Beruflich Dokumente

Kultur Dokumente

Gas Report 2012: Northwest Gasoline Consumption Makes A Modest Decline

Hochgeladen von

Statesman JournalOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Gas Report 2012: Northwest Gasoline Consumption Makes A Modest Decline

Hochgeladen von

Statesman JournalCopyright:

Verfügbare Formate

Shifting Into Reverse

Northwest gasoline consumption makes a modest decline

Clark Williams-Derry, Research Director Alex Broner and Zachary Howard, Research Interns August 2012

Executive Summary

High prices are taking a bite out of northwesterners appetite for gasoline. Tallying up all vehicle travel on state, county, and local roads, residents of Washington and Oregon are on track to burn less gasoline in their cars and trucks this year than at any time since 1996less even than in 2008, when gas prices spiked and the economy cratered.1 (See Figure 1.) At least for the moment, the plateau in gas consumption that began in the Figure 1. Annual gasoline late 1990s has turned into a gentle downward slide. consumption in Washington and Measured per person, though, northwesterners have Oregon has fallen from its 2002 peak. aggressively reduced their use of motor fuel. Last year, per Billions of Gallons capita combustion of gasoline in Oregon fell to its lowest 4.0 level since 1962back when a gallon of gasoline cost 31 2 Similarly, per person gas consumption in Washington cents. fell to its lowest level since 1965. Early trends suggest that per capita consumption in the two states may be headed for 3.5 a drop of as much as 2 percent in 2012. Two concurrent trends have spurred the reductions in gasoline consumption: people are driving less, and vehicles 3.0 Gasoline have become more efficient. Of the two, declines in driving particularly among northwesterners under the age of consumption in OR & WA 35have made the greater impact. Looking to the future, however, gains in vehicle efficiency, combined with high 2000 2010 1990 and volatile gas prices, demographic shifts, and a range of social and technological trends, all point towards continued declines in gasoline use in the Pacific Northwest.

Sightline Report

Shifting Into Reverse

August 2012

A fall in gasoline consumption is good news for the region in many ways. International oil markets have strapped Northwest consumers into a gut-tightening roller coaster ride of volatile price swings. The regions petroleum habit has contributed both to local pollution problems and to global climate change, while draining some $127 billion out of the two states economies over the last decadeincluding a record $14.6 billion in Washington and $6.9 billion in Oregon in 2011.3 Simultaneous declines in per-capita driving and in gas tax revenue may mean that the region doesnt need, and cant afford, the expensive highway construction ambitions of the regions transportation agencies.

Detailed Findings

During the average week in 2011, Washington residents consumed 7.3 gallons of gasoline per person. In Oregon, weekly gas consumption totaled 7.1 gallons per person. In both states, gas consumption per person fell to its lowest level in nearly 50 years. Early data suggests that gasoline consumption, measured per person, will drop even farther in 2012. (See Figure 2.) In fact, gas consumption in Oregon may dip below one gallon per person per day in 2012 compared with a habit of more than a gallon and a half per person in 1978, the peak year for personal gas consumption. The rapid decline in per capita consumption has begun to reduce the regions total consumption of gasoline. Motor fuel use in the Pacific Northwest crested in 2002, and stayed on a bumpy plateau through 2007. But after gas prices spiked in 2008, highway fuel use began a modest but perceptible downward trend. In totaland despite population increasesresidents of Washington and Oregon consumed about 4 percent less total gasoline in 2011 than they did in 2002. Its a modest dip, yet still a significant reversal of what, for many years, seemed like an endless expanding appetite for motor fuel. The fall in fuel consumption can be traced to two causes: reductions in per capita driving, and improvements in vehicle efficiency. Most of the drop in motor fuel consumption resulted from reduced driving. On state-owned roads in Oregon and Washington, annual vehicle mileage per capita has fallen by 13 percent over the last decade. (See Figure 3.) The decline has been gradual enough that it has gone largely unnoticed, yet it has added up to a major change in driving habits: its as if every driver left their car in the garage for a month and a half each year. These per-capita declines have offset

Figure 2. Northwest gas consumption per person is at its lowest level in nearly 50 years.

