Beruflich Dokumente

Kultur Dokumente

2011 - Potash Corp Industry Overview - Complete

Hochgeladen von

tarun.imdrOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2011 - Potash Corp Industry Overview - Complete

Hochgeladen von

tarun.imdrCopyright:

Verfügbare Formate

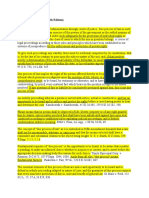

2005 2015F 2010

PotashCorp Potash Operational Capability

of PotashCorp and Its Industry 2011

overview

11.2mmt

17.1mmt

While parts of the world continue to deal with economic uncertainties,

some things remain unchanged: Population is increasing, people in

developing countries want better diets, per-capita arable land and water

resources are declining. Rising demand for food is placing unprecedented

pressure on global supplies and supporting higher prices for a wide range

of crops. To keep pace, farmers must grow bigger, better crops, and

fertilizer, especially potash, can help them reach that next stage of growth.

This Overview describes the industry and market conditions that infuence

our strategies and decisions today, and examines the trends that will

shape our business tomorrow.

This document contains forward-looking statements or forward-looking information (forward-looking statements). These statements are based on

certain factors and assumptions, including with respect to: foreign exchange rates; expected growth, results of operations, performance, business

prospects and opportunities; and effective income tax rates. While the company considers these factors and assumptions to be reasonable based

on information currently available, they may prove to be incorrect. Several factors could cause actual results to differ materially from those

expressed in the forward-looking statements, including, but not limited to: fuctuations in supply and demand in fertilizer, sulfur, transportation and

petrochemical markets; changes in competitive pressures, including pricing pressures; adverse or uncertain economic conditions and changes in

credit markets; the results of sales contract negotiations with major markets; timing and amount of capital expenditures; risks associated with

natural gas and other hedging activities; changes in capital markets and corresponding effects on the companys investments; changes in currency

and exchange rates; unexpected geological or environmental conditions, including water infow; strikes or other forms of work stoppage or

slowdowns; changes in and the effects of, government policies and regulations; and earnings, exchange rates and the decisions of taxing

authorities, all of which could affect our effective tax rates. Additional risks and uncertainties can be found in our Form 10-K for the fscal year

ended December 31, 2010 under the captions Forward-Looking Statements and Item 1A Risk Factors and in our other flings with the US

Securities and Exchange Commission and the Canadian provincial securities commissions. Forward-looking statements are given only as at the date

of this document and the company disclaims any obligation to update or revise the forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by law.

Advantages

Learn about our strategies and

the advantages we believe will

drive our long-term growth.

06 Potash

10 Phosphate

12 Nitrogen

Agriculture

Read about the key long-term

drivers of our business and the

fundamentals for key agricultural

commodities.

16 Global Development

20 Crop Overview

26 Crop Economics

Nutrients

Understand the key success

factors and the outlook for each

of our primary nutrients.

30 Potash

39 Phosphate

45 Nitrogen

Resources

52 Potash

53 Phosphate

54 Nitrogen

55 General

57 Planting Calendar

58 Nutrient Uptake /

Removal by Crop

59 Glossary of Terms

2 Overview

Our Business Is Meeting the Worlds Need for Fertilizer

PotashCorp has built the worlds largest fertilizer enterprise by capacity on world-class

potash resources and high-quality phosphate and nitrogen assets.

As our name suggests, potash is the primary focus of our company and the driver of our

growth. We are the worlds largest producer by capacity

1

, with fve large, low-cost mines

in Saskatchewan and one in New Brunswick. Our interests in offshore potash-related

businesses in Jordan, Israel, Chile and China add depth to our global position.

As the worlds third largest phosphate company by capacity, we have large, lower-cost rock

reserves and the industrys most diversifed product line.

By ammonia capacity, we are the third largest nitrogen producer, and our high-quality,

well-positioned assets enable us to be a lower-cost supplier to the large US market.

0

4

8

12

1o

20

24

Arror|a

l|osp|or|c Ac|d

KC|

K

+

S

^

g

r

iu

r

ls

ra

e

l C

h

e

r

ic

a

ls

C

l

lu

d

u

s

t

r

ie

s

Y

a

ra

0

C

l

8

e

la

r

u

s

k

a

li

u

ra

lk

a

li

V

o

s

a

ic

2

Q

V

C

U

J

%

Q

T

R

9QTNFU6GP.CTIGUV(GTVKNK\GT%QORCPKGU

|||||cr !crre l||ro|, l|cJ.c| Cooc||,

8oeJ cr lc|o|Cc| rore|o|e cooc||,

'c.|ce. 8|.e, lc|rcr, le||eccr, lc|o|Cc|, l.|||c |||r

/rrcr|o

l|c|c||c /c|J

rC|

Potash Facilities

1 Cory SK

2 Patience Lake SK

3 Allan SK

4 Lanigan SK

5 Rocanville SK

6 Sussex NB

Phosphate Facilities

Mining/Processing:

1 Aurora NC

2 White Springs FL

Upgrading:

3 Weeping Water NE

4 Joplin MO

5 Marseilles IL

6 Cincinnati OH

7 Geismar LA

Nitrogen Facilities

1 Geismar LA

2 Lima OH

3 Augusta GA

4 Trinidad

Investments

1 SQM, Chile (32%)

2 ICL, Israel (14%)

3 APC, Jordan (28%)

4 Sinofert, China (22%)

Potash

1 Cory SK

2 Patience Lake SK

3 Allan SK

4 Lanigan SK

5 Rocanville SK

6 Sussex NB

Investments

1 SQM, Chile (32%)

2 ICL, Israel (14%)

3 APC, Jordan (28%)

4 Sinofert, China (22%)

Phosphate

Mining/Processing:

1 Aurora NC

2 White Springs FL

Upgrading:

3 Weeping Water NE

4 Joplin MO

5 Marseilles IL

6 Cincinnati OH

7 Geismar LA

Nitrogen

1 Geismar LA

2 Lima OH

3 Augusta GA

4 Trinidad

1

Refers to nameplate capacity, which may exceed operational capability (estimated annual achievable production).

Our Company

3 Overview

All Three Nutrients Important, But Potash Is Our Primary Focus

We produce a broad range of products used to make fertilizers, animal feeds and products

for industry. With the worlds increasing need for more and better food, fertilizer is the

primary driver of our growth.

Each nutrient plays a vital and specifc role in food production around the world and to

PotashCorps success but we believe our unmatched potash assets provide the opportunity

to generate the greatest gross margin with the least volatility over the long term. To leverage

our position in this key nutrient, we employ a Potash First strategy.

What makes our potash position so advantageous? We believe that farmers rising demand

for this essential nutrient gives it the greatest long-term growth prospects, that its industry

structure is unique among the three nutrients and that the barriers to entering the business

make our existing and new capacity increasingly valuable.

How Produced:

Mined from evaporated sea deposits

How Used:

Fertilizer:

Improves root strength and disease

resistance, enhances taste, color and

texture of food

Feed:

Aids in animal growth and milk production

Industrial:

Used in food products, soaps, water

softeners, de-icers and drilling muds

How Produced:

Mined from ancient sea fossils

How Used:

Fertilizer:

Aids in photosynthesis, speeds crop

maturity

Feed:

Assists in muscle repair and skeletal

development

Industrial:

Used in soft drinks, food additives and

metal treatments

How Produced:

Synthesized from air using steam and

natural gas or coal

How Used:

Fertilizer:

Builds proteins and enzymes, speeds

plant growth

Feed:

Essential to RNA, DNA and cell maturation

Industrial:

Used in plastics, resins and adhesives

Share of 2010 0ross Marg|n

P

N

k

*OEVTUSJBM

'FFE

'FSUJMJ[FS

5CNGU8QNWOGUD[5GIOGPV

*OEVTUSJBM

'FSUJMJ[FS

0GGTIPSF

/PSUI"NFSJDB

5CNGU8QNWOGUD[4GIKQP

/PSUI"NFSJDB

0GGTIPSF

0GGTIPSF

/PSUI"NFSJDB

5CNGU8QNWOGUD[4GIKQP

/PSUI"NFSJDB

0GGTIPSF

0GGTIPSF

/PSUI"NFSJDB

5CNGU8QNWOGUD[4GIKQP

/PSUI"NFSJDB

0GGTIPSF

*OEVTUSJBM

'FFE

'FSUJMJ[FS

5CNGU8QNWOGUD[5GIOGPV

*OEVTUSJBM

'FFE

'FSUJMJ[FS

*OEVTUSJBM

'FFE

'FSUJMJ[FS

5CNGU8QNWOGUD[5GIOGPV

*OEVTUSJBM

'FSUJMJ[FS

'FFE

Nitrogen 2010 Phosphate 2010

Potash 2010

Our Nutrients

4

Section

Advantages

Advantages

PotashCorps growth potential increases as world demand

for potash rises. As the worlds largest potash producer

bycapacity with the majority of brownfeld expansions

under construction, we believe our unique leverage in our

namesake nutrient provides a signifcant opportunity to

increase earnings in the years ahead. We complement our

potash position with world-class phosphate and nitrogen

businesses and have strategic advantages in both nutrients.

