Beruflich Dokumente

Kultur Dokumente

2008B (Q)

Hochgeladen von

167xiaoOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2008B (Q)

Hochgeladen von

167xiaoCopyright:

Verfügbare Formate

This paper is not to be removed from the Examination Halls

UNIVERSITY OF LONDON

279 0059 ZB

BSc degrees and Diplomas for Graduates in Economics, Management, Finance and the Social Sciences, the Diploma in Economics and Access Route for Students in the External Programme

Financial Management Thursday, 22nd May 2008 : 2.30pm to 5.30pm

Candidates should answer FOUR of the following NINE questions: TWO from Section A, ONE from Section B and ONE further question from either section. All questions carry equal marks. Workings should be submitted for all questions requiring calculations. Any necessary assumptions introduced in answering a question are to be stated. Extracts from compound interest tables are given at the end of Section A of this paper. 8-column accounting paper is provided at the end of this question paper. If used, it must be detached and fastened securely inside the answer book. A calculator may be used when answering questions on this paper and it must comply in all respects with the specification given with your Admission Notice. The make and type of machine must be clearly stated on the front cover of the answer book.

University of London UL08/078

D02

PLEASE TURN OVER Page 1 of 7

SECTION A Answer two questions from this section and not more than one further question. (You are reminded that four questions in total are to be attempted with at least one from Section B.)

1.

Pembs plc produces and sells a line of goods to small and medium sized retailing companies. Pembs plc has just appointed a new financial director who is reviewing the cash inflow procedures. These procedures include the vetting process for new and existing customers. At present the sales section computes values for each of the four following ratios for each company that it deals with and compares them against annually agreed benchmarks. The benchmarks have been derived from industry averages for the four ratios. In Pembs present system a subjective assessment is made of each ratio against its benchmark. Generally, past experience has been to reject a company if it fails to achieve 2 or more of the benchmarks. The four ratios and their benchmarks used are: Benchmark 2x (minimum) 5% (minimum) 60 days (maximum) 30% (maximum)

Current ratio Return on Long-Term Capital Employed Payables period* Long-Term Debt / Long-Term Capital Employed (*Using cost of sales as denominator.)

The finance director is considering introducing the vetting process that was used in his previous company. The sales section there used a prediction model together with credit score cut-offs, as set out below. The prediction model had been purchased from a firm of financial consultants who had developed it using data from all publicly quoted companies. The model is as follows: Y = 2.1x1 + 5.7x2 + 0.13x3 Where Y = Credit score x1 = Dividend payout ratio (as a decimal) x2 = Ratio of Current Liabilities / Total Assets (as a decimal) x3 = Current Ratio

Credit Score Cut-offs: If Y value is 2.0 or less a very high bankruptcy risk Reject company. If Y value is above 2.0 and below 3.0 Accept company but monitor carefully. If Y value is 3.0 and above Accept company.

(question continues on next page)

UL08/078

D02

Page 2 of 7

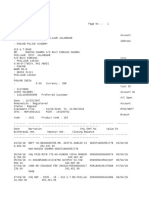

The following are recent simplified sets of accounts for three customers of Pembs, A, B and C. SUMMARISED BALANCE SHEETS NonCurrent Assets (net) Current Assets Inventory Trade receivables Bank Less Current Liabilities Trade payables Bank overdraft Loan Net Working Capital Less Non-Current Liabilities Long Term Loan Represented by: Ordinary Share Capital Retained Earnings Items From Income Statements Revenue Cost of sales Profit after taxation Dividend A 000 3500 B 000 100 C 000 850

800 50 150 1000 138 12 150 850 4350

900 100 10 1010 300 80 120 500 510 610

400 20 250 670 200 200 470 1320

1200 3150 2250 900 400 110

100 510 400 470

450 870

3150

510

870

2000 1200 100 50

1800 1260 60 50

1600 960 110 40

Required: (a) For each of the three companies A, B and C calculate the four ratios used by Pembs in its credit evaluation. (8 marks) For each of the three companies calculate their Y credit score. (9 marks)

(b) (c)

Using Pembs ratio benchmarks, and the criteria for ranking the Y credit scores, describe and discuss the results you have obtained under the two methods. Briefly use your results to evaluate the two ranking methods that underpin your results. (8 marks)

UL08/078

D02

Page 3 of 7

2.

