Beruflich Dokumente

Kultur Dokumente

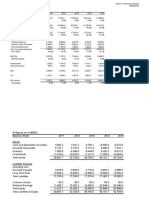

Direct Material Variance Example

Hochgeladen von

ImperoCo LLCCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Direct Material Variance Example

Hochgeladen von

ImperoCo LLCCopyright:

Verfügbare Formate

WHITE CELLS ARE ADJUSTABLE

Kristoffer Burnett - Certified Management Accountant, 2009-2011

Direct Material Variance Example

Total Direct Materials Variance

Actual Results

Cost

Units

Direct materials consumed

DM1

DM2

DM3

DM4

DM5

DM7

DM8

DM9

DM10

Total

112,575

67,722

71,315

92,889

278,940

67,420

68,986

50,435

351,138

1,161,420

2.19

6.54

6.83

8.47

5.08

1.31

7.34

4.95

1.68

Total

246,539

442,902

487,081

786,770

1,417,015

88,320

506,357

249,653

589,912

$ 4,814,550

112,575

67,722

71,315

92,889

278,940

67,420

68,986

50,435

351,138

2.16

6.74

6.74

8.99

4.75

1.28

7.44

5.18

1.67

2.16

6.74

6.74

8.99

4.75

1.28

7.44

5.18

1.67

Total

$

268,099

501,941

520,220

925,179

1,396,999

93,132

556,973

296,798

617,718

$ 5,177,060

DM Quantity Variance

Total DM Variance

DM Quantity Variance

3,377

(13,544)

6,418

(48,302)

92,050

2,023

(6,899)

(11,600)

3,511

27,034

(24,937)

(45,495)

(39,557)

(90,107)

(72,034)

(6,834)

(43,717)

(35,545)

(31,318)

$ (389,544)

Actual Total

Input

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

(21,560)

(59,039)

(33,139)

(138,409)

20,016

(4,811)

(50,616)

(47,145)

(27,806)

$ (362,509) Negative variances are favorable, costs were less than planned

Actual

Mix

Budgeted

Cost

9.7% $

5.8%

6.1%

8.0%

24.0%

5.8%

5.9%

4.3%

30.2%

2.16

6.74

6.74

8.99

4.75

1.28

7.44

5.18

1.67

Total

Total

$

243,162

456,446

480,663

835,072

1,324,965

86,298

513,256

261,253

586,400

$ 4,787,516

Actual Total

Input

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

1,161,420

Budgeted

Mix

Budgeted

Cost

9.9% $

6.0%

6.2%

8.2%

23.6%

5.8%

6.0%

4.6%

29.6%

2.16

6.74

6.74

8.99

4.75

1.28

7.44

5.18

1.67

Budgeted

Total Input

Total

$

249,579

467,268

484,284

861,269

1,300,497

86,698

518,499

276,296

575,047

$ 4,819,438

Budgeted

Mix

1,247,602

1,247,602

1,247,602

1,247,602

1,247,602

1,247,602

1,247,602

1,247,602

1,247,602

2.16

6.74

6.74

8.99

4.75

1.28

7.44

5.18

1.67

Total

$

268,099

501,941

520,220

925,179

1,396,999

93,132

556,973

296,798

617,718

$ 5,177,060

DM Yield Variance

DM Quantity Variance

Total

(6,417)

(10,822)

(3,621)

(26,197)

24,468

(401)

(5,243)

(15,043)

11,353

(31,922)

(18,520)

(34,673)

(35,936)

(63,910)

(96,502)

(6,433)

(38,475)

(20,502)

(42,671)

$ (357,622)

Dropdown menu

DM Quantity Variance Breakdown

Total DM Variance Breakdown

$5,000

$0

($5,000)

$11,353

($10,000)

($15,000)

($42,671)

($20,000)

($25,000)

($30,000)

($35,000)

DM10

DM Price Variance

Budgeted

Cost

9.9% $

6.0%

6.2%

8.2%

23.6%

5.8%

6.0%

4.6%

29.6%

DM Mix Variance

Variance analysis

DM1

DM2

DM3

DM4

DM5

DM7

DM8

DM9

DM10

DM10

124,120

74,472

77,184

102,912

294,105

72,759

74,862

57,297

369,891

1,247,602

DM Price Variance

Total

ITEM TO CHART:

Units

243,162

456,446

480,663

835,072

1,324,965

86,298

513,256

261,253

586,400

$ 4,787,516

Direct materials consumed

DM1

DM2

DM3

DM4

DM5

DM7

DM8

DM9

DM10

Static Budget

Cost

Total

$

Variance analysis

DM1

DM2

DM3

DM4

DM5

DM7

DM8

DM9

DM10

$10,000

Flexible Budget

Cost

Units

DM Quantity Variance

Total DM Variance

DM Mix Variance

Notes:

1 Note that the DM variances focus on those materials that were consumed . Contrast this with the flexible budget, which focused on materials purchased .

