Beruflich Dokumente

Kultur Dokumente

Final SCM

Hochgeladen von

KalemshahOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Final SCM

Hochgeladen von

KalemshahCopyright:

Verfügbare Formate

Risks in supply chain can cause organisations to fold up if not handled effectively.

It is often useful to consider categories of risks as a starting point to guide organisations in an initial assessment of their procurement, logistics and supply chain operations. In recent years, Logistics and Supply Chain risks have become major issue of concern to small, medium and 'large oil and gas organisations. Required: Select one or several logistics and supply chain activities (transport, warehousing, inventory etc.) and critically evaluate how technology (e-dimension) can be used to reduce risk in Procurement logistics and Supply Chain operations in a Small or Medium Oil and Gas company of your choice. Support your evaluation with a case example. /////////////////////////////////////////////////////////

Abstract

The oil and gas industry is involved in a global supply-chain that includes domestic and international transportation, ordering and inventory visibility and control, materials handling, import/export facilitation and information technology. Thus, the industry offers a classic model for implementing supply-chain management techniques. In a supply-chain, a company is linked to its upstream suppliers and downstream distributors as materials, information, and capital flow through the supply-chain. The purpose of this paper is to investigate the role of supply-chain management in the oil and gas industry. This paper also discusses the application of the Uniform Commercial Code (UCC) to supply-chain management issues. Then, several strategies are examined for improving supply-chains in the oil and gas industry. Finally, two case studies are introduced to show how improving supply-chain logistics in the oil and gas industry can improve efficiency and the bottom line. Introduction The last few years have witnessed a spurt in economic growth worldwide. The growth has been visible both across manufacturing as well as services sector. The growth in manufacturing has been accompanied by a sharp growth in world trade. The sharp growth in

global trade has led to a sharp increase in the need for logistic services. The logistic services like shipping, containerization and warehousing have also seen a sharp surge in demand. This surge in demand has led to large investments by several logistic players all over the world. The investments have been mainly for setting up the basic infrastructure required for carrying out these services. The economic growth across the globe has also seen a sharp growth in organized retail; this is manifested by a sharp increase in the number of retail establishments and also an increase in the proportion of organized retail in the total retail pie. This sharp growth in retail has led to a need for services like intra city transportation and warehousing. Supply- chain management (SCM) can be defined as the configuration, coordination and continuous improvement of a sequentially organized set of operations. The goal of supplychain management is to provide maximum customer service at the lowest cost possible. A customer is anyone who uses the output of a process. Therefore, the customers customer is important to any organization that is focused on customer service. In a supply-chain, a company will link to its suppliers upstream and to its distributors downstream in order to serve its customers. Usually, materials, information, capital, labour, technology, financial assets and other resources flow through the supply-chain. Since the goal of the firm is to maximize profits, the firm must maximize benefits and minimize costs along the supplychain. The firm must weigh the benefits versus the costs of each decision it makes along its supply-chain. Supply-chain management is therefore an extension of the focus on customer service. Today, there are more opportunities for coordinating activities across a supply-chain even in such complex operations as oil and gas, because of improving information systems and communication technologies. Integrating operations management with other functions of the operation allows all functions to be involved in the supply-chain management decisions. Historically, the ownership of business supply-chains has always been highly concentrated. Typically, it is common to manage high-tech operations separately from low-tech operations and capital intensive operations from labour intensive operations. It is also common to manage by considering scale economies. Thus, it is common to separate operations that produce standardized products and services in large quantities from those that produce a great variety of customized products in smaller quantities. In focusing on operations, it is desirable for a business in a supply-chain to have a homogeneous mix of products and customers. In recent times, there have been concerns and many have argued that the oil and gas industry may have entered an era of very scarce resources. In reality however, the resources are not