Gallons

10 8 6 4 2

Weekly OR & WA gas consumption, per person

1950 1960 1970 1980 1990 2000 2010

Figure 3. Northwesterners have reduced per capita driving by 13 percent since 2002.

Thousands of Miles

5 4 3 2 1

Per capita vehicle travel, state-owned roads in OR & WA

1990 2000 2010

1980

Sightline Report

Shifting Into Reverse

August 2012

population growth, leading to a virtual flat-lining of total Figure 4. On the Northwests statedriving on state roads for most of the last decade. (See owned roads, vehicle travel plateaued a decade ago. Figure 4.) Young Americans have decreased their driving the most. Billions of Miles In 2009, drivers between the age of 16 and 34 drove 23 50 percent less than their same-aged counterparts in 2001.4 Some of this trend can be traced to high unemployment 40 rates. But even among younger Americans with jobs, perperson driving fell by 16 percent.5 30 A host of social and technological trends have contributed to the drop in driving among younger 20 Americans. For many high school students, drivers education classes have become less convenient and more Total vehicle expensive over the last decade, while stringent licensing 10 travel, state-owned roads in OR & WA lawsincluding restrictions on when and with whom young drivers may travelhave crimped drivings allure. 2000 2010 1980 1990 At the same time, advances in Internet and mobile technologies increasingly make virtual mobility a low-cost substitute for the car. These same advances have boosted the convenience and utility of transit trips: even among Figure 5. Gains In real-world vehicle households earning $70,000 per year or more, young people efficiency have slowed. doubled their use of transit between 2001 and 2009.6 MPG Gains in vehicle efficiency play a surprisingly small role 20 in recent fuel trends. Despite stricter federal fuel economy standards and renewed consumer interest in higher-efficiency vehicles, the real-world efficiency of the nations vehicle 15 fleet improved by only a few percentage points over the last decade, and has remained virtually unchanged since 2008. (See Figure 5.)7 This suggests that gains in average vehicle 10 efficiency have accounted for less than 13 percent of the reduction in per capita gasoline consumption since 2002. Efficiency gains have been hampered by two automotive 5 Avg. real-world MPG of US trends: increased vehicle longevity, and a slowdown of vehicle eet sales of new vehicles. On average, todays cars and light trucks are nearly 11 years old, and vehicle age continues to 2010 2000 1970 1980 1990 increase: decades of improved craftsmanship have increased the lifespan of cars and trucks, even as vehicle sales slowed after the great recession.8 It will take several more years for sales of new, more efficient vehicles to penetrate deeply enough into the vehicle fleet to have a sizable impact on gasoline consumption. Much of the impetus for reduced driving can be traced to simple economics. Following more than a decade of price stability, the cost of a gallon of gasoline hit an all-time, inflation-adjusted low in 1999. But since then, gas prices have risen steeply and unpredictablyand the regions drivers have trimmed back on driving in response. (See Figure 6.)

Sightline Report

Shifting Into Reverse

August 2012

Figure 6. As gas prices climbed, northwesterners used less fuel.

Avg. cost per gallon of gas

$3

$2

Rising gas consumption

$1

Stable or falling gas consumption

1990

2000

2010

The Future: Further Declines?

Demographic, economic, and political trends point towards continued declines in gasoline consumption in coming years. The recent tightening of federal vehicle fuel economy will eventually yield major efficiency gains in the vehicle fleet. The most recent projection by the Washington Transportation Revenue Forecast Council, for example, predicts that the average realworld fuel economy of the passenger vehicle fleet will rise to 26.7 miles per gallon by 2027, up from 20.5 mpg todayleading to a 23 percent decline in fuel consumption per mile driven.9 Demographic trends provide good reason to believe that miles driven per capita will continue to fall. Once drivers hit the age of 45, they drive less.10 (See Figure 7.) The youngest baby boomers turn 47 this year, foretelling a steady decline in driving among the particularly large boomer generation. And on the boomers heelsand currently making their way through peak driving agessits the much smaller baby bust generation, born during a trough in birth rates in the late 1960s through early 1980s. The combination of a large, aging boomer population that is leaving their peak driving years and a smaller population of busters reaching peak driving ages portends a 6 percent decline in per capita driving through 2030, even if age-specific driving rates remain unchanged. Declines in the share of people employed or seeking work will likely trim driving as well. The decades-long rise in vehicle miles traveled (VMT) per capita coincided with an increase in the share of the US population in the labor force, particularly as growing numbers of women obtained paid work. But as women have moved closer to parity with men in employment rates, theres less potential for growth in the labor force. In fact, the Bureau of Labor Statistics projects that as the population ages, the share of people working or seeking work will fall by 6.5 percent through 2030a decline that can be expected to reduce per capita driving as well.11

Sightline Report

Shifting Into Reverse

August 2012

Figure 7. Driving peaks in middle age, then falls through the rest of life.

