Beruflich Dokumente

Kultur Dokumente

537674

Hochgeladen von

haginileOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

537674

Hochgeladen von

haginileCopyright:

Verfügbare Formate

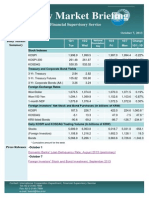

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Model

Market

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

(Rich)/Cheap

Helin Gai (+1 212 298 4226)

Delivery

Cheapest

Gross

Net

Implied

Invoice

Delivery

Deliv Date

Price

Current

Z-Score

Option

PV01

Duration

to Deliver

Yield

Basis

Basis

Repo

Spread

Prob

WNU2

09/28/12

170-160

(1.3)

1.2

1.1

289.9

17.01

4.375 02/15/38

2.495

21.2

(0.1)

0.24

(14.3)

50.0%

USU2

09/28/12

150-010

(0.7)

0.3

0.0

167.6

11.17

6.125 11/15/27

2.077

29.4

(0.7)

0.31

2.5

100.0%

TYU2

09/28/12

134-040

0.8

1.1

0.0

83.4

6.22

3.125 05/15/19

0.974

15.6

0.7

0.11

22.5

100.0%

FVU2

10/03/12

124-152

(0.1)

0.7

0.0

53.0

4.26

0.875 11/30/16

0.554

3.6

(0.1)

0.24

17.1

100.0%

TUU2

10/03/12

110-080

(0.4)

0.8

0.0

20.8

1.89

2.625 06/30/14

0.239

13.1

(0.4)

0.28

20.8

100.0%

WNZ2

12/31/12

169-010

(2.2)

1.8

0.9

289.8

17.15

4.375 02/15/38

2.495

53.4

(1.0)

0.28

(15.1)

50.0%

USZ2

12/31/12

151-020

(1.2)

(0.8)

0.0

179.8

11.91

5.500 08/15/28

2.127

68.1

(1.1)

0.28

(0.0)

99.9%

TYZ2

12/31/12

133-04+

(0.1)

0.0

0.0

85.2

6.40

3.625 08/15/19

1.011

44.9

(0.1)

0.23

23.6

100.0%

FVZ2

01/04/13

124-056

(1.0)

(0.5)

0.0

56.0

4.51

0.875 02/28/17

0.593

8.1

(0.8)

0.28

18.7

100.0%

TUZ2

01/04/13

110-080

(0.6)

0.8

0.0

23.7

2.15

2.375 09/30/14

0.244

29.0

(0.6)

0.27

22.7

100.0%

OTR Shift

(100)

(80)

(60)

(40)

(30)

(20)

(10)

10

20

30

40

60

80

100

WNU2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

USU2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

TYU2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

FVU2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

TUU2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

WNZ2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

USZ2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

TYZ2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

FVZ2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

TUZ2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

OTR Shift

(100)

(80)

(60)

(40)

(30)

(20)

(10)

10

20

30

40

60

80

100

WNU2

02/38

USU2

11/27

TYU2

05/19

FVU2

11/16

TUU2

06/14

WNZ2

02/38

USZ2

08/28

TYZ2

08/19

FVZ2

02/17

TUZ2

09/14

Current CTD Net Basis on Model Delivery Date

CTD on Model Delivery Date

Source: Nomura

See Disclosure Appendix A1 for the Analyst Certification and Other Important Disclosures

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

WNU2 First Delivery Date 09/04/2012 Last Trade Date 09/19/2012 Last Delivery Date 09/28/2012

Market

Model

Rho

Vega

OTR

Price

Price

Current

(Rich)/Cheap

Avg

Z-Score

Option (tk)

Delivery

//

Factor 1

PV01

Factor 2

Duration

Convexity

(tk/%)

(tk/10bp)

BP Vol

Current Cheapest to Deliver

Issue

BNOC

Inv Sprd

170-160

170-146

(1.3)

(2.2)

1.2

1.1

289.9

288.8

(18.4)

17.008

3.736

9.2

(0.1)

86.9

4.375 02/15/38

(0.1)

(14.3)

Delivery

Prob

Fwd

Price

Fwd

Yield

Conv

Fwd Px

Conv Fwd

DV01

Fwd

ASW

Gross

Basis

Net

Basis

Model

Basis

Repo

Implied

Repo

Implied

Beta

Parallel

Hedge

2-Factor

Hedge

Model Delivery Date 09/28/2012 (63 Days)

Cpn

Maturity

Price

Yield

Conv

Factor

4.375

02/15/38

135-113

2.495

0.7900

50.0%

134-221

2.517

170-157

289.8

(14.3)

21.2

(0.1)

0.9

0.22

0.24

0.996

7.894

7.901

4.500

05/15/38

138-001

2.493

0.8054

50.0%

137-102

2.515

170-160

290.2

(13.9)

21.9

0.0

1.1

0.22

0.21

0.995

8.059

8.053

3.500

02/15/39

118-107

2.545

0.6715

117-260

2.566

175-142

318.7

(18.0)

123.2

106.3

107.1

0.22

(16.57)

1.003

7.379

7.438

4.250

05/15/39

133-137

2.525

0.7692

132-252

2.547

172-202

304.3

(15.8)

73.1

52.5

53.4

0.22

(7.10)

0.995

8.071

8.066

4.500

08/15/39

138-186

2.523

0.8013

137-286

2.545

172-031

302.0

(15.2)

62.8

40.9

41.9

0.22

(5.30)

0.993

8.343

8.317

4.375

11/15/39

136-035

2.534

0.7841

135-143

2.555

172-237

306.5

(16.0)

77.5

56.3

57.3

0.22

(7.49)

0.994

8.285

8.268

4.625

02/15/40

141-106

2.532

0.8165

140-202

2.553

172-075

304.2

(15.5)

67.9

45.4

46.4

0.22

(5.79)

0.991

8.563

8.527

4.375

05/15/40

136-083

2.546

0.7825

135-192

2.568

173-092

310.9

(16.8)

91.1

69.9

70.9

0.22

(9.33)

0.993

8.389

8.363

3.875

08/15/40

125-306

2.570

0.7144

125-117

2.591

175-156

323.9

(18.8)

133.0

114.2

115.1

0.22

(16.73)

0.996

7.978

7.982

4.250

11/15/40

133-260

2.562

0.7641

133-053

2.584

174-090

317.9

(17.8)

113.0

92.4

93.4

0.22

(12.65)

0.992

8.376

8.349

4.750

02/15/41

144-127

2.551

0.8308

143-215

2.572

172-300

310.8

(16.4)

88.0

64.8

65.9

0.22

(8.17)

0.988

8.902

8.836

4.375

05/15/41

136-182

2.570

0.7794

135-290

2.591

174-120

319.8

(18.1)

117.8

96.6

97.6

0.22

(12.96)

0.991

8.595

8.551

3.750

08/15/41

123-13+

2.597

0.6935

122-273

2.617

177-047

336.2

(20.5)

165.8

147.6

148.5

0.22

(22.14)

0.995

8.040

8.034

3.125

11/15/41

110-040

2.627

0.6071

109-210

2.647

180-200

356.7

(23.3)

