Beruflich Dokumente

Kultur Dokumente

Low Cost Country Sourcing by International Tyre Industry

Hochgeladen von

Abhi TejaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Low Cost Country Sourcing by International Tyre Industry

Hochgeladen von

Abhi TejaCopyright:

Verfügbare Formate

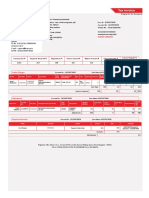

Summer Training Project Report On

A Study on Low Cost Country Sourcing by International Tyre Industry

(As a partial fulfillment of MBA programme)

Submitted to Mr. Amit Varma

President - Corporate Strategy JK Organisation

Submitted by Koondrapu Abhi Teja

Institute of Management JK Lakshmipat University, Jaipur.

A Study on Low Cost Country Sourcing by International Tyre Industry

ACKNOWLEDGEMENT

My sincere thanks to Mr. Amit Varma (President - Corporate Strategy, JK Organisation) for his valuable guidance, continuous encouragement and tremendous patience in discussing my problems in bringing this project report to shape. I am also thankful to Mr. Sameer Seth (Senior Strategic Officer, JK Organisation) and Mr. Ankit Suri (Officer, Corporate Strategy, JK Organisation) for their support, guidance and cooperation during my training. I also express deep sense of gratitude to my institutional guide, Dr. Biraj Kumar Mohanty (Professor) for providing me essential background to the project. I also extend my thanks to all other employees of JK Organisation and my University for providing me the platform to undertake this project.

(Koondrapu Abhi Teja)

A Study on Low Cost Country Sourcing by International Tyre Industry

Table of Contents

ACKNOWLEDGEMENT ......................................................................................... 2 Executive Summary............................................................................................. 5 Scope of the Project ............................................................................................ 6 OBJECTIVE ........................................................................................................... 7 Definitions: ......................................................................................................... 7 About The Tyre ................................................................................................... 8 Etymology and spelling ................................................................................... 8 History of the Tyre .......................................................................................... 9 Advancements of Tyres ................................................................................. 11 Technical advancement in Tyres ................................................................... 12 Tyre Manufacturing ...................................................................................... 13 Raw Materials Required ................................................................................ 13 Process Flow ................................................................................................. 13 Functional Characteristics of a Tyre .............................................................. 17 Construction of a Tyre ................................................................................... 18 World Tyre Industry .......................................................................................... 20 INDIAN TYRE INDUSTRY .................................................................................... 25 Background ................................................................................................... 25 Key Features ................................................................................................. 26 Evolutionary Phases of Tyre manufacturing in India ..................................... 29 INDUSTRY SIZE AND TRENDS OF GROWTH ........................................................ 30 Major Tyre Projects Completed/Scheduled for Completion during 2010-2011 ...................................................................................................................... 32 Growth of Indian Tyre Industry ..................................................................... 34

A Study on Low Cost Country Sourcing by International Tyre Industry

Competitive analysis of major players of Indian tyre industry........................... 36 POSITION OF THE COMPANY......................................................................... 36 Financial Analysis .............................................................................................. 37 COMPANY PROFILE ........................................................................................... 47 Data Analysis and Interpretation ...................................................................... 50 CAPITAL EXPENDITURE from 1999-2011 ........................................................... 51 Capital Expenditure in LCCs .............................................................................. 52 Yearly Percentage of Capital Expenditures in LCCs ........................................... 53 Company wise Percentage spending in LCCs .................................................... 54 CAPEX Country Wise ......................................................................................... 55 Percentage of investments in major countries .................................................. 56 Continent Wise CAPEX in LCCs ......................................................................... 57 Continent wise share of CAPEX ......................................................................... 58 Company wise share of CAPEX in LCCs ............................................................. 58 Segment wise Capacity Installments ................................................................. 59 Capacity installed at LCC ................................................................................... 60 Percentage of Sales in LCCs .............................................................................. 60 Yearly Trend in Capital Investments in LCCs ..................................................... 61 Preferred Countries for investments ................................................................. 62 Trend in selecting the destinations ................................................................... 62 Conclusion ........................................................................................................ 63 Observations: .................................................................................................... 64 Suggestions to India and JK Tyre ....................................................................... 65 Source of Information ....................................................................................... 66

A Study on Low Cost Country Sourcing by International Tyre Industry

Executive Summary

The profitability of Tyre Industry has gained worldwide attention. The industry has evolved from being strictly regulated to global outsourcing destination. This report A Study of Low Cost Country Sourcing by International Tyre Industries attempts to explore the trends of investments of International Tyre companies in Low Cost Countries. The facts identified through this report are The companies which are sourcing from Low Cost Country are able to cut the manufacturing costs. Majority of the companies are choosing Asian countries for sourcing their tyres. Of the many Low Cost Countries China has emerged as a preferred destination for all the companies.

A Study on Low Cost Country Sourcing by International Tyre Industry

Scope of the Project

This project has a wide scope in understanding the broad features of World Tyre Industry and sourcing from different countries and the trends of investments in low cost countries. The study is based mostly on the secondary data that includes Annual Reports of the companies, Company Websites, and few other information sources. The time frame considered for the study of companies is 13 years i.e. from 1999-2011. The study examines the investments of the selected companies in Low Cost Countries from 1999-2011. The currencies of Bridgestone, Continental and Yokohoma are converted into dollars w.r.t the conversion rates given in the company Annual Reports to make accurate analysis. Limitations Owing to the constraints of time and resources it is proposed to restrict the scope of study to some selected Companies which can represent the World Tyre Industry.

A Study on Low Cost Country Sourcing by International Tyre Industry

OBJECTIVE

This project is to explore the trends of investments of international Tyre companies in Low Cost Countries during the period 1999-2011. The other objectives of this project are to explore the reasons of outsourcing of tyres from Low Cost Countries. This project is also intended to find out the segments and countries which attracted majority of investments from the International tyre Companies.

Definitions:

1. Low Cost Country A country where the cost of manufacturing a particular product is less compared to countries which produce the similar product at a very high cost. 2. Sourcing It is a term used to describe the practice of procuring goods and services from the global market across geographical boundaries. 3. Low Cost Country sourcing It is a procurement strategy in which a company sources materials, which it cannot produce, from the host which has abundant supply of factor of production with low labour and production cost in order to reduce operating expenses.

A Study on Low Cost Country Sourcing by International Tyre Industry

About The Tyre

Etymology and spelling

The Oxford English Dictionary suggests that the word derives from "at tyre", while other sources suggest a connection with the verb "to tie". From the 15th to the 17th centuries the spellings tyre and tyre were used without distinction; but by 1700 tyre had become obsolete and tyre remained as the settled spelling. In the UK, the spelling tyre was revived in the 19th century for pneumatic tyres, though many continued to use tyre for the iron variety. The Times newspaper in Britain was still using tyre as late as 1905. The 1911 edition of the Encyclopedia Britannica states that "[t]he spelling 'tyre' is not now accepted by the best English authorities, and is unrecognized in the US", while Fowler's Modern English Usage of 1926 says that "there is nothing to be said for 'tyre', which is etymologically wrong, as well as needlessly divergent from our own [sc. British] older & the present American usage". However, over the course of the 20th century tyre became established as the standard British spelling.

A Study on Low Cost Country Sourcing by International Tyre Industry

History of the Tyre

A tyre (in American English) or tyre (in British English) is a ring-shaped covering that fits around a wheel rim to protect it and enable better vehicle performance by providing a flexible cushion that absorbs shock while keeping the wheel in close contact with the ground. The word itself may be derived from the word "tie", referring to the outer steel ring part of a wooden cart wheel that ties the wood segments together. The fundamental materials of modern tyres are rubber and fabric along with other compound chemicals. They consist of a tread and a body. The tread provides traction while the body ensures support. Before rubber was invented, the first versions of tyres were simply bands of metal that fitted around wooden wheels in order to prevent wear and tear. Today, the vast majority of tyres are pneumatic, comprising a doughnut-shaped body of cords and wires encased in rubber and generally filled with compressed air to form an inflatable cushion. Pneumatic tyres are used on many types of vehicles, such as bicycles, motorcycles, cars, trucks, earthmovers, and aircraft. In todays world of intense competition and

rapid dynamism, all the companies worldwide are tuning their focuses on the customer. Suddenly, the customer had succeeded in capturing all the attention of the companies towards him, so much so, that the once famous maxim, customer is the god has become so true and relevant today. There has been a paradigm shift in the thinking of these companies and none other than the customer has brought this about. Earlier there was a sellers market, since goods and services were in 9

A Study on Low Cost Country Sourcing by International Tyre Industry

short supply and the sellers use to call the shots. But, ever since the advent of the era of globalization, there has been total transformation in the way the customers being perceived. Today, marketers are directing their efforts in retaining the customers and customers base. Their focus has shifted towards integrating the three elements people, service and marketing. In the past, after sales service was consider as a cost center, Companies were lethargic in attending to customers complaints. Availability of trainee service personal and quality genuine spare parts posed serious problems. However, with the rising competition, there could not be much product differentiation, as price and quality were comparable and latest technology was to each and every company in the field. Since, there could not be much differential a tangible assets, the companies concentrated on the intangible assets, namely the service factor, which served as a major differentiator. Today after sales service is an important aspect of every company, and it is no more considered as a cost center, but considered as a profit center. Every organization strives hard to retain its existing customers at any cost since it is five times costly to get a new customer, then to retain an existing customer. Most of the industries today use of information technology to best services to their customers.

10

A Study on Low Cost Country Sourcing by International Tyre Industry

Advancements of Tyres

Iron tyres The earliest tyres were bands of iron (later steel), placed on wooden wheels, used on carts and wagons. The tyre would be heated in a forge fire, placed over the wheel and quenched, causing the metal to contract and fit tightly on the wheel. A skilled worker, known as a wheelwright, carried out this work. The outer ring served to "tie" the wheel segments together for use, providing also a wear-resistant surface to the perimeter of the wheel. The word "tyre" thus emerged as a variant spelling to refer to the metal bands used to tie wheels. Rubber tyres The first practical pneumatic tyre was made by John Boyd Dunlop, a Scot, in 1887 for his son's bicycle, in an effort to prevent the headaches his son had while riding on rough roads (Dunlop's patent was later declared invalid because of prior art by fellow Scot Robert William Thomson). Dunlop is credited with "realizing rubber could withstand the wear and tear of being a tyre while retaining its resilience. Pneumatic tyres are made of a flexible elastomeric material, such as rubber, with reinforcing materials such as fabric and wire. Tyre companies were first started in the early 20th century, and grew in tandem with the auto industry. Today, over 1 billion tyres are produced annually, in over 400 tyre factories, with the three top tyre makers commanding a 60% global market share.

11

A Study on Low Cost Country Sourcing by International Tyre Industry

Technical advancement in Tyres

Radialisation A radial tyre is a particular design of automotive tyre in which the cord plies are arranged at 90 degrees to the direction of travel, or radially. Radial Tyres were invented in 1900s. Radial tyres have advantages over crossply tyres. Rate of radialisation is an index of the status of road development. In spite of the superior qualities of radial tyres, it took 10-25 years for developed countries to switch to these tyres. In Europe, and in the US, they gained popularity by the late 1980s. In 1995, radial tyres constituted 98 per cent of the total tyres produced in Europe, 80 per cent of the tyres in the US, and 70 per cent of the tyres in other developed countries. The high investment requirements of a radial capacity have been responsible for the slow rate of switchover to radial tyres. In India, JK Tyres introduced radial tyres for passenger cars in 1979. Initially, radial tyres were used in the replacement market for passenger car tyres. In the early 1990s, radial capacities were added, and producers intensified their marketing efforts. With the launch of new models by Maruti Udyog (Zen and Esteem), Hindustan Motors and Premier Automobiles in the late 1990s, radial tyres were introduced in the original equipment market for passenger cars. In India, the penetration of radial tyres has increased significantly in the passenger car tyres segment to 63 per cent. However, penetration is low in the light truck and MUV (eight per cent) and MHCV tyres (one per cent) categories.

12

A Study on Low Cost Country Sourcing by International Tyre Industry

Tyre Manufacturing

Raw Materials Required

Natural rubber - Imparts heat resistance Poly Butadiene Rubber (PBR) -Imparts abrasion resistance Styrene Butadiene Rubber (SBR) - Imparts road grip Nylon Tyre Cord (NTC) fabric - Imparts reinforcement strength

Process Flow

Mixing the material The tyre manufacturing process begins with the preparation of a rubber compound. A pre-defined raw material mix of elastomers, carbon black, rubber chemicals and processing oils is mixed in a Banbury mixer. Processing oils ensure that the raw materials are properly mixed. Raw materials are mixed at a high temperature in the first stage and temperatures are lowered in the second. In the third stage, sulphur is added at a specified temperature and time parameters. These specifications vary for different tyre categories. The rubber compound obtained from the mixer is in the form of rubber sheets, which enables easy handling of the compound. The rubber sheets are used to make the tread, ply/band and bead. Side-wall making Rubber sheets are extruded through a die opening, at a specified pressure and temperature. The extruded sheets are cut to obtain treads, with a specific profile and gauge.

13

A Study on Low Cost Country Sourcing by International Tyre Industry

Calendaring The fabric is subsequently passed through a calendaring unit, where the dipped fabric is coated with the rubber compound (obtained from the Banbury mixer) on both sides. While coating the dipped cord fabric with rubber compound, it is ensured that the rubber compound and tyre cord fabric are well adhered to each other, with a uniform thickness of rubber coating on the fabric surface. Ply/Band making Dipping Nylon or rayon cord fabric is used as a reinforcement material in tyres. The fabric sourced from vendors is called undipped fabric. As this fabric has a low affinity for rubber compounds, it is immersed in a solution of latex, resorcinol and formaldehyde resin. Simultaneously, the fabric is stretched at a high temperature using rollers. This improves its dimensional stabilityand braking strength (strength required to tolerate a sudden halt), eliminating contraction due to the presence of moisture in the fabric. Bias cutting (cross-ply tyres) The rubber-coated fabric (calendared roll) is mounted on a bias cutting machine, where it is cut into plies of the required width and angle. Band building Two or more plies can be used to make a band, depending upon the size and the required strength of the tyre.

14

A Study on Low Cost Country Sourcing by International Tyre Industry

Bead making Five-seven steel wires are coated with the rubber compound to make a bead. The rubber compound acts as a filler and removes air gaps in the bead. A flipper cover of calendared cord fabric covers the bead, to protect it from dust and oxygen. Tyre building The components listed above are used to make a green tyre. The band is mounted on a rotary drum (one or more bands are used, depending upon the required strength of the tyre). The bead is then inserted within the band. After building the components together, a compact cylinder is obtained, this is known as a green tyre. Tyre curing In this process, the individual properties of every component (such as tensile strength, heat resistance, modulus ofelasticity for dimensional stability, braking strength, and grip) are combined by vulcanisation.

The two main types of tyre-curing processes are the conventional process (air bag curing process) and the Bag-o-Matic process. In the conventional process, air bags are used, while the Bag-o-Matic process uses bladders. TheBag-o-Matic process is widely used due to the shorter curing cycle, low labour requirements and lower costs.

15

A Study on Low Cost Country Sourcing by International Tyre Industry

In the Bag-o-Matic curing process, the unvulcanised green tyre is moulded into the required size and shape at ahigh temperature and pressure. The green tyre is mounted onto the press, and placed on one of the open sides. Hotsteam is passed from the top through the other open side of the green tyre. Simultaneously, radial pressure is applied on the tyre expanding the steam and exerting a force on the tyre from within. This changes the green tyres shape making it conical at its two open sides (as a result, the diameter at the centre of the green tyre becomes longer than that at its open sides).

The green tyre is kept in a mould, and heated using steam (a specific mould is used for each tyre category).Molten rubber from the tread flows into the mould, and results in the formation of grooves on the tread.

Subsequently, the green tyre is allowed to cool in an inflated condition, which is called 'post cure inflation'. This is done to overcome the shrinkage properties of nylon tyre cord. Final inspection A final quality inspection is conducted on the cured tyre for air pockets and other defects.

16

A Study on Low Cost Country Sourcing by International Tyre Industry

Functional Characteristics of a Tyre

The desired functional characteristics of tyres include the following: Shock absorption Elasticity, in terms of regaining its original shape with minimum delay Road grip Response to the steering force with minimum delay Ability to accelerate rapidly, and sustain uneven and rough terrain Durability Lower aspect ratio. (Aspect ratio is the height to width ratio of the tyre. If the aspect ratio is lower, the centre of gravity is lower; the maneuvrability and steering capacity of the tyre is higher.

17

A Study on Low Cost Country Sourcing by International Tyre Industry

Construction of a Tyre

Ply and band: Ply is a continuous layer of parallel rubber coated cord fabric. The cords are bias-cut into plies, by a bias cutting machine. A ply has a specific angle and width. Bias-cut plies are used to make bands. The bias-cut plies that are joined in a cross angle, form a band. Tread: It comes in direct contact with the road surface. Sidewall:

18

A Study on Low Cost Country Sourcing by International Tyre Industry

It lies between the bead and the tread, and controls the ride and offers support. The rubber compound for the sidewall makes the tyre flexible and weather resistant. Bead: It is located at the bottom of the sidewall, near the rim of the wheel. 5-7 bronze-coated steel wires are coated with a rubber compound. The bead is the strongest component of a tyre, as it helps mount the tyre firmly on the rim of the wheel. It imparts stiffness to the tyre

19

A Study on Low Cost Country Sourcing by International Tyre Industry

World Tyre Industry

The Tyre companies started from the year 1870. The turnover of the World Tyre Industry is $ 126.5 billion in 2009 with a CAGR of 34%.

Turnover of World Tyre Industry

160 140 120 Billion $ 100 100 92 140 126.5

115

80

60 40 20 0

2005

2006

2007

2008

2009

The World Tyre Industry is dominated by 10 major players. They are represented in the following table. Rank as per Turnover 1 2 3 4 5 6 7 8 9 10 Company Turnover In 2010 (Billion $) 38.9 28.8 22.7 12.2 7.9 6.8 5 4.6 3.4 3.1 5 year CAGR (%) 3.7 2.9 4.5 5 6.8 8 5.8 4 12 5.5 Market Share (%) 16.2 15.5 12.4 5.1 3.7 4.4 3.1 3 2.2 1.8 No of Brands 11 16 28 22 6 7 2 4 12 2 20

Bridgestone Michelin Goodyear Continental Sumitomo Pirelli Yokohama Hankook Cooper Toyo

A Study on Low Cost Country Sourcing by International Tyre Industry

The overview of the major companies is as follows 1. Bridgestone Bridgestone is the world leader of Tyre Industry, headquartered at Tokyo, Japan. Revenue of the company is $38 billion in 2010.It has sales CAGR of 3.7%. It has 47 Tyre manufacturing plants and sells over 150 countries. It manufactures tyres for all kind of vehicles such as passenger cars, construction and mining vehicles, commercial vehicles, aircraft, motorcycles and scooters, racing cars, karts, utility carts, subways, monorail. 2. Michelin

Michelin was established in 1905 in London. It is active on all continents and in more than 170 countries. Revenue of the company is $28.8 billion in 2010. It is growing with sales CAGR of 2.9%.

Michelin manufactures and sells tyres for all kinds of vehicles, including cars, vans, 4X4, SUV and many more.

The famous icon 'The Michelin Man' has been the drivers companion since 1898 and was voted as the "Best Logo Symbol of all time" in 2000, by a worldwide panel for the Financial Times.

21

A Study on Low Cost Country Sourcing by International Tyre Industry

In 2009, the Michelin Group produced more than 150 million tyres and continues to provide industry with leading technologies. 3. Continental Continental was founded in 1871 in Germany. It is the fourth largest Tyre manufacturer in the world. Revenue of the company was 10.1 billion $ in 2010. It has sales CAGR of 5%. Continental is a trusted Original Equipment supplier to European passenger car manufacturers. Since 2003, 1 in 4 of all cars produced in Europe has rolled off the assembly line with tyres developed by Continental. 4. Cooper It is a US based company with a revenue of 3.4 billion $ in 2010 with sales CAGR of 12%. It has 9 manufacturing locations in USA, Mexico, Serbia, China, and United Kingdom. It is the ninth largest Tyre manufacturer in the world and second largest in USA.

5. Goodyear It is the largest tyre manufacturer in USA. Its revenue is 18.8 billion $ in 2010 with sales CAGR of 4.5%. Goodyear production began on the 21st November 1898. Today, It is one of the world's leading tyre companies; No. 1 tyre manufacturer in North

22

A Study on Low Cost Country Sourcing by International Tyre Industry

America and Latin America, Goodyear is also Europe's second largest tyre manufacturer. It has 47 manufacturing plants in all the continents. The company manufactures and markets tyres recognised by the famous winged foot logo. The Goodyear tyre range includes car, van, 4X4, and SUV tyres. 6. Hankook It is a South Korean company with revenue of 4.6 billion $ in 2010. It has sales CAGR of 13.9%. It is the fifth largest tyre manufacturer in the world with a market share of 5%. It has 5 production facilities located in China, Hungary and Korea.

7. Pirell Pirelli Tyre is the world's fifth largest operator in the tyre market with revenue of $6.8 billion with sales CAGR of 8%. Pirelli is one of the worlds best known Italian brand names. It has 24 manufacturing plants in 12 countries and a commercial presence in more than 160 countries. 8. Sumitomo A Sumitomo Rubber industry is the second largest Japanese with revenue of $7.9 billion in 2010. Sumitomo Tire is a premium tire brand in Asia. Sumitomo is known for innovative design and superior quality.

23

A Study on Low Cost Country Sourcing by International Tyre Industry

9. Toyo It is a Japanese company with 16 plants across Japan. It is expanding in North America, China and Malaysia. It is growing with a CAGR of 5.5%

10.Yokohama It is a South Korean company with revenue of 5 billion $ in 2010. It grows with a CAGR of 3.3% It has 5 manufacturing locations in Japan, 3 in China, 2 in Thailand, 1 in USA, South Korea, Philippines, and Vietnam.

24

A Study on Low Cost Country Sourcing by International Tyre Industry

INDIAN TYRE INDUSTRY

Background

Tyres and tubes, the strategic rubber products and basic supplements to the automotive vehicles are of utmost importance to the country's economy. The tyre industry sector is providing direct employment to more than 50,000 people and indirect employment to lakhs of people. This industry sector is now being considered as a core industry sector.

The origin of the Indian Tyre Industry dates back to 1926 when Dunlop Rubber Limited set up the first tyre company in West Bengal. MRF followed suit in 1946. Since then, the Indian tyre industry has grown rapidly. Transportation industry and tyre industry go hand in hand as the two are interdependent. Transportation industry has experienced 10% growth rate year after year with an absolute level of 870 billion ton freight. With an extensive road network of 3.2 million km, road accounts for over 85% of all freight movement in India. Technology generation in the Indian tyre industry has witnessed a fair amount of expertise and versatility to absorb, adapt and modify international technology to suit Indian conditions. This is reflected in the swift technology progression from cotton (reinforcement) carcass to high-performance radial tyres in a span of four decades. Globalization has led to the linking of the economies of all the nations and therefore major Indian players in the tyre industry are pursuing global strategies to enhance their competitiveness in world markets. The present section broadly undertakes an overview of the Indian tyre industry through an examination of its growth trends with respect to production, exports and acquisition of technological capabilities.

25

A Study on Low Cost Country Sourcing by International Tyre Industry

Key Features

At present there are more than 40 listed companies in the tyre sector in India. Major players are MRF, JK Tyres, and Apollo Tyres & CEAT, which account for 63 per cent of the organized tyre market. The other key players include Modi Rubber, Kesoram Industriesand Goodyear India, with 11 per cent, 7 per cent and 6 per cent share respectively. Dunlop , Falcon, Tyre Corporation of India Limited (TCIL), TVS-Srichakra, Metro Tyres and Balkrishna Tyres are some of the other significant players in the industry. While the tyre industry is largely dominated by the organized sector, the unorganized sector is predominant with respect to bicycle tyres. The industry is a major consumer of the domestic rubber market. Natural rubber constitutes 80% while synthetic rubber constitutes only 20% of the material content in Indian tyres. Interestingly, world-wide, the proportion of natural to synthetic rubber in tyres is 30:70. The sector is raw-material intensive, with raw material accounting for 70% of the total costs of production Current level of radialization includes 95% for all passenger car tyres, 12% for light commercial vehicles and 3% for heavy vehicles (truck and bus) Restrictions were placed on import of used /retreaded tyres since April 2006 Import of new tyres & tubes is freely allowed, except for radial tyres in the truck/bus segment which has been placed in the restricted list since November 2008 The major factors affecting the demand for tyres include the level of industrial activity, availability and cost of credit, transportation volumes and network of roads, execution of vehicle loading rules, radialization, retreading and exports.

26

A Study on Low Cost Country Sourcing by International Tyre Industry

PORTERS FIVE FORCES

Entry Barriers: High The entry barriers are high for the tyre industry. It is a highly capital intensive industry. A plant with an annual capacity of 1.5 million cross-ply tyres costs between Rs.4,000 and Rs. 5,000 million. A similar plant producing radial tyres costs Rs. 8,000 million.

Bargaining Power of the Buyers: High The OEMs have total control over prices. In fact, the OEMs faced with declining profitability have also reduced the number of component suppliers to make the supply chain more efficient. Inter Firm Rivalry: Low The tyre industry in India is fairly concentrated, with the top eight companies accounting for more than 80% of the total production of tyres. Threat of Substitutes: Low but Increasing,

27

A Study on Low Cost Country Sourcing by International Tyre Industry

Over 1,10,000 passenger car tyres were imported. This constitutes over 2% of total radial passenger car tyre production in the country. However, with the reduction of peak custom duty, the import of tyres is likely to increase. Bargaining Power of the Suppliers: High The tyre industry consumes nearly 50% of the natural rubber produced in the country. The price of natural rubber is controlled by Rubber Control Board and the domestic prices of natural rubber have registered significant increase in recent times.

28

A Study on Low Cost Country Sourcing by International Tyre Industry

Evolutionary Phases of Tyre manufacturing in India Phase

(inception) Phase I

Period Characteristics

1920-35 No domestic production. Demand met through imports. Key players included Dunlop (U.K), Firestone & Goodyear (USA)

Policy Regime

Liberal imports

(development) Phase II

1936-60

Domestic production begins by erstwhile trading companies: Dunlop, Firestone, Goodyear and India Tyre & Rubber Company

Imposition of tariff & nontariff barriers on imports

(restriction) Phase III

1961-74

Indian companies-MRF, Premier & Regulation on capacity Incheck- enter manufacturing sector with foreign technology; licensing of additional production capacity expansion and repatriation of profits of foreign companies; enforcement of export obligation on MNC; protection from external competition

Phase IV

1975-91

Entry of large Indian business houses like Singhania & Modi & technical collaborations with MNCs, introduction of radial tyres, vertical integration and exponential growth in tyre production & exports

Delicensing of production, placing of imports under OGL with tariff & nontariff barriers

(modernization) Phase V

1992 onwards

External trade liberalization & reduction in import duty; re-entry of MNCs either independently or in collaboration with Indian capital

Progressive reduction in import duty; liberalized imports

29

A Study on Low Cost Country Sourcing by International Tyre Industry

INDUSTRY SIZE AND TRENDS OF GROWTH

Financial Year 2010-2011 (Est.) Turnover of Indian Tyre Industry Tyre Production (Tonnage) Tyre Production All Categories (Nos.) Tyre Export from India (Value) : Number of tyre companies: Industry Concentration Rs. 3625 crores 36 10 Large tyre companies account for over 95% of total tyre production. Radialisation Level - Current (as a % of total tyre production) Passenger Car tyres: 98% Light Commercial Vehicles: 18% Heavy Vehicles ( Truck & Bus ): 12% Rs. 25,000 Crores 13.50 lakh M.T. 971 Lakh

ICRA estimates the total installed domestic tyre capacity to increase by more than 47% from 122 million tyres in 2009-10 to around 180 million tyres by 2012-13 In line with demand trends, the TBR segment is expected .to attract the highest share of investments (over 50%) over the next three years followed by the PCR segment. Given the strong demand expectations from the domestic auto industry and the possibility of some delays in project implementation, we expect utilisation levels to remain high over the medium term, especially in the TBR segment. This incremental domestic capacity is, however, expected to

30

A Study on Low Cost Country Sourcing by International Tyre Industry

reduce imports, especially in the TBR segments, over the medium-to-long term. However, coupled with the expected margin pressure from raw material inflation, these expansion projects are likely to result in depressed cash flows, higher leverage and subdued RoCE over the next few years. With over 39 tyre manufacturers and 60 manufacturing plants, the Indian tyre industry enjoyed a turnover of about Rs. 25,000 Crores in 2009-10. India has the technical capability to manufacture the entire gamut of tyres for catering to its domestic requirements but still imports about Rs. 1,430 crores worth of tyres, largely low cost passenger car tyres and T&B tyres from China due to capacity constraints and cost advantage. India also exports Rs. 3,000 crore of tyres, largely CV tyres, to over 60 countries. The ten largest tyre companies (MRF India Limited, Apollo Tyres Limited, JK Tyre & Industries Limited, CEAT Limited, Balakrishnan Industries Limited, Goodyear India Limited, TVS Srichakra Limited, Falcon Tyres Limited, Kesoram Industries Limited (Birla Tyres)) in India, account for over 85-90% of the industry by value. Apollo India Limited (MRF) is the largest tyre manufacturer in India with a market share (value) of about 2122%, followed by MRF with about 20-21% and JK tyres with about 15-16%.

31

A Study on Low Cost Country Sourcing by International Tyre Industry

Major Tyre Projects Completed/Scheduled for Completion during 2010-2011

Company

Project

Product

Capacity Unit

MRF

Medak

Pcr+2w

26.7

Investment Expecte (in crore) d comp. dt Lac/annu 472 Sep11 m

Trichy

PCR

7.0

Lac/annu 900 m

Jan11

CEAT

vadodara Vadodara Nasik

PCR+UV TBR TBR

50 40 1.7

Tons/day 600 Tons/day Lac/annu m

Oct10

Oct10

Ambeanath SPECIALITY TYRES APOOLO Orangadam TBR Orangadam PCR FALCON Mysore 2W

200

Tons/day 140

Dec12

6000 8000 60

No/day No/day

2300

Apr11 Dec10 Jul11

Lac/annu 300 m

Uttranchal

2W/3W

Lac/annu 570 m

May12

KEZORAM Haridwar Balasore Haridwar JK Tamil nadu

TBR PCR TYRES TBR PH-1

85 80

Tons/day 350 Tons/day 450 1000

Sep11 Sep11 Mar13 Mar12

Lac/annu 1000

32

A Study on Low Cost Country Sourcing by International Tyre Industry

m Tamilnadu PCR PH-1 25 Lac/annu m Tamilnadu TBR PH-2 2 Lac/annu 500 m Tamilnadu PCR PH-2 25 Lac/annu m Karnataka TBR 2 Lac/annu 315 m BRIDGEST ONE Pithampur Pithampur TBR RADIAL TYRE Pune pune BALKRSIH NA DUNLOP MICHELIN Guwahatii Chennai OTR TBR 50 Bhuj TBR PCR SPEC. 110000 Tons/an num Tons/day 450 4000 Dec12 Dec11 1200 2600 Jun13 Aug13 Dec11 400 6000 No/day No/day 180 260 Dec10 Mar11 Jan11 Mar13

33

A Study on Low Cost Country Sourcing by International Tyre Industry

Growth of Indian Tyre Industry

2003 04 10821 9959 1440 3271 2007 08 13137 16437 1467 5320 1814 1234 886 409 11604 27921 0* 733 141 0 81103 2008 09 12839 16571 1469 5298 1842 1315 758 281 10882 30148 0 568 136 0 82107 2009 10 14811 20047 1402 5739 2386 1634 903 294 13558 35664 0 538 161 0 97137

CATEGORY Truck & Bus Passenger Car Jeep Light Comml. Veh. (L.C.V.)

2004 - 05 2005 - 06 2006 - 07 11092 11862 1462 3945 1311 1096 408 197 9992 18127 124 377 89 0 60082 11941 13605 1272 4529 1383 1134 596 325 9519 21053 55 514 106 0 66032 12367 14264 1368 4820 1754 1296 823 381 9643 26079 0* 635 115 0 73545

Tractor Front 1148 Tractor Rear Tractor Trailer A.D.V. Scooter Motor Cycle Moped Industrial O.T.R. Aero TOTAL 842 415 295 9274 16688 168 295 74 0 54690

(Production in india in 1000 no.s) 34

A Study on Low Cost Country Sourcing by International Tyre Industry

The Indian Tyre industry is expected to show a healthy growth rate of 9-10% over the next five years, according to a study by Credit Analysis and Research Limited (CARE). While the truck and bus tyres are set to register a compounded annual growth rate (CAGR) of 8%, the light commercial vehicles (LCV) segment is expected to show a CAGR of about 14 %.

35

A Study on Low Cost Country Sourcing by International Tyre Industry

Competitive analysis of major players of Indian tyre industry Market share in 2010-11

others 2% 2% JK 16% birla 14%

MRF 21%

apollo 22%

ceat13% 13%

POSITION OF THE COMPANY In terms of sales JK stood at the third position after Apollo and MRF with 16% of total market share of Indian tyre industry. Percentage share of the various companies in different tyre segments by production Company T&b Pass. Lcv Tractor rear Apollo 21 24 23 16 Birla 18 1 8 8 Bridgestone 0 19 0 0 Ceat 13 2 13 7 Falcon 0 0 0 1 Goodyear 0 13 0 35 Jk 22 14 18 7 Metro 0 0 0 0 Modi 4 0 0 0 Mrf 21 24 27 25 Tvs 0 0 0 0 Others 1 3 11 1 Tractor front 10 6 0 8 4 22 6 0 0 26 0 17 Tractor trailor 7 0 0 9 0 0 5 0 0 8 0 71 otr 2w/3w Motor cycle 1 0 0 6 0 7 0 0 0 25 9 8 0 14 19 4 0 0 28 0 0 0 2 2 0 0 0 27 29 27 0 22 24 9 23 13 36

A Study on Low Cost Country Sourcing by International Tyre Industry

Financial Analysis

The following Liquidity ratios, Activity ratios and Profitability ratios are explained under

1. Liquidity ratios Current ratio Quick ratio Inventory turnover ratio

2. Profitability ratios Net Profit Margin Gross Profit Margin Return on long term funds

3. Coverage & Leverage ratios Debt to Equity Owners fund as % of total source Fixed asset turnover ratio

37

A Study on Low Cost Country Sourcing by International Tyre Industry

Liquidity ratiosLiquidity ratios provide information about a firm's ability to meet its short-term financial obligations. They are of particular interest to those extending shortterm credit to the firm. We will be here seeing three of the liquidity ratios for the company and analyzing them. Current Ratio Current ratio is a financial ratio that measures whether or not a company has enough resources to pay its debt over the next business cycle (usually 12 months) by comparing firm's current assets to its current liabilities. Current ratio = current assets / current liability 2010 JK APOLLO 0.98 1.10 2009 1.18 1.30 2008 1.16 1.28

If current ratio is bellow 1 (current liabilities exceed current assets), then the company may have problems paying its bills on time. However, low values do not indicate a critical problem but should concern the management

2 1.5 1 0.5 0 2010 2009 2008 apollo jk tyres

As we can see that JKs current ratio is below 1 at 2010 it means they dont have enough current assets to meet its current liability. On the other hand Apollo performed well at every year having the current ratio above 1. 38

A Study on Low Cost Country Sourcing by International Tyre Industry

Quick Ratio The quick ratio is an alternative measure of liquidity that does not include inventory in the current assets. The quick ratio is defined as follows: Quick Ratio is an indicator of company's short-term liquidity. It measures the ability to use its quick assets (cash and cash equivalents, marketable securities and accounts receivable) to pay its current liabilities. Quick ratio formula is: Quick ratio = {current assets (inventories- prepaid expenses)} / current liabilities 2010 JK TYRES APOLLO 0.60 0.74 2009 0.72 0.91 2008 0.61 0.82

1 0.8 0.6 0.4 0.2 0 2010 2009 2008 APOLLO JK TYRES

Both the companies are not performing well in the case of quick ratio because it should be in the ratio of 1:1. . A quick ratio higher than 1:1 indicates that the business can meet its current financial obligations with the available quick

39

A Study on Low Cost Country Sourcing by International Tyre Industry

funds on hand, a quick ratio lower than 1:1 may indicate that the company relies too much on inventory or other assets to pay its short-term liabilities. Inventory turnover ratio- A ratio showing how many times a company's inventory is sold and replaced over a period. Formula for inventory turnover ratio isCost of goods sold/avg. inventory 2010 JK tyres Apollo 9.11 10.47 2009 14.03 11.77 2008 6.53 8.72

15 10 JK tyres 5 0 2010 2009 2008 Apollo

This ratio should be compared against industry averages. A low turnover implies poor sales and, therefore, excess inventory. A high ratio implies either strong sales or ineffective buying.

Profitability Ratios

These ratios, much like the operational performance ratios, give users a good understanding of how well the company utilized its resources in generating profit and value.

The long-term profitability of a company is vital for both the survivability of the company as well as the benefit received by

40

A Study on Low Cost Country Sourcing by International Tyre Industry

shareholders. It is these ratios that can give insight into the all-important profit. Net Profit Margin Often referred to simply as a company's profit margin, the socalled bottom line is the most often mentioned when discussing a company's profitability? While undeniably an important number, investors can easily see from a complete profit margin analysis that there are several income and expense operating elements in an income statement that determine a net profit margin. It behooves investors to take a comprehensive look at a company's profit margins on a systematic basis.

Net profit ratio = (net profit / net sales) * 100

2010 JK tyres Apollo 4.42% 8.19%

2009 0.38% 2.63%

2008 2.37% 5.89%

10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 2010 2009 2008 JK tyres Apollo

41

A Study on Low Cost Country Sourcing by International Tyre Industry

Net profit margin measure how much profit company is earning in relation to its sales, above graph shows Apollo profit is increasing higher rate year on year bases in comparison with JK tyres.

Gross Profit Margin By subtracting selling, general and administrative (SG&A), or operating, expenses from a company's gross profit number, we get operating income. Management has much more control over operating expenses than its cost of sales outlays. Thus, investors need to scrutinize the operating profit margin carefully. Positive and negative trends in this ratio are, for the most part, directly attributable to management decisions. A company's operating income figure is often the preferred metric (deemed to be more reliable) of investment analysts, versus its net income figure, for making inter-company comparisons and financial projections. Gross profit margin = (Gross profit / net sales) * 100 2010 JK tyres Apollo 10.14% 13.76% 2009 4.72% 6.31% 2008 6.58% 10.85%

15.00% 10.00% JK tyres 5.00% 0.00% 2010 2009 2008 apollo

42

A Study on Low Cost Country Sourcing by International Tyre Industry

Gross profit margins are fluctuating due to the change in the selling prize and the cost. It also affected because of wrong evaluation of stocks.

Coverage and Leverage ratios

Return on long term funds- It tells about the return of the company on the total capital employed or long term funds. Having a high return shows that company is operating in a good condition. 2010 JK tyres Apollo 30.48% 26.75% 2009 21.94% 13.95% 2008 18.55% 29.74%

40.00% 30.00% 20.00% 10.00% 0.00% 2010 2009 2008 JK tyres Apollo

We can see that for this ratio JK is performing well as compared to the Apollo. It means that the JK is operating in a very good condition.

2. Leverage Ratio

Financial leverage ratios provide an indication of the long-term solvency of the firm. Unlike liquidity ratios that are concerned with short-term assets and liabilities, financial leverage ratios measure the extent to which the firm is using long term debt. 43

A Study on Low Cost Country Sourcing by International Tyre Industry

Debt to Equity Ratio

This Debt/Worth or Leverage Ratio indicates the extent to which the business is reliant on debt financed money versus owner's equity): Debt equity ratio = total debt / total equity 2010 JK tyres Apollo 0.537 1.24 2009 0.459 1.91 2008 0.356 1.71

2.5 2

1.5

1 0.5 0 2010 2009 2008

JK tyres Apollo

Generally, the higher this ratio, the more risky a creditor will perceive its exposure in the business, making it correspondingly harder to obtain credit. By this ratio we can see that JKs debt equity ratio is increasing year to year and Apollos debt equity ratio is high so Apollo is more risky than JK. Owners fund as % of total source- owners fund in source shows that how much of this fund is involved in the total capital generated for company. It can be calculate as

44

A Study on Low Cost Country Sourcing by International Tyre Industry

Owners fund/total fund*100 2010 JK tyres Apollo

80.00% 60.00% 40.00% 20.00% 0.00% 2010 2009 2008 jk tyres apollo

2009 34.32% 66.04%

2008 36.85% 72.68%

44.63% 60.33%

We can see that Apollo have more share of its owner whether JK has comparatively low. Fixed asset turnover ratioA financial ratio of net sales to fixed assets. The fixed-asset turnover ratio measures a company's ability to generate net sales from fixed-asset investments - specifically property, plant and equipment (PP&E) - net of depreciation. A higher fixed-asset turnover ratio shows that the company has been more effective in using the investment in fixed assets to generate revenues. It can be calculated asNet sales/net property, plant and equipment 2010 JK tyres Apollo 1.44 2.10 2009 2.18 2.24 2008 1.16 2.38

45

A Study on Low Cost Country Sourcing by International Tyre Industry

2.5 2 1.5 1 0.5 0 2010 2009 2008 JK tyres apollo

This ratio is often used as a measure in manufacturing industries, where major purchases are made for PP&E to help increase output. When companies make these large purchases, prudent investors watch this ratio in following years to see how effective the investment in the fixed assets was.

46

A Study on Low Cost Country Sourcing by International Tyre Industry

COMPANY PROFILE

JK Tyre & Industries Ltd is one of the leading automotive tyre manufacturers in India. The company is engaged in manufacturing of automobile tyres, tubes and flaps. They manufactures Radial and Bias 4wheeler tyres for trucks, buses passenger cars, LCVs, tractors etc. They sell their products under the brand name 'JK Tyre'. They have four plants located in Rajasthan, Madhya Pradesh and Karnataka. The company has 134 sales, service and stock points located throughout the country. They have over 3,500 dealerships across India. The company's customer base covers virtually the entire Original Equipment Manufacturers in India together with Replacement Market for four wheeler vehicles, Defence and State Transport Units. Besides India, they have a worldwide customer base in over 45 countries across all six continents. JK Tyre & Industries Ltd was incorporated in the year 1951 as a private limited under the name JK Industries Pvt Ltd. Until March 31, 1970, the company was engaged in the managing agency business. Thereafter the company decided to undertake manufacturing activities and obtained a letter of intent in February 1972 for the manufacture of automobile tyres and tubes The company name was changed into JK Industries LTD with effect from May 24, 1974 consequent upon conversion of the company into a public limited company. In the year 1974, the company entered into a technical collaboration with General Tire International Co, USA, a subsidiary of General Tire & Rubber Co, USA for technical services and sales agreement for the supply of technical knowhow engineering and documentation for operational facilities. In the year 1989, the company introduced several new patterns and sizes of tyres including a semi-lug Nylon Truck tyre. In the year 1991, the company set up Banmore Tyre Plant with a capacity of 5.7 lakh tyres per annum. They launched radial tyres for tractors. In the year 1992, the company's international division expanded their activities by opening their office in Moscow. In addition, they set up a Research and Development center at HASETRI. 47

A Study on Low Cost Country Sourcing by International Tyre Industry

In the year 1993, they introduced new radial tyres namely, Brute and Ultima and in the next year, they launched 'Jet Track-39' to meet the need of the heavy load market. In June 1997, the company acquired 51% stake in Vikrant Tyres Ltd from Karnataka Government. They launched India's first HRated tyre. During the year 1998-99, as per the Scheme of Arrangement between the company and JK Drugs & Pharmaceuticals Ltd, the pharmaceutical undertaking of the company was transferred to and vested in JK Drugs & Pharmaceuticals Ltd with effect from appointed date July 1, 1996. During the year 2002-03, as per the Scheme of Arrangement and Amalgamation between the company, JK Agri, JK Sugar and Vikrant Tyres Ltd, the agri-genetics undertaking of the company was transferred to JK Agri, the sugar undertaking was transferred to JK Sugar and Vikrant Tyre Ltd was amalgamated with the company. During the year 2004-05, the expansion of capacity of Truck/ Bus Radials by 50% was completed. In addition, the expansion of the passenger radial capacity was completed. In December 2006, as per the Scheme of Arrangement and De-merger between the company and Netflier Technologies Ltd (name since changed to Netflier Finco Ltd), the business of holding and dealing in investments and some other assets and properties of the company and liabilities and obligations thereof stood transferred to and vested in Netflier Finco Ltd. In addition, Hansdeep Investment Ltd, Hidrive Finance Ltd, Panchanan Investment Ltd and Radial Finance Ltd ceased to be the subsidiaries of the company. During the year 2006-07, the company introduced a new tyre, offering high mileage 'Jet One' and launched new Semi-Lug and Rib pattern Truck Radial tyres. They also diversified into Special Application Tyres and commenced their exports. In order to capture the brand 'JK Tyre' and their value in the name of the company, they changed their name to JK Tyre & Industries Ltd with effect from April 2, 2007. The company entered into an arrangement with BEML for supply of OTR tyres on a long-term basis. In June 2008, the company acquired the controlling interest in Empresas Tornel, S A de C V (Tornel), a company incorporated under the laws of Mexico, by acquiring 100% of their equity capital for a consideration of USD 28.75 million. Tornel has three tyre manufacturing plants in Mexico with a combined capacity of 6.6 million tyres per annum During the year 2008-09, the company doubled the 48

A Study on Low Cost Country Sourcing by International Tyre Industry

capacity of Truck/Bus Radial plant to 8.00 lakh tyres from 3.67 lakh tyres per annum at an estimated project cost of Rs. 315 crore. This has further strengthened JK Tyre's commanding position in the fast growing Truck/Bus segment

49

A Study on Low Cost Country Sourcing by International Tyre Industry

Data Analysis and Interpretation

The list of companies considered for study is 1. 2. 3. 4. 5. Michelin (Europe) Bridgestone (Asia) Yokohama (Asia) Goodyear (America) Continental (Europe)

The above companies are shortlisted based on their global presence and their host continent. The Low Cost Countries that attracted investments from the above companies are 1. Asia a. China b. India c. Russia d. Indonesia e. Philippines f. Malaysia g. Thailand h. Turkey 2. Eastern Europe and Africa a. Slovakia b. Portugal c. Czech Republic d. Romania e. Hungary f. Poland g. South Africa 3. Latin America a. Brazil b. Mexico 50

A Study on Low Cost Country Sourcing by International Tyre Industry

CAPITAL EXPENDITURE from 1999-2011

The trend of Capital Expenditure (CAPEX) of the companies from 1999-2011 is as follows:

Capital Expenditure

3,000 2,500 2,000 Million $ 1,500 1,000 500 Good year Yokohama Michelin Bridgestone Continental

1,999 2,000 2,001 2,002 2,003 2,004 2,005 2,006 2,007 2,008 2,009 2,010 2,011

The total CAPEX of the companies during 1999-2011 is $ 55.9 billion. Michelin and Bridgestone are the companies with high Capital Expenditure of $19 billion and $21 billion and together constitute 71% of total CAPEX from all the companies. The Capital Investments for most of the companies started rising from the year 2002-03.This trend continued till 2008-09. During the year 2009 the Capital investments of all the companies fell due to Global recession and from the year 2010 there was a sharp increase in Capital investments as there was an expected demand rises for automobiles sector in the developing countries.

51

A Study on Low Cost Country Sourcing by International Tyre Industry

Capital Expenditure in LCCs The following chart shows the company wise Capital Expenditures in LCCs during 1999- 2011.

Million $ 5000 4500 4000 3500 3000 2500 1880

Mexico,Poland,South Africa

Company Wise Capital Expenditure

Romania, Mexico,Czech, Portugal, Malaysia Romania, Mexico, Hungary, Turkey Russia, China Portugal, Czech Asia Pacific Middle East Europe, Africa Latin America Thailand

2000

1500

1114

307 251

1284

Russia Philippines Slovakia

604

740 264 316 745 41 159 601

528

China Brazil

1000 500 0 873

420

415

1092

Mexico

512

Indonesia India

114 Michelin Continental Yokohama

Bridgestone

Good Year

Of the total LCC CAPEX $12.2 billion, Michelin and Goodyear invested $4.8 billion and $2.9 billion that constitute to 38% and 24% of investments by all the companies in LCCs. Almost all the Companies have their majority investments in Asian LCCs as they have attracted 55% of total investments followed by Latin America with 25% and Middle East, Africa and Eastern Europe collectively with 20 % of total investments.

52

A Study on Low Cost Country Sourcing by International Tyre Industry

Yearly Percentage of Capital Expenditures in LCCs

% of Capital Expenditures in LCC's

80% 70% 60% 50% 40% 30% 20% 10% 0%

75%

26% 7% 11% 0% 0% 0% 15% 18% 4% 1% 0% 13% 17% % in

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Total

The percentages of capital expenditures in LCCs have been steady during 200507 and increasing from 2010 onwards, this indicates the tyre companies are looking for LCCs to invest.

53

A Study on Low Cost Country Sourcing by International Tyre Industry

Company wise Percentage spending in LCCs

% of CAPEX spent in LCC's

80% 60% 40% 20% 0% Good year Michelin Continental Yokohama 56% 12% 15% 61% 14%

% CAPEX in LCC

Bridgestone

The above chart shows the companies percentage spending on LCCs. From the above chart we can observe that Yokohama and Goodyear invests majority of their CAPEX in LCCs. It can also be noticed that though the magnitude of CAPEX of Michelin and Bridgestone high, their percentage spending in LCCs is less. This shows that Michelin and Bridgestone are investing more in non LCCs.

54

A Study on Low Cost Country Sourcing by International Tyre Industry

CAPEX Country Wise

The country wise Capital Investments of the companies are given in the following chart.

3,000

2,500

2,000 1,500 1,000 500

415 16 512

Country Wise LCC CAPEX

114 1,880 1283.61,114 1092.3 873 822 740 745 604 601 528.4 420 316 159 41

Good Year Bridgestone Yokohama 2 Continental Michelin

From the above chart it can be observed that Brazil, Russia, India, China attracted major proportion of Investments as it was estimated that the automobile sales in BRIC nations would be 15 million units by 2010 with a growth rate of 10% per year. Among these China has been the preferred destination due to its abundant resources, low labour and manufacturing costs, and abundant resources.

55

A Study on Low Cost Country Sourcing by International Tyre Industry

Percentage of investments in major countries The major countries considered are India, Mexico, Brazil, China, Slovakia, Philippines, Russia and Thailand.

% of total Investments

(1-5)% 3% 5% 7% 6% India Mexico Brazil 10% (23-25)% China Slovakia Philippines Russia Thailand

Out of the total CAPEX of $12.278 billion the major countries like India, Mexico, China, Brazil, Slovakia, Philippines, Russia, and Thailand have got a $ 7.8 billion investment which is 63% of the total CAPEX in LCCs. China has the highest investments with 23% followed by Brazil, India and Mexico with 10% and 7% respectively.

56

A Study on Low Cost Country Sourcing by International Tyre Industry

Continent Wise CAPEX in LCCs The continents with LCCs are Asia, Latin America and East Europe with Africa. The continents are considered because there are joint investments in the countries that could not be segregated. The following chart gives the continent wise break up of investments.

8000 7000 6000 5000 4000 3000 2000 1000 0

Company wise CAPEX in Continents

1284

835 817 1116 2755 Asia 528 745 1137 Eastern Europe,Middle East & Africa 1092 114 1854 Latin America Good Year Bridgestone Yokohama Continental Michelin

From the above chart it can be observed that Asia has investments from all the companies and Continental and Michelin have invested in all the continents.

Million $

57

A Study on Low Cost Country Sourcing by International Tyre Industry

Continent wise share of CAPEX The following chart gives the percentage share of all the continents in the investments.

% of CAPEX in LCC's Continent wise

Asia

25% Eastern Europe,Middle East & Africa 55% 20% Latin America

We can observe that Asian LCCs are mostly preferred for Tyre Sourcing with an investment of $6.8 billion (55%) out of a total $12.3 billion. Company wise share of CAPEX in LCCs

Contribution of all Companies to LCC's

24% 37% Michelin Continental Yokohama Bridgestone 19% Good Year

13% 7%

Michelin and Goodyear are expanding vigorously in LCCs compared to other companies. They together contribute 61% of total CAPEX in LCCs. 58

A Study on Low Cost Country Sourcing by International Tyre Industry

Segment wise Capacity Installments The capacity installments have fallen broadly under three categories, namely 1. Commercial Vehicle Tyres 2. Passenger Tyres 3. Run Fat Tyres

Magnitude of Capacity installments in LCC's Segment wise

9%

Commercial Vehicle Tyres(Truck,Earth Movers & Bus ) Passenger Car Tyres

31% 60%

Run Flat Tyres

From the above chart we can conclude that majority of expansions took place in Commercial Tyre segment and most of the expansions took place in few countries like Thailand, China, and Brazil. The Passenger Car Tyre capacity is expanded in all the developing countries of Asia, East Europe and Latin America.

59

A Study on Low Cost Country Sourcing by International Tyre Industry

Capacity installed at LCC During 1999-2011 the cumulative percentage of capacity at LCC to the total capacity is as follows

% of Capacity at LCC to total Capacity

50% 40% 30% 20% 10% 0% 2004 2005 2006 2007 2008 2009 2010 2011 27% 28% 29% 36% 43%

45%

46%

47%

From this it is observed that the companies are gradually increasing their capacity at LCCs. This is also contributed by the ceasing of plants at high cost European and American sites. Percentage of Sales in LCCs During the period 1999-2011 the percentage of units sold in LCCs are as follows

70% 60% 50% 40% 30% 2000 2001 2002 47% 47% 49%

% Units sold at LCC's

61% 62% 63% 63%

52%

53%

55%

56%

59%

2003

2004

2005

2006

2007

2008

2009

2010

2011

This shows that the productions at LCC sites are mostly for the consumption in that LCC country.

60

A Study on Low Cost Country Sourcing by International Tyre Industry

Yearly Trend in Capital Investments in LCCs

Year 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Total Investment(Million $) 264 316 0 0 0 153 1160 727 991 57 0 671 5035

Till 2003 there were very less investments in LCCs. From 2005 the investments rushed to LCCs because of increasing competitiveness in the industry, increase of raw material, labour and mantainence costs in high cost countries. This was also attributed by the potential markets in growing countries like Brazil, China, Mexico, India and other African and East European countries. The year 2009 hit the global tyre industry as there was recession worldwide that led the companies to rationalize their activities at plants to reduce the costs.

61

A Study on Low Cost Country Sourcing by International Tyre Industry

Preferred Countries for investments

There are many LCCs and the companies have ample choices for sourcing. The following chart gives the number of companies invested in those countries.

Company vs No of Countries

No of companies

5 4 3 2 1 0

From the above chart it is evident that China is the most attractive destination for sourcing of Tyres due to its abundant raw materials, cheap labour and less product cycle. China has attracted (23-25) % of total LCC investments during 199-2011. Trend in selecting the destinations

During the years 1999-2001 companies like Continental and Bridgestone invested in their host continents. From 2004-07 the companies expanded vigorously in Eastern Europe, Asia and Latin America. After 2008 all the companies invested only in Asian Countries.

62

A Study on Low Cost Country Sourcing by International Tyre Industry

Conclusion

The companies are able to cut the manufacturing costs over the period of time. The following chart represents the percentage of manufacturing costs to the sales turnover.

85% 80% 75% 70% 65%

Trend of Manufacturing Costs as % of Sales

Bridgestone Goodyear Yokohama Continental

60%

55% 50% 45% 40% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Michilin

It can be observed that from the year 2009 most the companies have reduced their manufacturing costs. This was possible by Low Cost Country sourcing during the past years. Except Bridgestone all the companies registered had shown significant reduction in manufacturing costs. This is because Brigestone had invested more in High cost countries where as the remaining companies have invested in LCCs.

63

A Study on Low Cost Country Sourcing by International Tyre Industry

Observations:

1. Michelin and Bridgestone are the companies with highest Capital Expenditures but Michelin is investing more in LCCs whereas Bridgestone is investing more in non LCCs. 2. Capital Investments of all the companies have been increasing sharply from 2009. 3. China has emerged as the preferred destination for Tyre Sourcing followed by other countries like Mexico, Brazil, Russia, Thailand, India, Indonesia etc. 4. Commercial Tyre segment has attracted majority of investments in LCCs. 5. Most of the production in LCCs is used for the respective LCC. 6. The capacity at LCCs is gradually increasing year by year. 7. The companies started sourcing from East European, Latin American and Asian countries during 2004-2007 but from 2009 all the companies began to source from Asian LCCs. 8. The companies who have invested in LCCs showed reduction in their manufacturing costs over the period of time.

64

A Study on Low Cost Country Sourcing by International Tyre Industry

Suggestions to India and JK Tyre

1. As all the companies are looking for Asian countries it is the best opportunity for India to attract more companies if manufacturing costs are maintained low compared to other LCCs. 2. JK tyre which is located in an LCC and being the largest exporter of tyres in India can avail this opportunity to outsource tyres to more foreign tyre companies. 3. There are overseas opportunities for JK Tyres to increase their global footprint in much lower LCCs than India.

65

A Study on Low Cost Country Sourcing by International Tyre Industry

Source of Information

Secondary data is used mostly for the project. Most of the resources are obtained from internet. The following are the sources for the data collection. 1. 2. 3. 4. Company Annual Reports Company websites http://www.atmaindia.org http://www.ranker.com

66

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGDokument6 SeitenProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Valley Bread IncDokument29 SeitenValley Bread IncMae Richelle D. DacaraNoch keine Bewertungen

- AFAR Summative Assessment Problems (Kay Jared)Dokument75 SeitenAFAR Summative Assessment Problems (Kay Jared)jajajaredred100% (1)

- W-W New Hire (MaAurelia Aguirre)Dokument14 SeitenW-W New Hire (MaAurelia Aguirre)beth aguirreNoch keine Bewertungen

- Model ALM PolicyDokument9 SeitenModel ALM Policytreddy249Noch keine Bewertungen

- Ate Mapa PrintDokument10 SeitenAte Mapa PrintchosNoch keine Bewertungen

- 4 - Case Study - The IMF and Ukraine's Economic CrisisDokument2 Seiten4 - Case Study - The IMF and Ukraine's Economic CrisisAhmerNoch keine Bewertungen

- Constructing Low Volatility Strategies: Understanding Factor InvestingDokument33 SeitenConstructing Low Volatility Strategies: Understanding Factor InvestingLoulou DePanamNoch keine Bewertungen

- The New Economic Geography Theory by Paul Krugman and Our Proposed Economic TheoryDokument36 SeitenThe New Economic Geography Theory by Paul Krugman and Our Proposed Economic TheoryEulalio NinaNoch keine Bewertungen

- WEF A Partner in Shaping HistoryDokument190 SeitenWEF A Partner in Shaping HistoryAbi SolaresNoch keine Bewertungen

- ChallanFormDokument1 SeiteChallanFormAman GargNoch keine Bewertungen

- The Valuation of Olive Orchards: A Case Study For TurkeyDokument4 SeitenThe Valuation of Olive Orchards: A Case Study For TurkeyShailendra RajanNoch keine Bewertungen

- HR Policies and Challenges: - by Dr. Deepakshi JaiswalDokument9 SeitenHR Policies and Challenges: - by Dr. Deepakshi JaiswalAyushi GargNoch keine Bewertungen

- Nikita: Thanks For Choosing Swiggy, Nikita! Here Are Your Order Details: Delivery ToDokument2 SeitenNikita: Thanks For Choosing Swiggy, Nikita! Here Are Your Order Details: Delivery ToAkash MadhwaniNoch keine Bewertungen

- Assignment Inventory Management 12.7Dokument2 SeitenAssignment Inventory Management 12.7meriemNoch keine Bewertungen

- микроDokument2 SeitenмикроKhrystyna Matsopa100% (1)

- 55 EntrepreneuralintentionsDokument78 Seiten55 EntrepreneuralintentionsMathew RachealNoch keine Bewertungen

- The Wonderful World of Tax SalesDokument9 SeitenThe Wonderful World of Tax Saleslyocco1Noch keine Bewertungen

- Personal Finance & Tax Planning For Cost Accountants: Roven PereiraDokument13 SeitenPersonal Finance & Tax Planning For Cost Accountants: Roven PereiraK S KamathNoch keine Bewertungen

- SWOT Analysis of ItalyDokument22 SeitenSWOT Analysis of ItalyTarunendra Pratap SinghNoch keine Bewertungen

- Nisha RuchikaDokument24 SeitenNisha RuchikaRishabh srivastavNoch keine Bewertungen

- ExamDokument12 SeitenExamAvi SiNoch keine Bewertungen

- Invoice Act May 2022Dokument2 SeitenInvoice Act May 2022Pavan kumarNoch keine Bewertungen

- Chapter 3 - Influential Digital Subcultures - USUDokument14 SeitenChapter 3 - Influential Digital Subcultures - USUbambang suwarnoNoch keine Bewertungen

- Socioeconomic Conditions and Governance in The Atulayan Bay Marine Protected AreaDokument8 SeitenSocioeconomic Conditions and Governance in The Atulayan Bay Marine Protected AreaJohn Joseph AsuzanoNoch keine Bewertungen

- Urban Development Policies in Developing Countries: Bertrand RenaudDokument13 SeitenUrban Development Policies in Developing Countries: Bertrand RenaudShahin Kauser ZiaudeenNoch keine Bewertungen

- Analisis Perbandingan Model Springate, Zmijewski, Dan Altman Dalam Memprediksi Yang Terdaftar Di Bursa Efek IndonesiaDokument13 SeitenAnalisis Perbandingan Model Springate, Zmijewski, Dan Altman Dalam Memprediksi Yang Terdaftar Di Bursa Efek IndonesiahanifNoch keine Bewertungen

- Marketing Mix in Insurance IndustryDokument4 SeitenMarketing Mix in Insurance Industryrajnsab0% (1)

- NIC ASIA BANK Surkhet NepalDokument62 SeitenNIC ASIA BANK Surkhet NepalAshish Kumar100% (1)