2 The DM Price Variance measures the effect on Total DM Variance due to differences in budgeted and actual DM unit costs. This is similar to the purchase

price variance which measures the difference in unit costs for all units purchased, not just those consumed.

3 The DM Quantity Variance measures the effect on Total DM Variance due to differences in budgeted and actual DM quantities consumed.

4 Actual Results - Static Budget OR DM Price Variance + DM Quantity Variance.

5 Mix = individual units / total units.

6 The DM Mix Variance measures the effect on the DM Quantity Variance due to differences in budgeted and actual mix.

7 The DM Yield Variance measures the effect on the DM Quantity Variance due to differences in budgeted and actual total input.

8 DM Mix Variance + DM Yield Variance.

DM Yield Variance

(24,937)

(45,495)

(39,557)

(90,107)

(72,034)

(6,834)

(43,717)

(35,545)

(31,318)

$ (389,544) Negative variances are favorable, costs were less than planned

Das könnte Ihnen auch gefallen

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachVon EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachBewertung: 3 von 5 Sternen3/5 (3)

- Activity Based Costing ExampleDokument3 SeitenActivity Based Costing ExampleImperoCo LLCNoch keine Bewertungen

- Following the Trend: Diversified Managed Futures TradingVon EverandFollowing the Trend: Diversified Managed Futures TradingBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Flexible Budget ExampleDokument2 SeitenFlexible Budget ExampleImperoCo LLCNoch keine Bewertungen

- Lawsuit!: Reducing the Risk of Product Liability for ManufacturersVon EverandLawsuit!: Reducing the Risk of Product Liability for ManufacturersNoch keine Bewertungen

- Flexible Budget ExampleDokument2 SeitenFlexible Budget Examplebrenica_2000Noch keine Bewertungen

- HondaDokument2 SeitenHondaArslan JamilNoch keine Bewertungen

- Operating Budget ExampleDokument10 SeitenOperating Budget ExampleImperoCo LLCNoch keine Bewertungen

- Monmouth Case SolutionDokument19 SeitenMonmouth Case SolutionAkshat Nayer40% (10)

- Uv5631 Xls EngDokument37 SeitenUv5631 Xls EngCarmelita EsclandaNoch keine Bewertungen

- Case 28 AutozoneDokument39 SeitenCase 28 AutozonePatcharanan SattayapongNoch keine Bewertungen

- 26 Colgate Palmolive LimitedDokument15 Seiten26 Colgate Palmolive LimitedAkhil GoyalNoch keine Bewertungen

- Financial Statements and Financial AnalysisDokument42 SeitenFinancial Statements and Financial AnalysisAhmad Ridhuwan AbdullahNoch keine Bewertungen

- Joseph FMADokument119 SeitenJoseph FMAJoseph ThamNoch keine Bewertungen

- PM Kraft ExhibitSheetDokument19 SeitenPM Kraft ExhibitSheetkarthik_srinivasa_14Noch keine Bewertungen

- 61 10 Shares Dividends AfterDokument10 Seiten61 10 Shares Dividends Aftermerag76668Noch keine Bewertungen

- Crescent Point Energy BMO 9.8.13Dokument14 SeitenCrescent Point Energy BMO 9.8.13JorgeNoch keine Bewertungen

- Brantford 2011 Financial ReportsDokument168 SeitenBrantford 2011 Financial ReportsHugo RodriguesNoch keine Bewertungen

- BLS Consumer Spending 2022 PDFDokument23 SeitenBLS Consumer Spending 2022 PDFBill MerkelNoch keine Bewertungen

- 2.ratios CalculationsDokument4 Seiten2.ratios Calculationsahsanabid001Noch keine Bewertungen

- DataDokument11 SeitenDataA30Yash YellewarNoch keine Bewertungen

- Ratio: Formula Computation Ratio Current RatioDokument9 SeitenRatio: Formula Computation Ratio Current RatioShantaNoch keine Bewertungen

- Case 5 - What Are We Really WorthDokument7 SeitenCase 5 - What Are We Really WorthMariaAngelicaMargenApe100% (2)

- Aurora Textile CompanyDokument47 SeitenAurora Textile CompanyMoHadrielCharki63% (8)