K

P

N

of global potash capacity,

worlds largest producer

years of permitted reserves

at our Aurora facility

of lower-cost ammonia capacity primarily

supplying the large US market

20

%

30+

3.5MMT

5

Potash 6 Phosphate 10 Nitrogen 12

Advantages

6

Opportunity to Signifcantly Grow

Sales Volumes

We believe new potash supply will be required

in coming years to keep pace with rising

demand. In 2003, we began a CDN $7.5 billion

expansion program designed to raise annual

operational capability at our existing mines

to 17.1 million tonnes by 2015

approximately double our 2005 level.

By mid-2011, two-thirds of this expansion

capital was already spent and fve parts of

a nine-project program were completed. We

are continuing work on the remaining four

expansions at Cory, Allan, Rocanville and

New Brunswick.

Our operational capability is expected to

grow in each of the next four years, providing

the opportunity to signifcantly increase sales

volumes as demand for potash rises.

Largest Producer by Capacity

The structure of the potash industry is unique

among fertilizers, a result of concentrated

global reserves and signifcant barriers to

entry. In an industry with only 12 major

producers, PotashCorp is the largest, with

approximately 20 percent of global capacity.

With more mines than any other company,

we believe we are in the best position to

grow. By 2015, we expect our share of

global capacity to increase to approximately

23 percent.

Our investments in ICL, APC, Sinofert and

SQM further enhance our ability to beneft

from the projected growth in potash demand.

0

2

4

o

8

10

12

14

1o

18

lotas|Corp Lst|rated 0perat|ora| Capab|||t,

lotas|Corp Sa|es lorecast

2015l 2014l 2013l 2012l 2011l

PotashCorp Potash Uperat|ona| Capab|||ty

|||||cr !crre rC|

1T.1 MMJ

lotas|Corp Sa|es lorecast

L||ro|eJ orr.o| oc||e.o||e |cJ.c||cr |e.e| |cr e|||r ce|o||cr

20 o|e c|eco| c 9.o0.0 ||! o o| l.|, 28, 20 Wo ccr||o|reJ |, ce|o||cro| coo|||||,.

'c.|ce. lc|o|Cc|

lotas|Corp Lst|rated 0perat|ora| Capab|||t,

0 2 4 o 8 10 12 14 1o 18 20

Arrourced Lrpars|ors t|rou| 2015

0t|er lroducers (Capac|t,}

lotas|Corp lr.estrerts (Capac|t,}

lotas|Corp (0perat|ora| Capab|||t,}

va|e (8ra/||}

lrtrep|d (uS}

Ar|ur (Carada}

S0H (C|||e}

AlC (lordar}

C||ra

K+S (uerrar,}

lCL (lsrae|, Spa|r, uK}

8e|arus|a|| (8e|arus}

Hosa|c (Carada, uS}

ura||a|| (8uss|a}

2QVCUJ%QTR

9QTNF2QVCUJ2TQFWEGT2TQHKNG

|||||cr !crre rC| - 20 |c 20Sl

lotas|Corp (0perat|ora| Capab|||t,}

lotas|Corp lr.estrerts (Capac|t,}

0t|er lroducers (Capac|t,}

Arrourced Lrpars|ors !|rou| 2015

lc|o|Cc| |r.e|rer|. lCL (4, /lC (28, '0| (32 orJ '|rce|| (22

lc|o|Cc| |oeJ cr ce|o||cro| coo|||||, (e||ro|eJ orr.o| oc||e.o||e |cJ.c||cr W|||e ccre|||c| cooc||,

orJ eor|cr o|e |o|eJ rore|o|e, W||c| ro, eceeJ ce|o||cro| coo|||||,.

'c.|ce. le||eccr, C8u, l.|||c l|||r, lc|o|Cc|

Potash

Advantages

7

PotashCorp Brownfeld Expansion

Advantage

The advantage of our brownfeld expansion

program is even more pronounced when

measured against potential greenfeld mines.

PotashCorp can leverage existing

infrastructure and has a team with extensive

experience in developing potash assets,

therefore we believe our new tonnes are

being built at a fraction of the estimated

time and cost of a greenfeld mine.

Our ability to add operational capability

more quickly and cost-effectively is the

reason we believe our expansion program

is so important and holds such potential.

Greatest Relative Volume Growth

Potential

With more existing capacity and brownfeld

expansion projects under construction

than any other global producer, we consider

PotashCorp uniquely positioned to capitalize

on the anticipated growth in potash demand.

We believe our commitment to growing our

capability even through the global economic

downturn has given us a signifcant

advantage over competitors. We expect

PotashCorp will have more than half of the

new capability that comes on stream in

the next four years*, giving us the greatest

potential growth in volumes in the industry.

0

500

1,000

1,500

2,000

2,500

3,000

3,500

ureer|e|d (lrrastructure Cost}

ureer|e|d (Lrc|ud|r lrrastructure}

l0! lrojects lr lroress

l0! lrojects Corp|eted

SK ureer|e|d lrojects |r lroress lrojects Corp|eted

5CUMCVEJGYCP$TQYPHKGNFCPF)TGGPHKGNF%QUVU

Co||o| Cc| e| !crre - (Cu\S

l0! lrojects Corp|eted

l0! lrojects lr lroress

ureer|e|d (lrc|ud|r |rrastructure ard reser.e costs}

ureer|e|d (Lrc|ud|r |rrastructure costs}

\eW 8|.rW|c| cc| e| |crre |oeJ cr reW 2||! r|re (re| oJJ|||cr |c|o| .2||!.

8oeJ cr 2||! ccr.er||cro| |eer|e|J r|re ccr||.c|eJ |r 'o|o|c|eWor.

lc|o|Cc| |cjec| cc| ec|.Je |r|o||.c|.|e c.||Je ||e |or| o|e.

'c.|ce. /|LC, lc|o|Cc|

0

10

20

30

40

50

o0

lCL u8KA lll H0S S0H l0!

0

1

2

3

4

5

o

lCL u8KA lll H0S S0H l0!

$TQYPHKGNF2QVCUJ'ZRCPUKQP2TQHKNG

C|ore - Cooc||, C|cW|| (2020Sl |||||cr !crre - Cooc||, C|cW|| (2020Sl

lc|o|Cc| |oeJ cr ce|o||cro| coo|||||, (e||ro|eJ orr.o| oc||e.o||e |cJ.c||cr. Ccre|||c| cooc||, c|ore

|oeJ cr orrc.rceJ co||o| |cjec| orJ e||ro|eJ ccr||.c||cr ccr|e||cr Jo|e, W||c| Jc rc| |rc|.Je |or.,

orJ ro, eceeJ ce|o||cro| coo|||||,.

'c.|ce. le||eccr, C8u, l.|||c l|||r, lc|o|Cc|

Advantages

8

Opportunity to Lower Per-Tonne

Mining Taxes and Operating Costs

We also expect to achieve lower per-tonne

mining taxes and operating costs as our sales

volumes rise.

As we have increased our operational

capability, we have beneftted from the

deduction of our capital expenditures against

current potash proft taxes. As our capital

expenditure deductions decline, our proft

tax rates are expected to rise. While higher

gross margin per tonne increases the taxes

payable, we anticipate higher sales volumes

will lower our per-tonne taxes since proft

taxes are capped at 5.7 million tonnes.

Additionally, we expect that limited fxed

operating costs will be added as we increase

our operational capability, meaning that

per-tonne fxed costs should be lower as our

volumes grow.

Rising Demand Creates Potential

for Higher Prices

In 2011, potash prices have moved higher

as demand has continued to challenge the

operational capabilities of producers around

the world, reinforcing the need for investment

in new supply. In addition to upcoming

brownfeld projects, we anticipate greenfeld

production will be necessary early in the next

decade to meet growing demand, creating

the potential for prices to move higher to

encourage this more costly investment.

We believe our expansion projects will

provide the opportunity to sell more tonnes

at potentially higher prices, creating a

powerful earnings multiplier.

0

5

10

15

20

25

S100/uH

S500/uH

S300/uH

2015 2014 2013 2012

0

5

10

15

20

25

S100 uH/torre

S500 uH/torre

S300 uH/torre

2015 2014 2013 2012

0

5

10

15

20

25

S100/uH

S500/uH

S300/uH

2015 2014 2013 2012

PotashCorp Prov|nc|a| M|n|ng Jax Sens|t|v|ty

S300 uH/!orre

||r|r |o |rc|.Je |c.|rc|o| |cJ.c||cr |o orJ | |rc|.JeJ |r ||e l|c.|rc|o| r|r|r orJ c||e| |oe ||re c c.|

lrccre '|o|erer|.

