Beruflich Dokumente

Kultur Dokumente

September Interest Rate Decision: Deleted: Deleted

Hochgeladen von

api-162199694Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

September Interest Rate Decision: Deleted: Deleted

Hochgeladen von

api-162199694Copyright:

Verfügbare Formate

OctoberSeptember

Interest Rate Decision At its meeting today, the Board decided to lowerleave the cash rate by 25 basis points to unchanged at 3.2550 per cent, effective 3 October . Having picked up in the early months of 2012. The outlook for , growth in the world economy has since softened over recent months, with estimates for . Current assessments are that global GDP being edged down, and will grow at no more than average pace in 2012, with risks to the outlook still seen to be on the downside. Economic activity in Europe is contracting, while growth in the United States remains modest. Growth in China has also slowed, and uncertainty about near-term prospects is greater than it was some months ago. Around Asia generally, growth is being dampened by the more moderate Chinese expansion and the weakness in Europe. Key commodity prices for Australia remain significantly lower than earlier in the year, even though some have regained some ground in recent weeks. The terms of trade have declined by over 10 per cent since the peak last year and will probably decline further, though they are likely to remain historically high. Financial markets have responded positively over the past few months to signs of progress in addressing Europe's financial problems, but expectations for further progress remain high. Low appetite for risk has seen long-term interest rates faced by highly rated sovereigns, including Australia, remain at exceptionally low levels. Nonetheless, capital markets remain open to corporations and well-rated banks, and Australian banks have had no difficulty accessing funding, including on an unsecured basis. Share markets have generally risen over recent months. In Australia, most indicators available for this meeting suggest that growth has been running close to trend, led by very large increases in capital spending in the resources sector. Consumption growth was quite firm in the first half of 2012, though some of that strength was temporary. Investment in dwellings has remained subdued, though there have been some tentative signs of improvement, while non-residential building investment has also remained weak. Looking ahead, the peak in resource investment is likely to occur next year, and may be at a lower level than earlier expected. As this peak approaches it will be important that the forecast strengthening in some other components of demand starts to occur. Labour market data have shown moderate employment growth and the rate of unemployment has thus far remained low. The Bank's assessment, though, is that the labour market has generally softened somewhat in recent months. Inflation has been low, with underlying measures near 2 per cent over the year to June, and headline CPI inflation lower than that. The introduction of the carbon price is affecting consumer prices in the current quarter, and this will continue over the next couple of quarters. Moderate labour market conditions should work to contain pressure on labour costs in sectors other than those directly affected by the current strength in resources. This and some continuing improvement in productivity performance will be needed to keep inflation low as the effects of the earlier exchange rate appreciation wane. The Bank's assessment remains, at this point, that

Author 10/2/12 2:31 PM Deleted: is only Author 10/2/12 2:31 PM Deleted: remained reasonably robust in the first half of this year, albeit well below the exceptional pace seen in recent years. Some recent indicators have been weaker, which Author 10/2/12 2:31 PM Deleted: added to Author 10/2/12 2:31 PM Deleted: growth. Author 10/2/12 2:31 PM Deleted: Markets for key natural resources are adjusting accordingly. Some Author 10/2/12 2:31 PM Deleted: of importance to Author 10/2/12 2:31 PM Deleted: have fallen sharply Author 10/2/12 2:31 PM Deleted: peaked a year ago and Author 10/2/12 2:31 PM Deleted: significantly since then Author 10/2/12 2:31 PM Deleted: couple of Author 10/2/12 2:31 PM Deleted: are Author 10/2/12 2:31 PM Deleted: the past couple of Author 10/2/12 2:31 PM Deleted: , on very light volumes Author 10/2/12 2:31 PM Deleted: also Author 10/2/12 2:31 PM Deleted: the year Author 10/2/12 2:31 PM Deleted: , even with job shedding in some industries, Author 10/2/12 2:31 PM Deleted: remains Author 10/2/12 2:31 PM Deleted: starting to affect

inflation will be consistent with the target over the next one to two years. Interest rates for borrowers have for some months been a little below their medium- term averages. There are tentative signs of this starting to have some of the expected effects, though the impact of monetary policy changes takes some time to work through the economy. However, credit growth has softened of late and the exchange rate has remained higher than might have been expected, given the observed decline in export prices and the weaker global outlook. At today's meeting, the Board judged that, on the back of international developments, the growth outlook for next year looked a little weaker, while inflation was expected to be consistent with the target. The Board therefore decided that it was appropriate for the stance of monetary policy to be a little more accommodative.

