Beruflich Dokumente

Kultur Dokumente

Sunwest Order

Hochgeladen von

Statesman JournalOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sunwest Order

Hochgeladen von

Statesman JournalCopyright:

Verfügbare Formate

Case 6:09-cv-06056-HO

Document 2370

Filed 10/05/12

Page 1 of 8

Page ID#: 39944

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF OREGON

SECURITIES AND EXCHANGE COMMISSION, Plaintiffs, v. SUNWEST MANAGEMENT, INC., CANYON CREEK DEVELOPMENT, INC., CANYON CREEK FINANCIAL LLC, and JON M. HARDER,

) ) ) ) ) ) ) ) ) ) )

No. 6:09-cv-6056-HO ORDER

) Defendants, ) ) and ) ) DARRYL E. FISHER, J. WALLACE GUTZLER,) KRISTIN HARDER, ENCORE INDEMNITY ) MANAGEMENT LLC, SENENET LEASING ) COMPANY, FUSE ADVERTISING, INC., KDA) CONSTRUCTION, INC., CLYDE HAMSTREET, ) and CLYDE A. HAMSTREET & ASSOCIATES, ) LLC, ) ) Relief Defendants, ) _______________________________________ )

Case 6:09-cv-06056-HO

Document 2370

Filed 10/05/12

Page 2 of 8

Page ID#: 39945

The Securities and Exchange Commission

(SEC)

seeks civil

remedies from defendant Jon Harder and relief defendant Kristin Harder. 1 remedies. The court has broad discretion to impose civil Inc.,

See, e.g., S.E.C. v.

First Jersey Securities,

101 F.3d 1450, 1474-75 (2d Cir. 1996)

(where the court has found

federal securities law violations, there is broad equitable power to fashion appropriate remedies). well as disgorgement. The SEC seeks penalties as

A.

Civil Penalties There are three tiers of penalties: (I) First tier

The amount of the penalty shall be determined by the court in light of the facts and circumstances. For each violation, the amount of the penalty shall not exceed the greater of (I) $5, 000 for a natural person or $50,000 for any other person, or (II) the gross amount of pecuniary gain to such defendant as a result of the violation. (ii) Second tier Notwithstanding clause (I), the amount of penalty for each such violation shall not exceed the greater of (I) $50,000 for a natural person or $250,000 for any other person, or (II) the gross amount of pecuniary gain to such defendant as a result of the violation, if the

The Official Committee of the Tenants in Common Investors joins in the SEC's request. The Harders move to strike the joinder based on the Committee's assertion that it would take no position on penalties. The Committee withdraws any statements taking a position on penal ties, but still joins the SEC's motion with respect to disgorgement. The motion to strike (#1875) is denied.

1

2 - ORDER

Case 6:09-cv-06056-HO

Document 2370

Filed 10/05/12

Page 3 of 8

Page ID#: 39946

violation described in subparagraph (A) involved fraud, deceit, manipulation, or deliberate or reckless disregard of a regulatory requirement. (iii) Third tier Notwithstanding clauses (I) and ( ii) , the amount of penalty for each such violation shall not exceed the greater of (I) $100,000 for a natural person or $500,000 for any other person, or (II) the gross amount of pecuniary gain to such defendant as a result of the violation, if-(aa) the violation described in subparagraph (A) involved fraud, deceit, manipulation, or deliberate or reckless disregard of a regulatory requirement; and (bb) such violation directly or indirectly resulted in substantial losses or created a significant risk of substantial losses to other persons. 15 U.S.C.

78u(d) (3) (B) . 2

See also 15 U.S.C.

77t(d).

The SEC seeks third tier penalties asserting the Harders' conduct involved scienter-based fraud in violation of Section 17(a) of the Securities Act and Section 10(b) of the Exchange Act as determined in the court's prior ruling on summary judgment. The SEC anticipates a loss to investors in excess of $180 million as a result of these violations. The court does not minimize the significant violations that occurred, but does acknowledge the miraculous result in

The maximum amounts for the penalties for a natural person adjust with inflation to $7,500 for tier 1, $75,00 for tier 2, and $150,000 for tier 3. 17 C.F.R. 201.1004.

