Beruflich Dokumente

Kultur Dokumente

Uestion Paper Ift

Hochgeladen von

ArchitAgrawalOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Uestion Paper Ift

Hochgeladen von

ArchitAgrawalCopyright:

Verfügbare Formate

uestion Paper International Finance and Trade II (222) : July 2006 Section D : Case Study (50 Marks) This

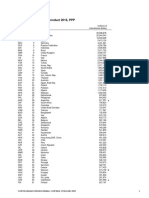

is section consists of questions with serial number 1 - 5. Answer all questions. Marks are indicated against each question. Do not spend more than 80 - 90 minutes on Section D. Case Study Read the case carefully and answer the following questions: 1. For an Indian Company, the choice between the borrowing in home currency or foreign currency would depend on a number of criteria. Discuss those criteria for choosing a currency of borrowing. (10 marks) < Answer > 2. What are the reasons for the growth of Eurodollar market? Discuss the advantages; Seven Seas Info-tech can gain by borrowing in Eurodollar market than in borrowing dollar in the US market. (8 marks) < Answer > 3. Explain how the Eurocurrency interest rates are determined. (6 marks) < Answer > 4. a. Show the cash-flows from the Eurodollar loan and euro currency loan and find out the effective rupee cost of the loans if the 6-month dollar and euro LIBOR turned out as follows: Period (Months) 612 1218 18 24 24 30 3036 36 42 42-48 48-54 54-60 US$ LIBOR LIBOR 5.30% 3.00% 5.45% 3.25% 5.50%

3.50% 5.25% 3.35% 5.50% 3.10% 5.40% 3.00% 5.25% 3.25% 5.50% 3.30% 5.50% 3.30% b. Show the cash-flows of the yen loan and find out the effective cost of the loan in rupee term. (14 + 6 = 20 marks) < Answer > 5. Explain the types of foreign exchange exposure Seven Seas Info-tech will face if it borrows in foreign currency. (6 marks) < Answer > Mr. Praveen, recently appointed as a Vice-President (Finance) in the Seven Seas Info-tech Ltd., (SSIL) Bangalore and also a member of Top Management Committee (TMC) of the company. He noticed that in the middle of June, 2006 the Head of the Financial Planning Group placed a note to TMC that the SSIL would soon reach the threshold limits fixed for short term working capital borrowings from banks in India. The company also requires term loan to the extent of Rs.200 crore to meet companys ongoing international expansion plans. For international expansion plans it is considering to borrow in foreign currency as the company can avoid the transaction cost for converting rupee into foreign currency, and also international interest rates are considered to be lower than the rupee term rates, so it can be cheap abroad. TMC is of the opinion that Govt. of India liberalized the terms and conditions for External Commercial Borrowings by Indian companies, the company should borrow from US market in view of companys good reputation in US market, even though the funds can be obtained on a softer terms from financial institutions in Japan and European countries. Mr. Praveen, explained that the company could opt for borrowings from European market at a lesser rate of interest and more softer terms than from financial institutions from USA. Due to various reasons and less number of regulations Euro banks can charge lower cost of dollar borrowings than the banks in US. It is far easier to get a dollar loan in the Eurodollar market than US since there is no central bank which controls this market. Another market Mr. Praveen considering is the Japanese yen market, due to prevailing low interest rates in Japanese market and ample liquidity it is easy to get a yen denominated loan. Mr. Praveen and his key staff members have negotiated with a number of banks to explore the possibility of getting loan for the company on favorable terms from the international market. The staff members of Mr. Praveen after a month long negotiations with various international financial institutions has short listed following three loan proposals: Proposal I

$ 44 million Eurodollar loan from a bank in London, interest is payable half-yearly at 6-month LIBOR + 100 basis points. The principal is to be repaid after 5 years with a bullet payment. Proposal II 35 million loan from a bank in Zurich, Switzerland. Interest is payable half-yearly at 6-month LIBOR + 250 basis points. The principal is to be repaid after 5 years with a bullet repayment. Proposal III 5 year 5000 million loan from a bank in Japan, interest is payable half-yearly at fixed rate of 3.00% p.a. and the principal is to be repaid in two equal annual installments at the end of 48 and 60 months. Mr. Praveen does not want to bear any foreign exchange risk and intend to hedge all his foreign exchange cash flows in the forward market. He is of the firm opinion that 6-month forward rates for euro, dollar and yen reflect values as per the purchasing power parity and current inflation rate will remain same for the future periods also. Further, the loan will be availed from July 1st, 2006. Current Exchange Rates on July 01, 2006 Rs./$ 45.48/45.52 Rs./ 0.4081/0.4091 Rs./ 58.43/58.47

Current Interest Rates on July 01, 2006 6-month LIBOR: US$ 5.5% 3.0% Inflation Rates India 5.0% USA 3.5% Japan 0.5% Euro-zone 2.0%

END OF SECTION D

Section E : Caselets (50 Marks) This section consists of questions with serial number 6 - 12. Answer all questions. Marks are indicated against each question. Do not spend more than 80 - 90 minutes on Section E. Caselet 1 Read the caselet carefully and answer the following questions: 6. How do you compare continuous linked settlement with CCIL settlement model? Do you think the settlement through CCIL has been able to increase the operational efficiency of the market participants? Discuss. (10 marks) < Answer > 7. Explain how CCIL settlement model has helped in risk reduction to market participants. (8 marks) < Answer > Domestic market in Indian rupee closes before the US dollar market becomes active. Settlement in Indian rupee funds for any Indian rupee/US dollar trade, therefore, happens before settlement of US dollar funds i.e., the settlement is not on Payment vs. Payment (PVP) basis and this type of settlement is known as continuous linked settlement. A trader who buys US dollar against Indian rupee can therefore loose the entire amount if the counterparty fails to pay US dollar after receiving Indian rupee. The counterparty exposure is therefore a major cause of concern for participants in this market. Increase in the size of the market over the years has been causing increase of counterparty exposures of the market participants. A possible consequence of a default by any market participant has also been increasing correspondingly. Moreover, with the increase in trade volume, settlement cost has also been mounting. To reduce the risk from any possible failed settlement, banks started changing their settlements from deal-wise settlements to settlements on net-basis with their counterparties (i.e. through bilateral netting). The Clearing Corporation of India Ltd. (CCIL) was set up in 2001. It came into existence to take over the responsibility of settlements in the Government Securities and Forex markets. It started working for development of a process for settlement of interbank trades in Indian rupee/US dollar. The settlement started in November 2002. The process that was formulated has remained more or less unchanged so far. In the process, the settlement participants are to report their trades to CCIL through electronic mode using RBI's INFINET network. The matching of reported trades of the participants (counterparties) are to happen in the books of CCIL. Following this, CCIL sets limits in terms of net US dollar sale positions per settlement date for all

settlement participants. Trades within limits are accepted for guaranteed settlement by CCIL as a Central Counterparty. On the other hand, forward trades are taken for guaranteed settlement only after those enter the Spot Window. US dollars payable to the settlement participants are to be released only after receipt of counter-value Indian rupee funds. For US dollar receivables, however, counter-value Indian rupee funds are to be paid to the settlement participants without waiting for receipt of the US dollar funds, causing principal risk to come into play in such cases. In case of settlement default in Indian rupee, counter-value US dollar funds are not to be released. Instead, if Indian rupee funds are not received by the next day, US dollar amounts held back are to be sold to arrange for the required Indian rupee amount. On the other hand, in case of a settlement default in US dollar, a principal risk for the respective amount is to arise. A provision to claw back funds from the defaulting participant's principal Indian rupee account with RBI also exists. In case the Indian rupee funds recovered are inadequate and the margin of the concerned member is also not adequate to take care of the likely loss, a provision exists for allocation of residual loss through a clearly designed and pre-notified loss allocation mechanism. The mechanism contains a provision for distribution of losses arising out of any settlement default to the bilateral counterparties, pro-rata, based on their exposures on the defaulting counterparty. The settlement of Indian rupee/US dollar trade started initially with only spot and forward trades. Maximum time allowed for reporting by the settlement participants was up to the midday of the day prior to the settlement date. A day's time was initially kept available as a buffer for the participants to get used to the process. It was also felt that the specific interaction protocol which was developed with the ABN AMRO Bank as settlement bank, would need time to mature. The developed process was to be efficient with abilities on the part of CCIL to monitor the movement of each transaction through the account so that operational slippages did not cause any payment failure. The settlement system worked efficiently from the very beginning and the market participants reposed their confidence in the newly developed settlement system by shifting most of their trades to the system for settlement. RBI, as a regulator, was closely monitoring the development. They also played the role of a catalyst by arranging an independent vetting of the processes in 2003 by an expert from the European Central Bank which gave the comfort to the settlement participants about the robustness of the settlement and risk management processes. Settlement of TOM and CASH trades i.e., trades with settlement on the next working day and on the same working day respectively, started in February 2004. It required significant restructuring of the processes and of the risk management systems. As CASH trades were allowed to be reported and matched in the CCIL system up to 12.30 pm of the day of settlement and the settlement participants were required to settle the trades which were not taken up for guaranteed settlement by CCIL through direct settlement, maintaining time discipline regarding processing at CCIL was critical for the success of the system. On the part of settlement participants also, this demanded a much more efficient response. It was a big challenge, but the Indian Financial System took it almost effortlessly. Caselet 2 Read the caselet carefully and answer the following questions: 8. Discuss the various factors which influence the exchange rate of US dollar. (7 marks) < Answer > 9. Do you think dollar can depreciate sharply against other major currencies? Discuss. (6 marks) < Answer > 10. How falling dollar is affecting the Asian countries? How they can combat the situation? (5 marks) < Answer >

