Beruflich Dokumente

Kultur Dokumente

Koutsoyannis

Hochgeladen von

Rahul JainOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Koutsoyannis

Hochgeladen von

Rahul JainCopyright:

Verfügbare Formate

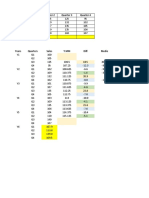

Case 1: maximization of output subject to a cost constraint (financial constraint) We assume: (a) A given production function

And (b) given factor prices, w,r for labour and capital respectively. The firm is in equilibrium when it maximizes its output given its total cost outlay and the prices of the factors, w and r. In figure 1, we see that the maximum level of output of the firm can produce, given the cost constraint, is X2 defined by the tangency of the isocost line, and the highest isoquant. The optimal combination of factors of production is K2 and L2, for prices w and r. Higher levels of output (to the right of e) are desirable but not attainable due to the cost constraint. Other points on AB or below it lie Insert Figure 1 on a lower isoquant than X2. Hence X2 is the maximum output possible under the above assumptions (of given cost outlay, given production function, and given factor prices). At the point of tangency (e) the slope of the isocost line (w/r) is equal to the slope of the isoquant (MPL/MPK). This constitutes the first condition for equilibrium. The second condition is that the isoquants be convex to the origin. In summary: the conditions for equilibrium of the firm are: (a) Slope of isoquant = Slope of isocost, or

(b) The isoquants must be convex to the origin. If the isoquant is concave the point of tangency of the isocost and the isoquant curves does not define equilibrium position (figure 2) Insert Figure 2 Output X2 (depicted by the concave isoquant) can be produced with lower cost at e which lies on a lower isocost curve than e. (with a concave isoquant we have a corner solution)

Formal derivation of the equilibrium condition The equilibrium conditions may be obtained by applying calculus and solving a constraint maximum problem which may be stated as follows. The rational entrepreneur seeks the maximization of his output, given his total cost-outlay and the prices of factors. Formally: Maximize Subject to (cost constraint)

This is a problem of constrained maximum and the above conditions for the equilibrium of the firm may be obtained from its solution.

We can solve this problem by using the Lagrangian multipliers. The solution involves the following steps: Rewrite the constraint in the form Multiply the constraint by a constant which is the Lagrangian multiplier: The Lagrangian multipliers are undefined constants which are used for solving constraint maxima or minima. Their value is determined simultaneously with the values of the other unknown (L and K in our example). There will be as many Lagrangian multipliers as there are constraints in the problem. Form the composite function It can be shown that maximization of the function implies the maximization of the output. The first condition for the maximization of a function is that its partial derivatives be equal to zero. The partial derivatives of the above function with respect to L, K and are:

Solving the first two equations for we obtain

and

The two expressions must be equal; thus

or

This firm is in equilibrium when it equates the ratio of the marginal productivities of factors to the ratio of the prices. It can be shown that the second-order conditions for equilibrium of the firm require that the marginal product curves of the two factors have a negative slope. The slope of the marginal product curve of labour is the second derivative of the production function: Slope of MPL curve = Similarly for capital: Slope of MPK curve = The second-order conditions are

and ( )( ) ( )

These conditions are sufficient for establishing the convexity of the isoquants.

Case 2: minimization of cost for a given level of output The conditions for equilibrium of the firm are formally the same as in the Case 1. That is, there must be tangency of the given isoquant and the lowest possible isocost curve, and the isoquant must be convex. However, the problem is conceptually different in the case of cost minimization. The entrepreneur wants to produce a given output (for example, a bridge, a building, or tons of a commodity) with the minimum total outlay. In this case we have a single isoquant (as in figure 3) which denotes the desired level of output, but we have a set of isoquant curves (figure 4). Curves closer to the origin show a lower total-cost outlay. The isocost lines are parallel because they are drawn on the assumption of constant prices of factors: since w and r do not change, all the curves have the same slope w/r. Insert figure 3 & 4. The firm minimizes its costs by employing the combination of K and L determined by the point of tangency of the isoquant with the lowest isocost line (figure 5). Points below e are desirable because they show lower cost but are not attainable for output . Points above e show higher costs.

Hence point e is the least-cost point, the point denoting the least-cost combination of the factors K and L for producing . Clearly, the conditions for equilibrium (least cost) are the same as in Case 1, that is, equality of the slopes of the isoquant and the isocost curves, and the convexity of the isoquant. Insert figure 5. Formally: Minimize Subject to Rewrite the constraint in the form

Premultiply the constraint by the Lagrangian multiplier From the composite function or Take the partial derivatives of with respect to L, K and and equate to zero:

( ( [

From the first two expressions we obtain

) )

( ( Dividing through these expressions we find

) )

This condition is the same as in Case 1 above. The second (sufficient) condition, concerning the convexity of the isoquant, is fulfilled by the assumption of negative slopes of the marginal product of factors as in Case 1, that is

)(

Das könnte Ihnen auch gefallen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- List of StudentsDokument8 SeitenList of StudentsRahul JainNoch keine Bewertungen

