Beruflich Dokumente

Kultur Dokumente

MF 1

Hochgeladen von

Abhik ChowdhuryOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MF 1

Hochgeladen von

Abhik ChowdhuryCopyright:

Verfügbare Formate

Mutual Fund:

A mutual fund is a type of professionally-managed collective investment scheme that pools money from many investors to purchase securities. While there is no legal definition of mutual fund, the term is most commonly applied only to those collective investment schemes that are regulated, available to the general public and open-ended in nature. Hedge funds are not considered a type of mutual fund. The term mutual fund is less widely used outside of the United States. For collective investment schemes outside of the United States, see articles on specific types of funds including open-ended investment companies, SICAVs, unitized insurance funds, unit trusts and Undertakings for Collective Investment in Transferable Securities. In the United States, mutual funds must be registered with the Securities and Exchange Commission, overseen by a board of directors or board of trustees and managed by a registered investment advisor. They are not taxed on their income if they comply with certain requirements. Mutual funds have both advantages and disadvantages compared to direct investing in individual securities. They have a long history in the United States. Today they play an important role in household finances. There are 3 types of U.S. mutual funds: open-end, unit investment trust, and closed-end. The most common type, the open-end mutual fund, must be willing to buy back its shares from its investors at the end of every business day. Exchange-traded funds are open-end funds or unit investment trusts that trade on an exchange. Open-end funds are most common, but exchange-traded funds have been gaining in popularity. Mutual funds are classified by their principal investments. The four largest categories of funds are money market funds, bond or fixed income funds, stock or equity funds and hybrid funds. Funds may also be categorized as index or actively-managed. Investors in a mutual fund pay the funds expenses. There is controversy about the level of these expenses. A single mutual fund may give investors a choice of different combinations of expenses by offering several different types of share classes.

Advantages and Disadvantages of Mutual funds:

Mutual funds have advantages compared to direct investing in individual securities. These include:

Increased diversification Daily liquidity Professional investment management Ability to participate in investments that may be available only to larger investors Service and convenience Government oversight Ease of comparison

Mutual funds have disadvantages as well, which include:

Fees Less control over timing of recognition of gains Less predictable income No opportunity to customize

History of Mutual Funds

The first mutual funds were established in Europe. One researcher credits a Dutch merchant with creating the first mutual fund in 1774The first mutual fund outside the Netherlands was the Foreign & Colonial Government Trust, which was established in London in 1868. It is now the Foreign & Colonial Investment Trust and trades on the London stock exchange. Mutual funds were introduced into the United States in the 1890s.They became popular during the 1920s. These early funds were generally of the closed-end type with a fixed number of shares which often traded at prices above the value of the portfolio. The first open-end mutual fund with redeemable shares was established on March 21, 1924. This fund, the Massachusetts Investors Trust, is now part of the MFS family of funds. However, closedend funds remained more popular than open-end funds throughout the 1920s. By 1929, open-end funds accounted for only 5% of the industry's $27 billion in total assets.[9] After the stock market crash of 1929, Congress passed a series of acts regulating the securities markets in general and mutual funds in particular. The Securities Act of 1933 requires that all investments sold to the public, including mutual funds, be registered with the Securities and Exchange Commission and that they provide prospective investors with a prospectus that discloses essential facts about the investment. The Securities and Exchange Act of 1934 requires that issuers of securities, including mutual funds, report regularly to their investors; this act also created the Securities and Exchange Commission, which is the principal regulator of mutual funds. The Revenue Act of 1936 established guidelines for the taxation of mutual funds, while the Investment Company Act of 1940 governs their structure.

When confidence in the stock market returned in the 1950s, the mutual fund industry began to grow again. By 1970, there were approximately 360 funds with $48 billion in assets.[10] The introduction of money market funds in the high interest rate environment of the late 1970s boosted industry growth dramatically. The first retail index fund, First Index Investment Trust, was formed in 1976 by The Vanguard Group, headed by John Bogle; it is now called the Vanguard 500 Index Fund and is one of the world's largest mutual funds, with more than $100 billion in assets as of January 31, 2011.

