Beruflich Dokumente

Kultur Dokumente

SWOT Analysis of The Indian Organized Retail Industry

Hochgeladen von

Mohammad Nazish MallickOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SWOT Analysis of The Indian Organized Retail Industry

Hochgeladen von

Mohammad Nazish MallickCopyright:

Verfügbare Formate

SWOT analysis of the Indian organized Retail industry : SWOT analysis of the Indian organized Retail industry : Strength:

Retailing is a technology-intensive" industry. It is technology that will help th e organized retailers to score over the unorganized retailers. Successful organi zed retailers today work closely with their vendors to predict consumer demand, shorten lead times, reduce inventory holding and ultimately save cost. Example: Wal-Mart pioneered the concept of building competitive advantage through distribution & information systems in the retailing industry. They introduced two innovative lo gistics techniques cross-docking and EDI (electronic data interchange). On an average a super market stocks up to 5000 SKU's against a few hundreds stoc ked with an average unorganized retailer. Weakness: Less Conversion level : Despite high footfalls, the conversion ratio has been ve ry low in the retail outlets in a mall as compared to the standalone counter par ts. It is seen that actual conversions of footfall into sales for a mall outlet is approximately 2025%. On the other hand, a high street store of retail chain has an average conve rsion of about 50-60%. As a result, a stand-alone store has a ROI (return on inv estment) of 25-30%; in contrast the retail majors are experiencing a ROI of 8-10 %. Customer Loyalty: Retail chains are yet to settle down with the proper merchandi se mix for the mall outlets. Since the stand-alone outlets were established long time back, so they have stabilized in terms of footfalls & merchandise mix and thus have a higher customer loyalty base. Opportunity: The Indian middle class is already 30 Crore & is projected to grow to over 60 Cr ore by 2011 making India one of the largest consumer markets of the world. The I MAGES-KSA projections indicate that by 2015, India will have over 55 Crore peopl e under the age of 20 - reflecting the enormous opportunities possible in the ki ds and teens retailing segment. Organized retail is only 3% of the total retailing market in India. It is estima ted to grow at the rate of 25-30% p.a. and reach INR 1,00,000 Crore by 2010. Percolating down : In India it has been found out that the top 6 cities contribu te for 66% of total organized retailing. While the metros have already been expl oited, the focus has now been shifted towards the tier-II cities. The 'retail bo om', 85% of which has so far been concentrated in the metros is beginning to percolate down to the se smaller cities and towns. The contribution of these tier-II cities to total o rganized retailing sales is expected to grow to 20-25%. Rural Retailing: India's huge rural population has caught the eye of the retaile rs looking for new areas of growth. ITC launched India's first rural mall "Chaup al Saga" offering a diverse range of products from FMCG to electronic goods to a utomobiles, attempting to provide farmers a one-stop destination for all their needs." Hariy ali Bazar" is started by DCM Sriram group which provides farm related inputs & s ervices. The Godrej group has launched the concept of 'agri-stores' named "Adhaa r" which offers agricultural products such as fertilizers & animal feed along with the required knowledge for effective use of the same to the farmers. Pepsi on th e other hand is experimenting with the farmers of Punjab for growing the right q uality of tomato for its tomato purees & pastes.

Threat: If the unorganized retailers are put together, they are parallel to a large supe rmarket with no or little overheads, high degree of flexibility in merchandise, display, prices and turnover. Shopping Culture: Shopping culture has not developed in India as yet. Even now m alls are just a place to hang around with family and friends and largely confine d to window-shopping.

Das könnte Ihnen auch gefallen

- Nishant ValseDokument44 SeitenNishant ValseNishant ValseNoch keine Bewertungen

- Indian Retail ScenarioDokument14 SeitenIndian Retail ScenarioDevraj Singh ChaudharyNoch keine Bewertungen

- Retail by BharathDokument12 SeitenRetail by BharathVISHU.SANDYNoch keine Bewertungen

- India Retail Industry-AbhilashDokument7 SeitenIndia Retail Industry-AbhilashAbhi_IMKNoch keine Bewertungen

- Retail Industry - Research 2022Dokument4 SeitenRetail Industry - Research 2022ANIKET SURNoch keine Bewertungen

