Beruflich Dokumente

Kultur Dokumente

Bank Asia

Hochgeladen von

Shahriar KabirOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bank Asia

Hochgeladen von

Shahriar KabirCopyright:

Verfügbare Formate

aaa - 1 Human Resource activities of Bank Asia -s 1 Executive Summary The Term paper is comprehensive study of the Human

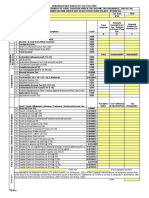

Resource activities of Bank Asia. In this term paper I tried to identify and explain the recruitment aa and selection process and other Human Resource activities in Bank Asia. In this term paper the Human Resource organogram of Bank Asia is shown. The criteria on which priority is given while recruitment and selection, lacking and recommendation are given in this term paper. The steps of recruitment and selection process are discussed. After Selection, how the Orientation and training are given and how feedback is taken from employees, this process is mentioned. SWOT analysis has been done for training of employees. After research some particular factors have been found that motivates employees to improve their performance such as bonus, yearly performance bonus, LFA, recreational activities etc. Performance appraisal process and SWOT analysis of Performance appraisal process have been explained in this term paper. AT last some problems have been identified and recommendations have been given to improve the Human Resource Activities of Bank Asia. It has been found that by adding more executives in HR department of Bank Asia can work more efficiently and effectively in the near future. - 2 Objective of our report The main objective of this project is to focus on the Human Resource activities of Bank Asia. I would like to focus on the following areas: 1. Recruitment & Selection 2. Training & Development 3. Motivation & 4. Performance Appraisal And also I want to relate the theoretical aspects of HRM with the practical aspe cts. Collecting Data- Sources and Methods I would like to follow the following 2 methods in our research work: 1. Primary Method: Under this I would like to take the interview of the Human Resource manager and also the employees of HR department of Bank Asia. 2. Secondary Method: Website (www.bankasia-bd.com), books, HR policy manual, annual report and newspapers will be my secondary sources. - 3 Brief overview of Bank Asia Bank Asia has been launched by a group of successful entrepreneurs with recognized standing in the society. The paid up capital of the Bank is 930 milli on. The management of the Bank consists of a team led by senior bankers with decades of experience in national and international markets. The senior management team is ably supported by a group of professionals many of whom have exposure in the internat ional market. Within a short span of time Bank Asia has established itself as one of the fast growing local private banks. It has at present a network of Twenty two branches

serving many of the leading corporate houses and is gradually moving towards retail bank ing. Another significant delivery channel is its own as well as shared ATM Network. B ank Asia has a network of 25 ATMs out of which 6 it owns. The other 19 ATMs are shar ed through ETN with eleven other banks. Since its humble beginning in 1999, it set milestone by acquiring the business operations of the Bank of Nova Scotia in Dhaka, first in the banking history of Bangladesh. It again repeated the performance by acquiring the Bangladesh operat ions of Muslim Commercial Bank Ltd. (MCB), a Pakistani bank. In the year 2003 the Bank again came to the limelight with oversubscription of t he Initial Public Offering of the shares of the Bank, which was a record (55 times) in our capital market s history and its shares commands respectable premium. The asset and liability growth has been remarkable. By Dec 2005 the total asset of the Bank grew to Tk 23,380 million, increase of almost 31% comparing to 2004. As of Dec 2005 deposits increased to Tk 18,500 million, an increase of 37% over that o f 2004, and Loans & Advances reached Tk 17,870 million, an increase of 50% over that of 2004. Bank Asia has been actively participating in the local money market as well as f oreign - 4 Currency market without exposing the Bank to vulnerable positions. The Bank s investment in Treasury Bills and other securities went up noticeably opening up opportunities for enhancing income in the context of a regime of gradual interes t rate decline. Bank Asia is maintaining it s competitiveness by leveraging on its Online Banking Software and modern IT infrastructure. It is the pioneer amongst the loc al banks in introducing innovative products like SMS banking, and under the ATM Network t he Stellar Online Banking software enables direct linking of a client s account, with out the requirement for a separate account. [Sources: http://www.bankasia-bd.com/about_us.php] [Accessed 15th November 2006] Vision of Bank Asia - 5 Bank Asia s vision is to have a poverty free Bangladesh in course of a generation in the new millennium, reflecting the national dream. Its vision is to build a s ociety where human dignity and human rights receive the highest consideration along with redu ction of poverty. [Sources: http://www.bankasia-bd.com/vs_statement.php][Accessed 15th November 2006] Mission of Bank Asia A mission statement defines what business the organization is in, including why it

exists and who its customers are. [Source: DeCenzo and Robbins, Fundamentals of Human Resource Management, Eighth Edition] The mission statement of Bank Asia is as follows: To assist in bringing high quality service to the customers and to participate in the growth and expansion of national economy. To set high standards of integr ity and bring total satisfaction to the clients, shareholders and employees. [Sources: http://www.bankasia-bd.com/ms_statement.php][Accessed 15 November 2006] Bank Asia s Business Ideology To become the most sought after bank in the country, rendering technology driven innovative services by our dedicated team of professionals. [Sources: http://www.bankasia-bd.com/ms_statement.php][Accessed 15 November 2006] Services of Bank Asia - 6 Gradually Bank Asia increases its product list. Every year it launches 2 product s. Since establish, its product list is so healthy and includes most features. When ever, they launch a product, they look deeply in its technical issue. This means, how the p roduct will be techno based and support online features. Considering these criteria, th ey have produced six products. Each product contains its specific link. However another related service or special features are also displayed follows: The following is a brief description of some of their services: Sms banking Through SMS facility clients can access account using his mobile phone from anywhere, anytime at his convenience to know the account position. SMS Push service: When any amount is debited or credited from client s account then within 5-10 seconds he will get a message. The message includes the beginning balance, the amount debited or credited and the last balance. This facility is only available for Grameen Phone and City cell subscribers. SMS Pull service: Every registered Grameen Phone and City cell subscribers can check their account balance through this service. They can get a mini statement of last five transactions of their account. Products Include: SMS Banking Mobile Banking Internet Banking Customized Loan Bonus Savings Schemes Poverty Alleviation ATM Service Credit Card Special Features: Real-time Online Banking Any Branch Banking Loan Syndication Corporate Banking Locker Facilities - 7 Mobile banking

