Beruflich Dokumente

Kultur Dokumente

Untitled

Hochgeladen von

api-132950818Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Untitled

Hochgeladen von

api-132950818Copyright:

Verfügbare Formate

LP L FINANCIAL R E S E AR C H

Weekly Market Commentary

August 6, 2012

What the Fed Cant Do

Jeffrey Kleintop, CFA

Chief Market Strategist LPL Financial

Highlights

As professional investors generally have maintained an outlook for gains this year, individual investors seem to be plagued by distrust in the financial system and continue to sell stocks. One of the reasons investors were able to get over the scandals and shocks to the market in prior decades relatively quickly was that investors were focused more on long-term results than they are today. Investor time horizons have contracted from three to five years* a few decades ago to less than six months today, making short-term market moving events and volatility a bigger negative factor for individual investors.

Last week, there was some encouraging news from the Federal Reserve (Fed) and the European Central Bank (ECB) along with some better U.S. economic reports. But individual investors do not seem to care much. Cash flows remain negative for mutual funds that invest in U.S. stocks despite gains for the year.* Despite the sluggish U.S. economy, European debt problems, and many other risks, the stock market has remained in positive territory this year, as professional investors generally have maintained an outlook for gains this year as the global economy and corporate earnings growth muddle through. In contrast, individual investors seem to be plagued by distrust in the financial system and continue to sell stocks. It is easy to see why. Setting aside the huge hit to confidence from the failure of Lehman Brothers in 2008 and the Flash Crash of 2010, recent headlines have featured plenty of confidence-shaking scandals. These include the major banks rigging LIBOR (a key benchmark intra-bank lending rate), insider trading by former Goldman Sachs director Raj Gupta, and the disappearance of customer funds from MF Global and PFG Best. Adding to the sense of injustice extending from these scandals are the botched Facebook IPO and stunning trading losses at JPMorgan, and last week, the glitch among the high-speed trading computers at Knight (a market maker that handles 17% of all trading on the NYSE and NASDAQ) that triggered millions of unintended orders sending the prices of some stocks on a wild ride.

Nothing New

To be sure, these issues of fairness and market integrity in the stock market are not a new phenomenon. The 1987 crash was driven by computer trading strategies. The selective information flow that disadvantaged individual investors in the late 1990s and led to Regulation Fair Disclosure (so-called Reg. FD) was followed by the corporate scandals of the early 2000s that included large U.S. companies such as Enron, Adelphia, Worldcom, and Tyco. But these events from decades past did not keep individual investors from returning fairly quickly to buying stocks, based on monthly mutual fund flow data from the Investment Company Institute (ICI). Investors got over these events relatively quickly perhaps given how strong returns were for stocks in the decade prior to when they occurred. Currently, the combination of lackluster returns for stocks over the past decade and

Member FINRA/SIPC Page 1 of 3

W E E KLY MARKE T CO MME N TAR Y

new questions about the integrity of the markets are making would-be stock market investors think twice about taking on the risk of owning stocks. The signs of a falloff in investor confidence are not hard to spot. While statements from the Fed and the ECB can push the market around and shift professional investor sentiment on any given day (as we saw this past Friday, August 3), individual investors remain steadfastly pessimistic as evidenced by continuing outflows and a preference for safe haven assets. Cash flows to U.S. stock mutual funds have been negative most months of the past five years. July 2012 was no exception to this trend. In fact, these funds have not seen a month of net inflows since April 2011. Net inflows have remained very strong for taxable bond funds despite low interest rates, and cash balances have remained at high levels.*

Short-Term Focus

While these events are unwelcome, they do not alter earnings growth for U.S. companies, the driver of long-term returns for stocks. One of the reasons stocks were able to move higher on improving fundamentals, such as earnings growth, in prior decades was that investors were focused more on long-term results than they are today. The time horizon of the average investors investment perspective has changed dramatically over the years, as you can see in Figure 1. According to data from the New York Stock Exchange, the average holding period for stocks in 1960 was about eight years. By 1970, it had slid to a little over five years. By 1980, it had fallen to just under three years, by 1990 to two years, by 2000 to just one year, and in 2010 it reached a mere six months. In 2012, the ETF that tracks the S&P 500 turns over its full market capitalization in trading volume about once every five days.

Investors Focus Has Become Short-Term

Average Holding Period for Stocks by Decade 9 8 7 6

Years

5 4 3 2 1 0 1940 1950 1960 1970 1980 1990 2000 2010

Source: LPL Financial, NYSE 08/06/12

LPL Financial Member FINRA/SIPC

Page 2 of 3

W E E KLY MARKE T CO MME N TAR Y

Andy Warhol famously made the statement that in the future, everyone will be famous for 15 minutes. What seems more certain is that in the near future, stocks may be owned by investors for just 15 minutes. One of the consequences of such a short investment time horizon is that investors have begun to fear short-term market events and volatility as much or more than the factors that shape prospects for long-term economic and profit growth that drive stocks over the longer term. While the Fed seeks to boost the confidence of investors in the economic environment, the regulator has proven powerless to restore the sense of integrity that many feel is missing from the stock market. The short-term stock market moves based on the outlook for action by the Fed and ECB have done little to boost confidence among individual investors. While stocks may go on to post gains this year, it is likely to be some time before individual investors return to the stock market and drive a meaningful lift in stock market valuations that remain low by historical standards. n

IMPORTANT DISCLOSURES The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Any other company mentioned herein is for educational or illustrative purposes only and it is not an offer to buy or sell nor provide any opinion on its product or service. *Unless otherwise noted, all statistical figures mentioned herein come from the Investment Company Institute (ICI).

