Beruflich Dokumente

Kultur Dokumente

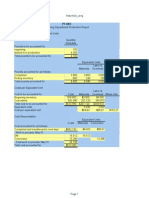

Departmental Expense Breakdown: Process Costing Example

Hochgeladen von

ImperoCo LLCOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Departmental Expense Breakdown: Process Costing Example

Hochgeladen von

ImperoCo LLCCopyright:

Verfügbare Formate

WHITE CELLS ARE ADJUSTABLE Kristoffer Burnett - Certified Management Accountant, 2009-2011

Process Costing Example

Item: Item1 Beginning Balance $ 7,126 24,674 43,921 $ 75,722 1,221 151,579 124.14 Monthly Expenses $ 29,393 60,964 37,823 $ 128,180 Cost Ending Transfers Balance $ (29,775) $ 6,745 (95,165) 20,249 (151,579) 25,330 $ (151,579) $ 52,324

Department A Department B Department C Totals Total completed units Total cost transferred to FG Average cost per unit

$70,000

Departmental Expense Breakdown

$70

$60,000

$60

$50,000

$50

Overhead

$40,000 $40

Direct Labor

$30,000 $30

Direct Material Per Unit Costs Added

$20,000

$20

$10,000

$10

$0 Department A Department B Department C

$0

WHITE CELLS ARE ADJUSTABLE Kristoffer Burnett - Certified Management Accountant, 2009-2011 Process Costing Example Beginning WIP Units Item Item1 Item2 Item3 Item4 Item5 1 Beginning WIP Dept A 345 418 572 292 754

Beginning WIP Dept B 354 403 835 370 1,082

Beginning WIP Dept C 428 383 616 417 1,107

Ending WIP Units Item Item1 Item2 Item3 Item4 Item5 Ending WIP Dept A 525 328 556 389 1,074 Ending WIP Dept B 448 385 682 305 1,040 Ending WIP Dept C 356 365 659 394 811

Units Started In Production

2

Item Item1 Item2 Item3 Item4 Item5

Dept A 1,423 1,118 2,160 818 2,416

Direct Material Cost Per Unit Item Item1 Item2 Item3 Item4 Item5 Dept A 7.67 13.18 25.16 23.44 14.06 Dept B 10.22 27.68 9.32 25.12 8.08 Dept C 7.67 90.94 12.11 35.17 7.78

Direct Labor Cost Per Unit Item Item1 Item2 Item3 Item4 Item5 Dept A 5.66 6.87 10.99 9.19 5.84 Dept B 19.39 10.08 12.82 20.81 9.18 Dept C 15.35 5.95 12.82 18.39 12.79

Overhead Cost Per Unit Item Item1 Item2 Item3 Item4 Item5 Dept A 7.33 4.75 15.36 9.28 11.13 Dept B 19.43 15.08 12.59 5.25 10.90 Dept C 9.90 8.10 2.76 25.82 0.68

Notes: 1 WIP = Work in process. Finished goods that have been started but not yet completed. 2 Units Started In Production need only be entered for the first department. All of the subsequent departments will be calculated based on beginning and ending WIP.

WHITE CELLS ARE ADJUSTABLE Kristoffer Burnett - Certified Management Accountant, 2009-2011

Process Costing Example

Item: Unit Reconciliation Beginning work in process (WIP) Started in production Total units into production Transferred to department B WIP percentage complete Ending WIP Total units reconciled 345 1,423 1,768 1,243 525 1,768 Item1

Direct Materials Direct Labor Factory Overhead 1,243 1,243 1,243 60% 50% 50% 315 263 263 1,558 1,506 1,506

These are the completed units transferred to the next stage in production For simplicity's sake overhead expenses are allocated by direct labor hours Ending WIP * WIP percentage complete Total units reconciled must equal Total units into production

Cost Per Equivalent Unit Beginning work in progress Department A expenses Total costs to be allocated Equivalent units Cost per equivalent unit $ $ 7,126 29,393 36,520 Direct Materials 2,645 10,912 13,557 1,558 8.70 Direct Labor 1,951 8,048 10,000 1,506 6.64 Factory Overhead 2,530 The costs associated with those units in beginning WIP. 10,433 The total costs incurred this period for those units started in production 12,963 1,506 Total units reconciled from above 8.61 Total cost to be allocated/ Equivalent units