- Snehal Umredkar - Assignment - GD - SNEHAL UMREDKAR PDFDokument3 SeitenSnehal Umredkar - Assignment - GD - SNEHAL UMREDKAR PDFVikas SinghNoch keine Bewertungen

- Groceries and Food Retail in IndiaDokument9 SeitenGroceries and Food Retail in Indiaabhi2799100% (1)

- RuralDokument3 SeitenRuralYupal ShuklaNoch keine Bewertungen

- Sarfraz BDokument25 SeitenSarfraz BSarfraz FrazNoch keine Bewertungen

- Lecture Note - Retail Management - (Marketing Specialisaion) PDFDokument51 SeitenLecture Note - Retail Management - (Marketing Specialisaion) PDFShaini EkkaNoch keine Bewertungen

- A Study of Consumer Perceptions Towards Organised Retail in JalandharDokument13 SeitenA Study of Consumer Perceptions Towards Organised Retail in JalandharDinesh KoulNoch keine Bewertungen

- 2VT10MBA19Dokument59 Seiten2VT10MBA19Safil FaizNoch keine Bewertungen

- Retail Marketing in India: Challenges, Strategies and OpportunitiesDokument8 SeitenRetail Marketing in India: Challenges, Strategies and OpportunitiesARYAN RATHORENoch keine Bewertungen

- Chapter 1Dokument12 SeitenChapter 1Deepak Rao RaoNoch keine Bewertungen

- Retail Sector: What Is Retailing?Dokument5 SeitenRetail Sector: What Is Retailing?Pradeep GuptaNoch keine Bewertungen

- Complete FileDokument51 SeitenComplete FileAkash SinghNoch keine Bewertungen

- Retail! Retail! Retail! Why Is There So Much Talk About This Industry, Which Is ProbablyDokument127 SeitenRetail! Retail! Retail! Why Is There So Much Talk About This Industry, Which Is ProbablySanjay RamaniNoch keine Bewertungen

- Neha Retailmarketing ThesisDokument109 SeitenNeha Retailmarketing ThesisBidisha BhattacharyaNoch keine Bewertungen

- Vishal Megamart and Its CompetitorsDokument101 SeitenVishal Megamart and Its CompetitorsGagan ChoudharyNoch keine Bewertungen

- Project Report Organised Retails in IndiaDokument70 SeitenProject Report Organised Retails in Indiabiswajit.hcl82% (11)

- Vishal Megamart and Its CompetitorsDokument100 SeitenVishal Megamart and Its Competitorstushar jain pagal100% (3)

- What Is Organised RetailDokument56 SeitenWhat Is Organised RetailAkshat Kapoor100% (1)

- MBA 6 - Akhilesh - Senapati - Research (Retail Lab)Dokument2 SeitenMBA 6 - Akhilesh - Senapati - Research (Retail Lab)AKHILESH SENAPATINoch keine Bewertungen

- Project Report Organised Retails in IndiaDokument58 SeitenProject Report Organised Retails in IndiaTariq MohammadNoch keine Bewertungen

- Indian Retail Sector: Trends and FutureDokument22 SeitenIndian Retail Sector: Trends and FutureSankalp KaushikNoch keine Bewertungen

- Customer Perceptoin & Satisfaction Survey of Organized FMCG Retail Outlets in LudhianaDokument66 SeitenCustomer Perceptoin & Satisfaction Survey of Organized FMCG Retail Outlets in Ludhianamandy s100% (1)

- Project Report On Organized Retail Sector in IndiaDokument50 SeitenProject Report On Organized Retail Sector in IndiaYogesh Bhatt100% (1)

- Retailing:: Retail Consists of The Sale of Goods or Merchandise From A Fixed Location, Such As A DepartmentDokument12 SeitenRetailing:: Retail Consists of The Sale of Goods or Merchandise From A Fixed Location, Such As A DepartmentRavi Nandan KumarNoch keine Bewertungen

- Submitted To: Mrs. Ambika RathiDokument69 SeitenSubmitted To: Mrs. Ambika RathiKarishma Bagga100% (1)

- Organized Retail in 2015Dokument3 SeitenOrganized Retail in 2015vj_aeroNoch keine Bewertungen

- Kiran Project 1Dokument35 SeitenKiran Project 1Kiran KumarNoch keine Bewertungen

