Beruflich Dokumente

Kultur Dokumente

Libby Chapter 6 Study Notes

Hochgeladen von

hatanoloveOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Libby Chapter 6 Study Notes

Hochgeladen von

hatanoloveCopyright:

Verfügbare Formate

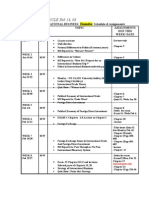

Chapter 6 Study Notes

I. ANALYZE THE IMPACT OF CREDIT CARD SALES, SALES DISCOUNTS, AND

SALES RETURNS ON THE AMOUNTS REPORTED AS NET SALES.

A. Cash Sales vs. Credit Card

1. Cash Sales

a. “Cash” sales are sales for cash (currency) or customer checks.

b. The entry to record cash sales includes a debit to Cash and a credit to Sales Revenue.

2. Credit Card Sales

a. Many companies accept credit cards as “collections” for goods and services.

b. Some widely accepted credit cards are American Express, Discover Card, MasterCard, and

VISA.

c. Reasons that companies accept credit cards for payment:

1. Acceptance will increase the number of customers.

2. Competitors accept credit cards.

3. The cost of directly extending credit to customers is avoided.

4. Bad debts due to NSF checks are avoided.

5. Credit card companies absorb losses from fraudulent card use if the merchant complies

with the credit approval verification process.

6. The credit card receipts are often deposited directly to the company’s bank account, so the

merchant usually receives payment sooner than when directly extending credit.

d. Credit card companies charge a fee for their services.

1. The fee is called a credit card discount, and is usually a percentage of the credit card

receipts.

2. The fee is an expense to the merchant. It may be reported as a contra revenue account (a

reduction of gross revenues in arriving at net sales) or as a selling expense.

B. Sales Discounts to Businesses

1. Credit sales made on open account create a customer’s promise to pay for goods or services at a

later date. This is less formal than a promissory note. Credit sales are granted because of greater

sales potential and competitors’ practices.

2. When credit is extended, credit terms are printed on the invoice. The credit period indicates when

the invoice amount (net of sales returns and allowances) is due.

Example: “n,/30” – net amount is due in 30 days.

3. Sales discount (cash discount) is an incentive to encourage early payment of open account

charges. Early payment must be made within the discount period.

Example: “2/10, n/30” – customer receives a 2% discount on the net amount due if payment is

made within 10 days; otherwise n (net), the full amount, is due within 30 days.

a. Provides significant discount to the customer when considering the discount rate on an

annualized basis.

b. May be reported as a contra revenue account or as a selling expense.

C. Sales Returns and Allowances

1. A contra revenue account used to record the return of goods previously sold. It reduces gross sales

to arrive at the net sales presented on the income statement.

2. Additionally, used to make adjustments to the sales price, as in the case of damaged goods.

3. It’s important to maintain this account rather than to directly debit (reduce) the sales revenue

account, because the SR&A account provides important information for management regarding

the quality of sales and customer satisfaction.

D. Reporting Net Sales

Sales

- Sales Returns and Allowances

- Sales Discounts (if a contra revenue)

- Credit Card Discount (if a contra revenue)

Net Sales

* ANALYZE AND INTERPRET THE GROSS PROFIT PERCENTAGE.

A. Represents the markup percent. For every dollar of net sales, how much winds up as gross profit?

B. The higher the gross profit ratio, the greater the markup.

Gross Profit

Gross Profit Percentage =

Net Sales

II. ESTIMATE, REPORT, AND EVALUATE THE EFFECTS OF UNCOLLECTIBLE

ACCOUNTS RECEIVABLE (BAD DEBTS) ON FINANCIAL STATEMENTS.

A. Measuring and Reporting Receivables.

1. Classifying receivables

a. Receivables are claims against other companies or persons for cash, goods, or services.

b. Two common types of receivables:

1. Accounts Receivables (A/R)

a. Open accounts owed to a company by trade customers.

b. Created when sales are made on credit in the normal course of business.

c. Normally a current asset because all are due within a year.

2. Notes Receivable

a. Written promises to pay evidenced by formal documents.

b. Contains the following information:

i. Sum of money due (principal)

ii. Date the principal is due (maturity date)

iii. Interest rate and interest due dates

c. Companies maintain separate records (subsidiary A/R ledger) for each customer. However,

the total balance of the A/R account (control account) is presented on the balance sheet.

d. Extending credit to customers is not without cost to the company.