The directors of Dyfed plc are considering building a new factory in Siberia to manufacture winter clothing. Over the past six months the company has spent 300,000 on researching the proposal and in obtaining the necessary licenses to build the factory and manufacture the clothing. It will cost 32million to build the factory and have it ready for operations. It will take a year before the factory is ready for operations and only then will the 32million be paid over. The factory will start operations on completion of its construction at the beginning of the second year and estimates of the likely annual net cash inflows, treated as received or paid at year-ends, and the probability of their occurrence are as follows: Estimated Net Cash inflows (million) Year 2 9 10 12 10 13 16 14 18 20 . Probability of occurrence 0.2 0.4 0.4 0.3 0.4 0.3 0.1 0.5 0.4

Year 3

Year 4

At the end of year 4, Dyfed expect to have to hand over the factory to the local council for nil reward. The cash flow estimates for each year are independent of each other. The company has a cost of capital of 12%. The riskless rate of interest is 8%. Required: (a) (b) (c) Calculate the expected net present value (ENPV) of the investment proposal and indicate whether or not it is worthwhile. Give reasons. (8 marks) Calculate the net present values of the worst and best possible outcomes and the probabilities of their occurrence. (6 marks) From the above figures the standard deviation of the net present values for the investment proposal has been calculated as 2.5million. You learn that a second proposal to build in China is being considered as an alternative. The ENPV and standard deviation of the Chinese proposal are 1.2million and 3.4million respectively and the net present values of the best and worst possible outcomes are 7.0 million and -7.0 million respectively, with probabilities of occurrence of 0.10 and 0.05 respectively. Using this information and the ENPV calculated in (a) above, select with reasons, whether Dyfed should invest in Siberia or China. Give your reasons. (6 marks) Now assume Dyfed has sufficient funds to invest in both projects. The partial correlation coefficient of the returns from the Siberian and Chinese projects is -0.3. Show which is the best investment for Dyfed to undertake, either invest in Siberia or China seperately or in both projects at the same time. Give your reasons. (5 marks)

(d)

UL08/078

D02

Page 4 of 7

3.

Powys Steam Company is a bulk-carrier shipping business registered in Germany, the currency of which is the euro. It has noticed the increasing international demand for grain and wishes to exploit this feature. It has agreed to buy a bulk-carrier from a British shipyard for 30.5million. The carrier is nearing completion as it was ordered by another company which has now gone into liquidation. Certain specification changes will be necessary first, and delivery and full payment will be made in six months time. Powys is considering the following possibilites in order to deal with the foreign exchange risk associated with the payment: (1) A purchase of euros futures contracts that will be sold in six months time to close the companys positon. The relevant futures contract size is 125,000. The tick value is 12.50 and one tick is 0.01 cent per . Euros futures contracts are currently priced at 1= 1.305. The current spot rate is 1.33 per 1. Assume that in six months time the spot rate will have moved to 1= 1.351 and the futures contract price to 1= 1.3209. A purchase of a euros forward contract. At present the six months forward rate is at a discount of 0.015 per . A money market hedge through the use of banks in Germany and UK. At present the annual interest rates are 2% and 4.5% in Germany and UK respectively. The company will have to pay a 0.1% administration charge on the sterling value to the bank.

(2) (3)

Required: (a) Calculate the total euro cost for each of the three hedging options under consideration. (13 marks) Calculate the hedge efficiency ratio if the futures contract option is taken. (4 marks) Describe the main features of each of the three methods used above to hedge the currency risk. Evaluate the three alternatives and recommed, in your view, the best method Powys Steam should use to make its payment. (8 marks)

(b)

(c)

UL08/078

D02

Page 5 of 7

4.

