Beruflich Dokumente

Kultur Dokumente

PGBP

Hochgeladen von

Amit SinghOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PGBP

Hochgeladen von

Amit SinghCopyright:

Verfügbare Formate

PROFITS AND GAINS OF BUSINESS OR PROFESSION

TABLE 1: SOME IMPORTANT PROVISIONS UNDER THE HEAD PROFITS AND GAINS OF BUSINESS OR PROFESSION. What is Covered i. Profits and gains of any business. under the Head? ii. Any compensation or other payments due to or received by any person specified in section 28(ii). (Sec. 28) iii. Income derived by a trade, professional or similar association from specific services performed for its members. iv. The value of any benefit or perquisite, whether convertible into money or not, arising from the business or the exercise of a profession. v. Export incentive available to exporters. vi. Any interest, salary, bonus, commission or remuneration received by a partner from firm. vii.Any sum received for not carrying out any activity in relation to any business or not to share any know-how, patent, copyright, trademark, etc. viii. Any sum received under a Keyman Insurance Policy. ix. Profits and gains of managing agency. x. Income from speculative transaction. Trading losses are allowed as deduction if the following Business Loss conditions are satisfied: i. These should be revenue losses, not capital losses ii. These should be real not the notional or fictitious iii. These must have been actually arisen and incurred (not merely anticipated to actually occur in future) iv. These should be incidental to the business or profession carried on by the assessee v. There should not be any express or implied prohibition in the Act which restricts their deductibility Method of An assessee can follow either of the following system of accounting: Accounting i) Cash or ii) Mercantile Only condition is that the method should be regularly followed. i. Income From House Property: Rental Income derived by Business assessees engaged in the business of owning and letting out Incomes not of houses shall be taxable under the head Income from Taxable House Property under the ii. Dividend Income: Dividend is taxable under the head head Income from other Sources. This is applicable even if the shares are held as stock-in-trade or the dealer or share broker receives dividend.

iii. Winning from Lotteries, Races etc.: These are taxable under the head Income from Other Sources even if derived as a regular business activity. TABLE 2: EXPENSES EXPRESSLY ALLOWED AS DEDUCTION PARTICULARS TAX TREATMENT 1. Rent, Rates, Taxes, Fully Deductible Repairs and Insurance for Repair should be of revenue nature. Buildings (Sec. 30)

Land

2. Repairs and Insurance of Machinery, Plant and Furniture (Sec. 31) 3. Depreciation Allowance (Sec. 32)

Revenue, Local Rates, and Municipal Taxes are covered by Section 43B.

Fully Deductible Repair should be of revenue nature. Allowed

as per income tax Rates subject to certain conditions.

4. Scientific Research Revenue/Capital Expenditure incurred by Expenditure (Sec. 35) the assessee himself are fully (100%) allowed, only if the research is related to the business of the Expenditure on In-house assessee. Research and Development: Cost of Land is however excluded. One and Half Times i.e. 150% CONTRIBUTION TO OUTSIDERS: of the Capital or Revenue WEIGHTED expenditure incurred by 1. Amount paid to approved DEDUCTION OF COMPANY ASSESSEES, Institutions, IIT, 1.75 TIMES i.e. engaged in bio-technology, Universities, 175% drugs, pharmaceuticals, Colleges etc. for electronic equipment, research related or computer, telecommunication unrelated to equipment, etc. is allowed as business deduction on satisfying certain 2. Contribution to WEIGHTED conditions. National DEDUCTION OF Laboratory 1.75 TIMES I.E. 175% Scientific Research means any activity for the extension of knowledge in the field of natural or applied sciences including agriculture, animal husbandry, or fisheries.

7. Expenditure on Acquisition A. If Acquired before 01/04/1998 of Patent Rights and Copyrights (Sec. 35A) Deductible in 14 Years or over unexpired period if unexpired life is less than 14 years B. If Acquired after 01/04/1998

Normal Depreciation is allowable @ 25%

u/s 32 8. Expenditure (Sec. 35AB) on Know-how

NO

DEDUCTION UNDER THIS SECTION BUT ASSESSEE CAN CLAIM DEPRECIATION U/S 32 deductible over the period starting from the year in which payment is made and ending in the year when the licence comes to an end.

