Beruflich Dokumente

Kultur Dokumente

Eurozone Proposals Press Release

Hochgeladen von

Mark HowbrookOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Eurozone Proposals Press Release

Hochgeladen von

Mark HowbrookCopyright:

Verfügbare Formate

NEWS RELEASE

EMBARGOED: 00:01 (EST) 21st December 2011

PwC predicts potential outcomes for 2012 ahead of the Greek and Eurozone economical crisis

Growing market pressures and sovereign debt have created a dire situation for the Eurozone and economies around the world, with businesses looking at four possible resolutions at the onset of the new year, according to a report issued today by PwC, "What next for the Eurozone? Possible scenarios for 2012".

Yael Selfin, head of macro-consulting and a director in PwCs economics team, commented:

We expect these scenarios could have an impact well beyond the Eurozone. Countries

like the UK and US are likely to see falls in exports and banking sector problems but possibly also increased levels of capital inflows, as investors look to place a larger proportion of their portfolios in safe haven markets. Other countries, like China, will have to deal with a decline in a significant proportion of their export markets.

Orderly defaults by the most indebted countries, a Greek exit, or strong monetary expansion in Eurozone are likely to highlight the UKs position as a safe haven for capital. Capital flows out of the Eurozone and into the UK would cause sterling to appreciate against the euro. Borrowing costs may well be lower as investors purchase UK gilts in preference to risky Eurozone bonds.

Report key themes:

However the UKs principal trading partner is the Eurozone which is the destination for around 50% of its exports. A relatively strong sterling and a recession in the Eurozone would weigh down on the UKs growth prospects.

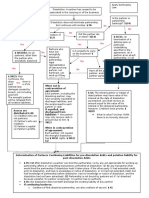

Scenario 1: Monetary expansion The ECB injects signicant liquidity into vulnerable economies and banks. Recession is avoided, but ination rises well above the 2% target. Monetary stimulus would be a shock to investors who likely would sell Euro assets and cause the currency to depreciate. Austerity measures undertaken in parallel by vulnerable economies would mean a struggle to grow before 2015.

Scenario 2: Orderly defaults Eurozone leaders agree to a program of voluntary defaults for highly indebted countries.

Estimates for post- debt restructuring foresee over 800bn in lost wealth by the private sector, with banks possibly losing over 100bn. Long term consequences include vulnerable countries struggling to regain access to nancial markets, requiring the intervention of European institutions, and thereby becoming a scal drain on surplus economies.

Scenario 3: Greek exit Both the remaining Eurozone and Greece agree to the latter's exit, with the Greek government re-denominating old and new contracts into a 'new-drachma' at parity with the Euro. New-drachma may depreciate by at least 50% once oated, increasing ination to about 30% in the rst quarter and averaging 10% in the rst year. Greek exit would spur bank losses and capital ight from the Eurozone as investors lose condence in the region.

Scenario 4: New currency bloc Begins with Franco-German acknowledgement that current Eurozone is no longer sustainable, resulting in a movement to create a new, smaller, and more stringently regulated monetary union. Investors are expected to support the new-euro, as the bloc benets from an inow of capital and increasing domestic demand but yet also suffers a loss in competitiveness Excluded countries would undergo an economic contraction and could expect a similar fate as that of Greece in scenario 3.

2012 Scenario 1 (% change) GDP growth Inflation Scenario 2 (% change) GDP growth Inflation Scenario 3 (% change) GDP growth Inflation Scenario 4 new euro outcomes (% change) -1 1.5 -3 1 1.5 4.5

2013

2014

2015

2016

2 3.5

2 3.5

1.5 3

1.5 2

-1.5 0

-0.5 0

1 1

2 2

0.5 1.75

1 2

1.6 2

1.8 2

GDP growth Inflation Scenario 4 periphery countries outcomes (% change) GDP growth Inflation

0.25 -1

2.5 0

2.5 0

2 2

2 2

-5 10

-2 8

0 7

2 5

3 3

Yael Selfin, head of macro-consulting and a director in PwCs economics team, concluded:

Source: PwC Projections

Expect surprises next year. We are currently experiencing unprecedented levels of uncertainty in the Eurozone. The potential political and economic outcomes emerging from the Eurozone crisis in 2012 are disparate, although all share a similar theme. A harsh adjustment to a new fiscal reality will be unavoidable, regardless of the path politicians decide to follow.

The Eurozone that re-emerges next year is likely to be very different to the one we know today and the implications for business within and outside this region are enormous. Growing market pressure and significant tranches of sovereign debt due for refinancing by early Spring point at a likely resolution to the current phase of the crisis around the first quarter of 2012."