Author 10/2/12 2:31 PM Deleted: The Bank's assessment is that Author 10/2/12 2:31 PM Deleted: Maintaining low inflation will, however, require growth in domestic costs to remain contained as the effects of the earlier exchange rate appreciation wane. Author 10/2/12 2:31 PM Deleted: As a result of the sequence of earlier decisions, interest Author 10/2/12 2:31 PM Deleted: are Author 10/2/12 2:31 PM Deleted: The Author 10/2/12 2:31 PM Deleted: those Author 10/2/12 2:31 PM Deleted: is still working its way Author 10/2/12 2:31 PM Deleted: , but dwelling prices have firmed a little and business Author 10/2/12 2:31 PM Deleted: picked up this year. The Author 10/2/12 2:31 PM Deleted: declined over the past month or two, though it has Author 10/2/12 2:31 PM Deleted: with Author 10/2/12 2:31 PM Deleted: and growth close to trend, but with a more subdued international outlook than was the case a few months ago, Author 10/2/12 2:31 PM Deleted: remained appropriate

Das könnte Ihnen auch gefallen

- RBA October 2012Dokument5 SeitenRBA October 2012Belinda WinkelmanNoch keine Bewertungen

- The RBA Observer - Likely To Cut Next WeekDokument6 SeitenThe RBA Observer - Likely To Cut Next WeekBelinda WinkelmanNoch keine Bewertungen

- Nordic Region Out Look 2013Dokument15 SeitenNordic Region Out Look 2013Marcin LipiecNoch keine Bewertungen

- Us Economic Outlook Bowed But Not BrokenDokument27 SeitenUs Economic Outlook Bowed But Not BrokenVarun Prasad ANoch keine Bewertungen

- Global Weekly Economic Update - Deloitte InsightsDokument8 SeitenGlobal Weekly Economic Update - Deloitte InsightsSaba SiddiquiNoch keine Bewertungen

- Economic CommentaryDokument2 SeitenEconomic CommentaryJan HudecNoch keine Bewertungen

- ANZ Economics Toolbox 20111507Dokument14 SeitenANZ Economics Toolbox 20111507Khoa TranNoch keine Bewertungen

- Lars Nyberg: The Repo Rate - Spring 2002: Why Was The Repo Rate Raised When Inflation Is On Its Way Down?Dokument3 SeitenLars Nyberg: The Repo Rate - Spring 2002: Why Was The Repo Rate Raised When Inflation Is On Its Way Down?Jose Calderon LimachiNoch keine Bewertungen

- Swedbank Economic Outlook June 2009Dokument37 SeitenSwedbank Economic Outlook June 2009Swedbank AB (publ)Noch keine Bewertungen

- Australian Interest Rates - OI #33 2012Dokument2 SeitenAustralian Interest Rates - OI #33 2012anon_370534332Noch keine Bewertungen

- Westpac WeeklyDokument10 SeitenWestpac WeeklysugengNoch keine Bewertungen

- Content But Not Complacent.: Policy PerspectiveDokument5 SeitenContent But Not Complacent.: Policy Perspectiveapi-162199694Noch keine Bewertungen

- Contentment: Neutral Stance Maintained: Economic InsightsDokument2 SeitenContentment: Neutral Stance Maintained: Economic InsightsAnonymous hPUlIF6Noch keine Bewertungen

- JPM Global Data Watch Se 2012-09-21 946463Dokument88 SeitenJPM Global Data Watch Se 2012-09-21 946463Siddhartha SinghNoch keine Bewertungen