8. Amortisation of Telecom Licence Fees (Sec. 35ABB)

Payment made to obtain telecom licence is

9. Payment to Associations and Institutions for Carrying Rural Development Programmes (Sec. 35AC) 10. Preliminary Expenses (Sec. 35D) 11. Amortisation of Expenditure on Amalgamation/Demerger (Sec. 35DD) 12. Expenditure on Voluntary Retirement Scheme (Sec. 35DDA)

Fully deductible Allowable in 5 equal installments. Allowable in 5 equal installments. Allowable in 5 equal installments

TABLE 2B: OTHER DEDUCTIONS UNDER SECTION 36 1. Insurance Premium on Allowable on Payment Basis Stocks (Sec. 36 (1)(i)) 2. Insurance on Health of Mediclaim insurance premium paid by cheque Employees (Sec. 36(1) under the scheme framed and by GIC and (ib) approved by Central Govt. 3. Bonus or Commission to Employees (Sec. 36(1)(ii)) 4. Interest on Borrowed Capital (Sec. 36(1)(iii))

Allowable

on Payment Basis. Covered by Sec. 43B i.e. payment is to be made before filing return of income.

Conditions for claiming deduction: i. Amount must be borrowed by the assessee ii. Borrowed money must have been used for the

purpose of business iii. Interest is paid or payable on such borrowed money. Loan taken from Public Financial Institutions, Scheduled Banks, or Cooperative Banks is covered by Section 43B. Interest on own capital is not deductible. Interest paid by one unit of the assessee to another is also not deductible. 5. Employers Contribution to Recognised Provident Fund or Approved Superannuation Fund (Sec. 36(1)(iv)) 6. Employers Contribution towards Approved Gratuity Fund (Sec 36(1) (v)) 7. Employees Contribution towards Staff Welfare Schemes (Sec. 36 (1)(va)) 9. Bad Debts (Sec. 36(1)(vii))

Allowable to the extent of limits laid down for the

purpose of recognising such fund. Covered by Section 43B, here payment must be made up to Return Filing Date to avail deduction.

Fully Allowable Covered by Section 43B, here payment must be made up to Return Filing Date to avail deduction It

is first included in the income and subsequently allowed as deduction, if such amount is paid/ credited to employees A/c before the due dates.

Bad Debts is allowed as deduction only when

if: i. it is written off and ii. already included in the income Following points need special mention: a. Provisions/Reserves for Doubtful Debts not allowed as deduction b. Recovery against bad debt earlier allowed as deduction are treated as income i.e. no adjustment would be done if such amount is appearing in the credit side of P & L A/c c. Recovery against bad debt earlier NOT allowed as deduction are NOT treated as income i.e. such amount would be deducted it is appearing in the credit side of P & L A/c only to Company Assessees under this section. Other assessees can claim deduction under section 32 and section 37: 1. Revenue Expen- Fully Deductible diture 2. Capital Expenditure 1/5th i.e. in 5 equal installments

9. Family Planning Expenditure (Sec. 36 (1) (ix)

Allowable

i. ii. iii. iv. v. vi.

TABLE 3: GENERAL DEDUCTION (SEC. 37(1)) This is residuary section Covers those business expenditure that are not covered by sections 30 to 36 Following conditions are to be satisfied to claim deduction under this head. The expenditure should: not be covered under sections 30 to 36 not be of capital nature have been incurred during the previous year not be of personal nature be in respect of business carried on by the assessee have been incurred wholly and exclusively for the purpose of such business