211.7

196.7

197.5

0.22

(33.07)

1.000

7.468

7.502

3.125

02/15/42

110-020

2.633

0.6058

109-190

2.653

180-290

359.2

(23.6)

216.8

201.7

202.5

0.22

(34.06)

1.000

7.502

7.537

3.000

05/15/42

107-120

2.641

0.5874

106-295

2.661

182-010

366.2

(24.3)

231.1

216.8

217.5

0.22

(37.41)

1.000

7.416

7.448

WI

08/15/42

98-120

2.691

185-156

(27.1)

253.9

251.6

0.22

(49.01)

1.003

Source: Nomura

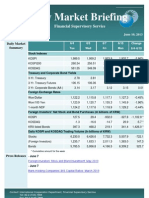

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

Net Basis for WNU2 on Model Delivery Date (09/28/2012) Factor Shift

On-the-Run Shift (bp)

(100)

(80)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

80

100

0.0

Cpn

Maturity

4.375

02/15/38

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

4.500

05/15/38

0.3

0.2

0.2

0.1

0.1

0.1

0.1

0.1

0.2

0.2

0.2

0.2

0.3

0.3

0.4

0.5

0.6

3.500

02/15/39

186.1

167.8

150.8

142.7

134.9

127.4

120.1

113.1

106.4

99.8

93.5

87.4

81.6

75.9

70.5

60.1

50.5

4.250

05/15/39

94.9

85.0

75.9

71.6

67.5

63.5

59.7

56.1

52.6

49.2

46.0

42.9

39.9

37.1

34.3

29.2

24.5

4.500

08/15/39

76.3

68.0

60.3

56.7

53.3

50.0

46.9

43.9

41.0

38.3

35.7

33.2

30.8

28.6

26.4

22.4

18.7

4.375

11/15/39

105.5

93.9

83.3

78.4

73.6

69.0

64.6

60.4

56.4

52.6

48.9

45.4

42.0

38.8

35.8

30.0

24.8

4.625

02/15/40

88.0

77.8

68.6

64.3

60.2

56.2

52.5

48.9

45.5

42.3

39.2

36.2

33.4

30.8

28.2

23.6

19.3

4.375

05/15/40

132.0

117.4

104.0

97.7

91.6

85.9

80.3

75.1

70.0

65.2

60.5

56.1

51.9

47.8

44.0

36.8

30.2

3.875

08/15/40

209.2

187.1

166.6

157.0

147.8

138.9

130.3

122.1

114.3

106.7

99.5

92.5

85.8

79.4

73.3

61.7

51.1

4.250

11/15/40

173.8

154.7

137.1

128.9

121.0

113.4

106.1

99.2

92.5

86.2

80.1

74.2

68.7

63.3

58.2

48.7

40.0

4.750

02/15/41

127.2

112.3

98.7

92.4

86.4

80.6

75.1

69.9

64.9

60.2

55.7

51.4

47.3

43.5

39.8

33.0

26.9

4.375

05/15/41

184.3

163.6

144.6

135.7

127.2

119.1

111.3

103.9

96.7

89.9

83.4

77.2

71.3

65.6

60.2

50.1

41.0

3.750

08/15/41

272.8

243.6

216.6

203.9

191.7

180.0

168.8

158.0

147.7

137.8

128.3

119.2

110.4

102.1

94.1

79.0

65.2

3.125

11/15/41

358.3

320.7

286.0

269.6

253.9

238.8

224.2

210.2

196.8

183.9

171.5

159.6

148.1

137.1

126.6

106.7

88.5

3.125

02/15/42

369.1

330.2

294.2

277.2

260.9

245.2

230.2

215.7

201.8

188.5

175.6

163.3

151.5

140.2

129.3

108.8

90.0

3.000

05/15/42

394.9

353.4

315.1

297.1

279.7

263.1

247.0

231.6

216.8

202.6

189.0

175.9

163.3

151.2

139.7

117.9

97.8

WI

08/15/42

458.7

411.2

367.2

346.4

326.5

307.2

288.8

271.0

254.0

237.5

221.8

206.6

192.1

178.1

164.6

139.4

116.0

Note

Shifts are applied to the forward yield of the on-the-run as of the model delivery date; the other issues are then shifted based on the implied betas

Source: Nomura

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

CTD Switch Grid for WNU2 on Model Delivery Date (09/28/2012)

Level Shift

Slope Change

Bull Flattening

Bear Flattening

(100)

(90)

(80)

(70)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

70

80

90

100

(10)

(9)

(8)

(7)

(6)

(5)

(4)

(3)

(2)

(1)

02/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

10

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

Bull Steepening

Notes

1. CTD switch grid is constructed assuming delivery on the model delivery date and ignores the end-of-month option

2. Slope change - for a 1 bp steepening, the forward yield of longest maturity security is increased by 0.5 bp, while that of the shortest maturity security is decreased by 0.5 bp;

the yield changes of the other securities are then linearly interpolated based to maturity; other slope changes are interpreted analogously

3. Asterisks (*) indicate that there are no CTD switches (i.e., the CTD is the same as the center grid)

Source: Nomura

Bear Steepening

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

USU2 First Delivery Date 09/04/2012 Last Trade Date 09/19/2012 Last Delivery Date 09/28/2012

Market

Model

Rho

Vega

OTR

Price

Price

Current

(Rich)/Cheap

Avg

Z-Score

Option (tk)

Delivery

//

Factor 1

PV01

Factor 2

Duration

Convexity

(tk/%)

(tk/10bp)

BP Vol

Current Cheapest to Deliver

Issue

BNOC

Inv Sprd

150-010

150-002

(0.7)

(0.9)

0.3

0.0

167.6

164.1

10.4

11.175

1.546

8.1

(0.0)

86.9

6.125 11/15/27

(0.7)

2.5

Delivery

Prob

Fwd

Price

Fwd

Yield

Conv

Fwd Px

Conv Fwd

DV01

Fwd

ASW

Model

Basis

Repo

100.0%

Model Delivery Date 09/28/2012 (63 Days)

Cpn

Maturity

Price

Yield

Conv

Factor

6.125

11/15/27

152-25+

2.077

1.0123

151-273

2.105

150-002

167.6

2.4

29.4

(0.7)

0.0

5.500

08/15/28

145-203

2.127

0.9494

144-253

2.154

152-162

179.8

0.8

102.4

75.3

76.0

5.250

11/15/28

142-131

2.150

0.9235

141-193

2.177

153-106

184.3

(0.4)

123.4

97.7

5.250

02/15/29

142-252

2.160

0.9227

141-31+

2.187

153-281

187.0

(0.4)

139.4

6.125

08/15/29

156-102

2.158

1.0130

155-121

2.185

153-122

185.6

1.5

6.250

05/15/30

159-233

2.181

1.0269

158-245

2.208

154-19+

192.4

1.6

5.375

02/15/31

147-201

2.226

0.9311

146-256

2.251

157-213

207.5

4.500

02/15/36

136-287

2.432

0.8132

136-067

2.455

167-162

4.750

02/15/37

142-057

2.452

0.8413

141-145

2.475

5.000

05/15/37

147-03+

2.452

0.8725

146-112

2.475

Source: Nomura

Gross

Basis

Net

Basis

Implied

Repo

Implied

Beta

Parallel

Hedge

2-Factor

Hedge

0.22

0.31

0.967

10.119

10.119

0.22

(9.44)

