Beruflich Dokumente

Kultur Dokumente

WT Tax Rates

Hochgeladen von

ericbacsalOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

WT Tax Rates

Hochgeladen von

ericbacsalCopyright:

Verfügbare Formate

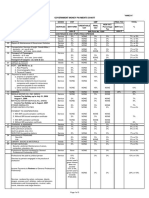

TAX RATES- WITHHOLDING

SCHEDULES OF ALPHANUMERIC TAX CODES ATC NATURE OF TAX INCOME PAYMENT RATE IND CORP

EWT- professional/talent fees paid to juridical persons/individuals (lawyers, CPAs, etc.) EWT- professional entertainers- if the current year's gross income does not exceed P720,000.00 - if the current year's gross income exceeds P720,000.00 10% WI WC 010 010

ATC NATURE OF INCOME TAX PAYMENT RATE IND CORP

EWT- gross commission or service fees of custom, insurance, stock, real estate, immigration & commercial brokers & fees of agents of professional entertainers EWT- payments for medical practitioners through a duly registered professional partnership 10% WI WC 140 140

10%

WI 020

10%

WI 141

20%

WI 021

EWT- professional athletes- if the current year's gross income does not exceed P720,000.00 - if the current year's gross income exceeds P720,000.00 EWT- movie, stage, radio, television and musical directors- if the current year's gross income does not exceed P720,000.00 - if the current year's gross income exceeds P720,000.00 EWT- management and technical consultants EWT- bookkeeping agents and agencies EWT- insurance agents and insurance adjusters EWT- other recipient of talent fees- if the current year's gross income does not exceed P720,000.00 - if the current year's gross income exceeds P720,000.00 EWT- fees of directors who are not employees of the company EWT- rentals : real/personal properties, poles,satellites & transmission

10%

WI 030

20%

WI 031

EWT- payments for medical/dental /veterinary services thru hospitals/clinics/ 10% health maintenance organizations, including direct payments to service providers EWT- payments to partners of 10% general professional partnerships EWT- payments made by credit 1% of 1/2% card companies EWT- payments made by government offices on their local 2% purchase of goods & services from local/resident suppliers

WI 151

WI 152 WI WC 156 156 WI WC 157 157

10%

WI 040

20% 10% 10% 10%

WI 041 WI 050 WI 060 WI 070

EWT- Income payments made by top 10,000 private corporations to their local/resident supplier of goods

1%

WI WC 158 158

EWT- Income payments made by top 10,000 private corporations to their local/resident supplier of services EWT- additional payments to government personnel from importers, shipping and airline companies or their agents for overtime services EWT- commission,rebates, discounts & other similar considerations paid/granted to independent & exclusive distributors, medical/technical & sales representatives & marketing agents & sub-agents of multi-level marketing companies EWT - Gross payments to embalmers by funeral companies

2%

WI WC 160 160

10%

WI 080

15%

WI 159

20%

WI 081

10%

20%

WI 090

WI WC 515 515

5%

WI WC 100 100

1%

WI 530

facilities, billboards

EWT- cinematographic film rentals EWT- prime contractors/subcontractors EWT- income distribution to beneficiaries of estates & trusts

5% 2%

WI WC 110 110 WI WC 120 120 WI 130

15%

EWT - payments made by preneed companies to funeral parlors EWT- Tolling fee paid to refineries EWT- Income payments made to suppliers of agricultural products EWT- Income payments on purchases of minerals, mineral products & quarry resources

1% 5% 1%

WI WC 535 535 WI WC 540 540 WI WC 610 610 WI WC 630 630

1%

Das könnte Ihnen auch gefallen

- Appliance, Television & Electronics Store Revenues World Summary: Market Values & Financials by CountryVon EverandAppliance, Television & Electronics Store Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryVon EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Ewt 20082Dokument384 SeitenEwt 20082JonelChavezNoch keine Bewertungen

- Schedules of Alphanumeric Tax CodesDokument5 SeitenSchedules of Alphanumeric Tax CodesKatherine YuNoch keine Bewertungen

