Beruflich Dokumente

Kultur Dokumente

Description: Tags: PRG2001ChaptVI

Hochgeladen von

anon-188377Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Description: Tags: PRG2001ChaptVI

Hochgeladen von

anon-188377Copyright:

Verfügbare Formate

Chapter VI Special Focus on Default Prevention

A. Reviews at Schools With High Cohort Default Rates

Reviews of institutions with high Federal Family Education Loan (FFEL) and

William D. Ford Federal Direct Loan (DL) Program cohort default rates (CDR) will

also focus on default management. Applicable default reduction and prevention

measures must be examined at institutions with high CDRs during reviews.

Reviewers should notify their Default Management adjunct of the scheduled

review and request all relevant loan information on the school (CDR rate trends,

loan program eligibility status, and appeal status.)

Every year, ED notifies each institution of its official fiscal year cohort default rate

on loans to students for attendance at that institution through the FFEL and DL

programs. (Although the Federal Supplemental Loan for Students (SLS)

program has been phased out, some SLS loans still appear in the calculation.)

The institutional profile will list the three most recent official cohort default rates

and dates of notification.

A new comprehensive Cohort Default Rate Guide, combining the separate Draft

and Official Cohort Default Rate Guides is available with the release of the FY 99

Official Cohort Default Rates. The guide should be used as a reference tool for

institutions desiring to challenge the draft cohort default rate and/or request an

adjustment to and/or appeal the official default rate(s). The review should refer

to the Cohort Default Rate Guide for detailed information on CDRs and rela ted

topics.

B. Review Items

During the review of a high CDR institution, a new institution, or an institution

under new ownership, reviewers should examine the following items.

• high withdrawal rates

• adequate consumer disclosure information

• low job placement rates

• adequate entrance and exit counseling

• accurate and timely SSCR reporting

• adequate resources committed to default reduction*

• adequate process to ensure accuracy of CDR* (review of Loan Record Detail

Report data at draft and official notification)

Case Management & Oversight Page VI - 1

• any school payments to avoid delinquent loans going into default

• default management plans for institutions undergoing changes in ownership

• compliance with sanction/benefit requirements

• changes in status

* although beneficial to reducing CDRs, not mandatory

For new institutions, reviewers should examine their default management plans.

C. Cohort Default Rate

Schools will receive Cohort Default Rates (CDRs) twice a year: first, as a draft

CDR, and then as an official CDR. The draft CDRs are calculated and mailed to

schools in January/February. The draft process is an opportunity for schools to

review and correct data prior to the calculation of the official CDR. The official

CDRs are calculated and mailed to schools in August/September. The Default

Management Division makes sanction and benefit status decisions based on the

official CDRs and not the draft CDRs. However, a school has limited

opportunities to request an adjustment or appeal its CDR, prior to implementation

of an official action.

1. Formulas Used to Calculate a School’s Official Cohort Default Rate

A CDR is the percentage of a school’s borrowers who enter repayment on certain

FFEL and/or DL program loans during a fiscal year and default or meet other

specified conditions within the fiscal year in which the loans entered repayment

or within the next fiscal year. Two types of formulas are used to calculate a

school’s official CDR:

• Non-Average Rate: For a school with 30 or more borrowers entering

repayment during a fiscal year.

• Average Rate: For a school with 29 or fewer borrowers entering repayment

during a fiscal year that had a CDR calculated for the two previous fiscal

years.

A school with 29 or fewer borrowers entering repayment during a fiscal year that

did not have a CDR calculated for either or both of the two previous fiscal years

will be notified of its unofficial CDR. No sanctions or benefits are associated with

unofficial CDR calculations.

Case Management & Oversight Page VI - 2

D. Sanctions and Benefits for Cohort Default Rates

1. Sanctions Associated with High CDRs (effective 7/1/01)

• Three most recent CDRs of 25.0 percent or greater will result in the loss of

FFEL/DL and Federal Pell Grant Program eligibility. (Schools meeting certain

conditions may retain Pell Grant Program eligibility.)

• Most recent official CDR that is greater than 40.0 percent will result in the loss

of FFEL/DL eligibility.

For both sanctions, the loss of eligibility is for the remainder of the fiscal year in

which the school was notified that it was subject to loss of eligibility and for two

subsequent fiscal years. Loss of eligibility is effective upon notice from the

Default Management Division that the school can no longer participate in these

programs. Schools can continue to participate while certain appeals are pending

in Default Management, but liabilities will be charged if the appeal is not

successful.

