Beruflich Dokumente

Kultur Dokumente

Print Article

Hochgeladen von

Dhanya AmritrajOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Print Article

Hochgeladen von

Dhanya AmritrajCopyright:

Verfügbare Formate

9/13/12

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

print this article

Policy and Management

ISSUE: MAY 2012 | VOLUME: 07:05

U.S. Prepares Groundwork For Biosimilar Approvals

With the recent release of FDA draft guidelines, launch of the first oncology biosimilars is looming

As biosimilar drugs make their way to American soil, clinicians, regulators, pharmaceutical executives and patients alike are asking: How long will it take for the first biosimilars to reach the U.S. market? How much lower will their prices be than the original molecules they mimic? And how quickly will they be accepted by clinicians and patients? Biosimilar medicationsalso known as follow-on biologicsare virtually identical or highly similar versions of large and intricate biologic molecules like monoclonal antibodies. Brandname biologics are already essential for the treatment of breast, colorectal, esophageal, gastric, head and neck, kidney and non-small cell lung cancers; and Hodgkins and nonHodgkins lymphoma. They also are vital in the treatment of cancer- and chemotherapyinduced anemia and neutropenia. The hope is that biosimilars will significantly improve the affordability of, and access to, cancer medications.

Table 1. FDA Approval Dates of Some Oncology Biologics

Reference Product Bevacizumab (Avastin) Cetuximab (Erbitux) Darbepoetin (Aranesp) Epoetin alfa (Epogen/Procrit) Filgrastim (Neupogen) Pegfilgrastim (Neulasta) Rituximab (Rituxan) Trastuzumab (Herceptin) Approved Feb. 6, 2004 Feb. 12, 2004 Sept. 17, 2001 June 1, 1989 Feb. 20, 1991 Jan. 31, 2002 Nov. 26, 1997 Sept. 25, 1998 2003 2014 2009 2010 Guaranteed Data Exclusivity 2016 2016 2013

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

1/9

9/13/12

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

The clock is already ticking toward the entry of biosimilars into the American market. This is because the 12-year patent-protection period will soon end for some brand-name products (Table 1). For the epoetin-alfa products Epogen (Amgen) and Procrit (Janssen Products), as well as Aranesp (darbepoetin alfa, Amgen) and Neupogen (filgrastim, Amgen), protection will run out in 2013. Some monoclonal antibody products, such as Rituxan (rituximab, Genentech/Biogen Idec), will likely lose their exclusivity protection as soon as the fourth quarter of 2015 and early 2016. Critically, on Feb. 9, 2012, the FDA released its draft guidance outlining the regulatory pathway required for the development and licensing of biosimilars. Several companies have already started to move proposed biosimilar products toward approval and as of mid-February the FDA had received requests to discuss drug approval of biosimilars for at least 11 different biologic drugs. In fact, a few started immediately after President Barack Obama signed the Biologics Price Competition and Innovation (BPCI) Act of 2009 into law on March 23, 2010, as part of the Affordable Care Act. Like the Drug Price Competition and Patent Term Restoration Act of 1984 for biologics, known colloquially as the Hatch-Waxman Act, the BPCI provides a legal framework for the approval of biosimilars in the United States. Cost Savings From Biosimilars In no other field are biologics as important as in oncology and biosimilars are expected to be equally dominant players. Six of the 10 top-selling biologics in the United States are used in oncology, according to a 2011 review of biosimilars by Bradford Hirsch, MD, and Gary Lyman, MD, MPH (J Natl Compr Canc Netw 2011;9:934-942, PMID: 21900222). And they are very expensive: The number one money-earner in 2009 was bevacizumab (Avastin, Genentech), with sales of $5.8 billion. It was followed closely by rituximab at $5.7 billion. At $5 billion and $4.9 billion respectively, the markets for epoetin alfa and trastuzumab (Herceptin, Genentech) were not far behind. In Europe, draft biosimilar development guidelines were released in 2004. The first product epoetin alfa Hexal (Hexal)was approved in August 2007 and now more than a dozen biosimilars are on the market. Erythropoiesis-stimulating agent biosimilars such as epoetin alfa account for 35% of the market (NCCN Biosimilars White Paper. J Natl Compr Canc Netw 2011;9:S1-S22, PMID: 21976013) and are marketed at a 25% to 30% discount from the originator or reference product, according to Drs. Hirsch and Lyman. This also has led to price reductions of the reference products themselves. The European Generic Medicines Agency estimated in a Vision 2015 document that the

