Beruflich Dokumente

Kultur Dokumente

HCPDSB

Hochgeladen von

paulyozOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HCPDSB

Hochgeladen von

paulyozCopyright:

Verfügbare Formate

Product Disclosure Statement - Part B Home and Contents Insurance Policy General Terms and Conditions

WHAT IS A PRODUCT DISCLOSURE STATEMENT? This Product Disclosure Statement will assist you to make an informed decision about our insurance product. It consists of two parts, which you should read before making a final decision to purchase: 1) PART A contains the general terms and conditions of all our policies. 2) PART B contains specific details about the product option that you selected. IF YOU HAVE ALREADY PURCHASED OUR POLICY: This Product Disclosure Statement becomes your INSURANCE CONTRACT together with the most recent: INSURANCE CERTIFICATE YOUR DECLARATIONS COVER LETTER After reading the documents carefully, you should keep them in a safe place for future reference. OUR AGREEMENT In return for you meeting your obligations under this agreement, we will give you the protection described in this policy for events which occur during the period of insurance shown on your insurance certificate.

This document prepared on 15 December 2010 Product Issuer: Auto & General Insurance Company Limited ABN 42 111 586 353 AFS Licence No 285571 Registered Office: Level 6, 9 Sherwood Road, Toowong, QLD 4066

th

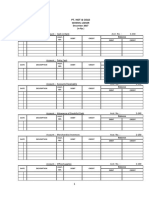

Page 1 Product Disclosure Statement - Part B LIMITS REFERRED TO IN PART A There are limits to the amounts we will pay for certain home items. Home Unfixed home building uninstalled home fittings materials and The most we will pay for any one insured event (this amount includes GST) up to $1,000 in total

There are limits to the amounts we will pay for certain contents items. Contents Hand woven carpets and rugs The most we will pay for any one insured event (this amount includes GST) up to $2,000 for any item, unless noted as specified contents on your insurance certificate up to $500 in total up to $2,500 in total, unless noted as specified contents on your insurance certificate up to $2,000 in total up to $10,000 in total up to $1,000 for any item or set, with a limit of $3,000 in total, unless noted separately as specified contents on your insurance certificate up to $2,000 for any item or set

Cash, cheques, and any other negotiable financial document CDs, DVDs, flash cards, digital media cards, audio and video tapes, records, computer discs, computer software, game cartridges and game consoles Firearms that are legally registered and stored Home office equipment Jewellery and watches

Silver & gold items, items plated with silver or gold (excluding jewellery and watches)

Page 2 Product Disclosure Statement - Part B LIMITS REFERRED TO IN PART A There are limits to the amounts we will pay for certain contents items. Contents Paintings, pictures, works of art, sculptures or art objects The most we will pay for any one insured event (this amount includes GST) up to $5,000 for any item or set, with a limit of $10,000 in total, unless noted separately as specified contents on your insurance certificate up to $2,000 in total for any one collection, unless noted as specified contents on your insurance certificate up to $1,000 in total up to the sum insured for the specified contents item that is shown on the insurance certificate

Collections, memorabilia, stamps, collectors pins, medals, and collectors nonnegotiable currency Tools of trade Specified contents items

There are limits to the amount we will pay relating to certain insured events. Insured event 9. Sudden and unexpected escape of liquid at the insured address The most we will pay for any one insured event (this amount includes GST) The most we will pay towards the cost incurred to locate the unknown source of a leaking pipe is $1,000.

Page 3 Product Disclosure Statement - Part B There are limits to the amount we will pay for additional benefits Additional benefit 1. Removal of debris and extra costs of rebuilding when we insure your home and/or contents The most we will pay for any one insured event (this amount includes GST) We will pay up to: 10% of your home sum insured, or 10% of your contents sum insured We will pay this amount in addition to your total sum insured. 2. Temporary accommodation costs when we insure your home and/or contents We will pay up to: 10% of your home sum insured if you own and live in the insured home, or 10% of your contents sum insured if you own and live in your unit, townhouse, apartment or villa, or if you are a tenant. The amount we pay will be based on the weekly rentable value of your home, or your weekly rental expense under your current lease agreement when you are a tenant. We will pay this amount in addition to your total sum insured.

