Beruflich Dokumente

Kultur Dokumente

Tata Sponge Iron (TSIL) : Performance Highlights

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tata Sponge Iron (TSIL) : Performance Highlights

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

2QFY2013 Result update | Metals

October 19, 2012

Tata Sponge Iron (TSIL)

BUY

CMP Target Price

1QFY2013 % chg (qoq) 189 41 21.9 30 3.5 (21.4) (527)bp (13.3)

Performance Highlights

Y/E March (` cr) Net sales EBITDA EBITDA margin (%) Reported PAT

Source: Company, Angel Research

`322 `384

12 Months

2QFY2013 2QFY2012 % chg (yoy) 196 33 16.6 26 174 30 17.2 22 12.6 8.9 (57) 18.6

Investment Period

Stock Info Sector Market Cap (` cr) Net debt Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Metals 496 (295) 0.5 365 / 233 9,133 10 18,682 5,684 TTSP.BO TTSP IN

For 2QFY2013, Tata Sponge Iron Ltd (TSIL) reported a top-line growth of 12.6% to `196cr from `174cr in 2QFY2012. However, the EBITDA margin contracted by 57bp on account of higher raw material cost as a percentage of sales. The net profit grew by 18.6% to `26cr in 2QFY2013 from `22cr in 2QFY2012 primarily due to one-time higher other income. Revenue growth normalizes, margin contracts: After a year of iron ore transportation issues, which impacted TSILs top-line performance, there has been a recovery in the companys capacity utilization to 81% in 2QFY2013 from 70% in FY2012. However, this was lower sequentially from 94% in 1QFY2013 owing to a planned shutdown during the quarter. The net raw material cost increased inspite of a fall in imported coal prices on account of utilization of high cost inventory from the previous quarter. This led to a contraction in the EBITDA margin by 57bp yoy to 16.6% in 2QFY2012. Recent media reports on deduction of bank guarantee for the Talcher coal block has been a matter of concern for the company. However, the company has not received any official notice regarding the same. Outlook and valuation: We expect TSIL to post a 12.5% CAGR in its revenue over FY2012-14E resulting from an improvement in the sales volume. The EBITDA margin is expected to expand by 62bp over FY2012-14E to 18.4% in FY2014E due to softening of raw material prices. The PAT is expected to grow at 18.6% CAGR over FY2012-14E to `106cr in FY2014E from `76cr in FY2012. The stock is currently trading at a PE of 4.7x its FY2014E earnings and P/B of 0.7x for FY2014E. We maintain our Buy recommendation on the stock with a revised target price of `384, based on a target P/B of 0.8x for FY2014E.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 54.5 1.8 10.0 33.7

Abs. (%) Sensex TSIL

3m 8.1 (5.8)

1yr 9.3 6.5

3yr 8.5 15.3

Key financials

Y/E March (` cr) Net sales % chg Net profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoIC (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2011 681 31.0 101 19.9 22.8 65.8 4.9 1.0 21.9 48.3 0.4 1.8

FY2012 634 (6.9) 76 (25.3) 17.8 49.1 6.5 0.9 14.1 28.8 0.4 2.2

FY2013E 750 18.3 101 33.0 18.6 65.4 4.9 0.8 16.5 33.6 0.3 1.5

FY2014E 803 7.0 106 5.7 18.4 69.1 4.7 0.7 15.3 32.8 0.2 0.9

Shareen Batatawala

+91- 22- 3935 7800 Ext: 6849 shareen.batatawala@angelbroking.com

Please refer to important disclosures at the end of this report

TSIL | 2QFY2013 Result Update

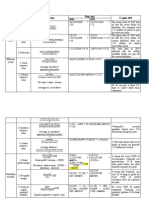

Exhibit 1: 2QFY2013 performance

Y/E March (` cr) Net Sales Net raw material (% of Sales) Staff Costs (% of Sales) Other Expenses (% of Sales) Total Expenditure EBITDA EBITDA margin(%) Interest Depreciation Other Income PBT (% of Sales) Tax (% of PBT) Reported PAT PATM Equity capital (cr) EPS (`)