15

Thousands of Miles

10

5

60 64 16 17 65 69 40 44 45 49 18 24 55 59 35 39 25 29 50 54 75 79 80 84 30 34

Annual vehicle travel by age

Finally, the gas price spikes over the last few years may have lingering effects on fuel consumption. Transportation economists find that, when faced with short-term increases in the cost of gasoline, drivers make modest changes to reduce consumption: chaining together trips, choosing efficient vehicles when more than one is available, and even forgoing some trips. But sustained price increases lead some consumers to make more fundamental, long-term changessuch as purchasing more efficient vehicles, changing jobs, or moving closer to work or shopping destinations. On net, these long-run changes have two to three times as much impact as the short-term ones.12 So unless fuel prices quickly fall from their current levels, recent fuel price increases will continue to reduce gas consumption for several years, as drivers make long-term lifestyle adjustments to reduce their exposure to high gas prices. Given all of the trends that have the potential to reduce future motor fuel use, it is little wonder that state departments of transportation now forecast a long-term decline in total gasoline consumption in the region.13 Declining gas tax revenues will exacerbate a full-blown crisis in highway finance. Oregon announced last fall that falling gas tax revenue, coupled with increased debt payments and other economic trends, will force the states transportation department to slash its road construction budget in half by 2015.14 Washingtons finances are in worse shape: the agency currently projects that payments on projects that have already been completed will sap 70 percent of all state gas tax revenue by 2016leaving precious little money left for new roads, let alone maintenance.15 The regions policy makers are now considering paying for new highway projects by increasing fuel taxes, by expanding the use of tolling, or both. But by raising the cost of driving, these steps would likely eat further into both vehicle travel and fuel

85 +

Sightline Report

Shifting Into Reverse

August 2012

sales. Researchers from Harvard University and Resources for the Future recently found that increases in gas taxes are more likely to reduce gas consumption than comparable increases in oil priceslargely because gas taxes send a consistent price signal, while the volatility of oil prices sends mixed signals.16 Similarly, Washingtons recent experiences with tolling suggest that driverseven many from high-income householdsare reluctant to pay tolls when there are nearby toll-free alternatives, and may respond to road tolling by selecting different routes or destinations, or by forgoing some trips.17 In short, declining gas consumption and flat-lining traffic volumes create a major crisis for transportation agencies in Oregon and Washington. Flat or declining traffic volumes in many parts of the region call into question the need for major road expansions; flat or declining gas tax revenue calls into question the states ability to pay for those expansions; and steps to raise additional revenue from drivers are likely to further erode the demand for vehicle travel. These trends all call for a comprehensive and public re-evaluation of the costs, benefits, and long-term financing plans for major highway expansions in the region.

About the Author

Clark Williams-Derry directs research and outreach for Sightline Institute. Alex Broner and Zachary Howard are research interns. Sightline staff members Pam MacRae, Mieko Van Kirk, Eric Hess, and Eric de Place provided valuable research and editorial assistance. Design assistance by Nicole Bernard. Charts by Devin Porter. Sightline Institute is a not-for-profit research and communication centera think tankbased in Seattle. Sightlines mission is to make the Northwest a global model of sustainabilitystrong communities, a green economy, and a healthy environment.

