Beruflich Dokumente

Kultur Dokumente

F7int 2008 Dec Q

Hochgeladen von

Kingsley ObiriOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

F7int 2008 Dec Q

Hochgeladen von

Kingsley ObiriCopyright:

Verfügbare Formate

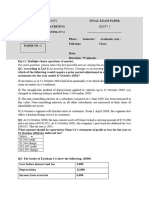

Fundamentals Level Skills Module

Financial Reporting (International)

Tuesday 9 December 2008

Time allowed Reading and planning: Writing:

15 minutes 3 hours

ALL FIVE questions are compulsory and MUST be attempted.

Do NOT open this paper until instructed by the supervisor. During reading and planning time only the question paper may be annotated. You must NOT write in your answer booklet until instructed by the supervisor. This question paper must not be removed from the examination hall.

The Association of Chartered Certified Accountants

Paper F7 (INT)

ALL FIVE questions are compulsory and MUST be attempted 1 On 1 April 2008, Pedantic acquired 60% of the equity share capital of Sophistic in a share exchange of two shares in Pedantic for three shares in Sophistic. The issue of shares has not yet been recorded by Pedantic. At the date of acquisition shares in Pedantic had a market value of $6 each. Below are the summarised draft financial statements of both companies. Income statements for the year ended 30 September 2008 Pedantic $000 85,000 (63,000) 22,000 (2,000) (6,000) (300) 13,700 (4,700) 9,000 Sophistic $000 42,000 (32,000) 10,000 (2,000) (3,200) (400) 4,400 (1,400) 3,000

Revenue Cost of sales Gross profit Distribution costs Administrative expenses Finance costs Profit before tax Income tax expense Profit for the year Statements of financial position as at 30 September 2008 Assets Non-current assets Property, plant and equipment Current assets Total assets Equity and liabilities Equity shares of $1 each Retained earnings Non-current liabilities 10% loan notes Current liabilities Total equity and liabilities The following information is relevant: (i)

40,600 16,000 56,600 10,000 35,400 45,400 3,000 8,200 56,600

12,600 6,600 19,200 4,000 6,500 10,500 4,000 4,700 19,200

At the date of acquisition, the fair values of Sophistics assets were equal to their carrying amounts with the exception of an item of plant, which had a fair value of $2 million in excess of its carrying amount. It had a remaining life of five years at that date [straight-line depreciation is used]. Sophistic has not adjusted the carrying amount of its plant as a result of the fair value exercise.

(ii) Sales from Sophistic to Pedantic in the post acquisition period were $8 million. Sophistic made a mark up on cost of 40% on these sales. Pedantic had sold $52 million (at cost to Pedantic) of these goods by 30 September 2008. (iii) Other than where indicated, income statement items are deemed to accrue evenly on a time basis. (iv) Sophistics trade receivables at 30 September 2008 include $600,000 due from Pedantic which did not agree with Pedantics corresponding trade payable. This was due to cash in transit of $200,000 from Pedantic to Sophistic. Both companies have positive bank balances. (v) Pedantic has a policy of accounting for any non-controlling interest at fair value. For this purpose the fair value of the goodwill attributable to the non-controlling interest in Sophistic is $15 million. Consolidated goodwill was not impaired at 30 September 2008. 2

Required: (a) Prepare the consolidated income statement for Pedantic for the year ended 30 September 2008. (9 marks) (b) Prepare the consolidated statement of financial position for Pedantic as at 30 September 2008. (16 marks) Note: a statement of changes in equity is not required. (25 marks)

[P.T.O.