2

3 - ORDER

Case 6:09-cv-06056-HO

Document 2370

Filed 10/05/12

Page 4 of 8

Page ID#: 39947

minimizing

losses

to

investors

due

to

the

efforts

of

all

concerned in this

and related litigation,

which includes the

efforts of the Harders. estimates recovery of the

The court also takes exception with the losses and suffered the full by investors from as the

ultimate are

efforts

ongoing

return

entities that grew out of the efforts to minimize losses has not been fully realized. At a minimum, many investors will receive Moreover, those investors

a return of approximately 60 percent.

who chose to reinvest in the rollover entity will, in most cases, receive more than a 100 percent return. Of perhaps equal importance, Harder's cooperation (in

addition to that of Wally Gutzler and Darryl Fisher) was critical not only to the sale of interests in many of the subject

properties to the Blackstone Group, but to avoiding substantial adverse advice tax to consequences the court to well the over 1, 000 and investors. creditors The from

from

investors

nationally and regionally recognized tax experts concluded that the contribution of the Harder assets was absolutely necessary to obtain the beneficial tax treatment received by investors in this case. Conversely, failure to cooperate would have resulted in

many dozens of foreclosures that would have in turn had dramatic negative tax impacts on investors, even if some investors were able to "salvage" properties being foreclosed.

4 - ORDER

Case 6:09-cv-06056-HO

Document 2370

Filed 10/05/12

Page 5 of 8

Page ID#: 39948

The Court also has to take into consideration the reality of the collapse of the real estate market in 2008 and 2009,

including the dramatic decline in the numbers of older Americans moving into assisted living facilities. bank in the Western United States Given that the largest Mutual Bank)

(Washington

failed; numerous banks who were lenders to Sunwest failed; and an uncountable number of real estate developers lost everything, clearly a substantial portion of the losses suffered by investors in Sunwest would have occurred simply due to market conditions, particularly in the more marginal properties and the properties that were right "in the middle" of development. While it was

apparent that Sunwest engaged in serious over-leveraging behavior and in moving money inappropriately between entities, this did

not make Sunwest particularly unique, and made it susceptible to the same type of failures that numerous lending institutions and developers suffered. Finally, it is worth noting that unlike a number of other alleged Ponzi-like schemes, Mr. Harder voluntarily and fully

cooperated with the Securities and Exchange Commission, through his counsel, and right to the understanding of this court, never of

invoked his

to avoid self-incrimination during days the SEC Receiver,

examination by the SEC,

and third parties.

5 - ORDER

Case 6:09-cv-06056-HO

Document 2370

Filed 10/05/12

Page 6 of 8

Page ID#: 39949

Accordingly,

the court

declines,

in its discretion,

to award

civil penalties.

B.

Disgorgement Again, the court has broad discretion with respect to the SEC v. First Pac. Bancorp, 142 This remedy is designed to

disgorgement of ill-gotten gains. F.3d 1186, 1191 (9th Cir. 1998).

deprive a violator of unjust enrichment, and to deter others from violating securities laws by making violations unprofitable. Id. The amount should include all gains flowing from the illegal

activities. SEC v. JT Wallenbrock & Assocs., 440 F.3d 1109, 1114 (9th Cir. 2006). Disgorgement need be only a reasonable SEC v. 1998).

approximation of profits connected to the violation. First Pac. Bancorp, 142 F.3d 1186, 1192 n. 6 (9th Cir.

The government bears the burden to show such an approximation. Id. Once the government establishes a reasonable approximation

of the wrongdoer's actual profits, however, the burden shifts to the wrongdoer to demonstrate that the figure is not reasonable. SEC v. Platforms Wireless, 617 F.3d 1072, 1096 (9th Cir. 2010). Here, the SEC asserts a figure that is a bit of a moving

target ranging from the $180,000,000 it asserts investors will lose, to $174,600,000, based on a math formula (that quite

frankly the court does not follow)

that takes into account an

6 - ORDER

Case 6:09-cv-06056-HO

Document 2370

Filed 10/05/12

Page 7 of 8

Page ID#: 39950

asserted return of $125,400,000 from Harder related entities, through the Blackstone sale. The SEC also asserts the Harders

received $10,618,158 in proceeds from the Sunwest enterprise from a time period just prior to this action through the present The

(including professional fees paid pursuant to court order). SEC also seeks prejudgment interest. What could has been accomplished in these have been realized without

related proceedings the $58,000,000 in

never

proceeds from the Lone Star sale, which cannot be equated to an impermissible business expense offset. Harders to sustain the Sunwest The cooperation of the throughout these

enterprise

proceedings to minimize losses rather than fighting liability is important in considering disgorgement. Further, Jon Harder's

contribution of Sunwest properties that he could have argued (unsuccessfully considered. mind you) belonged to him should also be

But perhaps most important is the fact that recovery

efforts are still underway and investors have been given the opportunity to further their recoveries through implementation of the Distribution Plan. Recovery to date has demonstrated far As noted above, in

less than the government estimates in losses. some cases there will be no loss.