ICB Mutual Fund

Introduction It is a recognized principle that diversification of investment reduces risk. An individual may not have the time, expertise and resources to undertake such diversification. Here arises the advantage of a Mutual Fund. Mutual Funds pool the savings of a great number of investors and make investments in a wide array of securities. In Bangladesh ICB has pioneered Mutual Funds for the sake of investors and of the capital market. ICB Mutual Funds Mutual Funds are also known as close ended Mutual Funds. The issued capital of a Mutual Fund is limited, that is, a Mutual Fund offers a limited number of certificates for sale to the public. The amount of capital and the number of certificates of each Mutual Fund remains unchanged. ICB Mutual Funds are independent of one another. A Mutual Fund being listed is traded on the Stock Exchanges. Price of Mutual Fund certificates after IPO is determined on the Stock Exchanges through interaction of supply and demand. The market price of a Mutual Fund certificates is available in Stock exchange quotations and in newspapers. How to Buy existing Mutual Funds An investor can purchase any of the existing eight ICB Mutual Funds certificates through the Stock Exchanges at the prevailing Market Price. However, if an investor buys Mutual Fund certificates through the Stock Exchanges he/she must be careful to submit the certificates along with duly filled-in transfer deed at ICB Head Office to ensure that the certificates are registered in his/her name.

Management of the Funds The Mutual Funds are managed by ICB as fund manager for which receives commission @1% . Assets of ICB Mutual Funds

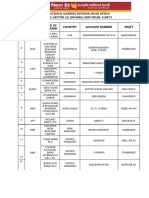

ICB Mutual Funds Certificates holders shall have unfettered ownership in the assets of the Fund to which they are related. In case of winding up of the Corporation the assets belonging to any ICB Mutual Fund shall not be treated as the assets of the Corporation. Management Fee, Charge etc. At present management fee @ 1% on the paid up capital of the Fund is charged annually. No amount is charged on account of custodial and trust services. Part of operating expenses are charged to the respective Mutual Funds on pro rata basis. Declaration of Dividend The net income received on investments of Funds on account of dividend, bonus, interest, capital gain etc. are distributed amongst the Certificate Holders as per decision of the Board of Directors of ICB. Board declares such income in the form of dividend at the end of July each year. Dividends declared by ICB in the past on the Mutual Funds were very attractive. The year-wise per certificate dividend performance of the Funds is given below. Rate of the Dividend per Certificate (Taka) FY ICB Mutual Funds 1 st 20 20 20 25 35 38 41 48 49 49 35 31 31.5 45 50 60 70 21 23 21 25.5 22.5 21.5 28 25.5 23 29 29 22 22 21 27 40 42 45 26 23.5 20.5 15.5 26 23.5 20.5 13.25 19 19 18 22 27 28 38 17 18 17 40 41 41 45 10 11 12 25 28 30 35 6 6 16 18 20 24 18 21 18 2 nd 3 rd 4 th 5 th 6 th 7 th 8 th

1980-1981 1981-1982 1982-1983 1983-1984 1984-1985 1985-1986 1986-1987 1987-1988 1988-1989 1989-1990 1990-1991 1991-1992 1992-1993 1993-1994 1994-1995 1995-1996 1996-1997

1997-1998 1998-1999 1999-2000 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010 Tax Concessions

70 100 125 170 175 180 200 210 210 265 310 400

30 32 35 40 42 45 50 55 55 75 95

35 38 40 45 50 50 50 52 52 56 65 85

32 35 36 38 40 40 45 48 48 52 60 80

22 20 21 23

18 15 16 17

14 13 13.5 14

12 12 12.5 13

24 17.50 14.50 13.50 24 17.50 14.50 13.50 24 17.50 27 18.50 27 18.50 33 45 56 23 30 37 75 15 16 16 22.50 30 35 70 14 15 15 18 25 32 65

190(1B:2,240) 62

200 140 125 100

(a) Investment in Certificates provides the same tax exemptions as an investment qualifying under Section 44 of the Income Tax Ordinance, 1984. (b) Capital gains received on investment in the Fund Certificates shall not be included in the total income of a Certificate holder within the limits specified in the Income Tax Ordinance, 1984. (c) Dividends received on investment in the Fund will be treated as dividend income under Income Tax Act, and will be exempted from tax with the limits specified in the Act. (d) The Fund incomes are to be exempted from all taxes as granted by the Government as per SRO No 80-L/80 dated April, 1980.

Objectives

To encourage and broaden the base of investment. To develop the capital market. To provide for matters ancillary thereto. To mobilize savings. To promote and establish subsidiaries for business development.

Business Policy To act on commercial consideration with due regard to the interest of industry, commerce, depositors, investors and to the public in general. To provide financial assistance to projects subject to their economic and commercial viability. To arrange consortium of financial institutions including merchant banks to provide equity support to projects and thereby spread the risk of underwriting. To develop and encourage entrepreneurs. To diversify investments. To induce small and medium savers for investment in securities. To create employment. To encourage Investment in IT sector. To encourage Investment in joint venture capital/project.

