Beruflich Dokumente

Kultur Dokumente

Bop & Iip - Q1 12

Hochgeladen von

patburchall6278Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bop & Iip - Q1 12

Hochgeladen von

patburchall6278Copyright:

Verfügbare Formate

BALANCE OF PAYMENTS & INTERNATIONAL INVESTMENT POSITION

FOR THE QUARTER ENDED MARCH 2012 FAST FACTS Current Account The Bermuda current account recorded a surplus of $145 million in the first quarter of 2012. The goods trade deficit contracted to $207 million in the first quarter of 2012 from $215 million in 2011. Services transactions realised a surplus of $84 million for the quarter. This represented a $3 million decrease year-over-year. The surplus on Bermudas primary income account grew to $302 million in the first quarter of 2012. Current Account Surplus = $145 million The current account recorded a surplus of $145 million. This represented a $31 million increase year-over-year. The growth mostly reflected a decline in payments which outpaced the decrease in receipts. First quarter payments fell by $53 million to $644 million when compared to the first quarter in 2011. In addition, receipts from goods and services for the same quarter abated $23 million totalling $789 million. The largest contributor to the increase in the current account surplus was the primary income account which recorded surplus gains of $25 million.

Q1 2012 CURRENT ACCOUNT RECEIPTS

Employee Comp 40.6%

CURRENT ACCOUNT BALANCES (BD$) million

900 750 600 450 300 150 Q1 Q2 Q3 Q4 Q1

Government 5.7%

Investment Income 13.9%

2011

Receipts Payments

2012

Current Account Balance

Business 25.9%

Other Income 6.0%

Travel 6.0% Transport 1.4% Exports 0.4%

Capital and Financial Account Transactions on Bermudas asset accounts resulted in a net lending position of $30 million. Factors influencing this performance include: Bermudas net acquisition of financial assets resulted in a draw down of $1,147 million compared to an accumulation of $209 million in 2011. Bermuda reduced its incurrence of financial liabilities by $1,177 million this quarter compared to an increase of $95 million in 2011.

Net payments for goods contracted The value of goods imported fell by 4 per cent to $211 million during the quarter. Revenue earned from exports was unchanged at $3 million compared to last year. These transactions resulted in a net deficit on trade in goods totalling $207 million during the first quarter of 2012.

DEPARTMENT OF STATISTICS

BERMUDA BALANCE OF PAYMENTS & INTERNATIONAL INVESTMENT POSITION

The surplus on trade in services totalled $84 million

Receipts generated from services transactions totalled $300 million for the quarter. This was $23 million below the level recorded in the corresponding quarter of the previous year. The decline in the services account receipts was driven by lower earnings on business services and travel services. Receipts from business services decreased $16 million reflecting lower revenue from financial services and other services such as legal, accounting and management consultancy services. Travel earnings stood at $46 million, or $4 million below the level of receipts recorded in the first quarter of 2011. The decline in travel receipts was partly attributed to a decrease in tourist expenditure during the quarter. Receipts from government services also fell $6 million compared to the previous years level.

TRAVEL SERVICES RECEIPTS $BD million

investments other than portfolio and direct investments. Income payments to non-residents on assets held in Bermuda fell $26 million due to a drop in dividend payments to direct investors. The surplus on income earned in the form of compensation from labour services grew $1 million over 2011. The increases in receipts from investment income and employee compensation were offset by a $9 million decline in payroll tax receipts received from the international business sector. Payments of secondary receipts by $33 million income exceeded

225 150

75

Q1

2009

The secondary income account reflects the balances on donations, insurance claims and other transfers between residents and non-residents. Payments totalled $54 million compared to transfer inflows of only $21 million. The $33 million deficit reflected primarily an excess of claims paid by insurance companies to nonresidents over premiums received during the quarter. CAPITAL AND FINANCIAL ACCOUNT Capital Account No transactions were recorded on the capital account Financial account transactions resulted in a net lending position of $30 million Bermuda residents withdrew more than they accumulated on asset holdings overseas, leading to a negative net acquisition of $1,147 million for the first quarter. Holdings of portfolio investment assets overseas experienced the largest decline of $1,374 million. During the same period, Bermuda residents paid back more on their debt than they incurred in new liabilities in the amount of $1,127 million. This decrease was mostly associated with investments of currency and deposits.

