Beruflich Dokumente

Kultur Dokumente

CFA Society of Alabama Presentation - April 21 2011

Hochgeladen von

bienvillecapOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CFA Society of Alabama Presentation - April 21 2011

Hochgeladen von

bienvillecapCopyright:

Verfügbare Formate

CONFIDENTIAL

CFA SOCIETY OF ALABAMA

April 21, 2011

M. Cullen Thompson, CFA Managing Partner & Chief Investment Officer cullen.thompson@bienvillecapital.com Phone: 212.226.7348 www.bienvillecapital.com

CONFIDENTIAL

THE U.S. ARE WE IN A FISCAL TRAP?

CONFIDENTIAL

U.S. FISCAL TRAP?

After credit growth well in excess of economic growth early in the decade, particularly in the household sector, the current recovery has once again been bought by the transfer of private sector leverage to the sovereign balance sheet

Growth of Domestic Nonfinancial Debt

Percentage Changes; quarterly data are seasonally adjusted annual rates

Total 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 6.3 7.4 8.1 8.8 9.5 9.0 8.6 6.0 3.0 4.6

Households 9.6 10.8 11.8 11.0 11.1 10.1 6.8 -0.1 -1.7 -1.8

Business 5.7 2.8 2.3 6.2 8.6 10.5 13.0 5.8 -2.7 1.5

State & Local 8.8 11.1 8.3 7.3 10.2 8.3 9.5 2.3 4.8 4.4

Federal -0.2 7.6 10.9 9.0 7.0 3.9 4.9 24.2 22.7 20.2

Source: Federal Reserve, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 3

CONFIDENTIAL

U.S. FISCAL TRAP?

Total Credit Market Debt, which includes all sectors, has surprisingly risen throughout the crisis. Therefore, no deleveraging has occurred yet

Ask yourself one simple question: Does debt matter? Kyle Bass, Hayman Capital Management

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 4

CONFIDENTIAL

U.S. FISCAL TRAP?

Central banks monetizing deficits-to-expenditures of greater than 40% has historically led to hyperinflations. In fact, every hyperinflation in history was caused by the financing of huge fiscal deficits through money creation

Source: Bloomberg, Monetary Regimes and Inflation; Peter Bernholz, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 5

CONFIDENTIAL

U.S. FISCAL TRAP?

Problematically, all of the additional debt comes with a cost, yet provides little marginal benefit. Today, each additional dollar of debt only produces 7 cents of economic growth, a fraction of its previous impact

Source: Federal Reserve Flow of Funds Accounts, Bloomberg, Hayman Advisors, LP, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 6

CONFIDENTIAL

U.S. FISCAL TRAP?

In order to restore debt ratios to pre-crisis levels, an unimaginable swing in the primary budget balance would be needed. This is true of nearly all developed markets

Source: Independent Strategy, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 7

CONFIDENTIAL

U.S. FISCAL TRAP?

The challenge to policymakers is increasing growth in excess of rising interest rates, which leads to the question: How do we leave the zero interest rate policy (ZIRP) of the Fed?

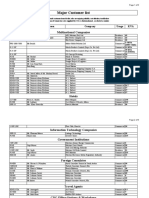

Fiscal Position with Current Interest Rates & Policies* Budget Deficit Debt Held by Public (in trillions) Increase in Deficit if Interest Rates Rise to: CBO Baseline Case Historical Average Decrease in Deficit from Possible Policy Changes: Phased in 20% Defense Cut Higher Taxes on "Rich" Starting in 2014 2-Year Pay Freeze Phased in 20% Domestic Discretionary Cut Total Difference: Increased Interest Expense vs. Policy Changes - CBO Baseline Case Difference: Increased Interest Expense vs. Policy Changes - Historical Average

CBO's Baseline Budget Outlook Total Revenues Total Outlays Total Deficit 14.9 23.8 -8.9 14.8 24.7 -9.9 16.3 23.3 -7.0 18.8 23.1 -4.3 19.9 23.0 -3.1 20.1 23.1 -3.0 20.0 23.5 -3.5 20.3 23.4 -3.1 20.4 23.3 -2.9 20.7 23.9 -3.2

