Beruflich Dokumente

Kultur Dokumente

Bill of Exchange Processing

Hochgeladen von

Krishna Kishore GaddamOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bill of Exchange Processing

Hochgeladen von

Krishna Kishore GaddamCopyright:

Verfügbare Formate

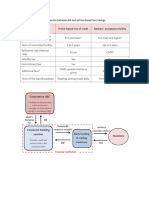

Bill of exchange Processing (Receivable) Bill of exchange processing offers the use of an additional payment method in the SAP

system. There is the option of beginning the bill of exchange process with a bill of exchange request to the customer, to which the bill of exchange receivable received is posted with reference to the bill of exchange request, or else to post a bill of exchange receivable received from the customer direct without a previous bill of exchange request. The system treats bills of exchange as special general ledger transactions. This means that these transactions are automatically managed in the subledger separately, and posted to a special reconciliation account in the general ledger. This gives you a continues overview of the bill of exchange transactions. If a bill of exchange receivable is posted, the open customer item is cleared on the customer account, and replaced by a bill of exchange receivable against the drawee. This bill of exchange receivable is updated as a special general ledger transaction to a separate reconciliation account. A bill of exchange may also be posted on account. The special general ledger functions enable you to gain an overview of the bills of exchange posted on the customer account at any time. The general ledger account assigned to the special general ledger transaction Bill of Exchange enables an overview of the total amount of all bill of exchange receivables posted. With the payment of a bill of exchange payable, the bill of exchange receivable or liability is extinguished. The bill of exchange receivables are copied to a bill of exchange list that functions as a separate subledger, and which in some countries meets the duly prescribed reporting standards. It includes all of the basic data of incoming bill of exchange receivable, such as the expiration date of the bill of exchange and the address data of the debtor. On the receivables side, the following bill of exchange transactions can be posted: Bill of exchange request (acceptors/bank bill of exchange) Bill of exchange receivable Check/bill of exchange receivable

The Bank Accounting (FI-BL) component provides also bill of exchange presentation functions, bill of exchange liability cancellation, and processing of failed bills of exchange. The business process consists of the following steps: 1. 2. 3. 4. 5. 6. 7. 8. Post outgoing invoice Post bill of exchange request Post bill of exchange by request Post customers bill of exchange Post discounting of bill of exchange Post collection of bill of exchange Post forfeiting of bill of exchange Cancel bill of exchange liability

Result: The system creates a document, updates the transaction figures of the accounts involved, and informs you of any internally assigned document number. An open item is created on the customer account that is cleared by the bill of exchange receivable (taking into account any possible bill of exchange request). The bill of exchange receivable against the customer is extinguished by the drawee when the bill of exchange is paid.

Das könnte Ihnen auch gefallen

- IBOE LanguageDokument1 SeiteIBOE Languageexousiallc100% (6)

- Auto Purchase Order For HSDDokument10 SeitenAuto Purchase Order For HSDAneesh ShamsudeenNoch keine Bewertungen

- Letter of AdviceDokument2 SeitenLetter of AdviceAndrew100% (6)

- Chicago Offering DocumentsDokument280 SeitenChicago Offering DocumentsThe Daily LineNoch keine Bewertungen

- Bill of ExchangeDokument4 SeitenBill of ExchangeSara SanamNoch keine Bewertungen

- Promissory Note Vs Bill PF ExchangeDokument2 SeitenPromissory Note Vs Bill PF ExchangelexscribisNoch keine Bewertungen

- Apostilles and Authentications: Office of The Secretary of State of Texas Government Filings SectionDokument37 SeitenApostilles and Authentications: Office of The Secretary of State of Texas Government Filings SectionJawan StarlingNoch keine Bewertungen

- Form 231Dokument2 SeitenForm 231Anissa Madewa100% (1)

- Acceptance For Value and Consideration ORWPDokument40 SeitenAcceptance For Value and Consideration ORWPSatepen Ra El100% (1)

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsVon EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNoch keine Bewertungen

- Promissory Note HBPDokument3 SeitenPromissory Note HBPMike SiscoNoch keine Bewertungen

- National Archives and Records Administration Civil Cases - Ordering InstructionsDokument2 SeitenNational Archives and Records Administration Civil Cases - Ordering InstructionstxkellerNoch keine Bewertungen

- UCC-3 Amendment Form DEBTOR ADD /COLLATERAL ADD (Registered Numbers: 2021-006737-3/2021-006738-5)Dokument5 SeitenUCC-3 Amendment Form DEBTOR ADD /COLLATERAL ADD (Registered Numbers: 2021-006737-3/2021-006738-5)MARK MENO©™0% (1)

- Bill of ExchangeDokument19 SeitenBill of ExchangeKNOWLEDGE CREATORS100% (3)