Source: Company, Angel Research

2QFY13 196 146 74.8 5 2.7 12 5.9 163 33 16.6 0 4 9.2 37 19.0 11 30.5 26 13.2 15 16.7

2QFY12 174 125 72.1 4 2.5 14 8.2 144 30 17.2 0 5 6.2 31 18.1 10 30.8 22 12.5 15 14.1

yoy chg (%) 12.6 16.7 24.6 (19.6) 13.4 8.9 (57)bp (3.2) 47.9 18.1 17.0 18.6

1QFY13 189 128 67.5 6 3.1 14 7.5 148 41 21.9 0 5 7 44 23.0 14 31.8 30 15.7 15

qoq chg (%) 3.5 14.6 (8.1) (19.4) 10.5 (21.4) (527)bp (1.3) 37.1 (14.9) (18.3) (13.3)

1HFY13 385 274 71.2 11 2.9 26 6.7 311 74 19.2 0 9 16 81 12.7 25 31.2 55 14.4 15

1HFY12 319 219 68.6 10 3.0 28 8.7 256 63 19.7 0 9 11 64 10.2 20 31.3 44 13.9 15 28.7

% chg 20.4 25.0 16.1 (7.3) 21.2 17.4 (50)bp (2.0) 48.7 12.6 24.8 25.4

18.6

19.3

(13.3)

36.0

25.4

Exhibit 2: Actual vs. Angel's Estimate (2QFY2013)

Actual (` cr) Total Income EBITDA EBITDA margin (%) Adjusted PAT

Source: Company, Angel Research

Estimate (` cr) 196 30 15.4 21

% variation (0.2) 7.6 120bp 21.6

196 33 16.6 26

In-line revenue, PAT above expectation

TSILs capacity recovered from 70% in FY2012 to 81% in 2QFY2013 inspite of a planned shutdown during the quarter. The volume sales during the quarter stood at 89,000MT, higher than the production, resulting in utilization of high cost inventory from the previous quarter. This led to an increase in net raw material cost inspite of a fall in imported coal prices by ~17%. However lower than expected other expenses led to a higher EBITDA margin of 16.6% as compared to our estimate of 15.4%. The net profit came at `26cr during 2QFY2013, 21.6% higher than our expectation of `21cr due to onetime higher other income during the quarter.

October 19, 2012

TSIL | 2QFY2013 Result Update

Investment rationale

Assured iron ore supply to evade manufacturing inconsistency

Iron ore supply is an important factor in controlling the capacity utilization and consequently the volume sales of sponge iron. TSIL has a long-term supply agreement with its parent Tata Steel for the supply of iron ore since the company leased out its mining assets to Tata Steel to operate Khondbond iron ore mines and supply iron ore to the company. This assured supply of iron ore to TSIL would evade the possibility of closure of the plants unlike other sponge iron manufacturers. The company had faced iron ore transportation issues during FY2012 which led to disruption in capacity utilization, thus impacting the revenue. These issues have been resolved and hence the company can now have uninterrupted manufacturing.

Exhibit 3: Capacity utilization normalized

120 100 111 94 97 76 73 74 94 81 120 110 100 90 80 70

('000 MT)

80 60 40

108

92

95

71

74

55

72

78

89

20 0

57

60 50

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

Volume sales (LHS)

Source: Company, Angel Research

Capacity utilization (RHS)

Coal block - clarity awaited

TSIL has a 45% stake in Talcher coal block in Odisha, which has estimated reserves of 120mn MT for captive consumption. Coal constitutes about 55% of the total raw-material cost for the company of which ~60% is imported from South Africa. The company has received environmental clearance for the block, deposited money for the first phase of land acquisition with the Odisha government while the last phase of the forest clearance is pending. Also the company has signed leasing agreement with three out of five villages for rehabilitation. The management expects the coal block to be operational by FY2014E end. Progress on forest clearance could be a potential trigger for the stock. As per media reports, the recent review of the old coal blocks by the government has led to deduction of bank guarantees for the Talcher coal block. However, the management has denied receiving any official notification for the same. We await clarity on the issue for further direction.