'c.|ce. lc|o|Cc|

S500 uH/!orre S100 uH/!orre

le|cer|oe c lc|o| C|

60% of Capab|||ty

le|cer|oe c lc|o| C|

80% of Capab|||ty

le|cer|oe c lc|o| C|

100% of Capab|||ty

0

200

400

o00

800

1,000

1,200

1,400

ureer|e|d 15 l88

ureer|e|d 10 l88

8rowr|e|d 15 l88

8rowr|e|d 10 l88

S3,150/torre S2,350/torre S1,000/torre S400/torre

Saskatchewan 8rownf|e|d and 0reenf|e|d Sens|t|v|t|es

u'S/!crre \e||oc| 8e.||eJ (l08 r|re

PotashCorp q2 2011 Netback = S416/MJ

Ccr||.c||cr Cc| e| !crre

8rowr|e|d 10 l88

8rowr|e|d 15 l88

ureer|e|d 10 l88

ureer|e|d 15 l88

Assumpt|ons:

8|cWr|e|J. r||||cr|crre |cjec| ccr||.c|eJ |r 'o|o|c|eWor, ec|.J|r cc| c |r|o||.c|.|e, S,eo|

ccr||.c||cr orJ |or. ||re||re, Jce rc| |rc|.Je |c|| |o o.|r |cr |rreJ|o|e C/lL/ JeJ.c||cr

C|eer|e|J. 2r||||cr|crre |cjec| ccr||.c|eJ |r 'o|o|c|eWor, |. cc| c |r|o||.c|.|e, r|r|r.r

1,eo| Je.e|crer| orJ |or. ||re||re, Su'/Cu\ o| o|

'c.|ce. lc|o|Cc|

Advantages

Potash

9

Signifcant Potential for Growth

in Potash Margin

In 2011, increased sales volumes and prices

have pushed potash gross margin to near

record levels. With demand expected to rise,

we believe our expanding potash capability

provides a unique growth opportunity.

The powerful levers of selling more volumes

at higher prices, with the potential for lower

per-tonne operating costs, offer signifcant

gross margin potential in the years ahead.

Beyond the opportunity for margin expansion,

the potential for lower per-tonne mining

taxes and improved earnings from our equity

investments provides signifcant growth

potential.

Potash-Related Investments

Provide Increased Financial Value

The value of our enterprise extends beyond

our individual operations and growth

opportunities. Our investments provide

signifcant fnancial and strategic value that

we believe is often overlooked.

Like PotashCorp, we believe producers APC,

ICL and SQM are preparing to participate

in anticipated future demand growth by

expanding their existing operations. We

also expect Sinofert, Chinas largest potash

distributor, to proft from increasing demand.

As earnings in these companies grow, we

expect to beneft through higher dividends

(ICL, Sinofert) and greater equity earnings

(APC, SQM).

0

2

4

o

8

10

12

14

1o

uH 8are

2011 lotas| uH

11 HH!

15 HH!

13 HH!

S800/torre S100/torre So00/torre S500/torre S400/torre S300/torre

PotashCorp Potash 0ross Marg|n Sens|t|v|ty

u'S 8||||cr

C|c |o||r e| !crre

13 HH! lotas|Corp Sa|es vo|ures (lostLrpars|or}.

2011 Potash 0ross Marg|n Iorecast

/ o| l.|, 28, 20

'c.|ce. lc|o|Cc|

15 HH! 11 HH!

0

50

100

150

200

250

300

350

400

450

500

u|.|derd |rcore (lCL, S|roert}

S|are o equ|t, earr|rs (AlC, S0H}

2011l 2010 2009 2008 2001

0

2,000

4,000

o,000

8,000

10,000

12,000

urrea||/ed ua|r (pretar}

Acqu|st|or Cost

2011 2010 2009 2008 2001

2QVCUJ%QTR1HHUJQTG+PXGUVOGPVU

u'S |||||cr

u|.|derd |rcore (lCL, S|roert}

S|are o equ|t, earr|rs (AlC, S0H}

'c.|ce. lc|o|Cc|, l.|||c l|||r

/ o| uecer|e| 3, 200

/ o| 'e|er|e| 1, 20

/ o| l.|, 28, 20

1VJGT+PEQOG%QPVTKDWVKQPUHTQO+PXGUVOGPVU

u'S |||||cr

urrea||/ed ua|r (pretar}

Acqu|s|t|or Cost

8CNWGQH+PXGUVOGPVU

Advantages

10

Integrated Rock Supply Provides

Lower-Cost Position

Access to lower-cost phosphate rock is the

basis for success in the phosphate business.

Our integrated operations at Aurora and

White Springs produce 93 percent of our

total phosphate rock requirements. Our

facility in Geismar, Louisiana, which accounts

for the remainder of our requirements,

purchases rock under contract from a global

phosphate rock supplier.

Non-integrated producers that must rely on

imports or domestic purchases for their rock

supply to produce processed phosphate

products have a signifcantly higher cost of

production than most integrated producers.

Access to Long-Lived, High-Quality

Phosphate Rock Reserves

PotashCorp is the third largest phosphate

company in the world by phosphoric acid

capacity, with mines at Aurora, North Carolina

and White Springs, Florida.

Our mines have access to long-lived,

permitted reserves which we believe is

an increasingly valuable position, especially

in North America.

Based on current reserve estimates at Aurora,

our largest phosphate operation, we can

mine at existing levels for more than 30 years,

with signifcant resource potential beyond

that time frame. At our White Springs

operation, we have a life-of-mine permit.

0

100

200

300

400

500

o00

100

800

0t|er

Arror|a

Su|ur

8oc|

Norlrterated lroducer

Scerar|o #2.

8oc| = S250/rt

Norlrterated lroducer

Scerar|o #1.

8oc| = S150/rt

lrterated lroducer

+PVGITCVGFXU0QP+PVGITCVGF%QUVQHTQFWEVKQP

u'S/!crre c u/l 8oc|

'c.|ce. le||eccr, lc|o|Cc|

Su|ur Arror|a 0t|er

0

5

10

15

20

25

30

35

w||te Spr|rs Aurora

PotashCorp Phosphate kock Prof||e

8ee|.e \eo| /rr.o| Cooc||, -|||||cr !crre 8cc|

l|c.er orJ |c|o||e |ee|.e e|r|||eJ orJ |c |e e|r|||eJ o c uecer|e| 3, 200.

lrc|.J|r Jec|| c|o||eJ o |ec.|ce, ||e r|re ||e o| /.|c|o Wc.|J |e o|c.| S2 ,eo|.

||re ||e | |oeJ cr o.e|oe orr.o| |cJ.c||cr |o|e c| ||e |e.|c. |||ee ,eo|.

'c.|ce. lc|o|Cc|

PotashCorp Phosphate kock keserves

65%

28%

33

1T

0

1

2

3

4

5

o

1

w||te Spr|rs Aurora

6.0

3.6

Advantages

Phosphate

11

Historically More Stable Margins in

Feed and Industrial Products

Historically, industrial and feed sales have

been less seasonal and cyclical than fertilizer

sales, increasing the quality of earnings for

our phosphate business.

While certain periods (like 2008) can offer

exceptional returns for companies primarily

leveraged to solid fertilizer markets, the

value of our diversifed product offering

becomes more pronounced in diffcult

market conditions (like 2009).

Over the long term, we believe relative

stability in the phosphate business can deliver

more value to our shareholders.

Diversifed Product Mix

PotashCorp has the phosphate industrys

most diversifed product line. The high

quality of our rock at Aurora allows us to

optimize our phosphoric acid to provide

the most proftable combination of

downstream products.

While fertilizer makes up a large portion of

our total phosphate sales volumes, we sell

a greater portion to the feed and industrial

markets than our competitors do. Few

producers globally have the high-quality

rock required to produce certain purifed

acid and feed products.

0

200

400

o00

800

1,000

L|qu|ds

So||ds

leed

lrdustr|a|

2011 2010 2009 2008 2001 200o 2005 2004

2QVCUJ%QTR+PFWUVTKCNCPF(GGF2JQURJCVG0GVDCEMU

u'S/!crre l|cJ.c| lrdustr|a|

/ c l.re 30, 20

'c.|ce. lc|o|Cc|

leed So||d (lert|||/er} L|qu|d (lert|||/er}

lrdustr|a|

leed

So||d (lert|||/er}

L|qu|ds (lert|||/er}

lrdustr|a|

leed

So||d (lert|||/er}

L|qu|ds (lert|||/er}

lrdustr|a|

leed

So||d (lert|||/er}

L|qu|ds (lert|||/er}

2JQURJCVG2TQFWEV5CNGU&KUVTKDWVKQP

2QVCUJ%QTR /QUCKE

'c.|ce. le||eccr, l.|||c l|||r, lc|o|Cc|

1%2/QTQEEQ

le|cer| 8oeJ cr l|cJ.c| !crre - 200

L|qu|d (lert|||/er} So||d (lert|||/er} leed lrdustr|a|

Advantages

12

Lower-Cost Supplier to the

US Market

Accessibility to lower-cost natural gas and

proximity to markets are critical factors for

success in the nitrogen business, and we

believe our facilities in the US and Trinidad

position us well to serve the large US market.

In Trinidad, we have four modern, highly

effcient ammonia plants. With a short sailing

distance to the US, we are a lower-cost

exporter to this market.

The competitiveness of our US assets has

improved with the rapid development of

shale gas, which provides a signifcant cost

advantage compared to nitrogen producers

in Ukraine and Western Europe. We expect

to further leverage this position by investing

$158 million to resume approximately

500,000 tonnes of ammonia production at

Geismar, Louisiana in the third quarter of 2012.

0 100 200 300 400 500 o00

lre||t to uS

Cas| Costs

u|ra|re lort l|art

8uss|a - \u/|r,,

!r|r|dad

H|dd|e Last

uS uu| lroducers

&GNKXGTGF#OOQPKC%QUV(QTGECUV

u'S/!crre - 20 Cas| Costs

'c.|ce. le||eccr, 0|', lc|o|Cc|

lre||t to uS

Well-Positioned to Supply Key

US Market

Nitrogen is largely a regional business and

the US is our primary market. We supply it

through the combined production from our

plants in Trinidad and the US, supplemented

to a small degree by purchased imports.