- Pacific Grove Spice CompanyDokument3 SeitenPacific Grove Spice CompanyLaura JavelaNoch keine Bewertungen

- Consolidated Statements of OperationsDokument7 SeitenConsolidated Statements of OperationsJoseph JensenNoch keine Bewertungen

- Cisco Systems, Inc. Historical Financials Income Statement AnalysisDokument3 SeitenCisco Systems, Inc. Historical Financials Income Statement AnalysisSameh Ahmed HassanNoch keine Bewertungen

- P Data Extract From World Development IndicatorsDokument15 SeitenP Data Extract From World Development IndicatorsLuiz Fernando MocelinNoch keine Bewertungen

- Answer 5 - " Modern Appliances Corporation"Dokument4 SeitenAnswer 5 - " Modern Appliances Corporation"Rheu ReyesNoch keine Bewertungen

- Jamo C 97 II Floorstanding Speakers PairDokument13 SeitenJamo C 97 II Floorstanding Speakers PairAndre LisboaNoch keine Bewertungen

- Cash Flow AssignmentDokument3 SeitenCash Flow AssignmentAnonymous VrRc5PFbNoch keine Bewertungen

- Group 2 EconomicDokument14 SeitenGroup 2 EconomicCourage ChigerweNoch keine Bewertungen

- Statistical Appendix (English-2023)Dokument103 SeitenStatistical Appendix (English-2023)Fares Faruque HishamNoch keine Bewertungen

- Financial Health of AN Organisat IONDokument23 SeitenFinancial Health of AN Organisat IONvivekgupta4444Noch keine Bewertungen

- Financial Highlights: Indicators Showing Major Business Performance Over The Past Five YearsDokument21 SeitenFinancial Highlights: Indicators Showing Major Business Performance Over The Past Five Yearsaditya tripathiNoch keine Bewertungen

- Golden Grove Profit and Loss 2010: 2010 2011 2012 CostsDokument16 SeitenGolden Grove Profit and Loss 2010: 2010 2011 2012 Costsrohanagg53Noch keine Bewertungen

- Case 6 MathDokument16 SeitenCase 6 MathSaraQureshiNoch keine Bewertungen

- Case 02 FedEx UPS 2016 F1773XDokument10 SeitenCase 02 FedEx UPS 2016 F1773XJosie KomiNoch keine Bewertungen

- University Budget IDokument21 SeitenUniversity Budget ICullen DonohueNoch keine Bewertungen

- Accounting Presentation (Beximco Pharma)Dokument18 SeitenAccounting Presentation (Beximco Pharma)asifonikNoch keine Bewertungen

- Terminal MultipleDokument39 SeitenTerminal MultiplegyanelexNoch keine Bewertungen

- Polaroid CorporationDokument14 SeitenPolaroid CorporationMandley SourabhNoch keine Bewertungen

- StepSmart Fitness ExlDokument9 SeitenStepSmart Fitness ExlNishiGogia50% (2)

- Application For Approval - Promotion Mr. Tran Thi Thu Ngan - SpecialistDokument3 SeitenApplication For Approval - Promotion Mr. Tran Thi Thu Ngan - SpecialistPhu, Le HuuNoch keine Bewertungen

- Statistical - Appendix Eng-21Dokument96 SeitenStatistical - Appendix Eng-21S M Hasan ShahriarNoch keine Bewertungen

- Financial Ratio Analysis Template for CooperativesDokument10 SeitenFinancial Ratio Analysis Template for Cooperativespradhan13Noch keine Bewertungen

- 17020841116Dokument13 Seiten17020841116Khushboo RajNoch keine Bewertungen

- 12 CebuCity2017 Part4 Consolidated FSDokument43 Seiten12 CebuCity2017 Part4 Consolidated FSKen AbabaNoch keine Bewertungen

- Model Assignment Aug-23Dokument3 SeitenModel Assignment Aug-23Abner ogegaNoch keine Bewertungen

- Mixed Use JK PDFDokument9 SeitenMixed Use JK PDFAnkit ChaudhariNoch keine Bewertungen

- Exhibit 1 Kendle International Inc. Financial Data Years Ended December 31Dokument12 SeitenExhibit 1 Kendle International Inc. Financial Data Years Ended December 31Kito Minying ChenNoch keine Bewertungen

- Standalone Financial Results For The Quarter / Year Ended On 31st March 2012Dokument9 SeitenStandalone Financial Results For The Quarter / Year Ended On 31st March 2012smartashok88Noch keine Bewertungen

- Government Finance 2Dokument7 SeitenGovernment Finance 2Yohannes MulugetaNoch keine Bewertungen