A gigantic current-account deficit ought to be bad news for a currency. For the dollar, reality seems at last to be coming into line with the textbooks. In the past month or so the greenback has lost 6% against the euro, 7% against the yen and 3% on a broad trade-weighted basis. This week it dipped below eight yuan for the first time since China abandoned its fixed rate of 8.28 to the dollar last July. Even before the markets' recent upset, caused largely by inflation worries, there was reason to believe that the dollar was on the prolonged slide that economic logic suggests is overdue. Before anybody starts talking about a turning point it is worth considering two caveats. First, the dollar has defied gravity less dramatically than many people thinkespecially once you cast your gaze beyond the euro, the yen and the yuan. The dollar's broad trade-weighted index has fallen by 18% since February 2002. Last year, notes Jim O'Neill, of Goldman Sachs, the greenback lost against the Canadian dollar (which has a weight almost as big as the euro's) and some important emerging-market currencies such as the South Korean won (which counts for about the same as the pound sterling). The second caveat is that once you look at the euro and the yen, the dollar has been here before, and not that long ago. At the start of 2005, the greenback was weaker against both the euro and the yen than it is now, but gained against both currencies in the course of the year. Asian central banks, which have helped sustain both the current-account deficit and the dollar by buying Treasury bonds in startlingly large quantities, have little interest in a weaker greenback. Oil-exporting countries are also thought to have been putting at least some of their extra revenues into dollar-denominated assets, including treasuries. Neither source of currentaccount funding looks likely to dry up just yet. Against these caveats there are a number of reasons to argue that something fundamental may just have shifted against the dollar. The first is the removal of a temporary prop. Last year American companies were allowed a lower tax rate on profits repatriated from abroad. Now, that support for the external deficit and the dollar has been taken away. A second change has to do with international differences in interest rates. Until recently, the dollar was helped by the Federal Reserve's policy of raising interest rates (a quarter of a percentage point at 16 consecutive meetings after June 2004) at a time when the Europeans held steady. Now the tables are turned: markets are worried that the Fed will stop at 5%, but the European Central Bank is raising interest rates and will probably soon be joined by the Bank of Japan. This is linked to a third point: there has been a change in beliefs about how economies are faring. Whereas the rattling pace of America's economy is expected to slacken in the second half of the year, the slower-growing euro area and Japan are thought to be picking upeven if in Europe this is still more evident in confidence surveys than in hard figures. Fourth and most pressing, there are deeper concerns about the American economy. Wall Street is much more worried about inflation than it was a few months agoand markets are yet to be convinced that the Fed's newish chairman, Ben Bernanke, will tackle inflation with sufficient vigour. It would be nice to think that the dollar's decline heralded an orderly adjustment of global imbalances (the greenback's latest tumble may have been started by a stern communiqu from the G7 last month about the world economy). But do not get your hopes up. Although a fall in the dollar should help to reduce America's current-account deficit, by making exports cheaper and imports dearer, it will have to go a lot further to make much of a dent. Indeed, the currentaccount deficit has carried on climbing these past few years, even though the greenback has been weakening for most of the time. One way or another, America is still going to have to save more and the rest of the world save less. Caselet 3 Read the caselet carefully and answer the following questions:

11. Keeping aside the positives and the negative outcomes of the meeting, the case for the Least Developing Countries (LDCs) is comparable to providing people with money to buy their coffins. Discuss. (7 marks) < Answer > 12. Discuss the probable impact of the ministerial meet on India's farm and manufacturing exports in the global markets. (7 marks) < Answer > The liberalization drive that is being promoted by the WTO has a potential to lead to the closure of local firms, resulting in the loss of livelihoods to many farmers. That is a cause of concern since in the past also; liberalization has proved disastrous for several local firms leading to their closure. With tariffs going down followed by cheaper imports, there is always a possibility of local products and jobs getting displaced. At the same time, one cannot ignore the brighter side of liberalization. Liberalization leads to the increase in exports that brings with it more jobs and revenues. At the same time, it needs to be kept in mind that not all countries possess the production capacity and efficiency to take the fullest of the advantage. There are some countries that benefit out of it while certain countries find it difficult to generate any gains out of the same. In the recently concluded sixth ministerial conference, both the aspects of fear of losing out the imports as well as the potential of increasing the exports were the center of discussion. The six days of the WTO Ministerial Conference held in Hong Kong were not free from brouhahas. There were several issues. Some of them had positive implications whereas some of the outcomes were shrouded in uncanny ambiguities. The biggest success that emerged out of the discussion was the concerted decision that one would not sacrifice the Doha Round at the cost of minimal national economic interests. Further there was also agreement on the fact that all the developed countries arrived at pertaining to the ending of all export subsidies by the end of 2013 and to begin the process of substantial reduction before that period, though the developing nations preferred a timeline of 2010. This was added to the removal of the cotton subsidies by the next year. Cotton exports from the Least Developed Countries (LDC) were allowed into the developed countries with zero duty. But, it is also to be remembered that the dumping of subsidized cotton would continue in days to come. One more important aspect of the discussion hovered around the aspect of the LDCs struggling hard to allow all their products to enter the markets of the rich countries free of duties and quotas. At the same time, it is worth mentioning that the meeting also had its share of certain negative aspects. A closer look at the declaration will reveal the fact that there lies no finality about the schedules pertaining to the export subsidies, since the same has been made dependent on the completion of the modalities, the timeframe for which has been set as April 30, 2006. Keeping in mind that the organization has failed several times to meet its deadline, there is no certainty that this date will be conformed to. One school of thought postulates that the poor countries lack the capacity to export most of the products and one of the clauses namely the escape clause facilitates the rich countries to block the imports of the products that the poor countries find competent to produce. The US feels apprehensive of the cheap textiles and the clothing from Bangladesh, and Japan feels jittery about the cheap rice from Cambodia. The outcome of the six-day conference also gave certain setbacks to the developing countries. The draft declaration requires these countries to participate in the new type of negotiations in the WTO that are designed primarily by the rich countries. Keeping aside the positives and the negative outcomes of the meeting, the case for the Least Developing Countries (LDCs) is comparable to providing people with money to buy their coffins. As rightly quoted by an activist "the results of the meeting has been a way to facilitate the countries to get into the trade agreements and calling it aid or developmental packages, it is more like moving forward the trade agenda that is about trade and not development". Well, whatever may be the viewpoints of the critics, the plan chalked out by the members is believed to benefit at least 50 LDCs in Africa, the Caribbean and the Pacific region. These countries mainly export agricultural products like bananas, sugar and tea. The so-called developmental

package includes the "quota-free and duty-free" access for all the 50 LDCs to markets in rich nations by 2008.