0.982

10.179

10.330

98.3

0.22

(12.55)

0.986

10.148

10.337

113.6

114.2

0.22

(14.65)

0.988

10.290

10.506

138.9

108.7

109.4

0.22

(12.77)

0.980

11.213

11.361

181.2

150.5

151.2

0.22

(17.30)

0.982

11.782

11.962

(0.5)

253.9

227.5

228.2

0.22

(28.58)

0.993

11.521

11.829

268.5

(10.8)

476.7

454.8

455.3

0.22

(61.88)

0.999

13.019

13.434

168-04+

274.3

(11.4)

510.8

487.6

488.2

0.22

(63.89)

0.995

13.763

14.152

167-235

272.9

(11.1)

518.7

494.3

494.9

0.22

(62.35)

0.992

14.200

14.562

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

Net Basis for USU2 on Model Delivery Date (09/28/2012) Factor Shift

On-the-Run Shift (bp)

(100)

(80)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

80

100

Cpn

Maturity

6.125

11/15/27

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

5.500

08/15/28

125.0

114.2

104.0

99.0

94.2

89.5

84.9

80.4

76.0

71.7

67.5

63.4

59.4

55.5

51.7

44.4

37.5

5.250

11/15/28

162.9

148.7

135.2

128.7

122.3

116.1

110.1

104.1

98.3

92.7

87.2

81.8

76.6

71.5

66.5

56.9

47.7

5.250

02/15/29

189.3

172.8

157.0

149.5

142.1

134.9

127.8

120.9

114.2

107.7

101.3

95.1

89.0

83.1

77.3

66.2

55.6

6.125

08/15/29

182.4

166.3

150.9

143.5

136.3

129.3

122.5

115.9

109.4

103.1

97.0

91.0

85.2

79.5

74.0

63.5

53.5

6.250

05/15/30

251.9

229.5

208.3

198.2

188.3

178.6

169.2

160.1

151.2

142.6

134.1

126.0

118.0

110.3

102.8

88.3

74.7

5.375

02/15/31

377.6

344.4

313.0

297.9

283.2

268.9

254.9

241.4

228.2

215.3

202.8

190.6

178.8

167.3

156.0

134.5

114.2

4.500

02/15/36

776.2

704.0

636.1

603.6

572.1

541.6

511.9

483.2

455.3

428.3

402.1

376.7

352.1

328.3

305.2

261.1

219.8

4.750

02/15/37

837.0

758.3

684.3

649.0

614.8

581.6

549.5

518.3

488.2

458.9

430.6

403.2

376.6

350.9

326.0

278.6

234.2

5.000

05/15/37

850.2

770.0

694.6

658.6

623.8

590.0

557.3

525.6

494.9

465.2

436.4

408.6

381.6

355.5

330.2

282.0

237.0

Note

Shifts are applied to the forward yield of the on-the-run as of the model delivery date; the other issues are then shifted based on the implied betas

Source: Nomura

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

CTD Switch Grid for USU2 on Model Delivery Date (09/28/2012)

Level Shift

Slope Change

Bull Flattening

Bear Flattening

(100)

(90)

(80)

(70)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

70

80

90

100

(10)

(9)

(8)

(7)

(6)

(5)

(4)

(3)

(2)

(1)

11/27

10

Bull Steepening

Notes

1. CTD switch grid is constructed assuming delivery on the model delivery date and ignores the end-of-month option

2. Slope change - for a 1 bp steepening, the forward yield of longest maturity security is increased by 0.5 bp, while that of the shortest maturity security is decreased by 0.5 bp;

the yield changes of the other securities are then linearly interpolated based to maturity; other slope changes are interpreted analogously

3. Asterisks (*) indicate that there are no CTD switches (i.e., the CTD is the same as the center grid)

Source: Nomura

Bear Steepening

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

TYU2 First Delivery Date 09/04/2012 Last Trade Date 09/19/2012 Last Delivery Date 09/28/2012

Market

Model

Rho

Vega

OTR

Price

Price

Current

(Rich)/Cheap

Avg

Z-Score

Option (tk)

Delivery

//

Factor 1

PV01

Factor 2

Duration

Convexity

(tk/%)

(tk/10bp)

BP Vol

Current Cheapest to Deliver

Issue

BNOC

Inv Sprd

134-040

134-046

0.8

0.5

1.1

0.0

83.4

63.7

20.9

6.220

0.438

7.2

(0.0)

75.3

3.125 05/15/19

0.7

22.5

Delivery

Prob

Fwd

Price

Fwd

Yield

Conv

Fwd Px

Conv Fwd

DV01

Fwd

ASW

Gross

Basis

Net

Basis

Model

Basis

Repo

Implied

Repo

Implied

Beta

Parallel

Hedge

2-Factor

Hedge

7.891

Model Delivery Date 09/28/2012 (63 Days)

Cpn

Maturity

Price

Yield

Conv

Factor

1.500

03/31/19

103-093

0.989

0.7607

103-025

1.009

135-163

86.2

19.1

40.4

33.7

33.1

0.22

(5.88)

0.787

7.856

1.250

04/30/19

101-202

0.999

0.7474

101-147

1.019

135-242

88.0

19.5

44.4

39.1

38.5

0.22

(6.97)

0.797

7.877

8.020

3.125

05/15/19

114-033

0.974

0.8471

113-203

0.994

134-046

83.4

22.8

15.6

0.7

0.0

0.22

0.11

0.783

8.468

8.468

1.125

05/31/19

100-223

1.019

0.7408

100-175

1.039

135-23+

89.3

19.1

42.9

38.1

37.6

0.22

(6.87)

0.807

7.925

8.162

1.000

06/30/19

99-24+

1.035

0.7258

99-20+

1.055

137-090

91.7

19.0

77.4

73.3

72.7

0.22

(13.55)

0.816

7.971

8.305

WI

07/31/19

99-167

1.072

137-046

18.7

69.6

69.5

0.22

(12.88)

0.823

3.625

08/15/19

117-232

1.011

0.8697

117-055

1.032

134-23+

85.6

23.5

34.5

16.9

16.2

0.22

(2.47)

0.801

8.917

9.114

100.0%

-

WI

08/31/19

99-181

1.093

136-305

18.0

65.0

65.1

0.22

(12.01)

0.831

3.375

11/15/19

116-070

1.058

0.8517

115-226

1.080

135-27+

89.5

23.2

63.5

47.3

46.6

0.22

(7.36)

0.823

9.136

9.603

3.625

02/15/20

118-065

1.103

0.8620

117-210

1.125

136-156

92.1

23.1

82.9

65.3

64.7

0.22

(10.12)