23.95

Cost Allocation Transferred to department B Ending WIP material Ending WIP conversion Total ending work in process Total cost allocation Total Cost $ 29,775 2,741 4,004 6,745 36,520 Direct Materials 1,243 315

Equivalent Units Direct Labor Factory Overhead 1,243 1,243 The number of units and dollar value of inventory transferred to the next department The quantity and total cost for those units in ending WIP 263 " The total value of ending WIP Transferred to department B + Total ending work in process. Must equal Total costs to be allocated

263

Notes: 1 There are two primary methods used in process costing. The weighted-average method, which is used in this example, and the first-in-first-out (FIFO) method.

WHITE CELLS ARE ADJUSTABLE Kristoffer Burnett - Certified Management Accountant, 2009-2011

Process Costing Example

Item: Unit Reconciliation Beginning work in process (WIP) Transferred from department A Total units into production Transferred to department C WIP percentage complete Ending WIP Total units reconciled 354 1,243 1,597 1,149 448 1,597 Item1

Direct Materials Direct Labor Factory Overhead 1,149 1,149 1,149 40% 60% 60% 179 269 269 1,328 1,418 1,418

These are the completed units transferred to the next stage in production For simplicity's sake overhead expenses are allocated by direct labor hours Ending WIP * WIP percentage complete Total units reconciled must equal Total units into production

Cost Per Equivalent Unit Beginning work in progress Department B expenses Transferred from department A Total costs to be allocated Equivalent units Cost per equivalent unit $ 24,674 60,964 29,775 $ 115,413 Direct Materials 6,334 12,708 10,816 29,858 1,328 22.48 Direct Labor 8,867 24,104 8,256 41,227 1,418 29.08 Factory Overhead 9,474 The costs associated with those units in beginning WIP. 24,151 The total costs incurred this period for those units started in production 10,703 The value of inventory transferred from the previous department 44,328 1,418 Total units reconciled from above 31.27 Total cost to be allocated/ Equivalent units

82.82

Cost Allocation Transferred to department C Ending WIP material Ending WIP conversion Total ending work in process Total cost allocation Total Cost $ 95,165 4,028 16,220 20,249 $ 115,413 Direct Materials 1,149 179

Equivalent Units Direct Labor Factory Overhead 1,149 1,149 The number of units and dollar value of inventory transferred to the next department The quantity and total cost for those units in ending WIP 269 " The total value of ending WIP Transferred to department C + Total ending work in process. Must equal Total costs to be allocated

269

Notes: 1 There are two primary methods used in process costing. The weighted-average method, which is used in this example, and the first-in-first-out (FIFO) method.

WHITE CELLS ARE ADJUSTABLE Kristoffer Burnett - Certified Management Accountant, 2009-2011

Process Costing Example

Item: Unit Reconciliation Beginning work in process (WIP) Transferred from Dept B Total units into production Transferred to finished goods WIP percentage complete Ending WIP Total units reconciled 428 1,149 1,577 1,221 356 1,577 Item1

Direct Materials Direct Labor Factory Overhead 1,221 1,221 1,221 80% 50% 50% 285 178 178 1,506 1,399 1,399

These are the completed units transferred to the next stage in production For simplicity's sake overhead expenses are allocated by direct labor hours Ending WIP * respective WIP percentage complete Total units reconciled must equal Total units into production

Cost Per Equivalent Unit Beginning work in progress Department C expenses Transferred from department B Total costs to be allocated Equivalent units Cost per equivalent unit $ 43,921 37,823 95,165 $ 176,909 Direct Materials 10,940 8,811 25,830 45,580 1,506 30.27 Direct Labor 17,291 17,639 33,411 68,342 1,399 48.85 Factory Overhead 15,690 The costs associated with those units in beginning WIP. 11,373 The total costs incurred this period for those units started in production 35,924 The value of inventory transferred from the previous department 62,987 1,399 Total units reconciled from above 45.02 Total cost to be allocated/ Equivalent units

124.14

Cost Allocation Transferred to finished goods Ending WIP material Ending WIP conversion Total ending work in process Total cost allocation Total Cost $ 151,579 8,621 16,709 25,330 $ 176,909 Direct Materials 1,221 285

Equivalent Units Direct Labor Factory Overhead 1,221 1,221 The number of units and dollar value of inventory transferred to the next department The quantity and total cost for those units in ending WIP 178 " The total value of ending WIP Transferred to finished goods + Total ending work in process. Must equal Total costs to be allocated

178

Notes: 1 There are two primary methods used in process costing. The weighted-average method, which is used in this example, and the first-in-first-out (FIFO) method.

