Beruflich Dokumente

Kultur Dokumente

Taxes That Affect Foreigners

Hochgeladen von

asiajcvrOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Taxes That Affect Foreigners

Hochgeladen von

asiajcvrCopyright:

Verfügbare Formate

Taxes that affect foreigners

Additional Tax: the additional tax applies to individuals or corporations that are not domiciled in Chile, at a rate of 35%. The taxable amount is based on the earnings that are transferred abroad from a source in Chile. This tax is accrued annually. The payers of this tax have the right to deduct the payments of First Category Tax paid for earnings transferred abroad.

Foreign Institutional Investors

The Chilean tax system includes an exemption from the Income Tax Law that may affect institutional investors, such as mutual funds and pension funds, for the earnings obtained due to the transfer of corporate stock that is publicly traded, or bonds or other publicly offered securities representing debt issued by the Central Bank of Chile, the Chilean government or by companies incorporated in Chile. The transfer of said assets must be effected on the Chilean Stock Exchange through a public offer of acquisition, according to the Chilean Stock Exchange Law No. 18,045, or through any other system authorized by the Superintendency of Securities and Insurance. In order to enjoy this exemption, foreign institutional investors must comply with the following requirements while operating in Chile:

To be established abroad and not be domiciled in Chile. To prove that the entity is a foreign institutional investor, according to requirements in the Income Tax Law Article 18 bis letters a) through f). To participate neither directly nor indirectly in the control of the companies whose issues the investor holds, nor to own directly or indirectly 10% or more of the capital or earnings of said entities. To hold a written contract with a bank or stock brokerage firm incorporated in Chile stating that the bank or brokerage firm will be responsible as intermediary for executing buy and sell orders, for verifying at the moment of the transaction that the earnings are exempt from the Income Tax Law, or, if the earnings are subject to this law, that the proper retentions are effected on behalf of the tax payers by the entities that pay or distribute the earnings. To be registered with the Internal Revenue Service, according to instructions in the Exemption Resolution No. 56 of 2001.

Taxation

General aspects of the Chilean tax system

Chiles tax structure includes indirect, direct and special taxes. The value-added tax (VAT) is the only indirect tax relevant to nonresident portfolio investors. It is assessed at a rate of 19% on the sale of goods and services, as well as on imports. At present,

both resident and non-resident investors pay VAT for financial services rendered in Chile (such as brokerage services by brokerage firms or participation in investment or mutual funds). However, there are some VAT exemptions, such as services rendered by lawyers or individual brokers. The government is also working on a new regulation which is expected to enter into force soon, which will exempt VAT payment for taxes on financial services rendered from Chile to non-resident investors. Direct taxes include business income tax and personal income tax. Non-resident persons or businesses are subject to income tax only on income earned in Chile. Income is considered Chileanearned when it arises from assets located in the country or activities performed in Chile. Chilean income tax is built around these basic principles: Individuals are the ones who are ultimately taxed. Taxes paid by an enterprise are only paid on account of the taxes that the owners of the enterprise will ultimately pay. Resident and non-resident business owners only pay taxes on the profits withdrawn from the enterprise. As a result, if profits remain in the enterprise, personal taxation is postponed. Business income is taxed annually under the so-called first-category tax at a rate of 17%. Taxable income corresponds to income as shown in the financial statements, adjusted in accordance with the income tax law. The first-category tax paid by a business entity may be credited against the tax assessed on dividends or profit distributions to equity holders, owners in the case of individual business entities, or the main office of local branches or permanent establishments of foreign companies. Locally domiciled individuals are subject to a personal progressive tax on gross income with a rate of up to 40%. Although, technically speaking, the progressive tax on wages and salaries is different from the progressive personal tax on other income sources; the effective tax burden is similar regardless of the source of income. Non-domiciled and non-resident individuals and entities are subject to an additional tax (AT), a withholding tax that applies to Chilean earned income and to certain specific payments defined in the law. To calculate the AT with respect to profit distributions, an amount equivalent to the first-category tax paid on the corresponding profits, distributed or remitted, should be included in the tax base and the income is thus grossed up. The amount of first-category tax paid may be deducted from the AT due. The AT is assessed at a general rate of 35%. There are, however, other rates for different types of income, like for instance a reduced rate of 4% applicable to interest paid to non-domiciled creditors of specific types of debt, including Government securities. Therefore, interest payments made by Chilean debt issuers to a foreign debt holder will be subject to a Chilean interest withholding tax assessed at a rate of 4%. Chilean issuers and intermediaries are deemed to be collection agents, therefore the foreign resident

