Beruflich Dokumente

Kultur Dokumente

BCCR Model Test

Hochgeladen von

anujkathuria11Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BCCR Model Test

Hochgeladen von

anujkathuria11Copyright:

Verfügbare Formate

BSEs Certification for Credit Rating (BCCR) Examination

MODEL TEST PAPER FOR BCCR Q. Id Question A Credit Rating agency is required to carry out all the following except: As per the SEBI, in India beyond what conversion period a convertible/ redeemable debenture needs to compulsorily rated by a credit agency: Which of the following ratings does not look at credit quality? Option 1 Collect information from the issuer of the debt instrument 12 months Option 2 Conduct audit of the accounts of the issuer Option 3 Interact in person with various entities Option 4 Collect relevant information from different sources

15 months

18 months

24 months

Corporate governance rating

Municipal obligation rating

Preference shares rating Always true except for structured finance ratings Credit Analysis & Research Ltd. (CARE Ratings)

Bank loan rat ing Depends on the type of instrument being rated

Credit ratings focus on timeliness of repayment of debt obligations and not the ultimate repayment

FALSE

Always true

Which of the following is the latest entrant among Indian Credit rating agencies?

Brickworks Ratings

Credit Rating Information Services of India Limited (CRISIL) Depends upon the risk-return trade-off

Fitch Ratings

Credit ratings provide the investors with recommendation to buy, hold or sell a particular financial instrument.

TRUE subject to review whenever required by the banker of the issuer recommend a buy/sell or hold action to the investor for a particular debt instrument

False

Depends upon the type of instrument being rated subject to surveillance during the life of the instrument provide an overall assessment of the ability of a firm to meet all its debt and interest obligations

Credit rating is

a one-time exercise

subject to review only once it accepted by the issuer

The primary objective of credit rating is to

provide an analysis of overall risks associated with a particular debt instrument

none of the above

BSE Institute Limited

Page 1 of 8

BSEs Certification for Credit Rating (BCCR) Examination

Which of the following indicates strong competitive position of an issuer

Presence in high growth industry Proximity to raw materials and markets Vintage of technology used Entity with dependenc e on few clients Brand equity Cyclical industries are subjected to volatility in annual cash flows High research and developme nt expenditure Utilities Cyclicality and seasonality

Affordable product pricing

Growing market share

None of the above

10

Cost of production of an issuer could be influenced by:

All the above

Average rate of interest Specific power and fuel consumption Entity with multiple business lines Access to working capital Downturns are more prolonged than upturns

Scale of operations Ability to command premium pricing None of the above

11

The factor that has no bearing on operating efficiency is: During a cyclical downturn, which of the following entities is least likely to be adversely affected

Yields and rejection rates Entity with least operating efficiency Access to distribution network

12

13

Following is not an entry barrier

Regulations

14

Entities operating in cyclical industries are exposed to more business risk than those operating in a stable environment because

Cycles are difficult to predict

a and b

15

Entry barriers in the global pharmaceutical industry are high because of

a and b

Presence of large number of players

Stringent regulations

16

Which of the following is an example of a non-cyclical industry The two key factors responsible for influencing an issuers competitive position are: The aspect that is not considered while assessing industry risk is

Hospitality Access to capital and group support Outlook of user industries Depends on the industry to which the entity belongs

Automobile Relationships with bankers and investors Performance of group companies

Cement Operational efficiency and market position Competitive intensity

17

18

Vulnerabilit y to imports

19

Business risk factors that are typically analyzed for any given entity are:

Size

Pricing power

Market share

BSE Institute Limited

Page 2 of 8

BSEs Certification for Credit Rating (BCCR) Examination

20

Identify the most relevant business risk parameter from the following, for aluminium industry Will increase in working capital funds have an impact on Return on Capital Employed (RoCE)?

