Beruflich Dokumente

Kultur Dokumente

Four-S Weekly PE Track 9th July - 15th July 2012

Hochgeladen von

seema1707Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Four-S Weekly PE Track 9th July - 15th July 2012

Hochgeladen von

seema1707Copyright:

Verfügbare Formate

9 T H - 1 5 T H

J U L Y

2 0 1 2

Private Equity Track

Research4India Weekly update on the Indian PE Sector

PE Activity for the week

During the week ended 15th July, 2012, there were 5 PE/VC deals worth $66.5mn compared to 8 deals worth $4.1mn (size of 6 deals were not disclosed), in the previous week. Out of the total, 2 were growth stage deals, 2 were PIPE deals and one was early stage deal. In the largest deal during the week, Carlyle bought a 9.96% stake in the Hyderabad-based IT firm Infotech Enterprises in the open market for a total of Rs 2.1bn ($38mn).

100.0 75.0 8 50.0 25.0 4.1 0.0 8th July'12 PE Investments 15th July'12 No. of Deals

16 14 66.5 12 10 8 6 5 4 2 0

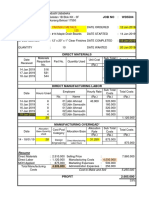

PE Deals During The week

Investor (s)

Target

Stake (%)

Value ($mn)

Stage

Sector

Industry

Segment

Carlyle Fidelity Growth Partners, Qualcomm Ventures, NVP, Catamaran SAIF Partners Jungle Ventures, others Evolvence India Life Sciences Fund

Infotech Enterprises

10.0

38.0

PIPE

Services

IT/ITeS

Software & services

Big Shoe Bazaar

NA

18.0

Growth

Services

Retail

Internet Retail

Blue Star Mobikon Asia Pte Ltd Dr. Agarwal's Healthcare

2.8

8.8

PIPE

Manufacturing

FMCG Media & Entertain ment Health Services

AC Digital marketing

NA

1.7

Early

Services

NA

NA

Growth

Services

Hospitals

Source: Four-S PE Database

Research4India is the research services arm of Four-S Services Pvt Ltd. Here we provide regular research reports on key sectors of the Indian economy, and large unlisted companies in these sectors. For subscription / custom queries, please contact Seema Shukla at seema@four-s.com.

Private Equity Track

Carlyle buys Enterprises 10% stake in Infotech Yebhi.com, has raised Rs 1bn ($18mn) in Series C funding, led by Fidelity Growth Partners India and Qualcomm Ventures. Existing investors Nexus Venture Partners and Catamaran also participated in the round. Yebhi.com is an ecom site offering products across categories like home, lifestyle & fashion and electronics. In 2010, the company had received Rs 100mn in Series A funding from Nexus Venture Partners. This was followed by a second round of funding of Rs 400mn last year, led by Catamaran Ventures. Four-S Comment: Big Shoe Bazaar is planning a huge push into the mobile commerce space and is set to create some unique M-commerce platforms over the next 6 months. Online shopping is set to receive further boost with the rapid rise of smartphones, tablets and social media networks will greatly influence the way people engage in online shopping. India's current mobile subscriber base stands at 700mn subscribers and has been on a rapid growth. SAIF Partners buys additional stake in Blue Star SAIF Partners has bought 25 lakh shares of Blue Star Limited at a price of Rs 190 per share representing an investment of Rs 475mn ($8.8mn) in the company and raising its stake from 1.39% to 4.17%, an additional 2.78% stake purchase. A major seller in the stock was HDFC Standard Life Insurance Company. The PE firm had invested Rs 170mn in Blue Star earlier in June this year. Blue Star is a central air-conditioning company with an annual turnover of Rs 27bn, a network of 29 offices, 7 modern manufacturing facilities, over 1,600 dealers and around 2,800 employees. The company was planning last year to add one more unit to its existing 5 manufacturing units, with an investment of Rs 500-600mn by this year. Mobikon raises Ventures, others $1.7mn from Jungle