- Weekly Market Compass - 23 NovDokument4 SeitenWeekly Market Compass - 23 NovYasahNoch keine Bewertungen

- Global Data Watch: Bumpy, A Little Better, and A Lot Less RiskyDokument49 SeitenGlobal Data Watch: Bumpy, A Little Better, and A Lot Less RiskyAli Motlagh KabirNoch keine Bewertungen

- Danske Daily: Trump To Intervene in Huawei Case If NecessaryDokument5 SeitenDanske Daily: Trump To Intervene in Huawei Case If NecessaryjjaypowerNoch keine Bewertungen

- Economics Commentary 2Dokument9 SeitenEconomics Commentary 2Berk AlemdarNoch keine Bewertungen

- Weekly Focus: New Year - Same Low Inflation PressureDokument17 SeitenWeekly Focus: New Year - Same Low Inflation PressurePaola VerdiNoch keine Bewertungen

- Weekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenDokument17 SeitenWeekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenAndrei Alexander WogenNoch keine Bewertungen

- Outlook 2012 - Raymond JamesDokument2 SeitenOutlook 2012 - Raymond JamesbubbleuppNoch keine Bewertungen

- SEB Report: Asian Recovery - Please Hold The LineDokument9 SeitenSEB Report: Asian Recovery - Please Hold The LineSEB GroupNoch keine Bewertungen

- UBS Weekly Guide: Help WantedDokument13 SeitenUBS Weekly Guide: Help Wantedshayanjalali44Noch keine Bewertungen

- Elevated Inflation May Linger, But Earnings Should Drive Equities HigherDokument7 SeitenElevated Inflation May Linger, But Earnings Should Drive Equities HigherMaria Virginia MarquinaNoch keine Bewertungen

- Weekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenDokument17 SeitenWeekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenAndrei Alexander WogenNoch keine Bewertungen

- SEB Asia Corporate Bulletin: MayDokument7 SeitenSEB Asia Corporate Bulletin: MaySEB GroupNoch keine Bewertungen

- NZ Economic OutlookDokument15 SeitenNZ Economic OutlookJohn ChoiNoch keine Bewertungen

- DA Davidson's Fixed Income Markets Comment - August 2, 2013Dokument3 SeitenDA Davidson's Fixed Income Markets Comment - August 2, 2013Davidson CompaniesNoch keine Bewertungen

- The Pensford Letter - 12.8.14Dokument4 SeitenThe Pensford Letter - 12.8.14Pensford FinancialNoch keine Bewertungen

- Barclays On Debt CeilingDokument13 SeitenBarclays On Debt CeilingafonteveNoch keine Bewertungen

- Oct 21st Bank of Canada Rate AnnouncementDokument2 SeitenOct 21st Bank of Canada Rate AnnouncementMortgage ResourcesNoch keine Bewertungen

- Policy Easing To Accelerate in H1: China Outlook 2012Dokument21 SeitenPolicy Easing To Accelerate in H1: China Outlook 2012valentinaivNoch keine Bewertungen

- ANZ Data Wrap 20220701Dokument7 SeitenANZ Data Wrap 20220701Gaurav JainNoch keine Bewertungen

- Weekly Economic Commentary 07-30-2012Dokument4 SeitenWeekly Economic Commentary 07-30-2012Jeremy A. MillerNoch keine Bewertungen

- Asian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012Dokument3 SeitenAsian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012api-162199694Noch keine Bewertungen

- NAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.Dokument18 SeitenNAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.International Business Times AUNoch keine Bewertungen

- Australian Monthly Chartbook - December 2012Dokument20 SeitenAustralian Monthly Chartbook - December 2012economicdelusionNoch keine Bewertungen

- Q3 2015 Economic and Capital Market CommentaryDokument8 SeitenQ3 2015 Economic and Capital Market CommentaryJohn MathiasNoch keine Bewertungen

- Statement by Philip Lowe, Governor: Monetary Policy Decision - Media Releases - RBADokument3 SeitenStatement by Philip Lowe, Governor: Monetary Policy Decision - Media Releases - RBATraderNoch keine Bewertungen