- Tax Rates For CWT (Expanded) PDFDokument2 SeitenTax Rates For CWT (Expanded) PDFRoseAnnFloriaNoch keine Bewertungen

- Schedules of Alphanumeric Tax Codes Nature of Income Payment TAX Rate ATC Nature of Income Payment TAX Rate ATC IND Corp Ind CorpDokument1 SeiteSchedules of Alphanumeric Tax Codes Nature of Income Payment TAX Rate ATC Nature of Income Payment TAX Rate ATC IND Corp Ind CorpMhyckee GuinoNoch keine Bewertungen

- Schedules of Alphanumeric Tax CodesDokument2 SeitenSchedules of Alphanumeric Tax CodesJon0% (1)

- Expanded Withholding Tax RatesDokument7 SeitenExpanded Withholding Tax RatesJaemar FajardoNoch keine Bewertungen

- BIR From 1601E - August 2008Dokument4 SeitenBIR From 1601E - August 2008mba_roxascapiz50% (4)

- BIR Form No. 1601E - Guidelines and InstructionsDokument4 SeitenBIR Form No. 1601E - Guidelines and InstructionsJinefer ButohanNoch keine Bewertungen

- ATC CodesDokument3 SeitenATC Codescatherine joy sangilNoch keine Bewertungen

- 2307Dokument16 Seiten2307Analyn Velasco Matibag100% (1)

- 1601E - August 2008Dokument4 Seiten1601E - August 2008HarryNoch keine Bewertungen

- 1601EDokument7 Seiten1601EEnrique Membrere SupsupNoch keine Bewertungen

- 1601E - August 2008Dokument3 Seiten1601E - August 2008lovesresearchNoch keine Bewertungen

- EWTDokument12 SeitenEWTdawngarcia1797Noch keine Bewertungen

- BIR Form 2307Dokument20 SeitenBIR Form 2307Lean Isidro0% (1)

- Withholding Tax RatesDokument35 SeitenWithholding Tax RatesZonia Mae CuidnoNoch keine Bewertungen

- Expanded Withholding TaxDokument6 SeitenExpanded Withholding TaxFernando II SuguiNoch keine Bewertungen

- BIR Form No. 1601E - Guidelines and InstructionsDokument3 SeitenBIR Form No. 1601E - Guidelines and Instructionsivy contrerasNoch keine Bewertungen

- Withholding Tax at Source OR Expanded Withholding Tax (EWT)Dokument32 SeitenWithholding Tax at Source OR Expanded Withholding Tax (EWT)rickmortyNoch keine Bewertungen

- Government Money Payments Chart - BirDokument3 SeitenGovernment Money Payments Chart - BirVan Caz89% (9)

- BIR Form No. 1601E - Guidelines and InstructionsDokument3 SeitenBIR Form No. 1601E - Guidelines and InstructionsGuia CatolicoNoch keine Bewertungen

- 1601e Form PDFDokument3 Seiten1601e Form PDFLee GhaiaNoch keine Bewertungen

- Expanded Withholding TaxDokument3 SeitenExpanded Withholding TaxCordero TJNoch keine Bewertungen

- 1601E BIR FormDokument7 Seiten1601E BIR FormAdonis Zoleta AranilloNoch keine Bewertungen

- EWT RatesDokument6 SeitenEWT RatesBobby Olavides SebastianNoch keine Bewertungen

- 2307 PDFDokument2 Seiten2307 PDFAnonymous BVowhxQPNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDokument3 SeitenCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNoch keine Bewertungen

- FinalDokument2 SeitenFinalJessica FordNoch keine Bewertungen

- ATC Codes 2018Dokument10 SeitenATC Codes 2018AJ QuimNoch keine Bewertungen

- 2307Dokument5 Seiten2307jblopez66Noch keine Bewertungen

- 2307Dokument3 Seiten2307Anonymous yCFuth7BL80% (1)

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307Dokument5 SeitenMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307i1958239Noch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDokument2 SeitenCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasgioNoch keine Bewertungen

- 2307Dokument16 Seiten2307Mika AkimNoch keine Bewertungen

- EPayments Import TemplateDokument10 SeitenEPayments Import TemplateGhulam MustafaNoch keine Bewertungen