US-based private equity firm Carlyle on Wednesday bought a 9.96% stake in the Hyderabad-based IT firm Infotech Enterprises in the open market at a price of Rs 190 a share, spending a total of Rs 2.1bn ($38mn). Three institutional investors - Kotak India Fund, American Funds Insurance and Small Cap World Funds - were the key sellers of the holding acquired by Carlyle. Infotech Enterprises is a global engineering services company which provides engineering solutions, including product development and life-cycle support, process, network and content engineering to major organizations worldwide and is headquartered in Hyderabad. Other major stakeholders in the company holding more than 10% include Carrier International Mauritius and GA Global Investments. Four-S Comment: Private investment in public equity (PIPE) is emerging as a hot spot for PE investors. For PE investors, PIPEs tend to become increasingly attractive in markets where control investments are harder to execute. And India has always been one such market characterized by growth investments of smaller size for minority stakes. It is more advantageous for a PE fund in India to have a relatively liquid minority position in listed companies than in unlisted companies. Moreover, investors are finding listed companies at increasingly attractive valuations relative to unlisted firms. In addition, such investments provide greater liquidity and easier exit options, which attract investors interest, especially in a market where traditional options of exit, especially IPO market, has almost dried up. In India, PIPE investments more than doubled in 2011 to $1.5 billion in 55 deals compared to $631 million in 30 deals a year earlier (Four-S Research). Big Shoe Bazaar raises $18mn in Series C funding Online wholesale cash and carry company Big Shoe Bazaar India Pvt. Ltd, the brand owner of

Mobikon Asia Pte Ltd, a digital marketing startup located in India and Singapore, has raised $1.7mn in a Series A round led by 2

Research4India

Private Equity Track

Singapore-based Jungle Ventures. Angel investors including Ravi Mantha, a member of the board of trustees at The Indus Entrepreneurs (TiE), and others also took part in the round. The funds will be used for expansion in India and across South-east Asia. The company is opening new offices in Bangalore, Mumbai and Delhi, as well as in Thailand, Indonesia and Australia. Jungle Ventures is a venture capital firm in Singapore that provides early-stage investments and business-building infrastructure to startups across the Asia Pacific. The firm focuses on early-stage funding across Singapore, India and the South-east Asia. Evolvence Life Sciences Agarwal's Healthcare invests in Dr. on investing and managing a number of quick service and casual dining restaurant chains. Quadria Capital to raise healthcare fund Quadria Capital and Investment Management is planning to raise $300mn healthcare fund. Religare Global Asset Management has committed to invest $15-20mn and become the anchor investor in the fund. The plan is to raise one third of the funds in next 5 months and the rest by end of 2013 from investors ranging from FIIs, fund of funds and HNIs. Quadria Capital Investment Management is an Asian healthcare PE fund with offices in New Delhi and Singapore. Its target investments include midsized healthcare companies with half the funds deployed in India and the rest in South and Southeast Asia.

Life Sciences-focused private equity fund EILSF (Evolvence India Life Sciences Fund) has acquired a minority stake in Chennai-based Dr. Agarwal's Healthcare, its second investment in the healthcare services segment. Dr. Agarwal's Eye Hospital is a comprehensive eye hospital, offering one stop solution for eye ailments.

Private Equity News

Karbonn Mobile to raise PE investment Karbonn Mobile is planning to raise Rs 10bn by diluting 15-20% stake to PE investors. It is planning to set up a manufacturing plant and acquiring a Korean R&D firm. Karbonn Mobiles will invest Rs 6bn in the mobile device manufacturing plant in Chennai over 2013-14, for which land has been acquired. The balance of Rs 4bn will be used in acquiring the R&D centre based out of Korea, for which duediligence was going on. As of now, all of Karbonns handsets, like for most domestic players, are imported largely from China and Taiwan while the designing is done in India. Alliance Dental expansion to raise funds for