Accordingly, ill-gotten gains

for purposes of disgorgement cannot be adequately approximated at this time. However, should the recoveries reach the level such

7 - ORDER

Case 6:09-cv-06056-HO

Document 2370

Filed 10/05/12

Page 8 of 8

Page ID#: 39951

that the HFG parties participate in the distributions under the distribution plan, the court reserves the right to revisit the issue of disgorgement.

CONCLUSION For the reasons stated above, the Harders' motion to strike (#1875) denied. DATED this day of October, 2012. is denied and the SEC's motion for remedies (#1749) is

8 - ORDER

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Con Law Flow Chart (EPC & DPC)Dokument2 SeitenCon Law Flow Chart (EPC & DPC)Ali Ammoura100% (10)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

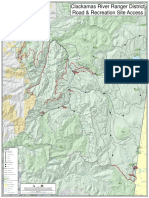

- Roads and Trails of Cascade HeadDokument1 SeiteRoads and Trails of Cascade HeadStatesman JournalNoch keine Bewertungen

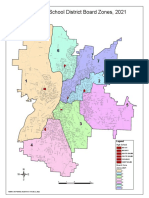

- School Board Zones Map 2021Dokument1 SeiteSchool Board Zones Map 2021Statesman JournalNoch keine Bewertungen

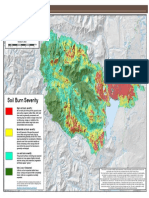

- Cedar Creek Vegitation Burn SeverityDokument1 SeiteCedar Creek Vegitation Burn SeverityStatesman JournalNoch keine Bewertungen

- Letter To Judge Hernandez From Rural Oregon LawmakersDokument4 SeitenLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNoch keine Bewertungen

- Cedar Creek Fire Soil Burn SeverityDokument1 SeiteCedar Creek Fire Soil Burn SeverityStatesman JournalNoch keine Bewertungen

- Matthieu Lake Map and CampsitesDokument1 SeiteMatthieu Lake Map and CampsitesStatesman JournalNoch keine Bewertungen

- Cedar Creek Fire Sept. 3Dokument1 SeiteCedar Creek Fire Sept. 3Statesman JournalNoch keine Bewertungen

- Oregon Annual Report Card 2020-21Dokument71 SeitenOregon Annual Report Card 2020-21Statesman JournalNoch keine Bewertungen

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Dokument4 SeitenComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNoch keine Bewertungen

- Mount Hood National Forest Map of Closed and Open RoadsDokument1 SeiteMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNoch keine Bewertungen

- Windigo Fire ClosureDokument1 SeiteWindigo Fire ClosureStatesman JournalNoch keine Bewertungen

- Revised Closure of The Beachie/Lionshead FiresDokument4 SeitenRevised Closure of The Beachie/Lionshead FiresStatesman JournalNoch keine Bewertungen

- LGBTQ Proclaimation 2022Dokument1 SeiteLGBTQ Proclaimation 2022Statesman JournalNoch keine Bewertungen

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDokument1 SeiteProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNoch keine Bewertungen

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDokument1 SeiteSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNoch keine Bewertungen

- SIA Report 2022 - 21Dokument10 SeitenSIA Report 2022 - 21Statesman JournalNoch keine Bewertungen

- Salem-Keizer Discipline Data Dec. 2021Dokument13 SeitenSalem-Keizer Discipline Data Dec. 2021Statesman JournalNoch keine Bewertungen

- Resource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeDokument3 SeitenResource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeStatesman JournalNoch keine Bewertungen

- Gcab - Personal Electronic Devices and Social Media - StaffDokument2 SeitenGcab - Personal Electronic Devices and Social Media - StaffStatesman JournalNoch keine Bewertungen

- Crib Midget Day Care Emergency Order of SuspensionDokument6 SeitenCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNoch keine Bewertungen

- SB Agenda 20210415 EnglishDokument1 SeiteSB Agenda 20210415 EnglishStatesman JournalNoch keine Bewertungen

- School Board Zone MapDokument1 SeiteSchool Board Zone MapStatesman JournalNoch keine Bewertungen

- Op Ed - Anthony MedinaDokument2 SeitenOp Ed - Anthony MedinaStatesman JournalNoch keine Bewertungen

- 2021 Ironman 70.3 Oregon Traffic ImpactDokument2 Seiten2021 Ironman 70.3 Oregon Traffic ImpactStatesman JournalNoch keine Bewertungen

- Statement From Marion County Medical Examiner's Office On Heat-Related DeathsDokument1 SeiteStatement From Marion County Medical Examiner's Office On Heat-Related DeathsStatesman JournalNoch keine Bewertungen

- Schools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramDokument3 SeitenSchools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramStatesman Journal100% (1)

- Zone Resolution PDFDokument2 SeitenZone Resolution PDFStatesman JournalNoch keine Bewertungen