Basic Functions Underwriting of initial public offering of shares and debentures Underwriting of right issue of shares Direct purchase of shares and debentures including Pre-IPO placement and equity participation Providing lease finance to industrial machinery and other equipments singly or by forming syndicate Managing investors' Accounts Managing Open End and Closed End Mutual Funds

Operating on the Stock Exchanges Providing investment counsel to issuers and investors Participating in Government divestment Program Participating in and financing of, joint-venture projects Dealing in other matters related to capital market operations Trusty, Custodian, Bank Guarantee Consumer Credit

Why should you invest in Mutual Funds?

If you are a less risk taker and a long-term investor you can consider investing on Mutual funds. 1) Reduce your risks: Mutual Funds diversify your portfolio by investing in various securities & minimize the risk because Mutual funds are not like volatile as other secondary market shares. 2) Maximize the security and expectation on investment opportunities: - The fund managers with the strong research take explore new investment options make available opportunities for your investments to flourish. Investments will be secured with a less risk and moderate returns. 3) Liquidity: Quick access to your money and Mutual Funds can be bought and sold on any business day. 4) Affordability: - Of course, you dont need a lots of money to invest in mutual fund as the minimum investment in mutual fund starts from 1,000 taka . A Mutual Fund because of its large corpus allows even a small investor to take the benefit of its investment strategy. 5) Low Costs - Mutual Funds are a relatively less expensive way to invest compared to directly investing in the capital markets because the benefits of scale in brokerage, custodial and other fees translate into lower costs for investors. 6) Tax Benefits - The tax benefits that Mutual Funds investors enjoy at the moment is the treatment of long-term capital gains. Double taxation can be avoided by investing in Mutual funds for long-term. 7) Transparency - The investor gets regular information on the value of his investment in addition to disclosure on the specific investments made by the fund, the proportion invested in each class of assets and the fund manager's investment strategy and outlook. If I ask you that I would give you 20% return on investing mutual funds over the year, would you do it? You bet, everyone would do it because it is risk free, lucrative return and no market can bid this kind of return or dividend. Let me show you how much dividend you would earn from mutual funds investment. These data are collected from CSE market: Let's not only talking but we also want to show you the trends and allocation of dividends over years so you can do some work on this. The following table gives you an idea what I am talking about. Investing in few mutual funds without any risk, you can make over 50% earning in some stocks or mutual funds per year. Let's do some math here, if you invest $100 in mutual fund for 5 years which provides at least 50% dividend return. In 1st year, it will grow to 150, and over 2 nd year it will grow to $225 and end of 5

years it will accumulate to $759.375 with the return of 50%. I am not sure where you can make this kind of return without stressing any risk.

Investment in share capital is becoming more risky business due to affecting of lots of factors but mutual fund is less risky than stock. So, all the big corporations and financial institutions allow public to invest the money in their mutual funds. If we talk about the main mutual funds in Bangladesh, first of all, we have to understand its economy. Latest news relating to economy of Bangladesh is that it has stopped to depend on foreign loan and it is developing the its own financial organizations who collect fund from own peoples of Bangladesh and this fund is utilized for developing of Bangladesh. If you are the citizen of Bangladesh, you should invest your countries' own mutual funds and this fund will be helpful for developing your country instead of going loan. I think, if a country demands loan from other country, it means that country is becoming beggar for getting loan. So, for pride of country, we should never demand loan from any other country. Indian may also invest in this mutual fund because Bangladesh was the part of India and still we behave it as our brother. We are interested to make Strong of our brother's economy.

Types of Mutual Funds

Now, I am writing List of Mutual Funds in Bangladesh. Following is the list of Bangladeshs largest mutual fund providers. They offer to public to invest in these mutual funds. In these providers include the companies of banking sector, insurance sector and finance sectors. There are 4 Top companies who are the providers of mutual funds. Ist EBL First Mutual Fund EBL First Mutual Fund is a closed-end fund incorporated in Bangladesh. The fund's objective is to provide high dividend income. The Fund invests in capital market and money market securities. The Fund is listed on the Dhaka Stock Exchange. 2nd Eighth ICB Mutual Fund This mutual fund has been made by investment corporation of Bangladesh. It is a closed-end fund incorporated in Bangladesh. The Fund's objective is to provide dividend income. The Fund invests in the Bangladeshi capital market. 3rd ICB AMCL Islamic Mutual Fund ICB AMCL Islamic Mutual Fund is a closed-end fund incorporated in Bangladesh. The fund's objective is to provide high dividend income. The Fund invests in Shariah compliant securities/instruments. The Fund is listed on the Dhaka Stock Exchange. 4rd Seventh ICB Mutual Fund Like other ICB financial product, it is also investment corporation's financial product.

