Beruflich Dokumente

Kultur Dokumente

Finolex Cables: Performance Highlights

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Finolex Cables: Performance Highlights

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

1QFY2013 Result update | Power Cables

August 16, 2012

Finolex Cables

Performance highlights

Y/E March (` cr) Net sales EBITDA EBITDA (%) PAT 1QFY2013 518 49 9.4 25 4QFY2012 605 58 9.6 45 % chg (qoq) (14.3) (16.2) (21)bp (43.7) 1QFY2012 461 34 7.5 20 % chg (yoy) 12.4 41.6 194bp 24.1

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Power Cables 601 0.9 47/21 46,064 2 17,657 5,363 FNXC.BO FNXC@IN

`39 `61

12 Months

Source: Company, Angel Research

For 1QFY2013, Finolex Cables (Finolex) reported a 12.4% yoy growth in its top-line to `518cr. The companys operating profit increased by a whopping 41.6% yoy to `49cr. The OPM expanded by 194bp yoy to 9.4%. The PAT came in at `25cr, up 24% yoy. Going ahead, the business outlook remains positive, given the growth prospects in user industries and higher sales from the high-tension (HT) cables plant. We maintain our Buy rating on the stock. Margins and PAT improve yoy: Finolex announced a good set of numbers for its 1QFY2013 results. Net sales grew by 12.4% yoy to `518cr on back of strong sales in the electrical segment. The electrical cables segment registered a 21.4% yoy growth in revenue to `456cr. The companys other two segments communication cables and copper rods continued with their poor run witnessing only 8.3% yoy growth and 32.9% yoy decline in revenue. The EBITDA increased by 41.6% yoy to `49cr on the back of higher revenue and margin expansion. The EBITDA margin expanded by 194bp yoy to 9.5% on the back of lower raw material costs. The raw material cost as a percentage of sales declined to 73.0% in 1QFY2013 compared to 79.3% in 1QFY2012. PAT increased by only 24.1% yoy to `25cr due to higher forex loss and lower other income. Other income declined by 72.6% yoy to `2cr while forex loss increased by 237% to `6cr. The PAT margin also increased by 45bp yoy to 4.8%. Outlook and valuation: We remain positive on the companys prospects going ahead, given the strong growth in user industries, which are showing no signs of abating. Higher sales from the HT cables plant and start of production at the extra high voltage (EHV) plant would further boost the companys growth. Overall, we expect the companys sales to post a 13.6% CAGR over FY201214E, while the PAT is expected to post a CAGR of 16.6% over the same period. At the current market price, the stock is trading at 3.8x its FY2014E EPS. We maintain our Buy rating on the stock with a target price of `61.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 35.7 12.0 0.9 51.5

Abs.(%) Sensex Finolex Cables

3m 9.9 10.5

1yr 5.5 (0.4)

3yr 14.6 (2.4)

Key financials

Y/E March (` cr) Net Sales % chg Net Profit % chg EBITDA Margin (%) FDEPS (`) P/E (x) P/BV (x) RoE (%) RoACE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2011 2,036 25.8 87 50.6 8.4 5.7 6.9 0.8 12.8 13.6 0.3 3.5

FY2012 2,064 1.4 98 13.1 8.4 6.4 6.1 0.8 12.9 13.5 0.2 2.7

FY2013E 2,334 13.1 117 19.0 8.8 7.6 5.1 0.7 13.7 16.0 0.2 2.1

FY2014E 2,687 15.1 156 33.9 9.3 10.2 3.8 0.6 16.1 19.2 0.1 1.4

Sharan Lillaney

+91 22 3935 7800 Ext: 6811 Sharanb.lillaney@angeltrade.com

Please refer to important disclosures at the end of this report

Finolex Cables | 1QFY2013 Result update

Exhibit 1: 1QFY2013 performance highlights

Y/E March (` cr) Net Sales Consumption of RM (% of Sales) Staff Costs (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM Interest Depreciation Other Income PBT (excl. Extr. Items) Extr. Income/(Expense) PBT (incl. Extr. Items) (% of Sales) Provision for Taxation (% of PBT) Reported PAT PATM Equity shares (cr) EPS (`)