The following trial balance relates to Candel at 30 September 2008: Leasehold property at valuation 1 October 2007 (note (i)) Plant and equipment at cost (note (i)) Plant and equipment accumulated depreciation at 1 October 2007 Capitalised development expenditure at 1 October 2007 (note (ii)) 20,000 Development expenditure accumulated amortisation at 1 October 2007 Closing inventory at 30 September 2008 20,000 Trade receivables 43,100 Bank Trade payables and provisions (note (iii)) Revenue (note (i)) Cost of sales 204,000 Distribution costs 14,500 Administrative expenses (note (iii)) 22,200 Preference dividend paid 800 Interest on bank borrowings 200 Equity dividend paid 6,000 Research and development costs (note (ii)) 8,600 Equity shares of 25 cents each 8% redeemable preference shares of $1 each (note (iv)) Retained earnings at 1 October 2007 Deferred tax (note (v)) Leasehold property revaluation reserve 466,000 The following notes are relevant: (i) Non-current assets tangible: The leasehold property had a remaining life of 20 years at 1 October 2007. The companys policy is to revalue its property at each year end and at 30 September 2008 it was valued at $43 million. Ignore deferred tax on the revaluation. On 1 October 2007 an item of plant was disposed of for $25 million cash. The proceeds have been treated as sales revenue by Candel. The plant is still included in the above trial balance figures at its cost of $8 million and accumulated depreciation of $4 million (to the date of disposal). All plant is depreciated at 20% per annum using the reducing balance method. Depreciation and amortisation of all non-current assets is charged to cost of sales. (ii) Non-current assets intangible: In addition to the capitalised development expenditure (of $20 million), further research and development costs were incurred on a new project which commenced on 1 October 2007. The research stage of the new project lasted until 31 December 2007 and incurred $14 million of costs. From that date the project incurred development costs of $800,000 per month. On 1 April 2008 the directors became confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 30 September 2008. Capitalised development expenditure is amortised at 20% per annum using the straight-line method. All expensed research and development is charged to cost of sales. (iii) Candel is being sued by a customer for $2 million for breach of contract over a cancelled order. Candel has obtained legal opinion that there is a 20% chance that Candel will lose the case. Accordingly Candel has provided $400,000 ($2 million x 20%) included in administrative expenses in respect of the claim. The unrecoverable legal costs of defending the action are estimated at $100,000. These have not been provided for as the legal action will not go to court until next year. $000 50,000 76,600 $000

24,600 6,000

1,300 23,800 300,000

50,000 20,000 24,500 5,800 10,000 466,000

(iv) The preference shares were issued on 1 April 2008 at par. They are redeemable at a large premium which gives them an effective finance cost of 12% per annum. (v) The directors have estimated the provision for income tax for the year ended 30 September 2008 at $114 million. The required deferred tax provision at 30 September 2008 is $6 million. Required: (a) Prepare the statement of comprehensive income for the year ended 30 September 2008. (b) Prepare the statement of changes in equity for the year ended 30 September 2008. (c) Prepare the statement of financial position as at 30 September 2008. Note: notes to the financial statements are not required. (25 marks) (12 marks) (3 marks) (10 marks)

[P.T.O.

Victular is a public company that would like to acquire (100% of) a suitable private company. It has obtained the following draft financial statements for two companies, Grappa and Merlot. They operate in the same industry and their managements have indicated that they would be receptive to a takeover. Income statements for the year ended 30 September 2008 $000 Revenue Cost of sales Gross profit Operating expenses Finance costs loan overdraft lease Profit before tax Income tax expense Profit for the year Note: dividends paid during the year Statements of financial position as at 30 September 2008 Assets Non-current assets Freehold factory (note (i)) Owned plant (note (ii)) Leased plant (note (ii)) Current assets Inventory Trade receivables Bank Total assets Equity and liabilities Equity shares of $1 each Property revaluation reserve Retained earnings Grappa $000 12,000 (10,500) 1,500 (240) (210) nil nil 1,050 (150) 900 250 $000 Merlot $000 20,500 (18,000) 2,500 (500) (300) (10) (290) 1,400 (400) 1,000 700

4,400 5,000 nil 9,400 3,600 3,700 nil

nil 2,200 5,300 7,500

2,000 2,400 600

5,000 14,400 2,000

7,300 14,800 2,000

900 2,600

3,500 5,500

nil 800

800 2,800

Non-current liabilities Finance lease obligations (note (iii)) 7% loan notes 10% loan notes Deferred tax Government grants Current liabilities Bank overdraft Trade payables Government grants Finance lease obligations (note (iii)) Taxation Total equity and liabilities

nil 3,000 nil 600 1,200 nil 3,100 400 nil 600

4,800

3,200 nil 3,000 100 nil 1,200 3,800 nil 500 200

6,300

4,100 14,400 6

5,700 14,800

Notes (i) Both companies operate from similar premises. (ii) Additional details of the two companies plant are: Grappa $000 8,000 nil Merlot $000 10,000 7,500

