Beruflich Dokumente

Kultur Dokumente

Suman

Hochgeladen von

Suman DalalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Suman

Hochgeladen von

Suman DalalCopyright:

Verfügbare Formate

1

GUIDE CERTIFICATE

This is to certify that the project entitled, Marketing survey on dyed yarn submitted in partial fulfillment of the requirement for the award of degree of Masters in Business Administration (MBA) from Punjabi University, Patiala is a bonafide research work carried out by, Somveer Singh, under my supervision and guidance and to the best of my knowledge and information, no part of project work has been submitted for any other degree or diploma.

Ms. Monika Sharma Asst. Prof. CBS

EXECUTIVE SUMMARY

In this project a market survey is undertaken on Ludhiana dyed yarn market to study the responses of dealers & customers towards the company and also to know the demand & consumption of dyed yarn in Ludhiana, Bombay Tirupur market. and

For this market survey the respondents are the dealers & customers of Vardhman Polytex Limited to know their response questionnaires were got filled from them to containing questions like monthly consumption, quality of yarn used or count used. And to know views about company questions like level of satisfaction, suggestions were asked for improvement.

Besides this a study is also made on the recent changes in textile industry at global level and also their impact on Indian textile industry whether it is a price rise , price fall or recession.

Along with that Porters five forces textile industry.

competition

model analysis is also made

taking Indian textile industry as base to know the competitiveness of Indian

Table of contents

Chapter no. 1 2 3 4 5 6

TOPIC Introduction to Indian industry Introduction TO VPL Research methodology Data analysis and Interpretation Suggestion/Recommendation Biblography

page no 5-13 14-26 27-30 31-45 46-56 57

Chapter 1

Introduction

Indian Textile Industry

Textile industry is one of the largest industries of India. It has been a significant role to in India as it fulfils the essential and the basic need of people. Textile industry in India stands at unique place and maintained a sustainable growth over the years .This is a self reliant and independent industry and has a great diversification and versatility.

Textile industry in India provides a great contribution for the development of economy. It is the second largesr textile industry in the world after china. It provides ample employment opportunities to people belonging to all classes. After agriculture this industry provides employment to maximum number of people in India employing 38 milliom people

.Textile industry represents the rich culture, tradition , heritage and economic well being of country with diversified range and versatility. At the same time industry is competitive enough to fulfil the different demand patterns of domestic and global markets.

Textile Industry is constituted of the following segments:

1. Readymade Garments 2. Cotton Textiles including Handlooms ( Mill made/Power loom/Handloom) 3. Man-made Textiles 4. Silk Textiles

5. Woollen Textiles 6. Handicrafts including Carpets 7. Coir 8. Jute

CURRENT SCENARIO

The Indian textile industry contributes about 14 per cent to industrial production, 4 per cent to the country's gross domestic product (GDP) and 17 per cent to the countrys export earnings. The industry provides direct employment to over 35 million people and is the second largest provider of employment after agriculture.

The total cloth production increased by 10.2 per cent during September 2010 as compared to September 2009. The highest growth was observed in the powerloom sector (13.2 per cent), followed by hosiery sector (9.1 per cent). The total cloth production during April-September 2011 has increased by 2.1 per cent compared to the same period of the previous year. The total textile exports during April-July 2011 (provisional) were valued at US$ 7.58 billion as against US$ 7.21 billion during the corresponding period of the previous year, registering an increase of 5.20 per cent in rupee terms. The share of textile exports in total exports was 11.04 per cent during April-July 2011. Cotton textiles has registered a growth of 8.2 per cent during April-September 2011-12, while wool, silk and man-made fibre textiles have registered a growth of 2.2 per cent while textile products including wearing apparel have registered a growth of 3 per cent. India has the potential to increase its textile and apparel share in the world trade from the current level of 4.5 per cent to 8 per cent and reach US$ 80 billion by 2020.

Textiles and apparel industry exports, valued at US$ 20.02 billion (INR 963.05 billion), contributed about 11.5 per cent to the countrys total exports in 2008 09.