Das könnte Ihnen auch gefallen

- Process Costing: This Is On The Other Side of The Continuum From Job CostingDokument28 SeitenProcess Costing: This Is On The Other Side of The Continuum From Job CostingRajeev NairNoch keine Bewertungen

- Process Costing Systems ExplainedDokument8 SeitenProcess Costing Systems ExplainedEwelina ChabowskaNoch keine Bewertungen

- Rei - Process CostingDokument12 SeitenRei - Process CostingSnow TurnerNoch keine Bewertungen

- Process Costing: Kristin RosalinaDokument42 SeitenProcess Costing: Kristin RosalinaKristin SoedjonoNoch keine Bewertungen

- Process CostingDokument17 SeitenProcess CostingSweta JaiswalNoch keine Bewertungen

- Process Costing Methods and CalculationsDokument21 SeitenProcess Costing Methods and CalculationsKaen Meagan Gasmen92% (12)

- ACC102 Chapter4newDokument17 SeitenACC102 Chapter4newjohn_26_jjmNoch keine Bewertungen

- Process Costing Production ReportsDokument16 SeitenProcess Costing Production ReportsmashhoodNoch keine Bewertungen

- Process Costing Chapter 4 SolutionsDokument39 SeitenProcess Costing Chapter 4 Solutionsmisterwaterr80% (15)

- Analisis Biaya: Semester Gasal TA 2016 - 2017 Process CostingDokument48 SeitenAnalisis Biaya: Semester Gasal TA 2016 - 2017 Process CostingMaulana HasanNoch keine Bewertungen

- Process Costing: Questions For Writing and DiscussionDokument49 SeitenProcess Costing: Questions For Writing and DiscussionKhoirul MubinNoch keine Bewertungen

- HorngrenIMA14eSM ch14Dokument40 SeitenHorngrenIMA14eSM ch14Piyal Hossain100% (1)

- Process Costing Equivalent Units CalculationDokument17 SeitenProcess Costing Equivalent Units CalculationnoowrieliinNoch keine Bewertungen

- ACC 2403 M K: Y U Sy Syms School of Business E I (V B)Dokument9 SeitenACC 2403 M K: Y U Sy Syms School of Business E I (V B)spewman2Noch keine Bewertungen

- ACCT505 Week 2 Quiz 1 Job Order and Process Costing SystemsDokument8 SeitenACCT505 Week 2 Quiz 1 Job Order and Process Costing SystemsNatasha DeclanNoch keine Bewertungen

- PROCESS COSTING METHODS AND CALCULATIONSDokument76 SeitenPROCESS COSTING METHODS AND CALCULATIONSAnggrainiNoch keine Bewertungen

- Process Costing (Power Point and Sample Problem)Dokument80 SeitenProcess Costing (Power Point and Sample Problem)kraviusNoch keine Bewertungen

- CH 06 Process CostingDokument67 SeitenCH 06 Process CostingShannon Bánañas100% (2)

- TB ch02 5e MADokument8 SeitenTB ch02 5e MAعبدالله ماجد المطارنهNoch keine Bewertungen

- Clsbe Universidade Católica Portuguesa: Test 3Dokument8 SeitenClsbe Universidade Católica Portuguesa: Test 3Inês VilafanhaNoch keine Bewertungen

- Cost 2 Midterm ExamDokument5 SeitenCost 2 Midterm ExamJp CombisNoch keine Bewertungen

- Chap 004 Process CostingDokument116 SeitenChap 004 Process CostingdhominicNoch keine Bewertungen

- Proces CostingDokument14 SeitenProces CostingKenDedesNoch keine Bewertungen

- Chapter 6 Practice QuestionsDokument9 SeitenChapter 6 Practice QuestionsAbdul Wajid Nazeer CheemaNoch keine Bewertungen