In accordance with 34 CFR 668 Subpart M Section 668.198, special institutions

(Historically Black Colleges or Universities as defined in Section 322(2) of the

HEA; Tribally Controlled Community College as defined in Section 2(a)(4) of the

Tribally Controlled Community College Assistance Act of 1978; and Navajo

Community Colleges under the Navajo Community College Act) are exempt from

these sanctions if they meet the exemption criteria. This exemption is due to

expire June 30, 2004. For information on special institutions qualifying for this

exemption, please contact the Default Management adjunct.

2. Benefits Associated with Low CDRs

• Three most recent official CDRs of less than 10.0 percent, the institution may

choose to deliver/disburse loan proceeds in a single installment for single-

term loans and not delay the delivery/disbursement of the first installment for

first-year, first-time borrowers. This benefit is scheduled to expire on

September 30, 2002.

• The most recent CDR that is less than 5 percent, and the institution is an

eligible home institution certifying/originating loans for a study abroad

program, the institution may choose to deliver/disburse loan proceeds in a

single installment and not delay the delivery/disbursement of the first

installment for first-year first-time borrowers.

Case Management & Oversight Page VI - 3

Schools must cease exercising these benefits beginning 30 calendar days after

receiving notice from the Default Management Division of a CDR that causes the

school to no longer meet the established thresholds.

E. Changes in School Status

If it is discovered that an institution changes its status through consolidation,

additional location, becoming free standing, mergers, changes of ownership, or

other means, but no change of affiliation or comments exist in PEPS, nor does

the school have a “P” or “C” rate in PEPS, reviewers should contact their Default

Management adjunct with updated information for the institution. The Default

Management Division will review the information provided and notify reviewers if

a revision to the CDR is necessary. Further, if it can be determined that an

institution may be attempting to avoid sanctions or obtain benefits by

manipulating its CDRs, reviewers should immediately notify their Default

Management adjunct. The Default Management Division will evaluate the

allegation and determine the action(s) to be taken against the school.

References:

Cohort Default Rate Guide

Official Cohort Default Rate for Schools

34 CFR Part 668 Subpart M Sections 668.181 through 668.198; 682.604(b)(5)

Appendices A and B of Subpart M of Part 668

Dear Colleague Letter GEN-01-08 Sample Default Management Plan

http://ifap.ed.gov/dpcletters/gen0108.html

Case Management & Oversight Page VI - 4

Das könnte Ihnen auch gefallen

- Credit InvestigationDokument23 SeitenCredit Investigationdeshmukhprajakta369Noch keine Bewertungen

- 2024 CPA Information Systems & Controls (ISC) Mock Exam AnswersDokument52 Seiten2024 CPA Information Systems & Controls (ISC) Mock Exam AnswerscraigsappletreeNoch keine Bewertungen

- CIS-Client Information Sheet - TEMPLATEDokument15 SeitenCIS-Client Information Sheet - TEMPLATEPolat Muhasebe100% (1)

- Description: Tags: SanctionsorBenefitsDokument2 SeitenDescription: Tags: SanctionsorBenefitsanon-203680Noch keine Bewertungen

- Description: Tags: GlossaryDokument10 SeitenDescription: Tags: Glossaryanon-529179Noch keine Bewertungen

- Description: Tags: GlossaryDokument10 SeitenDescription: Tags: Glossaryanon-590095Noch keine Bewertungen

- Chapter VI. Special Focus On Default Management: Program Review GuideDokument2 SeitenChapter VI. Special Focus On Default Management: Program Review Guideanon-653036Noch keine Bewertungen

- Description: Tags: TypesofChallengesAdjAppealsDokument3 SeitenDescription: Tags: TypesofChallengesAdjAppealsanon-469175Noch keine Bewertungen

- Description: Tags: PRG2001ChapIVDokument93 SeitenDescription: Tags: PRG2001ChapIVanon-971620Noch keine Bewertungen

- PSE-8913 - EPR - Sept2012finalDokument3 SeitenPSE-8913 - EPR - Sept2012finalanon_903394851Noch keine Bewertungen

- Direct Loan Participation: Essential QuestionsDokument6 SeitenDirect Loan Participation: Essential Questionsanon-995558Noch keine Bewertungen

