Beruflich Dokumente

Kultur Dokumente

What Is Fair Value Accounting

Hochgeladen von

Samantha Hwey Min DingOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

What Is Fair Value Accounting

Hochgeladen von

Samantha Hwey Min DingCopyright:

Verfügbare Formate

What is Fair Value?

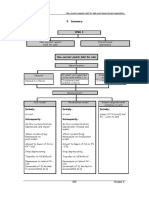

In common parlance, Fair Value is the price at which an asset can be exchanged between two knowledgeable parties in an arms length transaction. However, the Statement of Financial Accounting Standards issued by Financial Accounting Standards Board defines Fair Value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. It is not the price that would be paid to acquire an asset or received to assume the liability. The basic assumption of Fair value is that the firm has sufficient time to market the asset; it should not be estimated in a force liquidation or distress sale. Why Fair Value Accounting? It will be much better to answer this question with an example. Suppose, Mr.X has purchased a building worth Rs. 2, 20,000 one year ago and he has to pay Rs.2, 60,000 to purchase an equivalent size of Building now. But using his special marketing skills he can sell the building for Rs. 3, 10,000 less Rs. 20,000 in various fees to finalize the sale. Let us assume the building is 13000 square feet and Rs.20 per square foot. Now, at what amount should the building be recorded? Now, we will analyze 4 options: a) Historical Cost: (Rs. 2, 20,000) this can be easily defined as the amount paid to acquire an asset adjusted for Depreciation and it is also very reliable. But if this is considered as the perfect method, then why the concept of Impairment arise? b) Replacement Cost: (Rs. 2, 60,000) is the amount that would have to be paid to acquire the same or an equivalent asset. This reflects the general rise in price; it might also include the influence of the parties involved. c) Net Realizable value: ( Rs. 2,90,000) amount of cash into which an asset is expected to be converted in due course of business less direct costs, if any, necessary to make that conversion. It includes a profit element and as stated Mr.Xs special skill to sell the building at an increased price. d) Fair Value: (Rs. 2, 60,000) It includes a profit element without any influence of the parties involved and it is also a hypothetical arms length price.

Difference between Fair Value and Fair Market Value: Many people believe that Fair value and Fair market value is same, At this juncture, i would like to highlight the difference between both; Fair value of an asset is determined by using mathematical models in the finance theory. The fair value determined through these models can be substantially different from the fair market value of the same asset in certain cases. The fair market value is determined by the market forces and the demand and supply for a certain product or service. The inputs to the estimation of the fair value should be appropriately measured to arrive at the correct fair value for any asset. Analysts believe that assets will trade at their fair values in the long term and the fair market value may deviate from the fair value because of market anomalies. Market anomalies include financial barriers, mispricing or improper market expectations. So, Here comes the next question, how to determine the Fair Value? At least in theory all assets and liabilities should have a fair value, although it is not easy to determine them. Let us start from the idea that the best estimate of the Fair value is the Market price of the asset or liability, but this price does not exist for all items and even if it exits, it may not be reliable. When a published price in an active market exists, it should be used to value the financial asset or liability. A financial instrument is deemed to be quoted on an active market if the listed prices are easily and regularly available. If not, the fair value should be determined using a valuation technique incorporating all the factors that participants in the market would consider when establishing the price and which is consistent with accepted economic methods used to set the prices of financial instruments. According to circular 4/2004, which has set out the criteria to determine fair value. These rules are: First of all, reliable values from active markets should be applied Failing this, valuation mechanisms should be used If neither of the above can be used, presumed value or objective criteria should be applied

The above said circular also states, a market is active when: The assets traded are uniform Buyers and sellers willing to trade the assets can be found at almost any time. Prices are public. Valuation Techniques and Models:

Estimating fair value using valuation techniques and models aim to determine the price of a transaction for the measurement date in an arms length exchange between knowledgeable and willing parties. The application of valuation techniques and models necessarily implies the use of the directors 'judgment, which means it entails a certain degree of subjectivity. For this reason, the regulations establish a series of criteria in order to maximize the information from the market (to make maximum use of market inputs): 1. First of all, if the prices of the most recent market transactions between willing and duly informed parties acting independently are available, they should be used, provided there has not been a significant change in the economic conditions since the time of the transaction. If the economic conditions have changed (for example, a change in the risk-free interest rate), this price should be adjusted so that the fair view reflects this change. Similarly, the price of the most recent transaction should be adjusted if the institution can demonstrate that it is not the fair value (for example, because it is the result of a forced transaction, involuntary liquidation or urgent sale). 2. If the foregoing information is not available, references to the fair value of another, substantially similar, financial instrument should be used. 3. Valuation techniques and models (discounted cash flows, option pricing models such as Black-Scholes, etc.) will be used when the information enumerated above is not available. It is considered that a valuation technique offers a realistic estimate if the variables used are a reasonable representation of the expectations of market agents about this financial instrument and the risk/return factors inherent in it have been taken into account.