holder receives an after-tax net amount. Recently, the reduced rate of 4% has been extended from banks and other financial institutions to include other types of non-domiciled creditors, such as insurance companies and pension funds. Foreign investors that engage in direct investment projects under the provisions of the foreign investment statute (known as Decreto Ley 600, DL600) may choose to be taxed for a time period of 10 years (for investment projects exceeding US$50 million, this period is extended to 20 years) at an overall tax rate of 42% that remains invariable regardless of changes to Chilean tax laws. Foreign investors may invest under the DL600, where the foreign investor may choose to pay a higher tax of 42% instead of the AT of 35%. The rate is fixed for a period of 10 years, which may in certain circumstances be extended to a maximum period of 20 years. The investor may opt out of the special regime and thereby pay the AT, but after opting out s/he may not go back. A stamp duty applies to documents containing a credit agreement, such as bills of exchange or promissory notes. This tax was suspended for the year 2009 only and will be applied with a 50% discount for credit documents signed between January 1 and June 30, 2010. From that date forward, the tax rate will vary depending on the period of the loan, from 0.1% of the par value of the document for each month of the loans term, up to a maximum of 1.2%. Since December 2006 credit renegotiations do not pay the stamp tax. FICEs and FICERs mentioned above may also be eligible for a special reduced tax. The most notable requisite for this benefit is an obligation to maintain the investment in Chile for at least 5 years. The fund is taxed at a flat rate of 10% on its remittances, though any initial capital remitted is not subject to any tax.

Capital gains

Generally, capital gains are considered normal income. As a result, unless a tax exemption is applicable, capital gains realized on the sale or other disposition by a foreign holder of Chilean securities will be subject to Chilean income taxes but only when the corresponding assets are effectively disposed of or sold. Also, any premium payable on redemption of the securities will be treated as interest and subject to the Chilean interest withholding tax, as described above. There are some exceptions to this rule, the most important of which are described in the two following sections. i) Tax benefits Capital gains originating from the sale or transfer of shares in publicly-traded corporations limited by shares (sociedad annima abierta) may be subject to a flat tax of 17% if (a) the shares have been held for more than one year; (b) the operation is not part of the sellers habitual business or activities and (c) the buyer

is not related to the seller. Chile provides a credit of 30% for the foreign tax paid on dividends and remittance of profits or, when this is less, for the amount of tax paid abroad. This credit may be deducted from the firstcategory tax. Any unrelieved credits may be applied against the complementary global tax or the AT. When a tax convention is applicable there is also credit for other types of income.

Das könnte Ihnen auch gefallen

- TaxationDokument3 SeitenTaxationErwin MacaspacNoch keine Bewertungen

- The Philippines Income TaxDokument8 SeitenThe Philippines Income TaxmendozaivanrichmondNoch keine Bewertungen

- Business Tax Laws (Phils)Dokument15 SeitenBusiness Tax Laws (Phils)Jean TanNoch keine Bewertungen

- Summary of You Tube VideoDokument2 SeitenSummary of You Tube VideoErylle Jeen VivasNoch keine Bewertungen

- Module 1: Income Tax PrinciplesDokument18 SeitenModule 1: Income Tax PrinciplesJun MagallonNoch keine Bewertungen

- Doing Business Brazil Deloitte Corporate Taxation Indirect TaxesDokument18 SeitenDoing Business Brazil Deloitte Corporate Taxation Indirect TaxesGiulia CamposNoch keine Bewertungen

- Philippines Tax RatesDokument7 SeitenPhilippines Tax RatesRonel CacheroNoch keine Bewertungen

- Categories of Income and Tax RatesDokument5 SeitenCategories of Income and Tax RatesRonel CacheroNoch keine Bewertungen

- Different Kinds of Taxes in The PhilippinesDokument4 SeitenDifferent Kinds of Taxes in The PhilippinesJUDADRIEL MADRIDANONoch keine Bewertungen