THUMBPAY".Banking under your thumb....Bank Asia Limited is proudly announcing the launching of its (M-Banking Product) THUMBPAY . It will allow its customers to access their bank accounts from their Mobile Phone. This latest tec hnology driven product is designed to cater for and facilitate real time banking transac tions using a mobile phone and will be currently available to AKTEL subscribers only. THUMBPAY will provide Account Balance Query, Prepaid or Postpaid mobile phone bill payment, Fund Transfer, Fund collection (Charity or Relief Fund) serv ices through registered mobile phone. Customers need to fill up a registration form for THUMBPAY service. All branches of Bank Asia are ready to give this service to its valuable clients. Services available under "THUMBPAY" 1. Account Balance Query: Clients can check their account balance at any time an d from anywhere in the Bangladesh just after 15 seconds from their query through S MS 2. Pre-paid refill: Eligible clients will be able to share the pleasure to refil l their own account and also the account of third party through SMS. 3. Post paid bill Payment: Post paid AKTEL subscribers can pay their mobile bill as well as others from their account through SMS. 4. Fund Transfer service: Customers will be able to transfer fund from one accou nt of Bank Asia to another. 5. Changing password: Every customer will be given an initial password to avail the THUMBPAY service. They can change the password subsequently by SMS. 6. Real Time Round The clock: This service is available round the clock and real -time basis from anywhere ATM service - 8 The Bank carries its banking activities through twenty two branches in the country. Bank Asia customers have access to 20 ATMs as a member of ETN. Under th e ATM network the Stellar Online Banking Software enables direct linking of a clie nt's account, without the requirement of a separate account. The Bank has already set up its own ATM machine at 4 corresponding branches and is also in the process of settin g up its own ATM network at every focused point in the city with a view of providing reta il banking services. Then Branch list having ATM Booth and location of shared ETN Booth are showed in the appendix in [Table: 1] and [Table: 2] Customized loan Modern Banking is a result of evolutions driven by changing economic activities and lifestyles. Entering a new millennium, banking needs have become more divers e and exotic than ever before. Bank Asia Ltd. is a new entrant in the private banking scenario of Bangladesh with a promise to fulfill every possible customer need with high effi ciency and satisfaction. Its team of dedicated professionals is committed to provide an

unparalleled service by using the latest technology to make bankable proposals h arvest maximum benefits for the customers, the shareholders and the society at large. I t is an immense pleasure for Bank Asia to introduce Customized Loan to its customers as a unique Loans plan. Loans & advances are showed in the appendix in [Table:4] [Sources:http://www.bankasia-bd.com][Accessed 15 November 2006] - 9 Branches of Bank Asia The Bank at present carrying its banking activities through twenty two branches including ATM, Locker & Foreign Exchange services in the country. It has five ru ral branches as well. The following is a list of its 22 branches are showed in the a ppendix in [Table:3] [Sources:http://www.bankasia-bd.com][Accessed 15 November 2006] Human resource division in Bank Asia In Bank Asia there is no particular Human resource division. Because it human resources are allocated based on the need of the different branches. So it varie s in every branch. The following is the organogram of Bank Asia which summarizes all the divisions. This is not a standardized one. Organogram of Bank Asia - 10 Management Team (Executive & Officer Level) President & Managing Director Deputy Managing Director Deputy Managing Director & Head of Operations & Company Secretary Senior Executive Vice President (2) Executive Vice President (3) Senior Vice President (7) Vice president (8) First Vice President (5) Assistant Vice President (7) First Assistant Vice President (1) Senior Executive Officer Executive Officer Senior Officer Officer Junior Officer Assistant Officer Banking Officer Management Trainee, Trainee Officer, Provision Officer & Trailer (Cash) [Entry l evel] Receptionist Organogram of Human resource department of Bank Asia - 11 Under the human resource director there are 5 executive officers who conduct all the human resource development functions in Bank Asia. Though the overall decisi on making authority is centralized here, but the executives have the freedom to exp ress their viewpoint in any matter. The HRD is very much helpful and give preference to the

recommendations of the employees. [Sources: Interview: Executive Officer of Bank Asia] [On 10th December, 2006] Analysis and Findings After getting all these information, we have analyzed the Human Resource functio n in Bank Asia. As it is a vast topic to analysis, so we have narrowed down our re search on four main focuses. The focus of our analysis was Recruitment process Training and Development Motivation Performance Appraisal All these aspects of human resource management are widely practiced in Bank Asia . While analyzing we tried to find out the answers of these questionsHuman Resource Director (HRD) Executive Officer Executive Officer Executive Officer Executive Officer Executive Officer - 12 For Recruitment: How they get the skilled and the best employees from the all applicants? Do they give more emphasis on the external or the internal process? Do they have the same recruitment process for all level of employees? For Training and Development: What is the objective of the training? How is their training process? How do they develop their employee after recruitment? Is the training process same for all the employees? How do they know if the training process is effective of not? Motivation: How they motivate employee to put their best effort? Do they motivate employee to keep going further? For Performance Appraisal: What processes the company follow evaluating the performance? Who carries out this process? Do they have any objective behind this process? Recruitment process in Bank Asia Recruitment is the process by which organizations locate and attract individuals to fill job vacancies. Most organizations have a continuing need to recruit new emp loyees to replace those who leave or are promoted, to acquire new skills and to permit organizational growth. Recruitment follows HR planning and goes hand in hand wit h the selection process by which organization evaluates the suitability of candidates for various jobs. [Source: Cynthia D. Fisher, Lyle F. Schoenfeldt, and James B. Shaw, Human Resource management, 5th edition] Recruitment criteria