- 8 RemittanceDokument4 Seiten8 RemittanceSaif AzmanNoch keine Bewertungen

- INTERNATIONAL BILL OF EXCHANGE - OdtDokument1 SeiteINTERNATIONAL BILL OF EXCHANGE - OdtMarsha MainesNoch keine Bewertungen

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionVon EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNoch keine Bewertungen

- All Purpose Poa All NewDokument18 SeitenAll Purpose Poa All NewRoosevelt Kyle100% (1)

- Electronic Fund Transfer HelpDokument11 SeitenElectronic Fund Transfer Helpశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNoch keine Bewertungen

- Treasury Process: 1. ScopeDokument7 SeitenTreasury Process: 1. ScopestoneNoch keine Bewertungen

- Fiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / BeneficiaryDokument6 SeitenFiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / Beneficiarytony100% (21)

- SAP Bill of Exchange ProcessDokument12 SeitenSAP Bill of Exchange ProcessSrinath BabuNoch keine Bewertungen

- 1041 Tax Return Walk-ThroughDokument66 Seiten1041 Tax Return Walk-Throughdsfewr100% (4)

- 04-2013 b10 Form Court VersionDokument3 Seiten04-2013 b10 Form Court Versionjmaglich1100% (1)

- IRS EFTPS InstructionsDokument12 SeitenIRS EFTPS InstructionsLeon Hormel100% (2)

- F 8832Dokument6 SeitenF 8832IRS0% (1)

- Treasury Direct Information On Marketable SecuritiesDokument2 SeitenTreasury Direct Information On Marketable SecuritiesMARSHA MAINES50% (2)

- Remmittance Letter: Aulia Majid Bimo Teguh P Hana ValentineDokument12 SeitenRemmittance Letter: Aulia Majid Bimo Teguh P Hana ValentineRina Praba100% (1)

- Dealing With Credit Card StatementsDokument3 SeitenDealing With Credit Card Statementsjpes100% (6)

- IboeDokument2 SeitenIboeHossein ParastehNoch keine Bewertungen

- Adverse Action NoticeDokument2 SeitenAdverse Action NoticeNiko RomeroNoch keine Bewertungen

- Asset-Backed Commercial PaperDokument4 SeitenAsset-Backed Commercial PaperdescataNoch keine Bewertungen

- Registered Mail - S911Dokument6 SeitenRegistered Mail - S911El Mcknight100% (1)

- DTC Securities Settlement Systems FrameworkDokument54 SeitenDTC Securities Settlement Systems Frameworkstudent1919100% (4)

- 31 CFR 363.27Dokument4 Seiten31 CFR 363.27John Ox100% (1)

- 5 Bill of ExchangeDokument0 Seiten5 Bill of Exchangemy hoangNoch keine Bewertungen

- Form - FR2046 - Selected Balance Sheet Items For Discount Window BorrowersDokument1 SeiteForm - FR2046 - Selected Balance Sheet Items For Discount Window BorrowersPratus WilliamsNoch keine Bewertungen

- UNCITRAL Model For International PaymentsDokument8 SeitenUNCITRAL Model For International PaymentsroselinNoch keine Bewertungen

- Discounting Bills of ExchangeDokument7 SeitenDiscounting Bills of ExchangeEsha Ali ButtNoch keine Bewertungen

- Public Law Debt Insurance Securities Under Private Accounts PDFDokument2 SeitenPublic Law Debt Insurance Securities Under Private Accounts PDFJuliet Lalonne100% (5)

- International Bill of Exchange and Promissory NotesDokument41 SeitenInternational Bill of Exchange and Promissory NotesW897% (37)

- Accept For ValueDokument1 SeiteAccept For ValueRebecca Turner100% (3)

- Process of RemittanceDokument28 SeitenProcess of Remittancethehedonist33% (3)

- Preauthorzed Letter of CreditDokument1 SeitePreauthorzed Letter of Creditlakeshia1lovinglife10% (1)

- IRS Form 13909Dokument2 SeitenIRS Form 13909whoiscolleenlynnNoch keine Bewertungen

- JK 2008 Ias FormDokument7 SeitenJK 2008 Ias Formfreemanonland67% (3)

- WHFIT Transition GuidanceDokument12 SeitenWHFIT Transition GuidancejpesNoch keine Bewertungen

- Quit Claim Informational PacketDokument10 SeitenQuit Claim Informational PacketzaidNoch keine Bewertungen

- Bankers Acceptance CondensedDokument5 SeitenBankers Acceptance CondensedLuka Ajvar100% (1)

- Notice of TenderDokument2 SeitenNotice of Tendertony100% (22)

- Negotiable InstrumentDokument15 SeitenNegotiable InstrumentAngelitOdicta100% (2)

- Bill of Exchange GuideDokument1 SeiteBill of Exchange GuideDavid Oloo Stone100% (4)

- Secured Promissory Note TemplateDokument2 SeitenSecured Promissory Note TemplateSteve Vachani100% (2)

