Beruflich Dokumente

Kultur Dokumente

Douglas D. Brunelle and Renee C. Brunelle v. Federal National Mortgage Association, Green Tree Servicing, Merscorp, Bank of America, Northwest Trustee Services

Hochgeladen von

ChariseB2012Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Douglas D. Brunelle and Renee C. Brunelle v. Federal National Mortgage Association, Green Tree Servicing, Merscorp, Bank of America, Northwest Trustee Services

Hochgeladen von

ChariseB2012Copyright:

Verfügbare Formate

relevant transactions relating to the Real Property is annexed as Exhibit A hereto.

3. Brunelle and Mrs. Brunelle are being threatened by Defendants with a foreclosure

sale of their Real Property on Thursday, April 5, 2012, and this action is being brought to alert

the Defendants that they do not have the right to foreclose and sell for reasons set forth

hereinafter, and that anyone purchasing the Real Property at any such auction would be required

under law to reconvey the Real Property to Brunelle and Mrs. Brunelle, with possible liability of

Defendants for wrongful foreclosure damages. The Defendants are requested to refrain from

conducting the threatened auction (as a IIpractical injunction

ll

) to give the parties time to

determine their respective rights and obligations under what appears to be a securitized loan

governed under New York law.

4. Defendant, NORTHWEST TRUSTEE SERVICES, INC. (IiNorthwest

ll

), with

offices at 1241 E. Dyer Road - Suite 250, Santa Ana, California 92705, served and filed (on

December 5, 2011) a Notice of Default and Election to Sell the Real Property under the Deed of

Trust, identifying Defendant Green Tree Servicing, LLC as the IIcreditor

ll

Upon information

and belief, Northwest is transacting business in New York.

5. Defendant, GREEN TREE SERVICING, LLC (IIGreen Tree"), with offices at

P.O. Box 6172, Rapid City SD 57709 and 345 St. Peter Street, St. Paul MN 55102, claims to be

the current servicer of the loan, and upon information and belief is a "Special Servicer" under a

Pooling and Servicing Agreement executed in New York, New York (the "Pooling and Servicing

Agreement"), which regulates the activities of Green Tree as a Special Servicer under New York

law. Upon information and belief, Green Tree is transacting business in New York.

6. Defendant, BANK OF AMERICA, N.A. ("BOA"), with offices at 1 Bryant Park

- Bank of America Tower, New York NY 10036-6728, was servicer of the loan under the

2

... MERS holds only legal title to the interests granted by Borrower in this

Security Instrument, but, if necessary go comply with law or custom,

MERS (as nominee for Lender and Lender's successors and assigns) has the

right: to exercise any or all of those interests, including, but not limited to,

the right to foreclose and sell the Property; and to take any action required

of Lender including, but not limited to, releasing and canceling this Security

Instrument.

10. JOHN DOES 1-100,000, representing any persons (other than governmental

agencies) claiming any interest in (i) the real property located in San Diego County, California,

with an address of 8535 Paradise Valley Road - Unit No. 29, Spring Valley, California 91977, or

(ii) any note or deed of trust or mortgage signed by Douglas D. Brunelle and/or Renee C.

Brunelle and secured by such real property, or (iii) any securities secured in whole or in part by

any interests in such real property.

11. Local, State and/or Federal government agencies and/or authorities having or

possibly having an interest in the Real Property have not been named as Defendants, nor are they

intended to be any of the named John Does, since the interests of such agencieslauthorities will

not be adversely affected by Plaintiffs' within action to quiet title and for other relief.

{end of parties section]

Numerous and Conflicting

Claims of Ownership of the Note

12. The Note ($320,000 at 6.75% interest, 30-year, dated November 3, 2005) was

created through a refinancing during November, 2005 (see Exhibit A, page 4), and see Deed of

Trust recorded November 14, 2005 (Exhibit B hereto) and has apparently had at least the

following owners or purported owners:

A. First National Bank of Arizona (Exhibit A, 11122/05)

B. Bank One (Park Granada LLC) identified as creditor (Exhibit A, 12/5105)

4

C. Countrywide Home Loans, becoming loan servicer (Exhibit A, 111106), signaling

the probable securitization of the loan, involving various transfers of the Note [See Exhibit C

hereto, a Notice from Countrywide Home Loans to Brunelle advising Brunelle that loan

servicing rights were sold or transferred to Countrywide - account No. 115911929 - and that the

debt is owed to Bank One (Park Granada LLC)] which, upon information and belief, is an

affiliate of Countrywide and of BOA, and was engaged during 2005 and 2006 in securitizing

residential loans similar to Brunelle's loan.

1. To someone (called a "Depositor" in the securitization industry) buying a

group of notes for resale to a firm such as Merrill Lynch (which is also a Depositor as well as an

Underwriter);

2. To an underwriting firm such as Merrill Lynch,

3. To a group of underwriters,

4. To a REMIC trustee (or investor) under an Underwriting Agreement, Bill

of Sale, and Pooling and Servicing Agreement, all governed under New York Law, and taking

place in New York. Exhibit D is a copy of several pages from a Prospectus Supplement filed

with the SEC on January 31, 2006 by or with the participation of Countrywide, and upon

information and belief includes Brunelle's loan (Note and Mortgage).

D. BAC Home Loans Servicing, seeking to be named as mortgagee on the

Homeowners' Association master policy (Exhibit A, 7116/09, 7/16/10 and 7/18/11) and is loan

servicer for First National Bank of Arizona (Exhibit A, 7/1111)

E. FNMA, identified by MERSCORP as the creditor to whom the debt on the Note

is owed, purportedly (Exhibit A, 7/1/11).

F. Green Tree as new servicer, for FNMA (Exhibit A, 9/2-6/11)

5

G. Northwest, loan referred to Northwest for foreclosure (Exhibit A, 1118/11), with

the possibility that Northwest purchased the Note under the Pooling and Servicing Agreement.

13 This chain of title for the Note is lengthy and it is highly unlikely that all of the

assignments oftitle in the chain of title have taken place, and without defect (such as robo-

signing or failure to have a power of attorney when required).

14. Accordingly, the Plaintiffs seek a Practical Injunction to enable the facts to be

determined before any sale of the Real Property takes place.

15. In addition to the apparent failure of Northwest or FNMA to have valid title, there

are other claims by Brunelle which are defenses to a foreclosure and sale, such as

A. loan modification fraud,

B. failure to negotiate a loan workout in good faith,

C. failure to give the Plaintiffs an option to remain in their Real Property when they

are willing and able to pay more for the Real Property (through a refinancing at the present

market value at present interest rate, through one of the Defendant banks or other source of

financing);

D. the existence of credit default swaps or mortgage insurance which is a predatory

lending practice making the beneficiary unwilling to negotiate a loan modification in good faith,

because only through sale of the Real Property can the insurance be received; and

E. through possible payment of the Note in whole or in part -

all matters which need to be determined before any auction sale of the Real Property should

occur. Also,

F. there is an apparent failure to advertise the sale properly, which leads the Plaintiff

to believe that a favored person is expecting to be able to buy the Real Property at an artificially

6

low price with the insurance carrier picking up the added cost.

Damages

16. Plaintiffs have been damaged by reason of Defendants' activities in an amount of

$110,000 or more, including the payment of excessive interest on the Note and legal fees

($10,000 estimated).

17. Plaintiff is entitled to a cancellation of Defendants' purported security interest in

the Real Property and a release from any liability to Defendants.

18. These actions by Defendants and any John Does, demonstrate a high degree of

moral turpitude and wanton dishonesty as to imply a near criminal indifference to the civil

obligations owed to the Plaintiffs, and thus, entitle the Plaintiffs to punitive damages in an

amount equal to 9 times their actual damages, along with any such further relief as this court

deems just and proper.

19. Plaintiff is entitled to their actual damages, pre-judgment interest, costs and

attorneys' fees.

DEFINITIONS

20. A. "County and State for the Real Property" means San Diego County,

California.