Our extensive distribution system delivers

these products to our customers.

Trinidad provides approximately two-thirds

of PotashCorps ammonia and is well situated

to service the sizable US market. Our US

plants are located in regions geographically

insulated from the highly competitive

US Gulf, which we believe allows us to better

serve local agricultural markets and industrial

buyers for which quality and security of

supply are key.

#.#$#/#

#4-#05#5

1-.#*1/#

&'.#9#4'

(.14+&#

)'14)+#

-'067%-;

.17+5+#0#

/#4;.#0&

/+55+55+22+

0146* %#41.+0#

1*+1

2'005;.8#0+#

5176*

%#41.+0#

6'00'55''

6':#5

8+4)+0+#

9'56

8+4)+0+#

6TKPKFCF

+0&+#0# +..+01+5

/+55174+

+19#

-#05#5

0'$4#5-#

/+%*+)#0

9+5%105+0

/+00'516#

0146* &#-16#

5176* &#-16#

.KOC

2QKPV%QOHQTV

(TGGRQTV

2CUCFGPC

6CORC

2CUECIQWNC

#WIWUVC

)GKUOCT

1SPEVDUJPO'BDJMJUJFT

*NQPSU'BDJMJUJFT

6RXUFH3RWDVK&RUS

2QVCUJ%QTRU0KVTQIGP5VTGPIVJU

(SFFOSFQSFTFOUT1PUBTI$PSQ0XOFSTIJQ

#MBDLSFQSFTFOUT1PUBTI$PSQ*OEVTUSJBM

4VQQMZ$POUSBDUT4QPU#VTJOFTT

Advantages

Nitrogen

13

Long-Term Gas Contracts

in Trinidad

Our gas contracts in Trinidad are primarily

indexed to ammonia prices, supporting

proftability when those prices rise and

helping protect margins if they fall. While

the competitiveness of our US-based nitrogen

operations has signifcantly improved in

recent years, our asset position in Trinidad

provides added stability in an often volatile

commodity.

We believe this is a long-term advantage

more than 80 percent of our average

Trinidad natural gas volumes are locked in

through 2012, and more than 60 percent

are secured through 2018.

Target Historically More Stable

Industrial Markets

Industrial nitrogen markets have traditionally

provided more stable demand and margins

than fertilizer. We have focused our nitrogen

business on these markets because of their

relative stability. In 2010, 63 percent of

PotashCorps total nitrogen sales went to

industrial customers including close to

80 percent of ammonia sales from our

US plants.

With the ability to deliver more than half of

our US-produced ammonia sales by pipeline

to such customers, we also beneft from

lower transportation and distribution costs.

0

500

1,000

1,500

2,000

2,500

lert|||/er

lrdustr|a|

L|ra Auusta ue|srar !r|r|dad

2QVCUJ%QTRU5CNGUD[0KVTQIGP2NCPV

!|c.orJ !crre l|cJ.c| - 200 lrdustr|a|

'c.|ce. lc|o|Cc|

lert|||/er

0

10

20

30

40

50

o0

10

80

90

100

2018 2011 201o 2015 2014 2013 2012 2011

6TKPKFCF0CVWTCN)CU%QPVTCEVU

3HUFHQWRI7ULQLGDG*DV&RYHUHGE\&RQWUDFWV

6RXUFH3RWDVK&RUS

Advantages

14 Agriculture

Agriculture

Millions of people with rising incomes want to feed their

families better diets with high-quality fruits and vegetables

and protein from meat. With pressure on global crop

supplies mounting, the need to sustainably increase

production is clear and is supporting strong prices for a

wide range of crops grown globally. Farmers are responding

to these opportunities striving to increase yields by

applying more fertilizer, especially potash.

World Crop Consumption

1980

2.2 billion tonnes

2000

3.4 billion tonnes

2020F

4.9 billion tonnes

Source: USDA

15

Global Development 16 Crop Overview 20 Crop Economics 26

Agriculture

16

Large Developing Countries Lead

Economic Growth

In many cases, the countries where

population is rising dramatically are also

leading global economic growth, and their

economies are expected to continue to

thrive. While there will always be fuctuations,

the long-term potential of large developing

countries such as China and India is expected

to have a signifcant impact on global

economic growth for decades to come.

As economies grow and incomes rise, the

priority for most people in emerging nations

is to improve their diets. We expect that

ongoing economic growth will continue to

improve the affordability of and desire for

more and better food.

Signifcant Urban Growth in

Developing Countries

Each year, the global population grows by

about 75 million. By 2020, almost 800 million

people more than twice the number in

North America today are expected to be

added to the current world population. It is

a simple reality that more people mean more

food must be produced.

While population has grown at a steady

pace, its composition is changing. Most

growth is occurring in developing countries

and, more specifcally, in urban areas.

Urban dwellers today account for around

half of the world population, but this share

is expected to rise to more than two-thirds

by 2050. This is an important shift as urban

consumers tend to eat higher-quality diets

that include meat, fruits and vegetables.

0

5,000

10,000

15,000

20,000

25,000

lrd|a

C||ra

wor|d

2030l 2020l 2010 2000 1990 1980 1910

9QTNF)&2RGT%CRKVC

Cul e| Co||o - u'S wor|d

'c.|ce. l|l, ur||eJ \o||cr, l/0, lc|o|Cc|

C||ra lrd|a

0

2

4

o

8

10

ue.e|op|r

ue.e|oped

2050l 2030l 2010 1990 1910

0

2

4

o

8

10

urbar

8ura|

2050l 2030l 2010 1990 1910

9QTNF2QRWNCVKQP

3RSXODWLRQ%LOOLRQV 3RSXODWLRQ%LOOLRQV

ue.e|oped

6RXUFH8QLWHG1DWLRQV

ue.e|op|r 8ura| urbar

Agriculture

Global Development

17

Rising Population Places Strain on

Existing Land Base

As populations rise and urban areas expand,

less arable land per person is available for

agriculture. This trend has been occurring for

decades and is expected to continue, given

the worlds fnite land base and projected

growth in population.

The strain on arable land is most pronounced

in developing countries, where less than

0.2 hectares per person is available for crop

and animal production. These are also the

countries with the greatest need to raise

food production, which highlights the

importance of increasing crop productivity

on a long-term basis.

Food Consumption Increasing,

Diets Better Balanced

The shift towards more-balanced diets is

evident in many developing countries. In

China, a signifcant increase in the daily

intake of fruits, vegetables and protein from

meat, eggs and fsh continues to displace

starch-based diets.

In India, the movement to more balanced

diets is just beginning. Fruits and vegetables

are becoming a bigger component of the

daily diet and protein consumption has slowly

started to rise.

While consumption levels in these countries

are unlikely to soon approach those in

developed countries, the process of improving

diets in these nations is expected to be a

long-term driver of global food demand.

0.0

0.1

0.2

0.3

0.4

0.5

0.o

0.1

2010

1990

1910

!ota| wor|d ue.e|op|r wor|d ue.e|oped wor|d

#TCDNG.CPFRGT%CRKVC

lec|o|e/Co||o 1910

'c.|ce. l/0, ur||eJ \o||cr

1990 2010

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

0t|er

lru|t ard veetab|es

Heat, Ls, l|s|

Cerea|s

2010L 1990 1910 2010L 1990 1910 2010L 1990 1910

&CKN[%CNQTKE+PVCMGRGT%CRKVC

Co|c||e/le|cr/uo, Cerea|s

lrc|.Je .ee|o||e c||

lrc|.Je |o|c|e, .o|, .|e orJ |e.e|oe

'c.|ce. l/0

Heat, Ls, l|s| 0t|er lru|t 8 veetab|es

75 %JKPC +PFKC

Agriculture

18

Opportunity to Increase Yields

in Developing Countries

The Food and Agriculture Organization of

the United Nations (FAO) projects that

approximately 90 percent of growth in global

crop production over the next 40 years will

come from improvements in yield and

increasing cropping intensity. The greatest

opportunity will be in developing countries

where yields currently lag those in the

developed world.

While this process will not occur overnight,

we expect the adoption of best management

practices in these countries will lead to

signifcant yield improvements over time.

These practices include the use of balanced

fertilizer applications, improved seed

technology, greater mechanization and

more effcient irrigation systems.

Pressure on Water Supply Increases

as Populations and Economies Grow

Not only is land constrained, water availability

is becoming an increasingly important issue

in many countries. In the developing world,

renewable water resources per capita have

declined by more than 50 percent over the

past four decades. The strain on water supply

has occurred amid rising demand for

agriculture and industrial purposes.

The competition for available water is

unlikely to abate as populations expand and

economies grow in developing countries.

It will be vital that agriculture use its share

effciently, and potash which helps plants

retain water is expected to play an

important role in achieving this.