- Description: Tags: FY05Cohortguide2aDokument35 SeitenDescription: Tags: FY05Cohortguide2aanon-1892Noch keine Bewertungen

- Description: Tags: IntoductionDokument9 SeitenDescription: Tags: Intoductionanon-946005Noch keine Bewertungen

- Description: Tags: FY05Cohortguide2aDokument35 SeitenDescription: Tags: FY05Cohortguide2aanon-832451Noch keine Bewertungen

- Description: Tags: GEN0514AttachDokument10 SeitenDescription: Tags: GEN0514Attachanon-88104Noch keine Bewertungen

- City of Miami: Small Business Emergency Loan ProgramDokument5 SeitenCity of Miami: Small Business Emergency Loan Programal_crespoNoch keine Bewertungen

- SubHB59 ChangesDokument9 SeitenSubHB59 ChangesJosephNoch keine Bewertungen

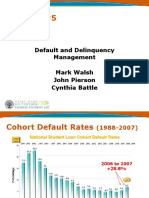

- Session #5: Default and Delinquency Management Mark Walsh John Pierson Cynthia BattleDokument65 SeitenSession #5: Default and Delinquency Management Mark Walsh John Pierson Cynthia BattleWedi TassewNoch keine Bewertungen

- AwardLetter PDFDokument3 SeitenAwardLetter PDFColby PalmerNoch keine Bewertungen

- Chapter II Review Preparation: A. Review Information in ED DatabasesDokument17 SeitenChapter II Review Preparation: A. Review Information in ED Databasesanon-805883Noch keine Bewertungen

- Description: Tags: 0623HERAOPGradPLUSAttachBRevAwardingDokument3 SeitenDescription: Tags: 0623HERAOPGradPLUSAttachBRevAwardinganon-477319Noch keine Bewertungen

- CFPB Upstart No Action Letter RequestDokument14 SeitenCFPB Upstart No Action Letter RequestCrowdfundInsiderNoch keine Bewertungen

- I DR Fact Sheet FinalDokument4 SeitenI DR Fact Sheet FinalWDIV/ClickOnDetroitNoch keine Bewertungen

- Description: Tags: Chapter2pnt2HowSchoolsGetRatesandLoanDataDokument3 SeitenDescription: Tags: Chapter2pnt2HowSchoolsGetRatesandLoanDataanon-45539Noch keine Bewertungen

- 2008 PT Employee SummaryDokument5 Seiten2008 PT Employee Summarydominique babisNoch keine Bewertungen

- Credit Collection ProcsDokument8 SeitenCredit Collection ProcsKaie AcadsNoch keine Bewertungen

- Education Savings AccountsDokument6 SeitenEducation Savings AccountsGazetteonlineNoch keine Bewertungen

- Description: Tags: Chapter4pnt8ParticipationRateIndexAppealDokument10 SeitenDescription: Tags: Chapter4pnt8ParticipationRateIndexAppealanon-185497Noch keine Bewertungen

- Description: Tags: Sec4-4revDokument26 SeitenDescription: Tags: Sec4-4revanon-214358Noch keine Bewertungen

- Michigan School Auditing Manual FINAL 654527 7Dokument193 SeitenMichigan School Auditing Manual FINAL 654527 7dineshalertNoch keine Bewertungen

- Description: Tags: 19992000DirectLoanLoanOrigChngRecsDokument26 SeitenDescription: Tags: 19992000DirectLoanLoanOrigChngRecsanon-394243Noch keine Bewertungen

- Description: Tags: 050128-AttDokument4 SeitenDescription: Tags: 050128-Attanon-24469Noch keine Bewertungen

- Credit AdministrationDokument5 SeitenCredit AdministrationCarl AbruquahNoch keine Bewertungen

- 632a90dfd242c221d1ccf712 - HCIN Qualified Education Plan (2022-23)Dokument7 Seiten632a90dfd242c221d1ccf712 - HCIN Qualified Education Plan (2022-23)yonas abebeNoch keine Bewertungen

- Description: Tags: InfoschlDokument142 SeitenDescription: Tags: Infoschlanon-331866Noch keine Bewertungen

- Description: Tags: ReceivingCDRsDokument1 SeiteDescription: Tags: ReceivingCDRsanon-29994Noch keine Bewertungen

- Description: Tags: Chapter4pnt8ParticipationRateIndexAppealDokument10 SeitenDescription: Tags: Chapter4pnt8ParticipationRateIndexAppealanon-474021Noch keine Bewertungen