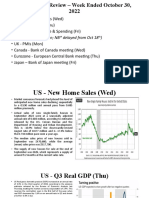

- Week of October 24, 2022Dokument17 SeitenWeek of October 24, 2022Steve PattrickNoch keine Bewertungen

- Bank of CanadaDokument1 SeiteBank of CanadaZerohedgeNoch keine Bewertungen

- RBA Rate Rise: Why Lowe Delivered The Christmas Present No One WantedDokument4 SeitenRBA Rate Rise: Why Lowe Delivered The Christmas Present No One WantedShtutsa.lisaNoch keine Bewertungen

- Ip Newhighs Finalv2Dokument4 SeitenIp Newhighs Finalv2Anonymous Feglbx5Noch keine Bewertungen

- Weekly Trends: The Boc Cuts Rates AgainDokument4 SeitenWeekly Trends: The Boc Cuts Rates AgaindpbasicNoch keine Bewertungen

- Global Real GDP Growth Is Currently Tracking A 3Dokument18 SeitenGlobal Real GDP Growth Is Currently Tracking A 3Mai PhamNoch keine Bewertungen

- More NewsDokument12 SeitenMore Newsn5f76qfbbwNoch keine Bewertungen

- Marquest Canadian Fixed Income Fund - What We Think (Q4 2015) - Lorica Investment Counsel IncDokument4 SeitenMarquest Canadian Fixed Income Fund - What We Think (Q4 2015) - Lorica Investment Counsel IncdpbasicNoch keine Bewertungen

- MFM Jul 15 2011Dokument13 SeitenMFM Jul 15 2011timurrsNoch keine Bewertungen

- Economic Update August 2022Dokument15 SeitenEconomic Update August 2022Sunny BanyNoch keine Bewertungen

- SNB Policy Assessment 2009-09-17Dokument5 SeitenSNB Policy Assessment 2009-09-17ParvanehNoch keine Bewertungen

- Weekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenDokument15 SeitenWeekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenAndrei Alexander WogenNoch keine Bewertungen

- Terranova Calendar Dec 2013Dokument5 SeitenTerranova Calendar Dec 2013B_U_C_KNoch keine Bewertungen

- Weekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenDokument17 SeitenWeekly Sentiment Paper: Distributed By: One Financial Written By: Andrei WogenAndrei Alexander WogenNoch keine Bewertungen

- RBI Cautiously Holds RatesDokument4 SeitenRBI Cautiously Holds RatesMeenakshi MittalNoch keine Bewertungen

- India economics flash monthly updateDokument13 SeitenIndia economics flash monthly updateRohan ShahNoch keine Bewertungen

- IB Economics Internal Assessment on the Reserve Bank of Australia's cash rate cutDokument5 SeitenIB Economics Internal Assessment on the Reserve Bank of Australia's cash rate cutQuang Nguyễn Nhựt Lâm0% (1)

- BMO Focus - 01-20-2012Dokument13 SeitenBMO Focus - 01-20-2012jrdawg88Noch keine Bewertungen

- ECM Quarterly Letter 2Q22Dokument14 SeitenECM Quarterly Letter 2Q22cybereisNoch keine Bewertungen

- Global Economic Outlook1Dokument2 SeitenGlobal Economic Outlook1Harry CerqueiraNoch keine Bewertungen

- Thoughts On RBA Rate CutDokument1 SeiteThoughts On RBA Rate Cutapi-162199694Noch keine Bewertungen

- UntitledDokument2 SeitenUntitledapi-162199694Noch keine Bewertungen

- Economic Letter Economic Letter: China's Slowdown May Be Worse Than Official Data SuggestDokument4 SeitenEconomic Letter Economic Letter: China's Slowdown May Be Worse Than Official Data Suggestapi-162199694Noch keine Bewertungen

- Data Scan: Japan June Machinery OrdersDokument2 SeitenData Scan: Japan June Machinery Ordersapi-162199694Noch keine Bewertungen