B. "Lender" refers to FNMA or such other person who owns or purports to

own the Note and to BOA, Green Tree or anyone else functioning as servicer or special servicer

of the loan represented by the Note, MERSCORP, any securitization (or REMIC) Trustee, and

the successors and predecessors thereof, and the John Doe defendants who have any interest or

claimed interest in the Real Property, Note and Mortgage including the (i) servicers of the loan

under any pooling and service agreement and (ii) investors in or legal or beneficial owners of any

7

part of the Note and Mortgage. The tenn "Lender" refers to all of the entities having any of the

interests, rights or duties under the Note and Mortgage existing in the owner of the Note and

Mortgage prior to any securitization of them, and also to any single entity in the chain of title

prior to start of the securitization process.

C. "Note and Mortgage" refers to the Note executed by Brunelle dated

November 3,2005 in the amount of$320,000 payable to First National Bank of Arizona and

Deed of Trust dated in November, 2005 and recorded on November 14,2005 (Exhibit B), as to

which Northwest claims there is more than $320,000 due and owing by Brunelle to the Lender.

The Note calls for 6.75% interest and matures December 1,2035. The loan number is

3318005672, and the MERSCORP identification (MIN) number for the loan is 1001355-

4000063836-2. The Deed of Trust names First American Title Company as Trustee, and

MERSCORP (Le., Mortgage Electronic Registration Systems, Inc. or "MERS" as "beneficiary"

and "Nominee").

D. "Original Note and Mortgage" refers to the original (or "wet-ink") Note

and Mortgage for the $320,000 loan as executed by the Plaintiff (Exhibit B as to the Mortgage).

E. "Practical Injunction" refers to voluntary discontinuance of the

threatened foreclosure sale of the Real Property by Northwest and the actual or purported Lender

now scheduled for April 5,2012, pursuant to a notice and warning in this Complaint, to enable

the parties to this lawsuit to detennine their respective rights and obligations, avoid incurring

injury or additional injury to the Plaintiffs, and to make the settlement of this lawsuit possible

through a reasonable loan modification agreement.

F. "Present Value of the Real Property" is equal to approximately

$180,000.

8

G. "Real Property" refers to the real property (a townhouse condominium

unit) described in the Note and Mortgage, with the property address of 8535 Paradise Valley

Road - Unit No. 29, Spring Valley, California 91977.

ADDITIONAL FACTS

21. Because ofa reduction in Brunelle's monthly income due to the loss of his full-

time permanent employment on November 6, 2009 caused by a deterioration of the economy

(resulting in part from financial activities ofMERSCORP, FNMA, BOA, Green Tree, the Lender

and others), the Plaintiffs no longer were able to make the monthly payments on the Note,

resulting in multiple applications by the Plaintiffs (starting in December, 2010) to BOA and the

Lender for a loan modification agreement, all of which applications were turned down or

ignored.

22. BOA and/or the Lender had a publicly declared position that they would not

entertain any loan modification applications unless the mortgagor was already in default.

Brunelle's loan modification application was first submitted when Brunelle was still current on

the loan. The application was not being processed (Le., it was being summarily rejected) by

BOA because of this requirement, unknown to the Plaintiffs, upon information and belief.

Brunelle stopped making payments and on February 16,2011, Brunelle received from BOA's

predecessor (BAC Home Loan Servicing, LP) a notice of intent to accelerate the loan and on or

about December 1, 2011 Brunelle received from Northwest a "Notice of Default and Election to

Sell Under Deed of Trust.

23. Upon information and belief, the loan modification application program of the

Defendants is a fraud, and is not based on any objective standards consistently applied, and

instead is biased in favor of denying any relief to enable one or more of the Defendants to collect

9

upon some type of insurance against loss based on a decline in value of the Plaintiffs' Real

Property, and possibly to enable one or more Defendants to obtain recovery in excess of their

supposed loss, but only if the Plaintiffs are forced to sell their Real Property through foreclosure

auction and sale or through a short sale.

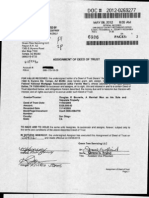

24. MERS executed an "Assignment of Deed of Trust", purportedly effective

September 1,2011, which was recorded in the Office of the San Diego County Clerk. Upon

infonnation and belief, this document is part of the chain oftitle and is defective as a matter of

law, because MERS never had the right under law to assign notes and deeds of trust.

25. One of the signatures in the purported chain of title is purportedly of a Linda

Green, whose name is notorious as a robo-signer, thereby invalidating the document. See

http://4closurefi'aud.orgl20 11/1 O/14I1inda-green-robo-signing-signing-scandal-hits-allen-county-recorder-john-

mcgauley-thousands-of-suspect-documents-including-his-ownl

26. Plaintiffs were advised by BOA and the Lender that they would not obtain a loan

modification agreement and, instead, that they should either consider a "Short Sale" or a "Deed

in Lieu of Foreclosure" and move out of their Real Property.

Securitization of the Note and

Mortgage by the Defendants

(Upon Information and Beliet)

27. Upon infonnation and belief, one of the Defendants or a predecessor in interest

securitized the Note and Mortgage secured by the Real Property by selling the Note and

Mortgage to one or more unknown investment banking entities, which then resold various

interests or tranches in the Note and Mortgage together with thousands of other notes and

mortgages to many thousands of investors throughout the world. The result is that the interests

10

of the original mortgagee have been divided up among many thousands of individuals and other

entities, which the Plaintiff defines herein as part of the "Lender" (see ~ 20-B above).

28. Upon information and belief, one or more of the Defendants or predecessor in

interest obtained insurance covering the collective securitized interests in the form of a credit

default swap or other derivative instrument or insurance policy from American International

Group or similar entity which was intended among other things to make the securitized investors

whole even if some of the homeowner-mortgagors (such as Brunelle) defaulted on his mortgage

and obtained no effective workout assistance from the Defendant, or anyone acquiring an interest

from any of them. In other words, the securitization arrangements entered into secretly by one or

more of the Defendants and/or predecessor in interest, undermined and destroyed the Lender's

duty to negotiate in good faith with a financially troubled homeowner-mortgagor (such as

Brunelle) to try to reach a reasonable workout or loan modification agreement to keep the

Plaintiffs and others similarly situated in their property especially when the Real Property

declined in value below the amount of the unpaid amount of the mortgage.

29. Through this secret securitization process, one or more of the Defendant and/or

predecessor in interest created a secret property interest in the Plaintiffs' Real Property which

would give the Defendants and predecessor a higher profit if they forced a resale of the Real

Property through foreclosure and sale, or through short sale, at the reduced value of the Real

Property rather than provide an option to the Plaintiffs or other homeowners-mortgagors (who

were unable to continue making monthly payments of their respective notes and mortgages on

their original terms) to permit them to stay in their Real Property if they refinanced their

mortgage by reducing the principal amount of the mortgage to the present, "under water" or

substantially reduced value of the Real Property, and set the interest rate to the current rate of

11

interest for such a transaction (about 4.1 %), assuming the Plaintiff (or others similarly situated)

were able to service the loan as restructured.

30. Defendants and predecessor in interest did not offer to the Plaintiffs any

opportunity to remain in their Real Property through any restructuring of the loan as described in

the preceding paragraph, and (because of Brunelle's inability to afford paying the Note and

Mortgage as currently written) are being threatened with foreclosure for not being offered a loan

modification agreement based on the present value of the property (the "Real Property's Present

Market Value") and the present rate of interest for residential home loans of this type

(approximately 4.1 %).

31. Defendants should not be able to sell the Real Property at auction to the Plaintiffs'

next door neighbor when the Plaintiffs are able to service a mortgage based on that reduced

value.

32. Defendants were active in foreclosing on the mortgages of other homeowners

throughout the United States instead of offering them the opportunity to stay in their property

through a loan modification agreement based on the Real Property's Present Market Value and

present interest rates. These activities of Defendants constitute a continuing threat against the

Plaintiffs for Defendants to commence foreclosure proceedings against the Plaintiffs, while the

Defendants are admitting that they are willing to sell the Plaintiffs' Real Property at a distress

sale based on the Real Property's Present Market Value. Such auction sale price generally would

result in less than the Present Market Value, but Defendants are not willing to let the Plaintiffs or

Brunelle restructure the mortgage with a principal amount of loan based on the Real Property's

Present Market Value.

12

33. This unwillingness is a predatory lending practice and a defense to any

foreclosure lawsuit or non-judicial foreclosure by the Defendants or successors in interest, and

entitles the Plaintiffs to a declaratory judgment that the Defendants and their predecessors or

successors in interest (including the Lender) have no enforceable claim against Brunelle or the

Plaintiffs' Real Property.