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management 2/9

9/13/12

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

European Union (EU) saved 1.4 billion euros (US$1.8 billion) from biosimilar use in 2009. Another analysis projects the total savings to exceed 8 billion euros (US$10.6 billion) by 2020. Most experts believe that overall, biosimilars will cost 20% to 30% less than reference products. Some project that in the United States, this will result in $25 billion in savings per decade. Others peg the windfall as high as $108 billion in the first 10 years and $378 billion over 20 years (Targ Oncol 2012 Jan. 17. [Epub ahead of print]). Biosimilar versions of simple, unmodified biologics may well be approved and accepted relatively quickly in the United States because companies have gained experience with biosimilar approval in Europe. Thus, it is possible that they will be marketed for less than their European equivalents. However, the price reductions with biosimilars will never be in the same ballpark as generics. Generics can be accompanied by price tags that are as much as 90% lower than their brandname counterparts. Biosimilars are made in living systems and are much more complex, and the steps regulators require for product testing and approval are concomitantly more onerous in both the United States and Europe. The estimated cost to bring a biosimilar to market is $10 million to $40 million and the time frame is six to nine years, compared with $1 million to $2 million and three years for generics. New FDA Draft Guidance on Biosimilars The American biosimilar regulatory bar has been set high. The BPCI Act requires biosimilars to be highly similar to the reference product notwithstanding minor differences in clinically inactive components and have no clinically meaningful differences from the reference product in terms of safety, purity and potency. The biosimilars also must have the same mechanism or mechanisms of action for the approved indications and the same route of administration, dosage form and strength. The BPCI Act also deems that biosimilars may be determined to be interchangeable with the reference product based on several criteria, including a demonstration that the biological product can be expected to produce the same clinical result as the reference product in any given patient and, if the biological product is administered more than once in an individual, the risk in terms of safety

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management 3/9

9/13/12

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

or diminished efficacy of alternating or switching between the use of the biological product and the reference product is not greater than the risk of using the reference product without such alternation or switch. On Feb. 9, 2012, the FDA released three draft guidance documents on the pathway for biosimilar development based on the framework set out by the BPCI Act and on feedback received in 2010 at public meetings. The FDA emphasized that it intends to consider the totality of the evidence and use a stepwise approach to determine the safety, efficacy, purity and potency of each proposed biosimilar. The regulations allow bridgingthat is, companies can use offshore data for compounds that have been tested or marketed as biosimilars in other countries. Firms can apply to have the compounds designated as being interchangeablein other words, suitable for substitution for the original or reference productalthough this will be subject to go ahead on a stateby-state basis. They also can apply for a period of exclusivity during which no other interchangeable version of a reference product can be launched into the U.S. market. First Guidance Document: The Science of Demonstrating Biosimilarity The first draft guidance document summarizes the scientific requirements for a biosimilar to reach the market. These range from analyses of its structure and function to manufacturing process considerations, and animal and human studies that may be required, including evaluating clinical immunogenicity. It also describes the framework for postmarketing safety monitoring that companies must set up for every product. That is the document that lays out our expectations that a sponsor will, if you will, squeeze out every bit of knowledge they can from the structure of their molecule, then come and talk to the agency so we give the right good advice on the extent and scope of the necessary animal and clinical testing, Rachel Sherman, MD, director of the FDAs Office of Medical Policy, said in a news teleconference on the day the documents were released. The law requires three, if you will, buckets of information: the physical-chemical testing, the animal studies and then the human studies, although it does permit us to waive any of the above. She added that although the overall process is not one size fits all, its not conceivable to me that we can make an interchangeability determination without clinical data. Dr. Sherman noted, in response to a question from a European journalist, that the FDA would like to be able to bridge the European data. That would be product-specific, but we would try very hard to make that bridge, because you guys are a number of years ahead of us and have a lot of clinical data. Robert Bell, PhD, who has occupied senior drug development positions in several companies, supports this approach. Data [from biosimilars that have been approved in other countries] is very relevant here, and would accelerate the approval process, said Dr. Bell, president of Drug & Biotechnology