Source: Company, Angel Research

1QFY2013 518.0 378.0 73.0 19.7 3.8 71.6 13.8 469.2 48.8 9.4 3.5 10.5 1.8 36.5 (6.5) 30.1 5.8 5.0 16.5 25.1 4.8 15.3 1.6

4QFY2012 604.8 453.1 74.9 18.5 3.1 75.0 12.4 546.5 58.2 9.6 7.5 7.1 9.4 53.0 (10.1) 42.9 7.1 (1.7) (3.9) 44.6 7.4 15.3 2.9

% chg (qoq) (14.3) (16.6) 6.4 (4.5) (14.1) (16.2) (21)bp (53.5) 47.6 (81.2) (31.1) (29.9) (396) (43.7) (253)bp (43.7)

1QFY2012 460.7 365.1 79.3 16.4 3.6 44.7 9.7 426.3 34.5 7.5 4.3 9.8 6.4 26.7 (1.9) 24.8 5.4 4.6 18.5 20.2 4.4 15.3 1.3

% chg (yoy) 12.4 3.5 20.0 60.0 10.1 41.6 194bp (20.0) 7.3 (72.6) 36.7 237 21.2 8.5 24.1 45bp 24.1

FY2012 2,064 1,595 77.3 69.5 3.4 225.8 10.9 1,890 173.8 8.4 25.1 39.5 36.4 145.6 (36.4) 109.3 5.3 11.1 10.1 98.2 4.8 15.3 6.4

FY2011 2,036 1,619 79.5 64.7 3.2 180.0 8.8 1,864 172 8.4 17.4 38.8 25.9 141.6 (34.4) 107 5.3 20.4 19.0 86.8 4.3 15.3 5.7

% chg 1.4 (1.5) 7.3 25.4 1.4 1.1 (2)bp 44.2 1.8 40.4 2.8 1.9 (45.7) 13.2 50bp 13.2

Segment-wise performance

The electrical cables segment reported a strong 21.4% yoy growth in sales to `456cr, driven by higher realization and contribution from the HT cables plant. The segments margin also expanded by 221bp yoy to 12.1%, with EBIT coming in at `55cr. The communication cables segment posted a mediocre growth of 8.3% yoy in the top-line, with sales of `38cr, as there was a considerable reduction in the number of tenders invited for the segment. The situation is expected to remain like this for some time. The segments margin improved by 333bp yoy to 7.8%. The copper rods segment reported a 32.9% yoy decline in its top-line to `192cr during the quarter. The EBIT came in at `0.2cr and the margin stood at 0.1%. The others segment registered a 19.5% yoy decline in sales to `40cr during the quarter.

August 16, 2012

Finolex Cables | 1QFY2013 Result update

Exhibit 2: Segment-wise performance

Y/E March (` cr) Total Revenue A) Electrical Cables B) Communications Cables C) Copper Rods D) Others Total Less: Inter-Segmental Rev. Net Sales EBIT Margin(%) A) Electrical Cables B) Communications Cables C) Copper Rods D) Others

Source: Company, Angel Research

1QFY2013 4QFY2012 1QFY2012 % chg (qoq) % chg (yoy) 456 38 192 40 726 208 518 12.1 7.8 0.1 (2.5) 506 37 231 35 809 204 605 12.7 10.3 1.0 (8.3) 376 35 286 50 747 286 461 9.9 4.4 0.7 (2.3) (9.8) 1.6 (17.1) 16.1 (10.3) 1.8 (14.3) (55)bp (253)bp (88)bp 580bp 21.4 8.3 (32.9) (19.5) (2.8) (27.2) 12.4 221bp 333bp (66)bp (19)bp

Sales up by 12.4% yoy

Finolex reported a 12.4% yoy growth in its top-line to `518cr during the quarter. Going ahead, we expect sales to grow, given the positive outlook for user industries and higher contribution to sales from the HT cables plant.

Exhibit 3: Sales Trend

700 600 500 491 513 539 461 499 499 605 518 25 20 15

(` cr)

300 200 100

5 0 (5)

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

Sales (LHS)

Source: Company, Angel Research

yoy Growth (RHS)

August 16, 2012

1QFY13

(10)

(%)

400

10

Finolex Cables | 1QFY2013 Result update

OPM expands yoy to 9.4%

The companys OPM expanded to 9.4% in 1QFY2013 from 7.5% in 1QFY2012. This improvement can be attributed to a lower raw-material cost. Going ahead, however, we expect the companys margin remain at current levels.