- 13 Qualification: Except for the post of trainee officer Bank Asia prefers fresh graduates majorin g in finance and economics, or masters in English, economics or have MBM degree. Academic result: Academic result is so important. They go through the whole academic result from o-levels or SSC to Graduate level. They fixed the CGPA according to the institut ion. For some reputed university (like EWU, NSU, IBA, AIUB, IUB, BRAC) CGPA has to be minimum 3(out of 4) and for others university (like Asian, Southeast) it is mini mum 3.6(out of 4). They also prefer reputed schools and colleges as there is a huge competition among qualified members. Age: Age is a major factor in recruitment an employee. For the entry level job the ag e limit is not above 27 and for other position like Branch manager or the sub-mana ger age limit is around 35. Related experience: They want experience for most of the managerial ranks. The total year of experience are fully depending on the post or ranks. But they do not want any ex perience for any entry level job. Others: The candidate must process good collective interpersonal and communication skill. Sound knowledge of computer use and good command in English will have spe cial consideration. [Sources: Interview: Executive Officer of Bank Asia] [On 10th December, 2006] Recruitment Process - 14 As I said, that the Human resource department in Bank Asia is fully centralized. So to find out the appropriate person for the Bank the HRM department contact wi th their all brunch and assign them to forecast the human resource need for the next thre e year. Every branch then forecast the needs. They often use trend analysis in order to determine the number of employees needed each period. After complete the analysis they sen t a report to HRM about how many employees they need in what field. The Bank Asia follows both the Internal and external recruiting. Most of the tim e they prefer internal recruiting but for the entry level job they go for external recruiting. Recruitment Sources: 1. Internal recruitment : Promotion Transfer The promotion usually held based on the employee personal and current achievement. They give the promotion to the employees who demonstrate themselves as a successful candidate. The promotion fully depends on the employee s achievement

rather than the seniority. Transfer is another way where employee switches the job to other branch or any other department. For this kind of recruitment HRM department often e-mail their employee about the vacancy and receive the application from. Then the head of HR along with some line manager take a formal interview of the employee. From that interv iew they pick up the best. 2. External recruitment: Newspaper advertising Online advertising They generally go for newspaper advertising and online advertising. They have al so the option of keeping the application from in their website. [Sources: Interview: Executive Officer of Bank Asia] [On 10th December, 2006] The Selection Process - 15 Employee selection is a process of measurement, decision-making and evaluation. The goal of employee selection is to bring to an organization individual who wil l perform well on the job and at the same time be fair to all applicants. [Source: Cynthia D. Fisher, Lyle F. Schoenfeldt, and James B. Shaw, Human Resource management, 5th edition] For the external recruitment & selection they divided the process into three par ts. For the top level executive For management trainee Trainee officer. These are describes as follows: The selection of the top level executive or other experience professional is not that complex. They give the advertisement to the newspaper with details about jo b description and other requirements. After collecting all the CV they call some o f them according to their criteria and just arrange a formal interview. From this inter view they select the best applicant. The selection process of management trainee is so extensive and complex. The Bank goes for outsourcing to organize the whole recruitment process. There are several steps of recruitment process. Flow chart of the selection process: Receipt of applications & CVs - 16 Step 1 The first step is to collect the application from. To collect the application fr om they use several different types of advertising. They generally go for newspaper advertising and online advertising. They have option of keeping the application from in their website. Step 2 Short-listing applications & CVs (1000-1200 applicants) Written test

(Select 150-200 candidates) Interview by the external board (Select 50-60 candidates) Final interview by the internal board (Select 10-12 candidates) Medical test & drug test Select employees and give offer letter - 17 In the second step they pick up around 1000-1200 application form from the total pull of applicant according to the job criteria and offer them to sit for the wr itten test. The test is based on essay writing, comprehension test, written math etc. Step 3 The written test is reliable and valid because it has been tested before. There is no base mark for the written test. The exams are proctored by ex- government sectar y, exVC of any reputed university, ex-deputy governor of Bangladesh bank etc. After t he test they decide the level and the top 150 or 200 are called for the interview. Step 4 After picking up the successful candidate in the written test, they make a panel made of officers working in financial institutions other than bank. And intervie w them. From this interview, the members of the interview board choose some 50-60 candid ates and sent them for the final interview with the company s internal executive. Step 5 The members of the final interview panel are the head of HR, board of directors and some top level executive of the company. Step 6 After interviewing, they select the best performers in both written test and interview. After selection, employees have to give a medical test which mainly c ontains of physical fitness test and drug test. Step 7 - 18 Finally the interview board selects 10-12 successful employees and gives them offer letter. The minimum requirement for the Trainee officer is BBA and they are selected only by formal interview conducted by the executives of the bank. [Sources: Interview: Executive Officer of Bank Asia] [On 10th December, 2006] Orientation Bank Asia generally uses formal orientation program. Mainly they have two types of employee orientations: They arrange an overall orientation for one day. In the orientation all the new recruiters are present and the management gives them an overall job descript ion and job specification. Then a supervisor gives the new recruiter some orientation about the department s job procedures, and makes him or her familiar with the working environment. After the orientation they are sent to the training program. [Sources: Interview: Executive Officer of Bank Asia] [On 10th December, 2006] Training and Development

- 19 Training is a learning experience designed to achieve a relatively permanent change in an individual that will improve the ability to perform on the job. And employee development means future-oriented training, focusing on the personal growth of the employee. [Source: DeCenzo and Robbins, Fundamentals of Human Resource Management, Eighth Edition] Training and development is a continuous process in Bank Asia. It held through o ut the whole year formally or informally. Training is the first priority of Bank Asia a fter hiring an employee. Every employee of Bank Asia from the top to lower level management mus t under go training immediate upon hire. The training program starts with recognizing training needs. In this step, they analyze the deficiency of personal performance and company performance, and comparing this two they analyze the need for training. The training program is d ifferent according to the needs. It fully depends on the position and requirements of the company. Training for management trainee officer (MTO): After hiring a fresh employee the company sends them for an extensive training program which is mainly a on the job training process that means having a person learn a job by actually doing it. The duration of this training process is 1-2 months. I t has several steps. The steps are showed in a flow chart in the following page: Flow chart of Training for management trainee officer (MTO): - 20 Step 1 It starts by assigning the employee to a particular branch. The trainee has to m ove departments to department to broaden their understanding of all parts of the bus iness and to test their ability. They work with every department for certain amount of per iod. It can be one or two week for each department. They are often given special assignments that give them experience of working on actual problem. After 2 month the management trainee make a report describing these activities and present it to the top leve l management. A panel of 3 managers evaluates the employee based on their performa nce like their interest, discipline, presentation etc. Step 2 After that, the MT works in a particular department for six month as a trainee. This is called as full day training where the trainee works like a normal employer. Duri ng this training process they are always paid. Step 3 Job rotation (For 1-2 months) Work in a particular department (For 6 months) Off the job training at BIMB (For 2 months)