0

1

2

3

4

5

o

2010

1990

1910

!ota| wor|d ue.e|op|r wor|d ue.e|oped wor|d

9QTNF%GTGCN;KGNFU

!crre/lec|o|e

'c.|ce. wc||J 8or|, l/0, lc|o|Cc|

1910 1990 2010

0

2

4

o

8

10

12

14

1o

2010

1990

1910

!ota|

wor|d

ue.e|op|r

wor|d

ue.e|oped

wor|d

0

20

40

o0

80

100

lrdustr|a|

Hur|c|pa|

Ar|cu|ture

2010 1990 1910

4GPGYCDNG9CVGT2TQHKNG

C.||c |e|e|/Co||o/\eo| wc||J ue |, Co|ec|, - le|cer|

Ar|cu|ture

'c.|ce. l/0 /.o|o|, u\, wc||J 8or|, lc|o|Cc|

Hur|c|pa| lrdustr|a| 1910 1990 2010

Agriculture

Global Development

19

Developing Countries Lag

US Corn Yield Progress

The disparity in corn yields between the

US and developing countries highlights the

importance of best management practices.

In the US, the use of balanced fertilizer

applications and other best management

practice has contributed to signifcant

yield growth.

Yields in most developing countries are a

fraction of the US total and have been

constrained primarily by less advanced farming

practices. Indias corn yields, for example, are

approximately one-quarter of those in the US,

much like the yields achieved there in 1940.

Need for Balanced Fertilizer

Application

Research has shown that more than

40 percent of the worlds food production

can be attributed to fertilizer use. Obtaining

the right application balance among nitrogen,

phosphate and potash is key to ensuring a

plant achieves its full potential.

Fertilizer application rates on corn in

developing countries, in particular the use

of potash, are a fraction of those in the US.

We believe that better fertilization practices

will play a signifcant role in improving yields

in these countries.

0

50

100

150

200

250

K20

l205

N

lrd|a Her|co 8ra/|| C||ra uS

%QTP(GTVKNK\GT#RRNKECVKQP4CVGU

lc.rJ//c|e N

'c.|ce. u'u/, ll/, lc|o|Cc|

l

2

0

5

K

2

0

0

20

40

o0

80

100

120

140

1o0

180

lrd|a 2010 \|e|d

Her|co 2010 \|e|d

8ra/|| 2010 \|e|d

C||ra 2010 \|e|d

uS u|stro|ca| \|e|d

2010 2000 1990 1980 1910 19o0 1950 1940

75%QTP;KGNF%QORCTKUQPVQ5GNGEVGF%QWPVTKGU

%XVKHOV$FUH

2010

lrd|a

2010

Her|co

2010

8ra/||

2010

C||ra

uS u|stor|ca| \|e|d

6RXUFH86'$

0t|er Courtr|es 2010 \|e|d

Agriculture

20

Grain Inventories Expected to

Remain Tight Beyond 2012

Multiple production defcits over the past

decade have pulled grain inventories well

below their historical level. This is not a

sustainable situation and provides little

margin for error in meeting the challenge

of anticipated rising world demand.

We believe replenishing global grain

inventories will require renewed commitment

to high-yield farming, including proper

fertilization. Crop production next year will

need to be nearly double the historical

average just to maintain inventories at their

current low levels and must triple that

average to make a positive impact on

grain supplies.

Grain Production Has Not Kept

Pace With Rising Demand

The need to increase food production is not

a new story. Grain consumption has been

rising steadily for decades and is projected

to exceed production in 2011 for the eighth

time in 12 years.

In 2011, grain production is forecast to

increase by almost 4 percent but is still

expected to fall short of world demand. We

believe that simply achieving good yields is

no longer adequate to meet long-term

growth in demand.

10

15

20

25

30

25\ear A.erae

Stoc|stouse Scerar|o 3

Stoc|stouse Scerar|o 2

Stoc|stouse Scerar|o 1

u|stor|ca|

12l 11l 10L 09 08 01 0o 05 04 03 02 01

Penny, the Historical line had to be faked because

the graph was horizontally scaled to allow for all the

text at the side. This distored the line a little, so the

dotted lines layer has new lines manually drawn overlaying

the Historical & Scenario lines. Please watch if

there are changes to this graph.

wor|d 0ra|n Stocksto0se kat|o

le|cer| u|stor|ca|

8oeJ cr c|c ,eo| Jo|o. lc| eor|e, l |ee| |c ||e 20/2 c|c ,eo|.

/.re JerorJ |cW|| c 2 e|cer|. l|e.|c. 0,eo| |cW|| |r |cJ.c||cr/ccr.r||cr o.e|oeJ o|c|ro|e|,

2 e|cer| orr.o||,.

'c.|ce. u'u/, lc|o|Cc|

25\ear A.erae

2012 lroductiou

6rowth 8ate Sceuarios

6% (~3X u|stor|ca| 8ate}

4% (~2X u|stor|ca| 8ate}

2% (~ u|stor|ca| 8ate}

1.4

1.5

1.o

1.1

1.8

lroduct|or

Corsurpt|or

2011l 2010l 2009 2008 2001 200o 2005 2004 2003 2002 2001 2000

1.9

9QTNF)TCKP2TQFWEVKQPCPF%QPUWORVKQP

8||||cr !crre Corsurpt|or

8oeJ cr c|c ,eo| Jo|o. lc| eor|e, 20l |ee| |c ||e 20/2 c|c ,eo|.

L||| |o| |e|ec| ,eo| W|er ccr.r||cr eceeJeJ |cJ.c||cr.

'c.|ce. u'u/

lroduct|or

Agriculture

Crop Overview

21

Mandated Ethanol Use Expected

to Support Strong Corn Demand

The US corn crop represents nearly 40 percent

of total world production, and most of it is

used for food and animal feed. However,

rising demand for alternative fuel sources over

the past decade has meant that more corn

has been dedicated to ethanol production.

In 2011, ethanol is expected to account for

approximately 39 percent of total corn

usage. Despite concerns around the potential

removal of tax credits and import tariffs,

government mandated blending levels remain

in place and support signifcant demand for

corn-based ethanol.

With strong demand and less than ideal

weather in key producing regions, corn

stocks-to-use ratios could reach record low

levels in 2011/12.

Strong Demand Has Tightened

Corn Stocks

Corn is a staple crop used primarily for food

and animal feed purposes and accounts for

nearly 50 percent of the worlds total grain

consumption and production.

The US and China are the two largest

producers with nearly 60 percent of total

global production. Despite signifcant

increases in acreage and yields in the US,

strong growth in consumption continues

to pressure global supply.

Although it is the second largest producer,

China represents only a small percentage

of global corn trade. However, its rising

livestock production has been a major factor

in its recent shift from major exporter to net

importer of corn. Its imports are expected to

increase in the years ahead.

0

2

4

o

8

10

12

14

1o

18

lroduct|or

u|scret|orar, 8|erd|r

Hardated Lt|aro| use

0t|er uses

2011l 2010 2009 2008 2001

0

5

10

15

20

25

10\ear A.erae

Scerar|o 2

Scerar|o 1

u|stor|ca|

2011l 2009 2001 2005 2003 2001

75%QTP5WRRN[CPF&GOCPF

8||||cr 8.|e| '|cc||cue - le|cer|

8oeJ cr c|c ,eo| Jo|o. lc| eor|e, 20l |ee|

|c ||e 20/2 c|c ,eo|.

'c.|ce. u'u/, ll8/, lc|o|Cc|

'cero||c - u'u/ /..| 20 c|eco|

'cero||c 2 - u|c|e||cro|, ||erJ|r e||r|ro|eJ

(2S0300 r||||cr |.|e| c cc|r

lroduct|or

u|scret|orar, Lt|aro| 8|erd|r

Hardated Lt|aro| use

0t|er uses

u|stor|ca|

10\ear A.erae

Scerar|o 1

Scerar|o 2

0

200

400

o00

800

1,000

0t|er

8ra/||

Lu

C||ra

uS

2011l 2009 2001 2005 2003 2001

0t|er

C||ra

!a|war

L,pt

Lu

Her|co

Sout| Korea

lapar

0

5

10

15

20

25

30

35

Stoc|stouse

wor|d Corn Prof||e

|||||cr !crre

0t|er

8ra/||

Lu

8oeJ cr c|c ,eo| Jo|o. lc| eor|e, 20l |ee|

|c ||e 20/2 c|c ,eo|.

'c.|ce. u'u/

!c|o| 200 lrc|| - 9 r||||cr |crre

C||ra

uS

Stoc|stouse

Product|on and Stocksto0se

'|cc||cue - le|cer|

Import Prof||e

lapar

Her|co

Sout|

Korea

L,pt

Lu

1T%

2%

5%

6%

8%

9%

9%

44%

0t|ers

!a|war

C||ra

Agriculture

22

Asian Countries Are Signifcant

Players in Vegetable Oils Markets

Not only are people in developing countries

striving for more balanced diets, their demand

for the oils required to add nutritional value

and favor to the food they eat is growing.

Over the past decade, the production of

vegetable oils (the category that includes all

edible oils) has more than doubled. With

more than 70 percent of the worlds total

production of palm oil, Southeast Asian

countries such as Malaysia and Indonesia

have become signifcant players in the global

vegetable oil market. Crops grown to produce

these oils have signifcant requirements for

nutrients, especially potash.

Growth in Soybean Production

to Meet Chinas Rising Demand

When it comes to soybeans, the US, Brazil

and Argentina are key. Together, they

account for more than 80 percent of

world supply.

Chinas rising demand for high-protein

animal feed and edible cooking oil has been

the primary driver behind the explosive

growth in its soybean imports more than

14 percent per year over the past 10 years.