Fund Raising & Liquidity Events

Bain raises $2.3bn for second Asia fund Bain Capital has completed fundraising for its second Asia fund, closing at $2.3bn. Bain is offering investors three options on the fees it charges to manage the money they invest from its latest global fund, and the concept was first tested on its second Asia fund. Bain offered Bain Capital Asia Fund II investors the option of either a 2% management fee and a 20% carried interest with a 7% hurdle rate, or 1% management fee and 30% carried interest with a 10% hurdle rate. Bain's first Asian fund raised $1bn but the firm has invested $4.4bn in total so far in the Asian region. SAIF Partners floats $18mn restaurant investment vehicle SAIF Partners (which invested in Mainland China in 2007 and made a killing on their investment during their IPO a month ago) has announced a Rs 1bn investment vehicle focused Research4India

Alliance Dental Care is planning to raise Rs 300mn through PE route. The funds will be utilized for expansion of the dental-care chain. The company is in talk with two domestic PE players which are interested in healthcare space. Alliance Dental Care, a subsidiary of Alliance Medicorp, is engaged in the business of running dental clinics. Alliance Medicorp is a JV between Apollo Hospital and medical technology company-Trivitron Healthcare. Currently, Apollo Hospital holds around 70% stake and Trivitron 3

Private Equity Track

Healthcare holds the rest. This February, Alliance Dental rebranded its dental care business to 'White Dental Care'. Omshakthy planning to raise PE funds for new projects Omshakthy Agencies (Madras) Pvt Ltd. is planning to raise Rs 1.5bn through PE investments for its proposed project at Tirumudivakkam near Chennai. The fund raised would comprise half the amount of initial investment of Rs 3bn. The company had entered into a 50:50 JV last year in Oct. with Fire Capital to develop residential projects and townships in and around Chennai named Omshakthy FIRE Realty Pvt. Ltd. The company has acquired more than 4,000 acres of land since its inception in 1991, and currently has a land bank of around 250 acre distributed across various locations. Blackstone to acquire Embassy Property's office portfolio Blackstone Group is set to acquire 36% stake in the tenanted office space portfolio of Embassy Property Developments Limited for $230mn. Embassy would be demerging the FDI complaint office buildings in which the PE firm will acquire a significant minority stake. The transaction values Embassy's new holding company for office buildings at $900mn after rolling over Blackstone's earlier investment in one of the projects. Embassy had shelved a $500mn IPO last year on account of sluggish stock market. It had entered into a Rs 56bn JV with MK Land Holding, a Malysian realty company and had set a Rs 60bn capex for new projects in next 3 years in November 2010. institutional placement, has sold 4.45 million shares or 5.7% stake. SKS Microfinance opened a QIP on July 12 at a share price of Rs 75.40. The deal would increase the stake held by WestBridge in SKS Microfinance to approximately 12.5%, making it one of the largest shareholders in the company. Avantha Power revives plan to raise Rs 1015bn through IPO Avantha Power and Infrastructure is planning to revive plans to hit the capital market with an initial public offer (IPO) to raise Rs 10-15bn, after having failed in its first attempt about two years ago. Avantha Power & Infrastructure has 191 MW of operational thermal power capacity, 2,460 MW of generating capacity under various stages of implementation and 1,320 MW of generating capacity under planning. Global private equity giant KKR has invested in the company. Avantha Power had filed draft IPO documents with SEBI way back in March 2010 and the regulator gave its go-ahead a few months later in August that year for the public offer. While the company had firmed up its plans to hit the market in October, adverse market conditions forced it to postpone the IPO. Fitch assigns grade 4 to Rashtriya Ispat Nigam IPO Fitch Ratings has assigned 'Fitch 4(ind)' grade to Rashtriya Ispat Nigam Ltd's proposed Initial Public Offering out of a maximum of 'Fitch 5(ind)'. The grade indicates above-average fundamentals of the issue relative to other listed equity securities in India. The grading reflects RINL's position as one of India's largest producers of long product steel, the favourable medium-to-long-term demand outlook for its products - driven by increasing infrastructure spend and a healthy balance sheet. The company was conferred 'Navratna' status by GoI in November, 2010, which provides a certain degree of operational and financial autonomy.