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management 4/9

9/13/12

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

Development, LLC, in Clearwater, Fla., in an interview with Clinical Oncology News. Specifically, data accumulated from the epoetin and myeloid growth factor biosimilars that have been approved in Europe potentially could be used to meet the FDA requirements. Because while typically the FDA likes to see data from clinical trials in the U.S., if there are data available from comparable populations, in Europe or other countries, that should suffice. Table 2. Fundamental Differences Between Small Molecule and Biologic Drugsa

Small Molecule Drugs Synthesis Structure Size Characterization Stability Chemical Well defined <800 Da Easy Relatively stable

Biologic Drugs Made in living cells Heterogeneous, mixtures of related molecules 30,000-150,000 Da Difficult Variable, sensitive to environmental conditions (e.g., light and temperature) Can be a problem

Immunogenicity

a

Not an issue

From Development of biosimilars is not an easy matter. Generics and Biosimilars

Initiative.http://gabionline.net/Biosimilars/Research/Development-of-biosimilars-is-not-an-easy-matter.

Second Guidance Document: Quality Considerations for Demonstrating Biosimilarity The second document provides details about the extensive, robust comparative physicochemical and functional studies required to show that the proposed biosimilar and the reference product are virtually identical in structure and function. The tests may include bioassays, biological assays, binding assays and enzyme kinetics. If you use current modern analytical technologies and the resulting data from the biosimilar can be superimposed on data from the reference compoundshowing for example that they are highly similaryou will have fewer issues demonstrating clinical comparability, Dr. Bell said, citing the evolution of mass spectrometry, which can now detect differences between monoclonal antibodies as small as 32 Da or about 5 10-26 kg. But as the proteins become more complex, the analytical methodology may not be able to detect all relevant structural and functional differences between the proteins so the sponsor, in a stepwise approach, will have to further rely on preclinical and clinical studies to demonstrate comparability. He gave a practical example of the importance of these analyses: the debacle with Eprex in Europe (erythropoietin alpha, Johnson & Johnson). In 1998, the company began to use rubber stoppers for the products prefilled syringes. This led to more than 200 reported cases of pure red cell aplasia in patients with chronic kidney disease over the next five years. Many experts believe this is what spurred Europeanand later, U.S.regulators to create their very