Access to good quality bauxite reserves Yes, increase RoCE Through higher raw material costs Non operating expense

a and b

Pricing power

Captive coal linkage for power plants

21

No impact Through changes in accretion/de cretion to stock Depreciation

Yes, reduce RoCE

Cannot comment

22

How will an inventory write off impact operating profits? Operating profit margin for a pure manufacturing company is Operating income-Cost of goods sold where COGS includes Indebted Incorporation Limited has an 8 percent return on total assets of Rs 300,000 and a net profit margin of 5%. What are its sales? Operating Profitability indicate a companys If purchases are overstated by Rs. 10 lacs, and COGS and opening inventory are correct, the closing inventory will beIf the interest rates were to change during the year, which of the following statement is incorrect? Shaky Limited suffered major loss on uninsured assets due to a major earthquake. As per Indian GAAP, losses incurred should be All else being the same( including no additional debt), high annual dividend payouts result in Give & Take Co. provides the following numbers. Calculate the sales? Variable Cost is 58% of sales, Profit is Rs. 90 lacs, and fixed Cost is Rs. 15 lacs.

Both A and B

None of the given options

23

Interest income

Selling and advertising expense

24

Rs. 37,50,000

Rs. 4,80,000

Rs. 15,00,000

Rs. 3,00,000

25

Ability to manage stock levels Understate d by Rs. 10 lacs

Ability to use the assets in an efficient manner Overstated by Rs. 10 lacs

Ability to repay debts

None of the above

26

Depends on the inventory method

Unaffected

27

ROCE changes

Neither A nor B

Both A and B

RONW remain the same

28

Deducted from sales

Treated as part of COGS

Taken below the line

None of the above

29

Reduced Operating profitability

Reduced net profitability

Increase in RoCE

All of the above

30

Rs. 105 lacs

Rs. 208.6 lacs

None of the above

Rs. 250.0 lacs

BSE Institute Limited

Page 3 of 8

BSEs Certification for Credit Rating (BCCR) Examination

31

What is the discount rate used while calculating the NPV using the free cash flow to the firm Despite strong contractual structure, a project with weak fundamental viability will get a low rating From amongst the projects given completion risks would be the highest for which category of projects What are the methods of mitigating construction risk

Cost of equity

Cost of debt

None of the above

Weighted Average Cost of Capital

32

Always true

Depends on a case-tocase basis

True only in case of FALSE capital intensive projects Petrochemica l projects Toll Road

33

Power

Cannot be generalized Liquidated Damages from construction contract Both time and cost overrun

34

Fixed Price Contracts

All the above

Sponsor support for cost overrun

35

EPC Contracts are not useful for mitigating which of the following risks

Cost overrun

Market risks

Time overrun

36

Which of the following has the maximum potential of delaying projects

Land acquisition

Environment al clearance Would depend on experience of the EPC contractor Technology Risk Approval for raising funds through borrowings Exemptions given to various sections

Availability of Right-Of-Way Would depend on the nature of the project Operational Risk Dependence for defining operating contours through Municipal Act Low collection efficiencies

All the above

37

A very tight project schedule is likely to lead to delays in the project A power plant is unable to generate power because of lack of fuel availability. This would be an example of Credit quality of Municipalities is linked to the State Governments on account of:

Usually true

FALSE

38

Market Risk

Funding Risk

39

Dependenc e for timely devolution and grants Lack of timely revision of taxes and user charges

All the above

40

Municipal revenues tend to be depressed on account of:

All the above

BSE Institute Limited

Page 4 of 8

BSEs Certification for Credit Rating (BCCR) Examination

41

Devolution to Municipalities from State Governments are:

Bound by the State Finance Commissio n's recommend ations Bonds and Loans

Fixed

Decided by the Legislature Residential and Commercial Real Estate Assets None of the above Mortgage loan backed transactions May be greater or lower depending on each transaction

None of the Above

42

Which of the following assets can a CDO be backed by? Swaps can be used in securitisation transactions to mitigate which of the following risks? Interest rate swaps are commonly used in which of the following securitisation transactions in India? In a premium transaction with single tranche of PTCs and staggering of investor payouts, the total scheduled pool cash flows are greater than total scheduled PTC cash flows. In a certain structure, there are two tranches - Series A1 and Series A2. Series A1 is senior and A2 is subordinated. Based on this information only, which of the two tranches is expected to have lower credit risk? If the loan is securitised through a premium transaction with investor yield @ 9% per annum, what is the purchase consideration? Everything else being the same, a large sized entity has lower business risk than a small sized entity. Most probable explanation for this statement could be:

Credit Derivatives

All of the above

43

Interest rate risk Auto loan backed transaction s

Exchange rate risk Personal loan backed transactions

Both of the above

44

None of the above

45

Not enough information

Agree.