- 21 After getting the experience from the real job, the management sent the trainee for a off the job training. For this, the management selects some of the renowned tr aining institute in banking sector. The company sends the Management trainee to the BIB M (Bangladesh Institute of Bank Management) for a foundation course. The employees undergo an extensive training program here for two month. Training for executives: Bank Asia sends their executive to the BIBM also for training. The training process is mainly an off-the job training. Training holds in classrooms. The emp loyees who have similar kind of training needs are taught together. They all join in a similar training program. They also send their top level executive to IBB (Institute of Bankers of Bangladesh) and TACK training (renowned training institute in Bangladesh), they also attain different workshops arranged in home and abroad. Here the executive mainl y learn about the business strategy. Some time they offer a training program outside the country (like Bangkok, China, Malaysia) to broader the employees outside perspective. Training for trainee officer: Trainee officer gets 7 days of general banking training which helps them to enhance their ability. For other employees, Bank Asia has several kinds of training process. It s a combination of both the on the job and the off the job training process. The need of this training are - 22 Personal (verbal skills) Managerial (leadership skills) Here, personal skill development means the training that can be implemented on the job by the individual for better performance. Under this there are also seve ral training methods. Managerial training is the process which improves managerial performanc e/ leadership skills. The ultimate aim is to enhance the better company future Objective of Training: Developing analytical and decision making skills of the employees Imparting technical knowledge to the operation level officers for efficient desk operations. Making available and ensuring adequately trained and skilled manpower within shortest possible time to cater the growing needs of the bank. Developing the understanding of job knowledge through theoretical knowledge of banking affairs. Feedback of training: Feedback is really important for conducting any job. Here trainees always get constant feedback from the trainers. The effectiveness of a training program is measured by evaluation of the trainee s. This evaluation is necessary in terms of assessing the value of the training and in terms of improving the design of future programs. There are mainly four outcomes based on

which the organization evaluates the success or failure of each training program . The four outcomes are- reaction, learning, behavior and results. The management uses the following techniques to get feedback. - 23 1. Sudden Test: During the training, quizzes and assignments are also given amon g the trainees. They also take sudden test in class to evaluate the current performance of the employees. The effects of training on their performance are evaluated through the performance they have done after taking part in the traini ng compared to the performance they used to do before the training and by this the organization measure the effectiveness of that. 2. Formal exam: The management conducts a formal exam for the employee after coming back from the training. If it shows the improvement on a certain skill then the training was effective otherwise not. 3. Behavior: Another approach is to follow the behavior of the employee. 4. Submit a report: The trainees who have gone abroad for attending the training program are required to submit a report regarding on the materials taught in the whole training program So by getting feedback, the training process is accomplished. [Sources: Interview: Executive Officer of Bank Asia] [On 10th December, 2006] SWOT analysis for training - 24 Strength Bank Asia uses different training institutions like BIBM, IBB, TACK training institutions, which are specializes on various training techniques. It has a hug e budget for its training, which ensures excellent quality training for its workfo rce. This gives a competitive advantage over other banks to build a good human resource. The in-house training facility is also good enough to accommodate many workers at the same time. The trainees need not be moved far away from the workplace saving the company s cost from lost production. They can also change its training method if it needs. Measuring the training effect is very important. It has 5 methods in measuring i t. Weakness It conducted its training program all through the year. As a result there might be a chance that the employees are facing boredom to take too many trainings. Training conducted outside the country may create problems to some of the employees. If the training feedback is not satisfactory then the whole cost for training wi ll be a great loss. An employee who doesn t get chance to go abroad to take training can be de motivated. Opportunities As in the training process the employees have to work on different department, s o they get a good opportunity to gain different types of experience. Different types of training will also enhance the ability of the employees. Threats

- 25 Other compete ting banks also conduct different types of training programs. So i n order to compete with them they also need to introduce new types of trainings. In order to get a competitive advantage they need to select the right employees to give training. Motivation Motivation is the processes that account for an individual s intensity, direction, and persistence of effort toward attaining a goal. [Source: S. Robbins 3rd edition.] Motivation is one of the most frequently researched topics in human resource management. Motivation is nothing but the process that account for individual s intensity, direction, and persistence of effort toward attaining a goal. Motivational factors that motivates or de motivates the employees We had given motivational factors such as Bonus, Promotion, Job security, Business tours once in a year as options. From this analysis we have conclude th at 100% of the high level employees and most of the mid and low-level employees cho ose Job security. Their second choice was promotion. Actually in a government based financial organization job is not that much secure. Anytime any employees can ge t fired. So, if the organization can assure employee s job they are motivated automatically . Another thing is that, most of the employee s likes job reputation. So, promotion also motivates the employees. Lower level employees are motivated by money. From the findings we can get that about the entire employees dislike Extra workload, Bank s policy. Some times workers get threatened with punishment or sometimes they are forced to work. We can relate These Behavior with Douglas McGregor s Theory X - 26 From the interview with a Human resource executive, we have find out some the motivational factor that has been use in Bank Asia. The main factors include1. Bonus: Bonus is one of the common motivational factors in any organization. They provide their employees some festival bonus such as 2 EID bonuses every year. Beside that they give another special bonus at the end of the year. 2. Yearly Performance Bonus: They distribute some percentage of the bank overall profit to its employees. 3. LFA (Leave fair assistance): This motivational factor contains 1 month s full salary and 10 days leave at the end of the year for every employee. 4. Recreational activities : Bank Asia also organize cultural night, picnic and get together where employee can share their view and expectation about the future with other employees from different department. These kinds of event really motivate the employee to motivate their best. [Sources: Interview: Executive Officer of Bank Asia] [On 10th December, 2006] Performance Appraisal Process Performance appraisal is a formal system of periodic review and evaluation of an individual s job performance. [Source: David A. DeCenzo and Stephen P. Robbins, 3rd edition, 2004] Performance appraisal refers to go back and see where you are. To evaluate the overall performance of the employee through the year Bank Asia follows an Annual