Sightline Report

Shifting Into Reverse

August 2012

Endnotes

1. Gasoline consumption data from US Department of Transportation, Federal Highway Administration, Office of Highway Policy Information, Highway Statistics Series (http://www. fhwa.dot.gov/policyinformation/statistics.cfm)Table MF-226: Highway Use of Gasoline, by State, 1949-1995 for 1949 through 1995, http://www.fhwa.dot.gov/ohim/summary95/section1. html; Table MF-21: Motor Fuel Use (by year) for 1996 through 2009; and Table MF-27: Highway Use of Motor Fuel, 2010 for 2010, http://www.fhwa.dot.gov/policyinformation/ statistics/2010/mf27.cfm. For Washington, fuel consumption trends for 2010 through 2012 derived from personal communication, Thao Manikhoth, finance and compliance manager, Prorate and Fuel Tax Services, Washington State Department of Licensing, August 9, 2012. For Oregon, trends for 2010 through 2012 derived from Oregon Department of Transportation, Fuels Tax Group, Motor Vehicle Fuel Monthly Taxable Distribution Reports, http://cms.oregon. gov/ODOT/CS/FTG/Pages/reports.aspx. For both Oregon and Washington, trends for 2010 through 2012 were partially derived from US Department of Transportation, Federal Highway Administration, Office of Highway Policy Information, Monthly Motor Fuel Reported by States, http://www.fhwa.dot.gov/policyinformation/motorfuelhwy_trustfund.cfm. 2. Population data through 1989 from US Census Bureau, Historical Annual Time Series of State Population Estimates and Demographic Components of Change: 1900 to 1990 Total Population Estimates, http://www.census.gov/popest/data/state/asrh/1980s/80s_st_totals.html; for 1990 to 1999 from US Census Bureau, Time Series of Intercensal Estimates by State and County, http://www.census.gov/popest/data/intercensal/st-co/index.html; for 2000 to 2010 from US Census Bureau, State Intercensal Estimates (2000-2010), http://www.census.gov/popest/data/ intercensal/state/state2010.html; for 2011 from US Census Bureau, Population Estimates: Current Estimates Data, http://www.census.gov/popest/data/index.html. In Washington, most recent year increment (preliminary) from Office of Financial Management, http://www.ofm. wa.gov/pop/. 3. 4. 5. Petroleum prices and consumption for Washington and Oregon from US Energy Information Administration, State Energy Data System, http://www.eia.gov/state/seds/. US Department of Transportation, Federal Highway Administration, 2009 National Household Travel Survey and 2001 National Household Travel Survey, http://nhts.ornl.gov. Benjamin Davis and Tony Dutzik, Frontier Group, and Phineas Baxandall, US PIRG Education Fund, Transportation and the New Generation: Why Young People are Driving Less and What It Means for Transportation Policy, April 2012, http://www.frontiergroup.org/sites/default/files/ reports/Transportation%20&%20the%20New%20Generation%20vUS.pdf. 6. 7. Ibid. Effective on-road miles per gallon for US passenger vehicles from US Department of Transportation, Federal Highway Administration, Office of Highway Policy Information, Highway Statistics Series (http://www.fhwa.dot.gov/policyinformation/statistics.cfm)Table VM-201A: Annual Vehicle-Miles of Travel and Related Data, by Vehicle Type, 1936-1995 for years prior to 1996, http://www.fhwa.dot.gov/ohim/summary95/section5.html, and Table VM-1: Vehicle Miles of Travel and Related Data, by Highway Category and Vehicle Type (by year) for 1996 to 2006. For 2007 through 2009, trend data estimated from US Department of Transportation, Federal Highway Administration, Office of Highway Policy Information, Highway Statistics Series, Table VM-1: Vehicle Miles of Travel and Related Data, by Highway