- BrunswickDistn Optn11Dokument8 SeitenBrunswickDistn Optn11ANZNoch keine Bewertungen

- Financial Analysis: P & L Statement of GE ShippingDokument4 SeitenFinancial Analysis: P & L Statement of GE ShippingShashank ShrivastavaNoch keine Bewertungen

- BNI 111709 v2Dokument2 SeitenBNI 111709 v2fcfroicNoch keine Bewertungen

- MBA 644 2019 Individual Assignment 1 - Gautam SaseedharanDokument6 SeitenMBA 644 2019 Individual Assignment 1 - Gautam SaseedharanGautamNoch keine Bewertungen

- Alliance Concrete Financial Statements and Key Metrics 2002-2005Dokument7 SeitenAlliance Concrete Financial Statements and Key Metrics 2002-2005S r kNoch keine Bewertungen

- Dows ExcelDokument18 SeitenDows ExcelJaydeep SheteNoch keine Bewertungen

- Case 21 Aurora Textile Company 0Dokument17 SeitenCase 21 Aurora Textile Company 0nguyen_tridung250% (2)

- Excessive Inventory AnalysisDokument23 SeitenExcessive Inventory AnalysisImperoCo LLCNoch keine Bewertungen

- Overhead Variance ExampleDokument1 SeiteOverhead Variance ExampleImperoCo LLCNoch keine Bewertungen

- Matching Demand ExampleDokument1 SeiteMatching Demand ExampleImperoCo LLCNoch keine Bewertungen

- Managing Variability ExampleDokument2 SeitenManaging Variability ExampleImperoCo LLCNoch keine Bewertungen

- Weighted Average Cost of Capital WorksheetDokument2 SeitenWeighted Average Cost of Capital WorksheetImperoCo LLCNoch keine Bewertungen

- Managing Current Assets ExampleDokument2 SeitenManaging Current Assets ExampleImperoCo LLCNoch keine Bewertungen

- Resource Utilization ExampleDokument4 SeitenResource Utilization ExampleImperoCo LLCNoch keine Bewertungen

- Break Even Analysis WorksheetDokument2 SeitenBreak Even Analysis WorksheetImperoCo LLCNoch keine Bewertungen

- Managing Investments WorksheetDokument7 SeitenManaging Investments WorksheetImperoCo LLCNoch keine Bewertungen

- Expected Value WorksheetDokument1 SeiteExpected Value WorksheetImperoCo LLCNoch keine Bewertungen

- Direct Labor Variance ExampleDokument1 SeiteDirect Labor Variance ExampleImperoCo LLCNoch keine Bewertungen

- Revenue Variance ExampleDokument1 SeiteRevenue Variance ExampleImperoCo LLCNoch keine Bewertungen

- Job Order Costing ExampleDokument3 SeitenJob Order Costing ExampleImperoCo LLCNoch keine Bewertungen

- Departmental Expense Breakdown: Process Costing ExampleDokument5 SeitenDepartmental Expense Breakdown: Process Costing ExampleImperoCo LLCNoch keine Bewertungen

- Financial Budget Example: White Cells Are AdjustableDokument5 SeitenFinancial Budget Example: White Cells Are AdjustableImperoCo LLCNoch keine Bewertungen

- Linear Programming ExampleDokument1 SeiteLinear Programming ExampleImperoCo LLCNoch keine Bewertungen

- Monte Carlo Simulation ExampleDokument1 SeiteMonte Carlo Simulation ExampleImperoCo LLCNoch keine Bewertungen

- Forecasting WorksheetDokument2 SeitenForecasting WorksheetImperoCo LLCNoch keine Bewertungen

- Capital Budgeting WorksheetDokument2 SeitenCapital Budgeting WorksheetImperoCo LLCNoch keine Bewertungen

- Flutter Layout Cheat SheetDokument11 SeitenFlutter Layout Cheat SheetJarrett Yew0% (1)

- How many times do clock hands overlap in a dayDokument6 SeitenHow many times do clock hands overlap in a dayabhijit2009Noch keine Bewertungen

- Vehicle and Driver Vibration - PPTDokument16 SeitenVehicle and Driver Vibration - PPTAnirban MitraNoch keine Bewertungen

- Sae Technical Paper Series 2015-36-0353: Static and Dynamic Analysis of A Chassis of A Prototype CarDokument12 SeitenSae Technical Paper Series 2015-36-0353: Static and Dynamic Analysis of A Chassis of A Prototype CarGanesh KCNoch keine Bewertungen

