Beruflich Dokumente

Kultur Dokumente

E Commerce

Hochgeladen von

devank1505Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

E Commerce

Hochgeladen von

devank1505Copyright:

Verfügbare Formate

What is e-Commerce?

E-commerce is an emerging concept that describes the processof buying and sellin g or exchanging of products, services, andinformation via computer networ s incl uding the internet. Definition of E-Commerce from Different Perspective 1. Communications Perspective EC is the delivery of information,products/services, orpayments over thetelephon e lines, computer networ sorany other electronic means. 2. Business Process Perspective EC is the application of technology towardthe automationof business transactions and wor flow. 3. Service Perspective EC is a tool that addresses the desire offirms, consumers,and management tocut s ervice costs while improvingthequality of goods and increasing thespeed of servi cedelivery. 4. Online Perspective EC provides the capability of buyingand selling productsand information onthe in ternet and other online services. Benefit of e-Commerce Access new mar ets and extend service offerings tocustomers Broaden current geographical parameters to operate globally Reduce the cost of mar eting and promotion Improve customer service Strengthen relationships with customers and suppliers Streamline business processes and administrative functions Scope of E-Commerce Mar eting, sales and sales promotion Pre-sales, subcontracts, supply Financing and insurance Commercial transactions: ordering, delivery, payment Product service and maintenance TYPES B2B - Business to Business e-commerce has been in use for quit a few years and is morecommonly nown as EDI (electronic data interchange). In thepast EDI was conducted on a direct lin of some form betweenthe two businesses where as today the most popular connectioni s the internet. The two businesses pass information electroni-cally to each othe r. B2B e-commerce currently ma es up about94% of all e-commerce transactions.Typ ically in the B2B environment, E-Commerce can be used inthe following processes: Procurement; order fulfillment;

Managing trading-partner relationships.

B2C - Business to Consumer Business to Consumer e-commerce is relatively new toAustralia. This is where the consumer accesses the system of thesupplier. It is still a two way function but is usually done solelythrough the Internet.B2C can also relate to receiving inf ormation such as share prices,insurance quotes, on-line newspapers, or weather f orecasts. Thesupplier may be an existing retail outlet such as a high streetstor e; it has been this type of business that has been successfulin using eCommerce to deliver services to customers. Thesebusinesses may have been slow in gearingup for eCommercecompared to the innovative dot.com start ups, but they usuallyha ve a sound commercial structure as well as in-depth experi-ence of running a bus iness - something which many dot.comslac ed, causing many to fail Example : A home user wishes to purchase some good qualitywine. The user accesses the In ternet site

Advantages and Disadvantages of Ecommerce The invention of faster internet connectivity and powerful online tools has resu lted in a new commerce arena Ecommerce. Ecommerce offered many advantages to com panies and customers but it also caused many problems. Advantages of Ecommerce Faster buying/selling procedure, as well as easy to find products. Buying/selling 24/7. More reach to customers, there is no theoretical geographic limitations. Low operational costs and better quality of services. No need of physical company set-ups. Easy to start and manage a business. Customers can easily select products from different providers without moving around physically. Disadvantages of Ecommerce Any one, good or bad, can easily start a business. And there are many bad si tes which eat up customers money. There is no guarantee of product quality. Mechanical failures can cause unpredictable effects on the total processes. As there is minimum chance of direct customer to company interactions, custo mer loyalty is always on a chec . There are many hac ers who loo for opportunities, and thus an ecommerce sit e, service, payment gateways, all are always prone to attac .

