Beruflich Dokumente

Kultur Dokumente

Securities and Exchange Board of India: Navigation Search

Hochgeladen von

Ashish ThengariOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Securities and Exchange Board of India: Navigation Search

Hochgeladen von

Ashish ThengariCopyright:

Verfügbare Formate

Securities and Exchange Board of India

From Wikipedia, the free encyclopedia Jump to: navigation, search Securities and Exchange Board of India It was formed officially by the Government of India in 1992 with SEBI Act 1992 being passed by the Indian Parliament. SEBI is headquartered in the business district of Bandra Kurla Complex complex in Mumbai, and has Northern, Eastern, Southern and Western regional offices in New Delhi, Kolkata, Chennai and Ahmedabad. Controller of Capital Issues was the regulatory authority before SEBI came into existence; it derived authority from the Capital Issues (Control) Act, 1947. Initially SEBI was a non statutory body without any statutory power. However in 1995, the SEBI was given additional statutory power by the Government of India through an amendment to the Securities and Exchange Board of India Act 1992. In April, 1998 the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India. The SEBI is managed by six members, i.e. by the chairman who is nominated by central government & two members, i.e. officers of central ministry, one member from the RBI & the remaining two are nominated by the central government. The office of

SEBI is situated at Mumbai with its regional offices at Kolkata, Delhi & Chennai.

[edit] Organization structure

Upendra Kumar Sinha was appointed chairman on 18 February 2011 replacing C. B. Bhave.[2] The Board comprises[3] NameDesignation Upendra Kumar SinhaChairman Prashant SaranWhole Time Member Rajeev Kumar AgarwalWhole Time Member Dr. Thomas MathewJoint Secretary, Ministry of Finance V. K. Jairath magyaMember Appointed Anand SinhaDeputy Governor, Reserve Bank of India Naved MasoodSecretary,Ministry of Corporate Affairs

Functions and responsibilities

SEBI has to be responsive to the needs of three groups, which constitute the market: the issuers of securities the investors the market intermediaries.

SEBI has three functions rolled into one body: quasi-legislative, quasijudicial and quasi-executive. It drafts regulations in its legislative capacity, it conducts investigation and enforcement action in its executive function and it passes rulings and orders in its judicial capacity. Though this makes it very powerful, there is an appeals process to create accountability. There is a Securities Appellate Tribunal which is a threemember tribunal and is presently headed by a former Chief Justice of a High court - Mr. Justice NK Sodhi. A second appeal lies directly to the Supreme Court. SEBI has enjoyed success as a regulator by pushing systemic reforms aggressively and successively (e.g. the quick movement towards making the markets electronic and paperless rolling settlement on T+2 basis). SEBI has been active in setting up the regulations as required under law. SEBI has also been instrumental in taking quick and effective steps in light of the global meltdown and the Satyam fiasco.[citation needed] It had[when?] increased the extent and quantity of disclosures to be made by Indian corporate promoters. More recently, in light of the global meltdown,it liberalised the takeover code to facilitate investments by removing regulatory structures. In one such move, SEBI has increased the application limit for retail investors to Rs 2 lakh, from Rs 1 lakh at present. [5]

[edit] Powers

For the discharge of its functions efficiently, SEBI has been invested

with the necessary powers which are: to approve bylaws of stock exchanges. to require the stock exchange to amend their bylaws. inspect the books of accounts and call for periodical returns from recognized stock exchanges. inspect the books of accounts of a financial intermediaries. compel certain companies to list their shares in one or more stock exchanges. levy fees and other charges on the intermediaries for performing its functions. grant license to any person for the purpose of dealing in certain areas. delegate powers exercisable by it. prosecute and judge directly the violation of certain provisions of the companies Act.