The items of export are written below in table no.1

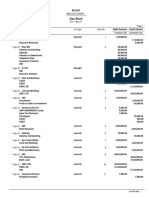

Table no.1

Export item

Export value US$ billion (INR Billion)

Share exports (%) 22.64 15.67 3.23 2.28 48.92 5.14 1.43 .71

in

total

textile

Cotton textile Man-made textile Silk textile Wool and Woollen textile RMG Handicrafts Jute Coir and Coir products

4.54 (218.08) 3.14(150.8) .64(31.06) .45(21.99) 9.81(471.7) 1.02(49.39) .28(13.75) .14(6.80)

The total textiles imports into India in 200809 were valued at US$ 3.33 billion (INR 160.93billion).

Table no.2

Import Items Raw Material Semi Raw Material Yarn, fabrics RMG Import value (08-09) US$ Billion(INR Billion) .78(37.84) .75(36.14) 1.46(70.49) .13(6.25) Share in total imports(%) 23.51 22.46 43.80 3.88

Key facts: 1. Indian is evolved as a major contributor in worlds cotton sector. India is the worlds third largest producer of cotton and the second producer of textiles and cotton yarns 2. India is the largest exporter of yarn in the international market and has a share of 25% in world cotton yarn export market. 3. India contributes for the 12% of the world s production of textile fibers and yarn.

10

4. Indian textile is the second largest after China, in terms of spindleage , and has capacity. 5. The country has the highest loom capacity, including share of 23% of the worlds spindle

handlooms,and has share of 61% in world loomage.

Major players of Textile industry in India Table no.3

Company

Turnover(20082009) US$ Billion) Billion(INR

Business Areas

Wels pun India Ltd.

1.19(57.4)

Home bathrobes

textiles. Terry

Vardhman group Alok industries

.7 .62(29.76)

towels Yarn fabrics, Sewing threads, acrylic Home textiles, woven and fabric knitted apparel ,garments,

Arvind mills

.48(23.44)

polyester yarn Spinning, weaving, processing and garments production. Bed linen ,towels, furnishing ,fabric for suits ,dresses Dyed and printed fabric

Bombay Dyeing and .27(13.16) manufacturing ltd. Garden silk mills .27(13.31)

11

Mafatlal industries ltd. Reliance industries ltd.

.03(1.27) 28.85(total)

Shirting,

poplins

bottom wear fabrics Fabric, formal mens wear

Indias Competitor in Textile Sector: Indias exports fall into the low risk category because of its well developed domestic industry. Despite this , Indias exports do face serous competition from these countries: China Bangladesh Pakistan Sri Lanka

Main markets for Indian Textiles are: Australia Mauritius New Zealand Belgium

12

Russia Canada Saudi Arabia Singapore Columbia Spain Egypt Hong Kong Syria Germany Thailand U.K. Italy Japan U.S.A Korea Malaysia

Conclusion:

13

The Indian textile industry currently one of the largest and most important sector in the economy in terms of output foreign exchange earnings and employment in India. The textile industry in India has gone through significant changes in anticipation of increasing.

Chapter 2

14

Introduction

Vardhman Polytex Limited

History

India The Industrial City of Ludhiana , also as the Manchester of India nestles the corporate headquarters of the Oswal group Oswal a household name in the northern India, has carved out a niche for itself in the textile industry. The

15

Vardhman group was set up in1962 by late Lala Rattan Chand Oswal, father of the president chairman cum managing director of Vardhman polytex ltd., Sh, Ashok Oswal. Since then , the group expanded manifold and is today , perhaps the largest textile conglomerate in India,. The group has recorded turnover of 1906 crores( 400 million $) in 2001-2002. The group portfolio includes manufacturing and marketing of yarns, fabrics, sewing threads, fibre and steels.

Vardhman Polytex Limited (VPL) was originally established with an initial spindle capacity of 11520 nos. The plant was setup at Bathinda and its initial commercial production started in October 1984. In 1987, Mahavir Spinning Mills Limited(MSML) took over the management of the company.

After take over, the management increased the capacity gradually to 25000 spindles in 1991.In order to diversify the product range, the company also set up a worsted unit at Ludhiana at the name of Anshupati textiles in 1990. With an installed capacity of 8000 worsted spindles. In 1992, under its integrated diversification project, it installing a new unit

named as Arisht spinning mills at Baddi ( H.P) with an installed capacity of 25000 spindles. Later on, the capacity was further expanded to 65760 spindles.