Highlights of the 10th Five-Year Plan

Following are the highlights of the 10th Five-Year Plan approved by the National Development Council in New Delhi [ Images ] on Saturday: 8 per cent average gross domestic product growth for the period 2002-07. Creation of 50 million employment opportunities in the next 5 years. Reduction of poverty ratio by 5 percentage points by 2007 and by 15 percenta ge points by 2012. Emphasis to be placed on completion of partially completed or on-going proje cts, and upgradation of existing capital assets before starting new projects. Rapid privatisation of public sector underta ings, particularly those wor in g well below capacity. Continue the policy of PSU disinvestments to enable the realization of Rs 16 ,000 crore (Rs 160 billion) per annum to finance the Plan. Progressive reduction in fertiliser subsidy as well as elimination of petrol eum subsidy. Food subsidy be better targeted through targeted public distribution system and specific programmes for the poor li e food-for-wor programme. Curtailment of pay and allowance bill of the government. All children in school by 2003; all children to complete 5 years of schoolin g by 2007. Reduction in gender gaps in literacy and wage rates by at least 50 per cent by 2007. Reduction in the decadal rate of population growth between 2001 and 2011 to 16.2 per cent. Increase in literacy rates to 75 per cent within the Plan period. Increase in forest and tree cover to 25 per cent by 2007 and 33 per cent by 2012. Encouraging foreign direct investment so as to achieve the annual target of $7.5 billion. Exemptions under corporate tax to be progressively eliminated. Single excise rate. Expansion of service tax net. All villages to have sustained access to potable drin ing water within the P lan period. Legal and procedural changes for facilitating quic transfer of assets, incl uding such measures as repeal of Sic Industrial Companies (special provision) A ct (Sica), introduction of ban ruptcy law, facilitating foreclosure and accelera ting judicial processes. Lower tariffs on imports to remove anti-export bias. Rationalisation of domestic tax structure, and the consequent simplification of the export promotion regime. Evolve a positive agenda for future negotiations at the World Trade Organisa tion. Improving tax/GDP ratio of the Centre and states through inclusion of servic es in tax base, removal of tax exemptions and concessions, harmonisation of tax rates, tightening of tax administration, and adopting an integrated valued-added tax (VAT) regime. Reduction of budget-based subsidies by raising user charges of departmental services, reducing expenditure by cutting administrative and establishment costs and privatisation and through the Centre's initiative switching over to ad valo rem rates of royalty on minerals Reducing staff strength through adoption of policy of net attrition and cons tituting a pension and amortisation fund to ma e committed payments li e termina l benefits and debt servicing. Enacting a ?fiscal responsibility and budget management' Bill under which bo rrowings shall be restricted to attain a non-rising debt to GDP ratio from curre nt levels in order to reduce the burden of interest payments. Improving internal resources of states' PSUs by implementing power sector re forms and reducing the burden of contingent liabilities on state budgets through a legislative or administrative ceiling on the issue of state guarantees.

Simplifying laws and procedures for investment. Eliminating inter-state barriers to trade and commerce. Reforming development financial institutions for long-term financing of smal l and medium enterprises. Removal of government and Reserve Ban of India [ Get Quote ] restrictions o n financing of stoc ing and trading. Calibration of the cost of borrowed funds for enhancing competitiveness. Essential Commodities Act to be repealed and replaced by an Emergency Act. Alignment of customs tariffs with average Asian rates. Exemptions and concessions that distort tariff structure to be eliminated. Improvement of the operational efficiency of railways and power sector units . User charges to be raised to cost-recover levels. Project-based assistance needs to be encouraged. Rationalisation of centrally sponsored schemes and central sector schemes us ing zero-based budgeting. Railway tariff regulatory authority needed to oversee the pricing of passeng er and freight traffic services. Opening of civil aviation sector and setting up a regulatory framewor for t he sector. Adoption of integrated approach to improvement in agriculture sector by util ising waste and degraded lands.