- 8279Dokument32 Seiten8279Kavitha SubramaniamNoch keine Bewertungen

- Worksheet Chapter 50 Introduction To Ecology The Scope of EcologyDokument2 SeitenWorksheet Chapter 50 Introduction To Ecology The Scope of EcologyFernando CastilloNoch keine Bewertungen

- Hegemonic Masculinity As A Historical Problem: Ben GriffinDokument24 SeitenHegemonic Masculinity As A Historical Problem: Ben GriffinBolso GatoNoch keine Bewertungen

- Standard OFR NATIONAL L13A BDREF Ed1.1 - 24 - JanvierDokument640 SeitenStandard OFR NATIONAL L13A BDREF Ed1.1 - 24 - JanvierosmannaNoch keine Bewertungen

- Positive Leadership and Adding Value - A Lifelong Journey: June 2017Dokument7 SeitenPositive Leadership and Adding Value - A Lifelong Journey: June 2017CescSalinasNoch keine Bewertungen

- Idea of CultureDokument28 SeitenIdea of CultureGustavo Dias VallejoNoch keine Bewertungen

- Curtis E50 Pump Parts ListDokument8 SeitenCurtis E50 Pump Parts ListrobertNoch keine Bewertungen

- Ake Products 001 2016Dokument171 SeitenAke Products 001 2016davidNoch keine Bewertungen

- Cahyadi J Malia Tugas MID TPODokument9 SeitenCahyadi J Malia Tugas MID TPOCahyadi J MaliaNoch keine Bewertungen

- T5N 630 PR221DS-LS/I in 630 3p F FDokument3 SeitenT5N 630 PR221DS-LS/I in 630 3p F FDkalestNoch keine Bewertungen

- Phy433 Lab Report 1Dokument9 SeitenPhy433 Lab Report 1rabbani abdul rahimNoch keine Bewertungen

- IGNOU FEG-02 (2011) AssignmentDokument4 SeitenIGNOU FEG-02 (2011) AssignmentSyed AhmadNoch keine Bewertungen

- The Reference Frame - Nice Try But I Am Now 99% Confident That Atiyah's Proof of RH Is Wrong, HopelessDokument5 SeitenThe Reference Frame - Nice Try But I Am Now 99% Confident That Atiyah's Proof of RH Is Wrong, Hopelesssurjit4123Noch keine Bewertungen

- Branding & Advertising (T NG H P) PDFDokument44 SeitenBranding & Advertising (T NG H P) PDFNguyễn Ngọc Quỳnh Anh100% (1)

- Prologue - Life InsuranceDokument4 SeitenPrologue - Life InsuranceCamila Andrea Sarmiento BetancourtNoch keine Bewertungen

- KL 8052N User ManualDokument33 SeitenKL 8052N User ManualBiomédica HONoch keine Bewertungen

- AS-9100-Rev-D Internal-Audit-Checklist SampleDokument4 SeitenAS-9100-Rev-D Internal-Audit-Checklist Samplesaifulramli69Noch keine Bewertungen

- Earning Elivery Odalities Study Notebook: Guinayangan North DistrictDokument48 SeitenEarning Elivery Odalities Study Notebook: Guinayangan North DistrictLORENA CANTONG100% (1)

- Bachelor of Science in Tourism Management: Iloilo City Community College Ge 1. Understanding The SelfDokument4 SeitenBachelor of Science in Tourism Management: Iloilo City Community College Ge 1. Understanding The SelfPaula Danielle HachuelaNoch keine Bewertungen

- Scor Overview v2 0Dokument62 SeitenScor Overview v2 0Grace Jane Sinaga100% (1)

- CASE ANALYSIS: DMX Manufacturing: Property of STIDokument3 SeitenCASE ANALYSIS: DMX Manufacturing: Property of STICarmela CaloNoch keine Bewertungen

- Sap - HR Standard Operating Procedure: Facility To Reset Password of ESSDokument6 SeitenSap - HR Standard Operating Procedure: Facility To Reset Password of ESSPriyadharshanNoch keine Bewertungen

- Large Generator Protection enDokument14 SeitenLarge Generator Protection enNguyen Xuan TungNoch keine Bewertungen

- Troubleshooting Lab 1Dokument1 SeiteTroubleshooting Lab 1Lea SbaizNoch keine Bewertungen

- Usg Sheetrock® Brand Acoustical SealantDokument3 SeitenUsg Sheetrock® Brand Acoustical SealantHoracio PadillaNoch keine Bewertungen

- Vision and Mission Analysis ChapterDokument15 SeitenVision and Mission Analysis Chapterzaza bazazaNoch keine Bewertungen