- Employee Loans: Purpose of The PolicyDokument19 SeitenEmployee Loans: Purpose of The PolicyomarelzainNoch keine Bewertungen

- Description: Tags: DefaultPreventionMgmtALLDokument32 SeitenDescription: Tags: DefaultPreventionMgmtALLanon-398275Noch keine Bewertungen

- Questa Education Foundation Loan Terms and Conditions and Payment NoteDokument6 SeitenQuesta Education Foundation Loan Terms and Conditions and Payment NoteInstitute for Higher Education PolicyNoch keine Bewertungen

- Description: Tags: 0999chapter4Dokument26 SeitenDescription: Tags: 0999chapter4anon-515913Noch keine Bewertungen

- HERO One PagerDokument1 SeiteHERO One PagerSenator Mike LeeNoch keine Bewertungen

- Description: Tags: 0304Vol8Ch1eligibleschoolDokument7 SeitenDescription: Tags: 0304Vol8Ch1eligibleschoolanon-321298Noch keine Bewertungen

- A) Studies in India. (Indicative List)Dokument4 SeitenA) Studies in India. (Indicative List)PinazNoch keine Bewertungen

- Monash College Students Should Not Use This Form.: ADM-01 V03/11Dokument3 SeitenMonash College Students Should Not Use This Form.: ADM-01 V03/11Nisha RoseNoch keine Bewertungen

- Gainful Employment Final Rule Executive Summary 11-6-2014Dokument5 SeitenGainful Employment Final Rule Executive Summary 11-6-2014dbandlerNoch keine Bewertungen

- 2021 22 Fee PolicyDokument10 Seiten2021 22 Fee PolicyGeleta AmanNoch keine Bewertungen

- 2011-2012 CalendarDokument632 Seiten2011-2012 CalendarMichael SartyNoch keine Bewertungen

- Comprehensive Loan Policy of A Large Western Credit UnionDokument9 SeitenComprehensive Loan Policy of A Large Western Credit UnionNauman MalikNoch keine Bewertungen

- Indian Education Sector Outlook 2013 by Fitch Rating AgencyDokument5 SeitenIndian Education Sector Outlook 2013 by Fitch Rating AgencykanabaramitNoch keine Bewertungen

- Session #6: School Compliance Update Doug Laine Linda HendersonDokument65 SeitenSession #6: School Compliance Update Doug Laine Linda Hendersonanon-991602Noch keine Bewertungen

- 14 Credit PolicyDokument48 Seiten14 Credit Policynallafirdos786Noch keine Bewertungen

- EDUCATIONAL LOANS AT SBH EdditedDokument103 SeitenEDUCATIONAL LOANS AT SBH EdditedravikumarreddytNoch keine Bewertungen

- Loan Modification Program InfoDokument3 SeitenLoan Modification Program InfoDeborah Tarpley HicksNoch keine Bewertungen

- Description: Tags: PRG2001ChaptIDokument7 SeitenDescription: Tags: PRG2001ChaptIanon-938410Noch keine Bewertungen

- MC Applicant GuideDokument10 SeitenMC Applicant GuideJayoNoch keine Bewertungen

- FINANCIAL RESPONSIBILITIES Promissory Note - Tabor OnlineDokument1 SeiteFINANCIAL RESPONSIBILITIES Promissory Note - Tabor OnlineKimberly GutierrezNoch keine Bewertungen

- SB1 Year 4 AmendmentDokument5 SeitenSB1 Year 4 AmendmentCommonwealth FoundationNoch keine Bewertungen

- Corporate Finance Comprehensive ExamFINALFEB2021Dokument4 SeitenCorporate Finance Comprehensive ExamFINALFEB2021Sam CleonNoch keine Bewertungen

- Oral Roberts University Award Terms and Conditions - Page 1 of 4Dokument4 SeitenOral Roberts University Award Terms and Conditions - Page 1 of 4Emmanuel KikugawaNoch keine Bewertungen

- Guide to Modern Personal Finance: For Students and Young Adults: Guide to Modern Personal Finance, #1Von EverandGuide to Modern Personal Finance: For Students and Young Adults: Guide to Modern Personal Finance, #1Noch keine Bewertungen

- Boy Scouts of The Philippines vs. Commission On AuditDokument13 SeitenBoy Scouts of The Philippines vs. Commission On AuditWendy PeñafielNoch keine Bewertungen