1. Billing systems and credit personnel must e maintained.

2. Not all customers will pay their debts to the company.

e. Nontrade receivables

1. Arise from transactions other than in the normal course of business.

2. Current or noncurrent assets, depending on when payment is expected.

3. Examples: loans to officers and employees, not evidenced by notes.

B. Accounting for Bad Debts

1. Bad debt expense is the estimated expense associated with uncollectible accounts.

2. Matching principle requires that bad debt expense is recorded in the same accounting period in

which the sales are recorded.

3. Allowance method bases bad debt expense on an estimate of uncollectible accounts, since it is

unknown which specific accounts will be uncollectible; i.e., which customers will not pay their

debts to the company.

4. Two primary steps in the allowance method are:

a. Making the end-of-period adjusting entry to record bad debt expense.

b. Writing off specific accounts determined to be uncollectible during the period.

5. Bad debt expense is reported as an adjusting entry at the end of the accounting period:

Bad Debt Expense xxx

Allowance for Doubtful Accounts xxx

a. Allowance for Doubtful Accounts is a contra (offset) asset account containing the estimated

amount of uncollectible accounts receivable.

b. A/R cannot be credited for the estimated amount of uncollectible accounts since it is not

known which specific accounts will not be paid.

c. Bad debt expense is a selling expense on the income statement. It decreases net income and

stockholders’ equity.

6. When it is determined that a specific account is uncollectible, that account should be written off

against the allowance.

Allowance for Doubtful Accounts xxx

Accounts Receivable (name of customer) xxx

a. Note that no expense is recognized at this time because bad debt expense was recognized with

the adjusting entry at the end of the previous period.

b. No income statement accounts are affected when a specific account is written off.

c. Net realizable value of accounts receivable (A/R minus Allowance for Doubtful Accounts)

doesn’t change because both of these accounts are reduced by the same amounts.

7. If a customer pays an account that was previously written off, the entry writing off the account

must be reversed (the account must be reinstated), and then the collection of cash can be reported

in the normal manner.

8. At the end of the accounting period, before the bad debt expense adjusting entry is made, the

Allowance for Doubtful Accounts may have either a debit or a credit balance.

a. A debit balance indicates that more specific accounts were written off than previously

estimated.

b. A credit balance indicates that fewer specific accounts were written off than previously

estimated.

9. After the end-of-period adjusting entry is made, the Allowance will always have a credit balance.

Note that adjustments to prior periods are not made for incorrect estimates.

C. Reporting Accounts Receivable and Bad Debts

1. The Allowance for Doubtful Accounts is netted against A/R to report the “net realizable value” of

accounts receivable for balance sheet reporting.

a. This represents the amounts that the company actually expects to collect.

2. Publicly traded companies include a detailed schedule of bad debt information in their Annual

Report Form 10-K filed with the SEC.

D. Estimating Bad Debts

There are two basic methods for estimating bad debt expense. Both are acceptable under GAAP.

1. Percentage of Credit Sales Method

a. Bases bad debt expense on the historical percentage of credit sales that results in bad debts.

b. Calculation:

Bad Debt Expense = Net Credit Sales x Bad debt loss rate

c. The amount calculated is the amount of the adjusting journal entry, regardless of any balance

in the allowance account prior to adjustment.

Percent of credit sales example:

Carolyn’s Curtains had total credit sales of $452,000 in 2005. Based on past experience,

Carolyn’s estimates that 2.5% of the credit sales will be uncollectible. Prior to making the

adjusting entry, the Allowance for Bad Debts had a debit balance of $300.

Required:

What is the adjusting entry to recognize bad debt expense for the year, and what will be

the balance in the Allowance for Bad Debts account after the adjustment?

Solution:

Allowan

ce for

Doubtfu

l

Account

s

Balance 3

before

Adjustment

1 Adjustme

nt

1 Balance

after

Adjustme

nt

Bad Debt Expense 11,300

Allowance for Doubtful Accounts 11,300

2. Aging of Accounts Receivable ( YOU ARE NOT RESPONSIBLE FOR THIS ON THE TEST)

a. Relies on the fact that, as accounts receivable become older and more overdue, it is more

likely that they will be uncollectible.

b. Accounts receivable are divided into age categories, and a different loss rate is applied to each

category. The oldest category would have the highest loss rate.

c. The total of the estimated losses for each category should be the balance in the allowance

account after the adjusting entry has been made.

1. The unadjusted amount is compared to the estimated uncollectible amount to determine

the amount of the adjustment needed.

d. The aging of receivables method is more accurate than the percent of sales method.