2010

-$1,294 $9.0

2011

-$1,427 $10.4

2012

-$1,093 $11.6

2013

-$865 $12.6

2014

-$761 $13.4

2015

-$841 $14.3

2016

-$931 $15.3

2017

-$954 $16.3

2018

-$973 $17.5

2019

-$1,086 $18.7

$9.7

Increase in Debt Held by Public

$0 $0

$24 $105

$34 $237

$86 $405

$167 $462

$256 $520

$340 $583

$414 $652

$487 $727

$563 $806

$26 $87 $6 $14 $133 $34 $329

$53 $97 $6 $29 $185 $71 $335

$81 $105 $7 $44 $237 $103 $346

$111 $113 $7 $60 $291 $123 $361

$142 $122 $8 $77 $349 $138 $378

$174 $129 $8 $95 $406 $157 $400

*Using the CBO assumptions of 4.1% GDP growth in 2012-2014 and 2.4% thereafter, extension of tax cuts, and discretionary spending growing in line with GDP

Source: CBO, OMB, The Lindsey Group, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 8

CONFIDENTIAL

U.S. FISCAL TRAP?

The most proximate example, Japan, has not been able to. Their Keynesian pursuit relies on cheap, internal funding. As this funding inevitably dries up, a sovereign crisis looms...

Japan Budget Analysis (in billion yen)

Tax Revenues Social Security Expenditures Interest Expense Surplus to Fund other Expenditures

FY 2009

46,103 24,834 9,563 11,706

FY 2010

37,396 27,269 9,807 320

% of Revenues

100% 73% 26%

Total Bond Issuance & Other Revenues Total Expenditures National Debt Service Interest Rate

42,445 88,548 20,243 1.4%

54,903 92,299 20,649

147% 247% 55%

Source: Ministry of Finance, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 9

CONFIDENTIAL

U.S. FISCAL TRAP?

In order to reduce public debt burdens, government policymakers can: cut spending accelerate GDP growth through supply-side reforms financial oppression (i.e. forced investment in government bonds at artificially low rates) However, governments cannot reduce their debt burden by: increasing the tax share of GDP, which will reduce growth below interest costs targeting the rich or corporations creating inflation, which would likely drive bond yields up, blowing a hole in fiscal budgets (as well as increase rollover risk)

Source: Independent Strategy, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 10

CONFIDENTIAL

CHINAS DANGEROUS GAME

CONFIDENTIAL

CHINAS DANGEROUS GAME

A countrys national accounting identity ensures that all financial flows in an economy must sum to zero. Therefore, one sectors financial balance cannot be analyzed in isolation as its effects will be felt elsewhere

U.S. Current Sectoral Financial Balances

PUBLIC SECTOR -10.0%

+ +

PRIVATE SECTOR 7.0%

+ +

FOREIGN ACCOUNT 3.0%

= =

0 0

HOUSEHOLDS 2.0%

BUSINESSES 5.0%

Source: Lombard Street Research, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 12

CONFIDENTIAL

CHINAS DANGEROUS GAME

In order for both the public and private sector to necessarily de-lever, by definition, the current account (i.e. the inverse of the foreign account) must move towards surplus. However, Chinas yuan peg prevents this from occurring

U.S. Sustainable Sectoral Financial Balances

PUBLIC SECTOR + -3.0% +

PRIVATE SECTOR 4.0%

+ +

FOREIGN ACCOUNT -1.0%

= =

0 0

HOUSEHOLDS 3.0%

BUSINESSES 1.0%

Source: Lombard Street Research, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 13

CONFIDENTIAL

CHINAS DANGEROUS GAME

When the flows are viewed over time, its clear that the current account must move to balance or even surplus in order for the US government to reduce its annual deficits without causing a demand collapse.