In 1999. The company further carried out the modernization of its existing plant at Bathinda with the total capital outlay of 32 crores. In order to further strengthen the unit the company added up the 12096 spindles. After family settlement in 2003, the company has set up a state of art technology spinning project at focal point , Ludhiana at the name of Vinayak Textiles limited with an installed capacity of 24288 spindles. Thereafter the company expanded its capacity at focal point Ludhiana with an installed capacity of 25315 spindles for the manufacture of of cotton yarn/blended yarn has started its commercial working in October ,2006.

16

In 2006. The company joined hands with one of the leading European shirting fabric manufacturer namely F.M. Haemmerele estd. 1836 for setting up of a green field project of dyed yarn shirting fabric. The said project has been undertaken in the newly formed subsidiary company namely Oswal 12 million meters. The dyed yarn shirting fabric plant of F.M. Heammerele textiles ltd. at Kolhapur(Maharashtra) with an annual capacity of OSWAL GROUP is one of the best plant in India with latest state of art machinery and equipments. The commercial production is expected in the month of Aug.2008.

In 2008,the company completed another expansion of 30000 spindles at this existing location in Bathinda and with this expansion , the total spinning capacity with Oswal Group stands increased to 1,65,872 spindles.

The company also has a strong presence in various countries like Hong Kong, Korea,UK. Mauritius, Singapore and EU in addition to the domestic market. Yet another forward integration project on readymade garments is offering and is to be realized soon. VPL is earning laurels by exporting yarn of international quality to several countries in the Europe and earning valuable foreign currency for the country. VPL is the first company among the textile industry to receive the ISO 9002/ISO 14002 quality awards in.

MARKETING TEAM OF VARDHMAN POLYTEX LIMITED

17

Mr. Ashok Oswal

(Chief Managing Director)

Mr. Adish Oswal

( Managing Director)

Mr. Ashok Goyal

( President Yarn Business)

Exports G.M. ( Mr. Rohit Bhaskar)

Delhi A.G.M. ( Mr. Manish Shawney)

Ludhiana

Grey Yarn A.G.M. ( Mr. Neeraj Modi )

Dyed Yarn A.G.M. ( Mr. Pankaj Bhardwaj)

Assistant manager ( Mr. Munish Rana)

Officer Level

Offiicer Level

MARKETING FUNCTION OF VPL

18

Receipt of Standards/ Samples

Standards are sent to r & d for developing labdips

Labdips are sent to party for approval with options

Receipt of order with price negotiations

Punching & placing the order in SAP

Execution of order from dyehouse

Delivery of material

Payment collection

After sale service and redressal of complaints

19

Markets For VPL

Markets

Exports

Ludhiana

Delhi

Tirupur

Mumbai

Physical distribution:

One of the critical factors for the success of any organisation is the physical factor in consideration, but does not have effective

distribution. An organisation that manufacturers products of the best quality while keeping the cost distribution network, would not be able to succeed in its business. Timely delivery is demanded by the customer who himself is a time bound. Presently we have following distribution network:

MILL

MILL

MILL

CONSUMERS

DEALERS

AGENTS

20

CONSUMERS Introduction About Project

CONSUMERS

QUALITY AND SERVICES SATISFACTION ON DYED YARN IN LUDHIANA, BOMBAY, TIRUPUR.

In this project my duty is find out the customer and dealers perception about the company and to find out customers are satisfied or not and note down their suggestions what improvements they want in working of the company. The products are cotton dyed yarn and cotton blends like cotton with viscose, cotton with bamboo and modal. We must study about the production process of grey yarn then we will come to dyed yarn.

Manufacturing process:

Spinning is the process of converting fibres into yarns. This process consists of following stages. This process is almost same of all types of yarns. Just the fibres are mixed according to blend desired in different type of yarns.

21

Blow room

Carding section Combing section

Draw Frame

Speed frame

Ring frame

Winding

Doubling

Packing

22

Blow room: The following tasks are performed in the above blow room

section; Opening the material Cleaning the material and removing the impurities Preparing the material for further process

Carding section:

Further opening and clearing of fibre Individualisation of the material i.e. removal of trap Silver formation Stretching of silver in rollers If the customers asks for more refined yarn then combing is done

Combing section:

Combing of lap is done to make the convenient package with unilap machine.

23

Viol i.e. rashes and other undesirable material is removed.