Page 4 Product Disclosure Statement - Part B Limits to the amount we will pay for additional benefits (continued) Additional benefit 3. a) Landlord benefit when we insure your home Loss of rent The most we will pay for any one insured event (this amount includes GST) The most we will pay for this benefit is the amount of net rental income lost for the period the home cannot be occupied, up to 10% of your home sum insured. (Net rental income means the amount of rental income you receive less any fees for agents commissions or administration costs.) The most we will pay for this benefit is 5% of the home sum insured. b) 4. Landlord's fixtures and fittings Mortgage discharge costs when we insure your home We will pay these amounts (if applicable) in addition to your home sum insured. The most we will pay for this benefit is $750 towards the legal and administrative costs associated with the discharge of any mortgage over the home at the insured address. The most we will pay for this benefit is $5,000 in any one period of insurance.

5.

Modifications to your Home as a result of paraplegia or quadriplegia when we insure your home and/or contents Funeral expenses when we insure your home and/or contents

6.

The most we will pay for this benefit is $5,000 in any one period of insurance.

Page 5 Product Disclosure Statement - Part B Limits to the amount we will pay for additional benefits (continued) Additional Benefit 7. Replacement of locks when keys are stolen when we insure your Contents Contents in the open air at the insured address when we insure your contents Contents temporarily removed from the insured address when we insure your contents The most we will pay for any one insured event (this amount includes GST) The most we will pay for this benefit is $500 in any one period of insurance. The most we will pay for any loss or damage resulting from theft or attempted theft is $1,000. The most we will pay for any loss or damage as a result of an insured event is 20% of the contents sum insured. The most we will pay for loss or damage as a result of fire or the collision or overturning of the transporting vehicle is 20% of the contents sum insured. The most we will pay for this benefit is $1,000 for any incident that results in a claim. The most we will pay for this benefit is $500 for any incident that results in a claim. The most we will pay for this benefit is $500 for any incident that results in a claim.

8.

9.

10. Contents when you are moving to a new address in Australia when we insure your contents 11. Credit or financial transaction card cover when we insure your contents 12. Cover for unattached equipment, spare parts or accessories when we insure your contents 13. Uninsured contents belonging to guests and visitors when we insure your contents

Page 6 Product Disclosure Statement - Part B EXCESS ON CLAIMS This is the amount you may have to pay towards each claim. A basic excess applies to all claims. It will be a standard amount, or you may also be able to alter the excess amount which will alter the premium that you pay. The basic excess amount will be shown on your insurance certificate. A fixed excess may apply to your policy when we decide to accept the risk. This excess cannot be removed. The fixed excess amount will be shown on your insurance certificate. An earthquake excess will apply to all claims for loss or damage as a result of earthquake. This excess is $500 in addition to your basic excess. The total excess you have to contribute to a claim is the sum of the basic excess and any other excesses that may apply. We will advise you of all excess amounts when you apply for the insurance, and the excess amount will be shown on your insurance certificate. FEES THAT MAY BE CHARGED Once you have taken out a policy, our agent as shown on your Insurance Certificate may charge any of the fees below (if applicable): Policy Amendments Early Cancellation Instalment Processing - New policies Instalment Processing - Renewing policies Payment Resubmission $11.00 $33.00 10 payments of 77 cents per $100 of premium or part thereof. 12 payments of 66 cents per $100 of premium or part thereof. $11.00

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Fundamental Analysis of Bandhan BankDokument41 SeitenFundamental Analysis of Bandhan BankAbhishekNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- School Awards 07Dokument3 SeitenSchool Awards 07paulyoz0% (1)

- Swan River Fishing MapDokument1 SeiteSwan River Fishing MappaulyozNoch keine Bewertungen

- Sample Will LetterDokument2 SeitenSample Will Letterhantarto5844Noch keine Bewertungen

- Doing IT Better Project: Summary ReportDokument32 SeitenDoing IT Better Project: Summary ReportpaulyozNoch keine Bewertungen

- Doing IT Better Project: Summary ReportDokument32 SeitenDoing IT Better Project: Summary ReportpaulyozNoch keine Bewertungen

- HVAC System RecirculatesDokument2 SeitenHVAC System RecirculatespaulyozNoch keine Bewertungen

- Hardifence ManualDokument20 SeitenHardifence ManualpaulyozNoch keine Bewertungen