IPO, Other Offerings

SKS Microfinance opens QIP SKS Microfinance Ltd is raising Rs 335.5mn through a preferential allotment to a fund managed by the existing investor WestBridge Capital Partners. SKS Microfinance, which is also mobilising funds through a qualified

Research4India

Private Equity Track

M&A Activity for the Week

During the week ended 15th July, 2012, there were 11 M&A deals worth $258.1mn (size of 6 deals were not known). In the largest deal during the week, Sutherland Global Services is acquiring Apollo Health Street, a health care BPO arm of Apollo Hospitals for Rs 8.75bn ($157mn).

Stake (%) 100 NA NA 100 NA NA NA NA 100 NA NA Deal value ($ mn) 157.4 52.5 18.0 17.6 12.7 NA NA NA NA NA NA

Acquiror Sutherland Global Services Tube Investments of India CHD Developers Providence Educational Academy Adcock Ingram Healthcare KPIT Parker Hannifin Corporation Solving Efeso InMobi Genpact Tamco Switchgear Source: Four-S PE Database

Target Apollo Health Street Shanthi Gears Empire Realtech Myra Mall Management Company Cosme Farma Laboratories - some assets Sankalp Semiconductor Private John Fowler (India) - filtration biz Q-Spread MMTG Labs Triumph Engineering Henikwon Corporation

Sector IT/ITeS Manufacturing Real estate Real estate Healthcare IT/ITeS Manufacturing IT/ITeS Media & Entertainment IT/ITeS Manufacturing

Market Update

Key Domestic Indices

Indian Market Movements Index BSE Sensex S&P CNX Nifty CNX Nifty Junior Nifty Mid Cap 50 CNX IT Bank Nifty CNX Infrastructure CNX Realty 6-Jul-12 17,521.12 5,316.95 10,334.65 2,190.35 6,027.25 10,655.35 2,471.05 233.05 13-Jul-12 Change (%) 17,213.70 5,227.25 10,185.95 2,147.75 5,713.90 10,594.45 2,424.95 230.90 -1.79% -1.72% -1.46% -1.98% -5.48% -0.57% -1.90% -0.93% High 19,619.65 5,740.40 11,526.10 2,515.70 6,835.25 11,451.25 3,191.60 302.20 52 Week Low 15,135.86 5,263.35 10,102.75 2,137.95 6,114.75 10,303.65 2,415.10 222.75

Key Global Indices

Global Market Movements Index NASDAQ Dow Jones Industrial Average S&P 500 NIKKEI 225 Hang Seng Straits Times Index FTSE 100 6-Jul-12 2,937.33 12,772.47 1,354.68 8,896.88 19,800.64 2,937.56 5,662.63 13-Jul-12 Change (%) 2,908.47 12,777.09 1,356.78 8,724.12 19,092.63 2,995.56 5,666.13 -0.99% 0.04% 0.15% -1.98% -3.71% 1.94% 0.06% High 3,134.17 13,338.66 1,422.38 10,255.20 22,835.03 3,227.28 6,084.08 52 Week Low 2,298.89 10,404.49 1,074.77 8,135.79 16,250.27 2,521.95 4,791.01

Source: Google Finance, Yahoo finance

Research4India

Private Equity Track

Four-S Services Pvt Ltd

Founded in 2002, Four-S has a strong & successful track record of genuine, accurate and objective advice to top Indian & global companies & PE Firms. Four-S has already proven success in corporate finance, strategy consulting, fund-raising, investment banking and investor relations mandates with 100+ corporates and large PE funds.

Four-S, trusted advisor to top Indian & Global Cos

Offering comprehensive bouquet of services to SMEs, Corporates and PE Funds

Research4India

Private Equity Track

About Research4India

Research4India is the research services arm of Four-S Services Pvt Ltd. Here we provide regular research reports on key sectors of the Indian economy, and large unlisted companies in these sectors. These reports will be available on our upcoming site www.research4india.com, as well as from leading international research sellers like Thomson Reuters, Bloomberg, Research and Markets, CapitalIQ etc.