Q2

2010 2011

Q3

2012

Q4

Payments for services decreased $18 million to $217 million. This decline was largely due to a $19 million fall in outflows related to business services. Resident outlays on all major business service categories which include insurance, financial and ICT services were reduced during the quarter. Expenditure on all other service categories declined with the exception of transportation services which increased $2 million. This increase was primarily due to a rise in air transport payments by residents on airline tickets. The surplus on the primary income account grew by $25 million. Transactions on the primary income account realised a surplus of $302 million. This represented a 9 per cent increase year-over-year. Inflows of investment income grew by $7 million mostly due to a rise in interest earnings on

DEPARTMENT OF STATISTICS PAGE 2

BERMUDA BALANCE OF PAYMENTS & INTERNATIONAL INVESTMENT POSITION

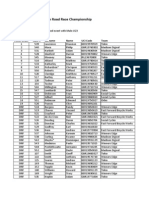

BALANCE OF PAYMENTS (BD$) MILLIONS 2011 2012 2011 YTD Q1 910 974 249 303 403 117 36 82 168 19 501 65 436 0 219 2,604 13 1,427 39 465 859 48 212 80 519 65 1,758 1,252 358 148 89 3,287 -897 453 -210 162 456 -69 176 -2 351 46 1,257 1,187 -78 148 -131 683 -333 2,311 128 1,461 11 3,577 112 -117 8 3,493 3,496 -81 0 81 -602 211 217 60 61 92 27 9 19 36 4 163 16 146 0 54 644 3 300 11 46 199 11 38 22 128 44 465 312 107 46 21 789 -207 84 -48 -15 107 -16 28 4 92 39 302 295 -39 46 -33 145 189 -1374 35 2 0 -1147 -142 226 -3 -1259 -1177 -30 0 30 -115 219 235 58 62 111 29 14 22 45 5 189 16 172 0 55 697 3 323 8 50 215 12 44 22 137 50 465 310 100 55 20 812 -215 87 -50 -12 104 -17 29 0 92 45 277 294 -73 55 -35 114 -57 141 33 86 6 209 -78 97 3 73 95 -114 0 114 0

Components CURRENT ACCOUNT PAYMENTS GOODS IMPORTS SERVICES Transportation Travel Business Services: Insurance services Financial services ICT services Other services Government services PRIMARY INCOME Employee Compensation Investment Income Other Income SECONDARY INCOME TOTAL PAYMENTS CURRENT ACCOUNT RECEIPTS GOODS EXPORTS SERVICES Transportation Travel Business Services: Insurance services Financial services ICT services Other services Government services PRIMARY INCOME Employee Compensation Investment Income Other Income SECONDARY INCOME TOTAL RECEIPTS CURRENT ACCOUNT BALANCES GOODS SERVICES Transportation Travel Business Services: Insurance services Financial services ICT services Other services Government services PRIMARY INCOME Employee Compensation Investment Income Other Income SECONDARY INCOME CURRENT ACCOUNT BALANCE FINANCIAL ACCOUNT Direct investment Portfolio investment Financial Derivatives Other investment Reserve assets NET ACQUISITION OF FINANCIAL ASSETS Direct investment Portfolio investment Financial Derivatives Other investment NET INCURRENCE OF FINANCIAL LIABILITIES TOTAL NET FINANCIAL ACCOUNT TOTAL NET CAPITAL ACCOUNT TOTAL NET LENDING (+)/NET BORROWING (-) BALANCING ITEM

2011 Q2 231 250 66 72 108 33 8 21 46 5 44 16 28 0 54 580 3 392 9 166 215 13 49 19 135 2 424 311 78 35 22 841 -228 142 -57 94 107 -21 40 -1 89 -3 380 295 49 35 -32 261 16 447 41 867 5 1376 51 -139 10 1040 962 -414 0 414 153

2011 Q3 242 251 66 88 92 27 7 19 39 5 122 16 105 0 54 668 4 391 14 165 210 11 55 19 125 1 419 310 81 28 25 837 -238 140 -52 77 119 -16 48 0 87 -4 297 293 -24 28 -30 169 -294 -145 33 505 -7 99 86 -81 1 142 148 49 0 -49 -218

2011 Q4 219 237 60 81 93 28 6 20 38 5 147 16 130 0 55 658 3 322 8 83 218 12 64 20 122 13 450 321 100 30 22 797 -215 84 -51 2 126 -16 58 0 84 8 304 305 -30 30 -34 139 1 1867 21 3 8 1893 53 7 -6 2239 2292 399 0 -399 -538

2012 Q1 211 217 60 61 92 27 9 19 36 4 163 16 146 0 54 644 3 300 11 46 199 11 38 22 128 44 465 312 107 46 21 789 -207 84 -48 -15 107 -16 28 4 92 39 302 295 -39 46 -33 145 189 -1374 35 2 0 -1147 -142 226 -3 -1259 -1177 -30 0 30 -115

R Revised, P Provisional

Numbers may not add due to rounding

BERMUDA BALANCE OF PAYMENTS & INTERNATIONAL INVESTMENT POSITION

INTERNATIONAL INVESTMENT POSITION

Bermudas net asset position increases to $1,525 million At the end of the 1st quarter 2012, Bermudas stock of foreign assets exceeded its stock of foreign liabilities by an estimated $1,525 million. This net foreign asset position increased by $57 million over the fourth quarter of 2011.