Exhibit 4: OPM trend

70 60 50 8.5 7.4 9.9 7.5 8.0 8.3 12 9.6 9.4 10 8

(` cr)

30 20 10 0 41 51 40 34 40 41 58 49

4 2 0

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

EBITDA (LHS)

OPM (RHS)

Source: Company, Angel Research

PAT up by 24.1% yoy

Finolex reported a strong profit in the 1QFY2013 on the back of strong sales growth and margin expansion (which was somewhat offset by higher forex loss and lower other income). Other income declined by 72.6% yoy to `2cr while the forex loss increased by 237% to `6cr. The companys PAT increased by 24.1% yoy to `25cr.

Exhibit 5: PAT trend

50 45 40 35 30 25 20 15 10 5 0 45

(` cr)

26 19 19 20 20 14

1QFY13

25

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

Source: Company, Angel Research

August 16, 2012

1QFY13

(%)

40

Finolex Cables | 1QFY2013 Result update

Investment arguments

LT and HT cables segments to drive growth: Finolex is poised to register a moderate growth over the next few years, owing to growth in the existing lowtension (LT) cables segment and entry into the HT and EHV cables verticals. In the LT cables segment, we expect organized players to gradually gain market share as their distribution reach expands and customers increasingly demand high-quality and branded wires. Entry into the HT cables segment gives accessibility to the generation and distribution segment, where the market opportunity is estimated at `37,000cr over the next ten years. Tax benefits from Roorkee plant to help in the companys turnaround: The company has shifted a major chunk of production to its Roorkee plant, which avails excise duty and income tax benefits. Owing to this, we expect excise duty and tax rates for the company to remain low at around 24% going ahead. The company has further increased the capacity of this plant by 50%. Proximity to the growing north Indian markets and tax benefits availed by this plant are expected to boost the companys turnaround. Major capex already undertaken: Finolex has already incurred the major capex required to register growth over the next four to five years. The company plans to further spend `80cr towards increasing/rebalancing of capacities for manufacturing various wire and cable products at its manufacturing units at Roorkee and Urse over FY2013-14. Thus, on account of high operating leverage and strong sales growth, we expect the companys net profit to increase to `156cr in FY2014E from `98cr in FY2012.

Outlook and valuation

We remain positive on the companys prospects going ahead, given the strong growth in user industries, which are showing no signs of abating. Higher sales from the HT cables plant and start of production at the EHV plant would further boost the companys growth. Overall, we expect the companys sales to post a 13.6% CAGR over FY2012-14E, while PAT is expected to post a CAGR of 16.6% over the same period. At the current market price, the stock is trading at 3.8x its FY2014E EPS. We maintain our Buy rating on the stock with a target price of `61.

August 16, 2012

Finolex Cables | 1QFY2013 Result update

Profit and loss statement

Y/E March (` cr) Total operating income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel Other EBITDA % chg (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Share in profit of Associates Recurring PBT % chg Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Add: Share of earnings of asso. Less: Minority interest (MI) Prior period items PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY10 1,619 20.7 1,422 1,221 28 59 113 197 93.5 12.2 37 160 153.5 9.9 19 24 14.6 165 102.5 76 89 32 35.4 58 58 134 63.8 3.8 3.8 FY11 2,036 25.8 1,864 1,619 34 65 147 172 (12.7) 8.4 39 133 (16.7) 6.5 17 26 18.3 142 (14.3) 34 107 20 19.0 87 87 121 (9.3) 4.3 5.7 5.7 50.6 FY12 2,064 1.4 1,890 1,568 38 69 214 174 1.1 8.4 39 134 0.9 6.5 25 36 25.0 146 2.8 36 109 11 10.1 98 98 135 11.0 4.8 6.4 6.4 13.1 FY13E 2,334 13.1 2,129 1,797 38 74 220 205 17.7 8.8 44 161 19.5 6.9 13 25 14.5 172 18.4 19 154 37 24.0 117 117 135 0.7 5.0 7.6 7.6 19.0 FY14E 2,687 15.1 2,438 2,069 44 85 239 249 21.7 9.3 46 203 26.3 7.5 6 25 11.3 222 28.7 16 206 49 24.0 156 156 172 27.3 5.8 10.2 10.2 33.9