- Higher Algebra - Hall & KnightDokument593 SeitenHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Wikborg Global Offshore Projects DEC15Dokument13 SeitenWikborg Global Offshore Projects DEC15sam ignarskiNoch keine Bewertungen

- NP & Debt Restructuring HO - 2064575149Dokument3 SeitenNP & Debt Restructuring HO - 2064575149JOHANNANoch keine Bewertungen

- HSC 2017 July Commerce Book Keeping PDFDokument5 SeitenHSC 2017 July Commerce Book Keeping PDFNivesh KandwalNoch keine Bewertungen

- IB ChallanDokument1 SeiteIB ChallanPrasad HiremathNoch keine Bewertungen

- Chapter 1 ACCOUNTING IN ACTIONDokument61 SeitenChapter 1 ACCOUNTING IN ACTIONWendy Priscilia Manayang100% (1)

- Lembar - JWB - Soal - B - Sesi 2Dokument11 SeitenLembar - JWB - Soal - B - Sesi 2Sandi RiswandiNoch keine Bewertungen

- fm4chapter03 기업가치평가Dokument45 Seitenfm4chapter03 기업가치평가quynhnhudang5Noch keine Bewertungen

- FRMDokument6 SeitenFRMAhmad Tawfiq DarabsehNoch keine Bewertungen

- Entrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual Full Chapter PDFDokument66 SeitenEntrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual Full Chapter PDFmelrosecontrastbtjv1w100% (13)

- Etf PDFDokument14 SeitenEtf PDFYash MeelNoch keine Bewertungen

- Cause List Court-2 17.10.2023Dokument6 SeitenCause List Court-2 17.10.2023divyanshu31Noch keine Bewertungen

- Project On HDFC Ltd. Bank (BL)Dokument26 SeitenProject On HDFC Ltd. Bank (BL)Animesh BoseNoch keine Bewertungen

- FAR 4204 (Receivables)Dokument10 SeitenFAR 4204 (Receivables)Maximus100% (1)

- Ta/Da Bill of Non-Official Member Invited To Attend The MeetingDokument3 SeitenTa/Da Bill of Non-Official Member Invited To Attend The MeetingVasoya ManojNoch keine Bewertungen

- PQ - Prequalification Document PDFDokument56 SeitenPQ - Prequalification Document PDFHema Chandra IndlaNoch keine Bewertungen

- What Is A Financial Intermediary (Final)Dokument6 SeitenWhat Is A Financial Intermediary (Final)Mark PlancaNoch keine Bewertungen

- A Commission To Both Lender and Borrower, Is A Bank. It Is Conceded That A Total of 59,463 SavingsDokument45 SeitenA Commission To Both Lender and Borrower, Is A Bank. It Is Conceded That A Total of 59,463 SavingsJustice PajarilloNoch keine Bewertungen

- T03 - Home Office & BranchDokument3 SeitenT03 - Home Office & BranchChristian YuNoch keine Bewertungen

- Financial Statement AnalysisDokument28 SeitenFinancial Statement AnalysisbillyNoch keine Bewertungen

- 1068026189-Special NoticeDokument4 Seiten1068026189-Special NoticeBVS NAGABABUNoch keine Bewertungen

- Module 4 PDFDokument19 SeitenModule 4 PDFRAJASAHEB DUTTANoch keine Bewertungen

- Project Finance EMBA - NandakumarDokument63 SeitenProject Finance EMBA - NandakumarKrishna SinghNoch keine Bewertungen

- Agricultural Project Planning Module-IIDokument96 SeitenAgricultural Project Planning Module-IIGetaneh SeifuNoch keine Bewertungen

- Vat Ec Fr-EnDokument27 SeitenVat Ec Fr-EnDjema AntohiNoch keine Bewertungen

- Eom Ii - Test - 15-08-2021Dokument21 SeitenEom Ii - Test - 15-08-2021Bithal PrasadNoch keine Bewertungen

- NTPC ReportDokument15 SeitenNTPC ReportKaushal Jaiswal100% (1)

- IMF Reformation of BangladeshDokument125 SeitenIMF Reformation of BangladeshSajjad HossainNoch keine Bewertungen

- Ci17 5Dokument11 SeitenCi17 5robmeijerNoch keine Bewertungen

- Problem 1 Investment in Equity SecuritiesDokument6 SeitenProblem 1 Investment in Equity SecuritiesGabriel OrolfoNoch keine Bewertungen