- Mexico tax guide highlights income, capital gains, social security ratesDokument5 SeitenMexico tax guide highlights income, capital gains, social security ratesJonas VetsNoch keine Bewertungen

- View in Online Reader: Text Size +-RecommendDokument7 SeitenView in Online Reader: Text Size +-RecommendRhea Mae AmitNoch keine Bewertungen

- Lecture Notes - Atty Steve Part 1Dokument9 SeitenLecture Notes - Atty Steve Part 1Tesia MandaloNoch keine Bewertungen

- UntitledDokument127 SeitenUntitledemielyn lafortezaNoch keine Bewertungen

- Business Tax Laws in The PhilippinesDokument12 SeitenBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaNoch keine Bewertungen

- Philippines Income Tax Rates Guide - Individual, Corporate, Capital GainsDokument6 SeitenPhilippines Income Tax Rates Guide - Individual, Corporate, Capital GainsKristina AngelieNoch keine Bewertungen

- Philippines Tax RatesDokument7 SeitenPhilippines Tax RatesJL GEN0% (1)

- Unit 5 - Inclusions & Exclusions To Bus & Other Sources of IncomeDokument10 SeitenUnit 5 - Inclusions & Exclusions To Bus & Other Sources of IncomeJoseph Anthony RomeroNoch keine Bewertungen

- Instructions For Form 4548 2011 Michigan Business Tax (MBT) Quarterly ReturnDokument4 SeitenInstructions For Form 4548 2011 Michigan Business Tax (MBT) Quarterly ReturnjoshisanjeevNoch keine Bewertungen

- Author Ayan Ahmed Blog Capital Gain in FranceDokument5 SeitenAuthor Ayan Ahmed Blog Capital Gain in FranceAYAN AHMEDNoch keine Bewertungen

- Angela Jano - 2C1Dokument2 SeitenAngela Jano - 2C1Angela Bea JanoNoch keine Bewertungen

- tAX LESSON B .Dokument10 SeitentAX LESSON B .intramuramazingNoch keine Bewertungen

- 3 Income Tax ConceptsDokument37 Seiten3 Income Tax ConceptsRommel Espinocilla Jr.Noch keine Bewertungen

- Chapter 13 ADokument22 SeitenChapter 13 AAdmNoch keine Bewertungen

- MidTerm Lesson Part 1Dokument34 SeitenMidTerm Lesson Part 1ARMAN WAYNE ANGELESNoch keine Bewertungen

- Income Taxation Finals - CompressDokument9 SeitenIncome Taxation Finals - CompressElaiza RegaladoNoch keine Bewertungen

- NT - Items of Gross Income 0510 - Income TaxDokument7 SeitenNT - Items of Gross Income 0510 - Income TaxElizah PorcadoNoch keine Bewertungen

- Income Tax Part IIIDokument6 SeitenIncome Tax Part IIImary jhoyNoch keine Bewertungen

- Capital Gains Tax - Wikipedia, The Free EncyclopediaDokument18 SeitenCapital Gains Tax - Wikipedia, The Free Encyclopediatsar_philip2010Noch keine Bewertungen

- Philippines Corporate Tax RatesDokument2 SeitenPhilippines Corporate Tax RatesAike SadjailNoch keine Bewertungen

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Dokument23 SeitenMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Jesse Rielle CarasNoch keine Bewertungen

- TaxLawRev1 UpdatedDokument277 SeitenTaxLawRev1 UpdatedKaira TanhuecoNoch keine Bewertungen

- Faqs Withholding TaxDokument50 SeitenFaqs Withholding TaxHarryNoch keine Bewertungen

- Tax Quiz 8-27Dokument5 SeitenTax Quiz 8-27mhilet_chiNoch keine Bewertungen

- Income and Business TaxationDokument21 SeitenIncome and Business TaxationFrance Jacob B. EscopeteNoch keine Bewertungen

- M5 - Final Income TaxationDokument31 SeitenM5 - Final Income TaxationTERRIUS Ace100% (1)

- CHILE Tax Chilehighlights 2017Dokument5 SeitenCHILE Tax Chilehighlights 2017Renato ManriqueNoch keine Bewertungen