- Challenges & Issues in Retailing of Pulses in India: DR Varsha S. Sukhadeve, Yogesh Yugalkishore BiyaniDokument5 SeitenChallenges & Issues in Retailing of Pulses in India: DR Varsha S. Sukhadeve, Yogesh Yugalkishore BiyaniNagunuri SrinivasNoch keine Bewertungen

- Overview On WalmartDokument23 SeitenOverview On WalmartSARTHAK BHARGAVANoch keine Bewertungen

- Project ReportDokument42 SeitenProject Reportanoopmangal33% (6)

- Retail Marketing An Empirical StudyDokument121 SeitenRetail Marketing An Empirical StudyAmit100% (1)

- Retailing in IndiaDokument110 SeitenRetailing in IndiaSyama KsNoch keine Bewertungen

- Shopping Mall - Project 2Dokument100 SeitenShopping Mall - Project 2Awadhesh YadavNoch keine Bewertungen

- Hemant Sachan Research PresentationDokument17 SeitenHemant Sachan Research PresentationHemant SachanNoch keine Bewertungen

- Marketing SpecializationDokument21 SeitenMarketing SpecializationGshaan AnsariNoch keine Bewertungen

- Project Reprt DudeeeDokument27 SeitenProject Reprt DudeeeSayed HabibullaNoch keine Bewertungen

- New Swot RetailDokument11 SeitenNew Swot RetailijustyadavNoch keine Bewertungen

- Retail Industry in India - A Case Study of Bharti RetailDokument10 SeitenRetail Industry in India - A Case Study of Bharti RetailAkhter0373Noch keine Bewertungen

- Satyajit Sahoo RMDokument3 SeitenSatyajit Sahoo RMChinmaya SahooNoch keine Bewertungen

- Organized Retail in Rural IndiaDokument3 SeitenOrganized Retail in Rural IndiaAnshuman SharveshNoch keine Bewertungen

- Final Copy Spar RepotDokument39 SeitenFinal Copy Spar RepotShyam VenkatNoch keine Bewertungen

- Retail DistributionDokument68 SeitenRetail DistributionMba ProjectsNoch keine Bewertungen

- Project Study of Changing Consumer Behavior From Unorganised To Organised RetailingDokument34 SeitenProject Study of Changing Consumer Behavior From Unorganised To Organised Retailinganigam22Noch keine Bewertungen

- Big Bazaae Vs National HandloomDokument104 SeitenBig Bazaae Vs National HandloomVarun KothariNoch keine Bewertungen

- TamannaDokument82 SeitenTamannaPreet ChahalNoch keine Bewertungen

- Smart Retail: Revolutionizing the Shopping Experience with AIVon EverandSmart Retail: Revolutionizing the Shopping Experience with AINoch keine Bewertungen

- Unleashing the Power of AI: A Comprehensive Guide to Monetizing Artificial IntelligenceVon EverandUnleashing the Power of AI: A Comprehensive Guide to Monetizing Artificial IntelligenceNoch keine Bewertungen

- Vending Machine Business: How to Start Making Money from Vending MachinesVon EverandVending Machine Business: How to Start Making Money from Vending MachinesNoch keine Bewertungen

- Harvard Business Review on Thriving in Emerging MarketsVon EverandHarvard Business Review on Thriving in Emerging MarketsNoch keine Bewertungen

- Appetite for Convenience: How to Sell Perishable Food Direct to ConsumersVon EverandAppetite for Convenience: How to Sell Perishable Food Direct to ConsumersNoch keine Bewertungen

- Twining's Tea Training For Costa Coffee: Tea Rituals - Varies All Around The WorldDokument8 SeitenTwining's Tea Training For Costa Coffee: Tea Rituals - Varies All Around The WorldPrtk SrsthaNoch keine Bewertungen

- Price Effect: Dr. Aruna Kumar Dash IBS HyderabadDokument16 SeitenPrice Effect: Dr. Aruna Kumar Dash IBS HyderabadNidhi SinghNoch keine Bewertungen

- Dayens Catering ServicesDokument19 SeitenDayens Catering Servicesdenden007Noch keine Bewertungen

- Aef 1 - Reading234Dokument22 SeitenAef 1 - Reading234Roshell Romero BustosNoch keine Bewertungen