Disclaimer The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. No representation, warranty, guarantee or undertaking, express or implied, is made as to the fairness, accuracy or completeness of any information, projections or opinions contained in this document or upon which any such projections or opinions have been based. Four-S Services Pvt. Ltd. will not accept any liability whatsoever, with respect to the use of this document or its contents. This document has been distributed for information purposes only and does not constitute or form part of any offer or solicitation of any offer to buy or sell any securities. This document shall not form the basis of and should not be relied upon in connection with any contract or commitment whatsoever. This document is not to be reported or copied or made available to others. The company may from time to time solicit from, or perform consulting or other services for, any company mentioned in this document.

For further details/clarifications please contact: Seema Shukla Seema@four-s.com Gurgaon Office: 214, Udyog Vihar, Phase I, Gurgaon 122016 Tel: +91-124-4251442 Ajay Jindal Ajay.jindal@four-s.com Mumbai Office: 101,Nirman Kendra, Opposite Star TV, Off Dr E Moses Road, Mahalaxmi, Mumbai 400001 Tel: +91-22-42153659

Research4India

Das könnte Ihnen auch gefallen

- Company Report - Venus Remedies LTDDokument36 SeitenCompany Report - Venus Remedies LTDseema1707Noch keine Bewertungen

- Four-S Fortnightly Logistics Track 7th August - 20th August 2012Dokument12 SeitenFour-S Fortnightly Logistics Track 7th August - 20th August 2012seema1707Noch keine Bewertungen

- Venus Remedies Report Update PDFDokument11 SeitenVenus Remedies Report Update PDFseema1707Noch keine Bewertungen

- Four-S Fortnightly Mediatainment Track 1st September - 14th September 2012Dokument8 SeitenFour-S Fortnightly Mediatainment Track 1st September - 14th September 2012seema1707Noch keine Bewertungen

- Four-S Fortnightly Logistics Track 7th August - 20th August 2012Dokument12 SeitenFour-S Fortnightly Logistics Track 7th August - 20th August 2012seema1707Noch keine Bewertungen

- Logistics Report SampleDokument10 SeitenLogistics Report Sampleseema1707Noch keine Bewertungen

- Four-S Weekly PE Track 28th May-3rd June2012Dokument6 SeitenFour-S Weekly PE Track 28th May-3rd June2012seema1707Noch keine Bewertungen

- Four-S Fortnightly PharmaHealth Track 23rd April - 5th May 2012Dokument10 SeitenFour-S Fortnightly PharmaHealth Track 23rd April - 5th May 2012seema1707Noch keine Bewertungen

- Four-S Weekly PE Track 19th March - 25th March 2012Dokument6 SeitenFour-S Weekly PE Track 19th March - 25th March 2012seema1707Noch keine Bewertungen

- Four-S Fortnightly Mediatainment Track 16th March - 30th March 2012Dokument8 SeitenFour-S Fortnightly Mediatainment Track 16th March - 30th March 2012seema1707Noch keine Bewertungen

- Four-S Fortnightly Mediatainment Track 11th Feb - 24the Feb 2012Dokument7 SeitenFour-S Fortnightly Mediatainment Track 11th Feb - 24the Feb 2012seema1707Noch keine Bewertungen

- Four-S Monthly Edutrack - 8th January - 5th Febuary 2012Dokument7 SeitenFour-S Monthly Edutrack - 8th January - 5th Febuary 2012seema1707Noch keine Bewertungen

- Four-S Monthly Cleantech Track February 2012Dokument9 SeitenFour-S Monthly Cleantech Track February 2012seema1707Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Mutual Fund Private Public Chapter 1 and 3Dokument34 SeitenMutual Fund Private Public Chapter 1 and 3sudhakar kethanaNoch keine Bewertungen

- Institutional Economics - Concise NotesDokument42 SeitenInstitutional Economics - Concise Notespoorvishetty2005Noch keine Bewertungen

- NERA The Impact of Online Video DistributionDokument56 SeitenNERA The Impact of Online Video DistributionAnonymous LhBzHYIHgsNoch keine Bewertungen