the cause of supply constraints, given the enormous potential still available including, currently known and booked reserves, the increasing scope for recovery from existing fields with new technologies, further potential discoveries, and the new frontier of vast oil sands and oil shale reserves that are in the money at todays prices. ////////////////// SUPPLY-CHAIN LINK IN THE OIL AND GAS INDUSTRY Exploration Production Refining Marketing Consumer The links shown above represent the major supplychain links in the oil and gas industry. The links represent the interface between companies and materials that flow through the supply-chain. As long as oil companies have needed a phalanx of vendors to keep their systems continuously re-supplied, there has been a supplychain. Within each stage there are many operations. For example, exploration includes seismic, geophysical and geological operations, while production operations include drilling, reservoir, production, and facilities engineering. Refining is a complex operation and its output is the input to marketing. Marketing includes the retail sale of gasoline, engine oil and other refined products. Each stage of the link can be a separate company or a unit of an integrated firm. The common issue along the links in the oil and gas industry supply-chain is economics; weighing benefits versus costs along the chain. Very few industries can benefit from maximizing supply-chain efficiencies more than the oil and gas companies. In this industry, the types of shipments made vary widely from gloves to pipes, valves, cranes, chemicals, cement, steel, and drilling rigs, just to mention a few. In addition, very few industries require this immense array of supplies to be moved daily and frequently in large quantities domestically, globally, onshore and offshore. In exploration and production, most of the work and activities are repetitive. The companies drill a lot of oil and gas wells every year. A drilling contractor is required and as many as 45 or more different services are required to drill and complete each well. In the oil and gas industry, almost all significant and important operations are planned in advance. Thus, the whole process can be massaged and fine-tuned into a high performance money making machine. The goal of supply-chain management is to provide maximum customer service at the lowest possible cost. In the industry supply-chain link, exploration operations create value through seismic analysis and identifying prospects. Production operations become the customers that use the output of exploration. In like manner, refining is the customer of production while marketing is the customer of refining and the consumer of refined products such as gasoline is the ultimate customer. There is a need to ensure that each company or operator along the supply-chain can

respond quickly to the exact material needs of its customers, protect itself from problems with suppliers and buffer its operations from the demand and supply uncertainty it faces. For oil and gas companies, the profit margin can be greatly enhanced if the companies manage their purchasing dollars throughout the entire supply-chain. One of the weaknesses of a supply-chain is that each company is likely to act in its best interests to optimize its profit. The goal of satisfying the ultimate customer is easily lost and opportunities that could arise from some coordination of decisions across stages of the supply-chain could also be lost. If suppliers could be made more reliable, there would be less need for inventories of raw materials, quality inspection systems, rework, and other non-value adding activities, resulting in lean production. Tubes and tubular goods are among the important goods supplied to the oil and gas industry on a daily basis. These goods are very crucial and form part of the supply-chain link. The supply-chain in tubular goods is the process through which oil field tubular goods such as pipes, tubing, and casing are ordered, manufactured, transported, stored, prepared, and then delivered to the website for installation into a well. Managing this part of the supply-chain can be both an operational and logistics nightmare for most oil and gas companies. Delays in the arrival of pipes, casing, tubing, and other accessories, can result in extensive rig downtime and consequently high operating costs. THE UNIFORM COMMERCIAL CODE (UCC) AND SUPPLY-CHAIN MANAGEMENT. Along the oil and gas industry supply-chain, the UCC governs the terms dealing with the sales of goods. Article 2 of the UCC applies to contracts that are primarily for sales of goods. It applies to suppliers of tangible goods to the oil and gas companies. The UCC not only applies to merchants, but also to private parties, in the sales of goods. The UCC does not apply to services. Under the UCC, there are delivery obligations for the seller of goods when no place of delivery has been agreed upon. Absent any prior agreement as to the place of delivery, then the place of delivery is the sellers place of business. However, if both the buyer and seller know that the goods are at a particular place or location, then that place is the place of delivery. Where there is an agreement as to place of delivery by a common carrier, then, there are two possibilities under the sellers delivery obligation. With shipment contracts, the seller will complete its delivery obligation when it gets the goods to the common carrier, makes reasonable arrangements for delivery, and notifies the buyer. Otherwise, delivery is not complete. In destination contracts, the sellers delivery obligation is not complete until the goods arrive where the buyer is. Sometimes, it may be difficult to determine whether a delivery contract is shipment or destination. Where there is free-on-