- Solvent Based Inks Solvents:: Flexographic Ink For Polyethylene FilmDokument7 SeitenSolvent Based Inks Solvents:: Flexographic Ink For Polyethylene Filmfarukh azeemNoch keine Bewertungen

- English Task Describing Object - A'TianaDokument7 SeitenEnglish Task Describing Object - A'TianaHhhg Ttree4rNoch keine Bewertungen

- Problem Statement: Experiment 1: ObjectiveDokument5 SeitenProblem Statement: Experiment 1: ObjectiveAman Palestin Johor Apj67% (3)

- Upselling TechniquesDokument18 SeitenUpselling TechniquesMario MatkovicNoch keine Bewertungen

- Unit 2.2.1 Theory of Consumer BehaviorDokument8 SeitenUnit 2.2.1 Theory of Consumer Behaviorraksmey_sok855asiaNoch keine Bewertungen

- Winter Passing - 3rd Draft by JosephDokument136 SeitenWinter Passing - 3rd Draft by JosephAditya BhattacharyaNoch keine Bewertungen

- Monokuma v2Dokument8 SeitenMonokuma v2Dorka Enyediné KuruczNoch keine Bewertungen

- Managerial Eco AssignmentDokument10 SeitenManagerial Eco AssignmentAMAN KUMARNoch keine Bewertungen

- A Study of Brand Awareness and Consumer Perception Towards Saffola Fittify and Cocosoul ProductsDokument20 SeitenA Study of Brand Awareness and Consumer Perception Towards Saffola Fittify and Cocosoul ProductsAbhishek guptaNoch keine Bewertungen

- 4p 7pDokument3 Seiten4p 7pWin BoNoch keine Bewertungen

- Pricing StrategiesDokument46 SeitenPricing StrategiesJabeer Ibnu Rasheed100% (1)

- THERMAX Yarn Dyed Fabrics Limited FinalDokument20 SeitenTHERMAX Yarn Dyed Fabrics Limited Finalsoyeb60100% (2)

- Textile Tufted Velvet Fustian: Roi (From French, The Cord of The King) Is ADokument2 SeitenTextile Tufted Velvet Fustian: Roi (From French, The Cord of The King) Is AEllaine Pearl AlmillaNoch keine Bewertungen

- Big Bazaar ProjectDokument38 SeitenBig Bazaar ProjectMegha GalbiNoch keine Bewertungen

- PTE Practice (Reading) : Year 9 30 March, 2020 Session Length: 60 MinutesDokument21 SeitenPTE Practice (Reading) : Year 9 30 March, 2020 Session Length: 60 Minutesmohamed adelNoch keine Bewertungen

- Marginal UtilityDokument27 SeitenMarginal UtilityfransiskaNoch keine Bewertungen

- ALI - Poltek Pos Seminar 18may06Dokument23 SeitenALI - Poltek Pos Seminar 18may06Wahyu TunggonoNoch keine Bewertungen

- Prepositions of Place Interactive GamesDokument17 SeitenPrepositions of Place Interactive GamescytronNoch keine Bewertungen

- Profile of Vintage GroupDokument1 SeiteProfile of Vintage GroupKhaled ChowdhuryNoch keine Bewertungen

- Itc Company ProfileDokument52 SeitenItc Company ProfileAshwin AshNoch keine Bewertungen

- TCS Owner's Manual (Rev. 0612-PC-02)Dokument54 SeitenTCS Owner's Manual (Rev. 0612-PC-02)Kito CanadaNoch keine Bewertungen

- Hermoso Angel A CrochetDokument22 SeitenHermoso Angel A CrochetLina Castro100% (10)

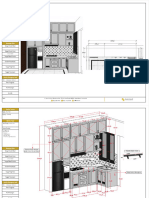

- Gambar Kerja Kitchen SetDokument8 SeitenGambar Kerja Kitchen SetDzilal HidayatNoch keine Bewertungen

- Fabric InspectionDokument20 SeitenFabric InspectionHarrison Kan100% (1)

- Consumer BehaviourDokument9 SeitenConsumer BehaviourDCDR1Noch keine Bewertungen

- Fruit Bandit - Apps by Tang - Critical Analysis of Promotion StrategyDokument9 SeitenFruit Bandit - Apps by Tang - Critical Analysis of Promotion StrategyMaleeha TarannumNoch keine Bewertungen