Confidential Report (ACR).the widely used graphic rating scale method is used fo r this purpose. The ACR reports are of 2 types. For executives - 27 For officers It contains four main parts which are described as follows: Part 1 Part one has three steps which focus on the overall background of the employee. It includes a) Personal Information b) Education and training c) Employment History After filling up all these information the employee will submit the form to the supervisor. The supervisor can be a manager in the branches or the Department He ad In the corporate office. Part 2 In this step the supervisor of the employee will evaluate the employees in the following 5 scales. 1. Consistently exceeds the normally accepted standard for this position. (Outst anding) 2. Consistently meets and frequently exceeds the normally accepted standard for this position. (Very good) 3. Occasionally falls below and occasionally exceeds the normally accepted stand ard for this position. (Good) 4. Frequently does not meet the normally accepted standard for this position. (A verage) 5. Usually does not meet the normally accepted standard for this position. (Belo w Average) The Bank Asia emphasis on two things when evaluate the employee. These two are - 28 Personal trait Performance Factors. The elements & the descriptions of Personal traits are: 1. Discipline and Punctuality: (Attendance & utilization of time: timely deliver y of tasks; follows through with assigned job.) 2. Initiative and Drive (Self starter & proactive in planning and completing an action; accepts responsibilities.) 3. Team Spirit (Others; places team goals by promoting team work; encourages and supports co-workers) 4. Intelligence, Diligence and Alertness (Have grasp of the job; can anticipate potential trouble and is prepared of the future needs) 5. Honesty, Integrity and Sincerity (Demonstrates the qualities to foster health y working environment) 6. Interpersonal Relationship skill (Friendly and caring attitude; listens and comprehends; responds positively to feedback) 7. Creativity and Innovations (Seeks mew approaches; establishes effective processes and procedures; contribute ideas and pursues professional/skills development)

8. Flexibility (Adapts to changing work demands and priorities; learns and assum es new task) - 29 9. Loyalty and Devotion (Is loyal to the bank s value system and corporate culture ; places the bank s interest ahead of personal gains) 10. Fitness ( Is physically fit and possess stamina for hard work; healthy; gene ral healthy conditions) Part 3 In this step the supervisor will evaluate the employees in his/her Performance Factors. These elements are different for executives and officers. The elements & the descriptions of Performance Factors (For executives are) 1. Professional Knowledge (Demonstrates knowledge necessary to carry out job responsibility; have understanding of the duties and responsibilities; have knowledge of the current field; competency in requited job skill & knowledge) 2. Improving Corporate Culture ( Shares the views, ideas & goals with colleagues ; have clear idea of the policies, objectives & procedures of the org) 3. Decision making Ability (Can analyze the situations and makes sound decisions that are in the best interest of the bank) 4. Ability to visualize and Plan (Establishes goals & milestones; clearly define s the objectives; establishes effective procedures & systems) 5. Ability to act on emergent situation (Anticipates potential problems and take s appropriate action; overcomes obstacles to meet objectives; identify problems, evaluate facts & reaches sound decision) - 30 6. Ability to implement decision ( Develops and implements cost saving measures; accepts responsibilities and delegates tasks where appropriate along with the authority to accomplish them) 7. Ability to guide and create team work (Participates constructively in teams & achieves result through/ with other people; develops a shared sense of purpose; encourages and supports coworkers; exhibits confidence in self & others) 8. Communication Skill (Demonstrates clear, concise & organized oral & written communication skills necessary for this position; encourage open exchanges of ideas and opinions; provides constructive feedback) 9. Customer Relationship (Establishes & maintains customer relationship) 10. Acquaintance with technological and market changes (Keeps in touch with the latest development in technological changes that helps the banking business; understands the economic changes & trends that have impact on the business) The elements of & the descriptions Performance Factors (For officers are) 1. Ability to perform duty (Effectively performs the job through timeliness, acc uracy and thoroughness; maintains high quality work) 2. Knowledge of rules and procedures (Understands the established rules and procedures; consistently follows rules and procedure) 3. Adherence to corporate culture (Meticulously follows the corporate guidelines regarding attendance, dress code, business ethics, etc) 4. Speed of work (Actively pursues completion of work assigned and meets

deadlines) - 31 5. Ability to Communicate (Demonstrates oral and written communication skills necessary for this position ; communicates important information) 6. Customer Service (Makes a concentrated effort to serve the needs of the customers & outsiders; is courteous and considerate) 7. Contribution to Development (Utilizes time and resources effectively; produce s appropriate output as establishes by goals and objective) 8. Organizational Skills (Establishes clear work objectives and priorities; effe ctively handles multiple assignments simultaneously) 9. Achievement in Training (Actively participate in training programs in and outside the bank) 10. Computer literacy (Have requisite training for handling the job efficiently; constantly strives for the perfection of the skills in computer & technology) After completing the ACR report up to part 3, the supervisor will submit it to Human Resource Department, Corporate Office. Part 4 In this part the HR Department will then review the ratings and form a view on the perfect ness. They decide a numerical weight age for the overall rating of t he supervisor. Then they calculate the revised rating (numerical) on that basis and in case, if it is not acceptable then they revised ACR from the supervisor. - 32 The points are as follows: Rating Points 1. Outstanding 5 2. Very Good 4 3. Good 3 4. Average 2 5. Below Average 1 [Sources: ACR report of Bank Asia] SWOT Analysis for Performance Appraisal Strength If the performance of the employee is good then employees feel motivated The method that is used by the Bank, is less time consuming Performance appraisal using Graphic Rating Scale gives an appraiser a chance to compare the performance of one individual employee to another. Weakness The rater can be biased to a particular employee. The common rating errors, such as unclear standard, halo effect, biasness, centr al tendency, strictness and leniency, can occur Opportunities Bank Asia can use new technology for their performance appraisal method. There are many types of software available in the market to facilitate appraisal syste ms such as graphic rating scale. It will save time as well as reduce paperwork Threats Some banks use more than 1 performance appraisal methods. But Bank Asia uses only one performance appraisal methods. So if it is not accurate then will creat e a huge problem by wasting of time, money & effort.

- 33 SWOT Analysis for all the processes Strength As Bank Asia goes for outsourcing to organize the whole recruitment process so, it is less time consuming and less biased. They have a formal orientation, which motivates the employees. Both on the job and off the job training is conducted during the whole year. It gives employees Yearly Performance Bonus and leave fare assistance. Uses standardized criteria for performance appraisal, it is less time consuming. Weakness While sorting out the CV s or resumes they only look for educational background (reputed institutions) Biasness often occurs while giving special promotions. They don t prefer seniority in promotion, so the senior workers may de motivated in their work. Most of the time the proper evaluation is not received due to the biasness of th e evaluators. Opportunities Bank Asia can use new technology for their performance appraisal method As they put more emphasis on external recruiting so they get more chance to get more qualified employees. Threats Multinational banks in Bangladesh such as HSBC, Standard Chartered and many local private banks have are the good competitors of Bank Asia. So it needs to make its employees more effective to get competitive advantage - 34 Problems of the organization and Recommendations As we have seen that the recruitment process for the executives and trainee officers are fully done by the internal executives. Their might be a chance for bias ness Recommendations: It can also be done by outsourcing or mixture of both systems. The HR Department has only 2 levels. There should be a middle level management level. Recommendations: Sometimes it is hard for the executives to go for every little problem to the HRD. So the existence of a middle level manager will solve this problem. The control of HR department is highly centralized. Recommendations: They should make it decentralized. Then employees can solve the ir problems quickly by communicating with each other. Conclusion Through this project I get an opportunity to have a close look at the human resource department of one of most reputed bank in Bangladesh-Bank Asia. I have learnt a lot form this project by matching the theoretical concepts of HRM with real li fe examples. By adding more executives in HR department we think that they can work more efficiently and effectively in the near future.