34. Any sale of the Real Property by the Defendant or Lender as threatened for April

5,2012 would be wrongful, without right under law, and require the purchaser to return the Real

Property to the Plaintiffs, in accordance with the recent Ibanez decision by the Supreme Judicial

Court in Massachusetts, and subject the selling Defendant(s) to liability (a) to the Plaintiffs for

wrongful foreclosure and (b) to any innocent purchasers for damages caused by the wrongful

sale to them.

35. Upon information and belief, the Lender and/or the investors, if any, have a

requirement that a homeowner be in default before they will consider any loan modification

application. Such requirement jeopardizes the homeowner's credit rating and creates a risk of

causing injury to any business activities and employment aspirations of the homeowners. It is a

predatory lending practice by the Defendants, amounting to unclean hands, which is a defense to

any judicial foreclosure action or non-judicial foreclosure by them.

Fraudulent Loan Modification Program

36. Upon information and belief, BOA and the Lender have had, and continue to

have, a fraudulent loan modification program, by pretending to offer the possibility of a loan

modification agreement to Plaintiffs and other homeowners while simultaneously pursuing or

threatening to foreclose against the same homeowners, as part of a false and misleading "dual-

track" process used by the Lender to lure mortgagor homeowners into defaulting on their

13

mortgages and any foreclosure actions. After encouraging homeowners to go into default, the

Lender then denies applications for loan modification and sells the mortgaged property without

judicial proceedings in most states, and after lulling homeowners into defaulting in foreclosure

actions against them in the other states. In this way, the Lender acquires the mortgaged

residential property at a distress price substantially lower than the actual market value for the

mortgaged property, to cash in on the secret, illegal insurance arrangements which encourage

throwing homeowners off their property through sale of the property rather than by giving

homeowners (including the Plaintiffs) a needed and deserved loan modification agreement to

keep them in their property.

37. The Plaintiff has applied for and been rejected by BOA and the Lender for a loan

modification agreement, without justification.

38. Upon information and belief, the dual-track process that BOA and the Lender

have pursued, and continue to pursue or would pursue, in its business dealings with the

homeowners including the Plaintiffs (and thousands of other similarly situated mortgagor

homeowners throughout the United States) is not, and is not intended as, a good faith attempt to

offer and negotiate a loan modification agreement. Instead, it is a ruse used by BOA and the

Lender to make the Plaintiffs and others similarly situated believe that there is a reasonable

opportunity for them to obtain a reasonable loan modification agreement when in fact there is no

such opportunity. The Lender has no intention of granting a loan modification agreement in the

vast majority of instances and instead is looking to create a default, to result in sale of the

property as described above, for the reasons set forth above.

39. The dual-track process is designed to create the appearance that BOA and the

Lender are working towards a resolution of the financial problem ofthe Plaintiffs and other

14

homeowners (with a loan modification agreement) while, behind the scenes, they are

aggressively pursuing or planning to pursue foreclosure and sale. The Lender and BOA are

leading the Plaintiffs and others similarly situated to believe that there is hope for a loan

modification agreement and no threat of foreclosure to lure them into going into default. But this

is not true. The Lender lulls the Plaintiff and others into a false sense of security (and deterring

them from seeking alternative refinancing or an extended period in which to sell their property at

the highest price) by pretending there is hope for a reasonable modification agreement when in

fact there is no hope. The Lender has no intention of granting any loan modification agreement

and plans to use the default to sell the Plaintiffs' and most other homeowners' property instead of

permitting the Plaintiffs and other homeowners to remain in their property through a reasonable

loan modification agreement.

40. This dual-track process is part of BOA's and the Lender's national business policy

for dealing with foreclosure actions in the judicial foreclosure states (including New York,

Florida, New Jersey and about 20 other states), and is the subject of various foreclosure-fraud,

class action lawsuits against BOA, Mellon (and other banks) in states including Maryland, New

Jersey and Massachusetts, as well as a federal suit in the Southern District of Indiana alleging

violations of RICO laws (see Index No. 10-01303).

AS AND FOR A FIRST CAUSE OF ACTION

Declaratory Judgment, Injunction, Damages - Predatory Lending Practice - Failure to

Offer a Loan Modification Agreement in Principal Amount Equal to Present Value of the

Real Property and Present Market Interest Rate

(against Defendants FNMA, Nortllwest, BOA, Green Tree and Jolm Does)

41. Plaintiffs repeat and reallege each of the allegations set forth above as if fully set

forth herein.

IS

42 The Plaintiffs have a financial hardship and are unable to service the existing

Note and Mortgage based on the outstanding principal amount of more than $320,000, as has

been known to the Defendants (including the Lender) at all relevant times, through information

provided by Plaintiffs to BOA (or the Lender).

43. The Plaintiffs have lived in the Real Property since 2002 (purchased 9 years after

Brunelle's retirement from the U.S. Army) and want to continue doing so, and believe that the

loss of their property through foreclosure sale could result in a a lower life expectancy through

anxiety, despair and failure to stop the illegal, predatory and destructive practices of the

defendants, when all they need to do is grant a reasonable loan modification agreement - and

wind up with as much or significantly more value than they can lawfully obtain through

foreclosure and sale. The Plaintiffs have the capacity to pay a reasonable loan modification

agreement and as such they should have an option to remain in the Real Property by being able

to give to the appropriate Defendant(s) through a loan modification agreement at the current

interest rate an amount in value equal to or greater than the amount the Defendant(s) can lawfully

realize through their threatened foreclosure on April 5, 2012.

44. The Plaintiffs have the financial capacity to service a restructured mortgage loan

in the principal amount of the Real Property's Present Market Value, at the present market rate

of interest of about 4.1 %.

45. Because the Plaintiffs are unable to service the Note and Mortgage as they are

presently structured, the Plaintiffs are threatened with the loss of the Real Property through said

scheduled foreclosure and sale, in which case the Defendants (or the Lender) will only obtain, at

most, the Real Property's Present Market Value, and an opportunity to finance a new owner of

the property at the current market rate of interest.

16

46. The Plaintiffs are willing and able to pay to the Lender andlor their successors in

interest the full amount which they are lawfully able to obtain through a foreclosure (through

refinancing with one of the Defendants or through another bank), and the failure of the

Defendant (or the Lender) to provide a right of first refusal or offer for the Plaintiffs to remain in

their Real Property under these terms is a predatory lending practice, and is a defense to any

foreclosure action, and disables Defendants (or the Lender and their successors) from asserting

any rights they may have otherwise as to the Plaintiffs' mortgaged property.

Relief

47. Plaintiff are entitled to a declaratory judgment, under CPLR 3001 AND 3017, that

A. The Lender and any successors in interest have forfeited their rights under the

Note and Mortgage to foreclose and sell the Real Property by their failure to provide the

Plaintiffs with the foregoing option to remain in the Real Property;

B. The documents on which the Lender, as well as anyone taking from or through

the Lender, are basing their attempts to collect mortgage payments from Brunelle concerning the

Real Property are invalid and unenforceable;

C. Plaintiffs' interest in the Real Property is without any lien or encumbrance of any

of the Lender or anyone with an alleged interest from or through the Lender.

48. Plaintiffs are entitled to a preliminary and permanent injunction against the

Lender and anyone taking from or through the Lender

A. prohibiting them from offering, selling, transferring, changing or otherwise

dealing with any actual or alleged interests in the Note and Mortgage or in the Plaintiffs' Real

Property; and

17

B. Directing the Lender to seek removal, deletion or expunging from the County

Clerk's records in the County and State for the Real Property, or elsewhere in such State, all

documents (including mortgages, deeds of trust, UCCI financing statements, notices of lis

pendens or default or auction sale) filed against the Real Property by the Lender or any

predecessors or successors thereto.

49. Plaintiffs have been damaged by reason of the Lender's activities in an amount of

$145,000 or more, including the payment of excessive interest on the Note and Mortgage

($135,000) and legal fees ($10,000 estimated).

50. Plaintiffs are entitled to a cancellation of the Lender's security interest in the Real

Property and a release from any liability to the Lender.

51. These actions by the Lender, including the named Defendants and the John Doe

investors, demonstrate a high degree of moral turpitude and wanton dishonesty as to imply a near

criminal indifference to the civil obligations owed to the Plaintiffs, and thus, entitle the Plaintiffs

to punitive damages in an amount equal to 9 times their actual damages, along with any such

further relief as this court deems just and proper.