Disagree.

46

A1

Both will have equal credit risk

Can not be determined

A2

47

100 Large sized entity will always have a dominant market share Market share is concentrate d with few top players

100.92 Large sized entity is likely to be more diversified than a small sized entitys Given the high level of fragmentatio n, significant capacity addition is not likely

110

109

48

Large sized entity will always have better operational efficiency The industry cannot survive unless significant consolidation takes place

Large sized entity is a price leader

49

Following is true of a highly fragmented industry

Price leadership is unlikely, even by the largest player

BSE Institute Limited

Page 5 of 8

BSEs Certification for Credit Rating (BCCR) Examination

50

Under the new capital adequacy norms prescribed under BASEL , banks would use ratings to decide on risk weight of exposures except

Cash Credit facility

Personal Loan

Bank Guarantee

Term Loan

BSE Institute Limited

Page 6 of 8

BSEs Certification for Credit Rating (BCCR) Examination

Answers: Q. Id 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 Answer Conduct audit of the accounts of the issuer 18 months Corporate governance rating Always true Brickworks Ratings FALSE subject to surveillance during the life of the instrument provide an overall assessment of the ability of a firm to meet all its debt and interest obligations Growing market share All the above Ability to command premium pricing Entity with multiple business lines Regulations a and b a and b Utilities Operational efficiency and market position Performance of group companies Depends on the industry to which the entity belongs a and b Yes, reduce RoCE Both A and B Selling and advertising expense Rs. 4,80,000 None of the above Understated by Rs. 10 lacs Neither A nor B None of the above Increase in RoCE Rs. 250.0 lacs Weighted Average Cost of Capital Always true Cannot be generalized All the above Both time and cost overrun All the above Usually true Operational Risk All the above All the above Decided by the Legislature All of the above Both of the above Mortgage loan backed transactions Disagree. A1

BSE Institute Limited

Page 7 of 8

BSEs Certification for Credit Rating (BCCR) Examination

47 48 49 50

100.92 Large sized entity is likely to be more diversified than a small sized entity Price leadership is unlikely, even by the largest player Personal Loan

BSE Institute Limited

Page 8 of 8

Das könnte Ihnen auch gefallen

- Fund Raising & Overview of IPO: Sharing NTPC ExperienceDokument38 SeitenFund Raising & Overview of IPO: Sharing NTPC ExperienceSamNoch keine Bewertungen

- Moodys - Sample Questions 4Dokument12 SeitenMoodys - Sample Questions 4ivaNoch keine Bewertungen

- ACC501 All Solved MCQ MidtermDokument73 SeitenACC501 All Solved MCQ MidtermMujtaba AhmadNoch keine Bewertungen

- FinQuiz - Smart Summary - Study Session 16 - Reading 56Dokument7 SeitenFinQuiz - Smart Summary - Study Session 16 - Reading 56Rafael100% (1)

- SBI - Credit AppraisalDokument31 SeitenSBI - Credit AppraisalSuvra Ghosh25% (4)

- 04-Aug-2018 - 1533294145 - 7. Hints - Indian Economy + Internal SecurityDokument44 Seiten04-Aug-2018 - 1533294145 - 7. Hints - Indian Economy + Internal SecurityMahtab AlamNoch keine Bewertungen

- Project Finance: Aditya Agarwal Sandeep KaulDokument96 SeitenProject Finance: Aditya Agarwal Sandeep Kaulabhishekbehal5012Noch keine Bewertungen

- Project Finance IntroductionDokument99 SeitenProject Finance IntroductionApoorvNoch keine Bewertungen

- FIN625Dokument27 SeitenFIN625Mahmmood AlamNoch keine Bewertungen

- MGT 201 All Solved Quiz 2 in One FileDokument77 SeitenMGT 201 All Solved Quiz 2 in One FilenargisNoch keine Bewertungen

- Excessive Availability of Credit For Unproductive Purpose, Does Not Affect The Inflationary Pressure in Any MannerDokument12 SeitenExcessive Availability of Credit For Unproductive Purpose, Does Not Affect The Inflationary Pressure in Any MannerRakesh KushwahaNoch keine Bewertungen