Das könnte Ihnen auch gefallen

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceVon EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceBewertung: 4 von 5 Sternen4/5 (9)

- Bank AsiaDokument28 SeitenBank AsiaAsad NabilNoch keine Bewertungen

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Von EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Noch keine Bewertungen

- Web - Based Spot CashDokument4 SeitenWeb - Based Spot CashMark HenryNoch keine Bewertungen

- Banking India: Accepting Deposits for the Purpose of LendingVon EverandBanking India: Accepting Deposits for the Purpose of LendingNoch keine Bewertungen

- Chapter 2Dokument5 SeitenChapter 2Faizeen NaharNoch keine Bewertungen

- Global Ime Bank 2013Dokument34 SeitenGlobal Ime Bank 2013Keshab PandeyNoch keine Bewertungen

- SwotDokument10 SeitenSwotmubasharnauman22Noch keine Bewertungen

- Bank Asia Limited: Executive SummaryDokument4 SeitenBank Asia Limited: Executive SummaryMinhaz UddinNoch keine Bewertungen

- An Economy of A Country Depends On BankingDokument22 SeitenAn Economy of A Country Depends On BankingOnline CornerNoch keine Bewertungen

- Commercial Bank of Ceylon, Service Marketing ConceptsDokument14 SeitenCommercial Bank of Ceylon, Service Marketing Conceptsert353592% (36)

- Section I: Note: Both The Sections Are CompulsoryDokument4 SeitenSection I: Note: Both The Sections Are CompulsoryAravind 9901366442 - 9902787224Noch keine Bewertungen

- Acknowledgment: Mustafa Mir " For His Continues, Valuable and Informative Support and Kind PieceDokument14 SeitenAcknowledgment: Mustafa Mir " For His Continues, Valuable and Informative Support and Kind Pieceayesha_121Noch keine Bewertungen

- MO 14A HANA GIRMA (3) .Docx 444Dokument10 SeitenMO 14A HANA GIRMA (3) .Docx 444Henok AsemahugnNoch keine Bewertungen

- Overview of National BankDokument23 SeitenOverview of National BankOnline CornerNoch keine Bewertungen

- 7'p's of Marketing MixDokument78 Seiten7'p's of Marketing MixDharmikNoch keine Bewertungen

- Ratio Analysis - HBLDokument31 SeitenRatio Analysis - HBLSunita Karki72% (29)

- Jamuna ReportDokument31 SeitenJamuna Reporttafsir163Noch keine Bewertungen

- Allied Bank LimitedDokument6 SeitenAllied Bank LimitedWafa AliNoch keine Bewertungen

- Banking System Project ReportDokument55 SeitenBanking System Project ReportRAM MAURYA0% (1)

- CRM Implementation in National Bank of PakistanDokument12 SeitenCRM Implementation in National Bank of Pakistanshahid bhatti100% (1)

- Report Submission Finance (Noboni)Dokument20 SeitenReport Submission Finance (Noboni)Afrid KhanNoch keine Bewertungen

- The Technology Which Prevails in The Current 21st Century Has Never Failed To Innovate The World and Change The Way The World FunctionsDokument13 SeitenThe Technology Which Prevails in The Current 21st Century Has Never Failed To Innovate The World and Change The Way The World FunctionsAnanth NiяoNoch keine Bewertungen

- Prime BankDokument24 SeitenPrime BankNazmulHasanNoch keine Bewertungen

- Body of The ReportDokument33 SeitenBody of The ReportJehan MahmudNoch keine Bewertungen

- Internship Final Report - For MergeDokument26 SeitenInternship Final Report - For MergeBirhanu KaruNoch keine Bewertungen

- SBI Internet BankingDokument21 SeitenSBI Internet BankingHiteshwar Singh Andotra60% (5)

- Internship ReportDokument64 SeitenInternship ReportIram Aziz ShahNoch keine Bewertungen

- Bank AlfahaDokument94 SeitenBank AlfahamcbNoch keine Bewertungen

- Canara Bank Priority Sector AnalysisDokument59 SeitenCanara Bank Priority Sector AnalysisSoujanya NagarajaNoch keine Bewertungen

- Assignment #1 MarketingDokument5 SeitenAssignment #1 MarketingUsman SheikhNoch keine Bewertungen

- Bank Asia HRM360 ReportDokument15 SeitenBank Asia HRM360 ReportProbortok Somaj67% (3)

- Final Edit Prime BankDokument95 SeitenFinal Edit Prime BankAbdullah MohammadNoch keine Bewertungen

- Final Project Report SimranDokument42 SeitenFinal Project Report SimransimranNoch keine Bewertungen

- Marketing Activities of Products and Services of The City Bank LimitedDokument61 SeitenMarketing Activities of Products and Services of The City Bank LimitedZiaul Onim0% (1)

- Executive Summary 1Dokument82 SeitenExecutive Summary 1madihaijazkhanNoch keine Bewertungen

- Bank AsiaDokument53 SeitenBank AsiaAninda R. DipNoch keine Bewertungen

- BOA Strategi Ass - BDDokument31 SeitenBOA Strategi Ass - BDBini Binisho67% (3)

- Online Banking System of Dhaka Bank LTDDokument66 SeitenOnline Banking System of Dhaka Bank LTDNasim Ahmed100% (2)

- SadDokument7 SeitenSadNAYAN HOSSAIN 1904044Noch keine Bewertungen

- JB Genaral BankingDokument40 SeitenJB Genaral BankingKajol HossainNoch keine Bewertungen

- HRM - AskaribankDokument23 SeitenHRM - AskaribankSharjil ZaiDiNoch keine Bewertungen