Draw frame:

The following are the tasks performed in the draw frame section: Drawing and stretching of material so as to make the weight/ length even Mixing of silvers of both fibers in case of p/c yarn

Speed frame:

Fiber roves are formed using the simplex machine

Ring frame:

Roving is converted in to yarn Yarn is rolled in the bobbins which are inserted in to spindles If the customer asks for doubling the yarn , then the company does it spinning process is completed at this stage.

Winding:

24

In this process the yarn is on wound on paper cones to produce bigger package as per requirements of the market

Doubling:

After cone winding the yarn is fed into cheese winding In the process 2plyor 4 ply is to be done as per requirement. After the yarn is fed into ring doubling and required T.P.I. is given to final yarn in to process,

Packing :

In this process the cones are packed in bags as per requirement. Packing of yarn is done in 42-50 kgs.

Dyed yarn:

The dyeing process at VTM as follows:

25

GREY ROOM

SOFT WINDING

PRESSING AND LOADING THE MACHINE

PROCESSING ( PRE TREATMENT , DYEING)

HYDRO EXTRCTOR

RF DYER

REWINDING

PACKING/ DISPATCH

Recent Phases in Textile Industry

26

The Global textile industry has recently faced the phases like price hike, price down recession phase and currently it is facing a critical situation in India. Because at present the prices of raw material are fluctuating continuously. There were reasons for the phases textile industry has faced.

The main reason for recession was recession in US. During 2009 and it effect the whole world but only effect textile industry of India. As U.S. is the main area of export of Asian countries so they also have to face the same condition. There were also reasons for price hike and price fall down.

Besides these changes the emerging economies in textile industry and their cuurent position is studied to know their strengths. At the end India five forces competition model is studied.

Porters five forces competition model In this model the following things are studied:

Threat of entry of new competitors Threat of substitutes Bargaining power of buyers Bargaining power of suppliers

27

Degree of rivalary between existing competitors

OBJECTIVES OF THE STUDY: To know the quality and count of cotton dyed yarn is mostly used. To find out the factors affecting the demand of dyed yarn are present . To know the response of people towards the working of the company. To know the major supplier of dyed yarn and problem faced by the customers and dealers. To study the affect of global textile trends on Indian textile industry in last 2 years.

28

Chapter 3

RESEARCH METHODOLOGY

29

.Research Design: It is a descriptive type of research as it describes the views of customers towards the company and their responses.

Sample size:

At first the sample size was taken 20 respondents but the research is based on 15 respondents.

Sample unit:

Ludhiana , Bombay, Tirupur city

Scope of the study:

Dealers and customers of all three cities of VPL are covered The area of the study is limited to three cities. i.e. Ludhiana,Bombay,Tirupur.

Data collection method:

In this study, primary and secondary data is collected and used for the research purpose. Primary data was collected by the survey through the structured questionnaire. The questionnaire contained open & closed ended questions. Respondents were personally interviewed and telephonically as questionnaires were got filled from them.

30

Secondary data is collected from magazines, and internet.

Sampling technique:

Convenience sampling technique is used to collect information. This technique is used because as Ludhiana has huge no. of dealers so who are dealers are known to company and are at known places are visited.

Time of the study:

6 weeks

31

32

Chapter 4 Data analysis and Interpretation

33

1. Which Quality of dyed yarn used?

Most of the respondents used combed quality of cotton dyed yarn.

34

Q:2 Monthly consumption of Dyed Yarn?

Most of the customers have monthly consumption of less than 30 tons.

35

Q:3 Demand Comparison?

Most of the dealers have same and less consumption this year as compared to previous year.

36

Q:4 Reasons for more consumption ?

Some dealers say that their consumption has been increased due to fall in prices in cotton yarn.

37

Q:5 Reasons for less consumption?

The reasons for less consumption are price fluctuations, market scenario and other Factors.

38

Q:6 Type of count used?

24s is used by most of the dealers as compared to other counts of cotton dyed yarn.

39

Q:7 Preferred supplier?

VPL is the most preferred supplier for dyed yarn in all three markets..

40

Q:8 Ranking given to VPL on measures like time of delivery?

41

Most dealers rate the after sale service of VPL is good as compared to their quality of yarn and time of delivery.

Q:9 Which Other quality of yarn used?