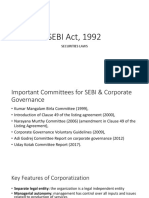

[edit] SEBI Committees

Technical Advisory Committee Committee for review of structure of market infrastructure institutions Members of the Advisory Committee for the SEBI Investor Protection and Education Fund Takeover Regulations Advisory Committee Primary Market Advisory

Committee (PMAC) Secondary Market Advisory Committee (SMAC) Mutual Fund Advisory Committee Corporate Bonds & Securitization Advisory Committee Takeover Panel SEBI Committee on Disclosures and Accounting Standards (SCODA) High Powered Advisory Committee on consent orders and compounding of offences Derivatives Market Review Committee Committee on Infrastructure Funds

[edit] Controversies

Supreme Court of India heard a Public Interest Litigation (PIL) filed by India Rejuvenation Initiative that had challenged the procedure for key appointments adopted by Govt of India. The petition alleged that, "The constitution of the search-cumselection committee for recommending the name of chairman and every whole-time members of SEBI for appointment has been altered, which directly impacted its balance and could compromise the role of the SEBI as a watchdog." [6]HYPERLINK \l "cite_notePIL_alleges_nexus_in_Sebi_appoint ments-6"[7] On 21 November 2011 the court allowed the petitioners to withdraw the petition and file a fresh petition pointing out constitutional

issues regarding appointments of regulators and their independence. The Chief Justice of India refused to the finance ministrys request to dismiss the PIL and said that the court was well aware of what was going on in SEBI.[6]HYPERLINK \l "cite_noteSC_allows_eminent_citizens_to_with draw_petition_against_SEBI_chief.27 s_appointment-7"[8] Further, it came into light that Dr KM Abraham (the then whole time member of SEBI Board) had written to the Prime Minister about malaise in SEBI. He said, "The regulatory institution is under duress and under severe attack from powerful corporate interests operating concertedly to undermine SEBI". He specifically said that Finance Minister's office, and especially his advisor Omita Paul, were trying to influence many cases before SEBI, including those relating to Sahara Group, Reliance, Bank of Rajasthan and MCX.[9]HYPERLINK \l "cite_note-PranabChidu_feud_may_be_revived_over_S ebi_chief_PIL-9"[10]

[edit] Corruption

CBI arrested a Deputy General manager (DGM) of SEBI for demanding and accepting a bribe amounting to 10 lakh (US$20,000) on 1st June 2012.[11]The DGM was denied bail by a sessions court on 20 June 2012. Taking a tough stand, the court observed (among other things), "when our country is fighting against the menace of corruption, if a high ranking official of SEBI is granted bail, that will send wrong signals to the society".[12]

[edit] See also

Stock Exchange () ()

[edit] References

Das könnte Ihnen auch gefallen

- Securities and Exchange Board of IndiaDokument6 SeitenSecurities and Exchange Board of IndiaSiddhi PatwaNoch keine Bewertungen

- History: The Securities and Exchange Board of India Act, 1992Dokument4 SeitenHistory: The Securities and Exchange Board of India Act, 1992Arulmani MurugesanNoch keine Bewertungen

- Securities and Exchange Board of IndiaDokument73 SeitenSecurities and Exchange Board of IndiaSurya ParkashNoch keine Bewertungen

- C C CM: MMMMMMDokument4 SeitenC C CM: MMMMMMGaurav RauthanNoch keine Bewertungen

- Securities and Exchange Board of India: Regulator Securities SEBI Act, 1992Dokument6 SeitenSecurities and Exchange Board of India: Regulator Securities SEBI Act, 1992Pawan LohanaNoch keine Bewertungen

- Securities and Exchange Board of IndiaDokument5 SeitenSecurities and Exchange Board of IndiaKanna RajeshNoch keine Bewertungen

- Difference Between Money Markets and Capital MarketsDokument4 SeitenDifference Between Money Markets and Capital MarketsSachin TiwariNoch keine Bewertungen

- Upendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesDokument4 SeitenUpendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesAbhishek ShuklaNoch keine Bewertungen

- Securities and Exchange Board of India: Jump To Navigation Jump To SearchDokument8 SeitenSecurities and Exchange Board of India: Jump To Navigation Jump To SearchShayan ZafarNoch keine Bewertungen

- Securities and Exchange Board of IndiaDokument32 SeitenSecurities and Exchange Board of IndiaMohan kashyapNoch keine Bewertungen