- Full Report MIFSDokument22 SeitenFull Report MIFSWeiXin Yeo100% (1)

- Dsu Report PDFDokument14 SeitenDsu Report PDFomNoch keine Bewertungen

- Assignment PointDokument9 SeitenAssignment PointAysha Begum ShantaNoch keine Bewertungen

- Bank of Maharashtra ProjectDokument39 SeitenBank of Maharashtra Projectchakshyutgupta76% (21)

- Term End Project: G Siva Prasad 10MBA0105Dokument10 SeitenTerm End Project: G Siva Prasad 10MBA0105Johnson YathamNoch keine Bewertungen

- Organizational Profile and AnalysisDokument6 SeitenOrganizational Profile and AnalysisAyush ShresthaNoch keine Bewertungen

- Punjab National Bank 1-Amit Kumar SrivastavaDokument66 SeitenPunjab National Bank 1-Amit Kumar SrivastavaAwanish Kumar MauryaNoch keine Bewertungen

- National BankDokument60 SeitenNational BankMridhaDeAlamNoch keine Bewertungen

- City Bank Is One of BangladeshDokument4 SeitenCity Bank Is One of BangladeshFarhana Rashed 2035196660Noch keine Bewertungen

- MCB IslamicDokument68 SeitenMCB IslamicHammad Lali100% (2)

- Background: Strategic Plan of The BankDokument6 SeitenBackground: Strategic Plan of The BankShimelis Tesema100% (9)

- Muslim Commercial Bank Ltd0200Dokument37 SeitenMuslim Commercial Bank Ltd0200Mir FaisalNoch keine Bewertungen

- Retail Banking Project BOIDokument107 SeitenRetail Banking Project BOIPooja Mathur100% (1)

- SWOT Analysis of Bank Alfalah ..24Dokument32 SeitenSWOT Analysis of Bank Alfalah ..24Ibad Hassan SyedNoch keine Bewertungen

- Final Report of Prime BankDokument50 SeitenFinal Report of Prime BankluckylibraNoch keine Bewertungen

- An Organizational Study of Pragathi Gramin Bank & Survey On Customer SatisfactionDokument15 SeitenAn Organizational Study of Pragathi Gramin Bank & Survey On Customer SatisfactionSatveer SinghNoch keine Bewertungen

- Table of Content: Chapter Number 1Dokument46 SeitenTable of Content: Chapter Number 1Hssan Ali0% (1)

- SME Activities of Bank Asia LTDDokument94 SeitenSME Activities of Bank Asia LTDRawnak AdnanNoch keine Bewertungen

- July 2019 SummaryDokument20 SeitenJuly 2019 SummaryShahriar KabirNoch keine Bewertungen

- Munyon Summers Thompson Ferrisinpress PSMetaDokument43 SeitenMunyon Summers Thompson Ferrisinpress PSMetaShahriar KabirNoch keine Bewertungen

- July 2019 SummaryDokument8 SeitenJuly 2019 SummaryShahriar KabirNoch keine Bewertungen

- September 2013 NPVDokument6 SeitenSeptember 2013 NPVShahriar KabirNoch keine Bewertungen

- Part 22 and 23 Pivot TableDokument18 SeitenPart 22 and 23 Pivot TableShahriar KabirNoch keine Bewertungen

- Non Ad Pad RegisterDokument65 SeitenNon Ad Pad RegisterShahriar KabirNoch keine Bewertungen

- Fourth Industrial Revolution and The Case of BangladeshDokument2 SeitenFourth Industrial Revolution and The Case of BangladeshShahriar KabirNoch keine Bewertungen

- A Guide To Understanding The Budget in Pakistan (English)Dokument48 SeitenA Guide To Understanding The Budget in Pakistan (English)Shahriar Kabir0% (1)

- Arbitration PDFDokument36 SeitenArbitration PDFShahriar KabirNoch keine Bewertungen

- Bank AsiaDokument17 SeitenBank AsiaShahriar KabirNoch keine Bewertungen

- Alm-Managing Core Risks in BankDokument60 SeitenAlm-Managing Core Risks in BankShahriar KabirNoch keine Bewertungen

- Bandarban ContactsDokument3 SeitenBandarban ContactsShahriar KabirNoch keine Bewertungen

- Bandarban ContactsDokument3 SeitenBandarban ContactsShahriar KabirNoch keine Bewertungen

- Measuring and Evaluating Bank Performance: Key Profitability Ratios in BankingDokument6 SeitenMeasuring and Evaluating Bank Performance: Key Profitability Ratios in BankingShahriar KabirNoch keine Bewertungen

- Metabank Ace Bank Statement TemplateDokument2 SeitenMetabank Ace Bank Statement TemplateSteven Lee100% (2)

- Indusind BankDokument65 SeitenIndusind BankNadeem KhanNoch keine Bewertungen

- Law214 Payment SystemsDokument11 SeitenLaw214 Payment SystemsBulelwa HarrisNoch keine Bewertungen

- Tax Invoice: Invois CukaiDokument18 SeitenTax Invoice: Invois CukaiCasc DzilNoch keine Bewertungen

- KBC Touch RegulationsDokument30 SeitenKBC Touch RegulationsirinelNoch keine Bewertungen

- Mentorship Report On Digitization in BankingDokument46 SeitenMentorship Report On Digitization in BankingravneetNoch keine Bewertungen

- Roll No. 161 (PROJECT REPORT ON "IMPACT OF E-BANKING ON SERVICE QUALITY OF BANKS")Dokument96 SeitenRoll No. 161 (PROJECT REPORT ON "IMPACT OF E-BANKING ON SERVICE QUALITY OF BANKS")Varun Rodi0% (1)

- Australia Commonwealth Bank Statement 2Dokument1 SeiteAustralia Commonwealth Bank Statement 2Юлия П100% (3)

- Consumer Rbi GuidlinesDokument44 SeitenConsumer Rbi Guidlinesg.prakash.delhiNoch keine Bewertungen

- Lezione08 RelativeClausesDokument5 SeitenLezione08 RelativeClausesGia KhanhNoch keine Bewertungen

- App Form Consultants and Specialists CON201-1508Dokument16 SeitenApp Form Consultants and Specialists CON201-1508gmantzaNoch keine Bewertungen

- Ausgrid AMB259996MRE1 NSW CZ5Dokument3 SeitenAusgrid AMB259996MRE1 NSW CZ5BaltNoch keine Bewertungen