42

Modal is used by most of dealers as compared to bamboo, viscose and blends.

Q:10 level of satisfaction?

43

Most of dealers are highly satisfied with the services and material supplied by VPL to them.

Q:11 Price comparison with competitors?

44

Most of the respondents argued that the prices of VPL dyed yarn is less than the prices of competitors.

6 Q:12 Quality expected in future?

45

Most of the respondents expect more variety in to blends in future.

Q:13 Problem faced?

46

Most of the dealers have never faced problem in dyed yarn supplied by company but some of them has faced problems.

Q:14 type of problem faced?

47

The problem faced by most of the respondents is of colour mismatching and other problem is late delivery.

48

Chapter 5 Suggestion/Recommendation , Conclusion

49

Suggestion

VPL has to improve its quality of yarn as most of the respondents have suggested this and they faced a problem because of this .

50

Recent changes in global textile industry

The textile industry has faced many changes recently and recession, price hike and price down are the main of these. These changes effect the whole world as well as Indian textile industry also. We shall take all the phases faced by the textile industry and their impact on Indian textile industry. First there was a recession phase in the global textile industry

Recession phase:

Meaning:

A period of general economic decline; typically defined as a decline in GDP for two or more consecutive quarters. A recession is typically accompanied by a drop in the stock market, an increase in unemployment, and a decline in the housing market. A recession is generally considered less severe than a depression, and if a recession continues long enough it is often then classified .

Causes of Recession :

The main cause for recession in the global textile industry was recession I US. It effects the whole world also have an impact on Indian textile industry. The other causes of recession in two largest producing countries is also the

51

recession inUS. Because their major area for exports is US. Less demand in US leads to less exports.

Impact of Recession :

On US For both apparel and for non-apparel (that is, textile) products, in terms of imports of T&G from all suppliers together, it is clear that 15 2008 was a worse year than 2007: there was a 3-4% drop in total import value, although UVs only fell slightly for garments and rose for non-apparel Extending the time period forward to the twelve months to May 2009, the deterioration is more marked than when comparing 2008 with 2007: the twelve months ending May 2009 overall were considerably worse than for the twelve months ending May 2008, both for apparel (a 12% fall in overall import value) and even worse for non-apparel (a 20% drop). For both apparel and non-apparel, there were small percentage falls in UVs, and quantities had fallen even more. Finally, taking only the five months to May 2009 compared to the same period in 2008, a further clear and sharp deterioration had taken place. Garments imports had

52

fallen 12% and textiles 20% in total import value. Quantity falls were substantial, and UVs fell sharply, especially in non-apparel (by nearly 9%)

On China: China, the largest supplier, has not escaped the overall downward price pressure, but the downward pressure has appeared later than for suppliers to the US as a whole. But unlike suppliers as a whole, China was maintaining its growth in apparel sales to the US. Made-ups, Chinas largest textile export to the US, were suffering falls in import value, however, and small UV falls in the five months to May 2009 compared to that period in 2008. 16 On India India also experienced larger and earlier UV falls than China in T&G and a large fall in import demand. America is the most effected country due to global recession, which comes as a bad news for India. India have most outsourcing deals from the US. Even our exports to US have increased over the years. Exports for January declined by 22 per cent

53

Price hike in textile industry:

Reasons for price hike In china the government has decreased the cultivated area for cotton and the huge amount of crop is spoiled by rain . so there was a less production. China's textile and apparel enterprises generally raise their prices by about 30 percent at the 108th Canton Fair, as prices of raw materials represented by cotton are sharply rising this year, which is accompanied by decreased number of buyers and export orders.

In India, Cotton prices remained very low over the two cotton seasons. This has brought down the cotton grown across the globe, except in India. In India the Government in the last year of the previous UPA Government announced various schemes to improve inclusive growth. One among them was a 40 per cent increase in support price for cotton. This made cotton farming a very lucrative operation so much so that even in a year when the cultivated land came down due to delayed monsoon we saw acreage under cotton actually grow. Power constitutes the second most important element of cost. This has effectively gone up by 30-40 per cent due to power cut and the need to buy power from the open market or generate it using liquid fuels. For mills paying fully for power the cost of power on yarn cost under normal conditions is 15 per cent and in todays situation it is as high as 20/21 per cent a six per cent increase in costs.