Most of this growth has been met by a rapid

rise in soybean acres in Brazil and Argentina,

where production has increased by more

than 70 percent over the last decade.

0

30

o0

90

120

150

180

0t|ers

Lu

C||ra

Ha|a,s|a

lrdores|a

2011l 2001 1991

0

20

40

o0

80

0t|ers

uS

lrd|a

Lu

C||ra

2011l 2001 1991

9QTNF8GIGVCDNG1KNU2TQHKNG

|||||cr !crre

0t|ers

Lu

C||ra

Ha|a,s|a

lrdores|a

8oeJ cr c|c ,eo| Jo|o. lc| eor|e, 20l |ee| |c ||e 20/2 c|c ,eo|.

'c.|ce. u'u/

2TQFWEVKQP

|||||cr !crre

0t|ers

uS

lrd|a

Lu

C||ra

+ORQTVU

0

50

100

150

200

250

300

350

Corsurpt|or

0t|er

C||ra

Arert|ra

8ra/||

uS

2011l 2009 2001 2005 2003 2001

0

20

40

o0

80

100

0t|er

Her|co

lapar

Lu

C||ra

2011l 2001 1991

9QTNF5Q[DGCP2TQHKNG

|||||cr !crre

0t|er

C||ra

Arert|ra

8ra/||

uS

8oeJ cr c|c ,eo| Jo|o. lc| eor|e, 20l |ee| |c ||e 20/2 c|c ,eo|.

'c.|ce. u'u/

0t|er

Her|co

lapar

Lu

C||ra

Corsurpt|or

2TQFWEVKQPCPF%QPUWORVKQP

|||||cr !crre

+ORQTVU

Agriculture

Crop Overview

23

Growth in Chinas Demand Driving

Increased Cotton Imports

China, India and the US account for

approximately 62 percent of the worlds total

cotton production. Although only 2 percent

of global acreage is dedicated to this crop, it

accounts for approximately 4 percent of total

fertilizer demand.

With the growth of China as a key

manufacturing region including the

production of clothing products its cotton

imports have risen more than eightfold over

the last two decades.

Concentration Among a Few

Wheat and Rice Exporters

Wheat and rice are typically referred to as

the staples in most diets. The move away

from starch-based diets has slowed

the growth in consumption, but rising

populations and increased demand for

wheat as animal feed are expected to

continue to require higher production of

both these important staples.

Global wheat and rice trade is concentrated

among a few large producing regions. The

former Soviet Union and the US are the major

wheat exporters while rice trade is dominated

by Thailand and Vietnam. Given their share

of global trade, variability in production levels

and government export policies in these

countries can have a signifcant impact on

the global marketplace.

0

40

80

120

1o0

Corsurpt|or

0t|er

8ra/||

uS

lrd|a

C||ra

2011l 2009 2001 2005 2003 2001

0

5

10

15

20

25

30

35

40

45

0t|er

!ur|e,

8ar|ades|

C||ra

2011l 2001 1991

9QTNF%QVVQP2TQHKNG

|||||cr 480 || 8o|e

Corsurpt|or

0t|er

8ra/||

8oeJ cr c|c ,eo| Jo|o. lc| eor|e, 20l |ee| |c ||e 20/2 c|c ,eo|.

'c.|ce. u'u/

uS

lrd|a

C||ra

2TQFWEVKQPCPF%QPUWORVKQP

|||||cr 480 || 8o|e

0t|er

!ur|e,

8ar|ades|

C||ra

+ORQTVU

0t|ers

Carada

Austra||a

Lu

uS

lSu

2011l 2009 2001 2005 2003 2001

0

5

10

15

20

25

30

35

40

45

0t|ers

lrd|a

ur|ted States

la||star

v|etrar

!|a||ard

2011l 2009 2001 2005 2003 2001

9QTNF9JGCVCPF4KEG'ZRQTVU

|||||cr !crre

0t|ers

Carada

Austra||a

8oeJ cr c|c ,eo| Jo|o. lc| eor|e, 20l |ee| |c ||e 20/2 c|c ,eo|.

'c.|ce. u'u/

Lu

uS

lSu

la||star

v|etrar

!|a||ard

9JGCV

|||||cr !crre

0t|ers

lrd|a

uS

4KEG

Agriculture

24

Signifcant Growth in Fruit and

Vegetable Production

The drive to improve diets in the developing

world has had a profound impact on global

production of fruits and vegetables, which

has risen by nearly a third over the past

decade. China has signifcantly increased its

production capacity for these typically

high-value, high-return crops to keep up

with growing domestic consumption and

capitalize on export opportunities to the

developed world.

Fruits and vegetables are important crops

for the fertilizer business as they are large

consumers of all nutrients, especially potash,

which aids in the maturing process and helps

enhance color, taste and texture.

Pressure on Brazilian Producers

to Meet Rising Demand for Sugar

While sugar is an important crop for

farmers in India, rising world demand for this

commodity has also given farmers in Brazil

signifcant incentive to increase acreage and

fertilizer consumption on land currently used

for sugar cane.

Brazil is the largest producer of sugar in the

world, accounting for almost one-quarter

of total production. More than half of its

sugar cane crop is used to produce ethanol

a proftable industry started in Brazil more

than 30 years ago and the demand for

sugar for both food and fuel usage is expected

to rise in the years ahead. Since sugar cane

is a signifcant consumer of potash, rising

demand for the crop is expected to

signifcantly impact Brazils need for potash.

0

500

1,000

1,500

2,000

2,500

3,000

0t|ers

8ra/||

uS

N|er|a

lrd|a

C||ra

2011l 2001 1991

0

20

40

o0

80

100

120

140

1o0

180

0t|ers

Ar|ca

westerr As|a

Sout| Last As|a

Last As|a

Nort|er Arer|ca

Lurope

2011l 2001 1991

'0t|ers' 8 'Ar|ca'

ra|e sare co|or to corb|re.

9QTNF(TWKVCPF8GIGVCDNG2TQFWEVKQP

0LOOLRQ7RQQHV

0t|ers

8ra/||

uS

6RXUFH)$23RWDVK&RUS

N|er|a

lrd|a

C||ra

0t|ers

w As|a

SL As|a

L As|a

N Arer|ca

Lurope

2TQFWEVKQP

0LOOLRQ7RQQHV

+ORQTVU

Corsurpt|or

0t|er

uS

C||ra

Lu

lrd|a

8ra/||

2011l 2009 2001 2005 2003 2001

0

200

400

o00

800

1,000

lood use

Lt|aro| use

2015l 2013l 2011l 2009L 2001 2005

9QTNFCPF$TC\KN5WICT2TQHKNG

|||||cr !crre

0t|er

uS

C||ra

8oeJ cr c|c ,eo| Jo|o. lc| eor|e, 20l |ee| |c ||e 20/2 c|c ,eo|.

'c.|ce. u'u/

Lu

lrd|a

8ra/||

Corsurpt|or

9QTNF2TQEGUUGF5WICT2TQFWEVKQP

|||||cr !crre

lood use

Lt|aro| use

$TC\KN4CY5WICT&GOCPF

Agriculture

Crop Overview

25

Cocoa Production Concentrated in

Africa and Southeast Asia

Cocoas production and import profle is

very similar to that of coffee. Production is

highly concentrated among the 10 largest

producing countries, which account for

94 percent of the world total, and imports

are primarily dominated by the EU and

the US.

While Africa is not a dominant producer

of many of the major world crops, it is a

signifcant producer of cocoa. Cte dIvoire

(Ivory Coast), Ghana, Nigeria and Cameroon

together account for more than 60 percent

of world production. With the expectation

that agricultural practices and production

will continue to improve in the decades

ahead, Africas potential fertilizer demand

is signifcant.

Brazil Is the Leading Coffee

Producer and Exporter

Coffee requires a specialized climate and

conditions and, as a result, the top

10 producing countries account for more

than 80 percent of world production. Brazil,

Vietnam and Colombia together produce

the majority. With coffee prices at or near

record levels, growers around the world are

striving to maximize production through

improved fertilizer usage to capitalize on the

unprecedented economic opportunity.

Most global coffee trade is concentrated

around developed countries, with the EU

and the US accounting for more than

two-thirds of total imports.

0

1

2

3

4

5

0t|ers

Careroor

N|er|a

u|ara

lrdores|a

Cte d'l.o|re

2011l 2001 1991

0t|ers

ur|ted States o Arer|ca

Ha|a,s|a

Lu

wor|d Cocoa Prof||e

|||||cr !crre

0t|ers

Careroor

N|er|a

u|ara

'c.|ce. u'u/, l/0

lrdores|a

Cte d'l.o|re

Product|on Import Prof||e

Lu

Ha|a,s|a

55%

13%

11%

21%

0t|ers

uS

!c|o| 200 |rc|| e||ro|e - 3. r||||cr |crre

0

2

4

o

8

10

0t|ers

lrd|a

lrdores|a

Co|orb|a

v|etrar

8ra/||

2011l 2001 1991

0t|er

lapar

ur|ted States

Lu

wor|d Coffee Prof||e

|||||cr !crre

0t|ers

lrd|a

lrdores|a

'c.|ce. u'u/, l/0

Co|orb|a

v|etrar

8ra/||

Product|on Import Prof||e

Lu

uS

45%

24%

T%

24%

0t|ers

lapar

!c|o| 200 lrc|| - o.3 r||||cr |crre

Agriculture

26

Crop Returns Expected to be Well

Above Historical Levels

Higher crop prices have supported

exceptionally strong farmer economics in

most key growing regions.