board (FOB) followed by city where the seller is or the place where the goods are, then it is a shipment contract. However, where you have FOB followed by any other city, there is a destination contract. Risk of loss issues may also arise if the goods are damaged or destroyed before the buyer receives the goods and neither party (buyer or seller) is to blame. Risk of loss can be determined by agreement of the parties. If the risk of loss is on the buyer, then the buyer has to pay the full contract price for the damaged or lost goods. On the other hand, if the seller has the risk of loss, then there is no obligation on the buyer, but a possible liability on the seller for non-delivery of the goods. If there is a breach of contract, then the breaching party is liable for any uninsured losses. If delivery is by a common carrier other than the seller, then the risk of loss shifts from the seller to the buyer at the time the seller completes its delivery obligation, described above. Otherwise, where there is no agreement, no breach, and no delivery by a common carrier, the risk of loss shifts from a merchant-seller to the buyer upon the buyers receipt of the goods. For a non-merchant seller, the risk of loss shifts to the buyer when the seller tenders the goods. IMPROVING SUPPLY-CHAIN LINKS IN THE OIL AND GAS INDUSTRY Once a supply-chain has been established, and coordination mechanisms are in place, it can still be improved. Today, oil and gas companies are looking for new ways of reducing total operating costs and improving efficiency and profits. In many cases, it is possible for the ideal configuration to change over time, due to changes in technology and consumer preferences. In some other cases, technology may allow several mechanisms for configuration across the supply-chain. Generally, oil and gas companies should view their supply-chain configuration and coordination systems as worthy of improvement. Making necessary improvements over time allows the firm to gain competitive Journal of Business & Economics Research June 2007 Volume 5, Number 6 33 advantages in the marketplace. A firm, believing its supply-chain has been optimized, can easily loose competitive advantages by being resistant to changes that might lead to improvements. The following eight strategies are recommended for improving oil and gas industry supply-chains. Segment Customers Based Upon Service Needs Different customers have different and sometimes unique requirements and meeting these requirements may necessitate different approaches to supply-chain configuration and coordination. Overall performance can be improved through effective matching of what is produced, when it is

produced and the quantities to be produced to the specific customer requirement. To do this will require a certain level of marketing research, operational flexibility and sophisticated cost accounting. 1.3 DHL Information Technology Development: The proliferation of information technologies (IT) and the internet technologies have provided impetus and challenges to the logistics. New technologies present new means to manage the flow of information. IT as a productivity tool can be utilized to both increase the capability and decrease the cost at the same time (Closs et al., 1997). It has been widely accepted that firms can achieve competitive advantage by cost reduction or differentiation with the proper implementation of IT (Porter & Millar, 1985). Enabled by IT the logistics has become a source of competitive advantage for many firms. So keeping in mind the DHL Company has launched DHL@ Home, a new delivery services to meet growing demand for business to customers deliveries. DHL@Home helps business to deliver goods direct to private residential addresses anywhere in UK. DHL is one of the first global companies who use TCP communication which helps its customers when they want to get information of their respective problems. (www.dhl.com)

IT role The step up of IT in the supply chain and logistics has change business pattern of DHL and business success depends on logistic and supply chain management. From 1969 to till now DHL develop its business promptly around the world and have successful to won the confidence of thousands of its customers by providing them excellent level of services. DHL IT control with correct data, timely and readily available with suitable schedule including individuals skills and capability and applies them while using new technology. DHL excellence is about achieving further than expectations for all its customers, whatever their size and wherever they need it. To develop a reliable and resourceful supply chain network companies are moving to 3PLs to ensure the economics of scale and decrease of cost. As a consequence of it logistic providers have started to globalise and integrated logistics to optimise their resources and mutually benefit to each other.

2a (ii)