54

Labour costs too have gone up as mills are forced to pay a wage much higher than NREGA to get workers. Minimum wages which was not implemented implementable has become a reality, thanks to NREGA, and most mills are forced to pay the minimum wages of 200 plus against 110/120 that they were paying earlier in spite of minimum wages being in force. Wages have gone up from 4 per cent on costs to 6 per cent now (mills are rapidly adopting technology to reduce worker dependence and therefore a less than proportionate increase in costs). The profitability of mills was minus 7 to 8 per cent during the last 18 months (thanks to incentivised exports of cotton done during that period, coupled with weak sentiments which made the pipeline stocks deplete and provide additional quantities of yarn). This has today gone up to plus 5 per cent, the pipeline is dry. Sentiments are getting better, closed capacity during the last 18 months is not getting revived. Huge shortage of labour in China, gas shortage in Bangladesh, political instability in Pakistan are factors that will keep yarn prices moving north for some time to come until new capacity gets created.

Impact of price hike on Indian textile industry Currently the textile industry is one of the worst hit sectors in India, as almost 50 percent of the industry is dependent on exports. Hence, maybe this is not the most opportune time to analyze performance and draw conclusions. However, if we go back a bit when the world was still growing we didnt have any great performances by the textile industry in exports. In the period from April to August 2007, our export turnover saw a meager rise of 0.15 percent in terms of US dollars over the same period last year, while in terms of rupees it fell by 10.52 percent. This shows that it is not only the exchange rate which is killing us, even in terms of dollars we had not grown at all. How will we then achieve those high targets set by us, when in a high GDP growth scenario we have

55

losses? And even more alarming is that cotton garments (which constitute about 45 percent of exports), fell over the same period by 6.86 percent in terms of dollar and 16.6 percent in terms of rupees. It clearly shows that we are losing not only on the aggregate basis, but are losing more on the value addition basis.

Price down in textile Industry :

When the prices were all the people indulge in overstocking the cotton to earn revenue by selling cotton in future which leads to increased supply and less demand therefore the prices of the cotton decreases and it has also effected the textile industry a lot.

Porters five forces model

The Indian textile industry is one of the oldest and most significant industriesin the country. It accounts for around 4 per cent of the gross domestic product(GDP), 14 per cent of industrial production and over 13 per cent of thecountry's total export earnings. In fact, it is the largest foreign exchangeearning sector in the country. Moreover, it provides employment to over 35million people. The Indian textile industry is estimated to be around US$ 52billion and is likely to reach US$ 115 billion by 2012. The domestic market islikely to increase from US$ 34.6 billion to US$ 60 billion by 2012. It isexpected that India's share of exports to the world would also increase fromthe current 4 per cent to around 7 per cent during this period.Textile industry provides one of the most fundamental necessities of thepeople. It is an independent industry, from the basic requirement of raw materials to the final products, with huge value-addition at every stage of processing . Infact , it is estimated that one out of every six households in thecountry directly or indirectly depend on this sector.Here we analyze the sector's dynamics through

56

Porters five forces competition model for Indian textile industry

1. Threats from new entrants

Indian Textile Industry is very dependent on personal contacts andexperience. The new actors would have to bring some kind of client base alongwith the new establishment. Product differentiation may constitute a barrierof entry as manufacturers are heavily dependent on references and word of mouth. Without any established client portfolio it is difficult to attract, endureincreased costs in creating sample collections to show potential customers.Hence, in startup phase costs are not only associated with the manufacturingrequired but also with the costs for designers and creating samples. In thesense of reference dependency, barriers en The new entrants are Bangladesh, Vietnam, Pakistan, South Korea.

2)Bargaining power of suppliers

Global textile & clothing industry is currently pegged at around US$ 440 bn.US and European markets dominate the global textile trade accounting for64% of clothing and 39% of textile market. With the dismantling of quotas,global textile trade is expected to grow (as per Mc

57

Kinsey estimates) to US$650 bn by 2012 (5 year CAGR of 10%). Although China is likely to become the'supplier of choice', other low cost producers like India would also benefit asthe overseas importers would try to mitigate their risk of sourcing from only one country. The two-fold increase in global textile trade is also likely to driveIndia's exports growth. India's textile export (at US$ 15 bn in 2005) isexpected to grow to US$ 40 bn, capturing a market share of close to 8% by 2012. India, in particular, is likely to benefit from the rising demand in thehome textiles and apparels segment, wherein it has competitive edge against. Other suppliers available with same production capacity and less cost like Bangladesh& china who are known for volume and less cost.