* ANALYZE AND INTERPRET THE ACCOUNTS RECEIVABLE TURNOVER

RATIO AND THE EFFECTS OF ACCOUNTS RECEIVABLE ON CASH FLOWS.

A. A measure of the effectiveness of a company’s credit granting and collections activities.

B. A higher ratio benefits the company.

Net credit sales

Receivables Turnover =

Averate net trade accounts receivable

Das könnte Ihnen auch gefallen

- Summary of Richard A. Lambert's Financial Literacy for ManagersVon EverandSummary of Richard A. Lambert's Financial Literacy for ManagersNoch keine Bewertungen

- Accounting FinalDokument40 SeitenAccounting FinalvarunNoch keine Bewertungen

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyVon EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNoch keine Bewertungen

- Chapter 07 - Accounts and Notes Receivable. Chapter OutlineDokument6 SeitenChapter 07 - Accounts and Notes Receivable. Chapter OutlinesatyaNoch keine Bewertungen

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Von EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Bewertung: 5 von 5 Sternen5/5 (1)

- Philippine School of Business Administration: Cpa ReviewDokument6 SeitenPhilippine School of Business Administration: Cpa ReviewYukiNoch keine Bewertungen

- StudyGuideChap08 PDFDokument27 SeitenStudyGuideChap08 PDFNarjes DehkordiNoch keine Bewertungen

- Chapter 4 Accounts Receivable Learning Objectives: Receivables."Dokument4 SeitenChapter 4 Accounts Receivable Learning Objectives: Receivables."Misiah Paradillo JangaoNoch keine Bewertungen

- 08 - Receivables PDFDokument2 Seiten08 - Receivables PDFJamie ToriagaNoch keine Bewertungen

- The Entrepreneur’S Dictionary of Business and Financial TermsVon EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNoch keine Bewertungen

- ReceivablesDokument5 SeitenReceivablesHanns Lexter PadillaNoch keine Bewertungen

- Debet and Credit 1Dokument23 SeitenDebet and Credit 1Jemal SeidNoch keine Bewertungen

- Survey of Accounting Homework Written AssignmentDokument22 SeitenSurvey of Accounting Homework Written AssignmentEMZy ChannelNoch keine Bewertungen

- Intermediate Accounting, Part 1Dokument7 SeitenIntermediate Accounting, Part 1dfsdfdsfNoch keine Bewertungen

- Receivables (Part 1) With AnswersDokument7 SeitenReceivables (Part 1) With AnswersUzziehllah Ratuita80% (5)

- ACC101 Chapter7new PDFDokument23 SeitenACC101 Chapter7new PDFJana Kryzl DibdibNoch keine Bewertungen

- IAcctg1 Accounts Receivable ActivitiesDokument10 SeitenIAcctg1 Accounts Receivable ActivitiesYulrir Alesteyr HiroshiNoch keine Bewertungen

- Receivables TheoriesDokument4 SeitenReceivables TheoriesRENZ ALFRED ASTRERONoch keine Bewertungen

- Acc CH 4Dokument15 SeitenAcc CH 4Bicaaqaa M. AbdiisaaNoch keine Bewertungen

- 2 Mock FAR 2nd LEDokument9 Seiten2 Mock FAR 2nd LENatalia LimNoch keine Bewertungen

- ReceivablesDokument17 SeitenReceivablesJaspreet GillNoch keine Bewertungen

- RecivablesDokument12 SeitenRecivablesGizaw BelayNoch keine Bewertungen

- Audit of Receivables-1Dokument16 SeitenAudit of Receivables-1jennyMBNoch keine Bewertungen

- Acc CH 4Dokument16 SeitenAcc CH 4Tajudin Abba RagooNoch keine Bewertungen

- Receivables: Credit Standards, Length of Credit Period, Cash Discount, Discount Period EtcDokument7 SeitenReceivables: Credit Standards, Length of Credit Period, Cash Discount, Discount Period EtcKristine RazonabeNoch keine Bewertungen

- Cash and Receivables: ObjectivesDokument25 SeitenCash and Receivables: ObjectivesAlex OuedraogoNoch keine Bewertungen

- Exercise Receivables 1Dokument8 SeitenExercise Receivables 1Asyraf AzharNoch keine Bewertungen

- 2100 Solutions - CH8Dokument58 Seiten2100 Solutions - CH8ds hhNoch keine Bewertungen