Sightline Report

Shifting Into Reverse

August 2012

Category and Vehicle Type (by year), adjusted to account for a change in federal methodology and to match subsequent data reported by the Washington Transportation Revenue Forecast Council. For 2010 through 2012, data from the Washington Transportation Revenue Forecast Council, June 2012 Transportation Economic and Revenue Forecasts, Volume 1: Summary Document, http://www.ofm.wa.gov/budget/info/June12transposummary.pdf; Washington Transportation Revenue Forecast Council, June 2011 Transportation Economic and Revenue Forecasts, Volume 1: Summary Document, http://www.ofm.wa.gov/budget/info/ June11transposummary.pdf; and Washington State Department of TransportationEconomic Analysis, Statewide Fuel Consumption Forecast Models, November 2010, http://www.ofm. wa.gov/budget/info/Nov10transpofuelconsumptionsummary.pdf. 8. Jerry Hirsh, Average Age of Cars on US Roads Rises to Record 10.8 Years, Los Angeles Times, January 17, 2012, http://articles.latimes.com/2012/jan/17/business/la-fi-mo-agingautos-20120117. 9. Vehicle fuel economy projections from Washington Transportation Revenue Forecast Council, June 2012 Transportation Economic and Revenue Forecasts, Volume I: Summary Document, http://www.ofm.wa.gov/budget/info/June12transposummary.pdf. 10. Miles driven by age from Federal Highway Administration, National Household Travel Survey, Trends Analysis (1995, 2001 and 2009 surveys), http://nhts.ornl.gov/det/Extraction4.aspx. 11. Labor participation rate projections from Mitra Toossi, US Bureau of Labor Statistics, A New Look at Long-Term Labor Force Projections to 2050, Monthly Labor Review, November 2006, http://www.bls.gov/opub/mlr/2006/11/art3full.pdf. 12. Short-run and long-run fuel elasticities from Todd Litman, Victoria Transport Policy Institute, Understanding Transport Demands and Elasticities: How Prices and Other Factors Affect Travel Behavior, July 26, 2012, http://www.vtpi.org/elasticities.pdf. 13. Washington Transportation Revenue Forecast Council, June 2012 Transportation Economic and Revenue Forecasts, Volume 1: Summary Document, http://www.ofm.wa.gov/budget/info/ June12transposummary.pdf. 14. Oregon Department of Transportation, Six Trends Spell Trouble for Transportation Funding, November 8, 2011, http://cms.oregon.gov/odot/govrel/pages/news/110811a.aspx. 15. Washington State Legislature, Transportation Budget, Transportation Resource Manual, 20092011, http://www.leg.wa.gov/JTC/Documents/TRM/2011UPDATE/4TransportationBudget.pdf. 16. Shanjun Li, Joshua Linn, and Erich Muehlegger, Gasoline Taxes and Consumer Behavior, March 2011, http://economics.stanford.edu/files/muehlegger3_15.pdf. 17. Zachary Howard and Clark Williams-Derry, How Much Do Drivers Pay for a Quicker Commute?, Sightline Daily blog, August 1, 2012, http://daily.sightline.org/2012/08/01/howmuch-do-drivers-pay-for-a-quicker-commute/. Clark Williams-Derry, Toll Avoidance and Transportation Funding, Sightline Institute, September 2011, http://www.sightline.org/research/ toll-avoidance-and-transportation-funding/.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Roads and Trails of Cascade HeadDokument1 SeiteRoads and Trails of Cascade HeadStatesman JournalNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

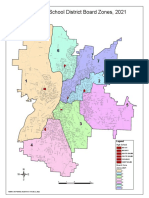

- School Board Zones Map 2021Dokument1 SeiteSchool Board Zones Map 2021Statesman JournalNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

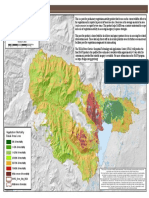

- Cedar Creek Vegitation Burn SeverityDokument1 SeiteCedar Creek Vegitation Burn SeverityStatesman JournalNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Letter To Judge Hernandez From Rural Oregon LawmakersDokument4 SeitenLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

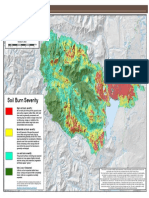

- Cedar Creek Fire Soil Burn SeverityDokument1 SeiteCedar Creek Fire Soil Burn SeverityStatesman JournalNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Matthieu Lake Map and CampsitesDokument1 SeiteMatthieu Lake Map and CampsitesStatesman JournalNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Cedar Creek Fire Sept. 3Dokument1 SeiteCedar Creek Fire Sept. 3Statesman JournalNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Oregon Annual Report Card 2020-21Dokument71 SeitenOregon Annual Report Card 2020-21Statesman JournalNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Dokument4 SeitenComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