2.0 Use of IT to Maintain a Relationship with Supplier Companies are facing increased business pressure from intensifying competition and dynamic demand in the markets. This leads to growing expectations for solution capabilities of concepts like supply chain management and collaboration. Fortunately, there might be new or unexploited potentials. Advanced planning and scheduling systems offer functionality for collaborative planning which has rarely been used in practice. The IT technology is regarded to provide a revolutionary potential for solutions in the area of supply chain and maintains the relationship between suppliers as well (Kelly, K., Allison, M., 1999). the impact of logistics has grown as it is increasingly recognized as a source of consistent, low lead time, damage free deliveries (Bardi et al., 1994). In pursuit of competitive advantages, firms outsource their functions which are noncore competencies so that they can focus on their core competencies. A recent survey found that 83 percent of the surveyed Fortune 500 companies reported having at least one contract with a third-party logistics provider (Lieb & Bentz, 2004). Over the years, the use of third-party logistics has been increasing. Similar survey of Fortune 500 companies taken in 1991 had only 38 percent of the respondents reporting the use of third-party logistics provider (Lieb, 1992). 2.1 Logistics Information System Logistics Information System (LIS) is the strategy component of logistics information technology. An effective LIS facilitates the proper information flow between inventory, warehousing and transportation to realize the high level of customer service. The ability to optimize the logistics cost and service levels is affected by the LIS of the company and its supplier. Firms that provide better logistics services at a lower cost can have competitive advantage over its competitors (Bardi et al., 1994). Two classes of LIS has been recognized in the literature (Closs et al., 1997). Logistics operating systems (LOS) refer to transactional applications such as order entry, order processing, warehousing, and transportation. Logistics planning systems (LPS) refer to coordinating applications such as forecasting, inventory management, and distribution requirements planning.

2b (i) IT and Supply Chain Electronic Data Interchange (EDI) has successfully enhanced the communication between different parts of supply chain which is essential for firms getting good logistics and supply chain. This technology requires company like DHL to have common data formatting and transmission standards or protocols. Such technologies have been employed by supply chain in companies to coordinate their value chain activities including logistics. Early applications of EDI have been on transmitting vehicle location information by one department to other in supply chain. Other types of logistics information carried by EDI are purchase orders/releases and changes, advanced shipping notices, bills of lading, and invoices. Timely and accurate information is crucial in decision making about complex logistics problems. Japan Airlines (JAL) adopted EDI to manage their complex supply chain logistics required for their integration, operations, including procurement and just-in-time delivery of aircraft fuel, repair and maintenance aircraft parts, food catering and other customer requirements (Chatfield & Bjorn-Andersen, 1997). If DHL utilizes EDI then it will better able for them to fulfil greater number of services to their customers (Rogers et al., 1992).

2B (ii)

3.0 Effective IT contribution to Supply Chain Management The effective IT capability of real-time communications is essential for maintaining the flow of information in supply chain management. As noted by Dudley & Lasserre (1989), one of the important roles of IT is to substitute information for inventory. To make real-time tracking of goods, logistic information systems of business partners should have real-time communications capability in supply chain. The supplier requires an integrated messaging

architecture which exchanges business data while customizing business flows and format transformation. Real-time communications also allows for schedule plans to change in dynamic routing and scheduling system when the vehicles are already out on the road. Any last minute changes in routing and scheduling system or constant tracking has been possible only with real-time communications ability of the respective systems.

3.1 RFID Contribution in Supply Chain Management RFID is a strategy which helps to identify, track and locate items automatically. The use of Radio Frequency Identification (RFID) is expected to increase rapidly in coming years. Often referred to as the next step in the evolution of bar-coding, RFID is growing rapidly in the automatic data capture and identification market (Srivastava, 2004). RFID is not a new strategy, in fact, its use dates back to 1940s but only now it is starting to make a significant impact within the supply chain. The growth in use of RFID will be enhanced to some extent by mandates from large retailers such as Wal-Mart and Target, and the US Department of Defense, who require their suppliers to adopt this technology within the next few years (Asif & Mandviwalla, 2005). Among the companies that are piloting RFID in their supply chain management prominent ones are Wal- Mart, Procter & Gamble, Coca-cola and Gillette and now in DHL. Although the biggest driver in the popularity of RFID has been supply chain, companies are experimenting in other applications as well. Other applications are theft detection, asset tracking, mobile payments, in-process inventory tracking and luggage tracking. Dell, Seagate, Boeing and Ford are among other companies that are using RFID to track their in-process inventory in manufacturing. An RFID system includes transponders or tags that can identify items; antennas that allows tags to be interrogated and to respond; and software that controls the RFID equipment, manages the data and interfaces with enterprise applications. RFID has lots of potential to improve the efficiency in the supply chain and reduce waste. For example, efficiency would result from automatic update of inventory system when products with RFID tags are unloaded from trucks into stores. The advantages of RFID over bar coding are as follows: RFID tags can provide longer read distances; store more data; require no direct line of sight between tag and reader; and can collect data from multiple sources simultaneously (Asif & Mandviwalla, 2005). There are some technical and business challenges to overcome before RFID can be ubiquitous. Technical issues include problems of interference, security and accuracy while

business issues relate to costs and lack of standards. Another significant business challenge in adopting RFID faced by managers is to work out a business case for the executive board. Early adopters of these technologies are marred by problems such as possible adverse consumer outbursts to perceived invasion of privacy, reliability of the RFID system, and issues related to health, safety and IT integration.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Marketing PlanDokument41 SeitenMarketing PlanKalemshahNoch keine Bewertungen

