Beruflich Dokumente

Kultur Dokumente

USA Retail

Hochgeladen von

ACopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

USA Retail

Hochgeladen von

ACopyright:

Verfügbare Formate

AUGUST 2012

MARKET RESEARCH REPORT

EVOLVEDATA

Retail in the USA

World's Biggest Retailers Detailed Content

A comparative view of the European, American and World's largest and most important retail chains.

2

World Market an Overview Total Retail Market Motor Vehicle & Parts 2011 Health & Pharma 2011 Food 2011 Clothing 2011 a Building & Garden 2011

10

11

Big Retail & Small Stores in the US / World's Biggest

World's Biggest

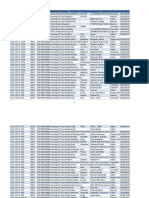

Rank 1 2 3 4 Company Wall-Mart Stores, Inc. Carrefour SA Tesco PLC Metro AG Country of origin US France UK Germany 2010 retail sales* 418,952 119,642 92,171 88,931 2010 group revenue* 421,849 121,519 94,244 89,311 2010 group net income* 16,993 754 4,131 1,243 Dominant operational format 2010 Hypermarket Hypermarket Hypermarket Cash & Carry/ Warehouse Club Supermarket #countries of operation 2010 16 33 13 9

Wall-Mart, the giant retailer from the United States, clearly dominates the top followed at a long distance by the French and British companies.

Dominated by the Western European and North American companies the world retail appears to be a bipolar rule. However this could not be further from the truth since important revenues come from China, Brazil, Japan and Russia. The importance of the new markets is the result of the orientation of the retailers towards markets capable of delivering growth, such as South America, Asia-Pacific and Africa. European retailers (mainly France and Germany) are the most active players on the Global scale and managed to reduce their dependence from the local market and have an impressive 40-% of revenue from other countries.

The Kroger Co.

US

82,189

82,189

1,133

Schwartz Unternehmens Treuhand KG Costco Wholesale Corporation The Home Depot, Inc

Germany

79,119

79,119

n/a

Discount store

26

US

76,255

77,946

1,323

Cash & Carry/ Warehouse Club Home Improvement

US

67,255

67,977

6,668

Wallgreen Co.

US

67,420

67,420

2,091

Drug Store/ Pharmacy Discount store

10

Aldi Einkauf GmbH & Co. oHG

Germany

67,112

67,112

n/a

18

* millions of US dollars

Source: Deloitte

EVOLVEDATA

AUGUST 2012

Big Retail & Small Stores in the US / European Retailers

European Retailers

Rank 1 2 3 4 5 6 7 8 9 10 Company Carrefour Tesco Metro Schwartz Aldi Rewe Auchan Edeka E.Leclerc Ahold Sales* 119,642 92,171 88,931 79,119 67,112 61,112 55,212 54,072 41,165 39,213 Country France UK Germany Germany Germany Germany France Germany France Netherlands

Source: Deloitte

European retailers found themselves capable of surpassing the lag of the local markets and find new sources of profit in the Global Market.

The French companies are by far the most determined to act an active role around the world proof is that all the French companies have international operations. France and Germany, only, generated around 400 billion in retail turnover. With an average of 30 countries where they operate, the French retailers lead the global expansion trend of the european retailers. There are significant variations among countries. Enormous growth occurred in Turkey (+22.4 %), Russia (+16.3 %), Sweden (+15.8 %), Poland (+13.3 %).

* millions of US dollars

The top countries in terms of turnover volume France, Germany, UK and Russia generated more than half of the total European retail turnover in 2010.

EVOLVEDATA

AUGUST 2012

Big Retail & Small Stores in the US / Top US Retailers

Top US Retailers

Rank 1 2 3 4 5 6 7 8 9 10 Company Wall-Mart Kroger Costco Home Depot Walgreen Target CVS Caremark Best Buy Lowe's Sears Holdings Sales* 418,952 82,189 76,255 67,887 67,420 65,789 57,345 50,272 48,815 43,326 Country US US US US US US US US US US

Source: Deloitte

Though it continues to be slow, the US retail grows steadily.