- Audit of ReceivablesDokument15 SeitenAudit of ReceivablesLouie De La Torre75% (4)

- ACEINT1 Intermediate Accounting 1 Midterm ExamDokument9 SeitenACEINT1 Intermediate Accounting 1 Midterm ExamMarriel Fate CullanoNoch keine Bewertungen

- Resume CH 8 IFRSDokument5 SeitenResume CH 8 IFRSDeswita CeisiNoch keine Bewertungen

- Chapter 9 - Accounting For ReceivablesDokument10 SeitenChapter 9 - Accounting For ReceivablesMajan Kaur100% (1)

- Financial and Managerial Accounting 10th Edition Needles Test Bank DownloadDokument68 SeitenFinancial and Managerial Accounting 10th Edition Needles Test Bank Downloadelainecannonjgzifkyxbe100% (24)

- ACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Dokument10 SeitenACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Marriel Fate Cullano0% (1)

- Notes 08Dokument11 SeitenNotes 08FantayNoch keine Bewertungen

- BA 114.1 - Quiz 2 SamplexDokument8 SeitenBA 114.1 - Quiz 2 SamplexPamela May NavarreteNoch keine Bewertungen

- ReceivableDokument17 SeitenReceivableairiiNoch keine Bewertungen

- Accounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFDokument37 SeitenAccounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (12)

- Accounting Principles 12th Edition Weygandt Solutions ManualDokument16 SeitenAccounting Principles 12th Edition Weygandt Solutions Manualmalabarhumane088100% (27)

- Financial Accounting Part 1Dokument11 SeitenFinancial Accounting Part 1christineNoch keine Bewertungen

- Audit of ReceivablesDokument3 SeitenAudit of ReceivablesJhedz CartasNoch keine Bewertungen

- Principles of Financial Accounting 12th Edition Needles Test BankDokument67 SeitenPrinciples of Financial Accounting 12th Edition Needles Test Bankmarthajessegvt100% (28)

- Principles of Financial Accounting 12Th Edition Needles Test Bank Full Chapter PDFDokument67 SeitenPrinciples of Financial Accounting 12Th Edition Needles Test Bank Full Chapter PDFBrianHunterfeqs100% (7)

- CH09Dokument28 SeitenCH09Will TrầnNoch keine Bewertungen

- Chapter 6Dokument43 SeitenChapter 6Awrangzeb AwrangNoch keine Bewertungen

- Chapter 9 To EndDokument77 SeitenChapter 9 To EndNga Lê Nguyễn PhươngNoch keine Bewertungen

- Reviewer - ReceivablesDokument5 SeitenReviewer - ReceivablesMaria Kathreena Andrea AdevaNoch keine Bewertungen

- Receivables Theories QuizDokument6 SeitenReceivables Theories QuizJoovs JoovhoNoch keine Bewertungen

- Test Bank For Intermediate Accounting 17th Edition Stice DownloadDokument68 SeitenTest Bank For Intermediate Accounting 17th Edition Stice Downloadjasondaviskpegzdosmt100% (27)

- FARAP 4702 ReceivablesDokument8 SeitenFARAP 4702 Receivablesliberace cabreraNoch keine Bewertungen

- RECEIVABLESDokument4 SeitenRECEIVABLESCyril DE LA VEGANoch keine Bewertungen

- Chapter 8 ReceivablesDokument23 SeitenChapter 8 ReceivablesNutchanan PrateepusanonNoch keine Bewertungen

- Week 5: Revenue Recognition and ReceivablesDokument24 SeitenWeek 5: Revenue Recognition and ReceivablesKapil GoyalNoch keine Bewertungen

- Accounting Lecture V HandoutsDokument34 SeitenAccounting Lecture V HandoutsКамилла МолдалиеваNoch keine Bewertungen

- Ac101 ch7Dokument15 SeitenAc101 ch7infinite_dreamsNoch keine Bewertungen

- Aaccounting Chap 9Dokument12 SeitenAaccounting Chap 9abed abedNoch keine Bewertungen

- ReceivablesDokument4 SeitenReceivablesyame teeNoch keine Bewertungen

- Practice Midterm KeyDokument4 SeitenPractice Midterm KeyhatanoloveNoch keine Bewertungen

- MoveDokument31 SeitenMovehatanolove100% (1)

- State Farm Auto PolicyDokument28 SeitenState Farm Auto Policyhatanolove80% (5)