- Financial Accounting II - MGT401 Final Term Mega QuizDokument69 SeitenFinancial Accounting II - MGT401 Final Term Mega Quizsania.mahar75% (4)

- Midterm Examination: PartnershipDokument10 SeitenMidterm Examination: Partnershiphk dhamanNoch keine Bewertungen

- Financial Notes by JMR SirDokument70 SeitenFinancial Notes by JMR SirAlekhya ThirumaniNoch keine Bewertungen

- Rating Action - Moodys-assigns-Baa3-rating-to-Country-Gardens-proposed-USD-notes - 11may21Dokument5 SeitenRating Action - Moodys-assigns-Baa3-rating-to-Country-Gardens-proposed-USD-notes - 11may21Winnie WongNoch keine Bewertungen

- MGT401 Mega Quiz File For Final Term by Innocent Prince: PartnershipDokument69 SeitenMGT401 Mega Quiz File For Final Term by Innocent Prince: PartnershipSana UllahNoch keine Bewertungen

- ACC501 Solved Current Papers McqsDokument36 SeitenACC501 Solved Current Papers Mcqssania.mahar100% (2)

- Moodys Practice MaterialDokument162 SeitenMoodys Practice MaterialBeing MentorNoch keine Bewertungen

- Banks To Benefit From Recent CBE Cut To RRR: Egypt - BankingDokument2 SeitenBanks To Benefit From Recent CBE Cut To RRR: Egypt - BankingAmina K. KhalilNoch keine Bewertungen

- Fixed Income Attribution WhitepaperDokument24 SeitenFixed Income Attribution WhitepaperreviurNoch keine Bewertungen

- 22BSPHH01C1222 - Subham Deb - IrDokument22 Seiten22BSPHH01C1222 - Subham Deb - Irnilesh.das22hNoch keine Bewertungen

- ManagementOfFinancialServices MB055 QuestionDokument38 SeitenManagementOfFinancialServices MB055 QuestionAiDLoNoch keine Bewertungen

- Ufa#Ed 2#Sol#Chap 06Dokument18 SeitenUfa#Ed 2#Sol#Chap 06api-3824657Noch keine Bewertungen

- Unit IIIDokument19 SeitenUnit IIISairaj DessaiNoch keine Bewertungen

- Business Finance - ACC501 Fall 2006 McqsDokument36 SeitenBusiness Finance - ACC501 Fall 2006 McqsSaifi Khan100% (1)

- Acc501 Midterm Solved Mega File With Reference by StudentsDokument36 SeitenAcc501 Midterm Solved Mega File With Reference by StudentsdaniNoch keine Bewertungen

- Q-1 What Do You Think Are The Strengths and Weaknesses of The Project? StrengthsDokument4 SeitenQ-1 What Do You Think Are The Strengths and Weaknesses of The Project? StrengthsDharmik GopaniNoch keine Bewertungen

- Tips On Project FinancingDokument3 SeitenTips On Project FinancingRattinakumar SivaradjouNoch keine Bewertungen

- SritexDokument5 SeitenSritexuzzyNoch keine Bewertungen

- HTTP WWW - Aphref.aph - Gov.au House Committee Economics Banking08 Subs Sub22Dokument14 SeitenHTTP WWW - Aphref.aph - Gov.au House Committee Economics Banking08 Subs Sub22Adam JonesNoch keine Bewertungen

- ICRA LTDDokument22 SeitenICRA LTDsandipgargNoch keine Bewertungen

- Working Capital FinancingDokument44 SeitenWorking Capital FinancingShoib ButtNoch keine Bewertungen

- HDFC Amc Mock TestDokument19 SeitenHDFC Amc Mock Testyogidildar100% (1)

- India Power RegulationsDokument23 SeitenIndia Power RegulationsRicha SinghNoch keine Bewertungen

- Moodys - Sample Questions 3Dokument16 SeitenMoodys - Sample Questions 3ivaNoch keine Bewertungen

- In Vertical Mergers and Acquisition What Synergies Exist?Dokument5 SeitenIn Vertical Mergers and Acquisition What Synergies Exist?Sanam TNoch keine Bewertungen