- Role of SEBI in Capital MarketDokument6 SeitenRole of SEBI in Capital MarketShashank HatleNoch keine Bewertungen

- Securities and Exchange Board of IndiaDokument21 SeitenSecurities and Exchange Board of IndiaDeepa A PoojaryNoch keine Bewertungen

- Introductio 1Dokument2 SeitenIntroductio 1Anil ShelarNoch keine Bewertungen

- Sebi PresentatationDokument21 SeitenSebi PresentatationDeepikaNoch keine Bewertungen

- History: Government of India Indian Parliament Bandra Kurla Complex Mumbai New Delhi Kolkata Chennai AhmedabadDokument2 SeitenHistory: Government of India Indian Parliament Bandra Kurla Complex Mumbai New Delhi Kolkata Chennai AhmedabadVishal SharmaNoch keine Bewertungen

- Assignment On SebiDokument17 SeitenAssignment On SebiSUFIYAN SIDDIQUINoch keine Bewertungen

- Financial Management Regulation PROJECTDokument25 SeitenFinancial Management Regulation PROJECTraj vardhan agarwalNoch keine Bewertungen

- Role of SEBI in Primary MarketDokument19 SeitenRole of SEBI in Primary MarketTwinkle RajpalNoch keine Bewertungen

- Role of SebiDokument3 SeitenRole of SebiAnkush PoojaryNoch keine Bewertungen

- Sebi'S Background: Securities and Exchange Board of IndiaDokument15 SeitenSebi'S Background: Securities and Exchange Board of IndiaAnjaliNoch keine Bewertungen

- Ministry of Corporate AffairsDokument10 SeitenMinistry of Corporate AffairsAzim SamnaniNoch keine Bewertungen

- SEBIDokument2 SeitenSEBIAkash ShrivastavaNoch keine Bewertungen

- SEBI Act, 1992: Securities LawsDokument25 SeitenSEBI Act, 1992: Securities LawsAlok KumarNoch keine Bewertungen

- SEBIDokument25 SeitenSEBIsumant singhNoch keine Bewertungen

- Securities and Exchange Board of India: SEBI - A Brief IntroductionDokument37 SeitenSecurities and Exchange Board of India: SEBI - A Brief IntroductionBhushan KharatNoch keine Bewertungen

- SebiDokument26 SeitenSebiHitesh MendirattaNoch keine Bewertungen

- Regulators of IndiaDokument29 SeitenRegulators of IndiaPoonam KumariNoch keine Bewertungen

- SEBI - The Securities and Exchange Board of IndiaDokument35 SeitenSEBI - The Securities and Exchange Board of IndiaRohan FodnaikNoch keine Bewertungen

- Investment and Securities AssignmentDokument16 SeitenInvestment and Securities Assignmentkhusboo kharbandaNoch keine Bewertungen

- Role of SEBI in Primary MarketDokument19 SeitenRole of SEBI in Primary MarketTwinkle RajpalNoch keine Bewertungen

- Project On SebiDokument15 SeitenProject On SebiVrushti Parmar86% (14)

- Topic: Sebi As A Regulatory Authority On Companies: Company LawDokument21 SeitenTopic: Sebi As A Regulatory Authority On Companies: Company LawsrivarshiniNoch keine Bewertungen

- SebiDokument26 SeitenSebikhilchiadilNoch keine Bewertungen

- Arnav 245 (Sebi)Dokument14 SeitenArnav 245 (Sebi)ArnavNoch keine Bewertungen

- Corporate Social ResponsibilityDokument9 SeitenCorporate Social Responsibilityperumbhuduru manoharNoch keine Bewertungen

- SEBIDokument1 SeiteSEBIApurva DipnaikNoch keine Bewertungen

- Anurag ProjectDokument3 SeitenAnurag ProjectAnurag LahaneNoch keine Bewertungen

- Investment Law PresentationDokument11 SeitenInvestment Law PresentationNanda SurajNoch keine Bewertungen

- Securities and Exchange Board of IndiaDokument10 SeitenSecurities and Exchange Board of IndiajaseelekaNoch keine Bewertungen