Bermuda's International Investment Position (BD$ millions)

$

15,000 13,000 11,000 9,000 7,000

5,000

3,000 1,000

Net International Investment Position

Total liabilities

Total assets

Q1

Q2

Q3

Q4

Q1

2011

2012

International assets fall with decline in portfolio investment holdings Bermudas stock of foreign assets stood at $13,242 million at the end of the 1st qtr 2012. This represented a decline from the 4th quarter 2011 asset position of $14,426 million. The decrease primarily reflected a reduction in portfolio investment assets held overseas, particulary short-term debt securities of the financial sector. Bermudas net liability position on direct investment narrows The stock of direct investment in the Bermuda economy by non-residents fell by $205 million to $1,417 million. In contrast, Bermudas stock of direct investment overseas grew by $180 million in the first quarter to $759 million as a result of increased equity and investment fund shares. As a result, Bermudas net direct investment liability position narrowed to $658 million. Non-financial corporations and general government hold a net liability position Two resident instutional sectors held a net liability position with the rest of the world at the end of the 1st quarter. The general government sectors net external debt stood at $974 million while non-financial corporations owed $774 million. Financial corporations held a net asset position of $3,252 million on the strength of portfolio investment holdings such as bonds, notes and money market instruments. Non-profit institutions serving households also recorded a net asset position of $21 million at the end of the first quarter.

DEPARTMENT OF STATISTICS PAGE 4

BERMUDA BALANCE OF PAYMENTS & INTERNATIONAL INVESTMENT POSITION

INTERNATIONAL INVESTMENT POSITION (IIP) (BD$) MILLIONS Components ASSETS BY FUNCTIONAL CATEGORY Direct investment Portfolio investment Financial Derivatives (other than reserves) and ESOs Other investment Reserve Assets BY INSTRUMENT Equity and investment fund share/units Debt instruments: Special drawing rights Currency and deposits Debt securities Loans Insurance, pension, standardized guarantee schemes Other accounts receivable/payable Other financial assets and liabilities TOTAL ASSETS LIABILITIES BY FUNCTIONAL CATEGORY Direct investment Portfolio investment Financial Derivatives (other than reserves) and ESOs Other investment BY INSTRUMENT Equity and investment fund share/units Debt instruments: Special drawing rights Currency and deposits Debt securities Loans Insurance, pension, standardized guarantee schemes Other accounts receivable/payable Other financial assets and liabilities TOTAL LIABILITIES NET IIP 2011 Q1 868 8,417 11 2,322 141 847 10,900 683 8,578 968 672 11 11,759 2011 Q2 879 8,864 22 2,584 146 854 11,620 1,574 9,035 944 67 22 12,495 2011 Q3 578 8,719 24 3,106 138 559 11,983 1,523 8,876 1,322 262 24 12,566 2011 Q4 579 10,586 14 3,101 147 548 13,865 1,293 10,763 1,242 567 14 14,426 2012 Q1 759 9,212 18 3,106 146 730 12,493 1,759 9,386 1,281 67 18 13,242

1,2

1,427 1,868 11 6,244 1,810 7,729 n.a. 5,151 1,485 1,075 17 11 9,550 2,209

1,484 1,729 21 7,285 1,831 8,667 n.a. 6,195 1,382 1,076 14 21 10,519 1,977

1,570 1,647 23 7,427 1,933 8,712 n.a. 6,289 1,284 1,125 14 23 10,667 1,899

1,622 1,654 16 9,666 1,979 10,963 n.a. 8,572 1,298 1,078 16 16 12,958 1,468

1,417 1,880 14 8,407 1,772 9,932 n.a. 7,361 1,524 1,030 16 14 11,717 1,525

IIP By Resident Institutional Sector (BD$) MILLIONS 2012 Q1 Households Non and General Financial financial 2,3 NPISHs government corporations corporations 21 13 8 6 6 980 13,148 730 9,178 18 3,075 146 9,896 626 21 980 (974) 1,872 14 7,384 3,252 841 790 7 0 44 (774) 67 29 21 17 Total economy 13,242 759 9,212 18 3,106 146 11,717 1,417 1,880 14 8,407 1,525

ASSETS Direct investment Portfolio investment Financial Derivatives (other than reserves) and ESOs Other investment Reserve Assets LIABILITIES Direct investment Portfolio investment Financial Derivatives (other than reserves) and ESOs Other investment NET IIP

1 Data are estimates only and subject to revision 2. Series does not include stock of household foreign assets and liabilities 3. NPISH: Non-profit institutions serving households. R Revised, P Provisional Numbers may not add due to rounding

BERMUDA BALANCE OF PAYMENTS & INTERNATIONAL INVESTMENT POSITION

WHAT IS THE BALANCE OF PAYMENTS? The balance of payments (BOP) is a statistical statement that systematically summarizes, for a specific time period, the economic transactions of an economy (resident) with the rest of the world (non-resident). Quite simply, the balance of payments covers all economic transactions between Bermuda and the rest of the world. It includes the current account and the capital and financial account. In principle, the current account and capital and financial account should balance each other out. If Bermuda sells more goods and services than it buys (i.e., if it has a current account surplus), it has to lend money abroad to finance its exports (i.e., run a capital and financial account deficit). In theory, therefore, the balance of payments is always zero. Example: Every dollar spent by a tourist in Bermuda earns the economy $1 in foreign currency which can be used to purchase goods and services from overseas.

