Beruflich Dokumente

Kultur Dokumente

NSE - Review Week Ended 28 Sept 2012

Hochgeladen von

kelanio2002780Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

NSE - Review Week Ended 28 Sept 2012

Hochgeladen von

kelanio2002780Copyright:

Verfügbare Formate

TARGET TECHNICAL REVIEW FOR THE WEEK ENDED 28TH SEPT 2012

Basically this is my comment on some selected stocks from the NSE 30 index/liquid stocks of the all share index that are showing good potential for an upward movement. The choices of stocks have indirectly considered the underlining fundamentals.

For the support and resistance for the last 3 weeks WAPCO, Unilever, PZ and Dangote Sugar are showing higher high and higher low and seem to be very promising in terms of price gain. The new week may see many of the stocks that have sustained losses turning around. Comment on Indexes: Despite the losses for the 1st 3days of trading, the all share index still managed to finish the week positive. Thus the positive trend is expected to continue in the new week. However, the Oil and Gas index has deteriorated further. The Insurance sector is coming on very strong and showing good upside trend.

A) SUMMARY OF CHANGES (YEAR TO DATE) MAJOR INDEXES FOR THE WEEK ENDED 28 SEPTEMBER 2012

Indexes

All Share Index Stochastics

Week Ended 28th Sept 2012 +25,47% 79.81% _32.02% 79.07% -27.55% 58.65% +278.92% 58.69% -5.75% 81.70% +45.25% 52.42%

Week Ended 21st Sept 2012 +24.81% 97.63% 31.44% 97.55% -24.31% 87.50% +280.85% 99.51% -6.61% 90.02% +46.63% 81.97%

Week Ended 14th Sept 2012 +22.26% 87.39% +29.14% 100% -24.81% 52.98% +273.94% 99.57% -12.39% 67.76% 45.61% 85.34%

NSE 30 -Stochastic NSE OIL AND GAS - Stochastic NSE FOOD & Bev Stochastic NSE INSURANCE StochasticNSE BANKING Stochastic

Source http://www.bloomberg.com/markets/indexes/country/nigeria/

B) 3 WEEKS SUPPORT AND RESISTANCE

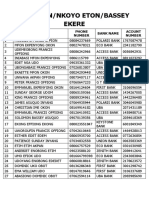

NSE

Week Ended 28th Sept 2012 25912.33 25503.33 26321.33 79.83 Buy Zone

Week Ended 21st Sept 2012 25719 25063 26375 97.63 Buy Zone

Week Ended 14th Sept 2012 25069.67 24753.86 25968.77 87.39 Buy Zone

PivotSupport S2Resistance R2Stochastic(%K) Summary

FIDELITY BANK

Week Ended 28th Sept 2012 1.75 1.65 1.85 51.38 Neutral

Week Ended 21st Sept 2012 1.76 1.66 1.86 88.54 Buy Zone

Week Ended 14th Sept 2012 1.70 1.42 1.98 91.93

PivotSupport S2Resistance R2Stochastic(%K) Summary

DANGOTE SUGAR

Week Ended 28th Sept 2012 4.94 4.76 5.12 46.87%

Week Ended 21st Sept 2012 4.90 4.69 5.11 65.49%

Week Ended 14th Sept 2012 4.76 4.56 5.21 70.99%

PivotSupport S2Resistance R2Stochastic(%K)

Summary

Buy Zone

Buy Zone

Buy Zone

PZ

Week Ended 28th Sept 2012 25.27 24.17 26.37 51.52 Buy Zone

Week Ended 21st Sept 2012 24.78 23.65 25.91 77.76

Week Ended 14th Sept 2012 24.20 22.35 26.05 94.40

PivotSupport S2Resistance R2Stochastic(%K) Summary

Fidson

Week Ended 28th Sept 2012 1.29 0.68 1.90 77.76 Neutral Zone

Week Ended 21st Sept 2012 1.4 0.95 1.85 98.23 Overbought

Week Ended 14th Sept 2012 1.03 0.97 1.09 95.55 Buy Zone

PivotSupport S2Resistance R2Stochastic(%K) Summary

UNILEVER

Week Ended 28th Sept 2012 40.74 36.63 44.85 77.76 Buy Zone

Week Ended 21st Sept 2012 38.37 36.17 40.57 51.52% Buy Zone

Week Ended 14th Sept 2012 37.80 36.60 39.89 88.06% Buy Zone

PivotSupport S2Resistance R2Stochastic(%K) Summary

WAPCO

Week Ended 28th Sept 2012 56.64 52.57 60.71 87.32 Buy Zone

Week Ended 21st Sept 2012 53.33 48.34 58.32 97.56

Week Ended 14th Sept 2012 48.91 44.18 53.64 92.06

PivotSupport S2Resistance R2Stochastic Summary

ACCESS

Week Ended 28th Sept 2012 8.93 7.94 9.87 15.09 Neutral/Oversold

Week Ended 21st Sept 2012 9.42 8.83 10.01 72.28

Week Ended 14th Sept 2012 10.01 7.41 10.93 91.81

PivotSupport S2Resistance R2Stochastic Summary

NASCON

Week Ended 28th Sept 2012 5.78 5.00 6.58

Week Ended 21st Sept 2012 5.91 4.98 6.84

Week Ended 14th Sept 2012 5.18 5.06 5.53

PivotSupport S2Resistance R2-

Stochastic Summary

72.26 Buy Zone

98.00 Buy Zone

84.74 Buy Zone

Writer: Yusuf Kelani ACA. Final Securities Trading Certification from Ghana Stock Exchange Explanation of Terms: Support: Price at which on can start thinking of buying. This is like saying get set to buy. It is a forecast buying Zone. Resistance: Price at which you should think of selling/taking some profit or exercise caution in buying at this price. Pivot: A central price. At this price the security seems to be appropriately priced.