Gogol plc is an all equity company with 90,000,000 1 shares currently valued at 3.00 each (ex div). The company currently generates an operating income of 37,800,000 per annum, which has remained constant for a number of years, and all of which is shared equally between the investors as a dividend payment. The company has an opportunity to invest in a new project that is expected to generate an income of 3,024,000 per annum into perpetuity. Investment in the project is estimated at 12,600,000 which is in the same risk class as the companys current projects. Gogol plc is considering raising funds for the new investment either through a retained earnings programme, or by raising new equity in the external market. In the former case, the dividend payment for the current year will be reduced by 12,600,000. In the latter case, while the dividend level will be retained, the company will make a rights issue of one for five at a discounted price of 70 pence each. Gogol will raise the new funds immediately within the ex-div period either by the rights issue or using its retained earnings. Jhumpa owns 90,000 shares in Gogol plc. As a pensioner, she relies extensively on her investment in Gogol plc. The new investment has caused Jhumpa great concern particularly if the company decides to opt for the retained earnings proposal. This is because, as she has always feared, her annual dividend level will be reduced. Required: Notes: For parts (a) to (d) below only, assume that the markets are perfect and complete. There are no transaction costs or taxes to pay and directors expectations as to future results will be successfully communicated to the shareholders once the new share issue has taken place. (a) i. ii. Calculate the total market value, dividend per share and the cost of equity before the new investment is undertaken. Determine Jhumpas annual income level from Gogol plc and the value of her shares before the investment is announced and started. (5 marks)

(b)

Assuming that the company opts to raise the funds for the investment opportunity by retaining earnings: i. ii. Calculate the new share price, and, show Jhumpas overall investment and cashflow profile under this approach. (6 marks)

(c)

Assuming that the company opts to raise the funds for the investment opportunity through a rights issue in which Jhumpa participates fully and that the issue is successful: i. ii. Calculate total number of shares in the firm and the new share price, and, show Jhumpas overall investment and cashflow profile under this approach. (4 marks) (question continues on next page)

UL08/078

D02

Page 6 of 7

(d)

Jhumpa decides that she is not happy to accept the dividend reduction associated with the retained financing option in (b) ii. above. Explain to her, how she can make up for that loss of income, and show her that her overall position post-new investment will still outstrip her current position. (4 marks) Briefly comment on the implications of your results in (b), (c) and (d) above for the firms dividend policy and discuss factors that may influence Jhumpas preference as to which method the company should use to raise the new funds. (6 marks) PRESENT VALUE TABLES Year 1 2 3 4 5 Interest Rates 8% 0.9259 0.8573 0.7938 0.7350 0.6806

(e)

12% 0.8929 0.7972 0.7118 0.6355 0.5674

SECTION B Answer one question from this section and not more than one further question. (You are reminded that four questions in total are to be attempted with at least two from Section A.)

5.

Analysts and stock brokers will often quote a value for a public companys when considering the company shares as a potential investment. Describe what this value is and discuss its relevance for a small private investor and for a large institutional investor. A public company wishes to raise further capital in order to expand. Describe three possible sources of funds and discuss the pros and cons of each of the three either as the sole source or as a part of a combination of sources. Describe the key elements of the financial planning process for a company. Describe the components of the working capital cycle. Describe management techniques that can be used to influence the components of the working capital cycle. Comment on whether or not the results of the changes to the elements of the cycle will necessarily be for the overall corporate good. Describe and discuss the rationales and motives that are presented as explaining merger and takeover activity.

6.

7. 8.

9.