Characteristics of valuation techniques: (I) The techniques used to estimate fair value must be appropriate and consistent with economic methodologies and financial theory. They must incorporate observable market data and any other factors that participants in the market would take into account when estimating the fair value of the financial instrument concerned. (II) If a valuation technique is in common use by market participants, and it has been demonstrated to give reliable and more realistic estimates of the prices obtained in recent market transactions, this technique should be used. (III) The valuation technique must maximize the use of market inputs and limit as far as possible the use of own estimates and non-observable data.

(IV) The choice of a valuation method or technique implies an exercise of judgment by the directors when deciding the fundamental principles and underlying theoretical assumptions. For this reason, the regulations require that there be a wide range of documentation available on the chosen valuation method and that the reasons for choosing one alternative rather than the others be reported where appropriate. (V) Once a particular valuation technique or model has been chosen, this should be used over time, unless there are changes to the assumptions that led to its being chosen. It needs to be borne in mind that the valuation technique may be modified if this would result in a more reliable estimate of fair value, such as, for example, if a new technique or an improvement in an existing technique has been developed. In such cases, these variations will be treated as changes in the estimates and applied prospectively. (VI) The valuation technique must be reviewed periodically to confirm its validity. (VII) The use of any valuation technique or model implies a risk known as "model risk". This risk covers the possibility that the chosen technique or model is incorrect, that it is based on erroneous assumptions or does not adequately reflect normal market behavior. This risk always exists as there is no model or technique that is a perfect substitute for a market transaction. The estimated fair value of a financial instrument will be based on one or more of the following factors: 1. The time value of money. On analyzing the discounted expected cash flows the observable risk free interest rate will be used for the period in which it is expected that each flow be produced. It is usually possible to deduce this interest rate from observable public debt prices. However, in most emerging countries, public debt is not free of credit risk. Therefore in these cases it may be more appropriate to use rates of interest on private fixed income securities, provided they are issued in the same currency and are traded on highly liquid markets between counterparties with good credit quality. 2. Credit risk. The effect of credit risk on fair value is shown in the premium on the risk-free interest rate. This may be inferred from the observable market prices of negotiable instruments with different credit qualities, or from observable interest rates applied by lenders to borrowers with different credit ratings. If there is insufficient information to determine the level of credit risk the market participants would consider when setting the price of the financial instrument, in the absence of evidence to the contrary, there

have been no variations in the credit risk differential compared to that existing on the date of registration. Notwithstanding the foregoing, it is to be expected that the institution will make reasonable efforts to determine if there is any evidence of a change in these factors. When such evidence exists, the institution will consider the effects of the change when calculating the fair value of the financial instrument. 3. Foreign currency exchange prices for transactions in different currencies. 4. Commodity prices (for example, in the case of derivatives on commodities). 5. Equity prices. For unlisted instruments, the fair value may be estimated from valuation techniques (ratio-based models, updating of free cash flows, multiple price approach, etc.) 6. Volatility. This may be estimated from historical market data, or using volatilities implicit in current market prices. 7. Liquidity, understood as the ease with which transactions involving particular financial instrument may be undertaken. For instruments listed on relatively inactive markets, liquidity is estimated depending on the time necessary to perform the transaction without a significant variation in prices occurring; for unlisted instruments, liquidity may be estimated in relation to the unique Characteristics of the instrument (necessary size of the transaction, etc.) 8. Risk of early cancellation (prepayment risk and surrender risk and risk of redemption). The estimate of the coincidence or not between the real maturity and contractual maturity may be estimated using historical data. On this point it should be noted that in any case, the fair value of the financial liabilities that may be cancelled on sight may not be less than the present value of amount that may be demanded calculated from the date on which its repayment may be demanded. 9. Servicing costs. These costs may be estimated from the commissions required by other market participants. INFORMATION DISCLOSURE REQUIREMENTS: As regards fair value, the management's responsibility mainly takes the form of informing users of financial statements of the hypotheses adopted and assumptions made when they value financial instruments and the fair value of those financial instruments valued at cost in financial statements. To do so, the institution must group together all its assets and liabilities into classes and it may only offset them when their book values can be offset on the balance sheet. Additionally, information will be given on:

1. The fair value of each portfolio of financial assets and liabilities compared with its corresponding book values shown on the balance sheet. Also, the fair value of the financial assets on the various portfolios must be disclosed. 2. If the fair values of the financial instruments have been determined in whole or in part by direct reference to quoted prices published by an active market, or if on the other hand, they have been obtained using some or other valuation technique, and the percentage each of these groups represents. 3. The main methods and hypotheses adopted by the company's managers to determine the fair values of the most significant classes of financial assets and liabilities for which there are no observable prices on an active market (proportions of early payments, estimated rate of losses on loans, interest rates, discount rates, etc.) 4. The fair value of the financial instruments that have not been valued in the financial statements using this criterion (portfolio of investments to maturity, credit investment, etc.) 5. When different fair value could be derived, if the hypotheses used in the estimate of the fair value of the financial instruments included in the financial statements were changed, in whole or in part, then the institution must disclose the effect of possible alternatives to this fair value. 6. Investments in unlisted equity instruments or the derivatives linked to them which are valued on a historical cost basis as their fair value cannot be measure reliably. Similarly, a description of the financial instruments should be given, with their main characteristics, book value, reasons why the fair value could not be determined reliably, and if possible, the range of values between which it is highly likely this value is located; whether the institution intends to sell or dispose of them, and the procedure for this. In the case of the sale of these instruments the book value will be indicated at the time of the sale and the amount of the profit or loss recognized, along with any information about the market for them. 7. In the case of assets that are available for sale, the amount of the profit or loss recognized in the equity during the financial year and the amount that has been withdrawn from the equity and recognised in the profit and loss account of the year must be reported. 8. The effect on the profit and loss account caused by the changes in fair value. However, for certain financial instruments such as short-term receivables or payables no information is required about their fair value provided that their book value is a good approximation to it.

General points regarding Fair Value: a) Although it does not say so expressly, underlying definition of fair value is the assumption that the company is a going concern. Overestimates or underestimates due to special circumstances are excluded b) Fair value is determined for a specific date. At this moment certain information is available and particular market conditions and expectations exist which may change over time. Thus, the fair value on one date may not be appropriate for another. That is to say, the fair value at a given moment may not be a good estimator of the fair value in the future. Advantages of Fair Value: Fair Value V/S Historical costs which literally means relevance V/S Reliability. Fair-value accounting provides relevant information, capable of making a difference in a decision. It is relevant because it offers: 1. Predictive Value- Fair-value is more relevant to investors and creditors as it reflects the current prices of assets, thus capturing a better exposure to the future. 2. Feedback Value- Relevant information allows the firm to conform or rethink their decisions. 3. Timeliness- Decision making is based on all the information available to investors and creditors. Fair-value accounting reports changes in value and components of that change to date, so all the information needed will be readily available, in time to make the right decision. 4. Valuing all financial instruments by their fair value will allow users of financial statements to obtain a truer and fairer view of the company's real financial situation as only fair value reflects the prevailing economic conditions and the changes in them. By contrast, historical cost-based accounting shows the conditions that existed when the transaction took place and any possible changes in the price do not appear until the asset is realized. 5. Book earnings are brought closer to financial earnings, which are considered a positive outcome for the efficient functioning of the market and for the use of accounting information in the valuation of companies. Disadvantages of Fair Value Accounting: 1. It is notoriously less reliable. Unless an asset is exchanged in an arm's length transaction, fair value has to be based on an estimate. No matter how scientific, all methods involve judgments that can have an enormous effect

on the final sum. Auditors generally are against fair value accounting because of this lack of reliability and the fear that in a company failure the value will turn out to have been unduly optimistic. Basing accounting values on historic cost means they are founded on a certain figure. 2. The second major disadvantage is that fair values can fluctuate significantly over a short time and thus produce major swings in reported results. Historical cost accounting generally produces smoother patterns of profit over time. Conclusion: Even though Fair Value has got its own limitations, it has got enormous advantages which cant be over sighted. For these reasons the regulations, and in particular Banco de Espaa Circular 472004 on Financial Reporting Standards for credit institutions, encourage the use of fair value when it facilitates solid risk management, limiting its application in the case of balance sheet items for which there is no deep market and when the estimate of fair value is not sufficiently reliable. The aim is to allow institutions to manage risks correctly and avoid artificial accounting volatility in the balance sheet and profit and loss statement, with the consequent negative impact this would have for shareholders and depositors.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Cesarini Case ExampleDokument4 SeitenCesarini Case ExampleSamantha Hwey Min DingNoch keine Bewertungen

- 4703 Solutions Defcomp 04Dokument17 Seiten4703 Solutions Defcomp 04Samantha Hwey Min DingNoch keine Bewertungen

- I Economics, Ethics and Contracting - Doc Jan 9Dokument13 SeitenI Economics, Ethics and Contracting - Doc Jan 9Samantha Hwey Min DingNoch keine Bewertungen

- FIN5342PS1Dokument3 SeitenFIN5342PS1Samantha Hwey Min Ding100% (1)

