Beruflich Dokumente

Kultur Dokumente

Binder - HCT - Collusion - Martin

Hochgeladen von

My-Acts Of-Sedition0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

404 Ansichten9 SeitenThe city of Lauderdale Lakes is in a rapidly deteriorating financial condition. The audit fails to identify the city's actual cash balance. City manager and auditor have engaged in an organized scheme to defraud the public.

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe city of Lauderdale Lakes is in a rapidly deteriorating financial condition. The audit fails to identify the city's actual cash balance. City manager and auditor have engaged in an organized scheme to defraud the public.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

404 Ansichten9 SeitenBinder - HCT - Collusion - Martin

Hochgeladen von

My-Acts Of-SeditionThe city of Lauderdale Lakes is in a rapidly deteriorating financial condition. The audit fails to identify the city's actual cash balance. City manager and auditor have engaged in an organized scheme to defraud the public.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

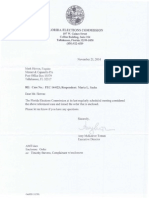

Saturday, August 11, 2012

David W. Martin, CPA

State of Florida Auditor General

Claude Pepper Building

111 West Madison Street

Tallahassee, FL 32399-1450

Chaz Stevens

MAOS / The Broward Post

1600 S. Dixie Highway #300

Boca Raton, FL 33432

Sent via: email, fax, and FedEx overnight.

RE: FY 2011 Financial Statements of the City of Lauderdale Lakes and the 2011

Audited Financial Statements by the firm Harvey, Covington & Thomas, LLC

Dear Sir:

After an exhaustive nine-month investigation into Lauderdale Lakes rapidly deteriorating

financial condition, I believe both City Manager Jonathan Allen and Rod Harvey, CPA have

engaged in an organized scheme to defraud the public by intentionally withholding the citys

actual cash balance.

Long-time friends, those individuals would appear to have a mutual vested financial interest in

the curtailing of such information.

From my painstaking audit review, I noted cash due to/from:

p. 17: Governmental Funds ($2.9M in loans)

p. 21: Proprietary Funds

p. 51: Non-major Governmental Funds

Cash and cash equivalents fund amounts including:

Proprietary Funds: $1,692,976

Total Pooled Cash: $1,726,312

Total Investments: $37,005

Governmental Funds: $33,336

Supposedly insolvent, the following loans were made:

General Fund: ($4.8M) deficit / $1.4M loan

Fire Fund: ($1.7M) deficit / $511,490 loan

Other restricted-usage fund loans listed:

Page 2

2005 Bond Construction Fund: $646,128

CDBG Minor Home Repair Fund: $206,987

Transportation Gas Tax Fund: $72,396

Law Enforcement Fund: $25,444

All together, these loans exceeded the FY11 Ending Total Pooled Cash balance; of which

there were two different reported balances:

2011 Audited Financial Statement: $1,726,312

Citys accounting system: $1,433,788

As the audit clearly fails to identify the actual cash balance, it therefore does not meet

Governmental Accounting Standards Board and Generally Accepted Accounting Practices

disclosure requirements.

Given all this, I request an investigation of Harvey, Covington, and Thomas, LLC.

Regards;

Chaz Stevens

Investigative Reporter

MAOS / The Broward Post

cstevens@browardpost.com

818-468-5433

CC:

Broward County Commission

Lauderdale Lakes City Commission

Broward Office of Inspector General

Broward State Attorneys Office

State of Florida Legislative Auditing Committee

Florida Department of Financial Services

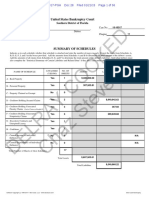

C1TY OF LAUDERDALE LAKES, FLORII>A

BALANCE SHEET

GOVERNMENTAL FUNDS

SEPTEMBER 30, 2011

2005GO Other Total

Fhe Grnnt Community Bond Construction Go,enmentl Gowrnmntul

General Rscue Fund Fund Redevelol!ment Fund Funds Funds

ASSETS

Cash and Cash oquivalents $ 16,237 $

-

$

-

$

-

$

-

s 17,099 $ 33,336

12,368

. .

23,881 756

.

37,005

1.747, 110 155, 142

. 4,766 . 452.214 2.359,232

"*Duo from other funds 1.414,015 511,490

-

50,000 646, 128 314.827 2,936,460

Due from other 272,630 16,212 1,049,539 135,420

. 2,859 1,476,660

Advance to general fund

. . . 2,518,031

.

2,518,031

Pn:paid assets 28,548

. . . . .

28,548

Inventory held for resale 99.390 . .

- -

.

99.390

Restricted cash

. . . 818 288 - 818.288

Total assets 3,590,298 682 844 1,049,539 3,550,386 646,884 786,999 10)06,950

.

LIABILITIES AND FUND BALANCES

Liabilities:

Accounts payable and accmcd liabilities 484,969 360 22,595 52,495 1,410 36,337

<

598, 166

to other fimds 50,000

-

1.414,015 106,534

. 1,365,911 2,936,460

Due to other agencies 5,293,054 2,245,576

. . . 83,034 7,621,664

Advance from CRA 2,518,03 1 . . . .