Owned plant cost Leased plant original fair value

There were no disposals of plant during the year by either company. (iii) The interest rate implicit within Merlots finance leases is 75% per annum. For the purpose of calculating ROCE and gearing, all finance lease obligations are treated as long-term interest bearing borrowings. (iv) The following ratios have been calculated for Grappa and can be taken to be correct: Return on year end capital employed (ROCE) 148% (capital employed taken as shareholders funds plus long-term interest bearing borrowings see note (iii) above) Pre-tax return on equity (ROE) 191% Net asset (total assets less current liabilities) turnover 12 times Gross profit margin 125% Operating profit margin 105% Current ratio 12:1 Closing inventory holding period 70 days Trade receivables collection period 73 days Trade payables payment period (using cost of sales) 108 days Gearing (see note (iii) above) 353% Interest cover 6 times Dividend cover 36 times Required: (a) Calculate for Merlot the ratios equivalent to all those given for Grappa above. (8 marks)

(b) Assess the relative performance and financial position of Grappa and Merlot for the year ended 30 September 2008 to inform the directors of Victular in their acquisition decision. (12 marks) (c) Explain the limitations of ratio analysis and any further information that may be useful to the directors of Victular when making an acquisition decision. (5 marks) (25 marks)

[P.T.O.

(a) The definition of a liability forms an important element of the International Accounting Standards Boards Framework for the Preparation and Presentation of Financial Statements which, in turn, forms the basis for IAS 37 Provisions, Contingent Liabilities and Contingent Assets. Required: Define a liability and describe the circumstances under which provisions should be recognised. Give two examples of how the definition of liabilities enhances the reliability of financial statements. (5 marks) (b) On 1 October 2007, Promoil acquired a newly constructed oil platform at a cost of $30 million together with the right to extract oil from an offshore oilfield under a government licence. The terms of the licence are that Promoil will have to remove the platform (which will then have no value) and restore the sea bed to an environmentally satisfactory condition in 10 years time when the oil reserves have been exhausted. The estimated cost of this on 30 September 2017 will be $15 million. The present value of $1 receivable in 10 years at the appropriate discount rate for Promoil of 8% is $046. Required: (i) Explain and quantify how the oil platform should be treated in the financial statements of Promoil for the year ended 30 September 2008; (7 marks)

(ii) Describe how your answer to (b)(i) would change if the government licence did not require an environmental clean up. (3 marks) (15 marks)

On 1 October 2005 Dearing acquired a machine under the following terms: Hours Manufacturers base price Trade discount (applying to base price only) Early settlement discount taken (on the payable amount of the base cost only) Freight charges Electrical installation cost Staff training in use of machine Pre-production testing Purchase of a three-year maintenance contract Estimated residual value Estimated life in machine hours 6,000 Hours used year ended 30 September 2006 1,200 year ended 30 September 2007 1,800 year ended 30 September 2008 (see below) 850 $ 1,050,000 20% 5% 30,000 28,000 40,000 22,000 60,000 20,000

On 1 October 2007 Dearing decided to upgrade the machine by adding new components at a cost of $200,000. This upgrade led to a reduction in the production time per unit of the goods being manufactured using the machine. The upgrade also increased the estimated remaining life of the machine at 1 October 2007 to 4,500 machine hours and its estimated residual value was revised to $40,000. Required: Prepare extracts from the income statement and statement of financial position for the above machine for each of the three years to 30 September 2008. (10 marks)

End of Question Paper

Das könnte Ihnen auch gefallen

- f7sgp 2007 Dec QDokument9 Seitenf7sgp 2007 Dec QDarkeside GarrisonNoch keine Bewertungen