0.845

9.514

10.264

3.500

05/15/20

117-141

1.153

0.8508

116-292

1.176

137-133

95.7

21.8

106.5

89.6

88.9

0.22

(14.00)

0.862

9.759

10.736

2.625

08/15/20

110-237

1.218

0.7932

110-11+

1.241

139-041

102.0

19.3

139.5

127.0

126.4

0.22

(21.24)

0.890

9.695

11.020

2.625

11/15/20

110-217

1.264

0.7880

110-09+

1.287

139-311

105.5

18.5

159.8

147.4

146.8

0.22

(24.64)

0.901

9.959

11.457

3.625

02/15/21

118-263

1.291

0.8472

118-087

1.315

139-19+

105.1

19.4

166.2

148.6

148.0

0.22

(23.17)

0.908

10.662

12.360

3.125

05/15/21

114-201

1.355

0.8107

114-051

1.379

140-261

110.2

16.3

188.6

173.6

173.0

0.22

(28.02)

0.928

10.699

12.680

2.125

08/15/21

105-316

1.417

0.7391

105-217

1.441

142-316

118.3

13.5

219.6

209.7

209.1

0.22

(36.81)

0.953

10.473

12.737

2.000

11/15/21

104-197

1.466

0.7249

104-105

1.491

143-295

122.5

11.9

236.6

227.4

226.8

0.22

(40.37)

0.970

10.641

13.173

2.000

02/15/22

104-112

1.508

0.7191

104-021

1.533

144-227

126.2

10.9

252.9

243.7

243.1

0.22

(43.49)

0.986

10.870

13.687

1.750

05/15/22

101-24+

1.555

0.6956

101-165

1.579

145-301

131.5

9.3

271.0

263.1

262.5

0.22

(48.08)

1.000

10.954

13.982

WI

08/15/22

99-086

1.628

147-055

7.4

281.0

280.4

0.22

(52.91)

1.012

Source: Nomura

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

Net Basis for TYU2 on Model Delivery Date (09/28/2012) Factor Shift

On-the-Run Shift (bp)

(100)

(80)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

80

100

Cpn

Maturity

1.500

03/31/19

39.2

38.0

36.8

36.1

35.5

34.9

34.3

33.7

33.1

32.5

32.0

31.4

30.8

30.2

29.6

28.5

27.4

1.250

04/30/19

50.3

47.9

45.5

44.3

43.1

42.0

40.8

39.6

38.5

37.4

36.2

35.1

34.0

32.9

31.8

29.7

27.5

3.125

05/15/19

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

1.125

05/31/19

53.9

50.5

47.2

45.6

43.9

42.3

40.7

39.1

37.6

36.0

34.4

32.9

31.4

29.9

28.4

25.4

22.5

1.000

06/30/19

95.5

90.8

86.1

83.8

81.6

79.3

77.1

74.9

72.7

70.6

68.4

66.3

64.2

62.1

60.0

55.9

51.9

WI

07/31/19

95.2

89.8

84.5

81.8

79.2

76.7

74.1

71.6

69.1

66.6

64.1

61.7

59.3

56.9

54.5

49.8

45.2

3.625

08/15/19

25.4

23.5

21.6

20.7

19.8

18.9

18.0

17.1

16.2

15.4

14.5

13.7

12.8

12.0

11.2

9.6

8.1

WI

08/31/19

94.3

88.1

82.0

79.0

76.1

73.1

70.2

67.3

64.5

61.6

58.8

56.0

53.3

50.6

47.9

42.5

37.3

3.375

11/15/19

70.3

65.4

60.5

58.1

55.8

53.4

51.1

48.8

46.6

44.4

42.1

40.0

37.8

35.6

33.5

29.4

25.3

3.625

02/15/20

100.6

93.1

85.8

82.1

78.6

75.0

71.5

68.1

64.7

61.3

57.9

54.6

51.4

48.1

45.0

38.7

32.6

3.500

05/15/20

137.8

127.6

117.6

112.7

107.8

103.0

98.3

93.6

88.9

84.4

79.8

75.4

70.9

66.6

62.2

53.8

45.5

2.625

08/15/20

194.2

180.0

166.1

159.3

152.6

145.9

139.3

132.8

126.4

120.1

113.8

107.6

101.4

95.4

89.4

77.6

66.1

2.625

11/15/20

225.5

209.0

192.9

185.0

177.2

169.4

161.8

154.3

146.8

139.5

132.2

125.0

117.9

110.9

104.0

90.4

77.1

3.625

02/15/21

233.6

215.6

198.1

189.5

181.0

172.6

164.3

156.1

148.0

140.0

132.1

124.3

116.6

109.0

101.5

86.8

72.4

3.125

05/15/21

273.9

252.7

232.0

221.8

211.8

201.9

192.2

182.5

173.0

163.6

154.3

145.1

136.1

127.1

118.3

101.0

84.2

2.125

08/15/21

327.3

302.4

278.2

266.3

254.6

243.0

231.5

220.2

209.1

198.1

187.2

176.5

165.9

155.5

145.2

125.0

105.3

2.000

11/15/21

358.0

330.4

303.4

290.2

277.2

264.4

251.7

239.1

226.8

214.6

202.6

190.7

179.0

167.4

156.0

133.7

112.0

2.000

02/15/22

387.3

356.9

327.3

312.8

298.5

284.3

270.4

256.7

243.1

229.8

216.6

203.6

190.7

178.1

165.6

141.2

117.4

1.750

05/15/22

418.8

385.8

353.6

337.9

322.4

307.1

292.0

277.2

262.5

248.0

233.8

219.7

205.9

192.2

178.7

152.3

126.7

WI

08/15/22

448.2

412.7

378.2

361.3

344.7

328.3

312.1

296.2

280.5

265.0

249.7

234.7

219.8

205.2

190.8

162.6

135.2

Source: Nomura

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

CTD Switch Grid for TYU2 on Model Delivery Date (09/28/2012)

Level Shift

Slope Change

Bull Flattening

Bear Flattening

(100)

(90)

(80)

(70)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

70

80

90

100

(10)

(9)

(8)

(7)

(6)

(5)

(4)

(3)

(2)

(1)

05/19

10

Bull Steepening

Notes

1. CTD switch grid is constructed assuming delivery on the model delivery date and ignores the end-of-month option

2. Slope change - for a 1 bp steepening, the forward yield of longest maturity security is increased by 0.5 bp, while that of the shortest maturity security is decreased by 0.5 bp;

the yield changes of the other securities are then linearly interpolated based to maturity; other slope changes are interpreted analogously

3. Asterisks (*) indicate that there are no CTD switches (i.e., the CTD is the same as the center grid)

Source: Nomura

Bear Steepening

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

FVU2 First Delivery Date 09/04/2012 Last Trade Date 09/28/2012 Last Delivery Date 10/03/2012

Market

Model

Rho

Vega

OTR

Price

Price

Current

(Rich)/Cheap

Avg

Z-Score

Option (tk)

Delivery

//

Factor 1

PV01

Factor 2

Duration

Convexity

(tk/%)

(tk/10bp)