October 19, 2012

2QFY13

(%)

TSIL | 2QFY2013 Result Update

Strong balance sheet with higher return ratios

TSIL is a debt free-cash rich company with a RoIC of 28.8% for FY2012 and cash reserves of `221cr. We expect the company to have a RoIC of 33.6% and 32.8% in FY2013E and FY2014E, respectively. The companys cash reserves are expected to be at `332cr by FY2014E-end.

Financials

Exhibit 4: Key assumptions

FY2013E Sponge iron volume growth (%) Change in MRP of Sponge iron (%)

Source: Angel Research

FY2014E 5.2 2.5

20.5 1.0

Exhibit 5: Change in estimates

Y/E March Net sales (` cr) EBITDA margin (%) EPS (`)

Source: Angel Research

Earlier estimates FY2013E 787 16.2 58.5 FY2014E 837 17.5 66.9

Revised estimates FY2013E 750 18.6 65.4 FY2014E 803 18.4 69.1

% chg FY2013E (4.7) 242bp 11.9 FY2014E (4.1) 95bp 3.3

Improved sponge iron volume sales to drive revenue growth in FY2013E

We expect the companys net sales to post an 18.3% yoy growth in FY2013E to `750cr in FY2013E from `634cr in FY2012 on account of improved sponge iron sales volume. The companys capacity utilization has resumed to higher levels at ~88% in 1HFY2013 as compared to ~75% during the same period last year. We expect the average capacity utilization to be at ~86% during FY2013E. However, revenue growth is expected to slowdown in FY2014E since there wouldnt be enough space for volume growth while sponge iron prices have been on a downtrend, thus leading to a minimal revenue growth of 7% in FY2014E.

Exhibit 6: Sponge iron sales volume trend

120 100 80 27.1 3.9 30.4 8.3 14.1 40 30 20 10

Exhibit 7: Revenue growth to moderate post FY2013E

1000 33.8 800 600 400 200 0 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E Revenue (LHS) Revenue growth (RHS) (6.9)

609 520 681 634 750

40 31.0 18.3 20 7.0

(%)

30

('000 MT)

(%)

0 (10)

(` cr)

60 40

3.8

10 0

108

92

95

71

74

55

72

78

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY13

(14.7)

803

(25.3)

(25.1)

89

20

(15.3)

(20) (30)

(10) (20)

Volume sales (LHS)

qoq growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

October 19, 2012

TSIL | 2QFY2013 Result Update

Softening raw material prices to aid margin expansion and PAT growth

The EBITDA margins are expected to expand by a mere 62bp over FY2012-14E to 18.4% due to softening of raw material costs, especially of coal, which would be partially set off by a fall in sponge iron prices. Consequently, we expect net profit to post an 18.6% CAGR over FY2012-14E to `106cr in FY2014E from `76cr in FY2012. The PAT margin, which has been consistently declining since FY2009, is expected to stabilize at higher levels of 13.3% in FY2014E from 11.9% in FY2012.