- Taiwanese July Trade Figures Confirm Asia Is Still Weakening, Not StabilizingDokument1 SeiteTaiwanese July Trade Figures Confirm Asia Is Still Weakening, Not Stabilizingapi-162199694Noch keine Bewertungen

- No Asia Inflection Over AugustDokument3 SeitenNo Asia Inflection Over Augustapi-162199694Noch keine Bewertungen

- China's New, Prudent Policy RegimeDokument6 SeitenChina's New, Prudent Policy Regimeapi-162199694Noch keine Bewertungen

- Data Scan: China July Expenditure DataDokument3 SeitenData Scan: China July Expenditure Dataapi-162199694Noch keine Bewertungen

- Data Scan: Japan Q2 GDPDokument2 SeitenData Scan: Japan Q2 GDPapi-162199694Noch keine Bewertungen

- Data Scan: China July Trade FiguresDokument2 SeitenData Scan: China July Trade Figuresapi-162199694Noch keine Bewertungen

- The Folly of A Payrolls Relief Rally: Asia Sentry DispatchDokument4 SeitenThe Folly of A Payrolls Relief Rally: Asia Sentry Dispatchapi-162199694Noch keine Bewertungen

- Data Scan: China July CPI and PPIDokument2 SeitenData Scan: China July CPI and PPIapi-162199694Noch keine Bewertungen

- I Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For TodayDokument4 SeitenI Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For Todayapi-162199694Noch keine Bewertungen

- Not The Gold, But A Silver Medal PerformanceDokument4 SeitenNot The Gold, But A Silver Medal Performanceapi-162199694Noch keine Bewertungen

- Content But Not Complacent.: Policy PerspectiveDokument5 SeitenContent But Not Complacent.: Policy Perspectiveapi-162199694Noch keine Bewertungen

- Pan-Asia Coincident Weakening in Exports and Imports ContinuesDokument3 SeitenPan-Asia Coincident Weakening in Exports and Imports Continuesapi-162199694Noch keine Bewertungen

- A Troika of Disappointment: Asia Sentry DispatchDokument4 SeitenA Troika of Disappointment: Asia Sentry Dispatchapi-162199694Noch keine Bewertungen

- Some August Thoughts On Asian Manufacturing: Glenn Maguire's Asia Sentry Dispatch August 01, 2012Dokument5 SeitenSome August Thoughts On Asian Manufacturing: Glenn Maguire's Asia Sentry Dispatch August 01, 2012api-162199694Noch keine Bewertungen

- Asian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012Dokument3 SeitenAsian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012api-162199694Noch keine Bewertungen

- Asia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic NewsDokument1 SeiteAsia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic Newsapi-162199694Noch keine Bewertungen

- Asia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic NewsDokument2 SeitenAsia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic Newsapi-162199694Noch keine Bewertungen

- How Long Can Talk Trump Data?: Glenn Maguire's Asia Sentry Dispatch July 30, 2012Dokument3 SeitenHow Long Can Talk Trump Data?: Glenn Maguire's Asia Sentry Dispatch July 30, 2012api-162199694Noch keine Bewertungen

- Slower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012Dokument3 SeitenSlower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012api-162199694Noch keine Bewertungen

- I'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012Dokument3 SeitenI'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012api-162199694Noch keine Bewertungen

- Global Trade Is Retrenching Sharply. More To Come.: Glenn Maguire's Asia Sentry Dispatch July 24, 2012Dokument3 SeitenGlobal Trade Is Retrenching Sharply. More To Come.: Glenn Maguire's Asia Sentry Dispatch July 24, 2012api-162199694Noch keine Bewertungen

- Mont BlancDokument3 SeitenMont BlancAlam ShaikhNoch keine Bewertungen

- Reinventing Metro Packet (9-19)Dokument42 SeitenReinventing Metro Packet (9-19)CincinnatiEnquirerNoch keine Bewertungen

- Chapter 6 Price DeterminationDokument9 SeitenChapter 6 Price DeterminationNeelabh KumarNoch keine Bewertungen

