: Anoothi, 3 Year Eco. HonsDokument13 SeitenSpandana Case Study: An Analysis: Anoothi, 3 Year Eco. HonsAnoothiNoch keine Bewertungen

- How Important Is Asset Allocation To Financial Security in Retirement?Dokument28 SeitenHow Important Is Asset Allocation To Financial Security in Retirement?Mc KirstenNoch keine Bewertungen

- Econ Project - MergedDokument14 SeitenEcon Project - MergeddjNoch keine Bewertungen

- 4044 4589 1 SMDokument5 Seiten4044 4589 1 SMArzu ZeynalovNoch keine Bewertungen

- Paper6 Actuarial Methodology For Evaluating DMDokument30 SeitenPaper6 Actuarial Methodology For Evaluating DMImran AhsanNoch keine Bewertungen

- Mba Semester 1 (Book ID: B1129) Assignment Set-1 (60 Marks)Dokument20 SeitenMba Semester 1 (Book ID: B1129) Assignment Set-1 (60 Marks)Zayed Abdul LatheefNoch keine Bewertungen

- A Flexible Copula Regression Model With Bernoulli and Tweedie Margins For Estimating The Effect of Spending On Mental HealthDokument34 SeitenA Flexible Copula Regression Model With Bernoulli and Tweedie Margins For Estimating The Effect of Spending On Mental Health金浩宇Noch keine Bewertungen

- Strategies to Explore Ways to Improve Efficiency While Reducing Health Care CostsVon EverandStrategies to Explore Ways to Improve Efficiency While Reducing Health Care CostsNoch keine Bewertungen

- Interest-Rate Risk in The Indian Banking SystemDokument80 SeitenInterest-Rate Risk in The Indian Banking SystemSuman MaratheNoch keine Bewertungen

- Total Mark: Donika RaifiDokument10 SeitenTotal Mark: Donika RaifidonikaNoch keine Bewertungen

- An Inquiry Into The Well Being of Indian Households: MIMAP-India Survey ReportDokument7 SeitenAn Inquiry Into The Well Being of Indian Households: MIMAP-India Survey Reportabhishek.abhilashiNoch keine Bewertungen

- Introduction To Applied Modeling. Regression Analysis. Simple Linear Regression ModelDokument32 SeitenIntroduction To Applied Modeling. Regression Analysis. Simple Linear Regression ModelBertrand SomlareNoch keine Bewertungen

- Estatikom Journal Editor 05. Daniel Limbong Yudi OkDokument12 SeitenEstatikom Journal Editor 05. Daniel Limbong Yudi OkHadi BuanaNoch keine Bewertungen

- Exam 2Dokument4 SeitenExam 2pedromfr97Noch keine Bewertungen

- Econ3510 Sample Final Exam WithanswersDokument10 SeitenEcon3510 Sample Final Exam Withanswerssimple975Noch keine Bewertungen

- The Application of Catastrophe Theory in The Credit Risk Assessment of Famers' MicrofinanceDokument4 SeitenThe Application of Catastrophe Theory in The Credit Risk Assessment of Famers' MicrofinanceJournal of Computer Science and EngineeringNoch keine Bewertungen

- Determinants of Household SavingsDokument12 SeitenDeterminants of Household Savingsqazikhurramali100% (2)

- Economic Solidarity Program the Best Financial Solutions Necessary to Provide Liquidity Material and How to Avoid the Financial Problem Facing Individual, Family, and CommunityVon EverandEconomic Solidarity Program the Best Financial Solutions Necessary to Provide Liquidity Material and How to Avoid the Financial Problem Facing Individual, Family, and CommunityNoch keine Bewertungen

- Tourism PolicyDokument6 SeitenTourism Policylanoox0% (1)

- 3.1.2 and 3.1.3.import - LC Open and Amend Karl Mayer - Nov.28.2014Dokument8 Seiten3.1.2 and 3.1.3.import - LC Open and Amend Karl Mayer - Nov.28.2014thanhtuan12Noch keine Bewertungen