In Malaysia, rising palm oil prices have nearly

tripled grower revenues, far exceeding the

rise in variable production costs. Returns for

key crops grown in Brazil have approached

record levels in 2011. Soybeans, the largest

potash-consuming crop in Brazil, are

projected to provide returns roughly twice

the previous fve-year average.

Higher crop prices have resulted in substantial

growth in US farm returns. In 2011, US corn

grower returns over variable costs are forecast

at more than $600 per acre.

This economic incentive has supported an

increase in fertilizer consumption in each of

these key regions.

Broad Strength in Global

Crop Prices

One of the keys to meeting the worlds

food needs is to ensure that farmers have an

economic incentive to increase production.

This requires crop prices at supportive levels,

not for short periods as has occurred in the

past but on a sustained basis.

In 2011, prices for many crops have

approached or exceeded record levels. This

strength extends beyond the traditional grains

and oilseeds, as key fertilizer-consuming

crops such as sugar, cotton and coffee also

have signifcantly higher prices.

0

400

800

1,200

1,o00

2,000

8e.erue

8eturr 0.er var|ab|e Costs

11l 10 09 08 01 0o 05

0

100

200

300

400

500

o00

8e.erue

8eturr 0.er var|ab|e Costs

11l 10 09 08 01 0o 05

0

200

400

o00

800

1,000

1,200

8e.erue

8eturr 0.er var|ab|e Costs

11l 10 09 08 01 0o 05

5GNGEVGF(CTOGT'EQPQOKEU

8e.erue

8eturr 0.er

var|ab|e Costs

8e|.|r |oeJ cr ro|.|e c|| o|r |or|o||cr

'c.|ce. |o|o,|or lo|r 0|| 8co|J, ll\l, C0\/8, u'u/, lc|o|Cc|

8e.erue

8eturr 0.er

var|ab|e Costs

8e.erue

8eturr 0.er

var|ab|e Costs

u'S//c|e

/CNC[UKC1KN2CNO

u'S//c|e

$TC\KN5Q[DGCP

u'S//c|e

75%QTP

50

100

150

200

250

300

350

11 10 09 11 10 09 11 10 09 11 10 09 11 10 09 11 10 09 11 10 09

5GNGEVGF%TQR%QOOQFKV[2TKEGU

l||ce lrJe (0,eo| o.e|oe = 00

Corr w|eat So,bear la|r 0|| Cottor Suar Coee

10,ear

A.erae

\eo||cJo|e o c l.|, 20

'c.|ce. wc||J 8or|

Agriculture

Crop Economics

27

Balanced Fertilization Can Provide

a Signifcant Economic Return

Balanced fertilization is critical for any crop

to achieve its full yield potential. Long-term

trials illustrate the signifcant yield beneft

from applying recommended levels of potash

in conjunction with nitrogen and phosphate.

In the case of oil palm in Malaysia, potash

accounts for up to 45 percent of the yield

potential. The impact is similar for other key

crops such as corn and soybeans.

We believe strong prices for crop commodities

have increased the long-term economic value

of applying potash, and encourage growers to

improve the fertility of their soils.

Expect Fertilizer Cost Percentage

Will Remain Below Historical Levels

Strong prices for a number of crops grown

globally have driven down the cost of

fertilizer as a percentage of revenue. Based

on current prices for corn and fertilizer, the

cost of nutrients as a percentage of crop

revenue is expected to remain well below the

historical average for the 2012 crop year.

We believe this makes the situation much

more sustainable than in 2008 when

fertilizer costs increased dramatically. It also

provides greater opportunity for improved

nutrient prices particularly for potash,

where supply/demand fundamentals are

expected to be tightest.

0

5

10

15

20

25

30

35

40

45

50

uS

Corr

8ra/||

So,bear

Ha|a,s|a

0|| la|r

0

2

4

o

8

10

12

5\ear A.erae

2011

uS

Corr

8ra/||

So,bear

Ha|a,s|a

0|| la|r

2QVCUJ+ORCEVQP%TQR;KGNFCPF4GVWTP

le|cer|

8oeJ cr |cr|e|r ,|e|J |||o|

'c.|ce. ll\l

;KGNF#VVTKDWVGFVQ2QVCUJ

u'S

4GVWTPRGT&QNNCT5RGPVQP2QVCUJ

2011

5\ear A.erae

0

5

10

15

20

25

30

35

10\ear A.erae

Scerar|o 3

Scerar|o 2

Scerar|o 1

u|stor|ca|

2012l 2011l 2010 2009 2008 2001 200o 2005 2004 2003 2002 2001

Iert|||ter Cost Percentage of 0S Corn kevenue

le|cer| u|stor|ca|

)DUP3ULFH

6FHQDULRV

(e| |.|e|

S5.00

S6.00

ST.00

'cero||c |oeJ cr l08 ||JWe| c|o| ||ce c SS90/'!, Cer||o| l|c||Jo u/l ||ce c So00/'! orJ \0L/ .|eo ||ce

c S41S/'!, cc|r ,|e|J c o4 |./oc|e

'c.|ce. u'u/, lc|o|Cc|

10\ear A.erae

Agriculture

28 Nutrients

Nutrients

As demand for food rises, so does the requirement for crop

nutrients. While all three nutrients work best together to

ensure the health of the plants they nourish, we believe

the greatest opportunity for PotashCorp lies with our core

nutrient, potash. Demand for potash is expected to grow

the fastest in coming years because it has been historically

under-applied relative to the other primary nutrients. Whats

more, high-quality, economically viable deposits are rare

and barriers to entering the business are signifcant.

6QVCN(GTVKNK\GT&GOCPFs/KNNKQP0WVTKGPV6QPPGU

(

Source: Fertecon, IFA, PotashCorp

29

Potash 30 Phosphate 39 Nitrogen 45

Nutrients

30 Nutrients

Economically Mineable Deposits

Are Geographically Concentrated

High-quality, economically mineable

deposits are geographically concentrated

and, as a result, potash is produced in only

12 countries. Canada, Russia and Belarus

together account for just over two-thirds

of global capacity and, according to the

United States Geological Service, almost

90 percent of estimated reserves. The

Canadian province of Saskatchewan has

almost half of world reserves and 35 percent

of global capacity.

Conventional Mines Account for

Most Potash Production

Potassium chloride (KCl), commonly called

potash, is mined from ore deposits located

deep underground or extracted from salt

lakes or seas.

Conventional underground mines account

for almost 80 percent of global potassium

chloride capacity, and underground solution

mines for approximately 6 percent. The

remainder is obtained by harvesting natural

brines from potassium-rich water bodies,

typically using solar evaporation.

Potash is sold for the agricultural market

primarily as solid granular and standard

products. Granular product has a larger and

more uniformly shaped particle that can

be easily blended with solid nitrogen and

phosphate fertilizers and is typically used in

more advanced agricultural markets such as

the US and Brazil.

Canada 46%

kuss|a 35% 0ermany 2%

8e|arus 8%

8rat|| 3%

Ch|na 2%

Israe| 0.5%

0S 1%

Ch||e 1%

Iordan 0.5%

wor|d Potash keserves

'|o|e c Wc||J' c|o| |ee|.e, |ee|.e o |rJ|co|eJ |, ||e u' Cec|c|co| '.|.e,

0||e| cc.r|||e |c|o| e|cer|.

'c.|ce. ur||eJ '|o|e Cec|c|co| 'e|.|ce

2QVCUJ#5KORNKHKGF(NQY&KCITCO

6RXUFH3RWDVK&RUS

5QNWDNGQT+PFWUVTKCN )TCPWNCT

'JOFT

8FU1PUBTI$PODFOUSBUF

%SZ

$PODFOUSBUF

5VCPFCTF

5QNKFQT.KSWKF(GTVKNK\GT

+PFWUVTKCN

5QNKF(GTVKNK\GT 5QNKF(GTVKNK\GT

1TGHTQO/KPG

%T[UVCNNK\CVKQP %QORCEVKQP

&GYCVGTKPI

&T[KPI

5K\KPI

5K\G4GFWEVKQP 4GOQXG%NC[

(NQVCVKQPVQ

5GRCTCVG2QVCUJ

(TQO5CNV

Potash

31

Greenfeld Projects Require

Signifcant Investment

Entry into the potash business carries

substantial risk because of the signifcant

cost to build new supply. We estimate

that CDN $4.1 billion would be needed to

develop a conventional 2-million-tonne

greenfeld mine and mill in Saskatchewan.

Surface facilities make up the largest portion

of the required investment, and would be

similar for any mining method.

Developing the necessary infrastructure

outside the plant gate (including rail

capabilities, utility system and port facilities)

and the potential purchase of a deposit

could push the total cost of developing a

greenfeld mine above CDN $6 billion.