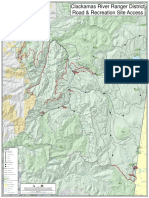

- Mount Hood National Forest Map of Closed and Open RoadsDokument1 SeiteMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Windigo Fire ClosureDokument1 SeiteWindigo Fire ClosureStatesman JournalNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Revised Closure of The Beachie/Lionshead FiresDokument4 SeitenRevised Closure of The Beachie/Lionshead FiresStatesman JournalNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- LGBTQ Proclaimation 2022Dokument1 SeiteLGBTQ Proclaimation 2022Statesman JournalNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDokument1 SeiteProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDokument1 SeiteSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNoch keine Bewertungen

- SIA Report 2022 - 21Dokument10 SeitenSIA Report 2022 - 21Statesman JournalNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Salem-Keizer Discipline Data Dec. 2021Dokument13 SeitenSalem-Keizer Discipline Data Dec. 2021Statesman JournalNoch keine Bewertungen

- Resource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeDokument3 SeitenResource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeStatesman JournalNoch keine Bewertungen

- Gcab - Personal Electronic Devices and Social Media - StaffDokument2 SeitenGcab - Personal Electronic Devices and Social Media - StaffStatesman JournalNoch keine Bewertungen

- Crib Midget Day Care Emergency Order of SuspensionDokument6 SeitenCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNoch keine Bewertungen

- SB Agenda 20210415 EnglishDokument1 SeiteSB Agenda 20210415 EnglishStatesman JournalNoch keine Bewertungen

- School Board Zone MapDokument1 SeiteSchool Board Zone MapStatesman JournalNoch keine Bewertungen

- Op Ed - Anthony MedinaDokument2 SeitenOp Ed - Anthony MedinaStatesman JournalNoch keine Bewertungen

- 2021 Ironman 70.3 Oregon Traffic ImpactDokument2 Seiten2021 Ironman 70.3 Oregon Traffic ImpactStatesman JournalNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Statement From Marion County Medical Examiner's Office On Heat-Related DeathsDokument1 SeiteStatement From Marion County Medical Examiner's Office On Heat-Related DeathsStatesman JournalNoch keine Bewertungen

- Schools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramDokument3 SeitenSchools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramStatesman Journal100% (1)

- Zone Resolution PDFDokument2 SeitenZone Resolution PDFStatesman JournalNoch keine Bewertungen

- City of Salem Photo Red Light Program 2021 Legislative ReportDokument8 SeitenCity of Salem Photo Red Light Program 2021 Legislative ReportStatesman JournalNoch keine Bewertungen

- Legal Writing Atty. MJ Cantorias Thursday 530-730 Seat Work No. 1Dokument3 SeitenLegal Writing Atty. MJ Cantorias Thursday 530-730 Seat Work No. 1Denzel Edward CariagaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- NHAIFinalDokument48 SeitenNHAIFinalhimanshusabooNoch keine Bewertungen

- Renato v. Diaz v. Secretary of Finance, GR No. 193007, 2011-07-19Dokument3 SeitenRenato v. Diaz v. Secretary of Finance, GR No. 193007, 2011-07-19Anonymous NiKZKWgKqNoch keine Bewertungen

- PNC Infratech Ltd. Initiating CoverageDokument29 SeitenPNC Infratech Ltd. Initiating Coveragekalpesh_chandakNoch keine Bewertungen

- NoidalofDokument227 SeitenNoidalofprem_k_sNoch keine Bewertungen

- Application of Machine Learning Techniques On Traffic Data For Customer's Segmentation, Churn Prediction and Customer's Lifetime Value EvaluationDokument113 SeitenApplication of Machine Learning Techniques On Traffic Data For Customer's Segmentation, Churn Prediction and Customer's Lifetime Value EvaluationDiana VargheseNoch keine Bewertungen

- ICICI Bank Aptitude Question Papers Set 3 - WWW - Bankexamportal.comDokument4 SeitenICICI Bank Aptitude Question Papers Set 3 - WWW - Bankexamportal.comMayuri LatpateNoch keine Bewertungen

- VAT NotesDokument21 SeitenVAT NotesiBEAYNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 51 Annual Revision of Toll Fee To Be Effective From 01.04.2019 PDFDokument5 Seiten51 Annual Revision of Toll Fee To Be Effective From 01.04.2019 PDFAnubhav JainNoch keine Bewertungen