- Contract For KDokument5 SeitenContract For KKalemshahNoch keine Bewertungen

- Sainsbury FinacialDokument12 SeitenSainsbury FinacialKalemshahNoch keine Bewertungen

- DHCP Server and TFTP Server More Than 5 IP Phones in A System Then Seprate DHCP AND TFTP Servers Must Be Used. LAN Socket: Category 5 CablingDokument1 SeiteDHCP Server and TFTP Server More Than 5 IP Phones in A System Then Seprate DHCP AND TFTP Servers Must Be Used. LAN Socket: Category 5 CablingKalemshahNoch keine Bewertungen

- Marketing PlanDokument41 SeitenMarketing PlanKalemshahNoch keine Bewertungen

- Starbucks - Targetting, Positioning and Marketing MixDokument7 SeitenStarbucks - Targetting, Positioning and Marketing MixSreerag Gangadharan89% (19)

- NhsDokument12 SeitenNhsKalemshah100% (1)

- Marketing PlanDokument41 SeitenMarketing PlanKalemshahNoch keine Bewertungen

- CRM and Its Effects On Customer'S Loyalty: Research TopicDokument13 SeitenCRM and Its Effects On Customer'S Loyalty: Research TopicKalemshahNoch keine Bewertungen

- Student Copy of Resource Management Feb 2010 HRM FRMDokument3 SeitenStudent Copy of Resource Management Feb 2010 HRM FRMKalemshahNoch keine Bewertungen

- FinlfriendDokument30 SeitenFinlfriendKalemshahNoch keine Bewertungen

- FRM ReviewDokument73 SeitenFRM ReviewKalemshahNoch keine Bewertungen

- Organizational Behaviour Pak Elektron LimitedDokument41 SeitenOrganizational Behaviour Pak Elektron LimitedM.Zuhair Altaf100% (3)

- Individual AssignmentDokument4 SeitenIndividual AssignmentKalemshahNoch keine Bewertungen

- QuestionaireDokument4 SeitenQuestionaireKalemshahNoch keine Bewertungen

- 18 - Mediation - An IntroductionDokument23 Seiten18 - Mediation - An IntroductionKalemshahNoch keine Bewertungen

- Individual AssignmentDokument4 SeitenIndividual AssignmentKalemshahNoch keine Bewertungen

- PsoDokument240 SeitenPsoumair feroze100% (3)

- E-Strategy (Ruksar Cousin)Dokument9 SeitenE-Strategy (Ruksar Cousin)KalemshahNoch keine Bewertungen

- Proposal FinalDokument8 SeitenProposal FinalKalemshahNoch keine Bewertungen

- PDP Task 1 & 2Dokument11 SeitenPDP Task 1 & 2KalemshahNoch keine Bewertungen

- Pakistan State Oil (PSO) : Company OverviewDokument5 SeitenPakistan State Oil (PSO) : Company OverviewKalemshahNoch keine Bewertungen

- Research Method QDokument9 SeitenResearch Method QKalemshahNoch keine Bewertungen

- Research Method QDokument9 SeitenResearch Method QKalemshahNoch keine Bewertungen

- SMM2Dokument10 SeitenSMM2KalemshahNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Week 1 - NATURE AND SCOPE OF ETHICSDokument12 SeitenWeek 1 - NATURE AND SCOPE OF ETHICSRegielyn CapitaniaNoch keine Bewertungen

- AoS Soulbound - Pregens - Skyrigger Malgra DainssonDokument2 SeitenAoS Soulbound - Pregens - Skyrigger Malgra DainssonAdrien DeschampsNoch keine Bewertungen

- 123 09-Printable Menu VORDokument2 Seiten123 09-Printable Menu VORArmstrong TowerNoch keine Bewertungen

- Shree New Price List 2016-17Dokument13 SeitenShree New Price List 2016-17ontimeNoch keine Bewertungen

- Liver: Anatomy & FunctionsDokument18 SeitenLiver: Anatomy & FunctionsDR NARENDRANoch keine Bewertungen

- Plastics and Polymer EngineeringDokument4 SeitenPlastics and Polymer Engineeringsuranjana26Noch keine Bewertungen

- Health Promotion Throughout The Life Span 7th Edition Edelman Test BankDokument35 SeitenHealth Promotion Throughout The Life Span 7th Edition Edelman Test Bankcourtneyharrisbpfyrkateq100% (17)

- User'S Guide: Tm4C Series Tm4C129E Crypto Connected Launchpad Evaluation KitDokument36 SeitenUser'S Guide: Tm4C Series Tm4C129E Crypto Connected Launchpad Evaluation KitLương Văn HưởngNoch keine Bewertungen

- Tuberculosis PowerpointDokument69 SeitenTuberculosis PowerpointCeline Villo100% (1)

- Assignment 2 Unit 20 Fully Completed - ReviewedDokument5 SeitenAssignment 2 Unit 20 Fully Completed - Reviewedchris.orisawayiNoch keine Bewertungen

- EN Manual Lenovo Ideapad S130-14igm S130-11igmDokument33 SeitenEN Manual Lenovo Ideapad S130-14igm S130-11igmDolgoffNoch keine Bewertungen

- 14p-220 Mud PumpDokument2 Seiten14p-220 Mud PumpMurali Sambandan50% (2)

- 1962 Gibson Johnny SmithDokument5 Seiten1962 Gibson Johnny SmithLuisNoch keine Bewertungen

- 3rd Quarter Exam (Statistics)Dokument4 Seiten3rd Quarter Exam (Statistics)JERALD MONJUANNoch keine Bewertungen

- EXP4 The Diels Alder ReactionsDokument3 SeitenEXP4 The Diels Alder ReactionsLaura GuidoNoch keine Bewertungen

- Tesla Coil ProjectDokument8 SeitenTesla Coil ProjectShivam singhNoch keine Bewertungen

- Assignment 1Dokument3 SeitenAssignment 1farhang_tNoch keine Bewertungen

- Honeycomb Kevlar 49 (Hexcel)Dokument3 SeitenHoneycomb Kevlar 49 (Hexcel)Julia GarciaNoch keine Bewertungen

- Updated Factory Profile of Aleya Apparels LTDDokument25 SeitenUpdated Factory Profile of Aleya Apparels LTDJahangir Hosen0% (1)

- Significance of GodboleDokument5 SeitenSignificance of GodbolehickeyvNoch keine Bewertungen

- Math AA SL P 1 Marks SchemeDokument6 SeitenMath AA SL P 1 Marks SchemeMrin GhoshNoch keine Bewertungen

- Ensemble Averaging (Machine Learning)Dokument3 SeitenEnsemble Averaging (Machine Learning)emma698Noch keine Bewertungen

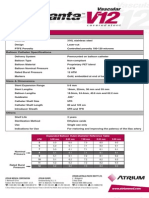

- Advanta V12 Data SheetDokument2 SeitenAdvanta V12 Data SheetJuliana MiyagiNoch keine Bewertungen

- Lecture Planner - Inorganic Chemistry (Legend) - Yakeen NEET 2.0 2024Dokument1 SeiteLecture Planner - Inorganic Chemistry (Legend) - Yakeen NEET 2.0 2024Dipendra KumarNoch keine Bewertungen

- Presentation On 4G TechnologyDokument23 SeitenPresentation On 4G TechnologyFresh EpicNoch keine Bewertungen

- Surface TensionDokument13 SeitenSurface TensionElizebeth GNoch keine Bewertungen

- Toshiba: ® A20SeriesDokument12 SeitenToshiba: ® A20SeriesYangNoch keine Bewertungen

- SPL Lab Report3Dokument49 SeitenSPL Lab Report3nadif hasan purnoNoch keine Bewertungen

- World's Standard Model G6A!: Low Signal RelayDokument9 SeitenWorld's Standard Model G6A!: Low Signal RelayEgiNoch keine Bewertungen

- HCPL 316J 000eDokument34 SeitenHCPL 316J 000eElyes MbarekNoch keine Bewertungen