- Sample 2307 2017Dokument4 SeitenSample 2307 2017jordzNoch keine Bewertungen

- A.J. Gen. MerchandisingDokument5 SeitenA.J. Gen. MerchandisingErish Jay ManalangNoch keine Bewertungen

- Creditable Tax ReportDokument131 SeitenCreditable Tax ReportJieve Licca G. FanoNoch keine Bewertungen

- A AtcDokument2 SeitenA Atckupalking100% (1)

- Revenue Memorandum Order No. 3-2004Dokument4 SeitenRevenue Memorandum Order No. 3-2004HarryNoch keine Bewertungen

- New Payment Sections TemplateDokument1 SeiteNew Payment Sections Templateiaeste20078797Noch keine Bewertungen

- Withholding Tax Bureau of Internal RevenueDokument10 SeitenWithholding Tax Bureau of Internal RevenueFunnyPearl Adal GajuneraNoch keine Bewertungen

- 1600 Tax RatesDokument2 Seiten1600 Tax RatesmelizzeNoch keine Bewertungen

- Lecture Witholding TaxDokument152 SeitenLecture Witholding Taxemytherese100% (2)

- Direct Taxes Withholding Tax Rate Card - Tax Year 2014 & 2015Dokument2 SeitenDirect Taxes Withholding Tax Rate Card - Tax Year 2014 & 2015Riaz AhmedNoch keine Bewertungen

- ATC-Alphanumeric Tax Codes - Ebirforms v7!2!1601EQDokument9 SeitenATC-Alphanumeric Tax Codes - Ebirforms v7!2!1601EQMark Lord Morales BumagatNoch keine Bewertungen

- Epayments Import TemplateDokument6 SeitenEpayments Import TemplateMohammad MohsinNoch keine Bewertungen

- RR No. 6-2001 (Digest) PDFDokument1 SeiteRR No. 6-2001 (Digest) PDFFrancis GuinooNoch keine Bewertungen

- Module 5 - Chapter 2 Business and Other Local Taxes FinalDokument82 SeitenModule 5 - Chapter 2 Business and Other Local Taxes Finalanne villarin100% (1)

- UAT - Tax CasesDokument14 SeitenUAT - Tax Casesjef comendadorNoch keine Bewertungen

- ATC HandbookDokument15 SeitenATC HandbookPrintet08Noch keine Bewertungen

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesVon EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNoch keine Bewertungen

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryVon EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Instruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandInstruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Alternators, Generators & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandAlternators, Generators & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Motorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryVon EverandMotorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Electrical & Electronic Goods Agents & Brokers Revenues World Summary: Market Values & Financials by CountryVon EverandElectrical & Electronic Goods Agents & Brokers Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- MVVNL RGGVY Approved Vendor List: S.NO. Name of Material Vendor Name AddressDokument10 SeitenMVVNL RGGVY Approved Vendor List: S.NO. Name of Material Vendor Name AddressELMEF LaboratoryNoch keine Bewertungen

- Electrofusion Jointing ProceduresDokument12 SeitenElectrofusion Jointing ProcedureslfpachecoNoch keine Bewertungen

- "Written Statement": Tanushka Shukla B.A. LL.B. (2169)Dokument3 Seiten"Written Statement": Tanushka Shukla B.A. LL.B. (2169)Tanushka shuklaNoch keine Bewertungen

- CDP Project InstructionsDokument6 SeitenCDP Project InstructionsNarendra ReddyNoch keine Bewertungen

- Rule 108 Republic Vs TipayDokument1 SeiteRule 108 Republic Vs TipayShimi Fortuna100% (1)

- Exotic - March 2014Dokument64 SeitenExotic - March 2014Almir Momenth35% (23)

- 1ST Periodical Test in English 10Dokument3 Seiten1ST Periodical Test in English 10kira buenoNoch keine Bewertungen

- ProjectDokument1 SeiteProjectDevil KingNoch keine Bewertungen

- 00664-Hepting Excerpts of RecordDokument240 Seiten00664-Hepting Excerpts of RecordlegalmattersNoch keine Bewertungen