Types of Economic Systems

Scarcity is the fundamental challenge confronting all individuals and nations. W e all face limitations... so we all have to ma e choices. We can't always get wh at we want. How we deal with these limitations that is, how we prioritize and allo cate our limited income, time, and resources is the basic economic challenge that has confronted individuals and nations throughout history. But not every nation has addressed this challenge in the same way. Societies hav e developed different broad economic approaches to manage their resources. Econo mists generally recognize four basic types of economic systems traditional, comman d, mar et, and mixed but they don t completely agree on the question of which system best addresses the challenge of scarcity. A traditional economic system is here's a shoc er shaped by tradition. The wor that people do, the goods and services they provide, how they use and exchange resou rces all tend to follow long-established patterns. These economic systems are not very dynamic things don t change very much. Standards of living are static; individ uals don t enjoy much financial or occupational mobility. But economic behaviors a nd relationships are predictable. You now what you are supposed to do, who you trade with, and what to expect from others. In many traditional economies, community interests ta e precedence over the indi vidual. Individuals may be expected to combine their efforts and share equally i n the proceeds of their labor. In other traditional economies, some sort of priv ate property is respected, but it is restrained by a strong set of obligations t

"You can't always get what you want." That's what the Rolling Stones sang, anywa y (chec it out: great song even if it's a bit before your time). And while Mic Jagger probably didn't have Econ 101 in mind, he managed to sum up perfectly th e core concept underlying all economics.

hat individuals owe to their community. Today you can find traditional economic systems at wor among Australian aborigi nes and some isolated tribes in the Amazon. In the past, they could be found eve rywhere in the feudal agrarian villages of medieval Europe, for example. In a command economic system or planned economy, the government controls the eco nomy. The state decides how to use and distribute resources. The government regu lates prices and wages; it may even determine what sorts of wor individuals do. Socialism is a type of command economic system. Historically, the government ha s assumed varying degrees of control over the economy in socialist countries. In some, only major industries have been subjected to government management; in ot hers, the government has exercised far more extensive control over the economy. The classic (failed) example of a command economy was the communist Soviet Union . The collapse of the communist bloc in the late 1980s led to the demise of many command economies around the world; Cuba continues to hold on to its planned ec onomy even today. In mar et economies, economic decisions are made by individuals. The unfettered interaction of individuals and companies in the mar etplace determines how resou rces are allocated and goods are distributed. Individuals choose how to invest t heir personal resources what training to pursue, what jobs to ta e, what goods or services to produce. And individuals decide what to consume. Within a pure mar e t economy the government is entirely absent from economic affairs. The United States in the late nineteenth century, at the height of the lassez-fa ire era, was about as close as we've seen to a pure mar et economy in modern pra ctice. A mixed economic system combines elements of the mar et and command economy. Man y economic decisions are made in the mar et by individuals. But the government a lso plays a role in the allocation and distribution of resources.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- This Study Resource Was Shared Via: B. Working Capital ManagementDokument9 SeitenThis Study Resource Was Shared Via: B. Working Capital ManagementGerry Sajol50% (2)

- RM FinalDokument19 SeitenRM FinalMonir HossainNoch keine Bewertungen

- Mock Exam II Midterm WITH SOLUTIONSDokument6 SeitenMock Exam II Midterm WITH SOLUTIONSAlessandro FestanteNoch keine Bewertungen

- Sawyers - Introduction To Managerial AccountingDokument29 SeitenSawyers - Introduction To Managerial AccountingTrisha Mae AlburoNoch keine Bewertungen

- Financial Analysis of ApexDokument31 SeitenFinancial Analysis of ApexAfrid Khan100% (1)

- 2010-11 Recruiting WebsitejkDokument27 Seiten2010-11 Recruiting Websitejkdevank1505Noch keine Bewertungen

- Degree Year Affiliation Division: ND STDokument4 SeitenDegree Year Affiliation Division: ND STdevank1505Noch keine Bewertungen

- Virtual MemoryDokument7 SeitenVirtual Memorydevank1505Noch keine Bewertungen

- What Is The IRQ (Interrupt Request) ?Dokument1 SeiteWhat Is The IRQ (Interrupt Request) ?devank1505Noch keine Bewertungen

- CPU Cache: From Wikipedia, The Free EncyclopediaDokument19 SeitenCPU Cache: From Wikipedia, The Free Encyclopediadevank1505Noch keine Bewertungen

