Beruflich Dokumente

Kultur Dokumente

SM 01

Hochgeladen von

NogtiolgaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SM 01

Hochgeladen von

NogtiolgaCopyright:

Verfügbare Formate

Introduction to Corporate Finance, Second Edition

Booth, Cleary

Chapter 1: An Introduction to Finance Multiple Choice Questions 1. Section: 1.1 Real versus Financial Assets Learning objective: 1.2 Level of Difficulty: Easy Solution: B 2. Section: 1.1 Real versus Financial Assets Learning objective: 1.2 Level of Difficulty: Medium Solution: C Net worth = Assets Debts. Examples of real assets are residential structures, non-residential structures, machinery and equipment, durables, inventories, and land. 3. Section: 1.2 The Financial System Learning objective: 1.3 Level of Difficulty: Easy Solution: B 4. Section: 1.2 The Financial System Learning objective: 1.3 Level of Difficulty: Medium Solution: A In the financial system, households are the primary fund providers to the government and businesses. 5. Section: 1.2 The Financial System Learning objective: 1.3 Level of Difficulty: Medium Solution: C Banks, pension funds, and insurance firms do transform the nature of their underlying financial securities. However, mutual funds do not transform the nature of the underlying financial securities. 6. Section: 1.3 Financial Instruments and Markets Learning objective: 1.4 Level of Difficulty: Medium Solution: C Practice Problems 7. Section: 1.1 Real versus Financial Assets Learning objective: 1.2 Level of Difficulty: Easy Solution: Balance sheet:

Solutions Manual 1 Chapter 1 Copyright 2010 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission is strictly prohibited.

Introduction to Corporate Finance, Second Edition

Booth, Cleary

Residential structures: $1,000+ $3,000+$1,500 = $5,500 As there are no foreign assets or liabilities, the net worth or equity of the island is $5,500 To deal with the Fred and Robinson`s debts: Assets Fred House Debt to Friday Robinson House Debt to Friday Friday House Loan to Fred Loan to Robinson Totals $1,000 $500 $3,000 $2,000 $1,500 $ 500 $2,000 $8,000 $2,500 Liabilities

As net worth equals assets minus liabilities, the net worth of the economy equals total assets minus total liabilities or $5,500. 8. Section: 1.2 The Financial System Learning objective: 1.3 Level of Difficulty: Medium Solution: In the financial system, there are mainly four major sectors: Households, Government, Business and Non-Residents. Within the field of finance there are four major areas: personal finance, government finance, corporate finance, and international finance. They closely interrelate to each other. Because they are all major parts of the whole financial system, what happens in one market will affect all the other markets. 9. Section: 1.2 The Financial System Learning objective: 1.3 Level of Difficulty: Medium Solution: Banks take in deposits and loan them out to fund borrowers. Pension funds take in pension contributions and pay out pensions to plan participants when they retire. Insurance firms take in premiums and pay out when a certain event occurs. Mutual funds pool small funds together and make investments that small investors cannot make. Mutual funds also offer investment expertise to ordinary investors. 10. Section: 1.2 The Financial System Learning objective: 1.3 Level of Difficulty: Medium Solution: Five main reasons why financial and market intermediaries exist are: i) They provide anonymousness and convenience to all transaction parties.

Solutions Manual 2 Chapter 1 Copyright 2010 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission is strictly prohibited.

Introduction to Corporate Finance, Second Edition

Booth, Cleary

ii) They efficiently match the needs of the participants in the financial market and aggregate all the small transactions. iii) They have procedures for documentation of legal contracts to ensure security. iv) The risk of non-payment is alleviated by maintaining credit ratings and by controlling other accounts. v) Financial institutions transform the nature of the underlying financial securities. 11. Section: 1.2 The Financial System Learning objective: 1.3 Level of Difficulty: Medium Solution: A credit crunch refers to a situation when financial intermediaries such as banks and other lenders are either unable or unwilling, in general, to offer credit to borrowers. The crunch usually arises due to a lack of confidence leading people, and other institutions, to be unwilling to lend to the financial intermediary. If very few people are willing to lend to the financial intermediary, then they, in turn, will not have the funds available to lend out and the crunch begins. 12. Section: 1.3 Financial Instruments and Markets Learning objective: 1.4 Level of Difficulty: Medium Solution: The two main types of primary market transactions are initial public offerings (IPOs), which are offered to the public by previously private firms, and seasoned equity offerings (SEOs), which are offered by firms previously listed on the stock exchange. 13. Section: 1.3 Financial Instruments and Markets Learning objective: 1.4 Level of Difficulty: Difficult Solution: Secondary market transactions are those where ownership of existing shares changes hands, but the corporations or governments who originally issued the securities receive no financing; trading takes place between investors.. This is critical to the functioning of the primary markets, because governments and companies would not be able to raise financing if investors were unable to sell their investments if necessary.