August 16, 2012

Finolex Cables | 1QFY2013 Result update

Balance sheet

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Preference Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Inventories Debtors Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 802 384 419 29 280 415 37 86 221 71 193 222 950 839 422 417 17 245 536 21 105 281 129 207 329 1,009 860 462 398 43 237 538 49 94 281 114 229 309 988 903 506 397 18 237 602 10 117 324 151 234 368 1,020 948 552 396 19 237 713 42 134 373 163 269 443 1,095 31 613 643 275 32 950 31 687 717 260 31 1,009 31 770 800 155 33 988 31 872 903 85 33 1,020 31 1,011 1,041 21 33 1,095 FY10 FY11 FY12 FY13E FY14E

August 16, 2012

Finolex Cables | 1QFY2013 Result update

Cash flow statement

Y/E March (` cr) Profit before tax Depreciation (Inc.)/ Dec. in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/ Dec. in Investments (Inc.)/ Dec. in loans and adv. Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY10 89 37 (81) 24 32 (10) (29) 34 1 24 30 (21) 11 21 (11) 9 28 37 FY11 107 39 (106) 26 20 (7) (25) 35 (19) 26 18 (15) 13 1 (27) (16) 37 21 FY12 109 39 35 36 11 136 (47) 8 11 36 8 (106) 18 7 (117) 28 21 49 FY13E 154 44 (76) 25 37 60 (18) (23) 25 (16) (70) 14 2 (82) (39) 49 10 FY14E 206 46 (30) 25 49 147 (46) (18) 25 (39) (63) 18 5 (76) 32 10 42

August 16, 2012

Finolex Cables | 1QFY2013 Result update

Key ratios

Y/E March (` cr) Valuation Ratio (x) P/E (on FDEPS) P/E (on basic, reported EPS) P/CEPS P/BV Dividend yield (%) Market cap. / Sales EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis (%) EBIT margin Tax retention ratio Asset turnover (x) ROCE (Post Tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) ROCE (Post-tax) Angel ROIC ROE Turnover ratios (x) Asset Turnover (Gross Block) Asset Turnover (Net Block) Asset Turnover (Total Assets) Operating Income / Invested Capital Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Gross debt to equity Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Interest) 0.4 0.2 0.8 8.5 0.4 0.3 1.1 7.6 0.2 0.1 0.3 6.0 0.1 0.0 0.1 12.2 0.0 (0.1) (0.3) 34.8 2.1 3.9 1.7 2.9 41 15 44 41 2.5 4.9 2.1 3.1 45 18 36 56 2.4 5.1 2.1 3.0 49 21 39 51 2.6 5.9 2.3 3.3 47 21 36 54 2.9 6.8 2.5 3.5 47 21 34 59 17.1 11.1 18.2 9.3 13.6 11.0 16.2 12.8 13.5 12.1 19.6 15.2 16.0 12.2 17.3 13.7 19.2 14.6 19.9 16.1 9.9 64.6 2.9 18.2 4.2 0.2 21.4 6.5 81.0 3.1 16.2 5.3 0.2 18.9 6.5 89.9 3.0 17.6 10.9 0.2 18.6 6.9 76.0 3.3 17.3 8.4 0.0 17.7 7.5 76.0 3.5 19.9 8.4 (0.0) 19.6 3.8 3.8 6.2 0.6 42.0 5.7 5.7 8.2 0.7 46.9 6.4 6.4 9.0 1.0 52.3 7.6 7.6 10.5 0.8 59.0 10.2 10.2 13.3 1.0 68.1 10.4 10.4 6.3 0.9 1.5 0.4 0.3 2.8 0.6 6.9 6.9 4.8 0.8 1.8 0.3 0.3 3.5 0.6 6.1 6.1 4.4 0.8 2.5 0.3 0.2 2.7 0.5 5.1 5.1 3.7 0.7 2.0 0.3 0.2 2.1 0.4 3.8 3.8 3.0 0.6 2.5 0.2 0.1 1.4 0.3 FY10 FY11 FY12 FY13E FY14E

August 16, 2012

Finolex Cables | 1QFY2013 Result update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Finolex Cables No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

August 16, 2012

10

Das könnte Ihnen auch gefallen

- 4-Accrual Accounting ConceptsDokument115 Seiten4-Accrual Accounting Conceptstibip12345100% (5)