END OF SECTION E

END OF QUESTION PAPER

Suggested Answers International Finance and Trade II (222) : July 2006 Section D : Case Study 1. For an Indian company, the choice between the domestic and international market would depend on a number of criteria, some of which are listed below: i. Currency Requirements: A decision has to be taken about the currency needs of the company, keeping in view the future expansion plans, capital imports, export earnings/potential export earnings. A conscious view on the exchange rate also needs to be taken. ii. Pricing: Pricing of an international issue would be a factor of interests rates and the value of the underlying stock in the domestic market. Based on these factors, the issue price conversion (for convertible) premium would be decided. Given the arbitrage available between interest rates in rupees and say, US dollars, and given the strength of the rupee, as well as the resilience a company can have in its operations against exchange fluctuation risk, due to export earnings, it is possible to take advantage of the low interest rates that are prevailing in the international markets. The above is possible without dilution of the value of the underlying stock. This is so, because, in the case of international issues, open pricing/book building is possible, which has the advantage of allowing the foreign investors to set the premium ensuring transparency and creating price tension. iii. Investment: At present greater flexibility is available in structuring an international issue in terms of pure equity offering, a debt instrument or a hybrid instrument like foreign currency convertible bond (FCCB). Each company can take a view on instrument depending upon the financials of the company and its future plans. iv. Depth of the Market: Relatively larger issues can be floated, marketed and absorbed in international markets more easily than in the domestic markets. v. International Positioning: Planning for an international offering has to be a part of the longterm perspective of a company. An international issue positions the issuing company, for a much higher visibility and an international exposure. Besides, it opens up new avenues for further

fund-raising activities. vi. Regulatory Aspects: For an international issue, approvals are required from the government of India and the Reserve Bank of India, whereas for a domestic issue the requirements to be satisfied are those of the SEBI and the stock exchanges. vii. Disclosure Requirements: The disclosure requirements for an international issue are more stringent as compared with a domestic issue. The requirements would, however, differ depending upon the market addressed and the place where listing is sought. viii. Investment Climate: The international offering would be affected by factors like the international liquidity and the country risk, which will not have an effect in a domestic issue. With the current country rating, companies have to depend on the strength of their balance sheets to raise funds at competitive rates in the international markets. < TOP > 2. Euro dollar market is mostly unregulated. This meant that Eurodollar banks could offer higher rates on deposits and charge lower rates on loans. So the most important factor affecting the supply of and demand for Eurodollars is the desire of dollar depositors to receive highest yield and the desire of dollar borrowers to pay the lowest interest on loans. Because of the absence of reserve requirements, deposit-insurance requirements and other costly regulations, the Euro banks can offer higher yields on dollar deposits than can US Banks. At the same time, the Euro banks can charge lower interest on their advances. The lower interest rates on loans are made possible by the absence of severe regulations and by the sheer size and number of informal contacts among Euro banks. Higher rates on deposits and lower costs to borrowers mean operating on narrow spreads for banks. So the growth of Eurodollar market is best attributed to the ability of the Euro banks to operate on a narrow spread. There are some advantages AIL can derive by borrowing Eurodollars rather than dollars in USA. There are many regulations of Federal Reserve like reserve requirements, deposit insurance etc., which make dollar deposits costly in the US. The controls and restrictions of Federal Reserve on borrowing funds in the US for reinvestment abroad make dollar borrowing costly for the outsiders. Euro currency market does not face such stiff financial regulations as the US domestic banking system. Also the flow of dollars in the Eurocurrency market is sufficient to keep the euro dollar interest rate lower than US domestic rates. Also credit rating criteria is much more lenient in euro currency markets than in the US. So the cost of borrowing will also be lower in Eurocurrency market than in US market. < TOP > 3. Eurocurrency interest rates cannot differ much from rates offered on similar deposits in the currencys home country. As we know, the rate offered to Eurodollar depositors is slightly higher than in the United States, and the rate charged to borrowers is slightly lower. Each countrys market interest rates influence the euro currency interest rates, and vice versa, as they are all part of the global money market. The total supply of each currency in this global market, together with the total demand, determines the rate of interest. The interest rate charged to borrowers of euro currencies are based on London Interbank Offer Rates (LIBOR) in the particular currencies. LIBOR rates are those charged in interbank transactions and are base rates for non-bank customers. LIBOR rates are calculated as the averages of the lending rates in the respective currencies of six leading London banks. Borrowers are charged on a LIBOR-plus basis, with the premium based on the credit worthiness of the borrower. With borrowing maturities of over 6 months, a floating interest rate is charged. Every 6 months, the loan is rolled over, and the interest rate is reset based on the current LIBOR rate. This reduces risk to both the borrowers and the lender, as neither will be left with a long-term contract that does not reflect the current interest costs. For example, if interest rates rise after the credit is extended, the lender will lose the opportunity to earn more interest rate

for maximum 6 months. If interest rates fall after a loan is arranged, the borrower will lose the opportunity to borrow more cheaply for only 6 months. With the lower interest-rate risk, credit terms frequently reach 10 years. < TOP > 4. a. i. Spot Rate Rs./$ 45.48/45.52 Middle rate = 45.50 Forward 6 month Rs./$ 45.50 = 45.8354 12 month Rs./$ 45.8354 = 46.1733 18 month Rs./$ 46.1733 = 46.5136 24 month Rs./$ 46.5136 = 46.8565 30 month Rs./$ 46.8565 = 47.2019 36 month Rs./$ 47.2019 = 47.5498 42 month Rs./$ 47.5498 = 47.9003

48 month Rs./$ 47.9003 = 48.2534 54 month Rs./$ 48.2534 = 48.6091 60 month Rs./$ 48.6091 = 48.9674

Month Principal ($ Million) Interest rate (%) Interest payment ($ Million) Principal repayment ($ Million) Exchange rate (Rs./$) Total repayment (Rs. crore) 0 44 45.48 (200.11) 6 44 6.50 1.430 45.8354 6.5545 12 44 6.30 1.386 46.1733 6.3996

18 44 6.45 1.419 46.5136 6.6003 24 44 6.50 1.430 46.8565 6.7005 30 44 6.25 1.375 47.2019 6.4903 36 44 6.50 1.430 47.5498 6.7996 42 44 6.40 1.408 47.9003 6.7444 48 44 6.25 1.375 48.2534 6.6348 54 44 6.50 1.430 48.6091 6.9511 60

6.50 1.430 44 48.9674 222.4589 Effective cost of the loan in rupee term is given by r in the following equation. 200.11 = 6.5545 PVIF (r/2, 1) + 6.3996 PVIF (r/2, 2) + 6.6003 PVIF (r/2, 3) + 6.7005 PVIF (r/2, 4) + 6.4903 PVIF (r/2, 5) + 6.7996 PVIF (r/2, 6) + 6.7444 PVIF (r/2, 7), 6.6348 PVIF (r/2, 8) + 6.9511 PVIF (r/2, 9) + 222.4589 PVIF (r/2, 10) For r/2 = 3% R. H. S. = 217.2616 For r/2 = 4% R. H. S. = 199.6650 \== = 3 + 0.9747 = 3.9747% \ r = 7.95% a. ii. Spot Rate Rs./ 58.43/58.47 Middle rate = 58.45 Forward 6 month Rs./ 58.45 = 59.3181 12 month Rs./ 59.3181 = 60.1990 18 month Rs./ 60.1990 = 61.0931 24 month Rs./ 61.0931 = 62.0003 30 month Rs./ 62.0003

= 62.9212 36 month Rs./ 62.9212 = 63.8557 42 month Rs./ 63.8557 = 64.8040 48 month Rs./ 64.8040 = 65.7665 54 month Rs./ 65.7665 = 66.7432 60 month Rs./ 66.7432 = 67.7344

Month Principal ( Million) Interest rate (%) Interest payment ( Million) Principal repayment ( Million) Exchange rate (Rs./ ) Total repayment (Rs. in crores) 0 35 58.43

(204.505) 6 35 5.50 0.9625 59.3181 5.7094 12 35 5.50 0.9625 60.1990 5.7942 18 35 5.75 1.00625 61.0931 6.1475 24 35 6.00 1.0500 62.0003 6.5100 30 35 5.85 1.02375 62.9212 6.4416 36 35 5.60 0.9800 63.8557 6.2579 42 35 5.50 0.9625 64.8040 6.2374 48

35 5.75 1.00625 65.7665 6.6178 54 35 5.80 1.0150 66.7432 6.7744 60 5.80 1.0150 35 67.7344 243.9454 Effective cost of the loan in rupee term is given by r in the following equation. 204.505 = 5.7094 PVIF (r/2, 1) + 5.7942 PVIF (r/2, 2) + 6.1475 PVIF (r/2, 3) + 6.5100 PVIF (r/2, 4) + 6.4416 PVIF (r/2, 5) + 6.2579 PVIF (r/2, 6) + 6.2374 PVIF (r/2, 7) + 6.6178 PVIF (r/2, 8) + 6.7744 PVIF (r/2, 9) + 243.9454 PVIF (r/2, 10) For r/2 = 4% R. H. S. = 211.2528 For r/2 = 5% R. H. S. = 194.1163 \== = 4.3938% \ r = 8.79% b. Spot Rate Rs./ 0.4081/0.4091 Middle rate = 0.4086 Forward 6 Month Rs./ 0.4086 = 0.4178 12 Month Rs./ 0.4178 = 0.4271