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management 5/9

9/13/12

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

rigorous biosimilar approval criteria. A team eventually found the source of the problem: Using high-pressure liquid chromatography of Eprex batches they detected a contaminant, a leachate, originating from the rubber stoppers (Nephrol Dial Transplant 2005;20:iii33-iii40, PMID: 15824129). Third Guidance Document: Implementing the BPCI The third draft document is a 15-page Q&A. It covers everything from when company officials should ask the FDA for a first meeting to whether applicants can extrapolate clinical data supporting a biosimilar application to one or more additional indications. The Q&A summarizes many of the most important issues expanded on in the previous two guidance documents, while also defining several ways in which biosimilars may be different from their reference products (e.g., differences in formulation or delivery device). Going Down the Regulatory Pathway For all the detail contained in the FDAs draft guidance, nobody knows what the entire regulatory process will entail and how long it will take for any product to be approved as a biosimilar. Its relatively difficult to foresee the complete development path because companies have to go step by step and dont know ahead of time what will be required, said Bernd Meibohm, PhD, a professor of pharmaceutical sciences at the University of Tennessee Health Sciences Center in Memphis. So I think this is going to be a learning experience on both sides. The FDA and the companies will go hand in hand and walk down the path set down by the draft guidance and try to make something out of it. He believes that it will be a couple of years until the first biosimilar appears on the U.S. market, and that it will take much longer for the first one to be deemed interchangeable. In Europe if youre a biosimilar, youre a biosimilarthey dont have a system for determining interchangeability. Here its built into the legislation, and I think the scary part [for companies] is this is a different hurdle, and a much higher hurdle. Some companies have already sprinted ahead in the biosimilar approval marathon. Dr. Sherman said at the Feb. 9 news conference that agency officials had received 35 preInvestigational New Drug (IND) inquiries and were reviewing nine INDs. An IND is the first step toward approval of a product. The agencys goals for 2013 are to review and act on 70% of original biosimilar biological product application submissions within 10 months of receipt, and to review and act on 70% of resubmitted original biosimilar biological product applications within six months of receipt. These percentages will be increased to 90% by 2017. None of the information submitted by companies in the approval pathway is publicly accessible except studies that have been published in peer-reviewed journals or presented at

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management 6/9

9/13/12

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

conferences. Companies are very likely following a similar sequence as in Europe, submitting applications first for smaller molecule biosimilars and later for monoclonal antibody biosimilars. Teva Pharmaceuticals anticipates that Phase II trials of its proposed rituximab biosimilar will be completed this yearputting it in a good position for application for biosimilarity status in Europe, where the patent-protection period for the reference product, Rituxan (Biogen Idec), expires in 2013. Since Rituxans patent protection ended in the United States in 2009, a biosimilar application by Teva to the FDA may also be in the foreseeable future. Large Manufacturers at an Advantage Small companies for the most part will not participate in this potentially very lucrative market. This is because the regulations are onerous. Alternately, firms that already market or will soon market biosimilars in Europe or other countries such as Canada and Japan have a huge head start. In fact, a number of large pharma and biotech companies are lining up to start the march toward manufacturing and selling biosimilars in the United States. Many are doing this by making linkages with muscular generic firms. For example, in December 2011 the large biotechnology company Amgen and U.S. generic manufacturer Watson Pharmaceuticals announced a worldwide collaboration for the development and commercialization of several as-yet-unspecified cancer antibody biosimilars. Biogen Idec and Samsung made a similar announcement that month. Pfizer, Merck and Novartis also intend to plunge into making biosimilars in the United States and elsewhere. This shift first took place in Europe. I see now that almost every company [that makes reference products] has its own subsidiary producing biosimilars [for the European market], said Arnold G. Vulto, PharmD, PhD, deputy head of hospital pharmacy at Erasmus University Medical Center in Rotterdam, The