- Travel Agent FeasibilityDokument30 SeitenTravel Agent FeasibilityShahaan ZulfiqarNoch keine Bewertungen

- CAPE Accounting MCQDokument10 SeitenCAPE Accounting MCQBradlee Singh100% (1)

- Mphasis: Performance HighlightsDokument13 SeitenMphasis: Performance HighlightsAngel BrokingNoch keine Bewertungen

- L&T 4Q Fy 2013Dokument15 SeitenL&T 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Accounting For Merchandising BusinessesDokument72 SeitenAccounting For Merchandising BusinesseswarsimaNoch keine Bewertungen

- Manac Quiz 2 With AnswersDokument4 SeitenManac Quiz 2 With AnswersReymilyn Sanchez78% (9)

- Intermediate Accounting I F R S Edition: Kieso, Weygandt, WarfieldDokument69 SeitenIntermediate Accounting I F R S Edition: Kieso, Weygandt, WarfieldTito Imran100% (2)

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- The Accounting Education EPFO Accounting MCQ QUIZDokument20 SeitenThe Accounting Education EPFO Accounting MCQ QUIZAnmol ChawlaNoch keine Bewertungen

- HCL Technologies: Performance HighlightsDokument15 SeitenHCL Technologies: Performance HighlightsAngel BrokingNoch keine Bewertungen

- IFRS For SME 2015 Disclosure ChecklistDokument25 SeitenIFRS For SME 2015 Disclosure ChecklistUmar Naseer100% (1)

- Bajaj Electricals: Performance HighlightsDokument10 SeitenBajaj Electricals: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hexaware Result UpdatedDokument13 SeitenHexaware Result UpdatedAngel BrokingNoch keine Bewertungen

- Finolex Cables, 1Q FY 2014Dokument14 SeitenFinolex Cables, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Larsen & ToubroDokument15 SeitenLarsen & ToubroAngel BrokingNoch keine Bewertungen

- Finolex Cables: Performance HighlightsDokument10 SeitenFinolex Cables: Performance HighlightsAngel BrokingNoch keine Bewertungen

- HCL Technologies: Performance HighlightsDokument15 SeitenHCL Technologies: Performance HighlightsAngel BrokingNoch keine Bewertungen

- KEC International, 1Q FY 14Dokument11 SeitenKEC International, 1Q FY 14Angel BrokingNoch keine Bewertungen

- Persistent Systems Result UpdatedDokument11 SeitenPersistent Systems Result UpdatedAngel BrokingNoch keine Bewertungen

- GSK Consumer, 21st February, 2013Dokument10 SeitenGSK Consumer, 21st February, 2013Angel BrokingNoch keine Bewertungen

- Indraprasth Gas Result UpdatedDokument10 SeitenIndraprasth Gas Result UpdatedAngel BrokingNoch keine Bewertungen

- Graphite India Result UpdatedDokument10 SeitenGraphite India Result UpdatedAngel BrokingNoch keine Bewertungen

- ITC Result UpdatedDokument15 SeitenITC Result UpdatedAngel BrokingNoch keine Bewertungen

- KEC International 4Q FY 2013Dokument11 SeitenKEC International 4Q FY 2013Angel BrokingNoch keine Bewertungen

- KEC International Result UpdatedDokument11 SeitenKEC International Result UpdatedAngel BrokingNoch keine Bewertungen

- Infosys Result UpdatedDokument14 SeitenInfosys Result UpdatedAngel BrokingNoch keine Bewertungen

- Persistent Systems: Performance HighlightsDokument12 SeitenPersistent Systems: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Performance Highlights: NeutralDokument12 SeitenPerformance Highlights: NeutralAngel BrokingNoch keine Bewertungen

- Persistent, 29th January 2013Dokument12 SeitenPersistent, 29th January 2013Angel BrokingNoch keine Bewertungen

- ABB India Result UpdatedDokument12 SeitenABB India Result UpdatedAngel BrokingNoch keine Bewertungen

- Infosys Result UpdatedDokument15 SeitenInfosys Result UpdatedAngel BrokingNoch keine Bewertungen

- FAG Bearings: Performance HighlightsDokument10 SeitenFAG Bearings: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hexaware Result UpdatedDokument14 SeitenHexaware Result UpdatedAngel BrokingNoch keine Bewertungen