- (Stats) Mean QuestionsDokument4 Seiten(Stats) Mean Questionsmonkeydluffy15498Noch keine Bewertungen

- The Ecuadorean Rose IndustryDokument2 SeitenThe Ecuadorean Rose IndustryFabian HagemannNoch keine Bewertungen

- Exam 20062011Dokument7 SeitenExam 20062011Rabah ElmasriNoch keine Bewertungen

- Variance Analysis Lecture NotesDokument5 SeitenVariance Analysis Lecture NotesIena IenaNoch keine Bewertungen

- Deed of Sale SampleDokument3 SeitenDeed of Sale Samplebarbiegirl9497Noch keine Bewertungen

- ConsignmentDokument4 SeitenConsignmentMaurice AgbayaniNoch keine Bewertungen

- PEB4102 Chapter 1Dokument37 SeitenPEB4102 Chapter 1LimNoch keine Bewertungen

- 5138 5604 Chapter 04 Forward ContractsDokument33 Seiten5138 5604 Chapter 04 Forward ContractsShomodip DeyNoch keine Bewertungen

- Innovation Operational ManagementDokument11 SeitenInnovation Operational Managementkimeli100% (2)

- Mergers and Acquisitions: Turmoil in Top Management TeamsDokument20 SeitenMergers and Acquisitions: Turmoil in Top Management TeamsBusiness Expert Press100% (1)

- Content Library ReadDokument40 SeitenContent Library Readfuck but TrueNoch keine Bewertungen

- CVP Analysis Techniques for Profit PlanningDokument3 SeitenCVP Analysis Techniques for Profit PlanningMadielyn Santarin MirandaNoch keine Bewertungen

- ACCA FR D19 Notes PDFDokument152 SeitenACCA FR D19 Notes PDFMohammed DanishNoch keine Bewertungen

- The Economics of Magazine PublishingDokument8 SeitenThe Economics of Magazine PublishingfedericosanchezNoch keine Bewertungen

- MB 4054 S TRACKTOR 6x4 (Full Spec.)Dokument18 SeitenMB 4054 S TRACKTOR 6x4 (Full Spec.)Mar Dha ZudyanNoch keine Bewertungen

- Learning CurvesDokument33 SeitenLearning Curvesayushc27Noch keine Bewertungen

- Machinery, Expenses, Ratios, Cash Flow AnalysisDokument3 SeitenMachinery, Expenses, Ratios, Cash Flow AnalysisAjit KumarNoch keine Bewertungen

- Body PartDokument73 SeitenBody PartRekha RamannavarNoch keine Bewertungen

- Mark Scheme (Results) October 2019Dokument20 SeitenMark Scheme (Results) October 2019nonNoch keine Bewertungen

- Flash Boys Insider Perspective on HFTDokument131 SeitenFlash Boys Insider Perspective on HFTPruthvish Shukla100% (1)

- Answers CRTDokument21 SeitenAnswers CRTAnonymous 3yqNzCxtTzNoch keine Bewertungen

- Budgeting Problem Set SolutionDokument21 SeitenBudgeting Problem Set SolutionJosephThomasNoch keine Bewertungen

- Car Sales Agreement TitleDokument3 SeitenCar Sales Agreement TitleEricNyaga100% (1)

- Power Development and Investment Opportunities in MyanmarDokument36 SeitenPower Development and Investment Opportunities in MyanmarArun KumarNoch keine Bewertungen

- NTA UGC NET Economics Syllabus PDFDokument8 SeitenNTA UGC NET Economics Syllabus PDFKajal RathiNoch keine Bewertungen

- Probate: What Is Probate? Probate (Or More Specifically 'Probate of The Will') Is An Official Form ThatDokument2 SeitenProbate: What Is Probate? Probate (Or More Specifically 'Probate of The Will') Is An Official Form ThatRoy2013Noch keine Bewertungen

- Business World (Jan. 15, 2016)Dokument33 SeitenBusiness World (Jan. 15, 2016)Peter RojasNoch keine Bewertungen