- 2-5hkg 2007 Jun QDokument11 Seiten2-5hkg 2007 Jun QKeshav BhuckNoch keine Bewertungen

- Candel Final AccountDokument2 SeitenCandel Final AccountRida FatimaNoch keine Bewertungen

- Dipifr 2003 Dec QDokument10 SeitenDipifr 2003 Dec QWesley JenkinsNoch keine Bewertungen

- Tuition Mock D11 - F7 Questions FinalDokument11 SeitenTuition Mock D11 - F7 Questions FinalRenato WilsonNoch keine Bewertungen

- Pilot Paper F7Dokument6 SeitenPilot Paper F7Dorian CaruanaNoch keine Bewertungen

- Consolidation QuestionsDokument16 SeitenConsolidation QuestionsUmmar FarooqNoch keine Bewertungen

- Assignment IV Advanced Financial Accounting Chapter 4&5Dokument6 SeitenAssignment IV Advanced Financial Accounting Chapter 4&5Lidya AberaNoch keine Bewertungen

- December 2002 ACCA Paper 2.5 QuestionsDokument11 SeitenDecember 2002 ACCA Paper 2.5 QuestionsUlanda2Noch keine Bewertungen

- Questions & Solutions ACCTDokument246 SeitenQuestions & Solutions ACCTMel Lissa33% (3)

- 371 PedanticDokument2 Seiten371 Pedanticabdirahman farah AbdiNoch keine Bewertungen

- Latihan Soal Consolidation of SOFP Dan SOPLDokument4 SeitenLatihan Soal Consolidation of SOFP Dan SOPLRaihan Nabilah AzaliNoch keine Bewertungen

- 1 60Dokument23 Seiten1 60Joshua Gabrielle B. GalidoNoch keine Bewertungen

- FSQsDokument8 SeitenFSQsNikesh KunwarNoch keine Bewertungen

- d15 Hybrid F7 Q PDFDokument7 Seitend15 Hybrid F7 Q PDFBrew BubbyNoch keine Bewertungen

- Paper T6 (Int) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Dokument155 SeitenPaper T6 (Int) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009haroldpsb50% (4)

- Consolidation Accounts QuestionsDokument43 SeitenConsolidation Accounts QuestionsAli Sheikh93% (14)

- Assignment 2Dokument5 SeitenAssignment 2Baburam AdNoch keine Bewertungen

- Revisionary Test Paper: Group IDokument52 SeitenRevisionary Test Paper: Group IabinashbeheraNoch keine Bewertungen

- Financial Reporting (United Kingdom) : Tuesday 9 December 2008Dokument8 SeitenFinancial Reporting (United Kingdom) : Tuesday 9 December 2008KristenNoch keine Bewertungen

- Fin AcctgDokument52 SeitenFin AcctgSanjay SinghNoch keine Bewertungen

- As Practice Paper 1Dokument10 SeitenAs Practice Paper 1Farrukhsg100% (1)

- F7INT 2014 Jun QDokument9 SeitenF7INT 2014 Jun QBilal PashaNoch keine Bewertungen

- Section B - ALL THREE Questions Are Compulsory and MUST Be AttemptedDokument6 SeitenSection B - ALL THREE Questions Are Compulsory and MUST Be AttemptedProf. OBESENoch keine Bewertungen

- P2int 2008 Dec QDokument8 SeitenP2int 2008 Dec Qpkv12Noch keine Bewertungen

- First Semester MBA Degree Examination, May/June 2010: Accounting For ManagersDokument4 SeitenFirst Semester MBA Degree Examination, May/June 2010: Accounting For Managersnitte5768Noch keine Bewertungen

- F7uk 2011 Dec AnsDokument10 SeitenF7uk 2011 Dec Ansahsan_zeb_1Noch keine Bewertungen

- F7.2 - Mock Test 1Dokument5 SeitenF7.2 - Mock Test 1huusinh2402Noch keine Bewertungen

- ACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersDokument7 SeitenACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersMr.XworldNoch keine Bewertungen

- f7hkg 2010 Jun QDokument9 Seitenf7hkg 2010 Jun QOni SegunNoch keine Bewertungen