- Cost Accounting The Process Costing SystemDokument29 SeitenCost Accounting The Process Costing SystemaasNoch keine Bewertungen

- Cost Accounting Traditions and Innovations: Process CostingDokument31 SeitenCost Accounting Traditions and Innovations: Process CostingBambang HaryadiNoch keine Bewertungen

- Chapter 3Dokument37 SeitenChapter 3Dawit AshenafiNoch keine Bewertungen

- Kinney8e PPT Ch06Dokument43 SeitenKinney8e PPT Ch06Christian GoNoch keine Bewertungen

- Job Order Vs Process Costing: Transparency Master 2-1Dokument14 SeitenJob Order Vs Process Costing: Transparency Master 2-1Patrick VoiceNoch keine Bewertungen

- Costing and Quantitative Techniques Chapters 7-8Dokument68 SeitenCosting and Quantitative Techniques Chapters 7-8jyotiyugalNoch keine Bewertungen

- CMA Part 1 Sec CDokument131 SeitenCMA Part 1 Sec CMusthaqMohammedMadathilNoch keine Bewertungen

- ACCTG 108 Pre Qua Answer KeyDokument18 SeitenACCTG 108 Pre Qua Answer KeyJamaica DavidNoch keine Bewertungen

- Jawaban Soal Bab 4 PT ABCDokument2 SeitenJawaban Soal Bab 4 PT ABCanwarlhNoch keine Bewertungen

- B 1. An Equivalent Unit of Material or Conversion Cost Is Equal ToDokument4 SeitenB 1. An Equivalent Unit of Material or Conversion Cost Is Equal ToKATHRYN CLAUDETTE RESENTENoch keine Bewertungen

- Slide of Chapter 2Dokument19 SeitenSlide of Chapter 2Uyen ThuNoch keine Bewertungen

- Process Costing StudentsDokument39 SeitenProcess Costing StudentsNour Al KaddahNoch keine Bewertungen

- Process Costing Weighted Average Method for Picture Frame Assembly DepartmentDokument3 SeitenProcess Costing Weighted Average Method for Picture Frame Assembly DepartmentRudy Setiawan KamadjajaNoch keine Bewertungen

- Activity Based CostingDokument52 SeitenActivity Based CostingraviktatiNoch keine Bewertungen

- CHAPTER 6 PROCESS COSTINGDokument23 SeitenCHAPTER 6 PROCESS COSTINGVibbula Iswaradewi Anindyasari0% (1)

- Module 1 Process Costing Nature and OperationsDokument19 SeitenModule 1 Process Costing Nature and Operationscha11100% (3)

- 1843 Question HelpDokument9 Seiten1843 Question Helpchong chojun balsaNoch keine Bewertungen

- CH 4 Cost by GWDokument34 SeitenCH 4 Cost by GWWudneh AmareNoch keine Bewertungen

- Revision For Final ExamDokument110 SeitenRevision For Final ExamWolf's RainNoch keine Bewertungen

- T6 Chapter 5 Solutions To The Essential ActivitiesDokument12 SeitenT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713Noch keine Bewertungen

- 6-MAC1Dokument52 Seiten6-MAC1nachofr2704Noch keine Bewertungen

- Acctg 108 Pre Qua Answer Key PDF FreeDokument23 SeitenAcctg 108 Pre Qua Answer Key PDF FreeKei CambaNoch keine Bewertungen

- CH 15Dokument29 SeitenCH 15ReneeNoch keine Bewertungen

- Equivalent Unit of Material or Conversion CostDokument26 SeitenEquivalent Unit of Material or Conversion Costnicolearetano417Noch keine Bewertungen

- Chapter 4 Cost and Management AcctDokument31 SeitenChapter 4 Cost and Management AcctDebebe DanielNoch keine Bewertungen

- Process Costing Report - Testing DepartmentDokument9 SeitenProcess Costing Report - Testing Departmentmousy_028Noch keine Bewertungen

- CH 17 SolDokument52 SeitenCH 17 SolCarlos J. Cancel AyalaNoch keine Bewertungen