- Latihan Soal CausativeDokument1 SeiteLatihan Soal Causativeanakosagista anakosagistaNoch keine Bewertungen

- Bond - Chemical Bond (10th-11th Grade)Dokument42 SeitenBond - Chemical Bond (10th-11th Grade)jv peridoNoch keine Bewertungen

- Jurnal Arang AktifDokument7 SeitenJurnal Arang AktifSurya KrisNoch keine Bewertungen

- Test 3 - EF Pre-Intermediate - AnswerkeyDokument3 SeitenTest 3 - EF Pre-Intermediate - AnswerkeyMihaela VladuNoch keine Bewertungen

- 1.2.7 Cell Membrane Structure and FunctionDokument5 Seiten1.2.7 Cell Membrane Structure and FunctionAYUSH ALTERNATE67% (3)

- 01.performing Hexadecimal ConversionsDokument11 Seiten01.performing Hexadecimal ConversionsasegunloluNoch keine Bewertungen

- Jurczyk Et Al-2015-Journal of Agronomy and Crop ScienceDokument8 SeitenJurczyk Et Al-2015-Journal of Agronomy and Crop ScienceAzhari RizalNoch keine Bewertungen

- Cambridge Assessment International Education: Information Technology 9626/13 May/June 2019Dokument10 SeitenCambridge Assessment International Education: Information Technology 9626/13 May/June 2019katiaNoch keine Bewertungen

- PMMSI Vs CADokument1 SeitePMMSI Vs CAFermari John ManalangNoch keine Bewertungen

- Chenrezi Sadhana A4Dokument42 SeitenChenrezi Sadhana A4kamma100% (7)

- Introduction To Mechanical Engineering Si Edition 4Th Edition Wickert Lewis 1305635752 9781305635753 Solution Manual Full Chapter PDFDokument36 SeitenIntroduction To Mechanical Engineering Si Edition 4Th Edition Wickert Lewis 1305635752 9781305635753 Solution Manual Full Chapter PDFwilliam.munoz276100% (13)

- Hallelujah: (Chords)Dokument4 SeitenHallelujah: (Chords)Oliver Price-WalkerNoch keine Bewertungen

- GOUSGOUNIS Anastenaria & Transgression of The SacredDokument14 SeitenGOUSGOUNIS Anastenaria & Transgression of The Sacredmegasthenis1Noch keine Bewertungen

- A Scale To Measure The Transformational Leadership of Extension Personnel at Lower Level of ManagementDokument8 SeitenA Scale To Measure The Transformational Leadership of Extension Personnel at Lower Level of ManagementMohamed Saad AliNoch keine Bewertungen

- Six Sigma PDFDokument62 SeitenSix Sigma PDFssno1Noch keine Bewertungen

- Intensive Care Fundamentals: František Duška Mo Al-Haddad Maurizio Cecconi EditorsDokument278 SeitenIntensive Care Fundamentals: František Duška Mo Al-Haddad Maurizio Cecconi EditorsthegridfanNoch keine Bewertungen

- Model Control System in Triforma: Mcs GuideDokument183 SeitenModel Control System in Triforma: Mcs GuideFabio SchiaffinoNoch keine Bewertungen

- Chemical Formula Sheet Class 9: Matter in Our SurroundingDokument4 SeitenChemical Formula Sheet Class 9: Matter in Our SurroundingMadan JhaNoch keine Bewertungen

- Micro Analysis Report - Int1Dokument3 SeitenMicro Analysis Report - Int1kousikkumaarNoch keine Bewertungen

- General Request Form Graduate School, Chulalongkorn University (Only Use For Educational and Research Scholarship, Graduate School)Dokument2 SeitenGeneral Request Form Graduate School, Chulalongkorn University (Only Use For Educational and Research Scholarship, Graduate School)Kyaw Zin PhyoNoch keine Bewertungen

- Safety Management in Coromandel FertilizerDokument7 SeitenSafety Management in Coromandel FertilizerS Bharadwaj ReddyNoch keine Bewertungen