- 2,5 18,031

Deferred revenue 97 744 172.470 . .

-

.

270 214

Total liabilities 8 443 798 2,418,406 1,436,610 159,029 1,410 1,485,282 13,944,535

Fund

Nonspendabk

Prep aids 28,548

. . . . . 28,548

Inventory held for resale 99,390

.

99,390

. . . . .

Advilnces

. .

-

2,518,031

. .

2,5 18,031

Restricted:

Special revenue fimd

. . . 873,327

.

235,966 l , 109,293

Capital project fund

. . . . 645,474

.

645,474

Un;usigned:

General Fund (4,98 1,438)

.

-

. . .

(4,981,438)

Special revenue fimds . (1,735,562) (387,071)

. . (445,318) (2,567,951)

Capital project limd

- -

. . (485,523) (485.523)

Debt service fund - - - -

Total fund balances (deficits) (4,8531500) (1,7351562) (3871071) 3,3911358 645 474 (698,2831 (3,637,584)

Tutalliabilities and fund bDlan<es $ 3,590,298 $ 682,844 $ 1,049,539 s 3,550,387 $ 646,884 $ 786,999 $ 10,306,951

The notes to the financial statements are an integral part of this statement. 17

CITY OF LAUDERDALE LAKES

COMBINING BALANCE SHEET

NON-MAJOR GOVERNMENTAL FUNDS

SEPTEMBER 30, Wtl

Setdal Revenue Debt Servlu Caplral Projllctr

Law Code Alz.hllimer Minor Trantt portatfun 2005 Bond Copltol Proj ect

Impact Enforcenumt Enforcement C:ue Centn HomeRep:dr G;nTax Debt Senlce Project Construction

Fee Fund Trurt Fund Trust Fund Fund Fund Funrl Fund Fund Fund TOTAL

ASSETS

Cash i\nd cash etJuival enls s s s s $ s 16.302 s 797 s s 17,099

Rt::ceivables, net 76,470 375, 744 452,214

* DUt:: fimn ofht::r funds 25,444 10,000 72,396

Due trom ofht::r Agencies 2,859 2,859

Toti11As:;e1s 28,303

___ l_O,ODO 76,470 206.987 88,698 797 375,744 786,999

Ll ABlLITIES

Accounts I 5,786 20,551 36,337

Payable

'

A..:cmerl pilyroll nnd relnted linbilities

Due to o1ht:r Agt:: m;it:: s 77,471 4,205

* Out: tD other fwuts 246.979 504,644 395,491 21S,797 1,365,91 l

Total LiAbilities 77.471 20,551 4,205 395,491 21S,797 I

FUND BALANCES

for:

Spt::liJAl revcmlt 10,000 129.516 235,966

projt:cts

Dt:bt st:Jvh:t:

(445, 3U) (445,318)

projr:.;;ts (! 46,9i9) (19,747) (218,?97) (485,523)

Debt St:lVictl (3,408! (3,408)

Total F1md BaJaucts (deficits) (!46,979) 2S,303 10,000 (445, 318! 129.516 (3,408! (19,747) (218,797) (6Y8,283)

Tot<ll Lillbilities: am1 Fm1d s s 2S,303 $ 10,000 $ 76, 470 s 206.987 s 88,698 $ 797 s 375,744 s $

51

ASSETS

-*cash and Cash equivalents

Accounts Receivable

~ D u e from other funds

Due from other agencies

Total current assets

Noncurrent assets

Capital assets:

Infrastructure

Equipment

Vehicles

Total capital assets

Less accumulated depreciation

Total Capital assets, net

Total assets

Overdraft

LIABILITIES

Current liabilities:

Accounts payable and accrued liabilities

Due to other agencies

Compensated absences payable

Other liabilities

Due to other funds

Bond payable

Total current liabilities

Noncurrent liabilities:

Compensated absences payable

Bond payable

Total noncurrent liabilities

Total liabilities

NET ASSETS

In vested in capital assets, net of related

debt

Unrestricted

Total net assets

CITY OF LAUDERDALE LAKES, FLORIDA

STATEMENT OF NET ASSETS

PROPRIETARY FUNDS

SEPTEMBER 30, 2011

Stonnwater Solid Waste Building Services

Fund Fund (Nonmajor Fund)

$ 707,028 $ 985,048 $

28,486 148

352,107

6,693

735,514 1,343,996

4,519,149

151,953 53,615

439,724 16,790

5,110,826 70,405

(2,671 , 9 9 2 ~ (47,951)

2,438,834 22,454

$ 3,174,348 $ 1,343,996 $ 22,454

53,710 436, 165 80,574

377

6,095

352,107

213,768

273,950 436, 165 432,681

30,475

1,479,242

1,509,717

1,783,667 436,165 432,681

745,824 22,454

644,859 907,831 (432,681)

$ 1,390,683 $ 907,831 $ (410,227)

The notes to the financial statements are an integral part of this statement.

Total

$ 1,692,076

28,634

352,107

6,693

2,079,510

4,519, 149

205,568

456,514

5,181,231

(2,719,943)

2,461,288

$ 4,540,798

570,449

377

6,095

352,107

2 13,768

1, 142,796

30,475

1,479,242

1,509,717

2,652,513

768,278

1, 120,009

$ 1,888,287

21

CITY OF LAUDERDALE LAKES

NOTES TO THE FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

reported as general revenues rather than as program revenues. Likewise, general revenues

include all taxes.

Proprietary funds distinguish operating rever.ues and expenses from non-operating items.

Operating revenues and expenses generally result from providing services and producing

and delivering goods in connection with a proprietary fund's principal ongoing operations.

The principal operating revenues of the stormwater, solid waste/recycling and the building

services funds are charges to customers for sales and services. Operating expenses for

enterprise funds include the costs of services, administrative expenses and depreciation on

capital assets. All revenues and expenses not meeting this definition are reported as non-

operating revenues and expenses.

D. Assets, liabilities, and net assets or equity

1. Deposits and investments

The City's cash and cash equivalents include cash on hand, demand deposits, and

investments with the State Board of Administration (SBA) and short-term investments with

original maturities of three months or less from the date of acquisition.

Resources of all funds have been combined into a pooled cash and investment system for

the purpose of maximizing earnings. Interest earned on pooled cash and investments is

allocated monthly based upon equity of the respective funds.

For the purpose of the statement of cash flows, cash and cash equivalents mean short term,

highly liquid investments with an original maturity of three months or less.

2. Receivables and Payables

Activity between funds that are representative of arrangements

outstanding at the end of the fiscal year are referred to as either "due to/from other funds"

(i.e. the current portion of interfund loans) or "advances to/from other funds" (i.e. the non-

current portion of interfund loans). All other outstanding balances between funds are

reported as "due to/from other funds." Any residual balances outstanding between the

governmental activities and business-type activities are reported in the government-wide

financial statements as "internal balances."

Advances between funds, as reported in the fund financial statements, are offset by a fund

balance reserve account in applicable governmental funds to indicate that they are not

available for appropriation and are not expendable available financial resources.

All trade and property tax receivables are shown net of an allowance for uncollectible

accounts. The receivable allowances are estimated based on historical trends.

27

13. Net Assets

CITY OF LAUDERDALE LAKES

NOTES TO THE FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

Net assets of the government-wide and proprietary funds are categorized as invested in

capital assets net of related debt, restricted ur unrestricted. The first category represents

net assets related to capital assets net of any outstanding debt associated with the capital

assets.

In the government-wide and proprietary fund financial statements, restricted net assets are

used to indicate the segregation of a portion of net assets equal to certain assets that are

restricted by requirements of revenue bonds and other externally imposed constraints or by

legislation in excess of the related liabilities payable from restricted assets. There were no

restricted net assets as of September 30, 2011.

NOTE 2- STEWARDSHIP, COMPLIANCE AND ACCOUNTABILITY

At September 30, 2011, the following funds reported deficits in fund balances (all deficit

balances were for governmental funds):

Fund

General fund

Fire rescue fund

Grant fund

Alzheimer Care Center

Project construction fund

Capital projects fund

Impact fee fund

Debt service fund

Deficit

$4,853,500

1,735,562

387,071

445,318

218,797

19,747

246,979

3,408

In the General fund the deficits were attributed to the decline in property values, a reduction

in State revenue sharing, reductions in various other revenue sources, coupled with an over

projections of revenues. The general fund expenditures continued on target with budget

projections. As a result expenditures exceeded revenues by nearly $3.4 million. The City

contracts Fire Rescue services through Broward Sheriffs Office. The cost for the contractual

services increase nearly by 5% annually, however the major source of revenue is the

special assessment which is insufficient to pay for the cost of service. This attributed to the

deficit in fund balance. The other governmental funds the revenues continued to decline

and expenditures continued on target therefore expenditures exceeded revenues to

perpetuate the deficits in fund balance.

~ NOTE 3- DEPOSITS AND INVESTMENTS

For accounting and investment purposes, the City maintains a cash and investment pool for

use by all City funds. This gives the City the ability to invest large amounts of idle cash for

short periods of time and to maximize earning potential. Each fund type's portion of this

pool is displayed on the combined balance sheet as cash and equity in pooled cash and

investments. Income earned on pooled cash and investments is allocated to the respective

funds based on average daily balances.

A. Cash deposits

As of September 30, 2011 , the City did not overdraw on its cash. Because of overdraft

protection plan the City's cash overdrafts are paid by the financial institution.

31

...

CITY OF LAUDERDALE LAKES

NOTES TO THE FINANCIAL STATEMENTS

SEPTEMBER 30, 2011

All deposits with financial institutions are fully insured or collateralized as required by the

City Commission. The deposits are covered by federal depository insurance and, for the

amount in excess of such federal depository insurance, by the State of Florida's Public

Deposits Act (the "Act") . Provisions of the Act require that public deposits may only be made

at qualified public depositories. The Act requires each qualified public depository to deposit

with the State Treasurer eligible collateral equal to or in excess of the required collateral as

determined by the provisions of. the Act. In the event of a failure by a qualified public

depository, losses, in excess of federal depository insurance and proceeds from the sale of

the securities pledged by the defaulting depository, are assessed against the other qualified

public depositories of the same type as the depository in default.

B. Investments

Florida Statutes, Chapter 218.415, authorize the City to establish its own investment policy

by ordinance. The investment ordinance allows up to 1 00% investment in the following

instruments, subject to maturity limitations: local government surplus trust fund (the "SBA");

Securities and Exchange Commission (the "SEC") registered money market funds with the

highest quality rating from a nationally recognized rating agency; savings accounts and

certificates of deposit in state-certified qualified public depositories; direct obligations of the

U.S. Treasury; and, securities issued by federal agencies and instrumentalities. Up to 10%

may be invested in common stocks, subject to quality restrictions.

The City's investments were insignificant to the individual fund assets and pooled cash

balances at September 30, 2011 and were comprised solely of amounts deposited with the

SBA.

NOTE 4- RECEIVABLES

The City uses a third party to manage the collection process for receivables associated with

its contracted service provider, Emergency Medical Services ("EMS"). With the exception of

fire inspection fees and occupational licenses, EMS receivables and the corresponding

allowance for doubtful accounts are recorded in the General fund. The receivables and

allowances for fire inspection fees and occupational licenses are recorded in the Building

Services and Fire Rescue funds, respectively. All allowances have been established based

on historical collection rates.

Receivables at September 30, 2011, in aggregate, are comprised of the following amounts,

net of allowances:

General Fire Rescue

CRA

Non major Total

Receivables:

Utility $ 562,180 $ - $

.