This research material has been prepared by LPL Financial. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Member FINRA/SIPC Page 3 of 3 RES 3794 0812 Tracking #1-089847 (Exp. 08/13)

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Paper Presentation EcbDokument3 SeitenPaper Presentation EcberikaNoch keine Bewertungen

- Activist Investing White Paper by Florida State Board of AdmistrationDokument48 SeitenActivist Investing White Paper by Florida State Board of AdmistrationBradley TirpakNoch keine Bewertungen

- Mutual Fund AssignmentDokument51 SeitenMutual Fund AssignmentKuljeet Singh83% (6)

- 40 SitaraDokument2 Seiten40 SitaraTIN_CUP_87100% (1)

- CASE 5 Rochester ManufacturingDokument5 SeitenCASE 5 Rochester Manufacturinglikha piao0% (1)

- Trade During The Industrial Revolution - EditedDokument3 SeitenTrade During The Industrial Revolution - EditedJames YangNoch keine Bewertungen

- Brs Practise SheetDokument1 SeiteBrs Practise Sheetapi-252642432Noch keine Bewertungen

- Industrial Estates in PakistanDokument3 SeitenIndustrial Estates in PakistanMuazzam Mughal33% (3)

- Reasonable AssuranceDokument12 SeitenReasonable AssuranceHossein DavaniNoch keine Bewertungen

- SMR - Group 5Dokument30 SeitenSMR - Group 5rishabhasthanaNoch keine Bewertungen

- The Bank of Nova ScotiaDokument18 SeitenThe Bank of Nova Scotiakash32192Noch keine Bewertungen

- The Following Is A List of Banks in IndiaDokument9 SeitenThe Following Is A List of Banks in IndiaSubash SundarNoch keine Bewertungen

- 12 - MWS96KEE127BAS - 1research Project - WalmartDokument7 Seiten12 - MWS96KEE127BAS - 1research Project - WalmartashibhallauNoch keine Bewertungen

- Malegam Committee Report 20-01-11Dokument2 SeitenMalegam Committee Report 20-01-11Mayank AgrawalNoch keine Bewertungen

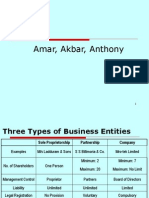

- Forms of Business EntityDokument20 SeitenForms of Business EntityMain Daiictian HuNoch keine Bewertungen

- Guidelines by RbiDokument7 SeitenGuidelines by RbiSandip BarotNoch keine Bewertungen

- FFMC Rbi DocsDokument51 SeitenFFMC Rbi DocsManikNoch keine Bewertungen

- JFK Killed Just Days After Shutting Down RothschildDokument12 SeitenJFK Killed Just Days After Shutting Down RothschildDomenico Bevilacqua100% (1)

- Donald Kohn Nomination Hearing For Federal Reserve Board - 2002Dokument151 SeitenDonald Kohn Nomination Hearing For Federal Reserve Board - 2002Matt StollerNoch keine Bewertungen

- Topic 3 - Todaro, Economic Development - Ch.3 (Wiscana AP)Dokument4 SeitenTopic 3 - Todaro, Economic Development - Ch.3 (Wiscana AP)Wiscana Chacha100% (1)

- Day Trading by Matthew MayburyDokument52 SeitenDay Trading by Matthew MayburyXRM09090% (1)

- Portfolio Management Professional Reference ListDokument1 SeitePortfolio Management Professional Reference ListMohammed AlnasharNoch keine Bewertungen

- RAPDokument42 SeitenRAPJozua Oshea PungNoch keine Bewertungen

- 2008 June Paper 1Dokument2 Seiten2008 June Paper 1zahid_mahmood3811Noch keine Bewertungen

- Company Introduction: Initial Report June 23rd, 2008Dokument19 SeitenCompany Introduction: Initial Report June 23rd, 2008beacon-docsNoch keine Bewertungen

- ACCA Corporate Governance Technical Articles PDFDokument17 SeitenACCA Corporate Governance Technical Articles PDFNicquainCTNoch keine Bewertungen

- Jurnal Imbalan KerjaDokument7 SeitenJurnal Imbalan KerjanikadekdiwayamiNoch keine Bewertungen

- Investor Presentation PDFDokument28 SeitenInvestor Presentation PDFshub56jainNoch keine Bewertungen

- Role of MNC/S in Growth of Indian EconomyDokument2 SeitenRole of MNC/S in Growth of Indian EconomyBhupen SharmaNoch keine Bewertungen

- Mubadala - Base Prospectus PDFDokument293 SeitenMubadala - Base Prospectus PDFAngkatan LautNoch keine Bewertungen