BP Vol

Current Cheapest to Deliver

Issue

BNOC

Inv Sprd

124-152

124-151

(0.1)

(0.6)

0.7

0.0

53.0

44.7

22.9

4.260

0.204

6.0

(0.0)

49.9

0.875 11/30/16

(0.1)

17.1

Delivery

Prob

Fwd

Price

Fwd

Yield

Conv

Fwd Px

Conv Fwd

DV01

Fwd

ASW

Model

Basis

Repo

100.0%

Model Delivery Date 10/03/2012 (68 Days)

Cpn

Maturity

Price

Yield

Conv

Factor

0.875

11/30/16

101-120

0.554

0.8135

101-082

0.568

124-151

53.0

17.0

3.6

(0.1)

0.0

0.875

12/31/16

101-092

0.579

0.8102

101-055

0.594

124-280

54.2

16.3

14.0

10.3

10.5

0.875

01/31/17

101-081

0.592

0.8069

101-04+

0.608

125-110

55.4

16.5

26.1

22.4

0.875

02/28/17

101-086

0.593

0.8037

101-051

0.608

125-276

56.6

18.0

39.5

1.000

03/31/17

101-23+

0.622

0.8053

101-191

0.638

126-052

57.6

16.9

0.875

04/30/17

101-045

0.630

0.7973

101-010

0.646

126-227

59.0

17.4

0.625

05/31/17

99-302

0.637

0.7840

99-280

0.653

127-12+

60.7

0.750

06/30/17

100-152

0.651

0.7858

100-122

0.668

127-237

WI

07/31/17

99-183

0.684

128-100

WI

08/31/17

99-20+

0.699

WI

09/30/17

99-222

0.716

Source: Nomura

Gross

Basis

Net

Basis

Implied

Repo

Implied

Beta

Parallel

Hedge

2-Factor

Hedge

0.22

0.24

0.860

8.132

8.132

0.22

(1.55)

0.886

8.275

8.522

22.5

0.22

(3.61)

0.904

8.426

8.852

35.8

35.9

0.22

(5.88)

0.920

8.583

9.183

47.8

43.5

43.6

0.22

(7.15)

0.940

8.751

9.563

60.8

57.1

57.2

0.22

(9.53)

0.962

8.874

9.921

18.6

75.4

73.1

73.2

0.22

(12.42)

0.983

8.965

10.241

61.7

18.9

85.2

82.2

82.4

0.22

(13.94)

1.000

9.139

10.625

18.7

96.2

95.3

0.22

(16.56)

1.020

128-235

18.9

105.5

105.6

0.22

(18.07)

1.039

129-052

19.1

115.4

115.7

0.22

(19.79)

1.058

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

Net Basis for FVU2 on Model Delivery Date (10/03/2012) Factor Shift

On-the-Run Shift (bp)

(100)

(80)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

80

100

0.0

Cpn

Maturity

0.875

11/30/16

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.875

12/31/16

16.7

15.5

14.2

13.5

12.9

12.3

11.7

11.1

10.5

9.9

9.3

8.7

8.1

7.5

6.9

5.8

4.6

0.875

01/31/17

34.2

31.8

29.4

28.2

27.1

25.9

24.8

23.6

22.5

21.4

20.3

19.2

18.1

17.0

15.9

13.8

11.7

0.875

02/28/17

52.9

49.4

45.9

44.2

42.5

40.8

39.2

37.5

35.9

34.2

32.6

31.0

29.4

27.8

26.3

23.2

20.1

1.000

03/31/17

66.0

61.4

56.8

54.6

52.3

50.1

47.9

45.7

43.6

41.4

39.3

37.2

35.1

33.0

30.9

26.9

22.9

0.875

04/30/17

86.3

80.3

74.4

71.4

68.6

65.7

62.8

60.0

57.2

54.5

51.7

49.0

46.3

43.6

40.9

35.7

30.5

0.625

05/31/17

109.0

101.6

94.3

90.7

87.2

83.6

80.1

76.6

73.2

69.8

66.4

63.0

59.7

56.4

53.1

46.7

40.3

0.750

06/30/17

123.7

115.1

106.7

102.6

98.5

94.4

90.3

86.3

82.4

78.4

74.5

70.6

66.8

63.0

59.2

51.8

44.5

WI

07/31/17

144.4

134.4

124.6

119.8

115.0

110.3

105.6

100.9

96.3

91.7

87.2

82.7

78.2

73.8

69.4

60.7

52.2

WI

08/31/17

159.5

148.3

137.4

131.9

126.6

121.3

116.0

110.8

105.6

100.5

95.4

90.3

85.3

80.4

75.5

65.8

56.3

WI

09/30/17

175.7

163.3

151.0

144.9

138.9

133.0

127.1

121.3

115.5

109.8

104.1

98.5

92.9

87.4

81.9

71.1

60.5

Note

Shifts are applied to the forward yield of the on-the-run as of the model delivery date; the other issues are then shifted based on the implied betas

Source: Nomura

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

CTD Switch Grid for FVU2 on Model Delivery Date (10/03/2012)

Level Shift

Slope Change

Bull Flattening

Bear Flattening

(100)

(90)

(80)

(70)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

70

80

90

100

(10)

(9)

(8)

(7)

(6)

(5)

(4)

(3)

(2)

(1)

11/16

10

Bull Steepening

Notes

1. CTD switch grid is constructed assuming delivery on the model delivery date and ignores the end-of-month option

2. Slope change - for a 1 bp steepening, the forward yield of longest maturity security is increased by 0.5 bp, while that of the shortest maturity security is decreased by 0.5 bp;

the yield changes of the other securities are then linearly interpolated based to maturity; other slope changes are interpreted analogously

3. Asterisks (*) indicate that there are no CTD switches (i.e., the CTD is the same as the center grid)

Source: Nomura

Bear Steepening

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

TUU2 First Delivery Date 09/04/2012 Last Trade Date 09/28/2012 Last Delivery Date 10/03/2012

Market

Model

Rho

Vega

OTR

Price

Price

Current

(Rich)/Cheap

Avg

Z-Score

Option (tk)

Delivery

//

Factor 1

PV01

Factor 2

Duration

Convexity

(tk/%)

(tk/10bp)

BP Vol

Current Cheapest to Deliver

Issue

BNOC

Inv Sprd

110-080

110-075

(0.4)

(1.0)

0.8

0.0

20.8

20.7

16.5

1.891

0.045

6.4

(0.0)

30.3

2.625 06/30/14

(0.4)

20.8

Yield

Conv

Factor

Fwd

Yield

Conv

Fwd Px

Conv Fwd

DV01

Model

Basis

Repo

Implied

Repo

Parallel

Hedge

2-Factor

Hedge

Model Delivery Date 10/03/2012 (68 Days)

Cpn

Maturity

Price

0.750

06/15/14

100-295

0.255

0.9140

2.625

06/30/14

104-180

0.239

0.9447

0.250

06/30/14

99-317

0.252

0.9058

0.625

07/15/14

100-226

0.261

0.9080

2.625

07/31/14

104-213

0.285

WI

07/31/14

0.500

08/15/14

100-155

2.375

08/31/14

WI

08/31/14

0.250

Delivery

Prob

Fwd

ASW

Gross

Basis

Net

Basis

Implied

Beta

100-265

0.258

110-102

20.6

17.8

5.1

2.1

2.4

0.22

(0.14)