The expenditure should not be incurred for the purpose which is an offence

or which law prohibits. SOME EXAMPLES OF EXPENSES DEDUCTIBLE UNDER THIS SECTION ARE: i. Diwali Expenses ii. Deposit for Tatkal/OYT Telephone Scheme or Deposit for Telex connection iii. Annual listing fee paid to stock exchanges iv. Payment to Registrar of Companies for various requirements Fees paid for changes in the Memorandum & Articles and fees paid for increase in authorised capital, being a capital expenditure is not allowable under this section. v. Professional Tax paid vi. Advertisement expenses Payment for advertisement in any souvenir, brochure, tract, pamphlet etc. published by a political party is not allowable vii. Expenditure on Guest House/Holiday Homes viii. Sales tax is allowable as it is tax on the sale or purchase of goods and not on profits like income tax ix. Loss due to embezzlement or theft x. Payment made to employee(s) whose services are terminated in the interest of business SOME EXAMPLES OF EXPENSES NOT DEDUCTIBLE UNDER THIS SECTION ARE

Contribution to a political party Penalty paid for violation or infringement of any law Penalty for non-payment of the sales tax within specified time Fines paid for traffic offences Income-tax or advance-tax paid

Some Other Miscellaneous Provisions

TABLE 4: SOME OTHER IMPORTANT PROVISIONS PROVISION EXPLANATION

1. Payments outside India Following expenditure not allowed if paid outside Without TDS India without deducting TDS (if applicable) (Sec. 40(a)) i. Interest ii. Royalty iii. Salary iv. Fees for technical services Also applies in case payment has been made to nonresidents/foreign companies in India 2. Payments In India Following expenditure not allowed if paid in India Without TDS to without deducting TDS (if applicable) Residents i. Interest (Sec. 40(a)(ia)) ii. Commission/brokerage iii. Fees for professional/technical services iv. Payment to contractors/sub-contractors 3. Securities Transaction Deductible Tax (Sec. 40(a)(ib)) 4. Income-Tax/Advance Not Deductible tax/Fringe Benefit Tax Rule also applies to interest /Penalty/Fine for non(Sec. 40(a)(ii)) payment of income tax. 5. Wealth-Tax Not Deductible (Sec. 40(a)(iia)) 6. Tax on Non-monetary Not Deductible Perquisites by Employer (Sec. 40(a)(v)) 7. Excessive and Unreas Expenses incurred that are unreasonable or onable Payments excessive are disallowed in the following cases if (Sec. 40A(2)) the payment is made to a person: i. Who is a relative or has substantial interest in the assessees business or ii. In whose business, assessee has a substantial interest. Rs. Expenditure incurred exceeding Rs. 20,000 in cash/bearer cheque i.e. otherwise than by an account payee cheque or bank draft, will be disallowed to the extent of: of such expense. In certain situations, however, Act allows payment to be made in cash. for Contribution towards unapproved Gratuity Fund or Unrecognised Provident Fund as well as any provision made for gratuity is not allowable

8. Expenditure > 20,000 in Cash (Section 40(A)(3))

100%

9. Payment Unapproved Funds

10. Certain Liabilities To avail deduction in the following cases, payment Deductible on Payment must be made: Basis (Section 43B) A.) Before furnishing return of income Any tax or duty Bonus or commission to employees iii. Interest on loan from public financial institution like IDBI, IFCI etc. or State Financial Corporation State Industrial Development Corp. iv. Interest on loan from scheduled bank or cooperative bank. v. Employers contribution towards PF or staff welfare schemes B.) Before Due Dates of Payment: i. Employees contribution towards PF or staff welfare schemes

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Index: A Study of Credit Cards in Indian ScenarioDokument8 SeitenIndex: A Study of Credit Cards in Indian Scenariorohit100% (1)

- BCD 4 Design and Build With Schedule of Contract AmendmentsDokument45 SeitenBCD 4 Design and Build With Schedule of Contract AmendmentstsuakNoch keine Bewertungen

- Multiple Form 26QB For Multiple Buyers, Sellers & Other FAQSDokument5 SeitenMultiple Form 26QB For Multiple Buyers, Sellers & Other FAQSprashantgeminiNoch keine Bewertungen

- IELTS Workshop Test Schedule 2015Dokument2 SeitenIELTS Workshop Test Schedule 2015Raihan YamangNoch keine Bewertungen