Solutions Manual 3 Chapter 1 Copyright 2010 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission is strictly prohibited.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Accounting 50 IMP QUESDokument94 SeitenAccounting 50 IMP QUESVijayasri KumaravelNoch keine Bewertungen

- E BankingDokument26 SeitenE BankingJojo DiazNoch keine Bewertungen

- IAS 12 - Income Tax: Prepared By: Sir Hamza Abdul HaqDokument33 SeitenIAS 12 - Income Tax: Prepared By: Sir Hamza Abdul HaqSrabon BaruaNoch keine Bewertungen

- Group 4 Merry Land Amusement ParkDokument9 SeitenGroup 4 Merry Land Amusement ParkPatricia BelmonteNoch keine Bewertungen

- IntermediariesDokument31 SeitenIntermediariesrajesh_natarajan_4Noch keine Bewertungen

- 01 Cbs - Dec012016 (1) Features & ControlDokument72 Seiten01 Cbs - Dec012016 (1) Features & ControlrakhalbanglaNoch keine Bewertungen

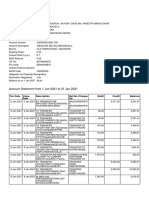

- Bank Statement 1)Dokument4 SeitenBank Statement 1)hbh2n8tgs4Noch keine Bewertungen

- Sample Bank StatementDokument9 SeitenSample Bank Statementemma adeoyeNoch keine Bewertungen

- Sbi Account Jan 2021Dokument2 SeitenSbi Account Jan 2021Manoj GaurNoch keine Bewertungen

- Accounting Vocabulary: Easy-To-Learn English Terms For AccountingDokument6 SeitenAccounting Vocabulary: Easy-To-Learn English Terms For AccountingRed WaneNoch keine Bewertungen

- Statement of Axis Account No:921010008259654 For The Period (From: 01-05-2021 To: 07-12-2021)Dokument2 SeitenStatement of Axis Account No:921010008259654 For The Period (From: 01-05-2021 To: 07-12-2021)PushpalataNoch keine Bewertungen

- Digital Banking & Sales Distribution: Program Kerja 2021Dokument8 SeitenDigital Banking & Sales Distribution: Program Kerja 2021Muhammad Nur Alim Labalo100% (1)

- MAG BF016 - FA Setup DocumentDokument101 SeitenMAG BF016 - FA Setup DocumentSharif AshaNoch keine Bewertungen

- AUD339 (NOTES CP2) - Companies Act 2016Dokument11 SeitenAUD339 (NOTES CP2) - Companies Act 2016pinocchiooNoch keine Bewertungen

- Modarabah and Deposit ManagementDokument34 SeitenModarabah and Deposit ManagementaleenaaaNoch keine Bewertungen

- SWIFT-gpi Final JAnuary-2018 PDFDokument30 SeitenSWIFT-gpi Final JAnuary-2018 PDFxyNoch keine Bewertungen

- Bill DiscountingDokument21 SeitenBill DiscountingsrinaathmNoch keine Bewertungen

- Chapter 4 - Secondary MarketsDokument29 SeitenChapter 4 - Secondary MarketsAMAL P VNoch keine Bewertungen

- 7 Steps To Understanding The Stock Market Ebook v6Dokument32 Seiten7 Steps To Understanding The Stock Market Ebook v6Afsal Mohamed Kani 004Noch keine Bewertungen

- FAR270 - FEB 2022 SolutionDokument8 SeitenFAR270 - FEB 2022 SolutionNur Fatin AmirahNoch keine Bewertungen

- Retail Banking in IndiaDokument3 SeitenRetail Banking in Indiabeena antuNoch keine Bewertungen

- Name: Instructor: Accounting Principles Primer On Using Excel in AccountingDokument14 SeitenName: Instructor: Accounting Principles Primer On Using Excel in Accountingranim m7mdNoch keine Bewertungen

- C6 Lecture NotesDokument2 SeitenC6 Lecture NotesJonathan NavalloNoch keine Bewertungen

- Chap 3 Slides Final For ClassDokument58 SeitenChap 3 Slides Final For ClassTarif Azad KhanNoch keine Bewertungen

- 1 Accounting For CashDokument1 Seite1 Accounting For CashAir CrlsNoch keine Bewertungen

- Review Material For Traditional Life InsuranceDokument2 SeitenReview Material For Traditional Life InsuranceS4M1Y4100% (1)

- Axis Bank - Financial Overview of Axis Bank & Comparative Study of Current Account and Saving AccDokument103 SeitenAxis Bank - Financial Overview of Axis Bank & Comparative Study of Current Account and Saving Accपं रामजी विदुआ हेमन्तNoch keine Bewertungen

- Commercial Law Review Outline 1Dokument102 SeitenCommercial Law Review Outline 1SGTNoch keine Bewertungen

- Topic 4 Audit ReportDokument55 SeitenTopic 4 Audit ReportKeerthana SegaranNoch keine Bewertungen

- The Working Group On Money Supply Analytics and Methodology of CompilationDokument116 SeitenThe Working Group On Money Supply Analytics and Methodology of Compilationlionshare148Noch keine Bewertungen