- Skechers U S A: PESTEL AnalysisDokument7 SeitenSkechers U S A: PESTEL AnalysisShruti JhunjhunwalaNoch keine Bewertungen

- Project On Parle-GDokument21 SeitenProject On Parle-GRavi Parmar79% (62)

- HSEDokument308 SeitenHSEAnonymous 2JNPJ2aXNoch keine Bewertungen

- In Problem 10 16 We Projected Financial Statements For Wal Mart Stores 126832Dokument2 SeitenIn Problem 10 16 We Projected Financial Statements For Wal Mart Stores 126832Amit PandeyNoch keine Bewertungen

- Running Head: Integrated Marketing Plan of Oyo Rooms 1Dokument14 SeitenRunning Head: Integrated Marketing Plan of Oyo Rooms 1Duong Trinh MinhNoch keine Bewertungen

- Finance ReviewerDokument3 SeitenFinance ReviewerRocelyn ManatadNoch keine Bewertungen

- Marketing Project: by Anu Thomas 11 ADokument11 SeitenMarketing Project: by Anu Thomas 11 AThomas AntoNoch keine Bewertungen

- IGNOU MBA MS-45 Solved Assignments December 2012Dokument8 SeitenIGNOU MBA MS-45 Solved Assignments December 2012Girija Khanna ChavliNoch keine Bewertungen

- System' Company: Analisis SwotDokument11 SeitenSystem' Company: Analisis SwotZzzz GamingNoch keine Bewertungen

- Microeconomics HomeworkDokument16 SeitenMicroeconomics HomeworkTaylor Townsend100% (1)

- Brightcom Group Limited: September 6, 2021Dokument9 SeitenBrightcom Group Limited: September 6, 2021Vivek AnandNoch keine Bewertungen

- Capital Markets Research in Accounting: S.P. KothariDokument10 SeitenCapital Markets Research in Accounting: S.P. Kothariilham doankNoch keine Bewertungen

- Altria in The U.S. Tobacco Industry - A Porter's Five Forces AnalysisDokument3 SeitenAltria in The U.S. Tobacco Industry - A Porter's Five Forces AnalysisJacNoch keine Bewertungen

- STATEMENTDokument11 SeitenSTATEMENTsahababai793Noch keine Bewertungen

- The Management of Society's Resources Is Important Because Resources Is ScarceDokument1 SeiteThe Management of Society's Resources Is Important Because Resources Is ScarceRodel Amante MedicoNoch keine Bewertungen

- MARKETING DssDokument22 SeitenMARKETING Dssamit100% (1)

- COST SHEET Atau JOB COSTDokument1 SeiteCOST SHEET Atau JOB COSTWiraswasta MandiriNoch keine Bewertungen

- G.R. No. 159647Dokument13 SeitenG.R. No. 159647Eunice KanapiNoch keine Bewertungen

- IAS 32, IFRS7,9 Financial InstrumentsDokument6 SeitenIAS 32, IFRS7,9 Financial InstrumentsMazni Hanisah100% (2)

- Module 7 - Mini Marketing PlanDokument13 SeitenModule 7 - Mini Marketing PlanCESTINA, KIM LIANNE, B.Noch keine Bewertungen

- 0b231module VII BDokument18 Seiten0b231module VII BsplenderousNoch keine Bewertungen

- Cicilia ResearchDokument41 SeitenCicilia ResearchHenry BarasaNoch keine Bewertungen

- Flores - Week 1 - BUSI-612 - D01 - Spring2023Dokument11 SeitenFlores - Week 1 - BUSI-612 - D01 - Spring2023Charlene de GuzmanNoch keine Bewertungen

- ICMApdfDokument6 SeitenICMApdfToni MartinezNoch keine Bewertungen

- Ch07 Tool KitDokument21 SeitenCh07 Tool KitQazi Mohammed AhmedNoch keine Bewertungen

- MohammadDokument2 SeitenMohammadxfzm99mr8rNoch keine Bewertungen

- MLMDokument27 SeitenMLMVanita AggarwalNoch keine Bewertungen