Ends

For more information contact: Mark Howbrook Position: Tel: Cell phone: About PwC

PwC rms provide industry- focused assurance, tax and advisory services to enhance value for their clients. More than 161,000 people in 154 countries in rms across the PwC network share their thinking, experience and solutions to develop fresh perspective and practical advice. See pwc.com for more information.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Installment Promissory Note With Balloon PaymentDokument3 SeitenInstallment Promissory Note With Balloon PaymentkennjrNoch keine Bewertungen

- The Determination of Exchange RatesDokument20 SeitenThe Determination of Exchange RatesSauryadeep DwivediNoch keine Bewertungen

- Mickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Dokument37 SeitenMickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Sandeep ManipatruniNoch keine Bewertungen

- Receivables ManagementDokument4 SeitenReceivables ManagementVaibhav MoondraNoch keine Bewertungen

- FPP1x - Slides Introduction To FPP PDFDokument10 SeitenFPP1x - Slides Introduction To FPP PDFEugenio HerreraNoch keine Bewertungen

- Exam1 WS1213Dokument10 SeitenExam1 WS1213Faisal AzizNoch keine Bewertungen

- Strategy - Tejasvi RanaDokument6 SeitenStrategy - Tejasvi RanaB AspirantNoch keine Bewertungen

- Corp Bank Monsoon Offer PDFDokument2 SeitenCorp Bank Monsoon Offer PDFMasroorHussainNoch keine Bewertungen

- The International Monetary System Chapter 11Dokument23 SeitenThe International Monetary System Chapter 11Ashi GargNoch keine Bewertungen

- The Three Basic Macroeconomics RelationshipDokument5 SeitenThe Three Basic Macroeconomics RelationshipNicole Echanes0% (1)

- Lecture 3 2015Dokument31 SeitenLecture 3 2015Ashish MathewNoch keine Bewertungen

- Leverages 1Dokument33 SeitenLeverages 1mahato28Noch keine Bewertungen

- Bankasdasd Das AsdDokument9 SeitenBankasdasd Das AsdRia AthirahNoch keine Bewertungen

- 2009 MFI BenchmarksDokument281 Seiten2009 MFI BenchmarksRogelio CuroNoch keine Bewertungen

- Chapter Nine Basic Macroeconomic RelationshipsDokument6 SeitenChapter Nine Basic Macroeconomic RelationshipsMaha GaberNoch keine Bewertungen

- Feasibility Study - Steel Products WeldingDokument7 SeitenFeasibility Study - Steel Products WeldingWaseem MalikNoch keine Bewertungen

- Consumer Credit in The PhilippinesDokument8 SeitenConsumer Credit in The PhilippinesJet GarciaNoch keine Bewertungen

- Bharat ElectronicsDokument12 SeitenBharat Electronicsnafis20Noch keine Bewertungen

- FIM Unit 1Dokument8 SeitenFIM Unit 1Nikhil MukhiNoch keine Bewertungen

- Make in IndiaDokument2 SeitenMake in IndiaßläcklìsètèdTȜèNoch keine Bewertungen

- 7110 s14 Ms 21Dokument8 Seiten7110 s14 Ms 21Muhammad UmairNoch keine Bewertungen

- Final Accounts - Principles of AccountingDokument9 SeitenFinal Accounts - Principles of AccountingAbdulla MaseehNoch keine Bewertungen

- Class 12th Paper 2017Dokument4 SeitenClass 12th Paper 2017AkankshaNoch keine Bewertungen

- High Return Investing: Passive Income and Financial FreedomDokument12 SeitenHigh Return Investing: Passive Income and Financial Freedomapi-154838839Noch keine Bewertungen

- Bba 101Dokument14 SeitenBba 101jithindas050% (1)

- Exchange Rate CurrencyDokument9 SeitenExchange Rate CurrencyAniruddha ChakrabortyNoch keine Bewertungen

- Cash FlowDokument6 SeitenCash FlowLara Lewis AchillesNoch keine Bewertungen

- Sometimes I Let Them Fill Up The CheckDokument4 SeitenSometimes I Let Them Fill Up The CheckGrethel H SobrepeñaNoch keine Bewertungen

- UPA DissolutionDokument1 SeiteUPA DissolutionNiraj ThakkerNoch keine Bewertungen

- Corporate Finance Practice Questions MidDokument9 SeitenCorporate Finance Practice Questions MidFrasat IqbalNoch keine Bewertungen