$ $ 562,180

Certificate of Use 7,188 7,188

Occupational Licenses 80,387 80,387

Alzheimer Care 76,470 76,470

Emergency Medical Service 1,004,254 1,004,254

Fire Inspections 155,142 155,142

Other 93,101 4,766 375,744 473,611

Total $ 1,747,110 $ 155,142 $ 4,766 $ 452,214 $ 2,359,232

32

:.:. mun1s Financials, Revenue & Citizen services and Human capital Management

r

06 / 05/2012 07 : 41 ICity of Lauderdale Lakes

l PG 1

chandrag ACCOUNT DETAIL HISTORY FOR 2012 01 TO 2012 09 glact hst

ACCOUNT NET LEDGER NET BUDGET

JNL EFF DATE SRC REF1 REF2 REF3 CHECK # OB AMOUNT BALANCE BALANCE

000 Cash Accound

I 1' 433-:-:;a 8. 87 J

SOY BALANCE

12/01 1008 10/03/11 CRP BL 100311 18,467.35 1, 452 ,256 . 22

12/01 1009 10/03/11 CRP BL 1032011 1,600 .00 1 , 453,856.22

12/01 1012 1 0/03/11 GEN D/R COMM DEV 3.60 1 ,453,859.82

12/01 1012 10/03/11 GEN D/R COMM DEV 20.09 1 ,45 3,879 .91

12/01 1012 10/03/11 GEN D/R COMM DEV 395.00 1 ,454,274.91

12/01 1012 10/03/11 GEN D/R COMM DEV 185. 00 1 ,454, 459.91

12/01 1012 10/03/11 GEN D/R COMM DEV 136.20 1 ,454,596.11

12/01 1012 10/03/11 GEN D/R COMM DEV 200 . 00 1,454,796.11

12/01 1012 10/03/11 GEN D/R COMM DEV 46 . 17 1,454,842.28

12/01 1012 10/03/11 GEN D/R COMM DEV 75.00 1,454,917 . 28

12/01 1012 10/03/11 GEN D/R COMM DEV 8.00 1, 454,925.28

12/01 1012 10/03/11 GEN D/R COMM DEV 4.48 1, 454,929 . 76

12/01 1012 10/03/11 GEN D/R COMM DEV 5 . 82 1 ,454,935.58

12/01 1012 10/03/11 GEN D/R COMM DEV 3 . 00 1,454,938 . 58

12/01 1012 10/03/11 GEN D/R COMM DEV 10.00 1, 454,948 . 58

12/01 1013 10/07/11 APP apchk ' 150.00 1, 455,098 .58

12/01 1014 10/07/11 APP apchk -584,518.75 870,579 . 83

12 /01 1015 10/10/11 APP apchk 251.00 870,830.83

12/01 1016 10/10/11 APP apchk -13,853. 12 856,977 . 71

12/01 1017 10/12/11 PRJ 100711 1100711 1100711 70,293 . 98 927,271 . 69

12/01 1017 10/12/11 PRJ 100711 1100711 1100711 - 153,634.11 773,637.58

12/01 1020 10/12/11 PRJ 100711 4100711 4100711 4,027.21 777,664. 79

12/01 1020 10/12/11 PRJ 100711 4100711 4100711 - 12,231.68 765,433 .11

12/01 1022 10/04/11 CRP BL 100411CASH 816 . 63 766,249 . 74

12/01 1023 10/04/11 GEN D/R COMM DEV 2,316.43 768,566.17

12/01 1030 10/03/11 GRV D/R COMM DEV - 136 .20 768,429.97

12/01 1030 10/03/11 GRV D/R COMM DEV - 200. 00 768,229 .97

12/01 1030 10/03/11 GRV D/R COMM DEV -4 6 . 17 768,183.80

12/01 1030 10/03/11 GRV D/R COMM DEV - 75 . 00 768,108.80

12/01 1030 10/03/11 GRV D/R COMM DEV

'

-8.00 768,100.80

12/01 1030 10/03/11 GRV D/R COMM DEV -4 .48 768,096.32

12/01 1030 10/03/11 GRV D/R COMM DEV - 5.82 768,090.50

12/01 1030 10/03/11 GRV D/R COMM DEV -3 .00 768,087.50

12/01 1030 10/03/11 GRV D/R COMM DEV - 10.00 768,077.50

12/01 1030 10/03/11 GRV D/R COMM DEV -395.00 767,682.50

12/01 1030 10/03/11 GRV D/R COMM DEV -185.00 767,497.50

12/01 1030 10/03/11 GRV D/R COMM DEV -3.60 767,493.90

12/01 1030 10/03/11 GRV D/R COMM DEV -20.09 767,473.81

12/01 1 031 10/03/11 GEN D/R COMM DEV 1 ,092.36 768,566.17

12/01 1032 10/05/11 GEN D/R COMM DEV 1 ,039 . 76 769,605 . 93

12/01 1 033 10/06/11 GEN D/R COMM DEV 3,552.94 773, 158 . 87

12/01 1034 10/06/11 CRP BL 10611 600.00 773,758 . 87

12/01 1035 10/06/11 CRP GB 100611 1,190.00 774,948.87

12/01 1036 10/06/11 CRP BL 100611 11, 111.35 786,060 .22

12/01 1037 10/11/11 CRP BL 101111CASH 904 . 78 786,965. 00

12/01 1038 10/12/11 CRP BL 1012 11 13, 949 . 06 800 ,914.06

12/01 1039 10/10/11 GEN D/R COMM DEV 2,263.23 803,177 . 29

12/01 104 0 10/11/11 GEN D/R COMM DEV 1 ,771.92 804,949.21

12/01 1041 10/12/11 GEN D/R COMM DEV 7,466.80 812,416.01

12/01 1046 10/13/11 APP apchk - 92,783.44 719,632.57

12/01 1049 10/14/11 APP apchk 14,205.00 733,837.57

Das könnte Ihnen auch gefallen

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsVon EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNoch keine Bewertungen

- Local Water UtilitiesDokument75 SeitenLocal Water UtilitiesadsleeNoch keine Bewertungen

- Exhibit 99.1 Message To ShareholdersDokument8 SeitenExhibit 99.1 Message To ShareholdersWilliam HarrisNoch keine Bewertungen

- 10-Casiguran Aurora 2010 Part1-Notes To FSDokument9 Seiten10-Casiguran Aurora 2010 Part1-Notes To FSKasiguruhan AuroraNoch keine Bewertungen

- Solutions Images Bingham 11-02-2010Dokument46 SeitenSolutions Images Bingham 11-02-2010Nicky 'Zing' Nguyen100% (7)

- Question Bank - Accounting For Government OrganisationsDokument1 SeiteQuestion Bank - Accounting For Government Organisationsgmurali_179568Noch keine Bewertungen

- Town of Blue River, ColoradoDokument13 SeitenTown of Blue River, ColoradoblueriverdocNoch keine Bewertungen

- 09-Casiguran Aurora09 Part1-Notes To FSDokument9 Seiten09-Casiguran Aurora09 Part1-Notes To FSKasiguruhan AuroraNoch keine Bewertungen

- NIF 2011 Financial StatermentsDokument33 SeitenNIF 2011 Financial StatermentsWeAreNIFNoch keine Bewertungen

- Microsoft Corporation: United States Securities and Exchange CommissionDokument75 SeitenMicrosoft Corporation: United States Securities and Exchange Commissionavinashtiwari201745Noch keine Bewertungen

- Accounting Clinic IDokument40 SeitenAccounting Clinic IRitesh Batra100% (1)

- Lagos State Audited Financial Statements, 2015Dokument77 SeitenLagos State Audited Financial Statements, 2015Justus OhakanuNoch keine Bewertungen

- Department of Science and Technology Executive Summary 2020Dokument7 SeitenDepartment of Science and Technology Executive Summary 2020Marco Rafael CrespoNoch keine Bewertungen