US retailers seem to be content with the opportunities that the local market provides and with the lead of Wall-Mart (180 million shoppers annually). No Canadian company made it to top ten retailers in North America. For individual retailers, such as Walmart and Target, online revenue accounts for less than 2 percent. Investments in better store experiences and more options in the power of their shoppers are considered a priority, however in terms of integrated channel environments, the retailers have started to understand the meas available. Nordstrom and Macys are some of the fast adopters by integrating their touchpoints, making their shoppers experience available on both mobile and web.

* millions of US dollars

EVOLVEDATA

AUGUST 2012

Big Retail & Small Stores in the US / Total US Retail

Total US Retail

Source: US Census

1Q 2012 4Q 2011 3Q 2011 2Q 2011 1Q 2011

The U.S. economy has shown signs of modest recovery. There is growth but not the kind that has followed previous recessions.

Despite the rather high level of the unemployment US consumer spending has been rising. Encouraged by the small signs of recovery that the economy has shown in the last period consumers have turned their attention for goods and services. 1,082,635 1,065,030 1,043,110 1,029,997 1,016,544

Source: Deloitte

US Retail Sales

1Q 2012 4Q 2011 3Q 2011 2Q 2011 1Q 2011

millions of dollars

Due to the credit market weakness that has transferred itself into other areas of the economy consumers seem to be prudent. For the US retailers a reasonable forecast would show slightly positive with a modest growth, the consumers will most certainly remain cautious and price sensitive.

EVOLVEDATA

AUGUST 2012

Big Retail & Small Stores in the US / Motor Vehicle

Motor vehicle and parts dealers 2011

Source: US Census

Jan 2011 Feb 2011 Mar 2011 Apr 2011 May 2011 Jun 2011 Jul 2011 Aug 2011 Sep 2011 Oct 2011 Nov 2011 Dec 2011

New cars sales raised to 53% of all motor vehicle sales in 1Q 2012, the highest numbers since 2009. More energy-efficient autos tended to have a better performance since the influence of higher gas prices has played a role in the trends of vehicle sales that made the consumer more price savvy. The increases in production and employment came from increased demand, which acted in US as well as in Europe. Exports also grew, having more than doubled since 2009. 6

EVOLVEDATA AUGUST 2012

Motor vehicle and parts dealers Jan 2011

58,718

Feb 2011

63,669

Mar 2011

76,556

Apr 2011

70,852

May 2011

70,618

Jun 2011

71,537

Jul 2011

70,503

Aug 2011

72,557

Sep 2011

68,024

Oct 2011

66,851

Nov 2011

64,740

Dec 2011

71,674

millions of dollars

Big Retail & Small Stores in the US / Health and Personal Care

Health and personal care stores 2011

Source: US Census

Jan 2011 Feb 2011 Mar 2011 Apr 2011 May 2011 Jun 2011 Jul 2011 Aug 2011 Sep 2011 Oct 2011 Nov 2011 Dec 2011

The per capita change in retail prescription volume, by state, ranged from -7.1% to 5.6%. Retail prescription usage, which averaged 11.33 prescriptions per person, declined in 41 states and fell by more than 3% in 10 states. Preparations seem to prove of little or no effectiveness in the case of the patent cliff expected to hit in 2012. Research-based and pharma companies have few products to replace the hole in the revenues. Two of the world largest pharma companies, Pfizer and Sanofi announced important job cuts, and the situation continues to determine changes throughout 2012.

Health and personal care stores Jan 2011

22,242

Feb 2011

21,290

Mar 2011

23,625

Apr 2011

22,250

May 2011

22,783

Jun 2011

22,413

Jul 2011

21,909

Aug 2011

23,032

Sep 2011

22,265

Oct 2011

22,622

Nov 2011

22,468

Dec 2011

25,387

millions of dollars

EVOLVEDATA

AUGUST 2012

Big Retail & Small Stores in the US / Pharmacies and Drug Stores

Pharmacies and drug stores 2011

The amount of drugs sold in retail around US for chronic and acute illness declined (on a per capita basis) in contrast with non-retail that remained steady. A person's use of retail prescriptions averaged 11.33 prescriptions in 2011 to amount to a total of 211 bn USD. quotation Especially in the cardiovascular area americans aged 65+ decreased their use of prescriptions by 3%.