18 Month Rs./ 0.4271 = 0.4367 24 Month Rs./ 0.4367 = 0.4465 30 Month Rs./ 0.4465 = 0.4566 36 Month Rs./ 0.4566 = 0.4668 42 Month Rs./ 0.4668 = 0.4773 48 Month Rs./ 0.4773 = 0.4880 54 Month Rs./ 0.4880 = 0.4989 60

Month Rs./ 0.4989 = 0.5101

Month Principal ( million) Interest rate (%) Interest payment Principal repayment Exchange rate (Rs./) Total repayment rupees in crores 0 5000 0.4081 (204.05) 6 5000 3.00 75.00 0.4178 3.1335 12 5000 3.00 75.00 0.4271 3.2033 18 5000 3.00 75.00 0.4367 3.2753 24 5000 3.00 75.00 0.4465 3.3488 30 5000

3.00 75.00 0.4566 3.4245 36 5000 3.00 75.00 0.4668 3.5010 42 5000 3.00 75.00 0.4773 3.5798 48 2500 3.00 75.00 2500 0.4880 125.6600 54 2500 3.00 37.50 0.4989 1.8709 60 3.00 37.50 2500 0.5101 129.4379 Effective cost of the loan in rupee term is given by r in the following equation. 204.05 = 3.1335 PVIF (r/2, 1) + 3.2033 PVIF (r/2, 2) + 3.2753 PVIF (r/2, 3) + 3.3488 PVIF (r/2, 4) + 3.4245 PVIF (r/2, 5) + 3.5010 PVIF (r/2, 6) + 3.5798 PVIF (r/2, 7) + 125.66 PVIF (r/2, 8) + 1.8709 PVIF (r/2, 9) + 129.4379 PVIF (r/2, 10) For r/2 = 4% R. H. S. = 200.6275 For r/2 = 3% R. H. S. = 217.7761 \==

= 3.8004% \ r = 7.60%. Though the effective interest rate on yen borrowing is lower than dollar borrowing, SSIL is advised to borrow in Eurodollar since yen is a very much volatile currency which may increase the cost of borrowing in yen. < TOP > 5. SSIL will face transaction and translation exposure if it borrows in dollar. Transaction Exposure Transaction exposure is the exposure that arises from foreign currency denominated transactions which an entity is committed to complete. In other words, it arises from contractual, foreign currency, future cash flows. For example, if a firm has entered into a contract to sell computers to a foreign customer at a fixed price denominated in a foreign currency, the firm would be exposed to exchange rate movements till it receives the payment and converts the receipts into the domestic currency. The exposure of a company in a particular currency is measured in net terms, i.e. after netting off potential cash inflows with outflows. Translation Exposure Translation exposure is the exposure that arises from the need to convert values of assets and liabilities denominated in a foreign currency, into the domestic currency. For example, a company having a foreign currency deposit would need to translate its value into its domestic currency for the purpose of reporting at the time of preparation of its financial statements. Any exposure arising out of exchange rate movement and the resultant change in the domesticcurrency value of the deposit would classify as translation exposure. It needs to be noted that this exposure is mostly notional, as there is no real gain or loss due to exchange rate movements since the asset or liability does not stand liquidated at the time of reporting. Hence, it is also referred to as accounting exposure. This fact makes the measurement of translation exposure dependent on the accounting policies followed for the purpose of converting the foreign-currency values of assets and liabilities into the domestic currency. < TOP >

Section E: Caselets Caselet 1

6. Unlikely to the continuous linked settlement system, in the CCIL settlement system the settlements are guaranteed by CCIL. Principal risk is substantially reduced in CCIL system. Also market risk is taken care of by CCIL which is not done in the continuous linked settlement system. All settlement participants are equal. They take exposures on CCIL as Central Counterparty. Under continuous linked settlement system Settlement Members are required to take credit exposure on another Settlement Member. Third party members settling through a Settlement Member really have no control on the exposures they take on the Settlement Member through whom they decide to settle their transactions. As CCIL settlement system is deferred net settlement, liquidity requirement is significantly lower compared to the continuous linked settlement system. The model is simple, easy to implement and extremely efficient. It brings in almost all market participants into the system irrespective of their credit standings while simultaneously reducing the systemic risk substantially.

Interbank settlements require huge settlement related activities: Matching of counterparty confirmations, effecting payments through the nostro accounts, tracking payments and receipts, reconciliation of nostro accounts, effecting back-valuation or payment of interest for delayed payments, ensuring collection of interest for delayed receipts etc. Settlement through CCIL results in contraction of all these activities into effecting a single payment in either of the currencies (Indian rupee or US dollar) and tracking a single payment and a single receipt per day. Cost savings in the form of reduction in back office activities has therefore been substantial. Payment or receipt of interest on delayed settlements had always been a contentious issue between the counterparties and required considerable cost and effort on the part of both the involved entities to resolve. In the past, these disputes or cases of delays used to finally reach FEDAI and used to take significant portion of their time and attention. Since settlement of trades started through the settlement system of CCIL, cases of such claims have come down to negligible numbers evidencing the extent of cost savings and efficiency achieved by the financial market as a whole. Standardization of the processes in regard to deal reporting, getting information about the status of the deals etc. has also provided opportunities for the creation of a cost effective online system for tracking of positions based on exceptional events. This offers significant opportunities for reduction of operational risk. < TOP > 7. On the risk management front, the benefits as expected have been enormous. Multilateral net settlement with closely controlled processes has virtually eliminated all principal risks except for the net US dollar sale position of the participants. This element of risk has also been kept restricted to acceptable amounts in respect of all participating entities by setting Exposure Limits and is also additionally covered by the margins collected for the principal risk element (varying from 3% for highly rated entities to 8.5% for the lowest rated entities allowed into the system). Moreover, the ability created to claw back the counter-value Indian rupee funds from the principal account of any defaulting entity with RBI has further reinforced the system. Furthermore, from the three days in the Spot Window (CASH, TOM and SPOT), principal risk is kept confined to only the CASH date by ensuring that in case of a default, no payout happens on the subsequent days to the account of any defaulting entity without receipt of the counter-value funds. Market risk in the system is taken care of by adding a market risk factor, for collection of margin, in respect of each settlement date. Thus market risk cover is also available for almost all positions of the participants for all settlement dates. The process, apart from causing huge reduction of risk to the individual settlement participant has also caused huge reduction of total risk to the system as a whole. In absence of a settlement system like the system run by CCIL, the maximum possible reduction in counterparty exposures could have been to reach such level of bilateral exposures. Moreover, for a bank, even US dollar sale position creates exposure as it is not possible for it to ensure receipt of counter-value Indian rupee funds before release of the US dollar payments. Thus, at bilateral level, both US dollar sale and US dollar buy positions create exposures Indian rupee exposure in case of US dollar sale and US dollar exposure in case of US dollar Buy. The counterparty wise net bilateral exposures, irrespective of whether those were US dollar Buy positions or US dollar Sale positions, were therefore summed up for each settlement date to arrive at the total bilateral exposures of the settlement participants for such settlement date. For the same settlement dates, total exposures of the settlement participants for settlement through CCIL were arrived at by taking the sum of net US dollar payable amounts for the respective settlement dates. As against such huge number of transactions, the settlement through CCIL's settlement system caused the number of payment transactions for the settlement participants to come down The enormous cost reduction and reduction in operational risk due to the reduced number of settlement is thus evident. It also made the system robust and significantly more reliable. < TOP >