Exhibit 8: EBITDA margin to improve slightly

200 160 120

(` cr)

Exhibit 9: PAT margin to stabilize going forward

31 29 27 150 120 90

(` cr) (%)

30.2

22 19.8 20 18

(%)

23.8 22.8

25 23 21 17.8 18.6

140 148

16.3 60 30 121 0 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E PAT (LHS) PAT margin (RHS) 85 101 76 14.9 11.9 101 106 13.4

16 13.3 14 12 10

80 40 0 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

18.4 19 17 15

184

124

155

EBITDA (LHS)

Source: Company, Angel Research

113

EBITDA margin (RHS)

Source: Company, Angel Research

Outlook and valuation

We have revised our revenue estimates downwards for FY2013E and FY2014E, considering a decline in sponge iron prices by ~8% during the quarter, while our earnings estimate has been revised upwards due to a ~17% fall in prices of imported coal, which would lead to margin expansion and consequently better profits. At the current levels, the stock is trading at a PE of 4.7x its FY2014E earnings and P/B of 0.7x for FY2014E. We maintain our Buy recommendation on the stock with a target price of `384, based on a revised target P/B of 0.8x for FY2014E.

Exhibit 10: One-year forward P/B band

700 600 500 400

(`)

Exhibit 11: One-year forward P/B chart

1.6 1.4 1.2 1.0

300 200 100 0 Oct-07 Oct-08 Price Oct-09 0.4x Oct-10 0.7x Oct-11 1.0x Oct-12 1.3x

(x)

0.8 0.6 0.4 0.2 0.0 Oct-07 Oct-08 Oct-09 Absolute P/B Oct-10 Oct-11 Oct-12

P/B (5 yr avg)

Source: Angel Research

Source: Angel Research

October 19, 2012

TSIL | 2QFY2013 Result Update

Risks

Volatile raw-material prices

Iron ore and coal are the major raw materials used in the manufacturing of sponge iron. Imported coal prices have declined by ~17% during 2QFY2013, thus reducing raw material costs. Also, iron ore prices have been volatile due to ban of mines in Karnataka. Raw material constitutes about 65% to the total expenditure and, hence, volatility in raw-material prices would affect the companys EBITDA margin.

Coal block de-allocation or deduction of bank guarantee

Recent review of the development of coal blocks by the Inter Ministerial Group (IMG) suggested a deduction in bank guarantee for the companys Radhikapur coal block. There may be a possible de-allocation of the coal block awarded to the company. The company has not received any notification regarding the same. This remains an overhang on the stock till further clarity emerges.

Company Background

TSIL is a subsidiary of Tata Steel, which holds a 51% stake in the company. TSIL is a leading manufacturer of sponge iron, which is used as a raw material in steel manufacturing through the electric arc furnace (EAF) route. The company has an installed capacity of 3,90,000TPA and a 26MW captive power plant based on waste heat recovery from its kilns. Moreover, the company has a 45% stake in the Talcher coal block with estimated reserves of 120mn tonne, which has received environmental clearance, while forest clearance is still pending. TSILs plans of expanding its power-generation capacity of 26MW to 51MW is pending for want of statutory clearances change in eco-dynamics, etc.

October 19, 2012

TSIL | 2QFY2013 Result Update

Profit & Loss Statement

Y/E March (` cr) Gross sales Less: Excise duty Net Sales Total operating income % chg Net Raw Materials Personnel Other Total Expenditure EBITDA % chg EBITDA margin (%) Depreciation EBIT % chg (% of Net Sales) Interest & other charges Other Income (% of Net Sales) PBT % chg Tax (% of PBT) PAT (reported) Extraordinary (Expense)/Inc. ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY2010 558 38 520 520 (14.7) 322 19 55 396 124 (33) 23.8 19 105 (37) 20.1 0 22 4.2 126 24.3 42 33.0 85 85 (30.0) 16.3 55 55 (30.0) FY2011 741 60 681 681 31.0 440 20 66 526 155 25 22.8 19 137 31 20.0 14 2.0 150 22.1 49 32.6 101 101 19.9 14.9 66 66 19.9 FY2012 689 55 634 634 (6.9) 438 20 63 521 113 (27) 17.8 20 93 (31) 14.9 6 23 3.6 111 17.7 36 32.5 75 75 (25.3) 11.9 49 49 (25.3) FY2013E 816 66 750 750 18.3 526 23 62 610 140 24 18.6 19 121 27 16.1 29 3.8 149 19.9 48 32.5 101 101 33.0 13.4 65 65 33.0 FY2014E 880 77 803 803 7.0 563 24 67 655 148 6 18.4 21 127 5 15.8 31 3.8 158 19.6 51 32.5 106 106 5.7 13.3 69 69 5.7