52. Plaintiffs are entitled to their actual damages, pre-judgment interest, costs and

attorneys' fees.

18

AS AND FOR A SECOND CAUSE OF ACTION

Declaratory Judgment, Injunction, Damages: Defendants Lack Standing to Demand or

Receive Mortgage Payments or to Foreclose on the Mortgage for Failure to Own the

Original Note and Mortgage

(against Defendants FNMA, Nortilwest, BOA, Green Tree, MERSCORP and Jolm Does)

53. Plaintiffs repeat and reallege each of the allegations set forth above as if fully set

forth herein.

54. Upon information and belief, none of the Defendants has the original Note or

Mortgage and that the Note and Mortgage have been destroyed intentionally or transferred to

persons unknown as part of a complex securitization process.

55. Upon information and belief, there are one or more unknown persons or entities

with an interest in one or more of the Note and Mortgage who could make claim against

Plaintiff Brunelle and the Real Property superior to the alleged claims of the Lender.

Relief

56. Plaintiffs are entitled to a declaratory judgment, under CPLR 3001 AND 3017,

that

A. The Defendants and any successors in interest have no enforceable interest in the

Note and/or Mortgage or the Real Property;

B. The documents on which the Lender, as well as anyone taking from or through

the Lender, is basing its attempts to collect mortgage payments from Plaintiff Brunelle

concerning the Real Property are invalid and unenforceable;

C. Plaintiffs' interest in the Real Property is without any lien or encumbrance of the

Lender or anyone with an alleged interest from or through the Lender or any of the Defendants.

19

D. The Lender and anyone taking from or through the Lender or any of the

Defendants are enjoined permanently from offering, selling, transferring, changing or otherwise

dealing with any actual or alleged interests in the Note and Mortgage or in the Plaintiffs' Real

Property; and

E. The Defendants are directed to seek removal, deletion or expunging from the

County Clerk's records in the County and State for the Real Property, or elsewhere in the State,

all documents (including mortgages, deeds of trust, VCC 1 financing statements, notices of lis

pendens or default or auction sale) filed against the Real Property by the Lender or any

successors thereto.

57. Plaintiffs have been damaged by reason of the Lender's activities in an amount of

$145,000 or more, including payment of excessive interest ($135,000 or more) and legal

expenses ($10,000 or more).

58. These actions by the Lender, including the name Defendants and the John Doe

investors, demonstrate a high degree of moral turpitude and wanton dishonesty as to imply a near

criminal indifference to the civil obligations owed to the Plaintiffs, and thus, entitle the Plaintiffs

to punitive damages in an amount equal to 9 times their actual damages, along with any such

further relief as this court deems just and proper.

59. Plaintiffs are entitled to their actual damages, pre-jUdgment interest, costs and

attorneys' fees.

20

AS AND FOR A THIRD CAUSE OF ACTION

Breach of Contract for Securitizing Plaintiff's Note and Mortgage

(against Defendants FNMA, Nortl,west, BOA, Green Tree, MERSCORP and Jolm Does)

60. Plaintiffs repeat and reallege each of the allegations set forth above as if fully set

forth herein, upon information and belief.

61. Upon information and belief, one of the Lender's predecessors [probably

Countrywide, a New York corporation, or its affiliate, Bank One (Park Granada LLC)] sold

and/or transferred its interest to a third-party as part of a securitization process for the Real

Property, Note and Mortgage. See Exhibit C.

62. The Lender's sale and transfer of its interest in the original Note and Mortgage,

upon information and belief, was accomplished by and through the pooling together of the note

and mortgage with other residential notes and mortgages for the purpose of creating publicly

marketable securities that were subsequently sold and/or resold to many of the John Does.

63. The securitization of such Note and Mortgage amounted to a breach of contract

with Plaintiff Brunelle for various reasons including the loss of an entity with an interest in

providing a reasonable loan modification agreement to the Plaintiffs, the secret insurance

arrangements without an insurable interest as alleged above, and leaving the Plaintiffs unable to

ascertain who is in fact the rightful owner of the Note and Mortgage, creating the risk that

multiple parties, including but not limited to the Defendants may pursue multiple actions to

collect mortgage payments based on the Note and Mortgage.

64. This securitization of the Note and Mortgage also amounts to a breach of contract

because it has resulted in the unlawful interference, by Defendants, with Plaintiffs' right to

peaceful and undisturbed possession and use of the Real Property through foreclosure, auction

21

and eviction and through threats of lawsuits from John Does and their potentially thousands of

successors in interest.

Relief

65. Plaintiffs are entitled to a declaratory judgment, under CPLR 3001 AND 3017,

that

A. The Lender has no enforceable interest in the Note and/or Mortgage or the Real

Property;

B. The documents on which the Lender, as well as anyone taking from or through

the Lender, is basing its monthly receipt of mortgage payments from Plaintiff Brunelle

concerning the Real Property are invalid and unenforceable;

C. Plaintiffs' interest in the Real Property is without any lien or encumbrance of the

Lender or anyone with an alleged interest from or through the Lender or any of the Defendants.

D. The Lender and anyone taking from or through the Lender or any of the

Defendants are enjoined pennanently from offering, selling, transferring, changing or otherwise

dealing with any actual or alleged interests in the Note and Mortgage or in the Plaintiffs' Real

Property; and

E. The Defendants are directed to seek removal, deletion or expunging from the

County Clerk's records in the County and State for the Real Property, or elsewhere in the State,

all documents (including mortgages, deeds of trust, VCC! financing statements, notices of lis

pendens or default or auction sale) filed against the Real Property by the Lender or any

successors thereto.

22

66. Plaintiffs have been damaged by reason of the Lender's activities in an amount of

$145,000 or more, including payment of excessive interest ($135,000 or more) and legal

expenses ($10,000 or more).

67. These actions by the Lender, including the named Defendants and the John Doe

investors, demonstrate a high degree of moral turpitude and wanton dishonesty as to imply a near

criminal indifference to the civil obligations owed to the Plaintiffs, and thus, entitle the Plaintiffs

to punitive damages in an amount equal to 9 times their actual damages, along with any such

further relief as this court deems just and proper.

68. Plaintiffs are entitled to their actual damages, pre-judgment interest, costs and

attorneys' fees.

AS AND FOR A FOURTH CAUSE OF ACTION

Fraud for Demanding and Collecting Monthly

Mortgage Payments under False Pretenses

(plaintiff Brunelle against Defendants FNMA, BOA, Green Tree and Jolin Does)

69. Plaintiff repeats and realleges each of the allegations set forth above as if fully set

forth herein, and further alleges, upon information and belief, that the activities of the Lender

amount to the collection of monthly mortgage payments from Brunelle under false pretenses.

70. From inception to the present, the above-identified Defendants (hereinafter, the

"Lender"), through agents andlor predecessors in interest, made false representations of material

fact by demanding (and thereafter collecting) mortgage payments from Brunelle.

71. Each time the Lender, or any of its predecessors or successors in interest, sent its

monthly mortgage statement to Plaintiff Brunelle, it has represented, impliedly or literally, that it

23

has the right to demand and collect such payments under the Note and Mortgage concerning the

Real Property.

72. Upon infonnation and belief, each such representation was a false representation

of material fact.

73. These representations of material fact by the Lender were made knowingly and

for the purpose of inducing said Plaintiff to make the mortgage payments to the Lender and/or its

predecessor in interest.

74. The Lender acted with scienter, and intended that Brunelle rely on the

representations.

75. Plaintiff Brunelle reasonably relied on each of such representations to his

detriment, by making the requested mortgage payments to the Lender or any of its predecessors.

76. The Lender knew the representations to be false at the time they were made to

Plaintiff Brunelle.

77. Plaintiff Brunelle reasonably relied on these false representations made by the

Lender when making payments on the Note and Mortgage between inception and the present.

78. The Lender collected payments resulting from PlaintiffBrunelle's reasonable

reliance despite knowing that the Lender was not, and is not, and was not representing, the

rightful owner in possession of the Original of the set of the Note and Mortgage involved, and

thus, was not, and is not, in fact entitled to collect such payments from said Plaintiff as to the

Note and Mortgage.