- Tir 08 2 BerggrenDokument19 SeitenTir 08 2 BerggrenhatanoloveNoch keine Bewertungen

- Risk and InsuranceDokument17 SeitenRisk and Insurancehatanolove100% (5)

- MoveDokument31 SeitenMovehatanolove100% (1)

- SHQ Practice QDokument1 SeiteSHQ Practice QhatanoloveNoch keine Bewertungen

- Auto InsuranceDokument14 SeitenAuto InsurancehatanoloveNoch keine Bewertungen

- Insurance ContractDokument6 SeitenInsurance Contracthatanolove100% (1)

- Supply Side Economics-GwartneyDokument3 SeitenSupply Side Economics-GwartneyhatanoloveNoch keine Bewertungen

- The Application of Austrian Business Cycle TheoryDokument21 SeitenThe Application of Austrian Business Cycle Theoryhatanolove100% (1)

- Keynes Robert ReichDokument4 SeitenKeynes Robert ReichhatanoloveNoch keine Bewertungen

- GNIPCDokument4 SeitenGNIPChatanolove100% (2)

- Study Questions For Chapters 14-16-20Dokument4 SeitenStudy Questions For Chapters 14-16-20hatanoloveNoch keine Bewertungen

- Martha StewartDokument4 SeitenMartha Stewarthatanolove100% (3)

- SCF - Practice QDokument3 SeitenSCF - Practice QhatanoloveNoch keine Bewertungen

- SHQ Practice Q Answer KeyDokument1 SeiteSHQ Practice Q Answer KeyhatanoloveNoch keine Bewertungen

- Midterm InformationDokument2 SeitenMidterm InformationhatanoloveNoch keine Bewertungen

- Milton FriedmanDokument3 SeitenMilton FriedmanhatanoloveNoch keine Bewertungen

- Sample Questions: Multiple ChoicesDokument4 SeitenSample Questions: Multiple ChoiceshatanoloveNoch keine Bewertungen

- Management Mistakes That President Bush MadeDokument5 SeitenManagement Mistakes That President Bush Madehatanolove100% (2)

- Libby Chapter 6 Study NotesDokument6 SeitenLibby Chapter 6 Study NoteshatanoloveNoch keine Bewertungen

- Libby Chap 11 Study NotesDokument16 SeitenLibby Chap 11 Study Noteshatanolove100% (4)

- Revised Schedule MGNT4670 Winter 2008 Section 02Dokument2 SeitenRevised Schedule MGNT4670 Winter 2008 Section 02hatanoloveNoch keine Bewertungen

- Mgmt3620 Syllabus (S08)Dokument4 SeitenMgmt3620 Syllabus (S08)hatanoloveNoch keine Bewertungen

- HW 7 Answer KeyDokument2 SeitenHW 7 Answer KeyhatanoloveNoch keine Bewertungen

- Income, Life-Satisfaction and Real Consumption InequalityDokument4 SeitenIncome, Life-Satisfaction and Real Consumption InequalityhatanoloveNoch keine Bewertungen

- Governor Frederic S. Mishkin: How Should We Respond To Asset Price Bubbles?Dokument10 SeitenGovernor Frederic S. Mishkin: How Should We Respond To Asset Price Bubbles?hatanoloveNoch keine Bewertungen

- Homework Assignment 6Dokument1 SeiteHomework Assignment 6hatanoloveNoch keine Bewertungen

- Governor Frederic S. Mishkin: How Should We Respond To Asset Price Bubbles?Dokument10 SeitenGovernor Frederic S. Mishkin: How Should We Respond To Asset Price Bubbles?hatanoloveNoch keine Bewertungen

- Ageing PopulationDokument3 SeitenAgeing PopulationBoglar BernadettNoch keine Bewertungen

- Marketing Management-Ass 2Dokument4 SeitenMarketing Management-Ass 2A Kaur MarwahNoch keine Bewertungen

- Cases Title IX Partnership General Provisions (1) Art. 1767 1.1 Partnership Defined Evangelista, Et Al vs. CIR Decided 15 October 1957Dokument9 SeitenCases Title IX Partnership General Provisions (1) Art. 1767 1.1 Partnership Defined Evangelista, Et Al vs. CIR Decided 15 October 1957Edward Kenneth Kung100% (1)

- Occupy Scenes From Occupied America PDFDokument2 SeitenOccupy Scenes From Occupied America PDFMichelleNoch keine Bewertungen