- Annual 030502Dokument40 SeitenAnnual 030502Ajay DesaiNoch keine Bewertungen

- Senior Analyst-FMS Finance MagazineDokument47 SeitenSenior Analyst-FMS Finance MagazineShas RockstoneNoch keine Bewertungen

- Drafted Assignment - GMDokument15 SeitenDrafted Assignment - GMAsmaa BaaboudNoch keine Bewertungen

- ADL 55 - Management of Financial Services Assignment-eLearningDokument7 SeitenADL 55 - Management of Financial Services Assignment-eLearningAD Lead100% (1)

- Project Finance and Loan Syndication ProceduresDokument28 SeitenProject Finance and Loan Syndication ProceduresKeerthi ThulasiNoch keine Bewertungen

- Practice Problems: Reading 37 Introduction To Industry and Company Analysis 354Dokument6 SeitenPractice Problems: Reading 37 Introduction To Industry and Company Analysis 354GNoch keine Bewertungen

- SME Credit: Loans at Low Interest To Fuel Your Sme BusinessDokument5 SeitenSME Credit: Loans at Low Interest To Fuel Your Sme Businessnishaantdec13Noch keine Bewertungen

- Acc 501 Mid Term QuizzDokument7 SeitenAcc 501 Mid Term QuizzDevyansh GuptaNoch keine Bewertungen

- Crisil Road ProjectDokument19 SeitenCrisil Road ProjectNagarajan YegnanarayananNoch keine Bewertungen

- Libdoc 329Dokument6 SeitenLibdoc 329Bala ArvindNoch keine Bewertungen

- ALL Solved Data of FIN622 Corporate FinanceDokument69 SeitenALL Solved Data of FIN622 Corporate Financesajidhussain557100% (1)

- RBC CaseAnswers Group13Dokument4 SeitenRBC CaseAnswers Group13Jayesh KukretiNoch keine Bewertungen

- SME Union: SME Financing - Is It Really ADokument20 SeitenSME Union: SME Financing - Is It Really ASumair SaleemNoch keine Bewertungen

- ACC501 Solved MCQsDokument6 SeitenACC501 Solved MCQsMuhammad aqeeb qureshiNoch keine Bewertungen

- Rating Methodology For Housing Finance Companies (HFCS) : Credit Analysis & Research LimitedDokument5 SeitenRating Methodology For Housing Finance Companies (HFCS) : Credit Analysis & Research Limiteddeptlab1Noch keine Bewertungen

- Credit Appraisal in Banking Sector PPT at Bec DomsDokument31 SeitenCredit Appraisal in Banking Sector PPT at Bec DomsBabasab Patil (Karrisatte)100% (2)

- How To Create A Research ReportDokument24 SeitenHow To Create A Research ReportJayden JiangNoch keine Bewertungen

- A Review of The Capital Requirements For Life Insurers in IndiaDokument46 SeitenA Review of The Capital Requirements For Life Insurers in Indiajdchandrapal4980Noch keine Bewertungen

- NiSM QuestionzssDokument709 SeitenNiSM Questionzssatingoyal1Noch keine Bewertungen

- Fin622 Solved Mcqs For Exam PreparationDokument9 SeitenFin622 Solved Mcqs For Exam PreparationLareb ShaikhNoch keine Bewertungen

- Series 22 Exam Study Guide 2022 + Test BankVon EverandSeries 22 Exam Study Guide 2022 + Test BankNoch keine Bewertungen

- Mergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketVon EverandMergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketBewertung: 1 von 5 Sternen1/5 (1)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Von EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Difference Between Art. 128 and 129 of The Labor CodeDokument3 SeitenDifference Between Art. 128 and 129 of The Labor CodeKarl0% (1)

- CM760 E-Brochure HemobasculaDokument6 SeitenCM760 E-Brochure Hemobasculajordigs50Noch keine Bewertungen

- Urban Issues: Rio Case StudyDokument4 SeitenUrban Issues: Rio Case Studyxbox pro hiNoch keine Bewertungen

- Media DRIVEON Vol25 No2Dokument21 SeitenMedia DRIVEON Vol25 No2Nagenthara PoobathyNoch keine Bewertungen