- Economics ProjectDokument3 SeitenEconomics ProjectRahul JainNoch keine Bewertungen

- Economics Report FinalDokument7 SeitenEconomics Report FinalRahul JainNoch keine Bewertungen

- Household BusinessDokument3 SeitenHousehold BusinessRahul JainNoch keine Bewertungen

- History of ConflictDokument4 SeitenHistory of ConflictRahul JainNoch keine Bewertungen

- Barriers To EntreprenuershipDokument2 SeitenBarriers To EntreprenuershipRahul JainNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Maurer, Göllmann - 2013 - Theory and Applications of Optimal Control Problems With Multiple Time-Delays-AnnotatedDokument30 SeitenMaurer, Göllmann - 2013 - Theory and Applications of Optimal Control Problems With Multiple Time-Delays-AnnotatedJese MadridNoch keine Bewertungen

- Mean, Median, Mode... MATH InvestigationDokument2 SeitenMean, Median, Mode... MATH InvestigationMaria Jocosa100% (1)

- Pt. Ravishankar Shukla University Scheme of ExaminationDokument28 SeitenPt. Ravishankar Shukla University Scheme of ExaminationGovind Singh PatelNoch keine Bewertungen

- Outline of A New Approach To The Analysis of Complex Systems and Decision Processes Article RevisionDokument3 SeitenOutline of A New Approach To The Analysis of Complex Systems and Decision Processes Article RevisionDamián Abalo MirónNoch keine Bewertungen

- Domain Decomposition Methods PDFDokument2 SeitenDomain Decomposition Methods PDFChandra ClarkNoch keine Bewertungen

- Taylor SeriesDokument13 SeitenTaylor SeriesSandip Desai100% (1)

- MATLAB Examples - OptimizationDokument15 SeitenMATLAB Examples - OptimizationClayssaNelNoch keine Bewertungen

- Chapter 1 - Modelling, Computers and Error AnalysisDokument35 SeitenChapter 1 - Modelling, Computers and Error AnalysisAzmiHafifiNoch keine Bewertungen

- Design ControllerDokument34 SeitenDesign ControllerMaezinha_MarinelaNoch keine Bewertungen

- Turingan - Lab Problem Set - ChromatographyDokument3 SeitenTuringan - Lab Problem Set - ChromatographyAlliah Turingan100% (1)

- Probability and Statistics - Linear RegressionDokument98 SeitenProbability and Statistics - Linear RegressionFaraz JawedNoch keine Bewertungen

- Machine Learning With MatlabDokument36 SeitenMachine Learning With MatlabAjit Kumar100% (1)

- Formula RioDokument82 SeitenFormula RioLuis RoblesNoch keine Bewertungen

- ODE StabilityDokument20 SeitenODE Stabilitybaraksh4Noch keine Bewertungen

- 20MA101 Set 2Dokument10 Seiten20MA101 Set 2Dheeraj KumarNoch keine Bewertungen

- Exponential ReviewDokument6 SeitenExponential Reviewapi-331293056Noch keine Bewertungen

- KPK1Dokument11 SeitenKPK1M.Hamdy A.ElNabyNoch keine Bewertungen

- UIUC Mock Putnam Exam 1/2005 SolutionsDokument4 SeitenUIUC Mock Putnam Exam 1/2005 SolutionsGag PafNoch keine Bewertungen

- BUFFER SOLUTION AND TITRATION GUIDEDokument59 SeitenBUFFER SOLUTION AND TITRATION GUIDEFebi AndrianiNoch keine Bewertungen

- Euler Method in MATLABDokument4 SeitenEuler Method in MATLABFaraz Ali ShahNoch keine Bewertungen

- Aplicatie 4Dokument35 SeitenAplicatie 4AndreeaPopescuNoch keine Bewertungen

- s08 973 01Dokument3 Seitens08 973 01philgiddyboyNoch keine Bewertungen

- Linear ProgrammingDokument8 SeitenLinear ProgrammingJackieWilsonNoch keine Bewertungen

- Automatic ForecastingDokument7 SeitenAutomatic ForecastingRodrigo Vallejos VergaraNoch keine Bewertungen

- U Zaw Zaw AungDokument9 SeitenU Zaw Zaw AungPrince JacintoNoch keine Bewertungen

- Adjust CDokument133 SeitenAdjust CFelipe Carvajal Rodríguez100% (1)

- Probability Theory and Stochastic ProcessDokument9 SeitenProbability Theory and Stochastic Processms_aramanaNoch keine Bewertungen

- Trigonometric Functions Grade 10Dokument47 SeitenTrigonometric Functions Grade 10Adhanom G.Noch keine Bewertungen

- EE5121: Convex Optimization: Assignment 5Dokument2 SeitenEE5121: Convex Optimization: Assignment 5elleshNoch keine Bewertungen

- DBA MathsDokument98 SeitenDBA Mathsvictor chisengaNoch keine Bewertungen