- City of Salem Photo Red Light Program 2021 Legislative ReportDokument8 SeitenCity of Salem Photo Red Light Program 2021 Legislative ReportStatesman JournalNoch keine Bewertungen

- Air France vs. CarrascosoDokument4 SeitenAir France vs. Carrascosojessalowie100% (1)

- List of Attorneys 102108Dokument11 SeitenList of Attorneys 102108patazo2000Noch keine Bewertungen

- Other Causes Full Text CasessDokument128 SeitenOther Causes Full Text Casessjed_sindaNoch keine Bewertungen

- Topic Date Case Title GR No Doctrine Facts: Criminal Procedure 2EDokument2 SeitenTopic Date Case Title GR No Doctrine Facts: Criminal Procedure 2EJasenNoch keine Bewertungen

- Evidence - Jurisprudence DoctrinesDokument46 SeitenEvidence - Jurisprudence DoctrinesFelora MangawangNoch keine Bewertungen

- Hunter MooreDokument20 SeitenHunter MoorenicholasdeleoncircaNoch keine Bewertungen

- 3-L PP Vs SanchezDokument2 Seiten3-L PP Vs SanchezShaine Aira ArellanoNoch keine Bewertungen

- Sagales Vs RustansDokument9 SeitenSagales Vs RustansAnthony MedinaNoch keine Bewertungen

- Public-Notice-Article - 22 in HinduDokument4 SeitenPublic-Notice-Article - 22 in Hinduapi-361601057Noch keine Bewertungen

- Pioneer v. TodaroDokument2 SeitenPioneer v. TodaroMark Jason Crece AnteNoch keine Bewertungen

- History and Civics 2Dokument2 SeitenHistory and Civics 2AMIN BUHARI ABDUL KHADERNoch keine Bewertungen

- Newstead v. London Express Newspaper, LimiteDokument16 SeitenNewstead v. London Express Newspaper, Limitesaifullah_100% (1)

- Moot - Rohingya PetitionerDokument18 SeitenMoot - Rohingya Petitionermanoj ktmNoch keine Bewertungen

- EO No. 008 2018 REORGANIZATION OF BPOC 2Dokument2 SeitenEO No. 008 2018 REORGANIZATION OF BPOC 2Christian Gatchalian100% (5)

- Arizona Foreclosure TimelineDokument5 SeitenArizona Foreclosure TimelineKeith CarrNoch keine Bewertungen

- Case StudyDokument5 SeitenCase StudyAayushNoch keine Bewertungen

- General Assembly: United NationsDokument11 SeitenGeneral Assembly: United NationspisterboneNoch keine Bewertungen

- Proposed Rule: Aircraft: Latinoamericana de Aviacion S.A.Dokument3 SeitenProposed Rule: Aircraft: Latinoamericana de Aviacion S.A.Justia.comNoch keine Bewertungen

- Form GST REG-06: Government of IndiaDokument3 SeitenForm GST REG-06: Government of IndiaKalpesh DaveNoch keine Bewertungen

- Supia and Batioco vs. Quintero and Ayala.Dokument2 SeitenSupia and Batioco vs. Quintero and Ayala.Di ko alamNoch keine Bewertungen

- West Coast Life Ins. Co. vs. Hurd.Dokument8 SeitenWest Coast Life Ins. Co. vs. Hurd.poiuytrewq9115Noch keine Bewertungen

- Hostile Witness: Critical AnalysisDokument5 SeitenHostile Witness: Critical Analysisadarsh kumarNoch keine Bewertungen

- Rimando Vs PeopleDokument3 SeitenRimando Vs PeopleAnything Under The SunNoch keine Bewertungen

- Court of RecordDokument16 SeitenCourt of RecordDannyDolla100% (1)

- Gregory Kim Complaint (Breach of Lease and Fraud)Dokument7 SeitenGregory Kim Complaint (Breach of Lease and Fraud)James Alexander KimNoch keine Bewertungen

- ROLANDO SANTOS, Petitioner, vs. CONSTANCIA SANTOS ALANA, RespondentDokument14 SeitenROLANDO SANTOS, Petitioner, vs. CONSTANCIA SANTOS ALANA, RespondentKobe BullmastiffNoch keine Bewertungen

- Best Memorial RESPONDENT 2nd RGNUL National Moot Court 2013Dokument40 SeitenBest Memorial RESPONDENT 2nd RGNUL National Moot Court 2013Vidushi Trehan100% (1)

- Briones Vs Cammayo 41 SCRA 404Dokument14 SeitenBriones Vs Cammayo 41 SCRA 404Kimberly Anne LatonioNoch keine Bewertungen

- 13Dokument3 Seiten13NympsandCo PageNoch keine Bewertungen