- The Science of Cop Watching Volume 008Dokument433 SeitenThe Science of Cop Watching Volume 008fuckoffanddie23579Noch keine Bewertungen

- Columbus Stainless Product CatalogueDokument14 SeitenColumbus Stainless Product CatalogueRPNoch keine Bewertungen

- SDS Salisbury Rub Out TowellettesDokument8 SeitenSDS Salisbury Rub Out TowellettesMarco Bonilla MartínezNoch keine Bewertungen

- MSI BidDokument7 SeitenMSI BidAshwin MNoch keine Bewertungen

- Foods: BY Gohar Abid Fatima Khalil Omer Jan Shaukat Shahbano Arshad Mehr NasirDokument13 SeitenFoods: BY Gohar Abid Fatima Khalil Omer Jan Shaukat Shahbano Arshad Mehr NasirGohar AbidNoch keine Bewertungen

- Veegum & XanthanDokument27 SeitenVeegum & XanthanConcept77Noch keine Bewertungen

- Roy Colby - A Communese-English DictionaryDokument156 SeitenRoy Colby - A Communese-English DictionaryTim Brown100% (1)

- UC Express 3.0 Softphone GuideDokument4 SeitenUC Express 3.0 Softphone Guideb1naryb0yNoch keine Bewertungen

- Critical Analysis of Anti-Competitive AgreementDokument13 SeitenCritical Analysis of Anti-Competitive AgreementAddyAdityaLadha100% (1)

- Ramiro, Lorren - Money MarketsDokument4 SeitenRamiro, Lorren - Money Marketslorren ramiroNoch keine Bewertungen

- The Bill of Rights in Real Life Teacher GuideDokument21 SeitenThe Bill of Rights in Real Life Teacher GuideRomen Elijah HuertasNoch keine Bewertungen

- Article 1419 DigestDokument1 SeiteArticle 1419 DigestCheng AyaNoch keine Bewertungen

- Aristotle PDFDokument6 SeitenAristotle PDFAnonymous p5jZCn100% (1)

- Diploma in Taxation: Pakistan Tax Bar AssociationDokument6 SeitenDiploma in Taxation: Pakistan Tax Bar AssociationAbdul wahabNoch keine Bewertungen

- Form ID 1A Copy 2Dokument3 SeitenForm ID 1A Copy 2Paul CNoch keine Bewertungen

- Petron Vs CaberteDokument2 SeitenPetron Vs CabertejohneurickNoch keine Bewertungen

- Part 1 Essay On Death PenaltyDokument2 SeitenPart 1 Essay On Death PenaltyLucretia MoruziNoch keine Bewertungen

- Intolerance and Cultures of Reception in Imtiaz Dharker Ist DraftDokument13 SeitenIntolerance and Cultures of Reception in Imtiaz Dharker Ist Draftveera malleswariNoch keine Bewertungen

- Corporate Advisory Service Integra GroupDokument24 SeitenCorporate Advisory Service Integra GroupJimmy InterfaxNoch keine Bewertungen

- UMIDIGI Power 3 - Android 10 - Android Development and HackingDokument7 SeitenUMIDIGI Power 3 - Android 10 - Android Development and HackingAahsan Iqbal احسن اقبالNoch keine Bewertungen

- Yamaha Digital Multi-Function Command Link Tachometer, Square 6y8-8350t-01-00 EbayDokument1 SeiteYamaha Digital Multi-Function Command Link Tachometer, Square 6y8-8350t-01-00 EbayYoises SolisNoch keine Bewertungen

- Intellectual CapitalDokument3 SeitenIntellectual CapitalMd Mehedi HasanNoch keine Bewertungen

- Rutherford County BallotsDokument8 SeitenRutherford County BallotsUSA TODAY NetworkNoch keine Bewertungen

- Conroy InformationDokument25 SeitenConroy InformationAsbury Park PressNoch keine Bewertungen

- Study Note 3, Page 114-142Dokument29 SeitenStudy Note 3, Page 114-142s4sahithNoch keine Bewertungen

- Local Development Investment Program, CY 2012 To 2014Dokument61 SeitenLocal Development Investment Program, CY 2012 To 2014Lgu Leganes100% (21)

- Prakas On Accreditation of Professional Accounting Firm Providing... EnglishDokument12 SeitenPrakas On Accreditation of Professional Accounting Firm Providing... EnglishChou ChantraNoch keine Bewertungen