- HPM N ScopeDokument2 SeitenHPM N Scopedevank1505Noch keine Bewertungen

- Course Financial Accounting I Course Code Status Level Credit Hours Pre-Requisites Methodology Evaluation Lecturer(s) Noor Suhaila ShaharuddinDokument3 SeitenCourse Financial Accounting I Course Code Status Level Credit Hours Pre-Requisites Methodology Evaluation Lecturer(s) Noor Suhaila ShaharuddinQassam_BestNoch keine Bewertungen

- 49 Working Capital Management of FMCG Companies in IndiaDokument87 Seiten49 Working Capital Management of FMCG Companies in IndiaPurvesh AmbekarNoch keine Bewertungen

- Oxford Scholarly Authorities On International Law - 5 Compensation in - Compensation and Restitution in InvestorDokument37 SeitenOxford Scholarly Authorities On International Law - 5 Compensation in - Compensation and Restitution in InvestorArushi SinghNoch keine Bewertungen

- DrillsDokument4 SeitenDrillsKRISTINA DENISSE SAN JOSENoch keine Bewertungen

- Training and Recruitment in Bharti AxaDokument49 SeitenTraining and Recruitment in Bharti AxaAshutoshSharmaNoch keine Bewertungen

- The Value of Remote Operating Centers VfinalDokument9 SeitenThe Value of Remote Operating Centers VfinalCseixas100% (1)

- Section 8 Business FinanceDokument11 SeitenSection 8 Business FinanceLeeana MaharajNoch keine Bewertungen

- 9707 s11 Ms 22Dokument6 Seiten9707 s11 Ms 22kaviraj1006Noch keine Bewertungen

- Unit 3-Time Value of MoneyDokument12 SeitenUnit 3-Time Value of MoneyGizaw BelayNoch keine Bewertungen

- Redemption of Preference SharesDokument9 SeitenRedemption of Preference SharesRahul VermaNoch keine Bewertungen

- Circular 323-2016Dokument52 SeitenCircular 323-2016Om PrakashNoch keine Bewertungen

- Bindura Nickel Corporation Limited PDFDokument1 SeiteBindura Nickel Corporation Limited PDFBusiness Daily ZimbabweNoch keine Bewertungen

- Solved Maurice Allred Is Going To Purchase Either The Stock orDokument1 SeiteSolved Maurice Allred Is Going To Purchase Either The Stock orAnbu jaromiaNoch keine Bewertungen

- Tutorial 10 PFPDokument6 SeitenTutorial 10 PFPWinjie PangNoch keine Bewertungen

- Dark Pool Trading Strategies 2011Dokument56 SeitenDark Pool Trading Strategies 2011b00sey100% (1)

- For UPSDokument16 SeitenFor UPSkeyur0% (1)

- Research Report For Kenya AirwaysDokument25 SeitenResearch Report For Kenya AirwaysShammah Wanyonyi100% (3)

- The Abington Journal 07-24-2013Dokument20 SeitenThe Abington Journal 07-24-2013The Times LeaderNoch keine Bewertungen

- Agriculture InsuranceDokument9 SeitenAgriculture InsuranceYogesh WadhwaNoch keine Bewertungen

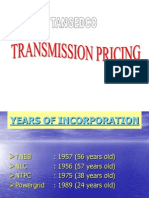

- Transmission PricingDokument57 SeitenTransmission PricingMuruganNoch keine Bewertungen

- Financial Markets Final CH 17 Flashcards - QuizletDokument15 SeitenFinancial Markets Final CH 17 Flashcards - QuizletDieter LudwigNoch keine Bewertungen

- Core Banking Transformation Measuring The ValueDokument16 SeitenCore Banking Transformation Measuring The ValueMohammadNoch keine Bewertungen

- Ci - Cni/ Nci-Cni Cni/Group NiDokument2 SeitenCi - Cni/ Nci-Cni Cni/Group NiMark CalapatanNoch keine Bewertungen

- EMS Full ProjectDokument31 SeitenEMS Full ProjectSarindran RamayesNoch keine Bewertungen

- Prashant SinghDokument9 SeitenPrashant Singhpr1041Noch keine Bewertungen