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management 7/9

9/13/12

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

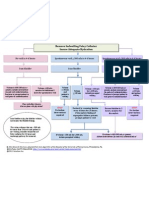

Netherlands. So I think the landscape is going to change very rapidly in the U.S.in Europe its already changed. Dr. Vulto is co-creator of the Generics and Biosimilars Initiative (GaBI) and the Web site www.GaBIonline.net where he and other experts monitor biosimilar-related developments around the world. Another observer of the biosimilarity field, Kristie C. Kuhl, JD, senior vice president at Makovsky + Company in New York City, also sees this as a significant sea change. This is an interesting transformation for the industry, said Ms. Kuhl. Before, there were generics and there were innovators. And now were seeing more of a confluence of the two. The large companies are pursuing both innovation and intellectual property thats in the public domain and seeing what they can do with that. Survey: Interest in Biosimiliars Is High, but Understanding Is Lacking Meanwhile, clinicians and members of the public are anticipating that biosimilars will cut the cost of cancer care considerably. A survey of 277 health care professionals conducted by the National Comprehensive Cancer Network (NCCN) Work Group and presented at the NCCNs 2011 annual conference indicated 66% had a high or moderate interest in biosimilars (Figures 1-3). Between 17% and 23% said they would use a biosimilar as soon as it was available, depending on the product, and 55% to 60% said they would require review and discussion before using a biosimilar. However, more than half were either not at all familiar or only slightly familiar with recent developments surrounding biosimilars, a fact that points to the necessity of education about these medications, according to the investigators. The NCCN Work Group also queried patients about their views of biosimilars. Clinicians can expect to hear from patients who want to be sure biosimilars are safe and effective and that the therapy they provide is as high quality as that of the reference products. Another survey by the pharmaceutical and biotech consulting firm Decision Resources

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management 8/9

9/13/12

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

showed that more than 50% of surveyed U.S. physicians would begin prescribing a biosimilar epoetin within six months of its launch and 88% would start using it within a year. Ultimately, there are both similarities and differences between the European biosimilar market and the one unfolding in the United States. There are many unsettled regulatory questions; nevertheless large shifts already are occurring as a result of the imminent arrival of biosimilars. I would think that the biggest thing we can take to the bank is that biosimilar regulatory review and approval processes will be dramatically different from anything weve been accustomed to with generic drugs here in the U.S., said Dwight Kloth, PharmD, the director of pharmacy at Fox Chase Cancer Center in Philadelphia. With generics, the issue is documenting that it is the same molecule, has the same purity, and if its a tablet, that dissolution rates are the same, the bioavailability of the compound is the same, and so forth. But if youre talking about a delicate monoclonal antibody thats produced by recombinant DNA technology and which can be denatured if its subjected to temperature extremes and where the biologic activity may be altered by seemingly minor differences in the manufacturing process, its a much more complicated question. Uncertainty always tends to make regulators worry and I think thats a good thing. Rosemary Frei, MSc

Drs. Bell, Kloth, Meib ohn and Vulto, and Ms. Kuhl, do not have any conflicts of interest to disclose.

www.clinicaloncology.com/PrintArticle.aspx?A_Id=20877&D_Id=151&D=Policy+and+Management

9/9

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Foly Catheter Removal ProtocolDokument1 SeiteFoly Catheter Removal ProtocolMostafa ShamaaNoch keine Bewertungen

- Preface: Encyclopedia (Marshall Sittig, Noyes Publications, WestwoodDokument4 SeitenPreface: Encyclopedia (Marshall Sittig, Noyes Publications, WestwoodJulcon Avanceña AraizNoch keine Bewertungen

- Sanofi PriceListDokument1 SeiteSanofi PriceListJohn EnochNoch keine Bewertungen

- A Review On Extended Release Drug Delivery SystemDokument9 SeitenA Review On Extended Release Drug Delivery SystemTuyến Đặng ThịNoch keine Bewertungen

- ACECLOFENACDokument7 SeitenACECLOFENACShifanath ANoch keine Bewertungen

- The Efficacy of Platelet-Rich Plasma in The Field of Hair Restoration and Facial Aesthetics A Systematic Review and MetaanalysisDokument19 SeitenThe Efficacy of Platelet-Rich Plasma in The Field of Hair Restoration and Facial Aesthetics A Systematic Review and MetaanalysisMariska Regina RannuNoch keine Bewertungen

- Top Prescription DrugsDokument3 SeitenTop Prescription DrugsArturo MacaranasNoch keine Bewertungen

- CCO Invasive Fungal Disease Downloadable 1Dokument25 SeitenCCO Invasive Fungal Disease Downloadable 1Vasantha KumarNoch keine Bewertungen

- Degroat RN ResumeDokument1 SeiteDegroat RN Resumeapi-363089889Noch keine Bewertungen