79. The payments to be made by Plaintiff Brunelle were demanded by the Lender

under false pretenses.

24

80. Plaintiff Brunelle has been injured by his reasonable reliance because he made

payments on the Note and Mortgage to Defendants BOA, FNMA and possibly one or more of

the John Doe investors, which entities (upon information and belief) are not the owner in

possession of the Note and Mortgage, and do not represent the owner or possessor of such, and

as a result, are not in fact entitled to collect payment for the Note and Mortgage.

Relief

81. In light of these actions by the Lender, Plaintiff Brunelle is entitled to a refund of

all payments made by him to such defendants, amounting to about $135,000, plus pre-judgment

interest.

82. These actions by the Lender, including Defendants FNMA, BOA and the John

Doe investors, demonstrate a high degree of moral turpitude and wanton dishonesty as to imply a

near criminal indifference to the civil obligations owed to said Plaintiff, and thus, entitle said

Plaintiff to punitive damages in an amount equal to 9 times his actual damages, along with any

such further relief as this court deems just and proper.

AS AND FOR A FIFTH CAUSE OF ACTION

Violation of 349 of the New York General Business Law and

California Business & Professional Code 17200, 17500

(Plaintiffs against Defendants FNMA, BOA, Green Tree, MERSCORP and Jolm Does)

83. Plaintiffs repeat and reallege each of the allegations set forth above, as if fully set

forth herein.

84. The activities of the Lender as alleged in the preceding causes of action constitute

deceptive acts and practices in the conduct of such defendants' businesses and furnishing of

25

services in the State of New York and similar California statutes, the California Business &

Professional Code 17200, 17500 (the "California Statute").

Relief

85. The activities described in the preceding causes of action are prohibited by 349

of the New York General Business Law and the California Statute, and thus, entitle Plaintiffs to

damages and relief as set forth in said sections of the New York General Business Law and the

California Statute, with any other and further relief as this Court deems just and proper.

86. Section 349(h) of the New York General Business Law provides:

(h) In addition to the right of action granted to the attorney general

pursuant to this section, any person who has been injured by reason of

any violation of this section may bring an action in his own name to

enjoin such unlawful act or practice, an action to recover his actual

damages or fifty dollars, whichever is greater, or both such actions.

The court may, in its discretion, increase the award of damages to an

amount not to exceed three times the actual damages up to one thousand

dollars, if the court finds the defendant willfully or knowingly

violated this section. The court may award reasonable attorney's fees to

a prevailing plaintiff.

87. Under 349(h), the Plaintiff is entitled to and requests a preliminary and

permanent injunction against Defendants FNMA, Green Tree and Northwest and the John Doe

investors to order them to stop these unlawful practices, and for an award of actual damages

caused to the Plaintiffs, and $1,000 in increased damages upon a finding that Defendants acted

willfully and knowingly to violate this provision of law. Also, Plaintiffs are entitled to an award

of attorney's fees.

88. Under the California Statute. the Defendants are prohibited from performing any

unlawful, unfair or fraudulent business act or practice and unfair, deceptive, untrue or misleading

advertising and any act prohibited by Chapter 1 (commencing with Section 17500) of Part 3 of

26

Division 7 of the Business and Professions Code and from publishing "false advertisements"

under 17500 of the California Business & Professional Code.

89. Defendants' activities are in violation of the California Statute, causing damage to

the Plaintiffs, in the amount of $1 0,000 or more, to be proven with certainty at the time of trial.

AS AND FOR A SIXTH CAUSE OF ACTION

Manipulating Securities and Real Estate Markets Causing

Frustration of Plaintiff Brunelle's Performance under the Note and Mortgage

(Brunelle against Defendants FNMA, BOA, Green Tree, MERSCORP and John Does)

90. Plaintiff Brunelle repeats and realleges each of the allegations set forth above, as

if fully set forth herein.

91. The Lender participated with other major banks and mortgage lenders to lend

money to unqualified borrowers (i.e., "subprime loans") or through predatory loans at

substantially higher interest rates and risks than the average mortgage loan and immediately

resell these high-risk subprime and/or predatory loans (including the loan to Plaintiff Brunelle) to

investment banking firms such as Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill

Lynch and Citigroup, which packaged them for worldwide resale as securities.

92. By making (subprime and/or predatory) home loans to unqualified borrowers such

as the Plaintiff, and adding transactional costs, fees and markups upon securitized resales, an

artificially high demand and price was created for residential homes, causing the market value of

real estate in the U.S. to increase substantially and artificially.

93. Because many of the loans were bad and predatory (including the loan to Plaintiff

Brunelle), the securities market collapsed and the market value of real estate also collapsed,

causing an economic crisis (Le., a severe recession or a depression) in the United States and

27

elsewhere in the world, and created a financial hardship for the Plaintiff and made him unable to

perform Under the Note and Mortgage as written.

94. The physical location where this securitization process centered, and at which

numerous witnesses and documentary evidence are located, is in New York County, New York,

the venue selected for this action by the Plaintiffs.

95. Upon infonnation and belief, the Lender was aware that the three main credit

rating agencies (Moody's, S&P and Fitch) were giving undeserved high credit ratings to the

securitization offerings, and that the resales were not investment grade securities, and that the

market for these securities and for real estate was being manipulated by the Lender and the

others participating with them.

96. Upon information and belief, the Lender, including each of the named Defendants

including John Does, was aware that the investment banking firms packaging and reselling the

securities were actively taking investment positions and insurance-type derivatives betting

against such securities and to profit from an expected decline in the value of the securities being

packaged and sold.

Relief

97. The activities of the Lender, including the named Defendants, amount to a

defense, or partial defense, for the Plaintiff as to the Lender's threatened foreclosure auction and

sale, at least to the extent that the value of the Real Estate declined, and the principal amount of

the loan which was predatory, and as to the predatory interest rate being charged on the Note and

Mortgage.

98. Plaintiff is entitled to a reduction in the principal amount of the Note and

Mortgage to the Real Property's Present Market Value, and a reduction of his mortgage interest

28

rate to the present market rate for new mortgages being created at this time (approximately

4.1%).

99. Brunelle alone or both Plaintiffs would be able to service the loan if modified in

accordance with the previous paragraph.

100. Plaintiff is entitled to a judgment of reformation to reform the Note and Mortgage

as set forth in two paragraphs above.

AS AND FOR AN SEVENTH CAUSE OF ACTION

Action to Quiet Title

(Plaintiffs against Defendants FNMA, BOA, Greell Tree, MERSCORP, Nortllwest "lid Jolin Does)

101. Plaintiffs repeat and reallege each of the allegations set forth above, as if fully set

forth herein.

102. Plaintiffs are the lawful owner of record of the Real Property.

103. The Lender, including the named Defendants and the John Doe investors, claim,

or might claim to have, a mortgage, security or other interests in the Real Property adverse to the

Plaintiffs' interests.

104. Upon information and belief, neither the Lender nor any of these Defendants has

any actionable or enforceable interest in the Real Property because none of them has produced

proof that it owns and/or possesses the original Note and Mortgage.

105. Upon information and belief, none of these named Defendants, which are the only

ones known to the Plaintiffs, is incompetent.

106. All other parties whose alleged interest in the Real Property may be affected by

this litigation have been identified as John Does or non-parties (see ~ ~ 10-11 above) [which have

29

not been made Defendants to this action because their respective interests in the Property will not

be affected by the outcome of this litigation].

Dam:tgcs

107. Plaintiffs are being threatened with Ihe loss of their Real Property, and with the

immediate lowering of their comparatively favorable credit rating, due to the wrongful and

illegal demands for monthly payment by Green Tree on behalf of the Lender, including the

named Defendants and the John Doe investors and their respective agents.

108. Plaintiffs are also being damaged by having to expend money and time bringing

suit to stop these and other possible Defendants from wrongfully taking over the Real Property

under false pretenses. Upon information and b e l i e l ~ Plaintiffs' attorneys' fees and out-of-pocket

expenses will amount to more than $10,000, and loss by reason of excessive or inappropriate

interest charges has already exceeded $ 110,000.