Resident The concept of residency is very important in the BOP because the BOP is in fact a statement of transactions between residents and non-residents. A unit must have a centre of predominant economic interest within an economic territory for at least one year or more to be considered resident of that territory. Seasonal workers Workers from overseas who come to Bermuda to work for a few months in the year or every year are considered seasonal workers. Their expenditure on living expenses in Bermuda is included as travel receipts. Similarly, their income received from employers in Bermuda is a BOP outflow under compensation of employees. Current Account Transactions on goods, services, income, and current transfers are allocated to the current account. Transactions in exports and interest income are examples of receipts, while imports and interest expenses are payments. The difference between payments and receipts determines if Bermudas current account is in surplus or deficit. Payments All monies that are paid by residents to non-residents are considered payments. Receipts All monies that are received by residents from nonresidents are considered receipts. Balancing Item (Net Errors & Omissions) A current account surplus or deficit should correspond to an equivalent outflow or inflow in the capital and financial account. In other words, the two accounts should add to zero. In fact, as data are compiled from multiple sources, the two balance of payments accounts rarely equate. As a result, the balancing item is the net unobserved inflow or outflow needed to balance the accounts.

DEFINITIONS AND NOTES Capital Account The capital account details transactions that involve the receipt or payment of capital transfers and acquisitions and disposal of non-produced, non-financial assets. Financial Account All transactions associated with changes of ownership in foreign financial assets and liabilities of the economy are included in the financial account. Such changes include the creation and liquidation of claims on, or by, the rest of the world. Reserve Assets Reserve Assets are those external assets that are readily available to and controlled by monetary authorities for meeting balance of payments financing needs, for intervention in exchange markets to affect the currency exchange rate, and for other related purposes (such as maintaining confidence in the currency and the economy, and serving as a basis for foreign borrowing).

DEPARTMENT OF STATISTICS PAGE 6

BERMUDA BALANCE OF PAYMENTS & INTERNATIONAL INVESTMENT POSITION

WHAT IS THE INTERNATIONAL INVESTMENT POSITION (IIP)?* The international investment position (IIP) is a record of Bermuda residents investment abroad and nonresidents investment in Bermuda. The IIP shows the balance sheet position of financial claims on nonresidents as assets and non-residents claims on Bermuda as liabilities. The balance between these two positions represents the IIP; that is, an excess of assets over liabilities indicates a positive contribution to the nations net wealth and the reverse signifies a negative contribution. WHY IS THE IIP IMPORTANT TO MEASURE?* The composition of the IIP allows financial analysts to assess the vulnerability of the economy to changes in external market conditions. Details from the IIP can highlight mismatches in maturity of instruments and currency that can affect an economys ability to service debt in the face of shock; financial structure problems; solvency problems and dependency problems where overreliance on another economy can present contagion concerns. Therefore, the IIP allows for a more in depth analysis behind balance sheet weaknesses that can lead to a modern-day financial crisis. DEFINITIONS AND NOTES Direct Investment Direct investment represents the value of long-term capital owned in subsidiaries, affiliates and branches by investors in a position to exercise control or a significant degree of influence on the management of the enterprise. A measure of total investment controlled in Bermuda by foreign direct investors, or abroad by Bermudian direct investors, indicates the leverage type impact of ownership. Portfolio Investment Portfolio investment abroad by Bermuda residents and in Bermuda by non-residents is defined as the holding of debt or equity securities other than those included in direct investment or reserve assets. Financial Derivatives A financial derivative contract is a financial instrument whose value is based on the value of an underlying security such as a stock or bond, commodity or other financial instrument. Other investment Other investment is a residual category that includes positions and transactions other than those included in direct investment, portfolio investment, financial

derivatives and employee stock options (ESO), and reserve assets. Currency and deposits Currency consists of notes and coins that are of fixed nominal values and are issued or authorized by central banks, monetary authorities such as the BMA or governments. Deposits include all claims that are (a) on the central bank and other deposit-taking corporations; and (b) represented by evidence of deposit. Debt securities Debt securities are negotiable instruments serving as evidence of a debt. Loans Loans represent the extension of money from Bermuda residents to non-residents and vice versa, with an agreement that the money will be repaid. Insurance, pension, standardized guarantee schemes Insurance, pension, and standardized guarantee schemes all function as a form of redistribution of income and wealth mediated by financial institutions. Other accounts receivable/payable Other accounts receivable/payable consists of trade credit and advances between Bermuda and nonresidents and, other miscellaneous receivables/payables.