- Sartsm V1 C10-11Dokument64 SeitenSartsm V1 C10-11Et100% (1)

- Ii. Concept and Attributes of A Corporat PDFDokument96 SeitenIi. Concept and Attributes of A Corporat PDFcecilegotamcoNoch keine Bewertungen

- National Highway SignDokument24 SeitenNational Highway SignAhsan KhanNoch keine Bewertungen

- Automated Toll Collection System Using RFID: Software RequirementDokument2 SeitenAutomated Toll Collection System Using RFID: Software RequirementRahul KaleNoch keine Bewertungen

- Disadvantages Etoll in AustraliaDokument6 SeitenDisadvantages Etoll in Australiatiago.ohori034151Noch keine Bewertungen

- Final Report Highway Toll Study - 1997Dokument175 SeitenFinal Report Highway Toll Study - 1997Welly Pradipta bin MaryulisNoch keine Bewertungen

- Traffic Report RAJUK Flyover DevConDokument161 SeitenTraffic Report RAJUK Flyover DevConTahmidSaanidNoch keine Bewertungen

- Intelligent Transport SystemDokument16 SeitenIntelligent Transport SystemMd.imthiyaz89% (9)

- Fastag DemoDokument12 SeitenFastag Demobigyan56Noch keine Bewertungen

- Dewas Bhopal Corridor P LTDDokument20 SeitenDewas Bhopal Corridor P LTDsurya401Noch keine Bewertungen

- 5th Issue EditioDokument16 Seiten5th Issue EditioLrtteams HssiNoch keine Bewertungen

- PPPDokument16 SeitenPPPAkanksha WaliaNoch keine Bewertungen

- Identifying Solutions: 1 - 2 0 1 1 Sick'S Customer MagazineDokument58 SeitenIdentifying Solutions: 1 - 2 0 1 1 Sick'S Customer MagazineNicuVisanNoch keine Bewertungen

- Renato Diaz V Secretary of FinanceDokument2 SeitenRenato Diaz V Secretary of FinanceDexter MantosNoch keine Bewertungen

- Diaz v. Secretary of Finance DigestDokument2 SeitenDiaz v. Secretary of Finance DigestTzarlene Cambaliza100% (2)

- RCA Study - Wilbur Smith Traffic & Revenue Forecasts - 012712Dokument103 SeitenRCA Study - Wilbur Smith Traffic & Revenue Forecasts - 012712Terry MaynardNoch keine Bewertungen

- Easytrip RFID Subscription Form and Terms ConditionDokument4 SeitenEasytrip RFID Subscription Form and Terms ConditionJen TurlaNoch keine Bewertungen

- OOP - Lab TasksDokument3 SeitenOOP - Lab TasksTouheed HassanNoch keine Bewertungen

- Toll Road Industry - Key Success Factors: Business Risk Assessment Economy of Service AreaDokument3 SeitenToll Road Industry - Key Success Factors: Business Risk Assessment Economy of Service Arealuqm4n99Noch keine Bewertungen

- Daily Expenses TrackerDokument2 SeitenDaily Expenses Trackerlai tubieronNoch keine Bewertungen

- Aptitude Questions and AnswersDokument120 SeitenAptitude Questions and AnswersMonesha SekarNoch keine Bewertungen

- Allison Transmissions: How to Rebuild & Modify: How to Rebuild & ModifyVon EverandAllison Transmissions: How to Rebuild & Modify: How to Rebuild & ModifyBewertung: 5 von 5 Sternen5/5 (1)

- Faster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestVon EverandFaster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestBewertung: 4 von 5 Sternen4/5 (28)

- How to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerVon EverandHow to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerBewertung: 4.5 von 5 Sternen4.5/5 (54)

- How to Fabricate Automotive Fiberglass & Carbon Fiber PartsVon EverandHow to Fabricate Automotive Fiberglass & Carbon Fiber PartsBewertung: 5 von 5 Sternen5/5 (4)

- Sustainable Design and Build: Building, Energy, Roads, Bridges, Water and Sewer SystemsVon EverandSustainable Design and Build: Building, Energy, Roads, Bridges, Water and Sewer SystemsNoch keine Bewertungen