Beruflich Dokumente

Kultur Dokumente

No Foreclosure Without The Note

Hochgeladen von

anon_410533234Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

No Foreclosure Without The Note

Hochgeladen von

anon_410533234Copyright:

Verfügbare Formate

WITHOUT THE NOTE - AREN'T THEY TRYING TO GET YOUR HOUSE FOR FREE!

Bankruptcy Law is Setting the Record Straight!

In re Walker - California Court (Eastern District Bankruptcy Court) confirming what we have been saying all along - MERS HAS NO INTEREST TO CONVEY TO ANY OTHER LENDER, in this case, CitiBank. Where is the note? The following is general legal information only, and not a substitute for legal advice. If you have specific foreclosure and bankruptcy questions, please seek out a qualified foreclosure attorney or bankruptcy lawyer in your area. Introduction: If someone owed you a million dollars would you have a copy of the agreement, and would you safeguard that agreement? Of course. But what we are witnessing in our State and Federal Courts in California, Arizona and across the nation, is lenders who cannot legally prove they have the right to enforce your mortgage. Why? They don't have the original promissory note. The reason for this is complicated and we will talk about the secondary loan market in other posts on UltimateBK.com. Suffice it to say that if you walked into a small claims court and demanded payment on a written contract, the judge would want to see a copy of the written contract. However, when it comes to securitized loans (especially in private nonjudicial foreclosure settings) apparently you don't have a right to ask if the real lender is foreclosing on you. If Wallmart sends you a Notice of Default and Notice of Sale for example, you are supposed to take their word for it that they can foreclose on you, and basically go quietly and gently into the foreclosure night. You have no right after all, being a delinquent borrower and asking such questions. Some might say you are simply "trying to get your house for free." But let me ask you this, if a "lender" is seeking to foreclose, or assert rights in a bankruptcy court, and if they cannot produce LEGAL EVIDENCE THAT THEY ARE THE OWNER OF THE LOAN (whether by purpose or by mistake), who is the one actually trying to get a house for free? This is the question we are asking and trying to get an honest answer to. The California Commercial Code and Arizona commercial code (the two states where we are licensed to practice law) both set forth specific rules for the enforceability of commercial notes. Why is it asking too much that an alleged creditor be able to prove its legal status to collect on your loan? Facts of the Walker case: Citibank, N.A. (the alleged creditor in this case), submitted a "Proof of Claim" in the amount of $1,320,650.52. The Debtor objected arguing Citibank was not the real party in interest, and had no standing to file the claim under Federal Rule of Bankruptcy Procedure 3001(c). In this case, when the borrower took out the loan, Bayrock Mortgage was the so-called "lender" and MERS was listed on the Deed of Trust as being the "nominee of the lender its successors and assigns" MERS attempted (supposedly as nominee of Bayrock) to assign the Deed of Trust to Citibank (the deed of trust is the security for payment of the note and is merely an incident of the debt). The Debtor claimed MERS had no interest in the note to convey to Citibank, and therefore Citibank got nothing by the MERS assignment of the Deed of Trust. No other evidence of note ownership (i.e. Citibank did not offer the original note as evidence) was offered by Citibank in filing its proof of claim. Legal Issue: Whether Citibank could prove it was the real party in interest entitled to bring a proof of claim in the bankruptcy Court. Court's Ruling: No. Citibank is not a real party in interest and can not establish such.