* Source: IMF Balance of Payments and International Investment Position Manual, Sixth Edition (BPM6)

Published by the Government of Bermuda August 2012 The Cabinet Office Department of Statistics Cedar Park Centre, 48 Cedar Avenue, Hamilton HM 11 P.O. Box HM 3015 Hamilton HM MX, Bermuda Tel: (441) 297-7761, Fax: (441) 295-8390 E-mail: statistics@gov.bm Website: www.statistics.gov.bm

DEPARTMENT OF STATISTICS PAGE 7

Das könnte Ihnen auch gefallen

- Balance of Payments & International Investment Position: For The Quarter Ended September 2012Dokument6 SeitenBalance of Payments & International Investment Position: For The Quarter Ended September 2012BermudanewsNoch keine Bewertungen

- Balance of Payments & International Investment Position: For The Quarter Ended June 2013Dokument6 SeitenBalance of Payments & International Investment Position: For The Quarter Ended June 2013BernewsAdminNoch keine Bewertungen

- BOP IIP - Q3 2014 PublicationDokument6 SeitenBOP IIP - Q3 2014 PublicationBernewsAdminNoch keine Bewertungen

- BOP IIP - Q1 2015 PublicationDokument6 SeitenBOP IIP - Q1 2015 PublicationAnonymous UpWci5Noch keine Bewertungen

- BOP IIP Publication - Q2 15Dokument6 SeitenBOP IIP Publication - Q2 15Anonymous UpWci5Noch keine Bewertungen

- Balance of Payments - Q4-14Dokument8 SeitenBalance of Payments - Q4-14Anonymous UpWci5Noch keine Bewertungen

- MBBBF PPTDokument71 SeitenMBBBF PPTamittrehan88Noch keine Bewertungen

- United States Securities and Exchange Commission: Washington, D.C. 20549Dokument15 SeitenUnited States Securities and Exchange Commission: Washington, D.C. 20549Damon MengNoch keine Bewertungen

- Itr AssignmentDokument8 SeitenItr AssignmentKoushikaNoch keine Bewertungen

- LG Electronics.2Q2012 Earnings PresentationDokument22 SeitenLG Electronics.2Q2012 Earnings PresentationSam_Ha_Noch keine Bewertungen

- Balance of PaymentsDokument6 SeitenBalance of PaymentsTonmoy BorahNoch keine Bewertungen

- AFSA Assign 1 Enron EditedDokument7 SeitenAFSA Assign 1 Enron EditedVarchas BansalNoch keine Bewertungen

- Manchester United PLC Risultati Q2 2013 (31.12.2013)Dokument13 SeitenManchester United PLC Risultati Q2 2013 (31.12.2013)Tifoso BilanciatoNoch keine Bewertungen

- Chapter 2-Flow of FundsDokument78 SeitenChapter 2-Flow of Fundsธชพร พรหมสีดาNoch keine Bewertungen

- Kordia Interim Report 2012Dokument11 SeitenKordia Interim Report 2012kordiaNZNoch keine Bewertungen

- L&T Reports 21% Revenue Growth in Q4 FY2012Dokument6 SeitenL&T Reports 21% Revenue Growth in Q4 FY2012blazegloryNoch keine Bewertungen

- FY2014 Analysis of Revenue and ExpenditureDokument28 SeitenFY2014 Analysis of Revenue and ExpenditureAzman JantanNoch keine Bewertungen

- CH 01 Review and Discussion Problems SolutionsDokument11 SeitenCH 01 Review and Discussion Problems SolutionsArman BeiramiNoch keine Bewertungen

- IFC AnnRep2013 Volume2 PDFDokument134 SeitenIFC AnnRep2013 Volume2 PDFcarlonewmannNoch keine Bewertungen

- Press Release Balance of Payments Performance in FY 2020-2021Dokument6 SeitenPress Release Balance of Payments Performance in FY 2020-2021rania tareqNoch keine Bewertungen

- Press Release Balance of Payments Performance in FY 2020-2021Dokument6 SeitenPress Release Balance of Payments Performance in FY 2020-2021Waleed ElsebaieNoch keine Bewertungen

- Q3 results and outlookDokument9 SeitenQ3 results and outlookSae Kyung JeonNoch keine Bewertungen

- Case Study 1 - Requirements - Travel Agency, All AbroadDokument12 SeitenCase Study 1 - Requirements - Travel Agency, All AbroadDinesh YogiNoch keine Bewertungen

- Amity University Kolkata IfmDokument8 SeitenAmity University Kolkata IfmPinki AgarwalNoch keine Bewertungen

- Financial Statement AnalysisDokument31 SeitenFinancial Statement AnalysisAnna MkrtichianNoch keine Bewertungen

- FXCM Q3 Slide DeckDokument20 SeitenFXCM Q3 Slide DeckRon FinbergNoch keine Bewertungen