Source: US Census

Jan 2011 Feb 2011 Mar 2011 Apr 2011 May 2011 Jun 2011 Jul 2011 Aug 2011 Sep 2011 Oct 2011 Nov 2011 Dec 2011

Pharmacies and drug stores Jan 2011

19078

Feb 2011

18016

Mar 2011

19913

Apr 2011

18808

May 2011

19357

Jun 2011

18935

Jul 2011

18406

Aug 2011

19349

Sep 2011

18736

Oct 2011

19214

Nov 2011

19048

Dec 2011

21105

Overall pharmacy retail volumes have declined in 2011, due to lower use of chronic disease medicines. The weak flu season in 2011 has been one of the causes pharma volumes showing worse than in 2010.

millions of dollars

EVOLVEDATA

AUGUST 2012

Big Retail & Small Stores in the US / Food and Beverage

Food and beverage stores 2011

Source: US Census

Jan 2011 Feb 2011 Mar 2011 Apr 2011 May 2011 Jun 2011 Jul 2011 Aug 2011 Sep 2011 Oct 2011 Nov 2011 Dec 2011

According to Datamonitor, the United States food retail industry grew by 5.6% in 2011. Industry leaders Wal-Mart, Costco, Kroger, and Safeway continue to leverage their scale to accommodate consumers need for low prices. This trend will continue unabated as consumers remain strapped for disposable income despite minor improvements in the broader economy.

Food and beverages store Jan 2011

48,674

Feb 2011

45,856

Mar 2011

50,069

Apr 2011

50,985

May 2011

51,905

Jun 2011

51,506

Jul 2011

53,005

Aug 2011

52,054

Sep 2011

50,360

Oct 2011

51,298

Nov 2011

51,730

Dec 2011

56,466

millions of dollars

EVOLVEDATA

AUGUST 2012

Big Retail & Small Stores in the US / Clothing

Clothing stores 2011

Source: US Census

Jan 2011 Feb 2011 Mar 2011 Apr 2011 May 2011 Jun 2011 Jul 2011 Aug 2011 Sep 2011 Oct 2011 Nov 2011 Dec 2011

2011 was a difficult year for retailers and manufacturers who use cotton which experienced volatile price changes and the highest price in almost 150 years. Due to the cost of raw materials, retailers and manufacturers alike, started exploring alternative fabrics, including synthetics and other non-cotton or non-petrolbased textiles. However, alternative fabrics are not fix-all solution as increased demand is pushing prices higher.

Clothing stores

Jan 2011

10,170

Feb 2011

11,360

Mar 2011

13,702

Apr 2011

13,842

May 2011

13,627

Jun 2011

13,259

Jul 2011

13,401

Aug 2011

13,876

Sep 2011

13,404

Oct 2011

13,787

Nov 2011

15,813

Dec 2011

21,735

millions of dollars

10

EVOLVEDATA

AUGUST 2012

Big Retail & Small Stores in the US / Building and Garden

Building materials and garden equipment and suppliers dealers 2011

Prices remained at a level comparable with 2010 levels by the end of 2011 although a general level of optimism for modest growth and recovery persisted. According to data from the National Climatic Data Center, January was the fifth snowiest month in the last 45 years, with approximately 71% of the country covered in snow by January 12. February was no different in terms of weather, which translated in an 8.2% decrease in building permits. The 517,000 units of building permits, in February 2011 marked the lowest rate on record.

Source: US Census

Jan 2011 Feb 2011 Mar 2011 Apr 2011 May 2011 Jun 2011 Jul 2011 Aug 2011 Sep 2011 Oct 2011 Nov 2011 Dec 2011

Building materials and garden equipment and supplies dealers

Jan 2011

16,476

Feb 2011

16,460

Mar 2011

22,643

Apr 2011

25,222

May 2011

28,694

Jun 2011

28,007

Jul 2011

24,256

Aug 2011

24,540

Sep 2011

23,299

Oct 2011

24,018

Nov 2011

23,222

Dec 2011

22,065

millions of dollars

111

EVOLVEDATA

AUGUST 2012

Big Retail & Small Stores in the US / Conclusions, Trends and Forecasts

You can download free the complete report - including 2012 data on our website.