- Conceptual Analysis Challenge of Marketing For Small Enterprise in BangladeshDokument4 SeitenConceptual Analysis Challenge of Marketing For Small Enterprise in BangladeshInternational Journal of Business Marketing and ManagementNoch keine Bewertungen

- Tourism in Jammu & Kashmir: Submitted By: Rajat Singh Submitted To: Prof.M Y KhanDokument8 SeitenTourism in Jammu & Kashmir: Submitted By: Rajat Singh Submitted To: Prof.M Y KhanRAJAT SINGH MBA-2017Noch keine Bewertungen

- AgrisexportDokument2 SeitenAgrisexportGracey MontefalcoNoch keine Bewertungen

- Ca Final DT (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalDokument5 SeitenCa Final DT (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalROHIT JAIN100% (1)

- Romona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingDokument15 SeitenRomona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingFondation Singer-PolignacNoch keine Bewertungen

- Dividend Theory Chap 17Dokument18 SeitenDividend Theory Chap 17Nihar KuchrooNoch keine Bewertungen

- Prof. Labitag (Property)Dokument49 SeitenProf. Labitag (Property)Chad Osorio50% (2)

- Globelics 2014 Proceedings PDFDokument620 SeitenGlobelics 2014 Proceedings PDFItiel MoraesNoch keine Bewertungen

- Day 2 - Lamson CorpDokument21 SeitenDay 2 - Lamson CorpFrans AdamNoch keine Bewertungen

- CEV 420 Basic Environmental SciencesDokument2 SeitenCEV 420 Basic Environmental Sciencesbotakmbg6035Noch keine Bewertungen

- 5037asd8876 HKDADokument4 Seiten5037asd8876 HKDAdaedric13100% (1)

- Top Tips On ExportingDokument2 SeitenTop Tips On ExportingUKTI South EastNoch keine Bewertungen

- CONGSONDokument2 SeitenCONGSONBananaNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Digital AnujNoch keine Bewertungen

- Efu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0Dokument1 SeiteEfu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0ASAD RAHMANNoch keine Bewertungen

- PPF CalculationDokument8 SeitenPPF CalculationcholaNoch keine Bewertungen

- Uh Econ 607 NotesDokument255 SeitenUh Econ 607 NotesDamla HacıNoch keine Bewertungen

- Annual Report 2011 Beximco PharmaDokument91 SeitenAnnual Report 2011 Beximco PharmaMD ABUL KHAYERNoch keine Bewertungen

- Econ 101 Cheat Sheet (FInal)Dokument1 SeiteEcon 101 Cheat Sheet (FInal)Alex MadarangNoch keine Bewertungen

- Absa and KCB RatiosDokument8 SeitenAbsa and KCB RatiosAmos MutendeNoch keine Bewertungen

- Brief Industrial Profile Virudhunagar District: MSME-Development Institute, ChennaiDokument21 SeitenBrief Industrial Profile Virudhunagar District: MSME-Development Institute, Chennai63070Noch keine Bewertungen

- 0 Method Statement-Trench Cutter FinalDokument36 Seiten0 Method Statement-Trench Cutter FinalGobinath GovindarajNoch keine Bewertungen

- What The World Bank Means by Poverty Reduction and Why It MattersDokument25 SeitenWhat The World Bank Means by Poverty Reduction and Why It MattersDingo PingoNoch keine Bewertungen

- Before The Notary Public at Bidhan Nagar, Kolkata Affidavit / No Objection CertificateDokument4 SeitenBefore The Notary Public at Bidhan Nagar, Kolkata Affidavit / No Objection CertificateSWAPAN DASGUPTANoch keine Bewertungen

- Tut9 Soln SlidesDokument20 SeitenTut9 Soln SlidesNathan HuangNoch keine Bewertungen

- 22DarnGoodQuestions v1Dokument15 Seiten22DarnGoodQuestions v1Grant WellwoodNoch keine Bewertungen

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyVon EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyBewertung: 4.5 von 5 Sternen4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 5 von 5 Sternen5/5 (13)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditVon EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditBewertung: 5 von 5 Sternen5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceVon EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNoch keine Bewertungen

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeVon EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeBewertung: 4 von 5 Sternen4/5 (21)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageVon EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageBewertung: 4.5 von 5 Sternen4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Von EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Von EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Bewertung: 4.5 von 5 Sternen4.5/5 (24)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingVon EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingBewertung: 4.5 von 5 Sternen4.5/5 (760)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesVon EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesBewertung: 5 von 5 Sternen5/5 (4)