3) Bargaining power of suppliers (supply scenario) India is a country where we have numerous players in textile industry whichall are varied in terms of size and power. There has been increase inproduction and supply of textile products in last few decades globally, mainly due to rapidly changing social and economic structure of the countries worldwide. In past few years, especially after the removal the trade related tariffs and non tariff barriers in 2005, Asian countries such as India, china,Hong Kong and Japan have emerged as major players in this particularindustry, mainly due to their changes on economic front and infrastructure developments. The large number of available suppliers

4) Threat of substitute products When using such a broad term as Textile, there are obvious reasons foridentifying substitute product groups proves difficult.Of course, there are variations in types of clothing and material. Variations intextile segment can also

58

be identified as trends in fashion and styles. Henceproducts within the apparel segment can act as substitutes but the general .

5) Competitive rivalary in the industry The textile manufacturing segment in India is made out of numerousmanufacturers which all are varied in terms of size and power. It is a massivesector with thousands of companies producing apparel. The apparent highgrowth rate of total textile exports indicates that the rivalry between manufacturers is low. The growth rate is high in some product segments buteven negative in others. Hence, the rivalry between apparel manufacturers isdiverse since they enjoy different growth rates. Additionally, textile as a perishable product group is in the risk of temptations to cut prices when demand slackens. For example, when there are recessions in the business cycle apparel prices will drop significantly in price. Both thesefactors exemplify and indicate that the rivalry between manufacturers is high.As Indian apparel manufacturers are pressured to lower prices in order to stay competitive with companies abroad, the overall rivalry within the industry gets companies to expand their customer base in order to keep profits up. It istherefore reasonable to believe that such expansions may occur on the behalf of competitors if possible, and thereby increase the rivalry in the industry.

Findings of the study:

1) Most of the dealers used combed quality of yarn & of 24s count is more popular among them.

59

2) The demand of cotton dyed in this year is same or less as compared to previous year. 3) VPL is the preferred supplier for dyed yarn n Ludhiana , Tirupur ,Bombay market. 4) The dealers are satisfied with the satisfied with the quality of yarn , and ervices supplied by VPL to hem 5) The dealers are mostly facing problem in colour mismatching because the dyed yarn is not similar to sample given by the party. Suggestions: 1. The dealers should be given proper services so that they can be loyal to the company. 2. The yarn should be dyed properly so that the party should not face any problem. 3. The supply period should be shortened so that buyer can get quic delivery as people are not satisfied with the supply of material.

References 1. Fibre2 fashion.com 2. Oswal group .com 3. The company profile .com 4. Cii.com

60

BIBLIOGRAPHY

WWW.GOOGLE.COM WWW.WIWIKEPEDIA.COM BOOKS: RESEARCH METHODOLOG MARKETING MANAGEMENT C.R.KHOTHARI PHILIP KOTLER

OFFICIAL RECORD:

COMPANY REPORT MARKETING SURVEY MAGZINES OFFICIAL RECORD

61

Annexure Questionnaire

Q:1 which quality of cotto dyed yarn do you use? Combed Compact carded other

Q:2 what is your monthly consumption?

62

Q:3 Is this consumption is more or less than previous year? More Q:4 less

what are the reasons for more consumption?

Q:5 what are the reasons for less consumption?

Q:6 which count of cotton dyed yarn is mostly used? Single 20s 24s 30s 34s 40s Above 40s double 2/20s 2/24s 2/30s 2/34s 2/40s

Q:7 who is the preferred supplier/

VPL Aurodyeing Nahar t.c.terry tex supreme Chenab textile

Q:8 what other quality of yarn you are using?