- Other Local TaxesDokument25 SeitenOther Local Taxesjoankristel19lNoch keine Bewertungen

- Taxation Reviewer Part 1: Introduction to Tax Laws and PrinciplesDokument8 SeitenTaxation Reviewer Part 1: Introduction to Tax Laws and PrinciplesIon FashNoch keine Bewertungen

- Chile's international tax highlightsDokument3 SeitenChile's international tax highlightsMikailOpintoNoch keine Bewertungen

- Taxation ProjectDokument14 SeitenTaxation ProjectrahulkoduvanNoch keine Bewertungen

- Basic Overview of Corporate Income Taxation in the PhilippinesDokument7 SeitenBasic Overview of Corporate Income Taxation in the PhilippinesMae Katherine Grande Lumbria100% (1)

- BASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmanDokument14 SeitenBASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmansaadmansheedyNoch keine Bewertungen

- Taxpayer's checklist for TRAIN law changesDokument6 SeitenTaxpayer's checklist for TRAIN law changesChrislynNoch keine Bewertungen

- Calculate Income Tax DueDokument8 SeitenCalculate Income Tax DueKhaira PeraltaNoch keine Bewertungen

- Guinea Tax 2Dokument6 SeitenGuinea Tax 2Onur KopanNoch keine Bewertungen

- INCOME TAX | Final Tax, Passive Income, Non-ResidentsDokument14 SeitenINCOME TAX | Final Tax, Passive Income, Non-ResidentsShane Mark CabiasaNoch keine Bewertungen

- TAXATIONDokument21 SeitenTAXATIONRichelle Ann CarinoNoch keine Bewertungen

- Tax exemptions defined for individuals, organizations and investmentsDokument4 SeitenTax exemptions defined for individuals, organizations and investmentsLuiza ŢîmbaliucNoch keine Bewertungen

- Direct Tax CodeDokument17 SeitenDirect Tax CodeRashmi RathoreNoch keine Bewertungen

- Lecture 3 - Income Taxation (Corporate)Dokument8 SeitenLecture 3 - Income Taxation (Corporate)Lovenia Magpatoc50% (2)

- TaxDokument11 SeitenTaxmnoor13245mnNoch keine Bewertungen

- Final Income Taxation Lesson 5: Passive Income and Withholding Tax RatesDokument28 SeitenFinal Income Taxation Lesson 5: Passive Income and Withholding Tax Rateslc50% (4)

- Deductibility of Interest ExpenseDokument2 SeitenDeductibility of Interest ExpenseFerjeanie BernandinoNoch keine Bewertungen

- Colombia Tax ReformDokument6 SeitenColombia Tax ReformshadiafeNoch keine Bewertungen

- Axsdaqgasdgasdg 123123 Aeasdfw SadgDokument6 SeitenAxsdaqgasdgasdg 123123 Aeasdfw SadgMark LimNoch keine Bewertungen

- Philippines Tax Rates Guide for Individuals and BusinessesDokument3 SeitenPhilippines Tax Rates Guide for Individuals and BusinesseserickjaoNoch keine Bewertungen

- 2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFDokument18 Seiten2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFtendaicrosby100% (1)

- Oing Business in GuatemalaDokument16 SeitenOing Business in GuatemalaJorge Luis Can MonroyNoch keine Bewertungen

- Regular Income Tax Inclusion RulesDokument33 SeitenRegular Income Tax Inclusion RulesAaron BuendiaNoch keine Bewertungen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- Effects of Merchant Banking on Financial Growth of ICICIDokument62 SeitenEffects of Merchant Banking on Financial Growth of ICICIij EducationNoch keine Bewertungen

- ONGC ValuationDokument34 SeitenONGC ValuationMoaaz AhmedNoch keine Bewertungen

- Feb 23 To Jan 24Dokument40 SeitenFeb 23 To Jan 24Next Media UKNoch keine Bewertungen

- Economic Factors Impacting International BusinessDokument29 SeitenEconomic Factors Impacting International BusinessRana Ankita100% (1)

- ITC Financial ModelDokument150 SeitenITC Financial ModelKaushik JainNoch keine Bewertungen