- UntitledDokument4 SeitenUntitledAastha ShettyNoch keine Bewertungen

- A 325Dokument28 SeitenA 325Pilly PhamNoch keine Bewertungen

- Practical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsVon EverandPractical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsNoch keine Bewertungen

- Cost Management: A Case for Business Process Re-engineeringVon EverandCost Management: A Case for Business Process Re-engineeringNoch keine Bewertungen

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesVon EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Excessive Inventory AnalysisDokument23 SeitenExcessive Inventory AnalysisImperoCo LLCNoch keine Bewertungen

- Flexible Budget ExampleDokument2 SeitenFlexible Budget ExampleImperoCo LLCNoch keine Bewertungen

- Matching Demand ExampleDokument1 SeiteMatching Demand ExampleImperoCo LLCNoch keine Bewertungen

- Managing Variability ExampleDokument2 SeitenManaging Variability ExampleImperoCo LLCNoch keine Bewertungen

- Revenue Variance ExampleDokument1 SeiteRevenue Variance ExampleImperoCo LLCNoch keine Bewertungen

- Weighted Average Cost of Capital WorksheetDokument2 SeitenWeighted Average Cost of Capital WorksheetImperoCo LLCNoch keine Bewertungen

- Managing Current Assets ExampleDokument2 SeitenManaging Current Assets ExampleImperoCo LLCNoch keine Bewertungen

- Resource Utilization ExampleDokument4 SeitenResource Utilization ExampleImperoCo LLCNoch keine Bewertungen

- Break Even Analysis WorksheetDokument2 SeitenBreak Even Analysis WorksheetImperoCo LLCNoch keine Bewertungen

- Direct Material Variance ExampleDokument1 SeiteDirect Material Variance ExampleImperoCo LLCNoch keine Bewertungen

- Managing Investments WorksheetDokument7 SeitenManaging Investments WorksheetImperoCo LLCNoch keine Bewertungen

- Expected Value WorksheetDokument1 SeiteExpected Value WorksheetImperoCo LLCNoch keine Bewertungen

- Direct Labor Variance ExampleDokument1 SeiteDirect Labor Variance ExampleImperoCo LLCNoch keine Bewertungen

- Overhead Variance ExampleDokument1 SeiteOverhead Variance ExampleImperoCo LLCNoch keine Bewertungen

- Activity Based Costing ExampleDokument3 SeitenActivity Based Costing ExampleImperoCo LLCNoch keine Bewertungen

- Job Order Costing ExampleDokument3 SeitenJob Order Costing ExampleImperoCo LLCNoch keine Bewertungen

- Financial Budget Example: White Cells Are AdjustableDokument5 SeitenFinancial Budget Example: White Cells Are AdjustableImperoCo LLCNoch keine Bewertungen

- Linear Programming ExampleDokument1 SeiteLinear Programming ExampleImperoCo LLCNoch keine Bewertungen

- Monte Carlo Simulation ExampleDokument1 SeiteMonte Carlo Simulation ExampleImperoCo LLCNoch keine Bewertungen

- Operating Budget ExampleDokument10 SeitenOperating Budget ExampleImperoCo LLCNoch keine Bewertungen

- Forecasting WorksheetDokument2 SeitenForecasting WorksheetImperoCo LLCNoch keine Bewertungen

- Capital Budgeting WorksheetDokument2 SeitenCapital Budgeting WorksheetImperoCo LLCNoch keine Bewertungen

- Chapter 1 Management Accounting OverviewDokument25 SeitenChapter 1 Management Accounting OverviewVrix Ace MangilitNoch keine Bewertungen

- Assesment 7 (Week 8)Dokument6 SeitenAssesment 7 (Week 8)hannaniNoch keine Bewertungen

- Jeans Manufacturing Industry-759387 PDFDokument73 SeitenJeans Manufacturing Industry-759387 PDFAmaan KhanNoch keine Bewertungen

- Introduction to Cost Accounting FundamentalsDokument23 SeitenIntroduction to Cost Accounting FundamentalsMARIAN DORIANoch keine Bewertungen

- PRTC First Answer Key PDFDokument48 SeitenPRTC First Answer Key PDFnanabaNoch keine Bewertungen