- A Level Recruitment TestDokument9 SeitenA Level Recruitment TestFarrukhsgNoch keine Bewertungen

- Ever Gotesco: Quarterly ReportDokument35 SeitenEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- 2012 Consolidated Financial StatementsDokument32 Seiten2012 Consolidated Financial StatementstessavanderhartNoch keine Bewertungen

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Dokument32 Seiten4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNoch keine Bewertungen

- Malolos City Executive Summary 2022Dokument10 SeitenMalolos City Executive Summary 2022100forplatesNoch keine Bewertungen

- Accounting Activities and Financial Statements: ACCT 100Dokument46 SeitenAccounting Activities and Financial Statements: ACCT 100gulafshanNoch keine Bewertungen

- LucenaCity08 Audit ReportDokument70 SeitenLucenaCity08 Audit ReportgulamskyNoch keine Bewertungen

- Chap 003Dokument80 SeitenChap 003Châu Anh ĐàoNoch keine Bewertungen

- Financial Statement SampleDokument172 SeitenFinancial Statement SampleJennybabe PetaNoch keine Bewertungen

- 2015 Shakopee Audit Presentation 2015Dokument22 Seiten2015 Shakopee Audit Presentation 2015Brad TabkeNoch keine Bewertungen

- Philippine Charity Sweepstakes Office Executive Summary 2013Dokument6 SeitenPhilippine Charity Sweepstakes Office Executive Summary 2013Den Mark AngudongNoch keine Bewertungen

- Central Bank of Eutopia Statement of Financial Position (Continued.)Dokument0 SeitenCentral Bank of Eutopia Statement of Financial Position (Continued.)Sanath FernandoNoch keine Bewertungen

- Accounting Information, Regression Analysis, and Financial ManagementDokument60 SeitenAccounting Information, Regression Analysis, and Financial ManagementShahrul FadreenNoch keine Bewertungen

- HorngrenIMA14eSM ch16Dokument53 SeitenHorngrenIMA14eSM ch16Piyal HossainNoch keine Bewertungen

- Ch6 SolutionsDokument9 SeitenCh6 SolutionsKiều Thảo AnhNoch keine Bewertungen

- Final Accounts 2005Dokument44 SeitenFinal Accounts 2005Mahmood KhanNoch keine Bewertungen

- American International Ventures Inc /de/: FORM 10-QDokument18 SeitenAmerican International Ventures Inc /de/: FORM 10-QChapter 11 DocketsNoch keine Bewertungen

- Consolidated Financial StatementsDokument78 SeitenConsolidated Financial StatementsAbid HussainNoch keine Bewertungen

- Company Final Accounts PDFDokument31 SeitenCompany Final Accounts PDFakshay64% (11)

- Land Transportation Office Executive Summary 2012Dokument13 SeitenLand Transportation Office Executive Summary 2012lymieng Star limoicoNoch keine Bewertungen

- DELL LBO Model Part 1 CompletedDokument45 SeitenDELL LBO Model Part 1 CompletedascentcommerceNoch keine Bewertungen

- Hannans Half Year Financial Report 2012Dokument19 SeitenHannans Half Year Financial Report 2012Hannans Reward LtdNoch keine Bewertungen

- ITC Cash Flow StatementDokument1 SeiteITC Cash Flow StatementIna PawarNoch keine Bewertungen

- Hyundai Motor Company and Its SubsidiariesDokument84 SeitenHyundai Motor Company and Its SubsidiariesCris TinaNoch keine Bewertungen

- MCB Annual Report 2008Dokument93 SeitenMCB Annual Report 2008Umair NasirNoch keine Bewertungen

- Pyrogenesis Canada Inc.: Financial StatementsDokument43 SeitenPyrogenesis Canada Inc.: Financial StatementsJing SunNoch keine Bewertungen

- Pro Hac Vice) : United States Bankruptcy Court Southern District of New YorkDokument11 SeitenPro Hac Vice) : United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Bayombong Executive Summary 2021Dokument8 SeitenBayombong Executive Summary 2021Aika KimNoch keine Bewertungen

- Financial Statements Govt of Sri Lanka 2012Dokument78 SeitenFinancial Statements Govt of Sri Lanka 2012Kushan PereraNoch keine Bewertungen

- University Budget IDokument21 SeitenUniversity Budget ICullen DonohueNoch keine Bewertungen

- January 14Dokument51 SeitenJanuary 14Nick ReismanNoch keine Bewertungen

- Bid 03312013x10q PDFDokument59 SeitenBid 03312013x10q PDFpeterlee100Noch keine Bewertungen

- Daily Treasury Statement: TABLE I - Operating Cash BalanceDokument2 SeitenDaily Treasury Statement: TABLE I - Operating Cash BalanceBecket AdamsNoch keine Bewertungen

- Fund Accounting BasicsDokument40 SeitenFund Accounting Basicsgaurav pareekNoch keine Bewertungen

- Chapter - Iii: 13 FC RecommendationsDokument3 SeitenChapter - Iii: 13 FC RecommendationsSushama VermaNoch keine Bewertungen