- Sri Lankan Bank Account ComparisonDokument18 SeitenSri Lankan Bank Account ComparisonVaruni_Gunawardana100% (1)

- Q1. What Do You Understand by E-Commerce and How Is It Different From D-Commerce and M - Commerce?Dokument5 SeitenQ1. What Do You Understand by E-Commerce and How Is It Different From D-Commerce and M - Commerce?payal yadavNoch keine Bewertungen

- SOP - New Appointment Line AgentDokument12 SeitenSOP - New Appointment Line AgentEstefania Martinez Rodriguez100% (1)

- FLR FP Version 04-15Dokument59 SeitenFLR FP Version 04-15test freNoch keine Bewertungen

- Loyalty Program of BRAC BankDokument6 SeitenLoyalty Program of BRAC BankAmi HimelNoch keine Bewertungen

- Jul2023Dokument6 SeitenJul2023anudasari1301Noch keine Bewertungen

- Individual Paper Return For Tax Year 2020: SignatureDokument26 SeitenIndividual Paper Return For Tax Year 2020: SignaturejamalNoch keine Bewertungen

- DocumentDokument5 SeitenDocumentcadencallero23Noch keine Bewertungen

- Nike CorruptionDokument41 SeitenNike CorruptionLas Vegas Review-JournalNoch keine Bewertungen

- Apnachirag Center (ACC) BriefDokument18 SeitenApnachirag Center (ACC) Briefperkin kothari33% (3)

- Beat The System - How To Get Out of Chexsystems!Dokument6 SeitenBeat The System - How To Get Out of Chexsystems!moneyjunkieNoch keine Bewertungen

- Statement of Account: Penyata AkaunDokument14 SeitenStatement of Account: Penyata AkaunJohn MortonNoch keine Bewertungen

- Alternative Banking ChannelDokument18 SeitenAlternative Banking ChannelAbdul Muhaymin MahdiNoch keine Bewertungen

- Tax Return1Dokument7 SeitenTax Return1Yudo Kuna100% (1)

- Front Office AccountingDokument8 SeitenFront Office AccountingJeevesh ViswambharanNoch keine Bewertungen

- Cash Delivery Mechanism Assessment ToolDokument20 SeitenCash Delivery Mechanism Assessment ToolMohamed Ouchabane BouzerdNoch keine Bewertungen

- Shop Cart Checkout v1.1Dokument6 SeitenShop Cart Checkout v1.1Malik IrfanNoch keine Bewertungen

- Individuals: Account Opening Form For F. No.-401Dokument17 SeitenIndividuals: Account Opening Form For F. No.-401Kishor AgrawalNoch keine Bewertungen

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (90)

- Summary: The Gap and the Gain: The High Achievers' Guide to Happiness, Confidence, and Success by Dan Sullivan and Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisVon EverandSummary: The Gap and the Gain: The High Achievers' Guide to Happiness, Confidence, and Success by Dan Sullivan and Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisBewertung: 5 von 5 Sternen5/5 (4)

- Financial Intelligence: How to To Be Smart with Your Money and Your LifeVon EverandFinancial Intelligence: How to To Be Smart with Your Money and Your LifeBewertung: 4.5 von 5 Sternen4.5/5 (540)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedVon EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedBewertung: 5 von 5 Sternen5/5 (81)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- Summary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisVon EverandSummary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisBewertung: 5 von 5 Sternen5/5 (15)

- A Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessVon EverandA Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessBewertung: 5 von 5 Sternen5/5 (159)

- Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotVon EverandRich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotNoch keine Bewertungen

- Summary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisVon EverandSummary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisBewertung: 4.5 von 5 Sternen4.5/5 (24)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterVon EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterBewertung: 5 von 5 Sternen5/5 (3)

- The 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!Von EverandThe 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!Bewertung: 5 von 5 Sternen5/5 (389)

- Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyVon EverandRich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyBewertung: 4 von 5 Sternen4/5 (8)

- Quotex Success Blueprint: The Ultimate Guide to Forex and QuotexVon EverandQuotex Success Blueprint: The Ultimate Guide to Forex and QuotexNoch keine Bewertungen

- Love Money, Money Loves You: A Conversation With The Energy Of MoneyVon EverandLove Money, Money Loves You: A Conversation With The Energy Of MoneyBewertung: 5 von 5 Sternen5/5 (40)

- Summary of I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works by Ramit SethiVon EverandSummary of I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works by Ramit SethiBewertung: 4.5 von 5 Sternen4.5/5 (23)

- Rich Dad's Cashflow Quadrant: Guide to Financial FreedomVon EverandRich Dad's Cashflow Quadrant: Guide to Financial FreedomBewertung: 4.5 von 5 Sternen4.5/5 (1387)

- Bitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerVon EverandBitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerBewertung: 4 von 5 Sternen4/5 (52)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationVon EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationBewertung: 4 von 5 Sternen4/5 (11)

- Meet the Frugalwoods: Achieving Financial Independence Through Simple LivingVon EverandMeet the Frugalwoods: Achieving Financial Independence Through Simple LivingBewertung: 3.5 von 5 Sternen3.5/5 (67)

- Fluke: Chance, Chaos, and Why Everything We Do MattersVon EverandFluke: Chance, Chaos, and Why Everything We Do MattersBewertung: 4.5 von 5 Sternen4.5/5 (20)

- Sleep And Grow Rich: Guided Sleep Meditation with Affirmations For Wealth & AbundanceVon EverandSleep And Grow Rich: Guided Sleep Meditation with Affirmations For Wealth & AbundanceBewertung: 4.5 von 5 Sternen4.5/5 (105)

- The Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomVon EverandThe Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomBewertung: 5 von 5 Sternen5/5 (8)

- Passive Income Ideas for Beginners: 13 Passive Income Strategies Analyzed, Including Amazon FBA, Dropshipping, Affiliate Marketing, Rental Property Investing and MoreVon EverandPassive Income Ideas for Beginners: 13 Passive Income Strategies Analyzed, Including Amazon FBA, Dropshipping, Affiliate Marketing, Rental Property Investing and MoreBewertung: 4.5 von 5 Sternen4.5/5 (165)

- Unshakeable: Your Financial Freedom PlaybookVon EverandUnshakeable: Your Financial Freedom PlaybookBewertung: 4.5 von 5 Sternen4.5/5 (618)