- Index: S. No. Title No. Remark SDokument17 SeitenIndex: S. No. Title No. Remark SSiddhi PatwaNoch keine Bewertungen

- Amity Law SchoolDokument12 SeitenAmity Law SchoolIshaan TandonNoch keine Bewertungen

- Co Law IiDokument15 SeitenCo Law IiRitik SharmaNoch keine Bewertungen

- Ifm AssignmentDokument15 SeitenIfm AssignmentRockstar KshitijNoch keine Bewertungen

- INTRODUCTIONDokument48 SeitenINTRODUCTIONtanisq10100% (2)

- SEBIDokument8 SeitenSEBIanandminz35Noch keine Bewertungen

- Dodgy Transaction: Powers of SEBIDokument11 SeitenDodgy Transaction: Powers of SEBIJesse JhangraNoch keine Bewertungen

- Financial Markets Assignment Sem-2Dokument14 SeitenFinancial Markets Assignment Sem-2Prerna BhansaliNoch keine Bewertungen

- Securities Exchange Board of IndiaDokument24 SeitenSecurities Exchange Board of IndiaasdNoch keine Bewertungen

- Functional Report of SEBIDokument9 SeitenFunctional Report of SEBIAMIT K SINGH100% (1)

- Security Exchange & Board of IndiaDokument11 SeitenSecurity Exchange & Board of IndiaLyco BhardwajNoch keine Bewertungen

- Index SR No. Topic PG No.: K.E.S Shroff CollegeDokument55 SeitenIndex SR No. Topic PG No.: K.E.S Shroff CollegeSaurabh sarojNoch keine Bewertungen

- Securities and Exchange Board of India (SEBI) : AboutDokument3 SeitenSecurities and Exchange Board of India (SEBI) : AboutLamheNoch keine Bewertungen

- Role of Sebi in Corporate GoveranceDokument13 SeitenRole of Sebi in Corporate GoveranceTanima RoyNoch keine Bewertungen

- SEBI PresentationDokument14 SeitenSEBI PresentationShubham PrabhatNoch keine Bewertungen

- Role of S.E.B.I. As A Regulatory Authority: AbhinavDokument5 SeitenRole of S.E.B.I. As A Regulatory Authority: AbhinavRahul JagwaniNoch keine Bewertungen

- 1.7 Business Legal Systems: Mfa 1 SemesterDokument53 Seiten1.7 Business Legal Systems: Mfa 1 SemesterSoumyaparna SinghaNoch keine Bewertungen

- Sebi Sensex Nifty Bse NseDokument47 SeitenSebi Sensex Nifty Bse NseKushal WaliaNoch keine Bewertungen

- Sebi Functional ReportDokument7 SeitenSebi Functional ReportRohan Pawar61% (18)

- Corporate Governance: A practical guide for accountantsVon EverandCorporate Governance: A practical guide for accountantsBewertung: 5 von 5 Sternen5/5 (1)

- Valero REC Form 3A Protocol AssessmentDokument5 SeitenValero REC Form 3A Protocol AssessmentMarian SolivaNoch keine Bewertungen

- Crim Law Deskbook V 1Dokument901 SeitenCrim Law Deskbook V 1jamesbeaudoinNoch keine Bewertungen

- Felipe Vs LeuterioDokument4 SeitenFelipe Vs LeuterioJoshua McgeeNoch keine Bewertungen

- Philippine Petroleum Corporation Vs Municipality of PilillaDokument2 SeitenPhilippine Petroleum Corporation Vs Municipality of PilillaCharmaine Key Aurea100% (3)

- Property Storage AgreementDokument2 SeitenProperty Storage AgreementLegal Forms100% (1)

- United States v. Carnell Kelly, 4th Cir. (2011)Dokument4 SeitenUnited States v. Carnell Kelly, 4th Cir. (2011)Scribd Government DocsNoch keine Bewertungen

- ALVIN JOSE vs. PEOPLE OF THE PHILIPPINESDokument2 SeitenALVIN JOSE vs. PEOPLE OF THE PHILIPPINESAnsai Claudine CaluganNoch keine Bewertungen