- Capture B (4 Files Merged)Dokument6 SeitenCapture B (4 Files Merged)Hamza Farooq KoraiNoch keine Bewertungen

- 03-LBP2015 Executive Summary PDFDokument7 Seiten03-LBP2015 Executive Summary PDFFrens PanlarocheNoch keine Bewertungen

- Form NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteDokument72 SeitenForm NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteVenkata ChalamNoch keine Bewertungen

- 2011 Interaction Audited Financial StatementsDokument16 Seiten2011 Interaction Audited Financial StatementsInterActionNoch keine Bewertungen

- Catholiccmmtyfdnfs2022 FinalDokument21 SeitenCatholiccmmtyfdnfs2022 FinalNeru MedilloNoch keine Bewertungen

- Executive Summary: Source/Nature Amount (In Million P)Dokument10 SeitenExecutive Summary: Source/Nature Amount (In Million P)Unice GraceNoch keine Bewertungen

- Consolidated Financial Statements For The Year Ended December 31, 2016Dokument20 SeitenConsolidated Financial Statements For The Year Ended December 31, 2016hussein768Noch keine Bewertungen

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Dokument17 SeitenRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNoch keine Bewertungen

- June Financial Soundness Indicators - 2007-12Dokument53 SeitenJune Financial Soundness Indicators - 2007-12shakira270Noch keine Bewertungen

- Chap 002Dokument7 SeitenChap 002ericle8767% (3)

- Balance of Payments & International Investment Position: For The Quarter Ended September 2012Dokument6 SeitenBalance of Payments & International Investment Position: For The Quarter Ended September 2012BermudanewsNoch keine Bewertungen

- Maos Chaz Stevens Suck On This: L L L LDokument3 SeitenMaos Chaz Stevens Suck On This: L L L LMy-Acts Of-SeditionNoch keine Bewertungen

- Sasser Decision - 022315Dokument7 SeitenSasser Decision - 022315My-Acts Of-SeditionNoch keine Bewertungen

- Chaz - Misuse Seal DonnellyDokument3 SeitenChaz - Misuse Seal DonnellyMy-Acts Of-SeditionNoch keine Bewertungen

- RedactedDokument2 SeitenRedactedMy-Acts Of-SeditionNoch keine Bewertungen

- Coddington - 106.071 - Sign - ElecCommDokument2 SeitenCoddington - 106.071 - Sign - ElecCommMy-Acts Of-SeditionNoch keine Bewertungen

- Cooked Chaz Stevens: United States Bankruptcy CourtDokument56 SeitenCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionNoch keine Bewertungen

- Delrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMDokument1 SeiteDelrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMMy-Acts Of-SeditionNoch keine Bewertungen

- Waste ManagementDokument38 SeitenWaste ManagementMy-Acts Of-SeditionNoch keine Bewertungen

- Maos Cease and Desist RobbDokument2 SeitenMaos Cease and Desist RobbMy-Acts Of-SeditionNoch keine Bewertungen

- Cooked Chaz Stevens: United States Bankruptcy CourtDokument56 SeitenCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionNoch keine Bewertungen

- BinderDokument17 SeitenBinderMy-Acts Of-SeditionNoch keine Bewertungen

- Coffey Wheelbrator BullshitDokument1 SeiteCoffey Wheelbrator BullshitMy-Acts Of-SeditionNoch keine Bewertungen

- Gha Oig Letter 10 2014Dokument47 SeitenGha Oig Letter 10 2014My-Acts Of-Sedition100% (1)

- Unpaid LienDokument1 SeiteUnpaid LienMy-Acts Of-SeditionNoch keine Bewertungen

- H Inners SettlementDokument18 SeitenH Inners SettlementMy-Acts Of-SeditionNoch keine Bewertungen

- Cooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5Dokument13 SeitenCooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5My-Acts Of-SeditionNoch keine Bewertungen

- Suggestion of BankruptcyDokument5 SeitenSuggestion of BankruptcyMy-Acts Of-SeditionNoch keine Bewertungen

- Binder 2Dokument12 SeitenBinder 2My-Acts Of-SeditionNoch keine Bewertungen

- Ron Gilinsky EvictionDokument4 SeitenRon Gilinsky EvictionMy-Acts Of-SeditionNoch keine Bewertungen

- ObjectionDokument10 SeitenObjectionMy-Acts Of-SeditionNoch keine Bewertungen

- Florida Elections Commission: W. Gaines Street Collins Building, 224 Ta Ahassee, Florida 32399 1050 (850) 922-4539Dokument4 SeitenFlorida Elections Commission: W. Gaines Street Collins Building, 224 Ta Ahassee, Florida 32399 1050 (850) 922-4539My-Acts Of-SeditionNoch keine Bewertungen

- Appeal Letter Purchasing AgentDokument7 SeitenAppeal Letter Purchasing AgentMy-Acts Of-SeditionNoch keine Bewertungen