- World-Class Banking For Indians Who Are Conquering The WorldDokument6 SeitenWorld-Class Banking For Indians Who Are Conquering The WorldRanvir RajNoch keine Bewertungen

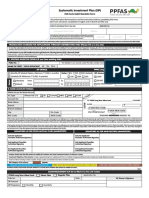

- Ppfas Sip FormDokument2 SeitenPpfas Sip FormAmol ChikhalkarNoch keine Bewertungen

- Indian Banking Sector ReformsDokument131 SeitenIndian Banking Sector Reformsanikettt50% (2)

- Board of Director Fiduciary DutiesDokument3 SeitenBoard of Director Fiduciary DutiesShan WsNoch keine Bewertungen

- 1 Kyc PDFDokument70 Seiten1 Kyc PDFMallikaNoch keine Bewertungen

- HDFC Life InsuranceDokument12 SeitenHDFC Life Insurancesaswat mohantyNoch keine Bewertungen

- Balance Sheet of Bata India LTDDokument1 SeiteBalance Sheet of Bata India LTDSanket BhondageNoch keine Bewertungen

- Project Report On Ratio Analysis of HDFC BankDokument15 SeitenProject Report On Ratio Analysis of HDFC BankRajat GuptaNoch keine Bewertungen

- Corporate Guarantee and Bank GuaranteeDokument1 SeiteCorporate Guarantee and Bank GuaranteeChaitanya SharmaNoch keine Bewertungen

- Leases Revised 5 30 20Dokument144 SeitenLeases Revised 5 30 20Jeasmine Andrea Diane PayumoNoch keine Bewertungen

- Iso 8583 PDFDokument10 SeitenIso 8583 PDFkartik300881100% (2)

- List of Credit Rating CompaniesDokument4 SeitenList of Credit Rating CompaniesNahid raihanNoch keine Bewertungen

- CH 4 In-Class Exercise 2 (Solutions)Dokument3 SeitenCH 4 In-Class Exercise 2 (Solutions)Zenni T XinNoch keine Bewertungen

- Double Entry SystemDokument17 SeitenDouble Entry SystemDastaan Ali100% (1)

- Al Safi PlatformDokument15 SeitenAl Safi PlatformbadrishNoch keine Bewertungen

- Taxation of Passed-On' GRTDokument3 SeitenTaxation of Passed-On' GRTjeorgiaNoch keine Bewertungen

- Ijarah and Dimishing Musharakah RevisedDokument10 SeitenIjarah and Dimishing Musharakah RevisedArooj PashaNoch keine Bewertungen

- Oracle R12 Payables Interview QuestionsDokument13 SeitenOracle R12 Payables Interview QuestionsPrashanth KatikaneniNoch keine Bewertungen

- Annuities and Sinking FundsDokument99 SeitenAnnuities and Sinking Funds张荟萍Noch keine Bewertungen

- General Ledger 3 ColmDokument2 SeitenGeneral Ledger 3 ColmMary100% (7)

- Account Opening-Board ResolutionDokument3 SeitenAccount Opening-Board ResolutionAbubakar ShabbirNoch keine Bewertungen

- IC 34 New - Q&A Module NewDokument25 SeitenIC 34 New - Q&A Module NewAmanjit Singh100% (1)

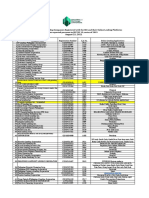

- List of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Dokument2 SeitenList of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Clark Adrian De Asis. Distor0% (1)

- FIRS's Circular On The Tax Implications of The Adoption of The IFRSDokument19 SeitenFIRS's Circular On The Tax Implications of The Adoption of The IFRSOnaderu Oluwagbenga EnochNoch keine Bewertungen

- Project Report On Bank of Baroda Marketing PlanDokument11 SeitenProject Report On Bank of Baroda Marketing PlanAshish CyrusNoch keine Bewertungen

- Machinery Breakdown PolicyDokument7 SeitenMachinery Breakdown PolicyDikshit KapilaNoch keine Bewertungen