109. Upon informati on and belieC the activities of the Lender, including the named

Defendants and the John Doe investors and their respective unknown principals and agents, are

willful and carried Ollt as part of a plan of divesting homeowners (including the Plaintiffs) of the

title to their real property under false pretenses for the purpose of repossessing these properties

and subsequently offering them for sale at a public auction, irrespective of valid defenses made

known to them by the homeowners and the other illegal purposes alleged above, all for the

purpose of crcating unnecessary costs and uncertainty for victimized property owncrs. When

sllccessful, the foregoing schemc has the result of creating illegal profits that would not

otherwi se be realized by these Defendants and others acting in concert with them (such as

persons buying at suppressed auction sales).

30

110. Upon information and belief, many hundreds of thousands or millions of

homeowners in the United States are being victimized by this scheme being perpetrated by the

Lender, including the named Defendants and the John Doe investors, and unknown John Doe

principals.

Ill. The Lender is using these false pretenses and illegal practices to coerce its victims

into making excessively high, monthly mortgage payments, and when the victims refuse to make

such excessive payments, the Lender uses a "dual-track process" of offering a loan modification

to its victims (with no real intention or significant possibility of actually granting the loan

modification agreement) while another unknown Defendant (acting in concert) or the same

Defendant simultaneously pursues aggressive collection practices and foreclosure proceedings

against the victims (including the Plaintiffs herein) with little or no notice to any of the aggrieved

parties.

Relief

112. Plaintiffs are entitled to a final judgment in this action under the New York CPLR

3001 and 3017 and New York common law for the quieting oftitle to the Real Property, as

follows:

A. Declaring invalid and unenforceable any claim or interest to the Real Property by

any of the Defendants, as well as anyone taking from or through the Lender; and

B. Forever barring the Lender along with anyone taking from or through the Lender

from asserting or reasserting any note, mortgage, security or other interest in the Real Property;

and

31

116. The named Defendants and John Does had a policy of not entering into loan

modification agreements by a series of evasive tactics, including falsely claimed non-receipt or

loss of documents, requiring unnecessary documents, delaying decisions, requiring mortgagors

to deal with telephone representatives who did not know how to help the mortgagor-callers,

falsely claiming that papers were submitted too late, failing to apply industry standards of review

of loan modification applications, wearing out the mortgagor until he/she stopped sending loan

modification papers to the Defendants, giving modifications of small, inconsequential dollar

amounts, refusing to reduce principal amounts, failing to give credit to the loan for payments

made on account of trial modifications, deceiving mortgagors by calling a forbearance agreement

a "loan modification agreement", failing to negotiate a workout or loan modification agreement

in good faith, failing to abide by industry custom and usage of attempting to salvage a loan

through a workout or loan modification agreement, failing to tell borrowers where they could

find out the information they sought, failing to tell borrowers that the Defendants could not prove

chain of title to the Note and Mortgage, requiring the mortgagor to stop paying the mortgage and

go into default (thus exposing the mortgagor to foreclosure and sale automatically, without any

legal protection) and a variety of other tricks and techniques to ensure that a small percentage of

deserving applicants ever obtained a reasonable loan modification agreement, and instead would

result in a loss of the property to the homeowner-mortgagor, through auction sale or short sale.

117. Upon information and belief another reason for not granting and not wanting to

grant loan modification agreements is that doing so would require the Defendants to decrease the

stated accounting value of the loan from the principal amount of the note ($320,000) to the

Present Value of the Real Property ($180,000).

33

118. Another predatory practice is requiring homeowners to spell out "hardship" and

then use the hardship to deny a loan modification agreement. Defendants should be advising

their mortgagors of the consequences of overstating the alleged hardships, which is the denial of

their loan modification agreement applications.

119. Defendants' loan modification program is a fraud, for the foregoing reasons and

the additional reasons set forth below.

120. BOA failed to tell the Plaintiffs that BOA had no interest in entering into a loan

modification agreement because it wanted Brunelle to sell the Real Property, through foreclosure

auction or short sale, to enable Defendants to collect on insurance they had purchased to ensure

against default (which BOA had actually encouraged and created) or to cover any loss to the

mortgagee (or investors) by reason of a decline in value of the Real Property below the amount

owed on the Note.

121. The insurance arrangements were unknown to the Plaintiffs and constitute a

conflict of interest, because the insurance discourages the Defendants from performing their duty

under the loan agreement of negotiating in good faith to try to reach a workout or loan

modification agreement for a troubled borrower.

122. The Defendants' activities amount to a predatory lending practice designed to

cause mortgagors to lose their mortgaged properties through short sale or foreclosure sale,

instead of being able to retain ownership and possession through a loan modification agreement.

Relief

123. This is a predatory lending practice and the Plaintiffs are entitled to cancellation

of the loan (including the Note and Mortgage) as a consequence.

34

4. As to the Fourth Cause of Action - the relief described in ~ ~ 81-82 above.

5. As to the Fifth Cause of Action - the relief described in ~ ~ 85-89 above.

6. As to the Sixth Cause of Action - the relief described in ~ ~ 97-100 above.

7. As to the Seventh Cause of Action - the relief described in ~ ~ 112-114 above.

8. As to the Eighth Cause of Action - the relief described ~ 123 above.

9. As to All Eight Causes of Action: Such other and further relief which this Court

deems just and proper.

10. Pre-judgment interests, costs and attorneys' fees.

Dated: New York, New York

April 2, 2012

Carl E. Person

Attorney for the Plaintiffs, Douglas D. Brunelle

and Renee C. Brunelle

225 E. 36th Street - Suite 3A

New York NY 10016-3664

Tel: (212) 307-4444

Fax: (212) 307-0247

Email: carlpers2@gmail.com

3S

Exhibit A

Exhibit A

February 23, 2012

Summary of case for

Douglas D. Brunelle

8535 Paradise Valley Road - Unit 29

Spring Valley, California 91977

On December 5,2011 a Notice of Default and Election to Sell Under Deed of Trust was filed against the

above named property (APN 586-170-18-29) by

Northwest Trustee Services, Inc.

1241 E. Dyer Road - Suite 250

Santa Ana, CA 92705

on behalf of their client:

Green Tree Servicing LLC

P.O. Box 6172

Rapid City, SO 57709

who Northwest has identified as being the "creditor" who is owed monies on a loan that Originated with

the First National Bank of Arizona on November 3, 2005.

Page 1 of9

".

BACKSTORY

In 2002 Douglas D. Brunelle, retired military (22 years Army Band) obtained a loan to purchase a

townhouse (unit #29) located at 8535 Paradise Valley Road in Spring Valley, CA. The loan was

acquired via a broker (ARAMCO MORTGAGE) and was in the amount of $250,000.

Deed of Trust details

Loan 10:

Dated:

Lender:

Trustee:

Beneficiary:

0026140772

August1,2002

Wells Fargo Home Mortgage, Inc.

Fidelity Nationallitle Insurance Company

Wells Fargo Home Mortgage, Inc.

Promissory Note details

Loan Number:

Dated:

Lender:

0026140772

August 1, 2002

Wells Fargo Home Mortgage, Inc.

Rate: 6.125% fixed until September 2007, then would change to an adjustable rate not to

exceed 11.125%

Maturity Date: September 1, 2032

In 2004 the loan was refinanced via a broker (don't recall the name) and 2 deeds of trust were created.

Deed of Trust #1 details

Loan Number: 0024167504

Dated: March 24, 2004

Note Amount: $238,500.00

Lender: World Savings Bank, FSB

Trustee: Golden West Savings Association Service Co.

Beneficiary: World Savings Bank, FSB

Maximum Aggregate Principal Balance Secured by Deed of Trust: $298,125.00

Deed of Trust #2 details - Open End Deed of Trust (Securing Future Advances)

Loan Number: 0024166217

Dated: March 24, 2004

Lender: World Savings Bank, FSB

Trustee: Golden West Savings Association Service Co.

Beneficiary: World Savings Bank, FSB

Equity Une of Credit Amount: $47,700.00

Promissory Note details

Unable to locate copy of note.

Page 2 of9

In 2005 the the original loan was refinanced a 2nd time. The new loan was acquired via a broker (don't

recall the name) in the amount of $320,000. This is the current loan on the property.

Deed of Trust details

Loan Number:

MIN Number:

Dated:

Lender:

Trustee:

Beneficiary:

Nominee:

3318005672

1001355-4000063836-2

November 3, 2005

First National Bank of Arizona

First American Title Company

"MERS" Mortgage Electronic Registration Systems, Inc.