- RE: Donation of Pabst Blue Ribbon Festivus PoleDokument1 SeiteRE: Donation of Pabst Blue Ribbon Festivus PoleMy-Acts Of-SeditionNoch keine Bewertungen

- Alaya-Ay, Regine MDokument3 SeitenAlaya-Ay, Regine MMae Ann AvenidoNoch keine Bewertungen

- Test Bank For Marketing 12Th Edition Kerin Hartley Rudelius 0077861035 978007786103 Full Chapter PDFDokument36 SeitenTest Bank For Marketing 12Th Edition Kerin Hartley Rudelius 0077861035 978007786103 Full Chapter PDFfrank.mosley595100% (13)

- CH 16Dokument8 SeitenCH 16Lex HerzhelNoch keine Bewertungen

- Disney Q1-Fy20-EarningsDokument15 SeitenDisney Q1-Fy20-EarningsImnevada AcidNoch keine Bewertungen

- Mellon ExcelDokument18 SeitenMellon ExcelJaydeep SheteNoch keine Bewertungen

- PT Winner Nusantara Jaya TBK 31 Mar 2023 - FinalDokument81 SeitenPT Winner Nusantara Jaya TBK 31 Mar 2023 - FinalTryout Stan On LineNoch keine Bewertungen

- Akl P 4-2 Gjo0Dokument12 SeitenAkl P 4-2 Gjo0galihNoch keine Bewertungen

- Adani Total GasDokument13 SeitenAdani Total GasShiv LalwaniNoch keine Bewertungen

- Acc15 Workbook Answers Chapter 1& 2Dokument8 SeitenAcc15 Workbook Answers Chapter 1& 2Angelo Michael GoNoch keine Bewertungen

- Distress PDFDokument65 SeitenDistress PDFKhushal UpraityNoch keine Bewertungen

- Basic Accounting Equation Exercises 2Dokument2 SeitenBasic Accounting Equation Exercises 2Ace Joseph TabaderoNoch keine Bewertungen

- Vasant Final ProjectDokument60 SeitenVasant Final Projectvas9338Noch keine Bewertungen

- Fsa 2014 18 PDFDokument242 SeitenFsa 2014 18 PDFTuu TueNoch keine Bewertungen

- Rosary College of Commerce and ArtsDokument5 SeitenRosary College of Commerce and ArtsChryston CardosoNoch keine Bewertungen

- Financial Management:: Understanding Financial Statements, Taxes, and Cash FlowsDokument103 SeitenFinancial Management:: Understanding Financial Statements, Taxes, and Cash Flowsfreakguy 313Noch keine Bewertungen

- Mas Cup 21 - QuestionsDokument4 SeitenMas Cup 21 - QuestionsPhilip CastroNoch keine Bewertungen

- Baskin, J., 1989, An Empirical Investigation of The Pecking Order Hypothesis, Financial Management, Spring, 26-35Dokument11 SeitenBaskin, J., 1989, An Empirical Investigation of The Pecking Order Hypothesis, Financial Management, Spring, 26-35Eva DivaNoch keine Bewertungen

- B326 MTA Fall 2013-2014Dokument2 SeitenB326 MTA Fall 2013-2014Ahlam AbbaqNoch keine Bewertungen

- Books of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007Dokument3 SeitenBooks of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007April Naida100% (1)

- The Term Sheet: by Katie BennerDokument8 SeitenThe Term Sheet: by Katie BennerSri ReddyNoch keine Bewertungen

- ACCOUNTINGDokument31 SeitenACCOUNTINGCHARAK RAYNoch keine Bewertungen

- ReportDokument74 SeitenReportnikhil yadavNoch keine Bewertungen

- (Case 2-3) 2-1 Maynard Company (A)Dokument1 Seite(Case 2-3) 2-1 Maynard Company (A)sheina100% (1)

- Journal Pre-Proof: Journal of Cleaner ProductionDokument41 SeitenJournal Pre-Proof: Journal of Cleaner ProductionIgnata PutriNoch keine Bewertungen

- Mystic Powerpoint TemplateDokument51 SeitenMystic Powerpoint TemplateEDINSONNoch keine Bewertungen

- Module 5 Packet: AE 111 - Financial Accounting & ReportingDokument13 SeitenModule 5 Packet: AE 111 - Financial Accounting & ReportingHelloNoch keine Bewertungen

- Basic Accounting QuestionnaireDokument7 SeitenBasic Accounting QuestionnaireSVTKhsiaNoch keine Bewertungen

- Introduction To Financial Ratios and The Cool PLC ExerciseDokument14 SeitenIntroduction To Financial Ratios and The Cool PLC ExerciseFebri AndikaNoch keine Bewertungen

- 14.1 Equity Versus Debt Financing: Capital Structure in A Perfect MarketDokument5 Seiten14.1 Equity Versus Debt Financing: Capital Structure in A Perfect MarketAlexandre LNoch keine Bewertungen

- Advac2 MidtermDokument5 SeitenAdvac2 MidtermgeminailnaNoch keine Bewertungen