63

Q:9 how do you feel about the services & material supplied by the company? Highly satisfied satisfied average below average

Dissatisfied Q:10 which quality of yarn you expect most inthe future/

Q:11 what do you say about the prices of dyed yarn of VPL as compared to competitors? Prices are more Prices are less Competitive Q:12 do you have faced any problem in the dyed yarn supplied by the company/ Yes 1 I no

64

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CERC Order on Adani Power Petition for Tariff RevisionDokument94 SeitenCERC Order on Adani Power Petition for Tariff RevisionPranay GovilNoch keine Bewertungen

- Wallinandreassen 1998Dokument35 SeitenWallinandreassen 1998diasaripermataNoch keine Bewertungen

- Sbi Code of ConductDokument5 SeitenSbi Code of ConductNaved Shaikh0% (1)

- Oral Communication - Noise Barriers To CommunicationDokument24 SeitenOral Communication - Noise Barriers To Communicationvarshneyankit1Noch keine Bewertungen

- 'Air Astana ' Airline Industry OrganisationDokument5 Seiten'Air Astana ' Airline Industry OrganisationФариза ЛекероваNoch keine Bewertungen

- AnuragDokument2 SeitenAnuragGaurav SachanNoch keine Bewertungen

- Southern Mindanao Colleges Pagadian City: Jeep Accel 2Dokument8 SeitenSouthern Mindanao Colleges Pagadian City: Jeep Accel 2Gennyse Balmadres-Selaras Pantorilla-FernandezNoch keine Bewertungen

- Prospectus of A CompanyDokument6 SeitenProspectus of A CompanyRayhan Saadique100% (1)

- Essential Links for Marketing, Finance & TechDokument3 SeitenEssential Links for Marketing, Finance & TechsouranilsenNoch keine Bewertungen

- Dir 3BDokument2 SeitenDir 3Banon_260967986Noch keine Bewertungen

- United States Court of Appeals Second Circuit.: Nos. 256-258. Docket 27146-27148Dokument16 SeitenUnited States Court of Appeals Second Circuit.: Nos. 256-258. Docket 27146-27148Scribd Government DocsNoch keine Bewertungen

- Final ST ProjectDokument114 SeitenFinal ST ProjectShreyansh JainNoch keine Bewertungen

- C Hanaimp142Dokument2 SeitenC Hanaimp142karamananNoch keine Bewertungen

- Group Directory: Commercial BankingDokument2 SeitenGroup Directory: Commercial BankingMou WanNoch keine Bewertungen

- Day Book 2Dokument2 SeitenDay Book 2The ShiningNoch keine Bewertungen

- Raza Building StoneDokument9 SeitenRaza Building Stoneami makhechaNoch keine Bewertungen

- Test Bank For Accounting Principles 12th Edition WeygandtDokument37 SeitenTest Bank For Accounting Principles 12th Edition Weygandtdupuisheavenz100% (13)

- Chapter 30Dokument2 SeitenChapter 30Ney GascNoch keine Bewertungen

- Non-Routine DecisionsDokument5 SeitenNon-Routine DecisionsVincent Lazaro0% (1)

- Test On Admission of PartnerDokument1 SeiteTest On Admission of PartnerShrirang ParNoch keine Bewertungen

- Steel Industry PitchDokument17 SeitenSteel Industry Pitchnavinmba2010Noch keine Bewertungen

- Daily Lesson Log: I. ObjectivesDokument5 SeitenDaily Lesson Log: I. ObjectivesRuth ChrysoliteNoch keine Bewertungen

- Training On APQPDokument38 SeitenTraining On APQPSachin Chauhan100% (1)

- Operational Effectiveness + StrategyDokument7 SeitenOperational Effectiveness + StrategyPaulo GarcezNoch keine Bewertungen

- Synopsis of Derivative ProjectDokument11 SeitenSynopsis of Derivative ProjectSHAIK YASINNoch keine Bewertungen

- E-Way Bill: Government of IndiaDokument1 SeiteE-Way Bill: Government of IndiaAtendra SinghNoch keine Bewertungen

- Imt Ghaziabad - The A-TeamDokument6 SeitenImt Ghaziabad - The A-TeamAbhishek GuptaNoch keine Bewertungen

- Test Bank For Financial Accounting 47 - 68Dokument4 SeitenTest Bank For Financial Accounting 47 - 68John_Dunkin300Noch keine Bewertungen

- A Study On Customer Relationship Management at Yamaha Srinivasa Motors PuducherryDokument6 SeitenA Study On Customer Relationship Management at Yamaha Srinivasa Motors PuducherryEditor IJTSRDNoch keine Bewertungen

- BT CaseDokument8 SeitenBT CaseAzaad Ius0% (1)