- Housing Finance in AfricaDokument12 SeitenHousing Finance in AfricaOluwole DaramolaNoch keine Bewertungen

- Narayan College Fee Structure 2021 22 Residential FeeDokument1 SeiteNarayan College Fee Structure 2021 22 Residential Feeankur agarwalNoch keine Bewertungen

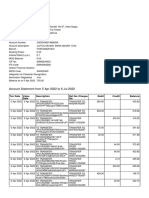

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument12 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceamool rokadeNoch keine Bewertungen

- Real Estate Investments and The Inflation-Hedging Question: A ReviewDokument10 SeitenReal Estate Investments and The Inflation-Hedging Question: A ReviewShanza KhalidNoch keine Bewertungen

- Regular Savings SOC 2023Dokument2 SeitenRegular Savings SOC 2023megha90909Noch keine Bewertungen

- DisruptionsandDigitalBankingTrends Wewegeetal200718Dokument43 SeitenDisruptionsandDigitalBankingTrends Wewegeetal200718Khushi BhartiNoch keine Bewertungen

- Bengal Money Lenders Act, 1940 PDFDokument27 SeitenBengal Money Lenders Act, 1940 PDFSutirtha BanerjeeNoch keine Bewertungen

- Apr FinalDokument48 SeitenApr FinalVivek PatilNoch keine Bewertungen

- Fim01 - 02 - Basic FsDokument8 SeitenFim01 - 02 - Basic FsJomar VillenaNoch keine Bewertungen

- Journal Ledger & Trial BalanceDokument32 SeitenJournal Ledger & Trial BalanceMr. Demon ExtraNoch keine Bewertungen

- Co Signers Statement2Dokument1 SeiteCo Signers Statement2Pharmastar Int'l Trading Corp.Noch keine Bewertungen

- HWRK Grading Criteria HWRK 1 Ch. 2 - 2017Dokument5 SeitenHWRK Grading Criteria HWRK 1 Ch. 2 - 2017Moulee DattaNoch keine Bewertungen

- Fixed Home Loan Statement SummaryDokument3 SeitenFixed Home Loan Statement Summaryผม หล่อNoch keine Bewertungen

- H14 - Tax RemediesDokument7 SeitenH14 - Tax Remediesnona galidoNoch keine Bewertungen

- April JuneDokument15 SeitenApril JuneSanjivNoch keine Bewertungen

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDokument4 SeitenSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNoch keine Bewertungen

- Accountancy Class XII Practice PaperDokument7 SeitenAccountancy Class XII Practice PaperмŕίȡùĻ νέŕмάNoch keine Bewertungen

- Form OC-10 Appl 4 FRNDokument51 SeitenForm OC-10 Appl 4 FRNBenne James100% (4)

- Performance Appraisal of Gold ETFS in India: Finance ManagementDokument4 SeitenPerformance Appraisal of Gold ETFS in India: Finance ManagementpatelaxayNoch keine Bewertungen

- Financial Instruments IAS 32, IfRS 9, IfRS 13, IfRS 7 Final VersionDokument50 SeitenFinancial Instruments IAS 32, IfRS 9, IfRS 13, IfRS 7 Final VersionNoor Ul Hussain MirzaNoch keine Bewertungen

- Financial Analysis of Public Company and Its Contribution To Nepalese Economy: A Case Study of Nepal TelecomDokument74 SeitenFinancial Analysis of Public Company and Its Contribution To Nepalese Economy: A Case Study of Nepal TelecomUmesh KathariyaNoch keine Bewertungen

- Role of Microfinance Institutions in Rural Development B.V.S.S. Subba Rao AbstractDokument13 SeitenRole of Microfinance Institutions in Rural Development B.V.S.S. Subba Rao AbstractIndu GuptaNoch keine Bewertungen

- 6681606Dokument3 Seiten6681606Jay O CalubayanNoch keine Bewertungen

- Financial Mathematics Exercises Actuarial Studies UNSWDokument115 SeitenFinancial Mathematics Exercises Actuarial Studies UNSWgy5115123Noch keine Bewertungen

- Calculating Percentage of Recovery and Distribution in InsolvencyDokument21 SeitenCalculating Percentage of Recovery and Distribution in InsolvencyJack HererNoch keine Bewertungen