Rationale: (1) In California, to perfect the transfer of mortgage paper as collateral, the OWNER should PHYSICALLY DELIVER the NOTE to the transferee. Bear v. Golden Plan of California, Inc., 829 F.2d 705, 709 (9th Cir. 1986). Taking this at face value, the original "lender" (in this case Bayrock Mortgage) should physically transfer the note to Citibank, if Citibank wants to be able to claim they are the new owner of the loan. (2) The Court went on, "without physical transfer (of the note) the sale of the note could be invalid as a fraudulent conveyance (under Cal. Civ. Code Section 3440) or as unperfected (under Cal. Com. Code 9313-9314)" See Roger Bernhardt, California Mortgages and Deeds of Trust and Foreclosure Litigation Section 1.26 (4th ed. 2009). (3) The note should have been physically transferred by Bayrock (the original "lender"), and endorsed and delivered to Citibank. It was not. The law on endorsements was not followed (See Cal Comm Code Section 3109, 3201, 3203, and 3204). The attachment to the proof of claim did not offer this proof. (4) MERS acted only as a "nominee" for Bayrock Mortgage under the Deed of Trust. Since no evidence was offered that the promissory note had been transferred, MERS could only transfer what ever interest it had in the Deed of Trust. (5) However, MERS was purporting to assign the Deed of Trust (not the note) and the "Note and Deed of Trust are inseparable.........the former as essential and the later as an incident." An assignment of the note carries the mortgage with it while the assignment of the later alone is a nullity" (yes, you heard it, when MERS attempts to assign only a Deed of Trust, the security for the debt, the attempted assignment "is a legal nullity"). See Carpenter v. Longan, 83 U.S. 271, 274 (1872). Note: The Carpenter case is a case the lenders themselves like to cite. I have seen it in pleadings. Yet, they usually cite this when they have not offered any proof, any usually not even any allegation they the note was assigned to them. See also Henley v. Hotaling, 41 Cal. 22, 28 (1871); Seidell v. Tuxedo Land Co., 216 Cal. 165, 170 (1932); California Civil Code Section 2936. The Court went on: "therefore, when one party receives the note and the other receives the deed of trust, THE HOLDER OF THE NOTE PREVAILS regardless of the order in which the interests were transferred." (See Adler v. Sargent, 109 Cal. 42, 49-50 ((1895). Given these cases, who the holder of the note is becomes the essential proof question. NOTE: DOES THIS MAKE IT A "HOUSE FOR FREE" QUESTION IF A BORROWER, BASED UPON THIS CASE LAW RELIED UPON BY OTHER BANKRUPTCY JUDGES IN CALIFORNIA, INSISTS TO KNOW WHO OWNS THE LOAN? ISN'T THIS AN ESSENTIAL QUESTION OF LAW? DOESN'T THE LAW APPLY TO EVERYONE, EVEN BANKS? (6) The Court went on to discuss how MERS does not own the underlying note, deed of trust, and has no right to try to transfer it and no right to foreclose. Yes, you heard that right. MERS cannot try to transfer your note or deed of trust. The Court cited In re Foreclosure Cases, 521 F. Supp. 2d 650, 653 (S.D. Oh. 2007), In re Vargas, 396 B.R. 511, 520, (Bankr. C.D. Cal. 2008), Landmark Nat'l Bank v. Kesler, 216 P.3d 158 (Kan. 2009), and LaSalle bank v. Lamy, 824 N.Y.S. 2d 769, (N.Y. Sup. Ct. 2006). In this case, MERS offered no proof that it would have owned the loan at issue and therefore, the court determined it had absolutely no interest to transfer to Citibank, and Citibank therefore had nothing either. Without proof it owned the note, there was likewise no right to attempt to transfer the deed of trust to Citibank. As a result, Citibank has no right to assert a claim in the bankruptcy case. (7) It is also interesting to note that the Plaintiff in this case also pointed out that 4 SEPARATE ENTITIES CLAIMED AN INTEREST IN THE DEED OF TRUST. We have seen similar scenarios in cases we have worked on. One has to ask: "what in the world is going on here" as we have asked in some of our cases. The Court answered the question in a sound fashion when he stated "THE TRUE OWNER OF THE UNDERLYING PROMISSORY NOTE NEEDS TO STEP FORWARD TO SETTLE THE CLOUD THAT HAS BEEN CREATED SURROUNDING THE RELEVANT PARTIES RIGHTS AND

INTERESTS UNDER THE DEED OF TRUST." Now that's not too much to ask for in a civilized society right? (8) The Court Concluded that "11 U.S.C. Section 502(a) provides that a claim supported by a proof of claim is allowed unless a party in interest objects." THIS POINTS OUT THE IMPORTANCE OF CALLING YOUR SELF-PROCLAIMED "LENDER" IN A BANKRUPTCY COURT. Here, "Citibank is unable to assert a claim for payment in this case." (9) So what happens to Citibank? That is a good question. The Court closed out its holding by stating: "the court disallowing the proof of claim does not alter or modify the trust deed or the fact that SOMEONE has an interest in the property which can be subject thereto..............the claim is disallowed in its entirety with LEAVE TO AMEND for the OWNER of the PROMISSORY NOTE to file a Claim in this case by June 18, 2010." Conclusion/ Thoughts: It is clear some Bankruptcy judges in California are requiring PROOF that an entity actual owns the note before it is allowed to come into a BK Court and make demands upon the Court. Citibank needs to come forward with the original note and proof of ownership of the loan at issue. A purported assignment of the deed of trust alone, by MERS (an entity without the right to transfer or assign the deed of trust according to the Court) will not suffice. Although the "produce the note" theory will most likely not provide tangible thoughts in a private foreclosure (non-judicial) there is legal authority and legal case law that dictates our commercial law standards in regard to proving note ownership still applies, EVEN THOUGH A BORROWER MAY BE IN DEFAULT. Where a fortune 500 lender, who is in the best position of protecting their legal interests, cannot produce the original note in a bankruptcy court, THEY ARE SEEKING TO GET A HOUSE FOR FREE. This seems to be the point some people are missing. Without proof of loan ownership and the right to effectuate on the security, the lender (who may simply be mistaken after all) is in the position of seeking a huge financial windfall at the expense potentially, of the REAL CREDITOR. Such a proposition puts a borrower at risk of "financial double jeopardy" in having to reopen their bankruptcy again in the future should the true owner of the loan appear with physical possession of a properly endorsed note in hand. No one is above the law, or at least that was the idea at one time. If you are in bankruptcy court and your lender files a proof of claim, or seeks to file a motion to lift the automatic stay in bankruptcy (in order to go sell your house in a private sale), make sure they are the real party in interest to the action by demanding they "prove they are your creditor" (how do they do that? Simple, pull out the note endorsed to them, they should have physical possession of the note).