- Id (E) 981Dokument11 SeitenId (E) 981abhishekray20Noch keine Bewertungen

- Application and Agreement For Standby Letter of Credit Names of Applicants - CompressDokument9 SeitenApplication and Agreement For Standby Letter of Credit Names of Applicants - CompressSalvatore MartinesNoch keine Bewertungen

- Eo No. 1008Dokument4 SeitenEo No. 1008Raine Buenaventura-EleazarNoch keine Bewertungen

- 006 DIGESTED Phil Bank of Commerce Vs CA - G.R. No. 97626Dokument5 Seiten006 DIGESTED Phil Bank of Commerce Vs CA - G.R. No. 97626Paul ToguayNoch keine Bewertungen

- Cfe 105 - JusticeDokument5 SeitenCfe 105 - JusticeFronda Jerome BlasNoch keine Bewertungen

- Permenent Lok AdalatDokument6 SeitenPermenent Lok AdalatHricha Gandhi100% (1)

- Special Power of AttorneyDokument4 SeitenSpecial Power of AttorneyMPDO ManticaoNoch keine Bewertungen

- Bayani Vs Collector of CustomsDokument4 SeitenBayani Vs Collector of CustomsLennart ReyesNoch keine Bewertungen

- OCA Circular 93-20 PDFDokument4 SeitenOCA Circular 93-20 PDFDaniel Al DelfinNoch keine Bewertungen

- Question Bank - LLB Sem-1 Gujarat UniversityDokument26 SeitenQuestion Bank - LLB Sem-1 Gujarat UniversityPatel jayNoch keine Bewertungen

- Oblicon Codal OutlineDokument6 SeitenOblicon Codal OutlineGab NaparatoNoch keine Bewertungen

- Ilagan v. EnrileDokument4 SeitenIlagan v. EnrilekathrynmaydevezaNoch keine Bewertungen

- Rosenthal FDCPADokument7 SeitenRosenthal FDCPAYared KimNoch keine Bewertungen

- Camlin Pvt. Ltd. Vs National Pencil Industries On 7 November, 1985 PDFDokument9 SeitenCamlin Pvt. Ltd. Vs National Pencil Industries On 7 November, 1985 PDFmic2135Noch keine Bewertungen

- 19-Pormento SR Vs PontevedraDokument7 Seiten19-Pormento SR Vs PontevedraLexter CruzNoch keine Bewertungen

- December 14, 2012, FM/27/12 Legal Brief Dated in response to Motion filed by 501376, a body corporate. FM/27/12 Charter Challenge - Charter Application – Andre Murray v. ROYAL BANK OF CANADA, 501376 N.B. Ltd., a body corporate, Province of New Brunswick, Canada.Dokument81 SeitenDecember 14, 2012, FM/27/12 Legal Brief Dated in response to Motion filed by 501376, a body corporate. FM/27/12 Charter Challenge - Charter Application – Andre Murray v. ROYAL BANK OF CANADA, 501376 N.B. Ltd., a body corporate, Province of New Brunswick, Canada.Justice Done Dirt CheapNoch keine Bewertungen

- Leonilo Sanchez Alias Nilo, Appellant, vs. People of The Philippines and Court of AppealsDokument6 SeitenLeonilo Sanchez Alias Nilo, Appellant, vs. People of The Philippines and Court of AppealsRap BaguioNoch keine Bewertungen

- Project On Evolution of Policing in India (Subject - Police Administration)Dokument23 SeitenProject On Evolution of Policing in India (Subject - Police Administration)soumilNoch keine Bewertungen

- CopyrightDokument4 SeitenCopyrightEnc TnddNoch keine Bewertungen

- Barangay ConciliationDokument5 SeitenBarangay ConciliationAlberto NicholsNoch keine Bewertungen

- Bustamante V CADokument9 SeitenBustamante V CAJan Igor GalinatoNoch keine Bewertungen

- Module 10 - Moral DeliberationDokument6 SeitenModule 10 - Moral Deliberationseulgi kimNoch keine Bewertungen

- Appointment Letter FormatDokument2 SeitenAppointment Letter Formatpanibapi6307Noch keine Bewertungen