List of Mutual Fund in Bangladesh:

IAIMF IAMC1 ICB1 ICB2 ICB ICB 1ST 2ND AMCL ISLAMIC MUTUAL FUND AMCL FIRST MUTUAL FUND ICB MUTUAL FUND ICB MUTUAL FUND Aug Aug Aug Aug 15 15 15 15 2007 2007 2007 2007 Aug Aug Aug Aug 15 15 15 15 2007 2007 2007 2007

ICB3 3RD ICB MUTUAL FUND Aug 15 2007 Aug 23 2007 ICB4 4TH ICB MUTUAL FUND Aug 15 2007 Aug 23 2007 ICB5 5TH ICB MUTUAL FUND Aug 15 2007 Aug 23 2007 ICB6 6TH ICB MUTUAL FUND Aug 15 2007 Aug 23 2007 ICB7 7TH ICB MUTUAL FUND Aug 15 2007 Aug 23 2007 ICB8 8TH ICB MUTUAL FUND Aug 15 2007 Aug 23 2007 INRB1 ICB AMCL FIRST NRB MUTUAL FUND Aug 15 2007 Aug 15 2007 .

No 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

NAME 1st Bangladesh Shilpa Rin Sangstha MF (STBSRS) AB Bank 1st Mutual Fund (ABB1STMF) AIBL First Islamic Mutual Fund (AIBL1STI) AIMS First Guaranteed Mutual Fund (AIMS1ST) DBH First Mutual Fund (DBH1ST) EBL First Mutual Fund (EBL1STMF) EBL NRB Mutual Fund (EBLNRBMF) Eighth Icb Mutual Fund (8THICB) Fifth ICB Mutual Fund (5THICB) First Bangladesh Fixed Income Fund (FBANGFI) First Janata Bank Mutual Fund (1JANATA) Fourth ICB Mutual Fund (4THICB) Grameen Mutual Fund Scheme 1 (GRAMEEN1) Grameen Mutual Fund Scheme 2 (GRAMEEN2) Green Delta Mutual Fund (GREENDEL) ) ICB AMCL First NRB Mutual Fund (ICBFNRB) ICB AMCL Islamic Mutual Fund (ICBIS) ICB AMCL Second Nrb Mutual Fund (ICBAMCL) ICB AMCL Third NRB Mutual Fund (ICBTNRB) IFIC Bank First Mutual Fund (IFIC1ST) IFIL Islamic Mutual Fund 1 (IFILIM1 MBL 1st Mutual Fund (MBL1STMF) ) (3RDICB) Phoenix Finance 1st Mutual Fund (PF1STMF) PHP First Mutual Fund (PHPMF1) Popular Life First Mutual Fund (POPULAR1) Prime Bank First ICB AMCL Mutual Fund (PRIME1IC) Prime Finance First Mutual Fund (PRFINFM) Reliance One Mutual Fund (RELIANC1)

TYPE Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Open-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Open-End Fund Closed-End Fund Open-End Fund Open-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund Closed-End Fund

OBJECTIVE Flexible Portfolio Balanced Government/C orporate Government/C orporate Region FundGeo FocusedAsset

Government/C orporate Government/C orporate

Government/C orporate Income Equity Region FundGeo FocusedGlobal Debt Government/C orporate Sector FundAlloc/Islamic Government/C orporate Government/C orporate

Government/C orporate

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- UntitledDokument1 SeiteUntitledAbhik ChowdhuryNoch keine Bewertungen

- Class Eight Corruption in BangladeshDokument2 SeitenClass Eight Corruption in BangladeshpuaviNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledAbhik ChowdhuryNoch keine Bewertungen

- Premier UniversityDokument2 SeitenPremier UniversityAbhik ChowdhuryNoch keine Bewertungen

- This Note Is An Update of The Political and Economic Situation in Bangladesh Provided in TheDokument5 SeitenThis Note Is An Update of The Political and Economic Situation in Bangladesh Provided in TheAbhik ChowdhuryNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledAbhik ChowdhuryNoch keine Bewertungen

- MF 5Dokument5 SeitenMF 5Abhik ChowdhuryNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Routing CodesDokument14 SeitenRouting CodesParag PenkerNoch keine Bewertungen