END OF PAPER

UL08/078

D02

Page 7 of 7

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Larcade Arcana LT 2.3 Module 2 The Development of World PoliticsDokument2 SeitenLarcade Arcana LT 2.3 Module 2 The Development of World PoliticsLarcade ArcanaNoch keine Bewertungen

- Job Satisfaction and MoraleDokument21 SeitenJob Satisfaction and MoraleChannpreet ChanniNoch keine Bewertungen

- Islamic Modes of Financing: Diminishing MusharakahDokument40 SeitenIslamic Modes of Financing: Diminishing MusharakahFaizan Ch0% (1)

- Operating ExposureDokument33 SeitenOperating ExposureAnkit GoelNoch keine Bewertungen

- Case StudyDokument17 SeitenCase Studysubakarthi0% (1)

- Afisco Insurance Corp. v. CIRDokument6 SeitenAfisco Insurance Corp. v. CIRJB GuevarraNoch keine Bewertungen

- 1538139921616Dokument6 Seiten1538139921616Hena SharmaNoch keine Bewertungen

- Procedure For Revalue The Fixed AssetsDokument5 SeitenProcedure For Revalue The Fixed AssetsjsphdvdNoch keine Bewertungen

- Characteristics of State Monopoly Capitalism in The USSRDokument4 SeitenCharacteristics of State Monopoly Capitalism in The USSRΠορφυρογήςNoch keine Bewertungen

- L01B Topic 2Dokument39 SeitenL01B Topic 2Emjes GianoNoch keine Bewertungen

- CFA二级 财务报表 习题 PDFDokument272 SeitenCFA二级 财务报表 习题 PDFNGOC NHINoch keine Bewertungen

- Secret of Successful Traders - Sagar NandiDokument34 SeitenSecret of Successful Traders - Sagar NandiSagar Nandi100% (1)

- Chapter 6 CostDokument144 SeitenChapter 6 CostMaria LiNoch keine Bewertungen

- 10 CIR V CitytrustDokument1 Seite10 CIR V CitytrustAnn QuebecNoch keine Bewertungen

- Dodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033Dokument1 SeiteDodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033yamanura hNoch keine Bewertungen

- UCD2F1209Dokument17 SeitenUCD2F1209sharvin05Noch keine Bewertungen

- K. Marx, F. Engels - The Communist Manifesto PDFDokument77 SeitenK. Marx, F. Engels - The Communist Manifesto PDFraghav vaid0% (1)

- Individual and Group Incentive PlansDokument47 SeitenIndividual and Group Incentive Plansankita78100% (4)

- Somaliland Food and Water Security StrategyDokument58 SeitenSomaliland Food and Water Security StrategyMohamed AliNoch keine Bewertungen

- A Presentation On Sales Forecasting: by Prof. (DR.) J. R. DasDokument20 SeitenA Presentation On Sales Forecasting: by Prof. (DR.) J. R. DasShubrojyoti ChowdhuryNoch keine Bewertungen

- Question Bank Macro EconomicsDokument4 SeitenQuestion Bank Macro EconomicsSalim SharifuNoch keine Bewertungen

- Code of Business Ethics and ConductDokument7 SeitenCode of Business Ethics and ConductShane NaidooNoch keine Bewertungen

- Module 2-APPLIED ECONDokument5 SeitenModule 2-APPLIED ECONMae EnteroNoch keine Bewertungen

- Ged105 MRR1Dokument3 SeitenGed105 MRR1Cy100% (1)

- Cera Sanitaryware - CRISIL - Aug 2014Dokument32 SeitenCera Sanitaryware - CRISIL - Aug 2014vishmittNoch keine Bewertungen

- Pfea 1Dokument1 SeitePfea 1Von Andrei MedinaNoch keine Bewertungen

- Inv TG B1 88173907 101003789746 January 2023 - 1 PDFDokument4 SeitenInv TG B1 88173907 101003789746 January 2023 - 1 PDFVara Prasad dasariNoch keine Bewertungen

- Why Blue-Collar Workers Quit Their JobDokument4 SeitenWhy Blue-Collar Workers Quit Their Jobsiva csNoch keine Bewertungen

- Practice 4a EPS & Dilutive EPSDokument2 SeitenPractice 4a EPS & Dilutive EPSParal Fabio MikhaNoch keine Bewertungen

- Type YZ - FLO - 251123Dokument5 SeitenType YZ - FLO - 251123Oky Arnol SunjayaNoch keine Bewertungen