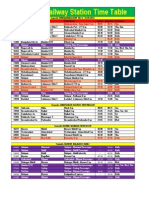

- Solapur Railway Station Time TableDokument2 SeitenSolapur Railway Station Time TableAndrea Lopez33% (3)

- Sap MM Standard Business ProcessesDokument65 SeitenSap MM Standard Business ProcessesDipak BanerjeeNoch keine Bewertungen

- Retainage Release Invoices in Oracle AP - ErpSchoolsDokument9 SeitenRetainage Release Invoices in Oracle AP - ErpSchoolsK.rajesh Kumar ReddyNoch keine Bewertungen

- Bradford Snell The Street Car ConspiracyDokument4 SeitenBradford Snell The Street Car ConspiracyDaniel DavarNoch keine Bewertungen

- Masan Group CorporationDokument31 SeitenMasan Group Corporationhồ nam longNoch keine Bewertungen

- Antwoordblad Instaptoets EngelsDokument4 SeitenAntwoordblad Instaptoets EngelskadpoortNoch keine Bewertungen

- Chapter 7Dokument18 SeitenChapter 7dheerajm88Noch keine Bewertungen

- Bangkok Retail 4q13Dokument1 SeiteBangkok Retail 4q13Bea LorinczNoch keine Bewertungen

- Rufino Tan Vs Ramon Del RosarioDokument1 SeiteRufino Tan Vs Ramon Del RosarioJocelyn MagbanuaNoch keine Bewertungen

- Cash Flows From Operating ActivitiesDokument5 SeitenCash Flows From Operating ActivitiesIrfan MansoorNoch keine Bewertungen

- Uy Balance SheetDokument8 SeitenUy Balance SheetMary Louise CamposanoNoch keine Bewertungen

- ARIIX Enrollment & Auto Delivery Options (US & Canada)Dokument10 SeitenARIIX Enrollment & Auto Delivery Options (US & Canada)ARIIX GlobalNoch keine Bewertungen

- Putting English Unit14Dokument13 SeitenPutting English Unit14Dung LeNoch keine Bewertungen

- Appendix 8 - Instructions - RAPALDokument1 SeiteAppendix 8 - Instructions - RAPALTesa GDNoch keine Bewertungen

- Indifference CurveDokument16 SeitenIndifference Curveএস. এম. তানজিলুল ইসলামNoch keine Bewertungen

- Jack Daniel'sDokument17 SeitenJack Daniel'sIon TarlevNoch keine Bewertungen

- Introduction To Business - 5Dokument11 SeitenIntroduction To Business - 5Md. Rayhanul IslamNoch keine Bewertungen

- Business Level StrategyDokument28 SeitenBusiness Level StrategyMohammad Raihanul HasanNoch keine Bewertungen

- Case Study-1 SHEENADokument2 SeitenCase Study-1 SHEENARushikesh Dandagwhal100% (1)

- Short AnswerDokument4 SeitenShort AnswerMichiko Kyung-soonNoch keine Bewertungen

- Tennis Ball Activity - Diminishing Returns - Notes - 3Dokument1 SeiteTennis Ball Activity - Diminishing Returns - Notes - 3Raghvi AryaNoch keine Bewertungen

- Corporate FinanceDokument11 SeitenCorporate Financemishu082002100% (2)

- VisuSon - Business Stress TestingDokument7 SeitenVisuSon - Business Stress TestingAmira Nur Afiqah Agus SalimNoch keine Bewertungen

- Capital StructureDokument44 SeitenCapital Structure26155152Noch keine Bewertungen

- Circular FlowDokument21 SeitenCircular FlowSheryl BorromeoNoch keine Bewertungen

- Logistics AccountingDokument131 SeitenLogistics AccountingCA Rekha Ashok PillaiNoch keine Bewertungen

- Respond To Business OpportunitiesDokument21 SeitenRespond To Business OpportunitiesRissabelle CoscaNoch keine Bewertungen

- MudraDokument19 SeitenMudraManoj MawaleNoch keine Bewertungen