October 19, 2012

TSIL | 2QFY2013 Result Update

Balance Sheet

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability Other Long Term Liabilities Long Term Provisions Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Long Term Loans and advances Other non-current assets Investments Current Assets Cash Loans & Advances Inventory Debtors Other current assets Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 359 154 206 122 1 215 93 16 68 38 78 138 466 355 166 189 12 121 34 283 188 8 63 22 2 90 193 550 356 182 174 16 164 0 25 353 221 11 89 28 5 127 225 604 392 202 190 18 164 0 25 417 267 19 85 41 6 127 290 687 411 223 189 19 191 0 25 487 332 20 85 44 6 137 351 775 15 405 420 0 46 466 15 492 507 0 39 3 550 15 553 568 33 3 604 15 636 651 33 3 687 15 724 740 33 3 775 FY2010 FY2011 FY2012 FY2013E FY2014E

October 19, 2012

TSIL | 2QFY2013 Result Update

Cash Flow Statement

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments (Inc.)/Dec. In L.T loans and adv Other income Others Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2010 126 19 (5) (15) (42) 85 (101) 22 (15) (94) 0 (14) 2 (12) (21) 115 93 FY2011 150 19 39 (18) (49) 142 115 (34) (121) 14 (8) (35) (0) (16) 4 (12) 95 93 188 FY2012 112 20 1 (26) (36) 69 (6) 9 (42) 23 (8) (25) (0) (14) 2 (12) 33 188 221 FY2013E 149 19 (19) (29) (48) 73 (37) 0 29 (9) (18) (18) 46 221 267 FY2014E 158 21 4 (31) (51) 101 (21) (28) 31 (18) (18) (18) 65 267 332

October 19, 2012

TSIL | 2QFY2013 Result Update

Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover Inventory / Sales (days) Receivables (days) Payables (days) WC (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (0.2) (0.8) 418.2 (0.4) (1.4) (0.4) (2.2) 17.1 (0.4) (2.1) (0.5) (2.4) 1.4 42 20 61 31 1.9 35 16 58 3 1.8 44 14 76 3 2.0 42 20 76 11 2.0 39 20 76 9 24.1 40.7 22.0 26.9 48.3 21.9 16.4 28.8 14.1 18.7 33.6 16.5 17.4 32.8 15.3 20.1 0.7 2.0 27.3 128.8 (0.2) 50.0 20.0 0.7 2.4 32.6 (0.4) 18.3 14.9 0.7 1.9 19.4 (0.4) 11.0 16.1 0.7 2.1 22.7 (0.4) 12.5 15.8 0.7 2.1 22.1 (0.5) 11.4 54.9 54.9 67.5 8.0 272.8 65.8 65.8 77.8 9.3 329.3 49.1 49.1 61.1 8.0 369.1 65.4 65.4 77.9 10.0 422.9 69.1 69.1 82.7 10.0 480.4 5.9 4.8 1.2 2.5 0.8 3.2 0.9 4.9 4.1 1.0 2.9 0.4 1.8 0.5 6.5 5.3 0.9 2.5 0.4 2.2 0.4 4.9 4.1 0.8 0.2 0.3 1.5 0.3 4.7 3.9 0.7 0.2 0.2 0.9 0.2 FY2010 FY2011 FY2012 FY2013E FY2014E

October 19, 2012

10

TSIL | 2QFY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

TSIL No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

October 19, 2012

11

Das könnte Ihnen auch gefallen

- High Speed Steel End Mills & Milling Cutters World Summary: Market Sector Values & Financials by CountryVon EverandHigh Speed Steel End Mills & Milling Cutters World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen

- Metal Heat Treating World Summary: Market Values & Financials by CountryVon EverandMetal Heat Treating World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Tata Sponge Iron Result UpdatedDokument11 SeitenTata Sponge Iron Result UpdatedAngel BrokingNoch keine Bewertungen

- Godawari Power, 12th February 2013Dokument10 SeitenGodawari Power, 12th February 2013Angel BrokingNoch keine Bewertungen

- Sarda Energy and MineralsDokument12 SeitenSarda Energy and MineralsAngel BrokingNoch keine Bewertungen

- Sarda Energy and MineralsDokument12 SeitenSarda Energy and MineralsAngel BrokingNoch keine Bewertungen

- Godawari Power & Ispat: Performance HighlightsDokument10 SeitenGodawari Power & Ispat: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Prakash Industries: Performance HighlightsDokument11 SeitenPrakash Industries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Sarda Energy 4Q FY 2013Dokument12 SeitenSarda Energy 4Q FY 2013Angel BrokingNoch keine Bewertungen

- NMDC 1qfy2013ruDokument12 SeitenNMDC 1qfy2013ruAngel BrokingNoch keine Bewertungen

- Godawari Power, 1Q FY 2014Dokument10 SeitenGodawari Power, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Sarda Energy and Minerals: Performance HighlightsDokument12 SeitenSarda Energy and Minerals: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Godawari Power 4Q FY 2013Dokument10 SeitenGodawari Power 4Q FY 2013Angel BrokingNoch keine Bewertungen

- MOIL Result UpdatedDokument10 SeitenMOIL Result UpdatedAngel BrokingNoch keine Bewertungen

- Prakash Industries 4Q FY 2013Dokument11 SeitenPrakash Industries 4Q FY 2013Angel BrokingNoch keine Bewertungen

- National Aluminium Result UpdatedDokument12 SeitenNational Aluminium Result UpdatedAngel BrokingNoch keine Bewertungen

- Electrosteel 4Q FY 2013Dokument11 SeitenElectrosteel 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Sterlite Industries: Performance HighlightsDokument13 SeitenSterlite Industries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Prakash Industries, 1Q FY 2014Dokument11 SeitenPrakash Industries, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Steel Authority of India Result UpdatedDokument13 SeitenSteel Authority of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Moil 2qfy2013Dokument10 SeitenMoil 2qfy2013Angel BrokingNoch keine Bewertungen

- Godawari Power & Ispat: Performance HighlightsDokument10 SeitenGodawari Power & Ispat: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Graphite India Result UpdatedDokument10 SeitenGraphite India Result UpdatedAngel BrokingNoch keine Bewertungen

- Vesuvius India: Performance HighlightsDokument12 SeitenVesuvius India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Graphite India: Performance HighlightsDokument11 SeitenGraphite India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Graphite India: Performance HighlightsDokument11 SeitenGraphite India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Coal India: Performance HighlightsDokument10 SeitenCoal India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Sarda Energy, 30th January 2013Dokument12 SeitenSarda Energy, 30th January 2013Angel BrokingNoch keine Bewertungen

- Coal India: Performance HighlightsDokument10 SeitenCoal India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Neutral: Performance HighlightsDokument10 SeitenNeutral: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Electrosteel Castings: Performance HighlightsDokument12 SeitenElectrosteel Castings: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Prakash Industries, 12th February, 2013Dokument11 SeitenPrakash Industries, 12th February, 2013Angel BrokingNoch keine Bewertungen

- Finolex Cables, 1Q FY 2014Dokument14 SeitenFinolex Cables, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Sail 1Q FY 2014Dokument11 SeitenSail 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Electrosteel Casting, 1Q FY 2014Dokument11 SeitenElectrosteel Casting, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Performance Highlights: Company Update - Capital GoodsDokument13 SeitenPerformance Highlights: Company Update - Capital GoodsAngel BrokingNoch keine Bewertungen