- Du Pont AnalysisDokument6 SeitenDu Pont AnalysisprashantNoch keine Bewertungen

- Tax Memorandum 2012 FinalDokument58 SeitenTax Memorandum 2012 FinalAzka KhalidNoch keine Bewertungen

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Dokument50 SeitenChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888Noch keine Bewertungen

- Press Release Balance of Payments Performance in The First Half of FY 2021-2022Dokument5 SeitenPress Release Balance of Payments Performance in The First Half of FY 2021-2022Ebtsam MohamedNoch keine Bewertungen

- Business Tax and Tax Planning Very RelevantDokument106 SeitenBusiness Tax and Tax Planning Very RelevantGracie KiarieNoch keine Bewertungen

- Online Presentation 11-1-11Dokument18 SeitenOnline Presentation 11-1-11Hari HaranNoch keine Bewertungen

- Summary - Presidency1 BudgetDokument44 SeitenSummary - Presidency1 BudgetelrufaidotorgNoch keine Bewertungen

- MFM-103 Balance of Payment-Current ScenarioDokument8 SeitenMFM-103 Balance of Payment-Current ScenarioAhel Patrick VitsuNoch keine Bewertungen

- Kodak's 4Q10 S&EDokument10 SeitenKodak's 4Q10 S&Ecsv92Noch keine Bewertungen

- PhilipsFullAnnualReport2013 EnglishDokument250 SeitenPhilipsFullAnnualReport2013 Englishjasper laarmansNoch keine Bewertungen

- InfraDokument11 SeitenInfrakdoshi23Noch keine Bewertungen

- What Are Quantitative FactorsDokument5 SeitenWhat Are Quantitative FactorsJunaid CheemaNoch keine Bewertungen

- Fourth Quarter FY 2012-13 Performance Reportt 09-10-13Dokument10 SeitenFourth Quarter FY 2012-13 Performance Reportt 09-10-13L. A. PatersonNoch keine Bewertungen

- Second Quarter Fiscal Update and Economic Statement: November 2012Dokument16 SeitenSecond Quarter Fiscal Update and Economic Statement: November 2012pkGlobalNoch keine Bewertungen

- AIA - FY21 Financial ReportDokument86 SeitenAIA - FY21 Financial ReportAditya DeshpandeNoch keine Bewertungen

- APQ3FY12Dokument19 SeitenAPQ3FY12Abhigupta24Noch keine Bewertungen

- GDP Growth Picks Up in Second QuarterDokument1 SeiteGDP Growth Picks Up in Second QuartershoeseNoch keine Bewertungen

- FP Report 2012Dokument180 SeitenFP Report 2012CY LiuNoch keine Bewertungen

- Annual Report: Registered OfficeDokument312 SeitenAnnual Report: Registered OfficeDNoch keine Bewertungen

- Turnover CitycellDokument25 SeitenTurnover CitycellsurajitbijoyNoch keine Bewertungen

- Rogers Communications Reports Fourth Quarter and Full-Year 2020 RESULTSDokument42 SeitenRogers Communications Reports Fourth Quarter and Full-Year 2020 RESULTSParadise KunaNoch keine Bewertungen

- Public Opinion Polls No Substitute for Thoughtful Macro AnalysisDokument6 SeitenPublic Opinion Polls No Substitute for Thoughtful Macro AnalysisMeghna B RajNoch keine Bewertungen

- India BudgetDokument23 SeitenIndia BudgetrachnasworldNoch keine Bewertungen

- Lecture 1 CHP 1 No SolutionsDokument20 SeitenLecture 1 CHP 1 No SolutionsHarry2140Noch keine Bewertungen

- BoPs US 2018Dokument25 SeitenBoPs US 2018Thắng Nguyễn HuyNoch keine Bewertungen

- Balance of PaymentsDokument14 SeitenBalance of PaymentsJagannath PadhiNoch keine Bewertungen

- Major 1 Finance Project - 20461Dokument12 SeitenMajor 1 Finance Project - 20461Augum DuaNoch keine Bewertungen

- Appropriation Bill 2012Dokument15 SeitenAppropriation Bill 2012Benjamin FelixNoch keine Bewertungen

- Union Budget 2012-13 HighlightsDokument43 SeitenUnion Budget 2012-13 HighlightsSatishkumar VmNoch keine Bewertungen

- Budget 2015-16Dokument100 SeitenBudget 2015-16bazitNoch keine Bewertungen

- Japan's Balance of Payments For 2009: This Is An English Translation of The Japanese Original Released On March 5, 2010Dokument56 SeitenJapan's Balance of Payments For 2009: This Is An English Translation of The Japanese Original Released On March 5, 2010keziavalenniNoch keine Bewertungen

- Union Budget SimplifiedDokument5 SeitenUnion Budget SimplifiedParin ChawdaNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- 2015 XL Catlin BNAA Championships Schedule of EventsDokument6 Seiten2015 XL Catlin BNAA Championships Schedule of Eventspatburchall6278Noch keine Bewertungen