- F7 - QuestionsDokument10 SeitenF7 - QuestionspavishneNoch keine Bewertungen

- Financial Accounting Practice May 2009Dokument8 SeitenFinancial Accounting Practice May 2009samuel_dwumfourNoch keine Bewertungen

- f7sgp 2010 Jun QDokument9 Seitenf7sgp 2010 Jun Q2010aungmyatNoch keine Bewertungen

- 22 MergedDokument27 Seiten22 MergedSajj PrrtyNoch keine Bewertungen

- Auditing Investments 1Dokument2 SeitenAuditing Investments 1Sabel FordNoch keine Bewertungen

- CAT Programme T10 Managing Finances: Mock Test Section A - ALL 10 Questions Are Compulsory and MUST Be Attempted. (20%)Dokument8 SeitenCAT Programme T10 Managing Finances: Mock Test Section A - ALL 10 Questions Are Compulsory and MUST Be Attempted. (20%)Thuy TranNoch keine Bewertungen

- 2019 DecemberDokument14 Seiten2019 DecemberHsaung HaymarnNoch keine Bewertungen

- CH18601 FM - II Model PaperDokument5 SeitenCH18601 FM - II Model PaperKarthikNoch keine Bewertungen

- Mac006 A T2 2021 FexDokument7 SeitenMac006 A T2 2021 FexHaris MalikNoch keine Bewertungen

- Managerial Accounting (Acct 321 - HTTM 302) 2nd Trimester 2016Dokument5 SeitenManagerial Accounting (Acct 321 - HTTM 302) 2nd Trimester 2016Nodeh Deh SpartaNoch keine Bewertungen

- Question 1: Tangible Asset Plant Machinery A B C DDokument7 SeitenQuestion 1: Tangible Asset Plant Machinery A B C DTrang TranNoch keine Bewertungen

- Dipifr 2003 Dec ADokument11 SeitenDipifr 2003 Dec AAhmed Raza MirNoch keine Bewertungen

- 2016 Accountancy IDokument4 Seiten2016 Accountancy IDanish RazaNoch keine Bewertungen

- Accountancy and Auditing-2017Dokument5 SeitenAccountancy and Auditing-2017Jassmine RoseNoch keine Bewertungen

- Strategic Business Reporting - United Kingdom (SBR - Uk)Dokument8 SeitenStrategic Business Reporting - United Kingdom (SBR - Uk)vaaniNoch keine Bewertungen

- Sample Final Exam - Intermediate Accounting I - Fall 2023Dokument4 SeitenSample Final Exam - Intermediate Accounting I - Fall 2023Айбар КарабековNoch keine Bewertungen

- Strategic Business Reporting - International (SBR - Int)Dokument8 SeitenStrategic Business Reporting - International (SBR - Int)Karan KumarNoch keine Bewertungen

- ACCT6003 Assessment 2 T1 2020 Brief PDFDokument7 SeitenACCT6003 Assessment 2 T1 2020 Brief PDFbhavikaNoch keine Bewertungen

- Soalan AccaDokument4 SeitenSoalan AccaBhutan ChayNoch keine Bewertungen

- Handbook - IFRS Financial Accounting 2021 - II OnlineDokument47 SeitenHandbook - IFRS Financial Accounting 2021 - II OnlineDany DanielNoch keine Bewertungen

- Exam June 2008Dokument9 SeitenExam June 2008kalowekamoNoch keine Bewertungen

- December 2003 ACCA Paper 2.5 QuestionsDokument10 SeitenDecember 2003 ACCA Paper 2.5 QuestionsUlanda20% (1)

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceVon EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Economic Indicators for East Asia: Input–Output TablesVon EverandEconomic Indicators for East Asia: Input–Output TablesNoch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- Offshore Energy and Jobs Act (H. R. 2231; 113th Congress)Von EverandOffshore Energy and Jobs Act (H. R. 2231; 113th Congress)Noch keine Bewertungen

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityVon EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityBewertung: 4 von 5 Sternen4/5 (2)

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesVon EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNoch keine Bewertungen

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryVon EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen