Beruflich Dokumente

Kultur Dokumente

What Is A Brand Image

Hochgeladen von

Kamal Kumar MishraOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

What Is A Brand Image

Hochgeladen von

Kamal Kumar MishraCopyright:

Verfügbare Formate

What is a brand image?

Read more: Truck Signage You might think that your brand image is your logo. Like the Nike logo, or the Disney logo, or any other famous logo. But in truth your brand image is every customer/prospect's interaction with your company that creates an impression. It's your company's character. It's a conglomeration of interaction and observation by people outside your organization: how your phone is answered, the quality of customer service, how your trucks look, or even how your web site looks. It's what makes your company unique among the hundreds of competitors. Your brand image should communicate the difference between you and the competition your reason for being. Your brand image should reinforce your corporate message so that it helps make you stand out in a crowd of look-a-likes.

Why spend money creating a brand image?

The truth is you don't have to spend a dime creating a brand image! Brand image is something you have whether you try or not. Brand image is what the public sees, it is the image they have of you --either good or bad. If you're in business today, you already have a brand image. Customers and prospects already have an image of your company based on everything you've done so far. The question is: is your brand image the brand image you want and is it one that works best for your success, and your company's. A quality brand doesn't have to cost a fortune to develop. (see sidebar for how much Nike spent). The most expensive part is the time you take to discover what your company's brand image should be. What will it take to make your company unique?

Building your brand image

We often hear from clients that they would like to build their brand image after they've been in business for a number of years. While it's great that they are thinking about their brand image, what a difference it would make if they had considered that brand image from day one!

A brand image should be positive. It should reflect the character of your company. It should look like you, feel like you, and smell like you--it must be a reflection of your best traits. It is better to take positive steps in developing a positive brand image rather than letting it just happen.

The concept

A strong brand creates a preference to purchase and an inclination to continue purchasing (brand loyalty). We most commonly think of branding as something the big guys do with their large ad budgets and extravagant television commercials. In recent years some observers have noted that branding is losing its power. We see more and more people buying generic prescriptions over the label brands. "Would generic be ok with you sir?" But in truth, when you go to buy a new vehicle, don't you consider the brand? Would you buy a $18,000 generic brand over a $22,000 Ford? As a small business owner what should you do? The concept of branding is an ideal method of forcing you to focus on what it is that you do, what you want to do, and what you want to become. To create a brand you must develop a set of guidelines for your business and identify how you want your business perceived. How do you want to be seen by the public? Here are some questions that will help sharpen your perception and clarify your focus on your brand image:

Identifying your brand image

1. Why are you in business? 2. What makes your business unique? What can customers get from you they can't get elsewhere? Price? Quality? Service? Guarantee? Product? 3. Is there something about your service your customers actually enjoy paying you money to do? o What are those qualities / services? o Think about what your customer would say and not what you think they would say. 4. What part of your business are you passionate about? Can you formulate that passion into one sentence? 5. Discuss with your employees. Get feedback on their perception of the company they work for. 6. What is your target market? Do you have a clearly defined service? Customer profile? Prospect demographic? 7. What do you offer your customers?

8. In a sentence, what is your company's promise to its customers? To its employees?

Branding image elements

In general there are 3 building elements used in your branded image: logo, slogan, and image identifier. 1. Is your company image distinctive or does it look the same as most of your local competition? 2. Logo -- is it distinctive and imply professionalism? 3. Are you comfortable with your logo? 4. Does your logo reflect your company's image? 5. Slogan -- in a phrase, what does it say about your business? 6. Are you using an image identifier that supports your core concepts? 7. Are you using that image identifier throughout all of business elements? o Letterheads / envelopes / business cards o Brochures / estimate forms / folders o Advertising media o Truck signage o Professional attire for techs working onsite ( bluejeans and a muscle shirt are not professional attire) o Web site o Every single piece of communication to customers and prospects

Implementation of brand image

Implementation involves development of 3 elements; installation of the elements; and educating the staff and management as to the importance these elements imply. Input from everyone is crucial before development begins. You are the final decision maker, but secondary input will help you see areas that may cause problems later. 1. Is there an integration of your brand-image concept as described above with your logo? 2. Does the implementation include vehicles? Equipment? Uniforms? Signage? 3. Does the implementation include all paper products? Electronic media? 4. Is there a conviction of you and your staff to implement the brand image concept? o Has the staff been educated about the brand image concept?

Review of brand image implementation

Once installed, review the results, make changes as needed. Don't wait, don't procrastinate. Seek areas for improvement.

1. After implementation, do you plan to do follow-up discussions on how effective the implementation has been? 2. What needs to be improved? 3. Will you discuss what the market place thinks and says about your company? 4. Can you be objective in those discussions?

Composite Models of Brand Valuation A group of brand value measurement indicators has established itself parallel to the focus on psychographics values. Consultancy firms and academicians have proposed many composite models of brand valuation. The Interbrands brand valuation approach, AC Nielsens brand balance sheet and brand performancer, Gfk brand power model, Semion brand value approach and Sattler brand value approach are a few of the famous composite brand valuation models. Interbrand consulting firms brand value system considers an earnings-based approach. The Interbrand model seeks to estimate the risk and inflation-adjusted benefitsthe current and future earnings or cash flowsflowing from brand ownership. Under this model, the value of a brand is a function of two factors: its earnings and its strength. While the brands earnings are a measure of potential profitability, the brands strength is the measure of its reliability of its future earnings. The greater the brands strength, greater is the reliability of its future earnings and lesser is the risk. Since it is difficult to attribute all the earnings to the brand per se, adjustments need to be made to the earnings estimates. In this model first of all the unbranded profit i.e., earning that would have accrued on a basic unbranded version of the product is eliminated and the historical profit at present day value is restated and adjusted for taxes. To calculate the actual brand earnings the profit attributable to other intangible associated with the business of the brand is deducted. The model calculates the brand value by multiplying brand earnings with the brand earning with the brand strength multiple. This brand strength multiple is a function of multiple of factors like leadership, stability, market, internationality, trend, support and protection. These factors have been evaluated on a scale of 1 to 100 to calculate the brand multiplier. Some of the IT companies like Infosys, Rolta and Satyam are following a similar practice of valuation for their brands. The seven determinants of the brand value are: Brand leadershipwhich stands for the ability of the brand to influence the market; Brand stabilitythe characteristic that has made the brand the inherent fabric of the market; Marketthe structural attractiveness of the market, its projected growth, et al.; International presence of the brandthe brands attractiveness and appeal in a multiplicity of markets with a view to distinguish between regional, national and international brands; Brand trendthe brands ability to remain contemporary and relevant to the consumers; Marketing supportthe quantity and quality of the investments made to support the brand and Legal protection enjoyed by the brand are the protection received from the legal system, patents, trademarks, etc. Based on these parameters, Interbrand consulting determines the value of brand. Interbrand has given weighting to all these seven parameters like brand leadership has 25% weighting,

brand stability enjoys 15%, market 10%, international presence of the brand 25%, brand trend 10%, marketing support 10% and legal protection enjoyed by the brand has 5% weighting. Measurement of the seven variables, based on a detailed audit would determine a brands strength. This provides the discount rate that needs to be applied to the adjusted estimates of the brands earnings for determining its present value. BV = Brand profit x Brand multiplier The Interbrand approach while being valuable, especially in an acquisition and merger context, suffers from an accounting focus. This stems from the desire to ensure that the value arrived at is auditable. Further from a marketers perspective, the Interbrand approach does not explicitly measure consumers perception of the brand, which is critical for marketing decision-making, especially on brand extension. Schulz and Brandmeyer, of AC Nielsen have used scoring model to develop a brand valuation model called The AC Nielsen brand balance sheet. The brand balance sheet relies on six criteria groups containing a total of 19 individual criteria that are deemed good indicators of brand value. The fundamental idea of the brand balance sheet is to relate a correlation between complex market environments, the significance of long-term brand cultivation and successful brand management. AC Nielsen felt that the brand balance sheet is not the absolute model for brand valuation and in search of better brand valuation model, it has developed an advanced model based on Brand Performancer. The Brand Performancer attempts to deliver an integrative consumer and company-oriented brand valuation system. It provides tailor made data to the decision-makers for any specific information needed. The modular structure makes it possible to supplement gauges of brand value with analyses for the purpose of brand steering, financial brand valuation and tracking of brand leadership. The four modules are brand steering system, brand value system, brand control system, and the central element brand monitor. BV = [Annual sales of respective brands x Net operating margin x Relative brand strength x Perpetual annuity NPV discount factor] One approach, which relies strongly on behavioral and image data in addition to financial values, is Semion brand value approach. He defines four brand values financial value of the company, which is determined by earning before taxes and earning trends, brand strength that is determined by market share, market influence, marketing activities, distribution rate degree of familiarity, identity and potential, brand protection determined by product classification, brand environment and intern protection and brand image determined by consumer association, image position on market among consumer and vis-vis product. BV = financial value x [financial value factor + brand protection factor + brand strength factor + brand image factor]

The market-oriented system of brand valuation, which combines a consumer-based perspective with a company-based perspective is proposed by Bekmeier-Feuerhahn model that operates on the assumption that brand value is derived from brand strength and brand earnings, both assessed on the basis of market prices. It is a comprehensive, integrative approach to build brand valuation that takes into account the special requirements of brand appraisal and yields a tangible monetary value. The other well-known composite brand valuation approaches are Sattler brand value approach, Gfk brand power model and brand rating valuation model.

BRAND VALUATION CONCEPT AND RELEVANCE

Source : Internet

AT ARE BRANDS EMERGENCE OF BRANDS

ose non-physical elements of a business, which have potential future earnings. They are separately identifiable, intangible assets that one capable of being reliably measured. ween Brand and Goodwill: Goodwill is defined as the difference between the net assets of a company and the price paid by its purchaser.

GROUND: The debate of the brands came to the force in the late 1980s with the activities of a number of food companies. In early 1988, Nestle (UK) made a bid for Rowntree, with more th arket capitalisation at that time. Mc Dougall started capitalising the brands that they owned or acquired, implying that these brands possessed hidden values. The service sector companies l , Lonhro plc etc have valued their brands and showed them in balance sheets. Thus began the hottest debate on brands in Balance Sheet.

E PRESENT SITUATION

d a divergent treatment for goodwill and brands. If brands can be shown as separable assets, they need not be written off, as goodwill should be. Brands should be fully amortised ove of upto 20 years except in special circumstances. Homegrown brands are not allowed to be shown in the balance sheet, as it is very difficult to identify the cost of the brand developed. Man ated brand values in their balance sheets. Wide Technical Report 780 UK had removed the differential treatment of brands. Now there is a distinction between brands and goodwill in UK p oodwill, brands should be written off immediately upon acquisition.

Y BRANDS SHOULD BE INCLUDED IN BALANCE SHEET

IONAL VIEW BLURRED:

The traditional view is that any valuation figure, other than one supported by a specific purchase price on change of ownership is too arbitrary the traditional view is that the balance sheet is not intended as a statement of corporate worth and that subsequently, inclusion of values of brands in fixed assets would mislead the f .

First of all the view that only those assets which have substance or spatial dimension should be properly considered as a valuable asset for accounting purposes is questionable. Any va s dubious, but many of the fixed assets that are shown in balance sheets have similar contestable figures- like land etc. Eg. Assets like Hero Honda (two wheeler) after being used for 8 ye e at Rs. 17,000 as against the cost of Rs.12, 000.

he effect of the above is that in the failure to recognize brands and in the systematic undervaluation of assets (at historic costs) acknowledged to exist, companies mainta serves. Such a practice can not be justified as fair in the interests of shareholders or investors. The shareholder has the right to be appraised of the totality of assets that are available with t rstatement of intangible assets like brands, when the company is using them to earn profits is not useful to the shareholders in judging the efficiency of management. We do value real estate ncome. Similarly brands should be valued based on their future earnings potential. Adventurous bankers, (in UK), have started to talk about issuing backed securities and/ or using brand ebt issues.

VIEW: T

OES BRAND VALUATION EFFECT STOCK MARKET:

hat the net worth of a company is readily calculable by the market price of the company. This price is reflective of the present and prospective returns there on. Then the difference between t ompany and as proclaimed by the company is of great importance to the shareholders and investors. Since the market prices are volatile, the shareholders, investors would rather prefer t t that includes future earnings potential of the company, than depending on the stock market prices. Brands in balance sheet would at least reduce his apprehensions since the inclusion rate of return. Further, the managements efficiency is reflected in the ROI that is achieved by the company. PAT / Fixed assets + Net current assets, without brand value, this would show a much higher value. The ROI thus becomes a better indicator if brand value is included.

DVANTAGES:

usion of brand value in balance sheet gives a better picture of the company as having good assets and good brand value. ame time apparent return on assets (without inclusion of brands) will be brought down to more realistic figures. of the takeovers, goodwill element in the price of the net assets has been increasing. Sometimes the price paid for goodwill is greater than the acquiring companys net worth with the re ated accounts show negative shareholders equity. This looks preposterous. Some of the companies have reassessed the assets acquired in take overs and reclassified the goodwill as brand nys brand management will certainly be sharpened up (e.g. brand P&L accounts) mpanys debt equity ratio is improved i.e. it reduces the gearing ratio and so increases the Companys borrowing capacity. ularly helps service sector companies where there are low assets levels, but strong cash flow and customer bases. mpany is more expensive to acquire which may deter hostile bids. et value does not come down as long as it is maintained by proper promotional and advertising efforts. There is no depreciation and thus no impact on P&L. odwill arising from an acquisition can be reduced. sing the value of brands separately at the time of acquisition reduces the amount of goodwill that must be written off either directly to reserves or by amortisation over a number of years. Im detrimental effect on consolidated reserves and confuses the real value of acquisition of the business whereas amortisation has a continuous adverse and unrealistic effect on future profits. etter comparison between companies operating in similar markets, or between companies with varying mixes of acquired and homegrown brands. editors have found in an insolvency situation that some current assets such as inventory are relatively worthless even though classified as current asset. Also, we cannot recover goodwill bu ferred and can be converted into cash. businessmen brands are often the most important competitive advantage. It is the success or failure of brands that so often determines the managers success or failure. This concept will ity if brands are included in the balance sheet.

BRAND BE AMORTISED?

ion period is the period during which benefits are expected to arise. The life is deemed to be finite (prudence principle) but not fixed. Most of the businessmen find it easier to write off immed weaken the balance sheet than to touch the EPS by amortising brands. Most of the companies are inclined to amortise it. But the guidelines prescribed by the Accounting bodies are against

LE COUNTING:

on of the brand is reflected in the balance sheet at cost. The companies spend significantly on marketing support of brands which is charged through P&L account. If the brands are dep double counting.

D HOMEGROWN BRANDS BE VALUED AND AMORTISED?

the capitalisation of homegrown brands, a degree of comparability between competing company is lost. Whether acquired or home grown, brands require considerable expenditure, generat dd substantial value to the company. Allowing home grown brands to be capitalised would eliminate this inconsistency.

MULTIPLE

0 APPLIED

50

100

Das könnte Ihnen auch gefallen

- Social Media Marketing Plan How To: Build A Magnetic Brand Making You A Known Influencer. Go from Zero to One Million Followers In 30 Days. Apply The 1-Page Advertising Secret to Stand OutVon EverandSocial Media Marketing Plan How To: Build A Magnetic Brand Making You A Known Influencer. Go from Zero to One Million Followers In 30 Days. Apply The 1-Page Advertising Secret to Stand OutNoch keine Bewertungen

- Business Branding: 7 Easy Steps to Master Brand Management, Reputation Management, Business Communication & StorytellingVon EverandBusiness Branding: 7 Easy Steps to Master Brand Management, Reputation Management, Business Communication & StorytellingNoch keine Bewertungen

- Starting My Own Business: My Name, Logo and Slogan: Nitty Gritty Marketing, #1Von EverandStarting My Own Business: My Name, Logo and Slogan: Nitty Gritty Marketing, #1Noch keine Bewertungen

- 10 Proven Strategies to Boost Your Digital Marketing R.O.I.Von Everand10 Proven Strategies to Boost Your Digital Marketing R.O.I.Noch keine Bewertungen

- 8 Important Steps For Creating Successful Corporate Brand StrategyDokument7 Seiten8 Important Steps For Creating Successful Corporate Brand StrategyNathish RajendranNoch keine Bewertungen

- Business Branding: A Guide to Successful Business BrandingVon EverandBusiness Branding: A Guide to Successful Business BrandingNoch keine Bewertungen

- Your Brand Is Your Business: Creating Value in Your Brands and Branding StrategyVon EverandYour Brand Is Your Business: Creating Value in Your Brands and Branding StrategyNoch keine Bewertungen

- The Great 8 Pillars: ROI-Driven Marketing for Manufacturing CompaniesVon EverandThe Great 8 Pillars: ROI-Driven Marketing for Manufacturing CompaniesNoch keine Bewertungen

- Get Real About Branding: How You Can Build Sales and Brand Value Without Spending a Fortune on Marketing, Advertising and BrandingVon EverandGet Real About Branding: How You Can Build Sales and Brand Value Without Spending a Fortune on Marketing, Advertising and BrandingNoch keine Bewertungen

- Think, Segment, Brand, Market and SuccessVon EverandThink, Segment, Brand, Market and SuccessNoch keine Bewertungen

- Making A Business ProfileDokument5 SeitenMaking A Business ProfileSanjay100% (1)

- Aaker on Branding: 20 Principles That Drive SuccessVon EverandAaker on Branding: 20 Principles That Drive SuccessBewertung: 4 von 5 Sternen4/5 (2)

- Corporate Branding Refers To A Company Applying Its Name To A ProductDokument8 SeitenCorporate Branding Refers To A Company Applying Its Name To A ProductSavitha KumarNoch keine Bewertungen

- Digital Entrepreneur: A Comprehensive Guide to Building a Successful Online BusinessVon EverandDigital Entrepreneur: A Comprehensive Guide to Building a Successful Online BusinessNoch keine Bewertungen

- 10 Reasons Why you are not Selling More: Powerful ways to Leverage the Internet to Drive Massive SalesVon Everand10 Reasons Why you are not Selling More: Powerful ways to Leverage the Internet to Drive Massive SalesNoch keine Bewertungen

- Brand Perception Unveiled: Building Brand Associations That ResonateVon EverandBrand Perception Unveiled: Building Brand Associations That ResonateNoch keine Bewertungen

- Branding Fundamentals: Framework of BrandingVon EverandBranding Fundamentals: Framework of BrandingBewertung: 4.5 von 5 Sternen4.5/5 (16)

- From Brand "X" to Brand Rex: 5 S.M.A.R.T. and Easy Steps to Create a Cult of Personality for Your Brand and Increase SalesVon EverandFrom Brand "X" to Brand Rex: 5 S.M.A.R.T. and Easy Steps to Create a Cult of Personality for Your Brand and Increase SalesNoch keine Bewertungen

- Brand Promise 101: A Beginner's Guide to Building TrustVon EverandBrand Promise 101: A Beginner's Guide to Building TrustNoch keine Bewertungen

- Latest Business 101 Guide: How to Start a Successful Business for Every BeginnerVon EverandLatest Business 101 Guide: How to Start a Successful Business for Every BeginnerNoch keine Bewertungen

- Strategies For Branding Success: Give Your Brand the Competitive Edge to Succeed In Today's Challenging EconomyVon EverandStrategies For Branding Success: Give Your Brand the Competitive Edge to Succeed In Today's Challenging EconomyNoch keine Bewertungen

- Mastering Inbound Marketing: Your Complete Guide to Building a Results-Driven Inbound StrategyVon EverandMastering Inbound Marketing: Your Complete Guide to Building a Results-Driven Inbound StrategyNoch keine Bewertungen

- Advertising, Branding & Marketing 101: Authority Author Series, #4Von EverandAdvertising, Branding & Marketing 101: Authority Author Series, #4Noch keine Bewertungen

- Personal Branding - Market Yourself!: Tips to sell yourself and stand out from the crowdVon EverandPersonal Branding - Market Yourself!: Tips to sell yourself and stand out from the crowdBewertung: 4 von 5 Sternen4/5 (1)

- Succeed Through Customer Knowledge: A Guide to Practical Customer-Originated MarketingVon EverandSucceed Through Customer Knowledge: A Guide to Practical Customer-Originated MarketingNoch keine Bewertungen

- Building Strong Brands (Review and Analysis of Aaker's Book)Von EverandBuilding Strong Brands (Review and Analysis of Aaker's Book)Noch keine Bewertungen

- Profit By Design: How to build a customer portfolio full of profitable promotersVon EverandProfit By Design: How to build a customer portfolio full of profitable promotersNoch keine Bewertungen

- Macro Projet of Rejoy GRP - 2 - 2Dokument43 SeitenMacro Projet of Rejoy GRP - 2 - 2Rejoy RajuNoch keine Bewertungen

- E-Branding Vaibhav Shukla MBADokument40 SeitenE-Branding Vaibhav Shukla MBAsonuji1187100% (2)

- Man VeerDokument77 SeitenMan VeerGorishsharmaNoch keine Bewertungen

- Digital Success Blueprint: Unlocking Your Path to Profitable Online VenturesVon EverandDigital Success Blueprint: Unlocking Your Path to Profitable Online VenturesNoch keine Bewertungen

- Branding Project ReportDokument20 SeitenBranding Project Reportrameshmatcha8375% (8)

- Attractive Thinking: The five questions that drive successful brand strategy and how to answer themVon EverandAttractive Thinking: The five questions that drive successful brand strategy and how to answer themNoch keine Bewertungen

- Brand Building in The Digital Age Lesson Pack - EnglishDokument4 SeitenBrand Building in The Digital Age Lesson Pack - EnglishKarla Angélica Traconis LozanoNoch keine Bewertungen

- Internal Branding: Growing Your Brand from WithinVon EverandInternal Branding: Growing Your Brand from WithinBewertung: 4 von 5 Sternen4/5 (1)

- Brand Research & Analysis: Understand Its Importance & ApplicationVon EverandBrand Research & Analysis: Understand Its Importance & ApplicationNoch keine Bewertungen

- The Brand Identity Handbook: A Designer's Guide to Creating Unique BrandsVon EverandThe Brand Identity Handbook: A Designer's Guide to Creating Unique BrandsNoch keine Bewertungen

- Summary of Don McGreal & Ralph Jocham's The Professional Product OwnerVon EverandSummary of Don McGreal & Ralph Jocham's The Professional Product OwnerNoch keine Bewertungen

- Brand Management - A - STDokument10 SeitenBrand Management - A - STaayush ranaNoch keine Bewertungen

- Brand Managment Syed Shaheer Ahmed (2707-2106)Dokument17 SeitenBrand Managment Syed Shaheer Ahmed (2707-2106)SyEd Shaheer AhmedNoch keine Bewertungen

- How to Leverage Endless Sales for Business Success and Growth: Create an Effective Everlasting Sales Strategy and Adopt a Customer Engagement Selling StrategyVon EverandHow to Leverage Endless Sales for Business Success and Growth: Create an Effective Everlasting Sales Strategy and Adopt a Customer Engagement Selling StrategyNoch keine Bewertungen

- Brand Management: 3-in-1 Guide to Master Business Branding, Brand Strategy, Employer Branding & Brand IdentityVon EverandBrand Management: 3-in-1 Guide to Master Business Branding, Brand Strategy, Employer Branding & Brand IdentityNoch keine Bewertungen

- Summary of Josh Anon & Carlos González de Villaumbrosia's The Product BookVon EverandSummary of Josh Anon & Carlos González de Villaumbrosia's The Product BookNoch keine Bewertungen

- MM Unit 4 & 5 NotesDokument25 SeitenMM Unit 4 & 5 Notesnive gangNoch keine Bewertungen

- Ped Xi Chapter - 3Dokument15 SeitenPed Xi Chapter - 3DebmalyaNoch keine Bewertungen

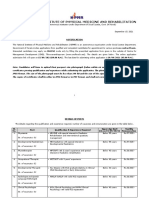

- NIPMR Notification v3Dokument3 SeitenNIPMR Notification v3maneeshaNoch keine Bewertungen

- BSP Training MatrixDokument2 SeitenBSP Training MatrixLeonisa V. BraganzaNoch keine Bewertungen

- 2018 UPlink NMAT Review Social Science LectureDokument133 Seiten2018 UPlink NMAT Review Social Science LectureFranchesca LugoNoch keine Bewertungen

- Effect of Employee Loyalty On Customer S PDFDokument37 SeitenEffect of Employee Loyalty On Customer S PDFShailendra DasariNoch keine Bewertungen

- Acc 106 Ebook Answer Topic 4Dokument13 SeitenAcc 106 Ebook Answer Topic 4syifa azhari 3BaNoch keine Bewertungen

- Girl: Dad, I Need A Few Supplies For School, and I Was Wondering If - . .Dokument3 SeitenGirl: Dad, I Need A Few Supplies For School, and I Was Wondering If - . .AKSHATNoch keine Bewertungen