0.965

9.031

8.801

104-04+

0.241

110-075

20.8

20.2

13.1

(0.4)

0.0

0.22

0.28

0.990

9.443

9.443

99-316

0.255

110-12+

21.1

18.8

4.2

4.1

4.4

0.22

(0.49)

1.000

9.175

9.266

100-20+

0.265

110-266

21.6

17.7

19.3

17.0

17.4

0.22

(2.71)

1.036

9.411

9.842

0.9422

104-077

0.291

110-205

21.8

15.0

25.4

11.8

12.2

0.22

(1.74)

1.066

9.853

10.611

99-29+

0.263

110-285

17.8

18.9

18.9

0.22

(3.06)

1.077

0.260

0.9018

100-141

0.263

111-121

22.7

17.9

34.1

32.5

32.9

0.22

(5.38)

1.116

9.803

11.044

104-120

0.271

0.9353

103-317

0.275

111-060

22.9

17.0

40.3

28.1

28.5

0.22

(4.42)

1.157

10.250

11.977

99-292

0.272

111-127

17.3

33.1

33.4

0.22

(5.53)

1.168

09/15/14

99-306

0.268

0.8931

99-305

0.272

111-29+

23.7

17.9

47.9

47.8

48.1

0.22

(8.05)

1.200

10.169

12.325

2.375

09/30/14

104-193

0.244

0.9326

104-072

0.246

111-242

23.9

21.2

57.2

45.0

45.4

0.22

(7.18)

1.227

10.671

13.222

WI

09/30/14

99-296

0.279

111-287

17.9

47.5

47.6

0.22

(8.02)

1.240

Source: Nomura

Fwd

Price

100.0%

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

Net Basis for TUU2 on Model Delivery Date (10/03/2012) Factor Shift

On-the-Run Shift (bp)

(100)

(80)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

80

100

Cpn

Maturity

0.750

06/15/14

0.3

0.8

1.2

1.4

1.6

1.8

2.0

2.2

2.4

2.7

2.9

3.1

3.3

3.5

3.7

4.1

4.5

2.625

06/30/14

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.250

06/30/14

5.8

5.5

5.3

5.1

5.0

4.8

4.7

4.6

4.4

4.3

4.2

4.0

3.9

3.8

3.6

3.4

3.1

0.625

07/15/14

22.3

21.3

20.3

19.8

19.3

18.9

18.4

17.9

17.4

16.9

16.4

16.0

15.5

15.0

14.6

13.6

12.7

2.625

07/31/14

19.8

18.2

16.7

16.0

15.2

14.4

13.7

13.0

12.2

11.5

10.7

10.0

9.3

8.5

7.8

6.4

5.0

WI

07/31/14

28.3

26.4

24.6

23.7

22.8

21.9

21.0

20.1

19.2

18.4

17.5

16.6

15.8

14.9

14.0

12.3

10.6

0.500

08/15/14

45.8

43.2

40.6

39.3

38.0

36.7

35.4

34.2

32.9

31.6

30.4

29.1

27.9

26.6

25.4

22.9

20.5

2.375

08/31/14

45.1

41.7

38.4

36.7

35.0

33.4

31.7

30.1

28.5

26.8

25.2

23.6

22.0

20.4

18.8

15.7

12.6

WI

08/31/14

51.3

47.7

44.1

42.3

40.5

38.7

37.0

35.2

33.5

31.7

30.0

28.3

26.6

24.8

23.2

19.8

16.4

0.250

09/15/14

69.8

65.4

61.0

58.8

56.7

54.5

52.4

50.2

48.1

46.0

43.9

41.8

39.7

37.7

35.6

31.5

27.4

2.375

09/30/14

70.2

65.2

60.2

57.7

55.2

52.7

50.3

47.8

45.4

43.0

40.6

38.2

35.8

33.4

31.1

26.4

21.8

WI

09/30/14

73.7

68.4

63.2

60.6

58.0

55.5

52.9

50.4

47.8

45.3

42.8

40.3

37.8

35.3

32.9

28.0

23.2

Note

Shifts are applied to the forward yield of the on-the-run as of the model delivery date; the other issues are then shifted based on the implied betas

Source: Nomura

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

CTD Switch Grid for TUU2 on Model Delivery Date (10/03/2012)

Level Shift

Slope Change

Bull Flattening

Bear Flattening

(100)

(90)

(80)

(70)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

70

80

90

100

(10)

06/14

06/14

06/14

06/14

06/14

06/14

(9)

06/14

06/14

06/14

06/14

06/14

(8)

06/14

06/14

06/14

06/14

(7)

06/14

06/14

06/14

(6)

06/14

06/14

06/14

(5)

06/14

06/14

(4)

06/14

(3)

(2)

(1)

06/14

10

Bull Steepening

Notes

1. CTD switch grid is constructed assuming delivery on the model delivery date and ignores the end-of-month option

2. Slope change - for a 1 bp steepening, the forward yield of longest maturity security is increased by 0.5 bp, while that of the shortest maturity security is decreased by 0.5 bp;

the yield changes of the other securities are then linearly interpolated based to maturity; other slope changes are interpreted analogously

3. Asterisks (*) indicate that there are no CTD switches (i.e., the CTD is the same as the center grid)

Source: Nomura

Bear Steepening

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

WNZ2 First Delivery Date 12/03/2012 Last Trade Date 12/19/2012 Last Delivery Date 12/31/2012

Market

Model

Rho

Vega

OTR

Price

Price

Current

(Rich)/Cheap

Avg

Z-Score

Option (tk)

Delivery

//

Factor 1

PV01

Factor 2

Duration

Convexity

(tk/%)

(tk/10bp)

BP Vol

Current Cheapest to Deliver

Issue

BNOC

Inv Sprd

169-010

168-307

(2.2)

(4.7)

1.8

0.9

289.8

288.7

(18.4)

17.152

3.736

23.4

(0.2)

87.5

4.375 02/15/38

(1.0)

(15.1)

Delivery

Prob

Fwd

Price

Fwd

Yield

Conv

Fwd Px

Conv Fwd

DV01

Fwd

ASW

Gross

Basis

Net

Basis

Model

Basis

Repo

Implied

Repo

Implied

Beta

Parallel

Hedge

2-Factor

Hedge

Model Delivery Date 12/31/2012 (157 Days)

Cpn

Maturity

Price

Yield

Conv

Factor

4.375

02/15/38

135-113

2.495

0.7909

50.0%

133-210

2.552

168-316

289.7

(15.2)

53.4

(1.0)

0.7

0.23

0.28

0.996

7.897

7.904

4.500

05/15/38

138-001

2.493

0.8061

50.0%

136-077

2.551

169-005

290.1

(14.9)

56.0

(0.3)

1.4

0.23

0.24

0.995

8.063

8.056

3.500

02/15/39

118-107

2.545

0.6729

116-315

2.600

173-27+

318.2

(18.8)