Source: Lombard Street Research, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 14

CONFIDENTIAL

CHINAS DANGEROUS GAME

Chinas growth model is deeply imbalanced, yet there is little tolerance for short-term pain. Consumption cannot accelerate fast enough to offset the necessary decline in investment as a share of GDP

In the case of China, there is a lack of balance, co-ordination and sustainability in economic development. Premier Wen Jiabao, September 2010

Source: Lombard Street Research, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 15

CONFIDENTIAL

CHINAS DANGEROUS GAME

Both bank lending and money supply in China has been expanding rapidly, with money supply increasing by 55% in just two years. Yet policymakers within China vigorously debate the source of the current inflation

The thesis of this book is that the cycle of manias and panics results from the pro-cyclical changes in the supply of credit. Charles Kindleberger, Manias, Panics & Crashes

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 16

CONFIDENTIAL

INFLATION IS IT COMING?

Inflation is not too much money chasing too few goods its simply too much money.

CONFIDENTIAL

INFLATION IS IT COMING?

Until the late 1990s, money supply largely grew in line with real GDP, before subsequently expanding much faster than the rate of economic growth

Source: Bloomberg, Bienville Capital Management, LLC, Fielder Research & Management

CFA Society of Alabama April 21, 2011| 18

CONFIDENTIAL

INFLATION IS IT COMING?

Ordinarily, excessive money growth would have ignited inflation, as defined by the CPI. However, beginning in the mid90s, capacity also began to grow faster than consumption, which served to mitigate consumer prices

Source: Bloomberg, Bienville Capital Management, LLC, Fielder Research & Management

CFA Society of Alabama April 21, 2011| 19

CONFIDENTIAL

INFLATION IS IT COMING?

As productive capacity increased, both inflation and interest rates fell. The result was a lower cost of capital and therefore higher economic profits for businesses. A virtuous cycle was unleashed. Unfortunately, this process cannot be repeated

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 20

CONFIDENTIAL

INFLATION IS IT COMING?

Despite efforts to re-engineer the credit cycle, employment has not recovered. Employment is part of the Feds dual mandate, yet over the past 10 years, the US economy has created zero net new non-farm payroll jobs

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 21

CONFIDENTIAL

INFLATION IS IT COMING?

The workforce has also become increasingly segmented by educational achievementa structural reality that monetary policy cannot resolve

Source: Bureau of Labor Statistics, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 22

CONFIDENTIAL

INFLATION IS IT COMING?

Individuals with college degrees are participating at dramatically higher levels than those with less education

Source: Bureau of Labor Statistics, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 23

CONFIDENTIAL

INFLATION IS IT COMING?

Currently, monetary policy is exceptionally loose (i.e. the price of money is too low). Yet when nominal GDP exceeds the cost of money for prolonged periods of time, bad things always happen

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 24

CONFIDENTIAL

INFLATION IS IT COMING?

What will be the unintended consequences of todays policies?

The Great Inflation

Equity Market Bubble

Real Estate Bubble

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 25

CONFIDENTIAL

INFLATION IS IT COMING?

The Fed wants to take credit for increases in equity prices

A wide range of market indicators supports the view that the Feds securities purchases have been effective.equity prices have risen significantly. Ben Bernanke

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 26

CONFIDENTIAL

INFLATION IS IT COMING?

But not commodity prices

Our analysis does not provide evidence that Federal Reserve large-scale asset purchases fueled the rise in commodity prices. Federal Reserve Bank of San Francisco, April 2011

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 27

CONFIDENTIAL

INFLATION IS IT COMING?

Inflation expectations are becoming unanchored

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 28

CONFIDENTIAL

INFLATION IS IT COMING?

And the USD is being debased

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 29

CONFIDENTIAL

INFLATION IS IT COMING?

To the surprise of many, gold has outperformed equities since a pure discretionary paper monetary regime was introduced

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 30

CONFIDENTIAL

INFLATION IS IT COMING?

For the past 30 years, the Fed has responded to every crisis by providing additional liquidity, encouraging more debt in order to generate economic growth. Given the low levels today, this tactic cannot be replicated

Penn Square Bank Failure Continental Illinois Failure

87 Crash S&L Crisis / Gulf War I Mexican Peso Crisis Russia Default / LTCM Failure Dot.com Bust 9-11 Subprime Credit Crisis

Source: Bloomberg, Macro Mavens, Fielder Research & Management, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 31

CONFIDENTIAL

INFLATION IS IT COMING?

Therefore, with QE, the Fed is targeting asset prices. Historically, equity markets served as a quasi-barometer of economic growth. Today they are a policy tool

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 32

CONFIDENTIAL

INFLATION IS IT COMING?

We are in unchartered territory. No man or womandead or alivehas ever managed a balance sheet the size of the Feds current one. In fact, none of the current FOMC members have ever managed an inflation or rising rate environment

2011 Members of the FOMC Ben Bernanke Janet Yellen Charles L. Evans Elizabeth Duke Daniel Tarullo Sarah Bloom Raskin William Dudley Narayana Kocherlakota Richard Fisher Charles Plosser Title Chairman Board of Governors Chicago Board of Governors Board of Governors Board of Governors New York, Vice Chairman Minneapolis Dallas Philadelphia Current Age 58 65 53 59 58 49 59 47 62 63 Age in 1973 20 27 15 21 20 11 21 9 24 25

Source: Bloomberg, Federal Reserve, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 33

CONFIDENTIAL

THE LESSON OF THE 70S

CONFIDENTIAL

THE LESSON OF THE 70S

Similar to today, the output gap between 1970 - 1972 was negative, suggesting inflation was not a threat and justifying loose monetary policy

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 35

CONFIDENTIAL

THE LESSON OF THE 70S

Utilization rates had also fallen from the previous years levels, implying an abundance of capacity. However, despite the overall economys excess capacity, bottlenecks were being created in critical sectors

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 36

CONFIDENTIAL

THE LESSON OF THE 70S

The velocity of money, a key ingredient to inflation, was also falling

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 37

CONFIDENTIAL

THE LESSON OF THE 70S

However, despite widely available economic data suggesting disinflation, the Great Inflation was unleashed in 1973

With the exception of the Great Depression of the 1930s, the Great Inflation of the 1970s is generally viewed as the most dramatic failure of macroeconomic policy in the United States since the founding of the Federal Reserve. Athanasios Orphanides, Federal Reserve Board of Governors, January 2002

Source: Bloomberg, Bienville Capital Management, LLC

CFA Society of Alabama April 21, 2011| 38

CONFIDENTIAL

CONCLUDING THOUGHTS

Everyone has a game planuntil they get hit in the mouth

- Mike Tyson

CFA Society of Alabama April 21, 2011| 39

CONFIDENTIAL

CONCLUDING THOUGHTS

Summary The US is in a precarious fiscal position. Future deficits are highly dependent on the level of interest rates. In order to keep them low, anticipate a rise in financial repression Chinas growth model is unsustainable. Look out for either a soft or hard landing. Unless China rebalances, expect the threat of protectionism to resonate during the 2012 Presidential campaign Inflation is here. For the moment, its simply hidden from view. The key to investment success will be anticipating where it will manifest. Significant inflations result from a collapse in confidence in the currency, not positive output gaps or cost-push pressures Monetary instability is the new reality. The likelihood that policymakers will get it exactly right is low We have not extinguished the business cycle. There will be another recession at some pointguaranteed. How will policymakers then respond?

Implications for Investing Emphasize skill-based opportunities and strategies High quality equities are attractive. Focus on security selection and/or talented stock pickers. Event-driven, uncorrelated strategies are compelling The risk-reward in duration is not attractive. Credit spreads are also now tight Hedge where appropriate either directly or through hedged strategies. Be prudent with risk. Avoid action bias until valuations improve across asset classes Fat tails are as probable as base case scenarios. Layer in insurance-like positions. Avoid style boxes and pie chart thinking

CFA Society of Alabama April 21, 2011| 40

CONFIDENTIAL

CONCLUDING THOUGHTS

The Bank can never go broke. If the Bank runs out of money, the Banker may issue as much as needed by writing on ordinary paper.

- Monopoly, Official Game Rules

The Americans will always do the right thing after theyve exhausted all the alternatives.

- Winston Churchill

CFA Society of Alabama April 21, 2011| 41

CONFIDENTIAL

FIRM AND CONTACT INFORMATION

About Us Bienville Capital Management, LLC is an SEC-registered, independent investment advisory firm offering sophisticated and customized investment solutions to a select number of high-net-worth, family office and institutional investors. Our investment process is focused on asset allocation, manager selection and portfolio constructionall of which is supported by intense fundamental macroeconomic research. The members of the Bienville team have broad and complementary expertise in the investment business, including over 100 years of collective experience in private wealth management, institutional investment management, trading, investment banking and private equity. We have established a performance-driven culture focused on delivering exceptional advice and service to a select number of investors. We communicate candidly and frequently with our clients in order to articulate our views. Bienville Capital Management has offices in New York, NY and Mobile, AL. Disclaimer Bienville Capital Management, LLC. (Bienville) is an SEC registered investment adviser. This document is confidential, intended only for the person to whom it has been provided, and under no circumstance may be shown, transmitted or otherwise provided to any person other than the authorized recipient. While all information in this document is believed to be accurate, the General Partner makes no express warranty as to its completeness or accuracy and is not responsible for errors in the document. This document contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. The views expressed here are the current opinions of the author and not necessarily those of Bienville Capital Management. The authors opinions are subject to change without notice. There is no guarantee that the views and opinions expressed in this document will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Past performance may not be indicative of future results and the performance of a specific individual client account may vary substantially from the foregoing general performance results. Therefore, no current or prospective client should assume that future performance will be profitable or equal the foregoing results. Furthermore, different types of investments and management styles involve varying degrees of risk and there can be no assurance that any investment or investment style will be profitable. This document is not intended to be, nor should it be construed or used as, an offer to sell or a solicitation of any offer to buy securities of Bienville Capital Partners, LP. No offer or solicitation may be made prior to the delivery of the Confidential Private Offering Memorandum of the Fund. Securities of the Fund shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. For additional information about Bienville, including fees and services, please see our disclosure statement as set forth on Form ADV.

CFA Society of Alabama April 21, 2011| 42

Das könnte Ihnen auch gefallen

- Bienville Macro Review (U.S. Housing Update)Dokument22 SeitenBienville Macro Review (U.S. Housing Update)bienvillecapNoch keine Bewertungen

- China's Paradox (October 2012)Dokument8 SeitenChina's Paradox (October 2012)bienvillecapNoch keine Bewertungen

- The Lost Decade - Commentary & Strategy (October 2009)Dokument6 SeitenThe Lost Decade - Commentary & Strategy (October 2009)bienvillecapNoch keine Bewertungen

- Deflation or Inflation (December 2010)Dokument37 SeitenDeflation or Inflation (December 2010)bienvillecapNoch keine Bewertungen

- Bienville Capital Managment - Presentation (December 2010)Dokument52 SeitenBienville Capital Managment - Presentation (December 2010)bienvillecapNoch keine Bewertungen

- Our FrameworkDokument5 SeitenOur FrameworkbienvillecapNoch keine Bewertungen

- European UpdateDokument5 SeitenEuropean UpdatebienvillecapNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 1AE69F23-EE3F-4BC9-B6A7-26EEF17F76A4 (1)Dokument7 Seiten1AE69F23-EE3F-4BC9-B6A7-26EEF17F76A4 (1)Parthiban Ban100% (1)

- Sir Ebenezer HowardDokument17 SeitenSir Ebenezer HowardtanieNoch keine Bewertungen

- Background of The StudyDokument42 SeitenBackground of The StudyOral Paul M. MarzanNoch keine Bewertungen

- Rural Marketing - Unit 3 (Targeting, Segmenting and Positioning)Dokument33 SeitenRural Marketing - Unit 3 (Targeting, Segmenting and Positioning)Vamshi NCNoch keine Bewertungen

- Rev Regs 16-2005 Sec 4.114-2 As Amended by RR 4-2007Dokument2 SeitenRev Regs 16-2005 Sec 4.114-2 As Amended by RR 4-2007Catherine Rae EspinosaNoch keine Bewertungen

- Confederate CurrencyDokument51 SeitenConfederate CurrencyMarques YoungNoch keine Bewertungen

- 12-13 IRD Awarded USAID Cooperative Agreement To Assist Afghan CiviliansDokument2 Seiten12-13 IRD Awarded USAID Cooperative Agreement To Assist Afghan CiviliansInternational Relief and DevelopmentNoch keine Bewertungen

- Impact of Advertisement On The Brand PreferenceIMPACT OF ADVERTISEMENT ON THE BRAND PREFERENCEDokument14 SeitenImpact of Advertisement On The Brand PreferenceIMPACT OF ADVERTISEMENT ON THE BRAND PREFERENCEramaswamiparameswaraNoch keine Bewertungen

- CBA of The 2022 FIFA World CupDokument75 SeitenCBA of The 2022 FIFA World CupNicolas Durr100% (1)

- 32 CRM in Hero MotocorpDokument105 Seiten32 CRM in Hero Motocorpnavyatha kanike100% (1)

- 2 Income Statement FormatDokument3 Seiten2 Income Statement Formatapi-299265916Noch keine Bewertungen

- Proof of InsuranceDokument1 SeiteProof of Insuranceapi-307567061Noch keine Bewertungen

- VFFS: Duterte's Health Saga: A Timeline Part 2 (Sources)Dokument3 SeitenVFFS: Duterte's Health Saga: A Timeline Part 2 (Sources)VERA FilesNoch keine Bewertungen

- Major Customer List: Multinational CompaniesDokument6 SeitenMajor Customer List: Multinational CompaniesDominic Alfred PascalNoch keine Bewertungen

- Profit and Loss Template Under 77k Turnover 1Dokument2 SeitenProfit and Loss Template Under 77k Turnover 1Edem Kofi BoniNoch keine Bewertungen

- The 19TH Century Philippine Economy, SocietyDokument24 SeitenThe 19TH Century Philippine Economy, SocietyMine MineNoch keine Bewertungen

- Bird FeederDokument4 SeitenBird FeederJayme LealNoch keine Bewertungen

- Income TaxationDokument138 SeitenIncome TaxationLimberge Paul CorpuzNoch keine Bewertungen

- Gerald Adrian D. Veloso ContempDokument2 SeitenGerald Adrian D. Veloso ContempGerald Adrian VelosoNoch keine Bewertungen

- Philippines - Cooperatives (FAQ)Dokument5 SeitenPhilippines - Cooperatives (FAQ)KAKKAMPI100% (12)

- Sample Accounts ProblemsDokument103 SeitenSample Accounts ProblemsJayashree MaheshNoch keine Bewertungen

- 2011 Ford F-650 and F-750 Super Duty TrucksDokument10 Seiten2011 Ford F-650 and F-750 Super Duty TrucksBartow Ford Company100% (1)

- Pin Code Summary 20200318Dokument234 SeitenPin Code Summary 20200318acrajeshNoch keine Bewertungen

- New ContactsDokument8 SeitenNew ContactsRoshani BhandariNoch keine Bewertungen

- Editors Comments - The Rise of Nationalism Redux - An Opportunity For Refl...Dokument6 SeitenEditors Comments - The Rise of Nationalism Redux - An Opportunity For Refl...André AguiarNoch keine Bewertungen

- Airline Reservation Confirmation - Finish - American Airlines - AADokument2 SeitenAirline Reservation Confirmation - Finish - American Airlines - AApetitfm100% (1)

- RBI PublicationsDokument33 SeitenRBI PublicationsJuned YaseerNoch keine Bewertungen

- Retirement Any AgeDokument100 SeitenRetirement Any AgeManas MohanNoch keine Bewertungen

- Strivector Recruiter Trainee TestDokument2 SeitenStrivector Recruiter Trainee TestManoj PrabhakarNoch keine Bewertungen

- Nationalization in Pakistan Entreprenure Assignment # 1Dokument8 SeitenNationalization in Pakistan Entreprenure Assignment # 1dilawaysNoch keine Bewertungen