- OPPOSITE: Legalization of Marijuana in The PhilippinesDokument2 SeitenOPPOSITE: Legalization of Marijuana in The PhilippinesNathalie GetinoNoch keine Bewertungen

- EP2477611B1Dokument2 SeitenEP2477611B1Yahya RizkiNoch keine Bewertungen

- Assessment Pada Ujian OSCEDokument38 SeitenAssessment Pada Ujian OSCEAnggraeni KusumaratihNoch keine Bewertungen

- Alternative MedicineDokument3 SeitenAlternative MedicineAntoniaMottaNoch keine Bewertungen

- MSD Numbers 0410612020 Am: ClosingDokument11 SeitenMSD Numbers 0410612020 Am: ClosingSanjeev JayaratnaNoch keine Bewertungen

- Biology Project: TOPIC - Study of Drugs, Their Types and Alcohol Abuse To AdolescentsDokument13 SeitenBiology Project: TOPIC - Study of Drugs, Their Types and Alcohol Abuse To AdolescentsSAFDAR HafizNoch keine Bewertungen

- Basics of Pharmacology: Speaker - DR - SantoshDokument76 SeitenBasics of Pharmacology: Speaker - DR - SantoshRamya ChallaNoch keine Bewertungen

- Dr. Rathnakar U.P.: Department of Pharmacology Kasturba Medical College, MangaloreDokument25 SeitenDr. Rathnakar U.P.: Department of Pharmacology Kasturba Medical College, MangaloreDr.U.P.Rathnakar.MD.DIH.PGDHM100% (1)

- Chemotherapeutic DrugsDokument4 SeitenChemotherapeutic DrugsEditor IJTSRDNoch keine Bewertungen

- Laporan Penggunaan Maret 2020Dokument6 SeitenLaporan Penggunaan Maret 2020siska thresiaNoch keine Bewertungen

- Daftar Obat Aman Dan Berbahaya Untuk Ibu Hamil DanDokument6 SeitenDaftar Obat Aman Dan Berbahaya Untuk Ibu Hamil Danirma suwandi sadikinNoch keine Bewertungen

- Top 200 DrugsDokument4 SeitenTop 200 DrugsEsther AhnNoch keine Bewertungen

- Drug and ClassificationDokument4 SeitenDrug and ClassificationdavidcalaloNoch keine Bewertungen

- Nsaids BcqsDokument1 SeiteNsaids BcqsDR AbidNoch keine Bewertungen

- Penggunaan Obat-Obat KhususDokument39 SeitenPenggunaan Obat-Obat KhususDeisy FebriantiNoch keine Bewertungen

- Fibromyalgia: by Tara E. Dymon, Pharm.D., BCACPDokument14 SeitenFibromyalgia: by Tara E. Dymon, Pharm.D., BCACPAnggi CalapiNoch keine Bewertungen

- Pep 2021 - October QuestionsDokument4 SeitenPep 2021 - October QuestionsCynthia ObiNoch keine Bewertungen

- Daftar Ketersediaan Obat Sesuai Formularium Nasional Puskesmas Candi TAHUN 2020Dokument18 SeitenDaftar Ketersediaan Obat Sesuai Formularium Nasional Puskesmas Candi TAHUN 2020octie0% (1)

- Pharmacovigilance Related Questions - 1585456120320Dokument10 SeitenPharmacovigilance Related Questions - 1585456120320Saravanan RamNoch keine Bewertungen

- Pharma MCQ214324324325Dokument17 SeitenPharma MCQ214324324325rab yoNoch keine Bewertungen

- Assess Appropriateness For Clinical Condition. Heart Rate Typically 50/min If BradyarrhythmiaDokument1 SeiteAssess Appropriateness For Clinical Condition. Heart Rate Typically 50/min If BradyarrhythmiaatikaNoch keine Bewertungen