- Cyrano de BergeracDokument209 SeitenCyrano de BergeracKayleeNoch keine Bewertungen

- An Improved Version of The Skin Chapter of Kent RepertoryDokument6 SeitenAn Improved Version of The Skin Chapter of Kent RepertoryHomoeopathic PulseNoch keine Bewertungen

- Iyengar S., Leuschke G.J., Leykin A. - Twenty-Four Hours of Local Cohomology (2007)Dokument298 SeitenIyengar S., Leuschke G.J., Leykin A. - Twenty-Four Hours of Local Cohomology (2007)wojtekch100% (1)

- Digital Electronics: Unit 1 FundamentalsDokument5 SeitenDigital Electronics: Unit 1 Fundamentalslalit_kaushish333Noch keine Bewertungen

- Cambridge English First Fce From 2015 Reading and Use of English Part 7Dokument5 SeitenCambridge English First Fce From 2015 Reading and Use of English Part 7JunanNoch keine Bewertungen

- Power System Planning Lec5aDokument15 SeitenPower System Planning Lec5aJoyzaJaneJulaoSemillaNoch keine Bewertungen

- Durability Problems of 20 Century Reinforced Concrete Heritage Structures and Their RestorationsDokument120 SeitenDurability Problems of 20 Century Reinforced Concrete Heritage Structures and Their RestorationsManjunath ShepurNoch keine Bewertungen

- 2nd Exam 201460 UpdatedDokument12 Seiten2nd Exam 201460 UpdatedAlbert LuchyniNoch keine Bewertungen

- Counter-Example NLPDokument8 SeitenCounter-Example NLPRafaelBluskyNoch keine Bewertungen

- Hanssen, Eirik.Dokument17 SeitenHanssen, Eirik.crazijoeNoch keine Bewertungen

- Datsasheet of LM347 IcDokument24 SeitenDatsasheet of LM347 IcShubhamMittalNoch keine Bewertungen

- Caisley, Robert - KissingDokument53 SeitenCaisley, Robert - KissingColleen BrutonNoch keine Bewertungen

- Elements of Visual Design in The Landscape - 26.11.22Dokument15 SeitenElements of Visual Design in The Landscape - 26.11.22Delnard OnchwatiNoch keine Bewertungen

- CSL - Reflection Essay 1Dokument7 SeitenCSL - Reflection Essay 1api-314849412Noch keine Bewertungen

- Abstraction and Empathy - ReviewDokument7 SeitenAbstraction and Empathy - ReviewXXXXNoch keine Bewertungen

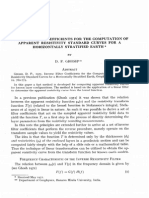

- Ghosh, D. P., 1971, Inverse Filter Coefficients For The Computation of Apparent Resistivity Standard Curves For A Horizontally Stratified EarthDokument7 SeitenGhosh, D. P., 1971, Inverse Filter Coefficients For The Computation of Apparent Resistivity Standard Curves For A Horizontally Stratified EarthCinthia MtzNoch keine Bewertungen

- MGMT 400-Strategic Business Management-Adnan ZahidDokument5 SeitenMGMT 400-Strategic Business Management-Adnan ZahidWaleed AhmadNoch keine Bewertungen

- LITERATURE MATRIX PLAN LastimosaDokument2 SeitenLITERATURE MATRIX PLAN LastimosaJoebelle LastimosaNoch keine Bewertungen

- Yahoo Tab NotrumpDokument139 SeitenYahoo Tab NotrumpJack Forbes100% (1)

- The Students Ovid Selections From The Metamorphoses by Ovid, Margaret Worsham MusgroveDokument425 SeitenThe Students Ovid Selections From The Metamorphoses by Ovid, Margaret Worsham MusgroveMiriaam AguirreNoch keine Bewertungen

- Massage Format..Dokument2 SeitenMassage Format..Anahita Malhan100% (2)

- SWOT ANALYSIS - TitleDokument9 SeitenSWOT ANALYSIS - TitleAlexis John Altona BetitaNoch keine Bewertungen

- Mount Athos Plan - Healthy Living (PT 2)Dokument8 SeitenMount Athos Plan - Healthy Living (PT 2)Matvat0100% (2)