- Hindustan Zinc, 1Q FY 2014Dokument11 SeitenHindustan Zinc, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- CESC Result UpdatedDokument11 SeitenCESC Result UpdatedAngel BrokingNoch keine Bewertungen

- Coal India, 15th February 2013Dokument10 SeitenCoal India, 15th February 2013Angel BrokingNoch keine Bewertungen

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDokument11 SeitenPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNoch keine Bewertungen

- Performance Highlights: NeutralDokument12 SeitenPerformance Highlights: NeutralAngel BrokingNoch keine Bewertungen

- Performance Highlights: CMP '203 Target Price '248Dokument10 SeitenPerformance Highlights: CMP '203 Target Price '248Angel BrokingNoch keine Bewertungen

- Monnet Ispat 4Q FY 2013Dokument12 SeitenMonnet Ispat 4Q FY 2013Angel BrokingNoch keine Bewertungen

- BGR Energy Systems: Performance HighlightsDokument11 SeitenBGR Energy Systems: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Sterlite Industries Result UpdatedDokument12 SeitenSterlite Industries Result UpdatedAngel BrokingNoch keine Bewertungen

- JSW Steel: Performance HighlightsDokument13 SeitenJSW Steel: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Coal India: Performance HighlightsDokument11 SeitenCoal India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Steel Authority of India: Performance HighlightsDokument12 SeitenSteel Authority of India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hitachi Home & Life Solutions: Performance HighlightsDokument13 SeitenHitachi Home & Life Solutions: Performance HighlightsAngel BrokingNoch keine Bewertungen

- GSPL, 11th February, 2013Dokument10 SeitenGSPL, 11th February, 2013Angel BrokingNoch keine Bewertungen

- BGR, 12th February 2013Dokument10 SeitenBGR, 12th February 2013Angel BrokingNoch keine Bewertungen

- Godawari Power & Ispat Result UpdatedDokument10 SeitenGodawari Power & Ispat Result UpdatedAngel BrokingNoch keine Bewertungen

- Coal India Limited (COAL IN) : OW: Improving Operational PerformanceDokument13 SeitenCoal India Limited (COAL IN) : OW: Improving Operational Performancecksharma68Noch keine Bewertungen

- BGR Energy Systems: Performance HighlightsDokument11 SeitenBGR Energy Systems: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Sterlite, 1Q FY 2014Dokument13 SeitenSterlite, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- GIPCL Result UpdatedDokument11 SeitenGIPCL Result UpdatedAngel BrokingNoch keine Bewertungen

- Ceat, 11th January, 2013Dokument12 SeitenCeat, 11th January, 2013Angel Broking100% (2)

- Monnet Ispat Result UpdatedDokument12 SeitenMonnet Ispat Result UpdatedAngel BrokingNoch keine Bewertungen

- Hindustan Zinc Result UpdatedDokument11 SeitenHindustan Zinc Result UpdatedAngel BrokingNoch keine Bewertungen

- Petronet LNG: Performance HighlightsDokument10 SeitenPetronet LNG: Performance HighlightsAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument12 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 12Dokument2 SeitenMetal and Energy Tech Report Sept 12Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 13 2013Dokument4 SeitenCurrency Daily Report September 13 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 12 2013Dokument2 SeitenDaily Agri Tech Report September 12 2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Currency Daily Report September 12 2013Dokument4 SeitenCurrency Daily Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 12 2013Dokument9 SeitenDaily Agri Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 12 2013Dokument6 SeitenDaily Metals and Energy Report September 12 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- KFin Technologies - Flash Note - 12 Dec 23Dokument6 SeitenKFin Technologies - Flash Note - 12 Dec 23palakNoch keine Bewertungen

- Mindtree: Reference ModelDokument54 SeitenMindtree: Reference ModelLiontiniNoch keine Bewertungen