- CT SS For Student Oct2018Dokument5 SeitenCT SS For Student Oct2018Nabila RosmizaNoch keine Bewertungen

- Joint Cost Allocation and By-Product AccountingDokument11 SeitenJoint Cost Allocation and By-Product AccountingKelvin CulajaráNoch keine Bewertungen

- Flexible Budgets, Variances, and Management Control: IIDokument44 SeitenFlexible Budgets, Variances, and Management Control: IIkoolyogeshNoch keine Bewertungen

- Job Order Costing - In-Class Example W Answer SheetDokument4 SeitenJob Order Costing - In-Class Example W Answer SheetAmir ContrerasNoch keine Bewertungen

- B5: Problem Solving: P.O.Box 10378 Mwanza-TanzaniaDokument9 SeitenB5: Problem Solving: P.O.Box 10378 Mwanza-TanzaniaSHWAIBU SELLANoch keine Bewertungen

- Manufacturing Company BudgetingDokument10 SeitenManufacturing Company BudgetingSajakul SornNoch keine Bewertungen

- Cost Accounting EntriesDokument4 SeitenCost Accounting EntriesSibgha100% (1)

- Revision Class QuestionsDokument6 SeitenRevision Class QuestionsNathiNoch keine Bewertungen

- Process Costing-FifoDokument8 SeitenProcess Costing-FifoMang OlehNoch keine Bewertungen

- Management Accounting FunctionsDokument30 SeitenManagement Accounting FunctionsMohammed ZourezNoch keine Bewertungen

- Johnny Lee Inc Produces A Line of Small Gasoline Powered EngiDokument1 SeiteJohnny Lee Inc Produces A Line of Small Gasoline Powered EngiAmit PandeyNoch keine Bewertungen

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDokument33 SeitenChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- Break-even analysis and pricing strategy for Medicare Supply hydraulic hoist productionDokument1 SeiteBreak-even analysis and pricing strategy for Medicare Supply hydraulic hoist productionAnamika ShakyaNoch keine Bewertungen

- ABC Blocher SolutionsDokument73 SeitenABC Blocher Solutionsmayankgrover8658% (12)

- DRILLS - ESTIMATION BEHAVIOR Page 2 JJDokument12 SeitenDRILLS - ESTIMATION BEHAVIOR Page 2 JJGrace Love Yzyry LuNoch keine Bewertungen

- Kyambogo University CE 415 lecture notes on estimation and tenderingDokument67 SeitenKyambogo University CE 415 lecture notes on estimation and tenderingIZIMBANoch keine Bewertungen

- Assignment 2: Sands Corporation A Report Submitted To Prof. Girija Shankar SemuwalDokument8 SeitenAssignment 2: Sands Corporation A Report Submitted To Prof. Girija Shankar SemuwalSubhajit RoyNoch keine Bewertungen

- Intermediate Accounting Volume 3 ValixDokument12 SeitenIntermediate Accounting Volume 3 ValixVyonne Ariane Ediong0% (1)

- Async Quiz MGT ScienceDokument2 SeitenAsync Quiz MGT ScienceJohn Daryl P. DagatanNoch keine Bewertungen

- RelevantCosts F07Dokument16 SeitenRelevantCosts F07aymanaym0% (1)

- Chapter 1133Dokument78 SeitenChapter 1133Basanta K Sahu100% (1)

- Cost Accounting System - E-Notes - Udesh Regular - Group 1Dokument53 SeitenCost Accounting System - E-Notes - Udesh Regular - Group 1r79qwkxcfjNoch keine Bewertungen

- Model Curriculum For B.Voc/ D.Voc in Banking Finance Services and Insurance (BFSI)Dokument43 SeitenModel Curriculum For B.Voc/ D.Voc in Banking Finance Services and Insurance (BFSI)Sadika KhanNoch keine Bewertungen

- Cost Accounting Chapter 5 AnswersDokument11 SeitenCost Accounting Chapter 5 AnswersMark Angelo AlvarezNoch keine Bewertungen

- Bachelor of Commerce: Bcoc - 138: Cost AccountingDokument4 SeitenBachelor of Commerce: Bcoc - 138: Cost Accountingsubhaa DasNoch keine Bewertungen