- Quick Commerce:: The Real Last MileDokument9 SeitenQuick Commerce:: The Real Last MileChhavi KhandujaNoch keine Bewertungen

- Technical Writing PDFDokument129 SeitenTechnical Writing PDFKundan Kumar100% (1)

- 24th SFCON Parallel Sessions Schedule (For Souvenir Program)Dokument1 Seite24th SFCON Parallel Sessions Schedule (For Souvenir Program)genesistorres286Noch keine Bewertungen

- White Paper - Data Communication in Substation Automation System SAS - Part 1 Original 23353Dokument5 SeitenWhite Paper - Data Communication in Substation Automation System SAS - Part 1 Original 23353sabrahimaNoch keine Bewertungen

- Bonus 6 - Mastering ASP - NET Core SecurityDokument147 SeitenBonus 6 - Mastering ASP - NET Core SecurityDark Shadow100% (1)

- Small Roller Granulator NPK Compound Fertilizer Production ProcessDokument3 SeitenSmall Roller Granulator NPK Compound Fertilizer Production Processluna leNoch keine Bewertungen

- Bp344 RampDokument29 SeitenBp344 RampmaeNoch keine Bewertungen

- SDS enDokument6 SeitenSDS enAnup BajracharyaNoch keine Bewertungen

- Pulido VsDokument14 SeitenPulido Vsroyel arabejoNoch keine Bewertungen

- Activity Diagram 1Dokument14 SeitenActivity Diagram 1Yousef GamalNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument18 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- National Knowledge Commision and Its Implication in Higher EducationDokument73 SeitenNational Knowledge Commision and Its Implication in Higher Educationabhi301280100% (1)

- Using Excel For Business AnalysisDokument5 SeitenUsing Excel For Business Analysis11armiNoch keine Bewertungen

- Jurnal Stamina: E-ISSN 2655-2515 P-ISSN 2655-1802Dokument9 SeitenJurnal Stamina: E-ISSN 2655-2515 P-ISSN 2655-1802Yogi TioNoch keine Bewertungen

- SQA Plan TemplateDokument105 SeitenSQA Plan Templatestudent1291Noch keine Bewertungen

- Organic Fertilizer RRLDokument8 SeitenOrganic Fertilizer RRLEldon Jay MaltoNoch keine Bewertungen

- Management of HondaDokument8 SeitenManagement of HondafarhansufiyanNoch keine Bewertungen

- OEM - Fuel Manager Brand Cross Reference P/Ns For Service Filter Elements 99642 - January 2006Dokument6 SeitenOEM - Fuel Manager Brand Cross Reference P/Ns For Service Filter Elements 99642 - January 2006Miguel RojasNoch keine Bewertungen

- SRB 301 Ma Operating Instructions Safety-Monitoring ModulesDokument6 SeitenSRB 301 Ma Operating Instructions Safety-Monitoring ModulesMustafa EranpurwalaNoch keine Bewertungen

- Saraswathi 2018Dokument4 SeitenSaraswathi 2018Daniel CoronelNoch keine Bewertungen

- Etpm Mód 3 Assignment 2.1 Grammar and Use of English SkillsDokument3 SeitenEtpm Mód 3 Assignment 2.1 Grammar and Use of English SkillsLourdes LimaNoch keine Bewertungen

- Cylinder Clamp For N2 Cylinder 84L and FM-200 Cylinder 82.5LDokument1 SeiteCylinder Clamp For N2 Cylinder 84L and FM-200 Cylinder 82.5LNguyễn Minh ThiệuNoch keine Bewertungen

- Add MITx Credentials To Resume and LinkedIn PDFDokument5 SeitenAdd MITx Credentials To Resume and LinkedIn PDFRizwanNoch keine Bewertungen

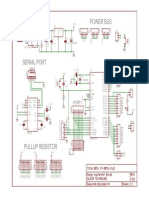

- 8051 Development Board Circuit DiagramDokument1 Seite8051 Development Board Circuit DiagramRohan DharmadhikariNoch keine Bewertungen

- Woman Magazine Who Was Changing Jobs To Be The Editor Of: Family Circle AdweekDokument11 SeitenWoman Magazine Who Was Changing Jobs To Be The Editor Of: Family Circle AdweekManish RanaNoch keine Bewertungen