Das könnte Ihnen auch gefallen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 136 Scra 487 - Us Vs RuizDokument7 Seiten136 Scra 487 - Us Vs RuizMj Garcia100% (1)

- People Vs SasotaDokument2 SeitenPeople Vs SasotaMitchi BarrancoNoch keine Bewertungen

- Rule 112-115Dokument14 SeitenRule 112-115Rosalie RecaidoNoch keine Bewertungen

- Resolution 56 83Dokument13 SeitenResolution 56 83Lucas ToledoNoch keine Bewertungen

- Sample Complaint Draft For ClassDokument9 SeitenSample Complaint Draft For ClassJoshuaWadeWilsonNoch keine Bewertungen

- Quinto vs. People, G.R. No. 126712, April 14, 1999Dokument5 SeitenQuinto vs. People, G.R. No. 126712, April 14, 1999Fides DamascoNoch keine Bewertungen

- In State of Rajasthan v. Shravan Kumar & AnrDokument4 SeitenIn State of Rajasthan v. Shravan Kumar & AnrprachiNoch keine Bewertungen

- Gandionco V PenarandaDokument1 SeiteGandionco V PenarandaCarlota Nicolas VillaromanNoch keine Bewertungen

- The Indecent Representation of Women Prohibition ActDokument11 SeitenThe Indecent Representation of Women Prohibition Actsangsangijahau77Noch keine Bewertungen

- 28 Gibbs v. CommissionerDokument2 Seiten28 Gibbs v. CommissionerDannaIngaran100% (1)

- Manuel v. PeopleDokument2 SeitenManuel v. PeopleMary Ann AmbitaNoch keine Bewertungen

- Geroche Vs People GR No. 179080, November 26, 2014Dokument6 SeitenGeroche Vs People GR No. 179080, November 26, 2014salinpusaNoch keine Bewertungen

- Custom As A Source of LawDokument16 SeitenCustom As A Source of LawshayneyyNoch keine Bewertungen

- Ventura Et Al. vs. Judge Yatco Et Al.Dokument9 SeitenVentura Et Al. vs. Judge Yatco Et Al.Trisha Paola TanganNoch keine Bewertungen

- Tender Doc PDFDokument143 SeitenTender Doc PDFAmit debroyNoch keine Bewertungen

- Confidential Disclosure AgreementDokument2 SeitenConfidential Disclosure AgreementAstra BeckettNoch keine Bewertungen

- Allan Bazar vs. Carlos A. Buizol, G.R. No. 198782. October 19, 2016Dokument3 SeitenAllan Bazar vs. Carlos A. Buizol, G.R. No. 198782. October 19, 201612345678Noch keine Bewertungen

- Restrictive Application of State Immunity From SuitDokument3 SeitenRestrictive Application of State Immunity From SuitMarkNoch keine Bewertungen

- Petition For DivorceDokument3 SeitenPetition For DivorceAdan HoodaNoch keine Bewertungen

- Asking Leading QuestionsDokument7 SeitenAsking Leading QuestionsDaniel Besina Jr.Noch keine Bewertungen

- Rem Rev Full Text Intro Rule 4Dokument177 SeitenRem Rev Full Text Intro Rule 4Jon Vincent Barlaan DiazdeRiveraNoch keine Bewertungen

- EVIDENCE COMPILED DIGESTS FatimaDokument138 SeitenEVIDENCE COMPILED DIGESTS FatimaAndrea DiwaNoch keine Bewertungen

- Mukmuthu Sha V Mohammed Afrin BanuDokument14 SeitenMukmuthu Sha V Mohammed Afrin BanuSubam ProjectsNoch keine Bewertungen

- Pecson v. Mediavillo, DIGEST ORIG PDFDokument2 SeitenPecson v. Mediavillo, DIGEST ORIG PDFSecret BookNoch keine Bewertungen

- Motion-For Judgment On The PleadingsDokument3 SeitenMotion-For Judgment On The Pleadingsjayson àrandia100% (1)

- 04 Comelec V NoynayDokument13 Seiten04 Comelec V NoynayJanine RegaladoNoch keine Bewertungen

- Guilty Until Proven InnocentDokument10 SeitenGuilty Until Proven Innocentapi-356504737Noch keine Bewertungen

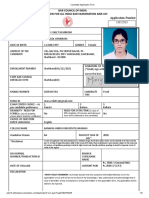

- Candidate Application Form AIBE 16Dokument2 SeitenCandidate Application Form AIBE 16Mary Voilet HembromNoch keine Bewertungen

- Imelda Darvin, Petitioner, vs. Hon. Court of Appeals and PEOPLE OF THE PHILIPPINES, RespondentsDokument5 SeitenImelda Darvin, Petitioner, vs. Hon. Court of Appeals and PEOPLE OF THE PHILIPPINES, RespondentsRadel LlagasNoch keine Bewertungen

- ILR (2003) II Del 377. AIR 2000 SC 2017Dokument6 SeitenILR (2003) II Del 377. AIR 2000 SC 2017Kumar NaveenNoch keine Bewertungen