147.2

103.9

105.4

0.23

(6.19)

1.003

7.382

7.441

4.250

05/15/39

133-137

2.525

0.7700

131-246

2.581

171-043

304.2

(16.8)

104.9

51.8

53.5

0.23

(2.61)

0.995

8.075

8.070

4.500

08/15/39

138-186

2.523

0.8022

136-266

2.579

170-183

301.8

(16.2)

95.6

39.6

41.3

0.23

(1.86)

0.993

8.346

8.321

4.375

11/15/39

136-035

2.534

0.7848

134-130

2.590

171-082

306.4

(17.0)

110.6

56.0

57.6

0.23

(2.77)

0.994

8.289

8.272

4.625

02/15/40

141-106

2.532

0.8173

139-171

2.587

170-232

304.1

(16.5)

102.0

44.4

46.1

0.23

(2.07)

0.991

8.567

8.531

4.375

05/15/40

136-083

2.546

0.7832

134-176

2.602

171-255

310.8

(17.8)

124.1

69.4

71.1

0.23

(3.49)

0.993

8.393

8.367

3.875

08/15/40

125-306

2.570

0.7155

124-146

2.625

173-302

323.6

(19.7)

160.6

112.5

114.1

0.23

(6.30)

0.996

7.982

7.986

4.250

11/15/40

133-260

2.562

0.7648

132-047

2.618

172-25+

317.8

(18.8)

145.2

92.1

93.7

0.23

(4.79)

0.992

8.379

8.352

4.750

02/15/41

144-127

2.551

0.8315

142-175

2.606

171-140

310.7

(17.4)

123.2

64.0

65.8

0.23

(3.01)

0.988

8.905

8.840

4.375

05/15/41

136-182

2.570

0.7801

134-275

2.625

172-281

319.7

(19.1)

150.7

96.1

97.7

0.23

(4.90)

0.991

8.598

8.555

3.750

08/15/41

123-13+

2.597

0.6946

121-311

2.650

175-191

335.9

(21.4)

192.4

146.0

147.5

0.23

(8.41)

0.995

8.043

8.038

3.125

11/15/41

110-040

2.627

0.6083

108-293

2.679

179-016

356.2

(24.1)

233.7

195.1

196.4

0.23

(12.70)

1.000

7.471

7.505

3.125

02/15/42

110-020

2.633

0.6071

108-27+

2.684

179-100

358.6

(24.4)

238.2

199.7

201.0

0.23

(13.03)

1.000

7.505

7.540

3.000

05/15/42

107-120

2.641

0.5887

106-070

2.692

180-135

365.6

(25.1)

251.7

214.7

215.9

0.23

(14.36)

1.000

7.419

7.451

WI

08/15/42

98-015

2.715

183-237

(27.2)

243.4

248.3

0.23

(17.70)

1.003

WI

11/15/42

98-140

2.721

185-013

(27.6)

247.3

255.3

0.23

(17.98)

1.003

Source: Nomura

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

Net Basis for WNZ2 on Model Delivery Date (12/31/2012) Factor Shift

On-the-Run Shift (bp)

(100)

(80)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

80

100

0.0

Cpn

Maturity

4.375

02/15/38

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

4.500

05/15/38

0.9

0.8

0.8

0.7

0.7

0.7

0.7

0.7

0.7

0.7

0.7

0.8

0.8

0.8

0.9

0.9

1.0

3.500

02/15/39

183.3

165.3

148.6

140.6

132.9

125.5

118.4

111.5

104.8

98.3

92.1

86.1

80.3

74.7

69.4

59.1

49.6

4.250

05/15/39

94.8

85.0

76.0

71.7

67.6

63.7

59.9

56.3

52.8

49.5

46.3

43.2

40.2

37.4

34.7

29.6

24.9

4.500

08/15/39

75.6

67.3

59.8

56.2

52.8

49.6

46.4

43.5

40.6

37.9

35.3

32.8

30.5

28.2

26.1

22.1

18.4

4.375

11/15/39

105.7

94.2

83.7

78.8

74.0

69.5

65.1

60.9

57.0

53.1

49.5

46.0

42.6

39.4

36.3

30.6

25.4

4.625

02/15/40

87.6

77.6

68.4

64.1

60.0

56.1

52.4

48.8

45.4

42.2

39.1

36.2

33.4

30.7

28.2

23.5

19.3

4.375

05/15/40

132.0

117.5

104.2

98.0

92.0

86.2

80.7

75.5

70.4

65.6

61.0

56.6

52.4

48.4

44.5

37.3

30.8

3.875

08/15/40

207.4

185.5

165.3

155.8

146.6

137.8

129.4

121.3

113.5

106.0

98.8

91.9

85.2

78.9

72.8

61.3

50.8

4.250

11/15/40

173.7

154.8

137.4

129.2

121.3

113.8

106.6

99.7

93.1

86.8

80.7

74.9

69.3

64.0

58.9

49.4

40.7

4.750

02/15/41

127.1

112.3

98.8

92.5

86.5

80.7

75.3

70.1

65.1

60.4

55.9

51.6

47.5

43.7

40.0

33.2

27.1

4.375

05/15/41

184.0

163.5

144.6

135.8

127.4

119.3

111.5

104.1

97.0

90.3

83.8

77.6

71.7

66.1

60.7

50.6

41.5

3.750

08/15/41

270.7

241.8

215.1

202.5

190.5

178.9

167.8

157.1

146.9

137.0

127.6

118.6

109.9

101.6

93.6

78.7

65.0

3.125

11/15/41

355.6

318.5

284.2

268.0

252.4

237.4

223.0

209.2

195.9

183.1

170.8

159.0

147.6

136.7

126.3

106.6

88.4

3.125

02/15/42

366.0

327.5

291.9

275.2

259.0

243.5

228.6

214.3

200.5

187.3

174.6

162.4

150.7

139.4

128.6

108.3

89.6

3.000

05/15/42

391.4

350.5

312.7

294.8

277.7

261.2

245.3

230.1

215.4

201.4

187.8

174.9

162.4

150.4

138.9

117.3

97.4

WI

08/15/42

442.0

396.1

353.5

333.5

314.2

295.6

277.8

260.6

244.1

228.2

213.0

198.3

184.3

170.7

157.8

133.3

110.8

WI

11/15/42

450.5

403.4

359.9

339.3

319.6

300.6

282.4

264.8

248.0

231.8

216.2

201.3

186.9

173.1

159.9

135.0

112.0

Note

Shifts are applied to the forward yield of the on-the-run as of the model delivery date; the other issues are then shifted based on the implied betas

Source: Nomura

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

CTD Switch Grid for WNZ2 on Model Delivery Date (12/31/2012)

Level Shift

Slope Change

Bull Flattening

Bear Flattening

(100)

(90)

(80)

(70)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

70

80

90

100

(10)

(9)

(8)

(7)

(6)

(5)

(4)

(3)

(2)

(1)