- 73e8ab49-e63b-48d0-9dc5-2459547fe32aDokument1 Seite73e8ab49-e63b-48d0-9dc5-2459547fe32arexhvelajdiamantNoch keine Bewertungen

- Middle East FundsDokument4 SeitenMiddle East FundsAli Gokhan KocanNoch keine Bewertungen

- Liza Yapp Ai Yun Goldsmith SDN BHD MDLD 0765 Public Villa Jaln Segama 91100 Lahad DatuDokument3 SeitenLiza Yapp Ai Yun Goldsmith SDN BHD MDLD 0765 Public Villa Jaln Segama 91100 Lahad Datupiu piuNoch keine Bewertungen

- LSF 555 Enterprise 2 JLN Silat Goyang 16 BNDR Selesa Jaya 81300 Johor BahruDokument5 SeitenLSF 555 Enterprise 2 JLN Silat Goyang 16 BNDR Selesa Jaya 81300 Johor Bahru小林Noch keine Bewertungen

- New Bank BR CodesDokument58 SeitenNew Bank BR CodesakilamadushankeNoch keine Bewertungen

- Monthly Registration Stats 2015 - DecemberDokument3 SeitenMonthly Registration Stats 2015 - DecemberBernewsAdminNoch keine Bewertungen

- IfsccodeDokument1.747 SeitenIfsccodeAman SharmaNoch keine Bewertungen

- Directors of Federal Reserve Bank of New York (1914-2014)Dokument47 SeitenDirectors of Federal Reserve Bank of New York (1914-2014)William Litynski100% (1)

- IPO Exits FactsheetDokument2 SeitenIPO Exits FactsheetPushpak Reddy GattupalliNoch keine Bewertungen

- Insurance ListDokument10 SeitenInsurance ListMark AkaphotNoch keine Bewertungen

- China Motor Proposal Form + Autosafe FormDokument3 SeitenChina Motor Proposal Form + Autosafe FormarimulNoch keine Bewertungen

- AR Absolute Return + Alpha Billion Dollar Club 2010Dokument3 SeitenAR Absolute Return + Alpha Billion Dollar Club 2010Absolute Return100% (1)

- Negotiable Instruments Law Case ListDokument3 SeitenNegotiable Instruments Law Case ListMary Joyce Lacambra AquinoNoch keine Bewertungen

- Rma ListiiDokument6 SeitenRma ListiiArshad IqbalNoch keine Bewertungen

- Classification of Commercial BanksDokument2 SeitenClassification of Commercial BanksPrakash KrishnanNoch keine Bewertungen

- Hedge Fund BackersDokument6 SeitenHedge Fund Backers1c796e65b8a4c8Noch keine Bewertungen

- FiiDokument45 SeitenFiiNeeta LokhundeNoch keine Bewertungen

- CFADokument1 SeiteCFAraza24Noch keine Bewertungen

- Export 24 - 02 - 2018 15 - 06Dokument1 SeiteExport 24 - 02 - 2018 15 - 06Anonymous 0JfyYG0Noch keine Bewertungen

- Total Retail Bond Trading 1512Dokument329 SeitenTotal Retail Bond Trading 1512Sorken75Noch keine Bewertungen

- Ssi PNBDokument3 SeitenSsi PNBKumar KalyanNoch keine Bewertungen

- JPM European CoveredbondsDokument304 SeitenJPM European CoveredbondsAjayCNoch keine Bewertungen

- Top 400 Financial AdvisorsDokument1 SeiteTop 400 Financial AdvisorsbgeltmakerNoch keine Bewertungen

- Bank ListsDokument4 SeitenBank ListsMhickLuceroNoch keine Bewertungen

- Fondos IndexadosDokument16 SeitenFondos IndexadosnosequenombreusarNoch keine Bewertungen

- Cancellation List From Date 04 Nov To 04 Dec 2019 - Consolidate of Premium RefundDokument3 SeitenCancellation List From Date 04 Nov To 04 Dec 2019 - Consolidate of Premium RefundTi BetoNoch keine Bewertungen

- Zimbabwe Banking Swift Codes: Here For AfricaDokument1 SeiteZimbabwe Banking Swift Codes: Here For AfricaTadiwanashe BurukaiNoch keine Bewertungen

- Financial ServicesDokument25 SeitenFinancial ServicesSaurav PandeyNoch keine Bewertungen

- FILE PlacementAgentsDokument6 SeitenFILE PlacementAgentsgsu2playNoch keine Bewertungen