- Infosys: Performance HighlightsDokument15 SeitenInfosys: Performance HighlightsAtul ShahiNoch keine Bewertungen

- HCL Technologies Result UpdatedDokument16 SeitenHCL Technologies Result UpdatedAngel BrokingNoch keine Bewertungen

- Hexaware Result UpdatedDokument13 SeitenHexaware Result UpdatedAngel BrokingNoch keine Bewertungen

- FAG Bearings Result UpdatedDokument10 SeitenFAG Bearings Result UpdatedAngel BrokingNoch keine Bewertungen

- Crompton Greaves Result UpdatedDokument14 SeitenCrompton Greaves Result UpdatedAngel BrokingNoch keine Bewertungen

- Crompton Greaves: Performance HighlightsDokument12 SeitenCrompton Greaves: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Infosys: Performance HighlightsDokument15 SeitenInfosys: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Exide Industries: Performance HighlightsDokument12 SeitenExide Industries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- KEC International, 4th February, 2013Dokument11 SeitenKEC International, 4th February, 2013Angel BrokingNoch keine Bewertungen

- Rallis India Result UpdatedDokument9 SeitenRallis India Result UpdatedAngel BrokingNoch keine Bewertungen

- Wipro Result UpdatedDokument14 SeitenWipro Result UpdatedAngel BrokingNoch keine Bewertungen

- S. Kumars Nationwide: Performance HighlightsDokument19 SeitenS. Kumars Nationwide: Performance HighlightsmarathiNoch keine Bewertungen

- LNT, 25th JanuaryDokument15 SeitenLNT, 25th JanuaryAngel BrokingNoch keine Bewertungen

- Godrej Consumer ProductsDokument12 SeitenGodrej Consumer ProductsAngel BrokingNoch keine Bewertungen

- Marico: Performance HighlightsDokument12 SeitenMarico: Performance HighlightsAngel BrokingNoch keine Bewertungen

- CESC Result UpdatedDokument11 SeitenCESC Result UpdatedAngel BrokingNoch keine Bewertungen

- Motherson Sumi Systems Result UpdatedDokument14 SeitenMotherson Sumi Systems Result UpdatedAngel BrokingNoch keine Bewertungen

- Idea 1Q FY 2014Dokument12 SeitenIdea 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Idea Cellular Result UpdatedDokument12 SeitenIdea Cellular Result UpdatedAngel BrokingNoch keine Bewertungen

- Hex AwareDokument14 SeitenHex AwareAngel BrokingNoch keine Bewertungen

- Bharti Airtel: Performance HighlightsDokument12 SeitenBharti Airtel: Performance HighlightsPil SungNoch keine Bewertungen

- Rallis India Result UpdatedDokument10 SeitenRallis India Result UpdatedAngel BrokingNoch keine Bewertungen

- Ceat Result UpdatedDokument11 SeitenCeat Result UpdatedAngel BrokingNoch keine Bewertungen

- Idea Cellular: Performance HighlightsDokument13 SeitenIdea Cellular: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Ll& FS Transportation NetworksDokument14 SeitenLl& FS Transportation NetworksAngel BrokingNoch keine Bewertungen

- HCLTech 3Q FY13Dokument16 SeitenHCLTech 3Q FY13Angel BrokingNoch keine Bewertungen

- MindTree Result UpdatedDokument12 SeitenMindTree Result UpdatedAngel BrokingNoch keine Bewertungen

- Reliance Communication: Performance HighlightsDokument11 SeitenReliance Communication: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Ashok Leyland Result UpdatedDokument13 SeitenAshok Leyland Result UpdatedAngel BrokingNoch keine Bewertungen

- Asian Paints Result UpdatedDokument10 SeitenAsian Paints Result UpdatedAngel BrokingNoch keine Bewertungen

- Relaxo Footwear 1QFY2013RU 070812Dokument12 SeitenRelaxo Footwear 1QFY2013RU 070812Angel BrokingNoch keine Bewertungen

- IRB Infrastructure: Performance HighlightsDokument13 SeitenIRB Infrastructure: Performance HighlightsAndy FlowerNoch keine Bewertungen