Caselet 2 8. There are many factors that influence the exchange rate of US dollar. Generally speaking, there are mainly four reasons: first, the health condition and the rate of return for investment of the US economy, secondly, the balance of international payment in the US, thirdly, the level of interest rates in the US compared with those in other countries, and fourthly, the rate of inflation. Meanwhile, there are also many other temporary pounding factors from without, such as wars, oil price, scandals from large companies as well as psychological factors etc, which are believed to have connections with former four factors. Judging from the estimation by various parties, evident enough, many economists take the balance of international payments as the decisive factor for the trend of the US dollar. Although this kind of view is not unreasonable, it is partial. If considered from history, people will find out that the balance of international payment featuring trade deficit and current account deficit has been dominating the US economy since 1970s. But the track of the US dollar's circulation does not show a plummet drop. The exchange rate of US dollar used to be high for two times since the US implemented the floating exchange rate: one occurred during Reagan's reign while the other was in Clinton's rule. So far as Reagan's reign is concerned, the federal budget deficit, trade deficit and current account deficit were high, but the exchange rate of US dollar was also high. It is simply because the high deficit triggered the high interest rate and high interest rate consequently resulted in high exchange rate. The trade deficit is not the result of the change of exchange rate but rather its reason. What was worth mentioning is that the surplus was realized during Clinton's rule. But the condition of international payment hadn't been much improved due to the low private saving rate and the exchange rate of US dollar still strong. The major reason is because of the strong growth of the US economy, low returning rate and high interest rate. < TOP > 9. Generally speaking, the sharp drop of the US dollar exchange rate is impossible unless all the US dollar holders worldwide sell US dollars in large amount simultaneously, just like depositors draw money from banks during the bank credit crisis. First, the US economy still boasts the highest growth rate and strongest competitiveness among major developed countries, and other countries are still confident about the US economy; secondly, the US dollar, serving a role of a currency for international reserve, has become the natural defense for the sharp devaluation of US dollar; thirdly, since foreigners hold a huge amount of US dollars, they will suffer severe losses if they sell dollars in large amount and will not easily find a suitable substitution. Furthermore, the safety and circulation of euro, Japanese yen and gold are no better than the US dollar. Although there is no sign of sharp drop in the exchange rate of US dollar, the possibility of gradual depreciation of it cannot be removed. In the view of Bush administration, instead of bringing harm on the growth of US economy, the orderly devaluation of US dollar can boost the exportation and narrow the trade deficit, particularly when the inflation is under control. Therefore, should the balance of international payment exist for a long time, it would definitely be the decisive factors for the depreciation of the US dollar. But some other factors would probably counteract its function in different periods and lead the US dollar to appreciation. This tendency is believed to be likely to happen in medium or short term. < TOP > 10. A falling dollar can substantially reduce the trade deficit. A lower US trade deficit will of course mean a decline in the exports of Asian countries. Countries that lose exports need to adopt policies to stimulate domestic spending in order to prevent a decline in their GDP and

employment levels. Where this all ends will depend not only on market forces but also on the policies of the governments and central banks of Asia. It will be tempting but wrong for them to resist the decline in the US trade imbalance by using a combination of monetary policy and exchange market intervention to prevent the dollar's shift to an appropriately competitive level. Without that competitive dollar, the higher saving rate in the US will mean slower US growth and rising unemployment. If that happens, the American political process is likely to turn to protectionist measures to shrink the trade imbalance and maintain employment. It would be far better to allow the natural market forces to bring about the needed currency realignment. Instead of seeking to resist the dollar's shift to a more competitive level, governments in Asia should focus on developing policies to maintain aggregate demand in their individual economies as their export sales decline. < TOP > Caselet 3 11. There is general talk of hopeful prospects for poor farmers gaining greater access to richworld markets. But the benefits will not flow evenly from rich to poor. The package includes quota-free and duty-free" access for 50 LDCs to markets in rich nations and increase in funds for the aid for trade program that is meant for the increasing capability of the poor countries to take part in trade. The package also makes a mention about technical assistance, helping to train the developing nations with the global regulations pertaining to trade and mechanisms. There were certain element of resistance from the US and Japan relating to the exclusion of certain products from duty-free, trade-free formula. One of the primary reasons for this resistance can be due to the fact that the US can take advantage of the ban and implement the same in the case of textiles. As a consequence, textile being one of the crucial exports of the poorest nations from the LDCs, namely Cambodia and Bangladesh, it would compensate for all the benefits arising out of exports in these countries. In another instance, Japan has also put up a cause for the inclusion of rice and leather products in the deal. Though some of the LDCs expect that the benefits arising out of the package would even be felt at the poorest sections of the society, mainly the farmers as most of their exports are in the agricultural products. At the same time, it needs to be mentioned that with the existent inequalities in the market, it is questionable as to how much effectively things would be put in place. Thus, it is important that one reviews the policy that seems to have an exaggerated focus towards market access as a road towards economic development. < TOP > 12. According to our commerce minister India had certain reasons to smile. It ensures that no subsidy-ridden farm products are exported to India the phase out of the export subsidies by developed countries would also give the Indian farmers a chance to compete in the world market. The success of India in the meet resulted out of its strategy of forming a coalition of the developing nations (G-110) that was established in the summit. The agreement intends to protect the domestic farmers against increase in imports through the provisions of Special Products and Special Safeguard Mechanism that was a part of the ministerial declaration. Under the provisions of the Special Products, India and other developing countries would not have to cut the tariffs on certain products while the Special Safeguard Mechanism would take into account both the prices and volume triggers in an effort to check the increase in cheap imports. Added to this, India will not have to undertake any cuts in the domestic support. In the nonagricultural market access, India's proposal along with that of Argentina and Brazil continues to top on agenda. On the services front, India has succeeded in confirming that there will be no compulsion on the part of developing countries to open up its service sectors. It has also been agreed that in relation to the discussions pertaining to geographical indications and the biological diversities that were of particular interest to India, it would be hastened by June 30, 2006. As per the Ministry of Commerce, India would also be able to draw up a list of 90 special

products that would lie outside the purview of the tariff reduction formula and would also enable the Indian farmers to protect their crucial crops from global competition. With all this in place, the Indian industry would stand to benefit as the developed countries decided to reduce the duties on products that are of interest to the developing countries.

Problems (50 Marks) This section consists of questions with serial number 1 5. Answer all questions. Marks are indicated against each question. Detailed workings should form part of your answer. Do not spend more than 110 - 120 minutes on Section B. 1 On 02.01.2006 M/s Sportsfolio Private Ltd., a Unit in Santacruz Exports Processing Zone, Mumbai, opened an L.C. for USD 100,000 for import of machinery from USA. As per the terms of LC, the last date for shipment is 15.02.2006 and negotiation is 28.02.2006. On 01.02.2006 the Finance Manager of the company booked a forward contract with option for delivery from 17.02.2006 to 16.03.2006, when the ongoing market rates were: As on 01.02.2006 Spot Rate Rs./$ 44.08/44.10 Forward 1-Month 03/05 Forward 2-Month 05/08 Forward 3-Month 08/12 The machinery could not be shipped due to non-availability of ship to carry the consignment to Mumbai. The Finance Manager was on leave and no decision was taken for extension of LC as well as extension of forward sale contract. The bank has cancelled the contract on 31.03.2006 as per FEDAI Rules. The ongoing rates on 31.03.2006 are as follows: Spot Rate Rs./$ 44.50 / 44.52 Forward 1-Month 04/06 Forward 2-Month 06/09 Forward 3-Month 09/13 Additional information: (i) Rs./$ Spot TT rates on 16.03.2006 is Rs.44.46/44.48

(ii) Interest rate applicable on outlay of funds is 12% p.a. You are required to calculate: a. The forward rate quoted by the bank on 01.02.2006. b. The cancellation charges payable by Sportsfolio. c. The interest amount payable on outlay of funds. (4 + 4 + 3 = 11 marks) < Answer > 2 Indian Remedies Ltd., a leading drug manufacturing company based at Gurgaon is planning to invest in a bulk drug manufacturing unit in Malaysia. After the initial appraisal of the project using the Adjusted Present Value (APV) technique, the firm arrives at a negative NPV of Rs.500 million. The Government of Malaysia evince interest to encourage the investment, in the form of arranging a concessional loan of US$ 200 million as the project is expected to create 3,000 jobs directly and indirectly. The principal of concessional loan has to be repaid in four equal installments, commencing at the end of third year and interest to be repaid annually. The financial institutions are charging 9% interest for similar type of loans in Malaysia. The current exchange rate is Rs.44.62/$. You are required to find out the interest rate on concessional loan to make the project viable (10 marks) < Answer > 3 Consider the following exchange rates : US $ Equivalent US Market Singapore Dollar (S$) Spot 0.6330/33 3 month forward 0.6357/60 Euro () Spot 1.2818/21 3 month forward 1.2898/01

Equivalent Singapore $

Singapore Market Euro () Spot 2.0379/82 You are required to a. Verify whether there is a possibility of triangular arbitrage to exploit the difference between S$-Euro cross rates in the U.S. market and the S$-Euro rates in the Singapore market. Indicate clearly which currency you would buy/sell and in which market. If you have $1 million, calculate the profit or loss from the triangular arbitrage. b. Compute what is the 3-month risk less interest rate in the U.S. (expressed as effective annual rate), if risk less rate of interest in the Singapore market for 3-month is 3.25% p.a. compounded annually? (6 + 5 = 11 marks) < Answer > 4 A Finance company in Mumbai proposes to invest rupee funds equivalent to 10 million for one year in London market. The return on investment over the period of investment will be 8%. The current exchange rates are as follows: Rs./ Spot 53.15/53.20 1- year forward 53.25/53.30 A foreign bank has agreed to offer 10 million at a rate of Rs.53.10/ and swap the same amount at Rs.53.20/ after one year. The rupee cost of the funds to the company is 7%. You are required to calculate the actual returns earned under forward cover and swap deal and suggest the company whether it should go for the simple forward cover or accept the foreign banks offer. (8 marks) < Answer > 5 Kwality Oils Ltd., an exporter of coconut oil in Kochi has submitted a 45 days bill for Can$ 600,000 drawn under an irrevocable LC for negotiation. The company asked its banker to retain 50% of the bill amount under EEFC (Exchange Earners Foreign Currency) account. The rates for US$ in the inter-bank market are quoted as under: As on 04.04.2006 Rs./US$ Spot 44.51 / 44.61 1-month forward 08/09

2-months forward 16/17 3-months forward 26/27 US$ is quoted in the Montreal market as under: Spot: Can $/US$ 1.1671 /1.1675 1- month forward 19 / 17 2- months forward 28 / 26 3- months forward 36 / 34 Additional information: (i) Transit period is 15 days (ii) Interest on post-shipment credit is 8.5% (iii) Exchange margin required is 0.1% You are required to compute a. Exchange rate quoted to the company. b. The rupee inflow to the company. (7 + 3 = 10 marks) < Answer > END OF SECTION B Section C : Applied Theory (20 Marks) This section consists of questions with serial number 6 - 7. Answer all questions. Marks are indicated against each question. Do not spend more than 25 -30 minutes on section C. 6 There are four methods to translate the financial statements of a foreign entity into domestic currency. Discuss those four methods. (10 marks) < Answer > 7 For India to increase its share in the global trade a comprehensive view is needed to be taken for the overall development of the economy. Explain briefly the highlights of the Foreign Trade Policy 2004-2009. Section B : Problems 1.

a. Computation of Forward Rate at which the Forward Sale contract was booked by the bank on 01.02.2006 (Rs./$) Spot Ask Rate 44.10 Ask rate for 17.02.2006 {(44.10) + (0.05 X) = 44.129 44.13 Ask rate for 16.03.06 {(44.15) + (0.08 X) = 44.189 44.19 The rate quoted should be higher of above two rates i.e. Rs.44.19/$. b. Cancellation charges payable by the customer +/- Exchange difference: Forward Sale contract will be cancelled at the spot TT buying rate of Rs/$ prevailing on 16.03.2006, the last day for taking delivery under the contract. Bank bought $ under cancellation Rs. 44.46 Bank sold the dollar under original contract Rs. 44.19 Exchange difference payable per dollar by customer Rs. 0.27 Exchange difference for $100,000 payable by customer is Rs.27,000 + Rs.100 towards cancellation charges c. Interest on outlay of funds: On 16.03.2006, due to the inability of the customer to take delivery of the currency under contract the bank was forced to execute the contract by purchasing $100,000 at Rs.44.46/$ from the market, the difference being 0.27 per 1$ and the total amount involved is Rs.27,000 and the interest payable works out as Rs.133.15( @ 12% for 15 days). < TOP > 2. Let the interest rate on concessional loan be r"

Year Principal Outstanding Repayment Interest Total repayment 1 200 -200r 200r 2. 200 200r 200r

3. 200 50 200r 200r + 50 4. 150 50 150r 150r + 50 5. 100 50 100r 100r + 50 6 50 50 50r 50r +50

Present value of repayments = 200r X PVIF (9% 1) + 200r X PVIF (9% 2) + (200r + 50) X PVIF (9% 3) + (150r+50 ) XPVIF (9% 4) + (100r + 50) X PVIF ( (9% 5) + (50r +50) X PVIF (9% 6) = (200r x 0.9174) + ( 200r x 0.8417) + (200r + 50) ( 0.7722) + (150r + 50) ( 0.7084) + (100r + 50 ) ( 0.6499) + (50r + 50) (0.5963) = 183.48r + 168.34r + ( 154.44r +38.61) + (106.26r + 35.42) + (64.99r + 32.50) + (29.82r + 29.82) = 707.33r + 136.35 If the project is to be accepted APV = 0 So, [ 200 (707.33r + 136.35)] x 44.62 = 500

Or, [ 63.65 707.33r ] = Or, 707.33r = 63.65 11.206 Or, r = = 7.41%. So the interest on the concessional loan should be less than 7.41% to make the project viable. < TOP > 3. a. In the U.S. market the cross rate of S $/Euro is: (S$/)bid = (S$/$)bid ($/)bid = ($/)bid = = 2.0240 (S$/)ask = (S$/$)ask ($/)ask = ($/)ask = = 2.0254 Cross rates: S$/ 2.0240/2.0254 Spot rate: S$/ 2.0379/2.0382 Since synthetic ask rate is lower than the actual bid rate there is possibility of three point arbitrage. Thus, Euro is cheaper in the US market and worth more in Singapore. Therefore, we can buy Euro in the US, sell Euro in Singapore for Singapore $. Which we will sell in the US to convert back into US$. The triangular arbitrage will be implemented as follows: First we buy euro for $1,000,000 in US. Thus we get Euro 1,000,000 = 779,970.36 Then we sell this 779,970.36 in Singapore market for S$ Thus we get S$ = 779,970.36 2.0379 = S$ 1,589,501.60 Finally we sell this S$ in US market for dollars = 1,589,501.60 0.6330 = $1,006,154.51 Profit from the trasaction = 1,006,154.51 - 1,000,000 = $ 6,154.51. b. 3 month risk less rate in Singapore = = 0.8028% By interest rate Parity.

Or, 1+ rus = rus = 0.01233 for 3 months Effective annual rate = (1 + 0.01233)4 1 = 1.05024 1 = 5.024%. < TOP >

4. Rupee out flow at spot rate for acquiring 10 million 10 53.20 = Rs.532 million Rupee cost of funds = 532 0.07 = 37.24 million Return from Investment = 10 0.08 million = 0.80 million Total inflow = 10 + 0.80 = 10.80 million Rupee inflow if covered through forward market = 10.80 53.25 = Rs.575.10 million Net gain = 575.10 [500 + 37.24] = Rs.37.86 million. Return = , say 7.12%. If the company accepts foreign banks offer: Initial rupee outflow = 10 m 53.10 = 531.00 million Rupee cost of funds = 531.00 0.07 = 37.17 million Out of the total investment matured, 10 million is to be paid back to foreign bank and will pay Rs. 53.20/ and rest 0.80 million can be sold through forward cover @ Rs. 53.25/. Rupee inflow from swap deal = 10m 53.20 = Rs.532 million Rupee inflow from forward cover = 0.80m 53.25 = Rs.42.60 million Total rupee inflow after one year = 532 + 42.60 = Rs.574.60 million Net gain = 574.60 (531.00 + 37.17) = 574.60 568.17 = Rs.6.43 million Return = The finance company should reject the banks offer, as the return is less. < TOP > 5. (i) Exchange Rate quoted to the Company: Usance of the bill and transit period come to 60 days i.e. two months. US$/Rs. Spot rate = 44.51 Add: Premium for two months = + 0.16 = 44.67 Less: Exchange Margin. 0.1% = +0.0445 Bill Buying rate for US$ = 44.6255

In the Montreal Market US$ is quoted at discount, dollar selling rate for 2 months is Can.$/US $ spot ask rate = 1.1675 Less : Discount for two months = (-) 0.0026 Can.$/US$ ask rate = 1.1649 Can.$ Bill buying rate : (Rs/US$)bid = = 38.3084 Exchange Rate quoted to company = Rs./Can.$ 38.3084. ii. Rupee Inflow to the Company: Can. $ 3,00,000 @ Rs. 38.3084, the exporter will receive 1,14,92,520 Less: Interest for 45 days Usance period + 15 days transit period @ 8.5% p.a (-) 1,62,810 Net Cash inflow to the Company Rs.1,13,29,710 < TOP > Section C: Applied Theory 6. There are four methods which guide the translation of the financial statements of a foreign entity, whether independent or integrated. These are Current/Non-Current method Monetary/Non-monetary method Temporal method Current rate method For understanding these methods, we need to first understand a few terms: Historical exchange rate: It is the rate at which a transaction was actually settled. For example, the rate which was used to convert the domestic currency into the foreign currency for settling the payment for a machinery bought by the company. In cases where no actual currency conversion takes place, it is the rate prevailing at the time the original transaction took place. For example, if the machinery in the above example was bought by a foreign subsidiary, there would have been no conversion of currency. In that case, the historical rate would have been the rate prevailing when the machinery was bought. Current or closing exchange rate: It is the rate prevailing on the date of translation of accounts. Average rate: It is the average of the rates prevailing over a certain period of time. CURRENT/NON-CURRENT METHOD

This method is based on the premise that exposure is linked to the maturity of the asset or liability and hence, does not give importance to its nature. It advocates the conversion of all current assets and liabilities at the closing rate, and all non-current assets and liabilities at the historical rate. All items of income and expenditure are required to be converted at the average rate for the relevant period, except those items that are related to non-current assets and liabilities. All such items (like depreciation) are to be converted at the same rate as the related asset or liability. As the non-current assets and liabilities are converted at the historical rate, this method results in only the current assets and liabilities being exposed to exchange rate movements. Hence, when the foreign subsidiary has a positive working capital, the parent company books an exchange gain on depreciation of the domestic currency, and an exchange loss on its appreciation. Conversely, when the foreign subsidiary has a negative working capital, the parent company would book an exchange loss on depreciation of the domestic currency, and an exchange gain on its appreciation. MONETARY/NON-MONETARY METHOD This method emphasizes the nature of the item rather than its maturity. It classifies assets and liabilities into monetary and non-monetary. Monetary items are money held and assets and liabilities to be received or paid in fixed or determinable amounts of money. Under this method, the monetary assets and liabilities (like cash, accounts receivables, accounts payable) are translated at the closing rate, and the non-monetary items (like inventory, building are translated at the historical rate). Items of the income statement are translated at the average rate, except for those related to the non-monetary items (like depreciation and cost of raw material consumed). These are translated at the rate at which the corresponding non-monetary asset or liability is translated. This differentiation between the items of the income statement may lead to some mismatches. For example, while sales are translated at the average rate, a part of cost of goods sold (to be specific, cost of raw materials consumed) may get reflected at the historical rate. TEMPORAL METHOD This method classifies items on the basis of whether they are valued at historical basis or on market price basis. All the items of the balance sheet that are valued on historical cost basis are translated at the historical rate, and those which are valued on current value (or realizable value) are valued at the closing rate. Effectively, this method is a modification of the monetary/non-monetary method, as the monetary assets and liabilities get converted at the closing rate, with the non-monetary items getting converted at the historical cost. The modification lies in the fact that under the temporal method, the inventory gets converted at the closing rate despite being a non-monetary item, if it is valued in the balance sheet at the realizable value. Under this method, the income statement items are also translated in the same way as under the monetary/ non-monetary method. CURRENT RATE METHOD Under this method, all assets, liabilities, incomes and expenditures are translated at the current or closing rate. The idea is to retain the relationship (ratios) between various items of the balance sheet and income statement. < TOP > 7. FOREIGN TRADE POLICY 2004-2009 For India to become a major player in world trade, an all encompassing , comprehensive views need to be taken for the overall development of the countrys foreign trade. While increase in exports is of vital importance, we have also to facilitate those imports, which are required to stimulate our economy. Coherence and consistency among trade and other economic policies is important for maximizing the contribution of such policies to development. Thus, while

incorporating the existing practice of enunciating an annual trade policy, it is necessary to go much beyond and take an integrated approach to the developmental requirements of Indias foreign trade. The principal objectives of the foreign trade policy are: i. To double our percentage share of global merchandise trade with in the next five years. ii. To stimulate sustained economic growth by providing access to essential raw materials, intermediates, components, consumables and capital goods required for augmenting production and providing services. iii. To enhance the technological strength and efficiency of Indian agriculture, industry and services, thereby improving their competitive strength while generating new employment opportunities and to encourage the attainment of internationally accepted standards of quality. iv. To provide consumers with good quality goods and services at internationally competitive prices while at the same time creating a level playing field for the domestic producers. The first National Foreign Trade Policy for the period 2004-09 incorporating the export and import policy for the period 2002-07 came into force with effect from 1st September, 2004 and shall remain in force up to 31st August, 2009. The Policy has for the first time tried to integrate the trade policy with the process of Country's Economic development. The be new trade policy replaces the five-year Export-Import Policy of 2002-07. The most important factor that proves the similarity between the new and existing policy is the implication of WTO agreement and the Free Trade Agreement between India and other countries. The new initiatives announced for agriculture and other thrust areas such as handicrafts, hand looms, gems and jewelry, and leather and footwear are appreciable. Further, in the new trade policy export-oriented units will be exempted from the service tax and biotechnology parks in the country would get all the facilities of 100% export-oriented units. In addition to the above, the government has liberalized the EPCG benefits, the permission to transfer capital equipment to group companies, the extension of duty-free entitlement benefits to some more sectors, duty relief on fuel consumed by exporting units, and determination to double exports and keep a special focus on agriculture, all as a part of focusing on the new policy. Foreign Trade Policy (2004-2009) Highlights 1. Strategy It is for the first time that a comprehensive Foreign Trade Policy is being notified. The Foreign Trade Policy takes an integrated view of the overall development of India's foreign trade. The objective of the Foreign Trade Policy is two-fold: i. To double India's percentage share of global merchandise trade by 2009; and ii. To act as an effective instrument of economic growth by giving a thrust to employment generation, especially in semi-urban and rural areas. The key strategies are: i. Unshackling of controls; ii. Creating an atmosphere of trust and transparency;

iii. Simplifying procedures and bringing down transaction costs; iv. Adopting the fundamental principle that duties and levies should not be exported; v. Identifying and nurturing different special focus areas to facilitate development of India as a global hub for manufacturing, trading and services. Foreign Trade Policy 2. Special Focus Initiatives Sectors with significant export prospects coupled with potential for employment generation in semi-urban and rural areas have been identified as thrust sectors, and specific sectoral strategies have been prepared. Further sectoral initiatives in other sectors will be announced from time to time. For the present, Special Focus Initiatives have been prepared for Agriculture, Handicrafts, Handlooms, Gems & Jewelry and Leather and Footwear sectors. The threshold limit of designated. Towns of Export Excellence is reduced from Rs.I ,000 crore to Rs.250 crore in these thrust sectors.

3. Package for Agriculture The Special Focus Initiative for Agriculture includes: A new scheme called Vishesh Krishi Upaj Yojana has been introduced to boost exports of fruits, vegetables, flowers, minor forest produce and their value added products.Duty free import of capital goods under EPCG scheme. Capital goods imported under EPCG for agriculture permitted to be installed anywhere in the Agri Export Zone. ASIDE funds to be utilized for development for Agri Export Zones also. Import of seeds, bulbs, tubers and planting material has been liberalized. Export of plant portions, derivatives and extracts has been liberalized with a view to promote export of medicinal plants and herbal products. 4. Gems & Jewelry Duty free import of consumables for metals other' than; gold and platinum allowed up to 2% of FOB value of exports. Duty free re-import entitlement for rejected jewelry allowed up to 2% of FOB value of exports. Duty free import of commercial samples of jewelry increased to Rs.I lakh. Import of gold of 18 carat and above shall be allowed under'. the replenishment scheme. 5. Handlooms & Handicrafts Duty free import of trimmings and embellishments for Handlooms and Handicrafts sectors increased to 5% of FOB value of exports. Import of trimmings and embellishments and samples shall be exempt from CVD. Handicraft Export Promotion Council authorized to import trimmings, embellishments and samples for small manufacturers. A new Handicraft Special Economic Zone shall be established.

6. Leather & Footwear Duty free entitlements of import trimmings, embellishments and footwear components for leather industry increased to 3% of FOB value of exports. Duty free import of specified items for leather sector increased to 5% of FOB value of exports. Machinery and equipment for Effluent Treatment Plants for leather industry shall be exempt from Customs Duty. 7. Export Promotion Schemes a. Target Plus A new scheme to accelerate growth of exports called Target Plus has been introduced. Exporters who have achieved a quantum growth in exports would be entitled to for duty free credit based on incremental exports substantially higher than the general actual export target fixed. Rewards will be granted based on a tiered approach. For incremental growth of over 20%, 25% and 100%, the duty free credits would be 5%, 10% and 15% of FOB value of incremental exports. b. Vishesh Krishi Upaj Yojana Another new scheme called Vishesh Krishi Upaj Yojan (Special Agricultural Produce Scheme) has been introduced to boost exports of fruits, vegetables, flowers, minor forest produce and their value added products. Export of these products shall qualify for duty free credit entitlement equivalent to 5% of FOB value of exports. The entitlement is freely transferable and can be used for import of a variety of inputs and goods. c. Served from India Scheme To accelerate growth in export of services so as to create a powerful and unique "Served from India" brand instantly recognized and respected the world over; the earlier DFEC scheme for services has been revamped and re-cast into the Served from India scheme. Individual service providers who earn foreign exchange of at least Rs.5 lakhs, and other service providers who earn foreign exchange of at least Rs.I0 lakhs will be eligible for a duty credit entitlement of 10% of total foreign exchange earned by them. In the case of standalone restaurants, the entitlement shall be 20%, whereas in the case of hotels, it shall be 5%. Hotels and Restaurants can use their duty credit entitlement for import of food items and alcoholic beverages. d. EPCG Additional flexibility for fulfillment of export obligation under EPCG scheme in order to reduce difficulties of exporters of goods and services. Technological upgradation under EPCG scheme has been facilitated and incentivized. Transfer of capital goods to group companies and managed hotels now permitted under EPCG. In case of movable capital goods in the service sector, the requirement of installation certificate from Central Excise has been done away with. Export obligation for specified projects shall be calculated based on concessional duty permitted to them. This would improve the viability of such projects. e. DFRC Import of fuel under DFRC entitlement shall be allowed to transfer to marketing agencies authorized by the Ministry of Petroleum and Natural Gas. f. DEPB

The DEPB scheme would be continued until replaced by a new scheme to be drawn up in consultation with exporters. Income tax benefits on plant and machinery shall be extended to DT A units, which convert to EOUs. Import of capital goods shall be on self-certification basis for EOUs. For EOUs engaged in Textile & Garments manufacture leftover materials and fabrics up to 2% of ClF value or quantity of import shall be allowed to be disposed off on payment of duty on transaction value only. Minimum investment criteria shall not apply to Brass Hardware and Handmade Jewelry EOUs (this facility already exists for Handicrafts, Agriculture, Floriculture, Aquaculture, Animal Husbandry, IT and Services). . 8. New Status Holder Categorization A new rationalized scheme of categorization of status holders as Star Export Houses has been introduced as under: Category Total performance over three years Star Export Houses shall be eligible for a number of privileges including fast-track clearance procedures, exemption from furnishing of Bank Guarantee, eligibility for consideration under Target Plus Scheme, etc. 9. EOUs EOUs shall be exempted from Service Tax in proportion to their exported goods and services. EOUs shall be permitted to retain 100% of export earnings in EEFC accounts. Income tax benefits on plant and machinery shall be extended to DTA units, which convert to EOUs. Import of capital goods shall be on self-certification basis for EOUs. For EOUs engaged in Textile and Garments manufacture leftover materials and fabrics up to 2% of CIF value or quantity of import shall be allowed to be disposed off on payment of duty on transaction value only. 10. Free Trade and Warehousing Zone A New scheme to establish Free Trade and Warehousing Zone has beenintroduced to create trade-related infrastructure to facilitate the import and export of goods and services with freedom to carry out trade transactions in free currency. This is aimed at making India into a global trading-hub. Units in the FTWZs would qualify for all other benefits as applicable for SEZ units. 11. Services Export Promotion Council An exclusive Services Export Promotion Council shall be set up in order to map opportunities for key services in key markets, and develop strategic market access programs, including brand building, in co-ordination with sectoral players and recognized nodal bodies of the services industry. 12. Common Facilities Center

Government shall promote the establishment of Common Facility Centers for use by home based service providers, particularly in areas like Engineering and Architectural design, Multimedia operations, software developers etc., in State and District-level towns, to draw in a vast multitude of home-based professionals into the services export arena. 13. Procedural Simplification & Rationalization Measures Import of second-hand capital goods shall be permitted without any age restrictions. Minimum depreciated value for plant and machinery to be re-located into India has been reduced from Rs.50 crores to Rs.25 crores. All exporters with minimum turnover of Rs.5 crores and good track record shall be exempt from furnishing Bank Guarantee in any of the schemes, so as to reduce their transactional costs. All goods and services exported, including those from DT A units, shall be exempt from Service Tax. Validity of all licenses/entitlements issued under various schemes has been increased to a uniform 24 months. Number of returns and forms to be filed has been reduced. This process shall be continued in consultation with Customs & Excise. Enhanced delegation of powers to Zonal and Regional offices of DGFT for speedy and less cumbersome disposal of matters. Time bound introduction of Electronic Data Interface (EDI) for export transactions. 75% of all export transactions to be on EDI within six months. 14. Pragati Maidan In order to show case our industrial and trade prowess to its best advantage and leverage existing facilities, Pragati Maidan will be transformed into a world-class complex. There shall be state-of-the-art, environmentally controJled, visitor friendly exhibition areas and marts. A huge Convention Center to accommodate 10,000 delegates with flexible hall spaces, auditoria and meeting rooms with high-tech equipment, as well as multi-level car parking for 9,000 vehicles will be developed within the envelope of Pragati Maidan. 15. Legal Aid Financial assistance would be provided to deserving exporters, on the recommendation of Export Promotion Councils, for meeting the costs of legal expenses connected with trade-related matters. 16. Grievance Redressal A new mechanism for grievance redressal has been formulated and put into place by a Government Resolution to facilitate speedy redressal of grievances of trade and industry. 17. Quality Policy DGFT shall be a business-driven, transparent, corporate-oriented organization. Exporters can file digitally signed applications and use Electronic Fund Transfer Mechanism for paying application fees. All DGFT offices shall be connected via a central server making application processing faster.

DGFT HQ has obtained ISO 9000 certification by standardizing and automating procedures. 18. Board of Trade The Board of Trade shall be revamped and given a clear and dynamic role. An eminent person or expert on trade policy shall be nominated as President of the Board of Trade, which shall have a Secretariat and separate Budget Head, and will be serviced by the Department of commerce. International Financial management Q.1 Answer the following questions: (a) Define exposure, differentiating between accounting and economic exposure. (b) Describe at least three circumstances under which economic exposure is likely to exist. (c ) Of What relevance are the International Fisher effect and purchasing power panty to you answer to parts (a) and (b) (d) What is exchange risk as disinter form exposure?

Q.2 The principal problem in analyzing different form of export financing is the distribution of risk between the exporter and the importer. Analyze the following export financing instruments in this respect: 1. 2. 3. 4. Confirmed revocable letter of credit Confirmed irrevocable letter of credit Open account credit Time draft D/A Cash in advance Consignment

5. 6.

Q.3 (a) What risks confront dealers in the foreign exchange market? (b) an investor wishes to buy French spot (at $0.10 IN Rs.5.5880) and sell French francs forward for 180 days (at $0.10 IN Rs.5.5886)

Q.4 Todays high interest rates put a premium on careful management of cash and marketable securities. (a) What techniques are available to an MNC with operating subsidiaries in many countries to economize on these short term assets? (b) What acre the advantages and disadvantages of centralizing the cash management function? (c ) What can the firm do to enhance the advantages and reduce the disadvantages described in part (b) ?

Q.5 The experiences of fixed exchange rate systems and target zone arrangements have not been entirely satisfactory. (a) What lessons can be drawn form the breakdown of the Breton woods system?

(b) What lessons can be draws form the exchange rate experiences of the European Monetary system?

Q.1 (a) The international economy is fast Turing into a borderless global village. Critically examine. (b) What is the impact of devaluation on foreign investment? How is foreign direct investment different form imitational capital movements in general?

Q.2 (a) Explain the functions and role of the world Bank IDA and IFC. How do they differ form each other? (b) How effective has the regulation of international financial system been? Discuss with suitable examples.

Q.3 what are the various kinds of foreign exchange exposures? If you are a finance manager of anIndia software Multinational Company how would you measure the possible translation exposure, if Re. devalues by 5% against $

Q.4 what is a political risk? How is it forecasted? Do you think management of political risk is very crucial for successful foreign direct investment decision? If yes how? Given some examples of recent political risks in the India context.