"MERS" Mortgage Electronic Registration Systems, Inc.

Promissory Note details

Loan Number:

Dated:

Lender:

Rate:

Maturity Date:

3318005672

November 3, 2005

First National Bank of Arizona

6.7500%

December 1, 2035

,

Page 3 of9

Timeline of loan activity for the townhouse

8535 Paradise Valley Road (Unit 29) in Spring Valley, California. A.P.N.586-170-18-29.

2002

- August 1, 2002

Obtained a $250,000 loan from Wells Fargo Home Mortgage, Inc. (Loan Number 0026140772)

2004

- March 24, 2004

Refinanced Wells Fargo loan with a $238,500.00 loan from World Savings Bank, FSB

(Loan Number 0024167504)

- March 24, 2004

Opened an equity line of credit account for $47,700.00 with World Savings Bank, FSB

(Loan Number 0024166217)

- April 2, 2004

Paid off Wells Fargo Home Mortgage, Inc. (Loan Number 0026140772)

2005

- September 14, 2005

World Savings Bank, FSB charges a $4,770.00 prepayment fee when a payoff demand is

submitted to them for Loan Number 0024166217.

- November 3, 2005

Refinanced World Savings Bank. FSB loans with a $320,000.00 loan from First National Bank of

Arizona (Loan Number 318005672) (MIN Number 1001355-4000063836-2)

- November 22, 2005

Received letter from Chicago Title Closing Services stating that escrow closed on November 14,

2011 for the First National Bank of Arizona loan.

- November 29, 2005

Paid off World Savings Bank, FSB (Loan Number 0024167504)

- November 30, 2005

Paid off World Savings Bank, FSB (Loan Number 0024166217)

- December 5, 2005

Bank One (Park Granada LLC) is identified as the creditor to whom the debt is owed for the First

National Bank of Arizona loan.

Page 4 of9

2006

- January 1, 2006

Countrywide Home Loans (Account Number 115911929) becomes loan servicerof First National

Bank of Arizona (Loan Number 318005672)

2008

- June 30, 2008

First National Bank of Arizona merged with First National Bank of Nevada.

- July 25, 2008

First National Bank of Nevada was closed by the Office of the Comptroller of Currency (OCC).

FDIC was named the Receiver.

2009

- May 1, 2009

BAC Home Loans Servicing, LP (Account Number 115911929) becomes servicer of First National

Bank of Arizona (Loan Number 318005672)

- July 16, 2009

Received letter from BAC Home Loans Servicing, LP. requesting to be listed as mortgagee on the

Homeowners' Association master policy.

- November 6, 2009

Lost full-time permanent employment with QinetiQ North America - Mission Solutions Group.

2010

- July 16, 2010

Received Jetter from SAC Home Loans Servicing, LP. requesting to be listed as mortgagee on the

Homeowners' Association master policy.

- December 2010

Telephoned BAC Home Loans Servicing, LP to discuss loan modification options.

- December 31,2010

Received application packet from BAC Home Loans Servicing, LP for Home Affordable

Modification Program.

Page 5 of9

2011

- January 4,2011

Submitted application packet for Making Home Affordable Program to SAC Home Loan Servicing,

LP. Packet sent via FedEx.

- January 6, 2011

Application packet for Making Home Affordable Program was delivered via FedEx to SAC Home

Loan Servicing, LP.

- January 18, 2011

Received letter from SAC Home Loan Servicing, LP regarding options to avoid foreclosure.

- January 31, 2011

Called SAC Home Loans Servicing, LP to follow up on loan modification application. was informed

that there was documentation missing from packet. Wrote letter to Merissa Sherrill which

summarized activity to date. Faxed letter and copies of "missing

ll

documentation.

- February 2, 2011

Faxed a 2nd copy of the January 31st letter and copies of "missing" documentation to Merissa

Sherrill at SAC Home Loans Servicing, LP.

- February 4, 2011

Received letter from SAC Home Loans Servicing, LP claiming that documentation was missing

from loan modification packet that was submitted to them on January 4,2011.

- February 11, 2011

Received letter from SAC Home Loan Servicing, LP regarding options to avoid foreclosure.

- February 16,2011

Received Notice of Intent to Accelerate letter from SAC Home Loan ServiCing, LP.

- February 16, 2011

Responded to SAC Home Loan Serving, LP. letter dated February 4, 2011 and re-submitted

documentation. Sent packet via FedEx on February 17, 2011.

- February 21,2011

SAC Home Loan Servicing, LP. received packet that was sent via FedEx on February 16, 2011.

- March 10,2011

Received letter from SAC Home Loans Servicing, LP claiming that documentation was missing

from loan modification packet that was submitted to them on February 16, 2011.

- March 17, 2011

Responded to SAC Home Loan Servicing, LP letter dated March 10, 2011 and re-submitted

documentation. Packet was sent via FedEx on March 18, 2011.

Page 6 of9

2011

- March 21, 2011

BAC Home Loan Servicing, LP. received packet that was sent via FedEx on March 18. 2011.

- March 22,2011

Faxed packet from March 17. 2011 to BAC Home Loan Servicing. LP.

- April 7, 2011

Received letter from BAC Home Loans Servicing. LP stating that the loan was not eligible for the

Home Affordable Modification Program because the documents requested "alledgedly" were not

submitted.

- April 26, 2011

Received loan modification rejection letter from BAC Home Loan Serving. LP.

- May 15, 2011

Received statement from BAC for loan payment due June i. 2011.

- May 18, 2011

Received letter from BAC Home Loan Servicing. LP regarding loan payment.

- June 9, 2011

Received letter from BAC Home Loan Servicing. LP regarding escrow account.

- June 10,2011

Received letter from BAC Home Loan Servicing, LP regarding loan payment.

- June 10, 2011

Received a second letter from BAC Home Loan Servicing, LP regarding loan payment.

- June 13,2011

Received statement from BAC for loan payment due July i. 2011.

- June 29, 2011

Received statement from BAC for loan payment due July i. 2011.

- June 30, 2011

Received statement from BAC for loan payment due July i. 2011.

- July 1,2011

Bank of America, N.A (Account Number 115911929) becomes loan servicer of First National

Bank of Arizona (Loan Number 318005672)

Page 7 of9

2011

- July 1, 2011

FNMA SCH/SCH MBS FIX INT ONLY is identified as the creditor to whom the debt is owed.

- July 18, 2011

Received letter from Bank of America, N.A. requesting to be listed as mortgagee on the

Homeowners Association master policy.

- July 28, 2011

Received statement from Bank of America, N.A. for payment due August 1, 2011.

- Ju\y 27, 2011

Received letter from BAC Home Loan Servicing, LP regarding loan payment. Enclosed was a

refund check for funds that BAC would not apply to a loan payment.

- August 30, 2011

Received statement from Bank of America, N.A. for loan payment due September 1, 2011.

- September 2, 2011

Received letter from Green Tree Servicing LLC stating that the servicing of the loan has been

transferred from Bank of America N.A. to them. Fannie Mae is listed as the loan creditor.

- September 6, 2011

Received "Notice of Assignment, Sale, or Transfer of Servicing Rights" letter from Green Tree

Servicing LLC letter stating the servicing of the loan has been transferred from Bank of America

N.A. (account number 115911929) to them (new account number 682097928).

- September 14,2011

Received statement from Green Tree for payment due October 1, 2011.

- September 15, 2011

Received Green Tree Servicing LLC letter identifying the assigned account representative effective

September 15, 2011.

- October 6, 2011

Received statement from Green Tree for payment due November 1, 2011.

- October 13, 2011

Received annual escrow account disclosure statement from Bank of America, N.A.

- October 28, 2011

Received Green Tree Servicing LLC letter identifying the assigned account representative effective

October 28,2011.

Page 8 of9

2011

- November 8, 2011

Received letter from Northwest Trustee Services, Inc. stating that the mortgage loan has been

referred to them for foreclosure.

- November 14,2011

Received "Fannie Mae - Making Home Affordable" application booklet from Green Tree Servicing

LLC.

- December 1, 2011

"Notice Under Fair Debt Collection Practices Act" document, "Notice of Default and Election to Sell

Under Deed of Trust" document, and "Declaration of Due Diligence" document received from

Northwest Trustee Services, Inc.