- Itnl 4Q Fy 2013Dokument13 SeitenItnl 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Collection Agency Revenues World Summary: Market Values & Financials by CountryVon EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryVon EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 12 2013Dokument2 SeitenDaily Agri Tech Report September 12 2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 13 2013Dokument4 SeitenCurrency Daily Report September 13 2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument12 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 12Dokument2 SeitenMetal and Energy Tech Report Sept 12Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 12 2013Dokument6 SeitenDaily Metals and Energy Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 12 2013Dokument9 SeitenDaily Agri Report September 12 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 12 2013Dokument4 SeitenCurrency Daily Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNoch keine Bewertungen

- 5 Worksheet FormatDokument1 Seite5 Worksheet FormatRJ DAVE DURUHANoch keine Bewertungen

- Chapter 9 Audit Procedures and Obtaining EvidenceDokument4 SeitenChapter 9 Audit Procedures and Obtaining Evidencekevin digumberNoch keine Bewertungen

- Quiz 2 Financial ManagementDokument6 SeitenQuiz 2 Financial ManagementMARVIE JUNE CARBONNoch keine Bewertungen

- Ratio Analysis For Nissan (2008) : Liquidity Ratios RatiosDokument2 SeitenRatio Analysis For Nissan (2008) : Liquidity Ratios Ratiosatifrazzaq007Noch keine Bewertungen

- CH 01 Review and Discussion Problems SolutionsDokument11 SeitenCH 01 Review and Discussion Problems SolutionsArman BeiramiNoch keine Bewertungen

- Technical English WordDokument147 SeitenTechnical English WordJORGE LUIS JIMENEZ CASTILLONoch keine Bewertungen

- Acc 102 - Module 3aDokument12 SeitenAcc 102 - Module 3aPatricia CarreonNoch keine Bewertungen

- Multiple Choice: Topic: Posting Name: YR.&SEC. Course: DateDokument4 SeitenMultiple Choice: Topic: Posting Name: YR.&SEC. Course: DateJenny BernardinoNoch keine Bewertungen

- AIGT SG 2020 (2nd Draft)Dokument27 SeitenAIGT SG 2020 (2nd Draft)marienette quinagonNoch keine Bewertungen

- Exercise 6.2Dokument3 SeitenExercise 6.2Lester MojadoNoch keine Bewertungen

- 2021 Annual Report BMW International Investment BVDokument51 Seiten2021 Annual Report BMW International Investment BV廖捷Noch keine Bewertungen

- Adjusted Trial BalanceDokument1 SeiteAdjusted Trial BalanceRezaqul Haider ChowdhuryNoch keine Bewertungen

- OutcomeofBoardMeeting10082023 10082023173019Dokument5 SeitenOutcomeofBoardMeeting10082023 10082023173019PM LOgsNoch keine Bewertungen

- Kuis 1 Akuntansi Keuangan Lanjutan Semester Antara 2019/2020Dokument3 SeitenKuis 1 Akuntansi Keuangan Lanjutan Semester Antara 2019/2020danu prayuda0% (1)

- CSC - Chapter11 - Corporations and Their Financial Statements - F2021Dokument72 SeitenCSC - Chapter11 - Corporations and Their Financial Statements - F2021AlecNoch keine Bewertungen

- at The End of Its First Month of Operations, Watson Answering Services Has The Following UnadjustedDokument11 Seitenat The End of Its First Month of Operations, Watson Answering Services Has The Following UnadjustedShuvro Chakravorty100% (1)

- FABM1-11 q3 Mod4 Typesofmajoraccounts v5Dokument23 SeitenFABM1-11 q3 Mod4 Typesofmajoraccounts v5Anna May Serador CamachoNoch keine Bewertungen

- Admission of Partner PDFDokument6 SeitenAdmission of Partner PDFBHUMIKA JAINNoch keine Bewertungen

- Quiz2 PDFDokument28 SeitenQuiz2 PDFSamantha CabugonNoch keine Bewertungen

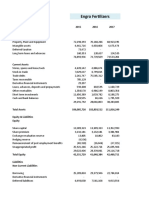

- Engro FertilizerDokument9 SeitenEngro FertilizerAbdullah Sohail100% (1)

- Chapter 03 Consolidations-Subsequent To The Date of AcquisitionDokument111 SeitenChapter 03 Consolidations-Subsequent To The Date of AcquisitionDenise Jane RoqueNoch keine Bewertungen

- Ppe RevaluationDokument6 SeitenPpe RevaluationjonapdfsNoch keine Bewertungen