- Chapter 2 Problems and SolutionDokument19 SeitenChapter 2 Problems and SolutionSaidurRahaman100% (1)

- Acct 310 Final Exam (Umuc)Dokument10 SeitenAcct 310 Final Exam (Umuc)OmarNiemczykNoch keine Bewertungen

- Afar 01 - Partnership Formation and LiquidationDokument6 SeitenAfar 01 - Partnership Formation and LiquidationMarie GonzalesNoch keine Bewertungen

- Module 4 PDFDokument22 SeitenModule 4 PDFJerin MathewNoch keine Bewertungen

- Bài tập chương 3 Financil ratiosDokument14 SeitenBài tập chương 3 Financil ratiosThu LoanNoch keine Bewertungen

- Week 4 To 8Dokument8 SeitenWeek 4 To 8Ray MundNoch keine Bewertungen

- Audit of Liabilities Quiz 3Dokument3 SeitenAudit of Liabilities Quiz 3Cattleya50% (2)

- Akuntansi 3Dokument4 SeitenAkuntansi 3Icha Novia R.Noch keine Bewertungen

- On January 1Dokument2 SeitenOn January 1UNKNOWNNNoch keine Bewertungen

- Valuation Apr 05Dokument10 SeitenValuation Apr 05justine reine cornicoNoch keine Bewertungen

- Finm1416 Individual Compenent 4Dokument5 SeitenFinm1416 Individual Compenent 4Ma HiNoch keine Bewertungen

- Module 11k DepreciationDokument16 SeitenModule 11k DepreciationCarljohari Hussein AriffNoch keine Bewertungen

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDokument12 SeitenBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNoch keine Bewertungen

- Towr LK TW Iii 2020Dokument161 SeitenTowr LK TW Iii 2020ray ArdianNoch keine Bewertungen

- 02 PPT Statement of Financial Position PDFDokument61 Seiten02 PPT Statement of Financial Position PDFRaizah GaloNoch keine Bewertungen

- Wasting Asset Answer KeyDokument4 SeitenWasting Asset Answer KeyMets Ryota50% (2)

- RCS Finance GuideDokument32 SeitenRCS Finance GuideSameer JainNoch keine Bewertungen

- Practice Test 1Dokument2 SeitenPractice Test 1Khail GoodingNoch keine Bewertungen

- NTP - Group 6 - Assigment - FIN201Dokument35 SeitenNTP - Group 6 - Assigment - FIN201Nguyen Ngoc Minh Chau (K15 HL)Noch keine Bewertungen

- Finance Report of Bharat BiotechDokument5 SeitenFinance Report of Bharat BiotechUnicorn SpiderNoch keine Bewertungen

- Chapter 8 - ProblemDokument26 SeitenChapter 8 - ProblemMa. Leonor Nikka CuevasNoch keine Bewertungen

- Nike Balance SheetDokument2 SeitenNike Balance SheetDukeIClub100% (1)

- Finacc4 Assignment 2 Property, Plant and Equipment, Part 2 Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each ProblemDokument3 SeitenFinacc4 Assignment 2 Property, Plant and Equipment, Part 2 Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each ProblemAlrac GarciaNoch keine Bewertungen

- Part-2 Cash Flow Apex Footwear Limited Growth RateDokument11 SeitenPart-2 Cash Flow Apex Footwear Limited Growth RateRizwanul Islam 1912111630Noch keine Bewertungen

- Partnership FormationDokument69 SeitenPartnership FormationIts SaoirseNoch keine Bewertungen

- Problem IntxDokument7 SeitenProblem IntxSophia KeratinNoch keine Bewertungen

- Gail India Ltd. ReportDokument8 SeitenGail India Ltd. Reportsakshi gulatiNoch keine Bewertungen

- BM102TDokument25 SeitenBM102TMariamma KuriakoseNoch keine Bewertungen