- 2015 Award ProgramDokument2 Seiten2015 Award Programpatburchall6278Noch keine Bewertungen

- Madison Digicel Road Race Aug 15 ResultsDokument2 SeitenMadison Digicel Road Race Aug 15 Resultspatburchall6278Noch keine Bewertungen

- Madison Digicel Criterium October 5th, 2014Dokument2 SeitenMadison Digicel Criterium October 5th, 2014patburchall6278Noch keine Bewertungen

- BASA Swimming Results Jan 3 2015Dokument3 SeitenBASA Swimming Results Jan 3 2015patburchall6278Noch keine Bewertungen

- Flying Colours Series Race 6 ResultsDokument1 SeiteFlying Colours Series Race 6 Resultspatburchall6278Noch keine Bewertungen

- Telford Mile ResultsDokument15 SeitenTelford Mile Resultspatburchall6278Noch keine Bewertungen

- 2015 Cruise Ship ScheduleDokument8 Seiten2015 Cruise Ship Schedulepatburchall6278Noch keine Bewertungen

- Public Bodies Reform Act 2014Dokument25 SeitenPublic Bodies Reform Act 2014patburchall6278Noch keine Bewertungen

- Eventcontent Hippoonline deDokument1 SeiteEventcontent Hippoonline depatburchall6278Noch keine Bewertungen

- TPC Judgment OrderDokument1 SeiteTPC Judgment Orderpatburchall6278Noch keine Bewertungen

- CURB Position Paper - Bermuda Immigration FINALDokument35 SeitenCURB Position Paper - Bermuda Immigration FINALpatburchall6278Noch keine Bewertungen

- 1St Innings: Runs Mins Balls 4's 6's FOW Batsman How Out BowlerDokument2 Seiten1St Innings: Runs Mins Balls 4's 6's FOW Batsman How Out Bowlerpatburchall6278Noch keine Bewertungen

- Bermuda Four Ball - Final ResultsDokument2 SeitenBermuda Four Ball - Final Resultspatburchall6278Noch keine Bewertungen

- (313332591) Commonwealth Games 2014Dokument1 Seite(313332591) Commonwealth Games 2014patburchall6278Noch keine Bewertungen

- Ninth Annual Report 2013Dokument36 SeitenNinth Annual Report 2013patburchall6278Noch keine Bewertungen

- Bermuda Immigration and Protection Amendment Act 2014 - Opposition BillDokument2 SeitenBermuda Immigration and Protection Amendment Act 2014 - Opposition Billpatburchall6278Noch keine Bewertungen

- Consumer Price Index - Apr 2014Dokument4 SeitenConsumer Price Index - Apr 2014patburchall6278Noch keine Bewertungen

- 2014 RMS Construction Road Race Championships ResultspdfDokument2 Seiten2014 RMS Construction Road Race Championships Resultspdfpatburchall6278Noch keine Bewertungen

- PRC FactsDokument2 SeitenPRC Factspatburchall6278Noch keine Bewertungen

- Final Race Results For BernewsDokument4 SeitenFinal Race Results For Bernewspatburchall6278Noch keine Bewertungen

- May 2014 Public Evaluations v1.1Dokument4 SeitenMay 2014 Public Evaluations v1.1patburchall6278Noch keine Bewertungen

- Bike 140615Dokument3 SeitenBike 140615patburchall6278Noch keine Bewertungen

- Aon Triathlon ResultsDokument6 SeitenAon Triathlon Resultspatburchall6278Noch keine Bewertungen

- BoBF Foundation Time Trial Championships 2014 (Category) All CompetitorsDokument3 SeitenBoBF Foundation Time Trial Championships 2014 (Category) All Competitorspatburchall6278Noch keine Bewertungen

- PAC - Misuse of Public Funds PAC REPORT - FINAL Dd. 6 JUNE 2014 (+ Written Submissions)Dokument12 SeitenPAC - Misuse of Public Funds PAC REPORT - FINAL Dd. 6 JUNE 2014 (+ Written Submissions)patburchall6278Noch keine Bewertungen

- 5385 Lmi 2014 FinalDokument8 Seiten5385 Lmi 2014 Finalpatburchall6278Noch keine Bewertungen

- Final Draft UKOTBS Update 2Dokument28 SeitenFinal Draft UKOTBS Update 2patburchall6278Noch keine Bewertungen

- 2014 FIFA World Cup Authorised Broadcaster Letter - BBC - BermudaDokument2 Seiten2014 FIFA World Cup Authorised Broadcaster Letter - BBC - Bermudapatburchall6278Noch keine Bewertungen

- Peoples Campaign LettersDokument4 SeitenPeoples Campaign Letterspatburchall6278Noch keine Bewertungen

- Hofa Iq Limiter Manual enDokument8 SeitenHofa Iq Limiter Manual enDrixNoch keine Bewertungen