- Chap 005Dokument89 SeitenChap 005Samantha Hwey Min DingNoch keine Bewertungen

- Chap 004Dokument60 SeitenChap 004Samantha Hwey Min Ding67% (3)

- Chap 003Dokument48 SeitenChap 003Samantha Hwey Min Ding80% (5)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- HSBC Bank India's Annual ReportDokument40 SeitenHSBC Bank India's Annual ReportRavi RajaniNoch keine Bewertungen

- Mark To Market AccountingDokument12 SeitenMark To Market AccountingAnnie AnNoch keine Bewertungen

- Bdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 BillionDokument7 SeitenBdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 Billionk100% (1)

- Financial Accounting Chapter 7Dokument57 SeitenFinancial Accounting Chapter 7Waqas MazharNoch keine Bewertungen

- Real-Time Credit Valuation Adjustment and Wrong Way RiskDokument13 SeitenReal-Time Credit Valuation Adjustment and Wrong Way RiskCognizantNoch keine Bewertungen

- Text-Book P3Dokument147 SeitenText-Book P3Nat SuphattrachaiphisitNoch keine Bewertungen

- SEx 3Dokument33 SeitenSEx 3Amir Madani100% (4)

- Enron ScandalDokument2 SeitenEnron ScandalKoko LaineNoch keine Bewertungen

- SOX Compliance With SAP TreasuryDokument57 SeitenSOX Compliance With SAP Treasurymarinas800% (1)

- Definations of Every Word Used in Stock Market To Be Known.............. Must READ - December 9th, 2007Dokument24 SeitenDefinations of Every Word Used in Stock Market To Be Known.............. Must READ - December 9th, 2007rimolahaNoch keine Bewertungen

- Midterm FarDokument7 SeitenMidterm FarShannen D. CalimagNoch keine Bewertungen

- IFRS 9 Financial Instruments - F7Dokument39 SeitenIFRS 9 Financial Instruments - F7TD2 from Henry HarvinNoch keine Bewertungen

- Deemed Loan RelationshipsDokument11 SeitenDeemed Loan RelationshipsRevamp TwentyoneNoch keine Bewertungen

- Ehp8 Sp10 Delta Scope FinalDokument143 SeitenEhp8 Sp10 Delta Scope FinaljoeindNoch keine Bewertungen

- ITAL PINAS Audited Financial Statement 2015 ItalpinasDokument93 SeitenITAL PINAS Audited Financial Statement 2015 ItalpinasDaves VestNoch keine Bewertungen

- Ias and IfrsDokument2 SeitenIas and IfrsE-kel Anico JaurigueNoch keine Bewertungen

- Test BankDokument136 SeitenTest BankLouise100% (1)

- Enron Corporation: Enron's Energy OriginsDokument7 SeitenEnron Corporation: Enron's Energy Originsislam hamdyNoch keine Bewertungen

- Financial InstrumentsDokument48 SeitenFinancial InstrumentsAshura ShaibNoch keine Bewertungen

- Ifrs 5: 9. SummaryDokument14 SeitenIfrs 5: 9. SummaryCISA PwCNoch keine Bewertungen

- Auditing Problem From Audit of InvestmentDokument61 SeitenAuditing Problem From Audit of InvestmentNicole Anne Santiago SibuloNoch keine Bewertungen

- JPM CDS Handbook 2006Dokument180 SeitenJPM CDS Handbook 2006iceninedNoch keine Bewertungen

- Contemporary Issues in Accounting: Solution ManualDokument17 SeitenContemporary Issues in Accounting: Solution ManualKeiLiewNoch keine Bewertungen

- Proposed Changes in Insurance Accounting RulesDokument3 SeitenProposed Changes in Insurance Accounting Rulesharis gunawanNoch keine Bewertungen

- PUSEQF Prospectus SC PDFDokument43 SeitenPUSEQF Prospectus SC PDFIdo Firadyanie MarcelloNoch keine Bewertungen

- Annexure - Financial AccountingDokument14 SeitenAnnexure - Financial AccountingAndrea AgliettiNoch keine Bewertungen

- frm二级 2020 模拟题(practice exam)Dokument137 Seitenfrm二级 2020 模拟题(practice exam)JMNoch keine Bewertungen

- CIS CMFAS M8A MCQ (Set A)Dokument9 SeitenCIS CMFAS M8A MCQ (Set A)philip tan100% (2)

- Financial Markets - Products-1Dokument470 SeitenFinancial Markets - Products-1Heet Gandhi100% (1)

- Disbursement of MTM Profit in DFC PDFDokument3 SeitenDisbursement of MTM Profit in DFC PDFomarNoch keine Bewertungen