Caution: Investing is a risky venture. This is just my opinion and I cannot be liable for any loss suffered as a result of following this recommendation. Contact: +233247429534,+2348023054935, E-Mail- kelanio2002@yahoo.com

See Videos on stock Investment- http://www.youtube.com/user/newyorktraders/feed?filter=2 Get text of document at http://www.scribd.com/doc/106101305/NSE-Review-Week-Ended-14Sept2012

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Market News in 2010 and Impact On NSEs ASI - Proshare - 040111Dokument162 SeitenMarket News in 2010 and Impact On NSEs ASI - Proshare - 040111ProshareNoch keine Bewertungen

- Nigerian BanksDokument9 SeitenNigerian BanksKolawole KehindeNoch keine Bewertungen

- H1 2010 NCM Market Report - Proshare - 020710Dokument169 SeitenH1 2010 NCM Market Report - Proshare - 020710ProshareNoch keine Bewertungen

- SchoolDokument3 SeitenSchoolCollins EzugwuNoch keine Bewertungen

- Bashiru Muhammed Abdulrahman: 6 Sanni Street Shasha, Ikeja, LagosDokument38 SeitenBashiru Muhammed Abdulrahman: 6 Sanni Street Shasha, Ikeja, LagosRich KidoNoch keine Bewertungen

- List of Nigerian BanksDokument13 SeitenList of Nigerian Banksaliyuab49Noch keine Bewertungen

- The Impact of Unclaimed Dividends On Capital Market Development in NigeriaDokument45 SeitenThe Impact of Unclaimed Dividends On Capital Market Development in Nigeriamryuuz100% (1)

- Name: Hassan Shedrack Joseph Wallet Number: 7084543702Dokument39 SeitenName: Hassan Shedrack Joseph Wallet Number: 7084543702rakimmeans766Noch keine Bewertungen

- Customer StatementDokument18 SeitenCustomer Statementmuhyideen6abdulganiyNoch keine Bewertungen

- Mama TheoDokument17 SeitenMama TheophantomhabzicNoch keine Bewertungen

- Azeez, Abdulahi: 9 Sülë Akanni, Abule-Egba, Abule-Egba, Lagos StateDokument242 SeitenAzeez, Abdulahi: 9 Sülë Akanni, Abule-Egba, Abule-Egba, Lagos Staterosesmith19992eNoch keine Bewertungen

- User Statement 65246 5409888907720648Dokument27 SeitenUser Statement 65246 5409888907720648Muniru QudusNoch keine Bewertungen

- Sterling Bank PLC Extra-Ordinary General Meeting Press Release - February 2, 2011Dokument2 SeitenSterling Bank PLC Extra-Ordinary General Meeting Press Release - February 2, 2011Sterling Bank PLCNoch keine Bewertungen

- BankSortcodes - 12072011Dokument228 SeitenBankSortcodes - 12072011Stan Louis100% (1)

- The Role of Nigerian Stock Exchange in Capital Formation in Nigeria (Chapters 4 and 5Dokument14 SeitenThe Role of Nigerian Stock Exchange in Capital Formation in Nigeria (Chapters 4 and 5Newman EnyiokoNoch keine Bewertungen

- Nigerian Stock Exchange and Economic DevelopmentDokument14 SeitenNigerian Stock Exchange and Economic DevelopmentAbdulhameed BabalolaNoch keine Bewertungen

- Dividend History of Quoted CompaniesDokument37 SeitenDividend History of Quoted CompaniesOLU DAVIESNoch keine Bewertungen

- Nse Seminar Sept, 2015Dokument36 SeitenNse Seminar Sept, 2015ToniNoch keine Bewertungen

- Siwes Placement ListDokument17 SeitenSiwes Placement ListchriscroftmanNoch keine Bewertungen

- Seplat Petroleum ProspectusDokument635 SeitenSeplat Petroleum ProspectusAF Dowell MirinNoch keine Bewertungen

- BookDokument38 SeitenBookD-Blitz StudioNoch keine Bewertungen

- Customer StatementDokument139 SeitenCustomer StatementAngel MarieNoch keine Bewertungen

- List of Quoted Companies in Nigeria Company Name 0 - 9 A - DDokument6 SeitenList of Quoted Companies in Nigeria Company Name 0 - 9 A - DAdetokunbo AdemolaNoch keine Bewertungen

- Domiciliation LetterDokument2 SeitenDomiciliation LetterOtunba Adeyemi Kingsley100% (3)

- Sortcodes of BanksDokument148 SeitenSortcodes of BanksAdebowale JacobsNoch keine Bewertungen

- The Beginners Guide To Investing in The Nigerian Stock MarketDokument50 SeitenThe Beginners Guide To Investing in The Nigerian Stock MarketMuhammad Ghani100% (1)

- EMOJOHNDokument9 SeitenEMOJOHNMxllyNoch keine Bewertungen

- SEC Nigeria Statitical Bulletin 2010 PDFDokument74 SeitenSEC Nigeria Statitical Bulletin 2010 PDFOmotayo AkinpelumiNoch keine Bewertungen

- Ossai, Chinedu Destiny: Skala Street, Kwale, Delta StateDokument11 SeitenOssai, Chinedu Destiny: Skala Street, Kwale, Delta StateDestiny OssaiNoch keine Bewertungen

- Sec Committee Report On Capital MKT Structure - 2009Dokument101 SeitenSec Committee Report On Capital MKT Structure - 2009ProshareNoch keine Bewertungen