Major Consuming Markets Are

Heavily Dependent on Imports

Not only are potash deposits geographically

concentrated, the major offshore consuming

markets in Asia and Latin America have

little or no indigenous production capability

and rely primarily on imports to meet their

needs. This is an important difference

between the potash business and the other

major crop nutrients. Trade typically

accounts for approximately 80 percent of

demand for potash, which ensures a globally

diversifed marketplace

The large producing regions of Canada

and the former Soviet Union have small

domestic requirements and therefore are

signifcant exporters.

0

1

2

3

4

5

o

1

!ota| Acqu|s|t|or

o uepos|ts

ue.e|oprert o

lrrastructure

Surace

lac|||t|es

H|re

ue.e|oprert

Lst|mated 0reenf|e|d Potash Cap|ta| Costs

Cu\S 8||||cr

lrrastructure ard

lotert|a| uepos|t

lurc|ase

H|re ard H|||

S1.18

S3.08

S0.6M

S1.28

S0.0M

S1.08

S4.18

S0.68

S2.28

S4.T8S6.38

8oeJ cr 2rr|e|,eo| ccr.er||cro| r|re |r 'o|o|c|eWor, cc| cc.|J .o|, JeerJ|r cr ccr.er||cro|

.. c|.||cr r|re, Je|| c c|e |cJ,, ec|o||c |cco||cr orJ c||e| oc|c|. lrc|.Je eco|o||cr, ccr||rerc, orJ

cWre| cc|.

ueerJer| cr ec|o||c |cco||cr, occe orJ J||orce |c c||. lrc|.Je |o||co|, .|||||, ,|er, c|| oc|||||e, e|c.

8oeJ cr .|||c|, |ec||eJ cc| c |ecer| .|c|oe.

'c.|ce. /|LC, lc|o|Cc|

As|a

3.9

3.3

19.0

22.5

IS0

10.2

16.6

North Amer|ca

8.6

2.2

5.5

0.T

Lat|n Amer|ca

M|dd|e Last

0.8

Afr|ca

0.5

Ucean|a

5.3

6.T

Lurope

1PUBTI5SBEF

%PNFTUJD4BMFT

22%

T8%

wor|d Potash Product|on and 0emand

|||||cr !crre rC| - 200 1SPEVDUJPO

'c.|ce. le||eccr, lc|o|Cc|

%FNBOE

1PUBTI5SBEF

%PNFTUJD

4BMFT

Nutrients

32 Nutrients

PotashCorp Is the Largest Producer

by Capacity

PotashCorp is the industrys largest producer,

accounting for approximately 20 percent of

global capacity. This position is strengthened

by our investments in other potash producers

around the world: ICL, APC, SQM and

Sinofert (through its ownership stake in

Qinghai Salt Lake Potash).

We supply the export market primarily

through Canpotex, the offshore marketing

agent for the three Saskatchewan producers.

Including exports from our New Brunswick

mine, Canadian producers account for

approximately 37 percent of global trade.

Following the merger of Uralkali and Silvinit

in 2011, exports from producers in Russia

and Belarus will be handled by Belarusian

Potash Company (BPC).

Building New Potash Supply

Requires Signifcant Time

The extensive time required to develop new

supply is also a major consideration in potash

capacity investment decisions. We believe it

would take at least seven years from the start

of development to achieve full operational

capability, assuming no major permitting or

construction diffculties.

Existing infrastructure can be leveraged in

brownfeld expansions, so they typically take

less time than a new mine. After construction

is complete, however, both require extensive

ramp-up which can take at least two years

for greenfeld and some major brownfeld

projects. This fact is often underestimated in

evaluations of potential potash projects.

0UIFS

,4

#FMBSVTLBMJ

6SBMLBMJ

42.

"1$

*$-

"HSJVN

.PTBJD

1PUBTI$PSQ

0UIFS

&VSPQF

.JEEMF&BTU

'46

$BOBEB

wor|d Potash Producer and Lxport Prof||e

Percentage of 2010 kC| Capac|ty

u|o|o|| |e|eer| ||e re|eJ er|||, c u|o||o|| orJ '||.|r||

lc|o|Cc| |r.e|rer|. lCL (4, /lC (28, '0| (32 orJ '|rce|| (22

8oeJ cr rore|o|e cooc||,, W||c| ro, eceeJ ce|o||cro| coo|||||, (e||ro|eJ orr.o| oc||e.o||e |cJ.c||cr |e.e|.

'c.|ce. le||eccr, C8u, ll/, lc|o|Cc|

.PTBJD

"HSJVN

*$-

"1$

1PUBTI$PSQ

20%

14%

1T%

14%

8%

8%

9%

3%

4% 3% 6SBMLBMJ

#FMBSVTLBMJ

42.

0UIFS

,4

Percentage of 2010 kC| Lxports

$BOBEB

3T%

36%

13%

10%

4%

'46

&VSPQF

0UIFS

.JEEMF

&BTU

*

)TGGPHKGNF&GXGNQROGPV6KOGNKPG

8oeJ cr 2 rr| ccr.er||cro| r|re |r 'o|o|c|eWor, cc.|J .o|, JeerJ|r cr Je|| c c|e |cJ,, ec|o||c |cco||cr, e|c.

'c.|ce. lc|o|Cc|

&GXGNQROGPV6KOGNKPG Year 1 Year 2 Year 3 Year 4 Year 5 Year Year 1 Year 8

Viueral Lease

Lxploratiou

Luviroureutal

lufrastructure

head lrare/Shaft Siukiug

Viue 0evelopreut/8arpup

Lugiueeriug 8 0esigu

Coustruct Vill

Potash

33

Shorter Shipping Routes Beneft

PotashCorp

With most global potash traded across

borders, mainly by ocean vessels, timely and

cost-effective distribution systems are key

to supplying customers needs. Sailing times

of 30 days or more are common to some

markets, requiring signifcant upfront

planning between supplier and customer

to ensure the potash arrives in time for key

application seasons.

Producers in the Middle East ICL and APC

have logistical advantages into India, while

Canadian producers beneft from a shorter

sailing distance to China out of Canpotexs

West Coast terminals. PotashCorp, the only

producer shipping from the East Coast of

Canada, at Saint John, New Brunswick, has

a signifcantly shorter route to Brazil than our

competitors do.

Majority of Capacity Is Located

Near the Lower End of Cost Curve

Potash operating costs are largely impacted

by geological conditions such as ore grade

and consistency, operational size, labor costs

and degree of automation. Energy prices are

a relatively small factor for conventional

mines, which on average require less natural

gas per tonne produced than solution mines.

When producing at high operating rates

and in a low energy cost environment the

cash cost of production for most producers is

within a relatively narrow band. Higher-cost

facilities are primarily older, smaller-scale

European and US plants. When energy costs

are high, solution mines are likely to reside

on the higher end of the cost curve.

Additionally, limited scalability of solution

mines compared to conventional mines

is an important consideration in capital

investment decisions.

Comparat|ve Ucean Ire|ght Sa|||ng 0ays

6RXUFH206

Ch|na Ind|a 8rat||

vancouver 1T 30 28

Sa|nt Iohn 35 26 16

Israe| 24 10 23

Iordan 24 10 23

0ermany 3T 22 19

kuss|a 38 23 21

0

25

50

15

100

125

150

115

200

225

S|te Cost

0

20

40

o0

80

100

Curu|at|.e Capac|t,

2QVCUJ+PFWUVT[5KVG%QUV2TQHKNG

u'S/!crre C.r.|o||.e Cooc||, - le|cer|

'||e cc| o|e co|c.|o|eJ |oeJ cr |cJ.c||cr cc| o| |ec||eJ cooc||,.

'c.|ce. C8u, lc|o|Cc|

S|te Cost

Curu|at|.e Capac|t,

Nutrients

34 Nutrients

Prices Are Strong for Many

Potash-Intensive Crops

Potash is consumed globally by a wide range

of crops. Grains and oilseeds account for just

over half of total consumption and most of

the remainder is consumed by crops such as

sugar, cotton, coffee, fruits and vegetables.

This market diversity means that demand for

potash is not reliant on the economics of

only a few crops.

The current strength in prices for a broad

range of crops grown around the world is

supporting strong demand for potash in

most major markets.

Lower Freight Rates Have

Enhanced Potash Netbacks

Ocean freight rates declined sharply in late

2008 as commodity trade dropped during

the global economic downturn. A signifcant

increase in new ship builds in the past few

years has kept rates relatively low despite a

recovery in global shipping demand.

With more than 90 percent of Canpotexs

sales made on a delivered basis (meaning the

shipper pays the freight), lower freight rates

have the potential to positively affect our

realized prices.

0 30 o0 90 120 150 180

8araras

w|eat

8|ce

!ea

Cocoa

So,bear

la|r 0||

Cottor

Corr

Suar

Coee

8ubber

0t|er

Suar 8 Cottor

lru|ts 8 veetab|es

0||seeds

ura|rs

wor|d Crop Pr|ces and Potash 0se

le|cer|oe lrc|eoe Ccro|eJ |c 0\eo| /.e|oe

'c.|ce. wc||J 8or|, ll/

wor|d Crop Pr|ces (lu|, 2011} wor|d Potash 0se by Crop

ura|rs

0||seeds

36%

1T%

22%

14%

11%

lru|ts 8

veetab|es

Suar 8

Cottor

0t|er Crops

0

10

20

30

40

50

o0

10

80

11 10 09 08 01 0o 11 10 09 08 01 0o 11 10 09 08 01 0o 11 10 09 08 01 0o