- December 5, 2011

"Assignment of Deed of Trust" document submitted by MERS is recorded at San Diego County

office. Effective date of Assignment is shown as September 1, 2011.

- December 5, 2011

"Substitution of Trustee" document submitted by Green Tree Servicing LLC is recorded at San

Diego County office.

- December 5, 2011

"Notice of Default and Election to Sell Under Deed of Trust" document submitted by Northwest

Trustee Services, Inc. is recorded at San Diego County office. The attached "Declaration of Due

Diligence" document is dated October 17, 2011.

- December 20, 2011

Written request for "validation of debt" letter is sent to Northwest Trustee Services, Inc. in response

to their "Notice Under Fair Debt Collection Practices" document dated December 1, 2011.

2012

- January 26, 2011

Received documentation from Northwest Trustee Services, Inc. in response to the December 20,

2011"written request for validation of debt" letter.

Page 9 of9

Exhibit B

Exhibit B

15694

I DOC # 2005-0984778

Reeording requested by

Fim AmeriCiln Title

. : 1111

RetumTo:

NOV 14, 2005 4:06 PM

DFROAL RECORDS

FIRST NATIONAl BANK OF ARIZONA

P.O. BOX 66604

PHOENIX. AZ 85082

S6JI DIEGO COUNTY RECORDER'S OFFICE

GREGORY J. SMITH. COUNTY RECORDER

fEES: 66.00

PAGES: 2D

OA: 1

.

Prepared 8y:

.

. .

LUCINDA DURAZO

8911 BALBOA AVENUE

SAN DIEGO. CA 92123

'---------1

L

_---)-- --)

L - AboYeTlds LiDe For Reconliaa DataI-" _____ _

DEED OF TRUST

NON 1001355.4000063836-2

DEFINITJONS

Words used in multiple sections of dUs doauneDl an: defined below and other words an: detiDed in

Sectiom3, 11. 13, 18,20 and 21. Certain rules regarding the usage of words used in Ibis document are

also provided in Seccion 16.

(A) "Security Instrument" means this document, which is dated NOVEMBER 3. 2005

together with aU Riders to this document.

(B) "Borrower" is DOUGlAS D BRUNELLE. A MARRIED MAN. AS HIS SOLE AND SEPARATE

PROPERTY

Borrower is the tnISCOr under this Security IlIStrUment.

(C) "Lender" is FIRST NATIONAl BANK OF ARIZONA

Lender is a NATIONAL BANKING ASSOCIATION

organized and existing under the laws of UNITED STATES OF AMERICA

4000063836 3318005672

CAUFORNIA-5lnllle Family-Fannie MuJFnddie Mac UNIFORM INSTRUMENT WITH MERS Fonn3005 1/01

_ -SA(CA) 10005)

... ' at 15 tlNCIMIO

I 1I1II1

VMPMORTOAOE FORMS 18OO152172In

Lender's addn:ss is 8911 BAlBOA AVENUE. SAN DIEGO. CA 92123

(0) 1'Trustee" is FIRST AMERICAN TITLE COMPANY

15695

(E) "MEltS" is Mortgage E1CC11ODic Registration Sysrcms, Inc. MERSis a separace corporation that is

accing solely as a nominee for Lemler and Lcru!cr's successors and assigns. MERS k the IJeaefidary

UDder this Security IastnameaL MERS is organized aud existing under d1c laws of Delaware, and bas an

address and CClephODC IlUIDberofP.O. Box 2026, Flim, MI48S01-2026, tel. (888) 679-MERS.

(Ii') "NOle

Il

meaDS the promissory DOte signed by Borrower aDd dated NOVEMBER 3, 2005

The Note states that Borrower owes Lender THREE HUNDRED TWENTY 1lI0USAND AND NOI100

Dollars

(U .s. $ 320 , 000 . 00 ) plus inteRSt. Bonowcr has promised to pay Ibis debt iD regular Periodic

Paymems and to pay Ihc debt in foJlllOt 1ater cban DECEMBER 1. 2035 .

(G) "Property" meaDS the propcny dW is described below UDder the heading -Transfer of Rights in d1c

Property.-

(H) "LoaD

1I

meaDS tbc debt evidenced by the Note, plus inten:st, any prepayment cbarges aDd late charges

due UDder the Note, and all sums due UDder Ibis Security IosuumeDt. plus iDlCrCSt.

(I) IlRiders" means all Riders to this Security Instn1meot that arc executed by Bonower. The following

Riders arc to be executed by Borrower [check box as applicable]:

o Adjustable Rate Rider [[] CoDdomiDium Rider 0 Second Hom: Rider

o Balloon Rider 0 Plamled Unit Developmcm Rider B 1-4 Pamily Rider

D VA Rider . 0 Biweekly Payment Rider Otbcr(s) [specify)

(J) "Applicable Law" iJICaDS all controlling applicable federal, state ami local statutes, egulatioDS.

ordioanccs aDd adminisuative ndes aDd orders (that have the effect of law) as well as all applicable fiDaJ,

noo.appcalable judicial opinions.

(K) "Conummily Association Dues, Fees, and Assessments" means all dues, fees, assessments aDd other

charges that 8!C imposed on Borrower or die Property by a condominium associatioa. bomeowncrs

association or similar organization.

(L) "Elec:tronic Funds Tnasfer

tl

means any uansfer of ftmds, oeber lhan a transaction originated by

check, draft, or similar paper illSUUD1CDt, which is inidated through an c1ecaonic terminal, telephonic

iastrumeot, computer, or masoetic tape so as to order, iosuuct, or authorize a fimacial institution to debit

or cedil an ac:c:ount. Such reno includes, but is DOt limited to, poim-of-sale traasfers, automated teller

machine transactions. tranSfers initiated by telephone, wire transfers, and automated clearloghousc

transfers.

(M) "Escrow Items" DICaIIS those items that are described in SectiOD 3.

(N) "Miscellaneous PrcM:eeds'" meaas any compensation. settlement. award of damages, or proceeds paid

by any chlrd party (other Chan insurance proceeds paid UDder the coverages described in Section S) for: (i)

damage to, or desaucdOD of, die Property; (ii) coDdemDation or ocher lalciq of all or any part of the

Propeny; (iii) conveyance in lieu of condCJDDabOn; or (iv) misJepresematioDS of, or omissions as to, Ihe

value and/or condition oftbe Property.

(0) "Mongage IasunulCe" meaDS iosurance protecUug LeDdcr agaiDSt the noopaymcut of. or default 00.

the Loan.

(P) "Periodic Payment" means the regularly scheduled amount due for (i) priDcipai and interest under the

Note. plus (ii) any amoUDts under SectiOD 3 of this Security Instrument.

4000063836 3318005672

",2a.15 Form 3005 1/01

15696

(Q) "RESPA" means the Real Estate Senlcmenl Procedures Act (12 U.S.c. Section 2601 et seq.) and itS

implemcatiag regulation. Regulation X (24 C.f.R. Pan 3SOO), as they might be ame:oded from time CD

time, or any additional or sucteSSOI' IegislatiOD or regulation that governs the same subject matter. As used

in Ibis Security lnstnuncD1, "RESPA" refers to all requircDlC1dS and rcstrictioDS rhat are imposed in regard

10 a "federally reJaIed DlDrtgage loan" even if the Loan does oot qualify as a -federaUy related monpge

loan- under RESPA.

(R) "Successor ID IDterest of BolTOwer" means any party abat bas taken title to the Pmperty, whether or

nol that pany has assumed Borrower's obligations under the Note aadlor this Security 1nstrumeIu.

TRANSFER OF RIGHTS IN THE PROPERTY '

The beneficiary of this Security IlISUUDleIlt is MERS (solely as nominee for Leader and Lenders

successors and assigns) and the successors and assigns of MERS. 'Ibis Security Instrument

secures 10 Lcudcr: (i) d:te repayment of the Loan, and all reaewals, extensions and modificatioDS

of the Note. and (ii) the performance of Borrower's coveDaDlS and asRCDleDlS under Ibis

Security losUwncot and the Note. Por Ibis purpose, Borrower irrevocably grants and conveys to

Trustee, in uust, wilh power of sale. Ihe following descn'bed property located in the

COUNTY of SAN DIEGO

(Type otRecordiD& JurisdldiaJlJ

***SEE ATTACHED LEGAl OESCRIPTION***