02/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

05/38

05/38

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

05/38

05/38

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

10

05/38

05/38

05/38

05/38

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

02/41

Bull Steepening

Notes

1. CTD switch grid is constructed assuming delivery on the model delivery date and ignores the end-of-month option

2. Slope change - for a 1 bp steepening, the forward yield of longest maturity security is increased by 0.5 bp, while that of the shortest maturity security is decreased by 0.5 bp;

the yield changes of the other securities are then linearly interpolated based to maturity; other slope changes are interpreted analogously

3. Asterisks (*) indicate that there are no CTD switches (i.e., the CTD is the same as the center grid)

Source: Nomura

Bear Steepening

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

USZ2 First Delivery Date 12/03/2012 Last Trade Date 12/19/2012 Last Delivery Date 12/31/2012

Market

Model

Rho

Vega

OTR

Price

Price

Current

(Rich)/Cheap

Avg

Z-Score

Option (tk)

Delivery

//

Factor 1

PV01

Factor 2

Duration

Convexity

(tk/%)

(tk/10bp)

BP Vol

Current Cheapest to Deliver

Issue

BNOC

Inv Sprd

151-020

151-007

(1.2)

(0.5)

(0.8)

0.0

179.8

178.4

8.3

11.905

1.730

21.0

(0.0)

87.5

5.500 08/15/28

(1.1)

(0.0)

Delivery

Prob

Fwd

Price

Fwd

Yield

Conv

Fwd Px

Conv Fwd

DV01

Fwd

ASW

Gross

Basis

Model

Basis

Repo

99.9%

Model Delivery Date 12/31/2012 (157 Days)

Cpn

Maturity

Price

Yield

Conv

Factor

5.500

08/15/28

145-203

2.127

0.9500

143-152

2.197

151-007

179.8

(0.2)

68.1

(1.1)

0.0

5.250

11/15/28

142-131

2.150

0.9242

140-107

2.220

151-272

184.2

(1.5)

89.6

23.3

24.4

5.250

02/15/29

142-252

2.160

0.9235

140-232

2.229

152-123

187.0

(1.4)

105.1

39.1

6.125

08/15/29

156-102

2.158

1.0130

153-290

2.227

151-297

185.7

0.5

105.5

28.2

6.250

05/15/30

159-233

2.181

1.0265

157-082

2.250

153-062

192.6

0.5

149.2

5.375

02/15/31

147-201

2.226

0.9318

145-165

2.292

156-05+

207.5

(1.5)

219.8

4.500

02/15/36

136-287

2.432

0.8142

135-046

2.491

165-316

268.3

(11.7)

445.0

4.750

02/15/37

142-057

2.452

0.8421

140-105

2.511

166-205

274.2

(12.4)

5.000

05/15/37

147-03+

2.452

0.8730

145-047

2.512

166-08+

272.9

(12.2)

Source: Nomura

0.1%

Net

Basis

Implied

Repo

Implied

Beta

Parallel

Hedge

2-Factor

Hedge

0.23

0.28

0.982

9.491

9.491

0.23

(0.97)

0.986

9.461

9.497

40.2

0.23

(1.77)

0.988

9.594

9.652

29.4

0.23

(1.09)

0.980

10.455

10.438

70.1

71.3

0.23

(2.97)

0.982

10.985

10.990

152.3

153.4

0.23

(7.31)

0.993

10.742

10.868

388.9

389.9

0.23

(20.52)

0.999

12.138

12.342

479.1

419.9

420.8

0.23

(21.34)

0.995

12.832

13.002

487.5

424.8

425.7

0.23

(20.83)

0.992

13.240

13.379

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

Net Basis for USZ2 on Model Delivery Date (12/31/2012) Factor Shift

On-the-Run Shift (bp)

(100)

(80)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

80

100

Cpn

Maturity

5.500

08/15/28

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

5.250

11/15/28

40.9

37.3

33.8

32.2

30.5

28.9

27.4

25.9

24.4

22.9

21.5

20.1

18.8

17.5

16.2

13.8

11.4

5.250

02/15/29

67.2

61.2

55.6

52.8

50.2

47.6

45.0

42.6

40.2

37.8

35.5

33.3

31.1

29.0

26.9

23.0

19.2

6.125

08/15/29

50.3

45.6

41.1

39.0

36.9

34.9

33.0

31.2

29.4

27.6

25.9

24.3

22.7

21.2

19.7

16.9

14.3

6.250

05/15/30

119.0

108.3

98.2

93.4

88.7

84.1

79.7

75.4

71.3

67.3

63.3

59.6

55.9

52.4

48.9

42.4

36.2

5.375

02/15/31

253.7

231.4

210.2

200.1

190.2

180.6

171.3

162.2

153.4

144.8

136.4

128.3

120.5

112.8

105.4

91.1

77.7

4.500

02/15/36

666.1

603.8

545.3

517.3

490.2

463.9

438.5

413.8

389.9

366.7

344.3

322.5

301.5

281.1

261.4

223.8

188.5

4.750

02/15/37

723.4

655.0

590.7

560.1

530.4

501.7

473.8

446.9

420.8

395.6

371.1

347.5

324.6

302.4

281.0

240.3

202.2

5.000

05/15/37

733.2

663.6

598.3

567.1

537.0

507.8

479.6

452.2

425.8

400.1

375.4

351.4

328.2

305.8

284.1

242.8

204.3

Note

Shifts are applied to the forward yield of the on-the-run as of the model delivery date; the other issues are then shifted based on the implied betas

Source: Nomura

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

CTD Switch Grid for USZ2 on Model Delivery Date (12/31/2012)

Level Shift

Slope Change

Bull Flattening

Bear Flattening

(100)

(90)

(80)

(70)

(60)

(50)

(40)

(30)

(20)

(10)

10

20

30

40

50

60

70

80

90

100

(10)

(9)

(8)

(7)

(6)

(5)

(4)

(3)

(2)

(1)

08/28

10

Bull Steepening

Notes

1. CTD switch grid is constructed assuming delivery on the model delivery date and ignores the end-of-month option

2. Slope change - for a 1 bp steepening, the forward yield of longest maturity security is increased by 0.5 bp, while that of the shortest maturity security is decreased by 0.5 bp;

the yield changes of the other securities are then linearly interpolated based to maturity; other slope changes are interpreted analogously

3. Asterisks (*) indicate that there are no CTD switches (i.e., the CTD is the same as the center grid)

Source: Nomura

Bear Steepening

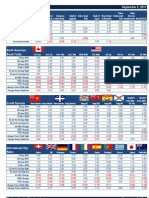

US Treasury Futures Basis Report

George Goncalves (+1 212 667 2254)

Trade Date: 07/27/2012

Stanley Sun (+1 212 667 1236)

Helin Gai (+1 212 298 4226)

TYZ2 First Delivery Date 12/03/2012 Last Trade Date 12/19/2012 Last Delivery Date 12/31/2012

Market

Model

Rho

Vega

OTR

Price

Price

Current

(Rich)/Cheap

Avg

Z-Score

Option (tk)

Delivery

//

Factor 1

PV01

Factor 2

Duration

Convexity

(tk/%)