- VRIL-Compendium-Vol-7-Dendritic Ground Systems-1992 PDFDokument204 SeitenVRIL-Compendium-Vol-7-Dendritic Ground Systems-1992 PDFAnton Dremlyuga100% (3)

- DTC CommandDokument3 SeitenDTC CommandAod CsgNoch keine Bewertungen

- Clovis Horse Sales Spring 2013 CatalogDokument56 SeitenClovis Horse Sales Spring 2013 CatalogClovis Livestock AuctionNoch keine Bewertungen

- Student Name Student Number Assessment Title Module Title Module Code Module Coordinator Tutor (If Applicable)Dokument32 SeitenStudent Name Student Number Assessment Title Module Title Module Code Module Coordinator Tutor (If Applicable)Exelligent Academic SolutionsNoch keine Bewertungen

- Bank AlfalahDokument62 SeitenBank AlfalahMuhammed Siddiq KhanNoch keine Bewertungen

- Vda. de Villanueva vs. JuicoDokument3 SeitenVda. de Villanueva vs. JuicoLucas Gabriel Johnson100% (1)

- TeramisoDokument1 SeiteTeramisoNasriyah SolaimanNoch keine Bewertungen

- Ciphertext-Policy Attribute-Based EncryptionDokument15 SeitenCiphertext-Policy Attribute-Based EncryptionJ_RameshNoch keine Bewertungen

- Cement Lined Piping SpecificationDokument167 SeitenCement Lined Piping SpecificationvenkateshwaranNoch keine Bewertungen

- BS Iec 61643-32-2017 - (2020-05-04 - 04-32-37 Am)Dokument46 SeitenBS Iec 61643-32-2017 - (2020-05-04 - 04-32-37 Am)Shaiful ShazwanNoch keine Bewertungen

- Final IEQC MICRODokument10 SeitenFinal IEQC MICROWMG NINJANoch keine Bewertungen

- M100 PD ENDokument2 SeitenM100 PD EN윤병택Noch keine Bewertungen

- Final Eligible Voters List North Zone 2017 118 1Dokument12 SeitenFinal Eligible Voters List North Zone 2017 118 1Bilal AhmedNoch keine Bewertungen

- Djiwandono, Indonesian Financial Crisis After Ten Years: Some Notes On Lessons Learned and ProspectsDokument12 SeitenDjiwandono, Indonesian Financial Crisis After Ten Years: Some Notes On Lessons Learned and ProspectsMuhammad Arief Billah100% (1)

- Ultrasonic Pulse Velocity or Rebound MeasurementDokument2 SeitenUltrasonic Pulse Velocity or Rebound MeasurementCristina CastilloNoch keine Bewertungen

- AeroCRS 5.95-Premier AirlinesDokument1 SeiteAeroCRS 5.95-Premier AirlinesmohamedNoch keine Bewertungen

- Factors Supporting ICT Use in ClassroomsDokument24 SeitenFactors Supporting ICT Use in ClassroomsSeshaadhrisTailoringNoch keine Bewertungen

- SPIE/COS Photonics Asia Abstract Submission Guidelines: Important DatesDokument1 SeiteSPIE/COS Photonics Asia Abstract Submission Guidelines: Important Dates李健民Noch keine Bewertungen

- Motion For Release On Own RecognizanceDokument4 SeitenMotion For Release On Own RecognizanceCaitlin Kintanar50% (2)

- Financial Management Toolkit For Recipients of Eu Funds For External ActionsDokument12 SeitenFinancial Management Toolkit For Recipients of Eu Funds For External ActionsGeorge BekatorosNoch keine Bewertungen

- Breadtalk AR 2011Dokument158 SeitenBreadtalk AR 2011Wong ZieNoch keine Bewertungen

- Manufacturing of Turbo GenratorsDokument27 SeitenManufacturing of Turbo Genratorspavan6754Noch keine Bewertungen

- (OBIEE11g) Integrating Oracle Business Intelligence Applications With Oracle E-Business Suite - Oracle Bi SolutionsDokument11 Seiten(OBIEE11g) Integrating Oracle Business Intelligence Applications With Oracle E-Business Suite - Oracle Bi SolutionsVenkatesh Ramiya Krishna MoorthyNoch keine Bewertungen

- Sheet 4Dokument3 SeitenSheet 4Apdo MustafaNoch keine Bewertungen

- CBP Form 434Dokument2 SeitenCBP Form 434Heather SoraparuNoch keine Bewertungen

- 325W Bifacial Mono PERC Double Glass ModuleDokument2 Seiten325W Bifacial Mono PERC Double Glass ModuleJosue Enriquez EguigurenNoch keine Bewertungen

- Boiler Automation Using PLCDokument91 SeitenBoiler Automation Using PLCKishor Mhaske100% (1)

- Speech ExamplesDokument6 SeitenSpeech Examplesjayz_mateo9762100% (1)

- E No Ad Release NotesDokument6 SeitenE No Ad Release NotesKostyantinBondarenkoNoch keine Bewertungen