EVOLVEDATA

AUGUST 2012

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Birchbox Rep Marketing PlanDokument18 SeitenBirchbox Rep Marketing Planapi-32128012750% (2)

- Econ 161 Exercise Set 3Dokument2 SeitenEcon 161 Exercise Set 3SofiaNoch keine Bewertungen

- Case Study - TESCO HomeplusDokument8 SeitenCase Study - TESCO HomeplusrnsbakhietNoch keine Bewertungen

- HDFC Sip Report - Ayushi Gaba CompleteDokument50 SeitenHDFC Sip Report - Ayushi Gaba CompleteAYUSHI GABANoch keine Bewertungen

- Cambridge International Examinations: Business Studies 0450/22 March 2017Dokument12 SeitenCambridge International Examinations: Business Studies 0450/22 March 2017Wambui KahendeNoch keine Bewertungen

- NTCC ReportDokument33 SeitenNTCC ReportAkshit JhingranNoch keine Bewertungen

- Parthenon-EY Adapt-To-Win ThoughtLeadership Final 072016Dokument16 SeitenParthenon-EY Adapt-To-Win ThoughtLeadership Final 072016Mario Morales RodriguezNoch keine Bewertungen

- Fisher LP-Gas Regulators and Equipment Application Guide d450104t012Dokument87 SeitenFisher LP-Gas Regulators and Equipment Application Guide d450104t012Alfredo Castro FernándezNoch keine Bewertungen

- Role of Marketing ResearchDokument5 SeitenRole of Marketing ResearchRupesh Chaube100% (1)

- Impact of ERP On Supply Chain Optimization in Malls of Nagpur Region.Dokument10 SeitenImpact of ERP On Supply Chain Optimization in Malls of Nagpur Region.Deepak SinghNoch keine Bewertungen

- Value Merchants Anderson eDokument5 SeitenValue Merchants Anderson esarah123Noch keine Bewertungen

- Dynamic PackagingDokument2 SeitenDynamic PackagingChristine P. ToledoNoch keine Bewertungen

- 616 E St. Businss LicensesDokument14 Seiten616 E St. Businss LicensesGlennKesslerWPNoch keine Bewertungen

- Multi Level MarketingDokument2 SeitenMulti Level MarketingGlenn RumbaoaNoch keine Bewertungen

- MathhhDokument11 SeitenMathhhMyca DueñasNoch keine Bewertungen

- Characteristics of A Good IdeaDokument25 SeitenCharacteristics of A Good IdeaKerrice RobinsonNoch keine Bewertungen

- Daraz Seller CenterDokument3 SeitenDaraz Seller CenterBD State NewsNoch keine Bewertungen

- CH 06Dokument40 SeitenCH 06lalala010899Noch keine Bewertungen

- Comm Project ProposalDokument2 SeitenComm Project ProposalRakesh Sonu PathakNoch keine Bewertungen

- Modelo Examen EBAU-1 Leng. Ext. InglésDokument2 SeitenModelo Examen EBAU-1 Leng. Ext. InglésTeresaNoch keine Bewertungen

- Annexure - XVIII Zoning Regulations Residential Use ZoneDokument2 SeitenAnnexure - XVIII Zoning Regulations Residential Use Zonemike mollyNoch keine Bewertungen

- Marketing Plan: Market Study of Nescafe Gold in The PhilippinesDokument15 SeitenMarketing Plan: Market Study of Nescafe Gold in The PhilippinesHazel Pablo0% (1)

- MGN601A Product Launch PDFDokument16 SeitenMGN601A Product Launch PDFAnweshaNoch keine Bewertungen

- Walmart's HRM - Recruitment, Selection, Employee Retention - Panmore InstituteDokument6 SeitenWalmart's HRM - Recruitment, Selection, Employee Retention - Panmore InstituteNamita DeyNoch keine Bewertungen

- Dodge Brass InsertsDokument40 SeitenDodge Brass InsertsAce Industrial SuppliesNoch keine Bewertungen

- CH 01Dokument42 SeitenCH 01UriVermundoNoch keine Bewertungen

- EDEKA - Kaiser's Tengelmann-Prohibition of Merger Overridden by Minister For Economic Affairs in GermanyDokument5 SeitenEDEKA - Kaiser's Tengelmann-Prohibition of Merger Overridden by Minister For Economic Affairs in GermanyKanoknai ThawonphanitNoch keine Bewertungen

- Starbucks CoffeeDokument32 SeitenStarbucks Coffeebusinessdatabases100% (2)

- Pepsi Cola v. City of ButuanDokument2 SeitenPepsi Cola v. City of ButuanCindee YuNoch keine Bewertungen

- The 8Ps of Luxury Brand MarketingDokument6 SeitenThe 8Ps of Luxury Brand MarketingforumajmeraNoch keine Bewertungen