- Chapter Summary: A. Financing Foreign TradeDokument9 SeitenChapter Summary: A. Financing Foreign TradeStaidCasper100% (1)

- Chapter 10Dokument28 SeitenChapter 10YourMotherNoch keine Bewertungen

- Utility - Initiation of CoverageDokument15 SeitenUtility - Initiation of CoverageMariana IgnácioNoch keine Bewertungen

- Annual Report 2014-2015 of Jamuna Oil Company Limited PDFDokument100 SeitenAnnual Report 2014-2015 of Jamuna Oil Company Limited PDFfahimNoch keine Bewertungen

- Interview QuestionsDokument2 SeitenInterview Questionsgemrod floranoNoch keine Bewertungen

- Pacific Grove Real Estate Sales Market Report For June 2015Dokument4 SeitenPacific Grove Real Estate Sales Market Report For June 2015Nicole TruszkowskiNoch keine Bewertungen

- Cooper Tire Case Thompson Book FinalDokument31 SeitenCooper Tire Case Thompson Book FinalTran Cao Minh Hung100% (1)

- PJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Dokument15 SeitenPJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Neel DoshiNoch keine Bewertungen

- Baye 9e Chapter 11 PDFDokument32 SeitenBaye 9e Chapter 11 PDFnita sugiarta wijayaNoch keine Bewertungen

- The Walt Disney CompanyDokument4 SeitenThe Walt Disney CompanyAhsan Ul HaqNoch keine Bewertungen

- Globalization of Services: True/FalseDokument6 SeitenGlobalization of Services: True/FalseAaiysha MistryNoch keine Bewertungen

- Questionnaire On Cement BrandDokument4 SeitenQuestionnaire On Cement Branddigvijay_b201283% (12)

- Security AnalysisDokument11 SeitenSecurity AnalysisAshley WintersNoch keine Bewertungen

- Musharakah FinancingDokument23 SeitenMusharakah FinancingTayyaba TariqNoch keine Bewertungen

- Marketing in PractiseDokument19 SeitenMarketing in PractiseMikhil Pranay SinghNoch keine Bewertungen

- Master Plan Amritsar - 2031: Guru Ramdas School of Planning, Guru Nanak Dev University, Amritsar (Punjab)Dokument31 SeitenMaster Plan Amritsar - 2031: Guru Ramdas School of Planning, Guru Nanak Dev University, Amritsar (Punjab)Säbrinä ShukrìNoch keine Bewertungen

- Karen The SupertraderDokument2 SeitenKaren The SupertraderHemant Chaudhari100% (1)

- 6p Mock Exam AnswersDokument44 Seiten6p Mock Exam Answersshexi325Noch keine Bewertungen

- Chennai Metro Rail Limited: Terms of Reference For Outsourcing of Internal AuditDokument15 SeitenChennai Metro Rail Limited: Terms of Reference For Outsourcing of Internal Auditpvraju1040Noch keine Bewertungen

- Prelims Exam MGMT Acctg 1Dokument9 SeitenPrelims Exam MGMT Acctg 1geminailnaNoch keine Bewertungen

- Outsourcing ofDokument19 SeitenOutsourcing ofsaranevesNoch keine Bewertungen

- Basic Safety Procedures in High Risk Activities and IndustriesDokument2 SeitenBasic Safety Procedures in High Risk Activities and IndustriesLlanah Luz Marie Grate33% (3)

- IMC Plan of Interwood Mobel PVT LTDDokument15 SeitenIMC Plan of Interwood Mobel PVT LTDUnEeb WaSeemNoch keine Bewertungen

- CBS Research Proposal - GuidelinesDokument3 SeitenCBS Research Proposal - GuidelinesSnishatNoch keine Bewertungen

- Lectures For Basic Seminar On Cooperative Development 1203395026675748 4Dokument37 SeitenLectures For Basic Seminar On Cooperative Development 1203395026675748 4Marlon CorpuzNoch keine Bewertungen

- Case Study - FM LogisticsDokument3 SeitenCase Study - FM Logisticssaurs24231Noch keine Bewertungen

- Technical Bid (Packet-I) E-Tender No: CEE-P-WB-PSI-MUTP-IIIA/01 Dated 06.05.2021 ForDokument44 SeitenTechnical Bid (Packet-I) E-Tender No: CEE-P-WB-PSI-MUTP-IIIA/01 Dated 06.05.2021 ForHetal PatelNoch keine Bewertungen

- Final MBA - 3rd Semester-22Dokument38 SeitenFinal MBA - 3rd Semester-22rajjurajnish0% (1)

- HBR Case StudyDokument5 SeitenHBR Case StudyRahul KumarNoch keine Bewertungen

- The Attractive CharacterDokument3 SeitenThe Attractive Characterwhitneyhenson994150% (2)

- FABM FS and Closing EntriesDokument18 SeitenFABM FS and Closing EntriesMarchyrella Uoiea Olin Jovenir100% (1)